A Dilution Calculation Excel Template for Startup Founders helps track ownership percentages throughout funding rounds, ensuring clear visibility of equity changes. This tool simplifies complex dilution scenarios by automatically updating shareholder stakes after each investment or share issuance. It empowers founders to make informed decisions about fundraising and equity distribution efficiently.

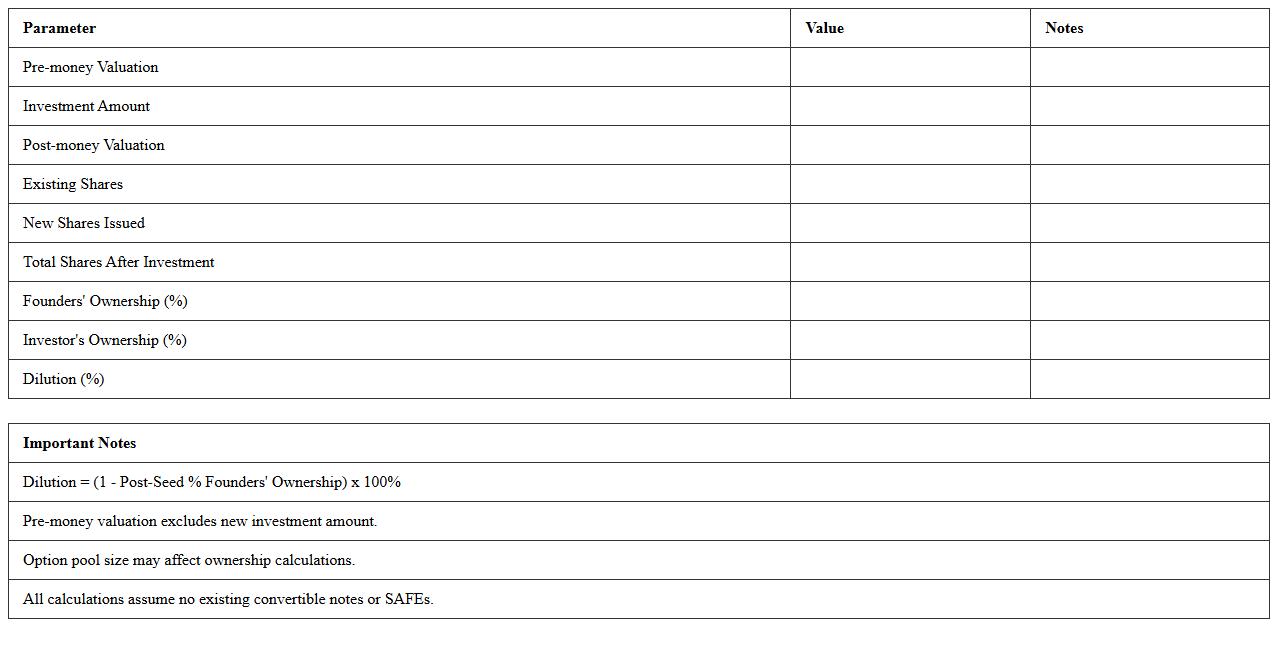

Pre-Seed Dilution Tracker Excel Template

The

Pre-Seed Dilution Tracker Excel Template is a specialized spreadsheet designed to monitor ownership percentages and equity dilution during the early stages of startup fundraising. It helps founders and investors accurately calculate the impact of new investments on existing stakeholders, ensuring clear visibility of changes in share distribution. By providing real-time updates on dilution effects, this tool supports informed decision-making and effective capital management in pre-seed funding rounds.

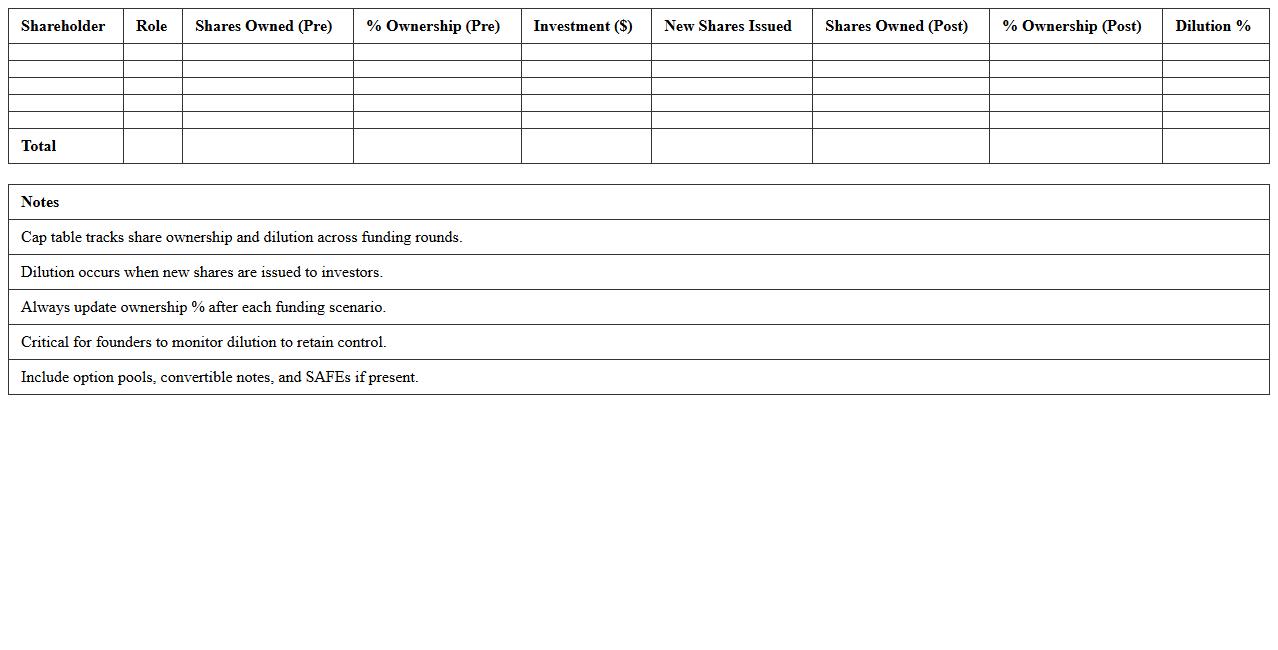

Seed Round Equity Dilution Calculator

The

Seed Round Equity Dilution Calculator document is a financial tool designed to help startup founders and investors accurately determine ownership percentage changes after raising initial funding. It enables users to input various investment amounts and pre-money valuations to forecast how much equity will be diluted during the seed round. This calculator is essential for making informed decisions on capital structure and protecting stakeholder value throughout early-stage fundraising.

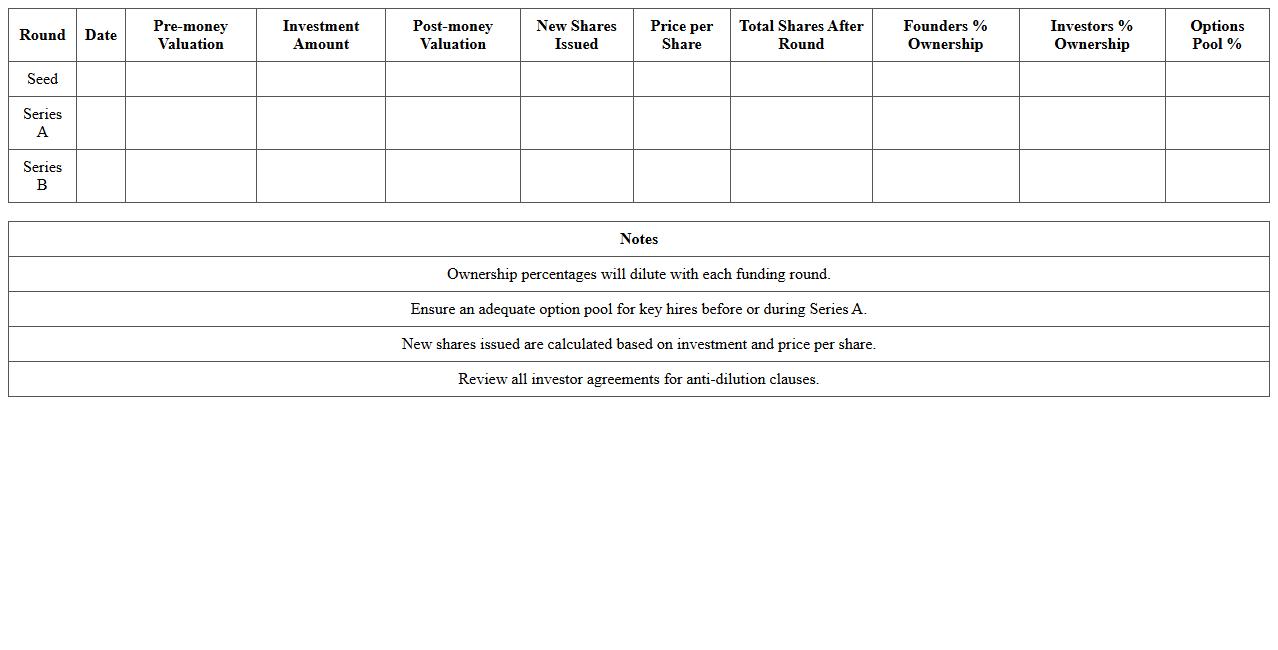

Startup Cap Table & Dilution Scenario Model

A

Startup Cap Table & Dilution Scenario Model document outlines the ownership structure of a startup by tracking equity stakes and investor shares over time. It helps founders and investors visualize how ownership percentages change with new funding rounds, option grants, or exits, providing crucial insights into potential dilution effects. This model is essential for strategic decision-making, ensuring transparent communication and informed negotiations regarding equity distribution and future financing.

Series A Funding Dilution Analysis Template

A

Series A Funding Dilution Analysis Template document helps founders and investors visualize the impact of new equity investments on ownership percentages during early-stage funding rounds. It provides a clear breakdown of share distributions before and after the Series A round, enabling stakeholders to assess dilution effects and make informed decisions on capital structure. This template is essential for strategic financial planning and maintaining control over company equity during critical growth phases.

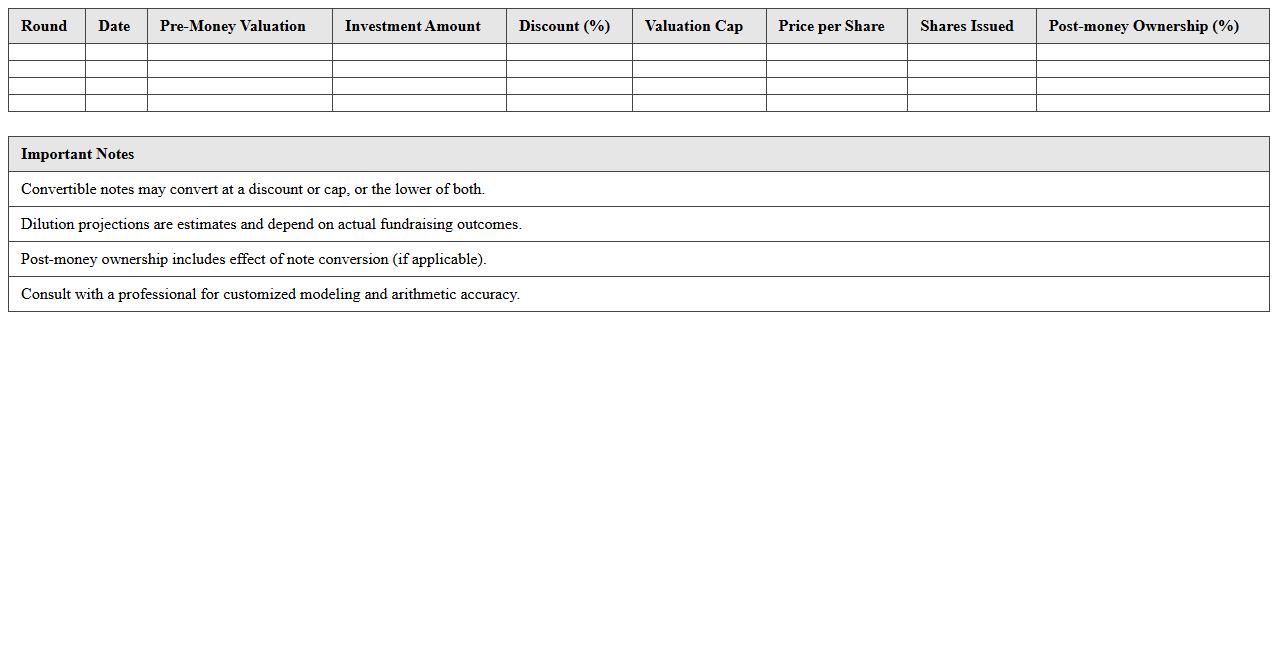

Convertible Note Dilution Projection Spreadsheet

A

Convertible Note Dilution Projection Spreadsheet is a financial tool that models the impact of convertible notes on a company's equity ownership, projecting how shares will be diluted when notes convert to equity. It helps founders, investors, and financial analysts visualize potential ownership stakes after financing rounds, ensuring informed decision-making regarding fundraising and capitalization strategies. This spreadsheet is essential for understanding future shareholder percentages and managing dilution risks effectively.

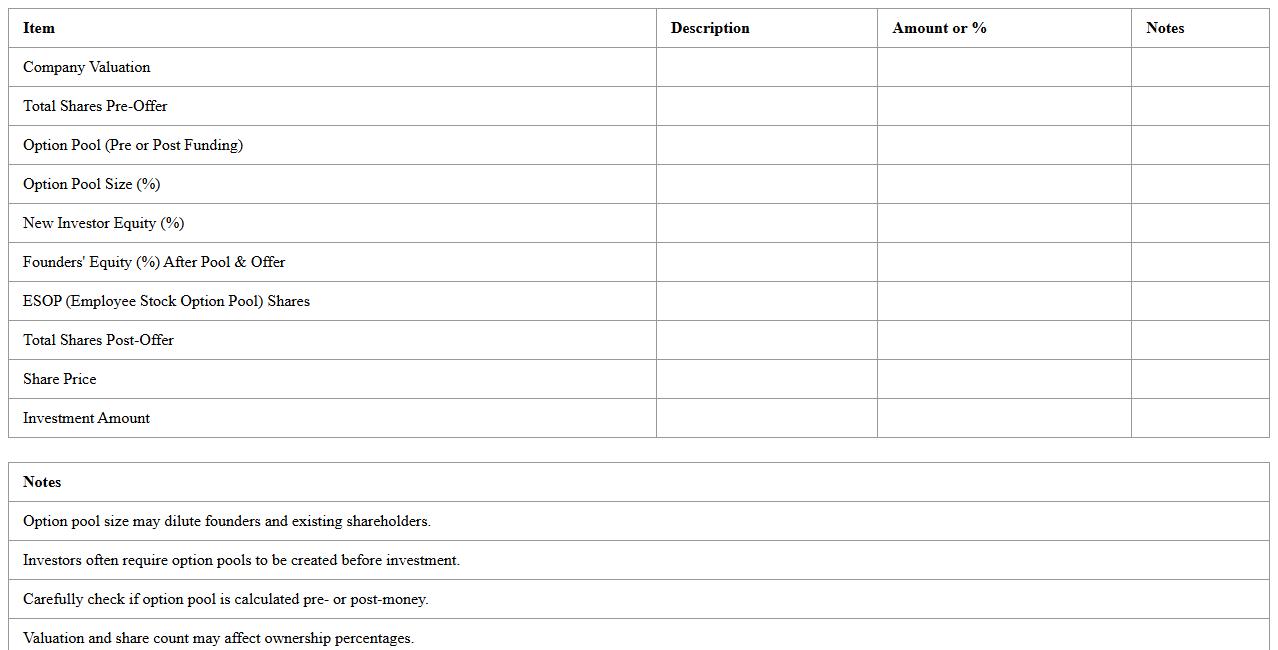

Equity Offer and Option Pool Calculation Template

An

Equity Offer and Option Pool Calculation Template document serves as a comprehensive tool to accurately allocate and manage stock options and equity shares within a company. It enables startups and businesses to plan ownership distribution clearly, ensuring transparency for founders, employees, and investors while facilitating strategic equity planning during funding rounds. Utilizing this template helps prevent dilution issues, maintain proper cap table management, and supports informed decision-making regarding employee stock option plans (ESOPs).

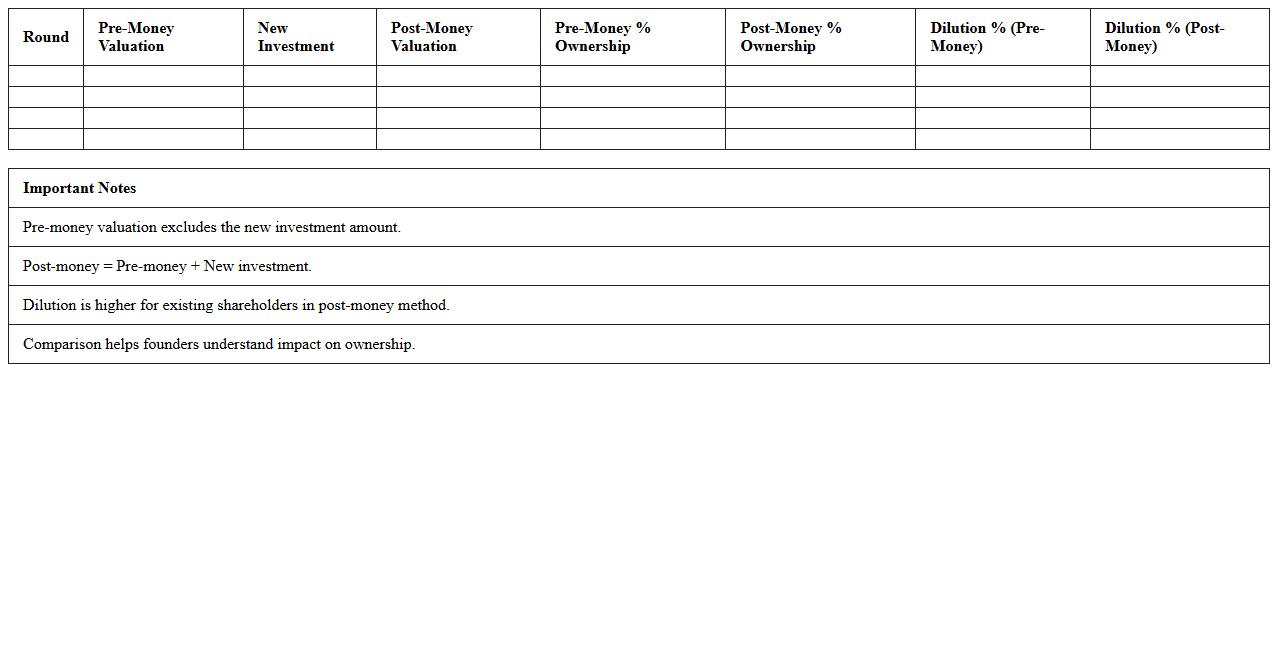

Post-Money vs Pre-Money Dilution Comparison Sheet

A

Post-Money vs Pre-Money Dilution Comparison Sheet document highlights the impact of investment rounds on ownership percentages before and after funding. It is essential for startups and investors to understand how equity is diluted when new shares are issued, ensuring transparent decision-making and accurate valuation assessments. This comparison aids in forecasting ownership stakes, enabling better negotiation and strategic planning during fundraising.

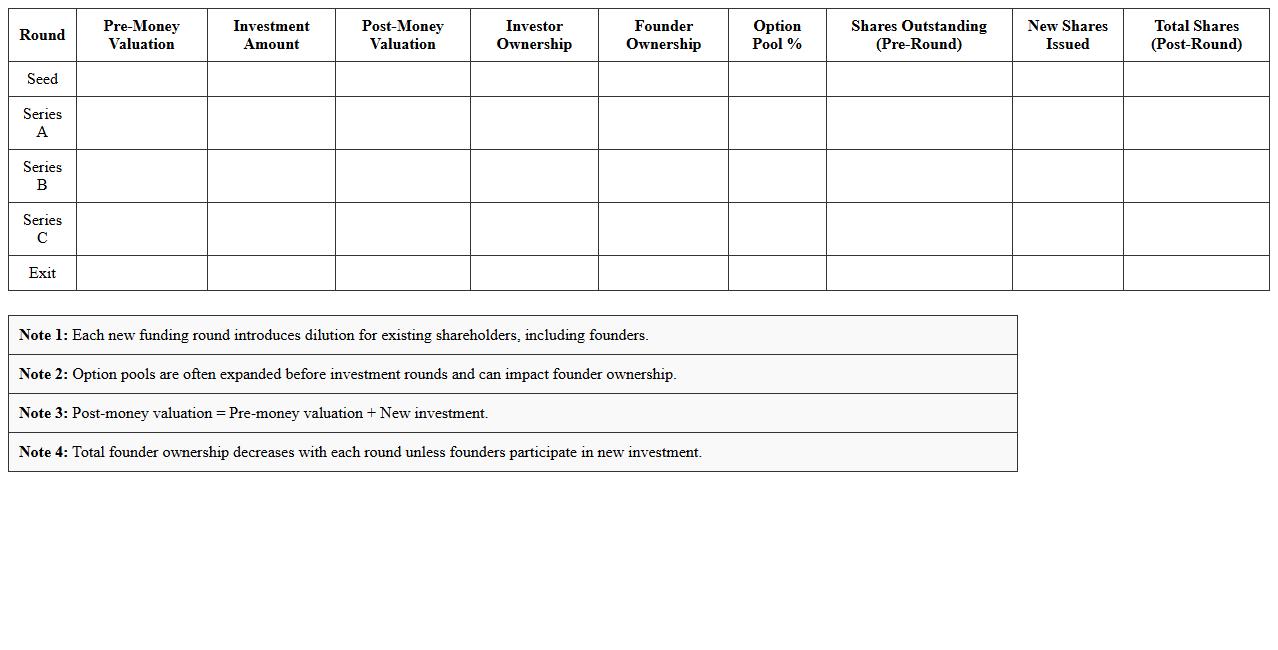

Multi-Round Founder Ownership Dilution Model

The

Multi-Round Founder Ownership Dilution Model document outlines how a founder's equity stake decreases through successive funding rounds, providing a clear visualization of ownership changes over time. It is essential for founders to understand the impact of investment rounds on their control and financial returns in the company. This model aids strategic decision-making by forecasting dilution effects and aligning expectations with investors.

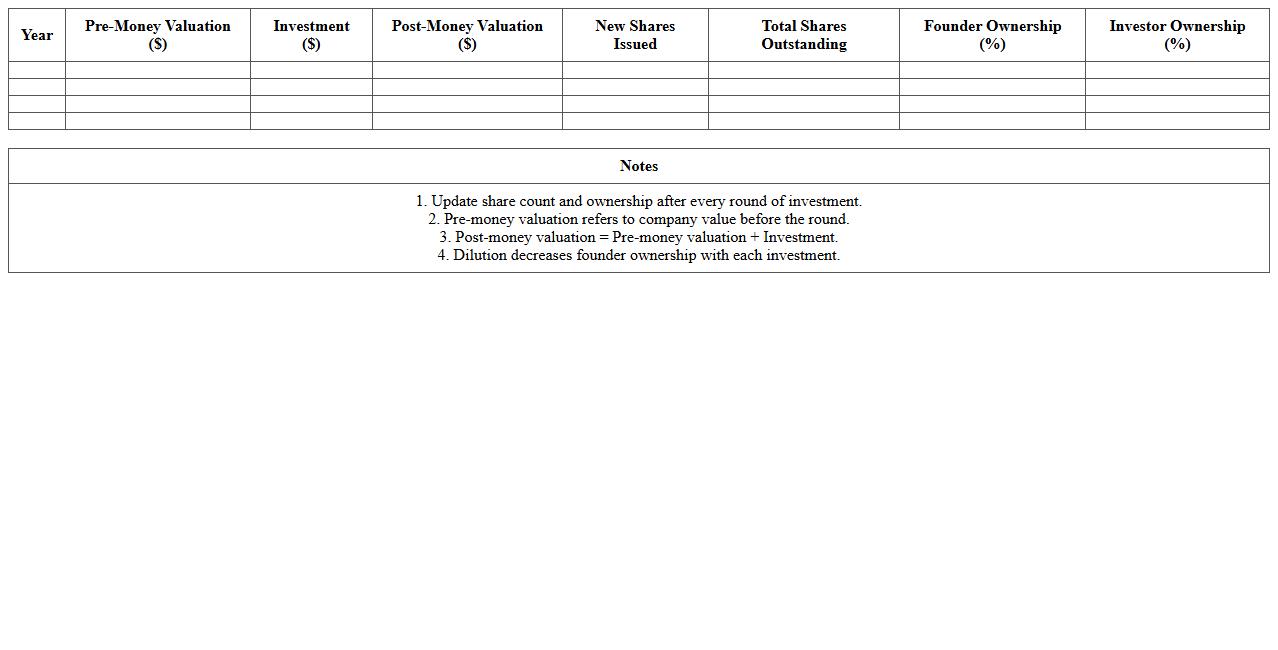

Simple Pro Forma Dilution Forecast Excel

The

Simple Pro Forma Dilution Forecast Excel document is a financial modeling tool designed to project the impact of equity dilution on shareholder ownership over time. It helps users visualize changes in ownership percentages resulting from funding rounds, stock options, or convertible securities issuance. This tool is essential for startups, investors, and financial analysts to make informed decisions about equity allocation and fundraising strategies.

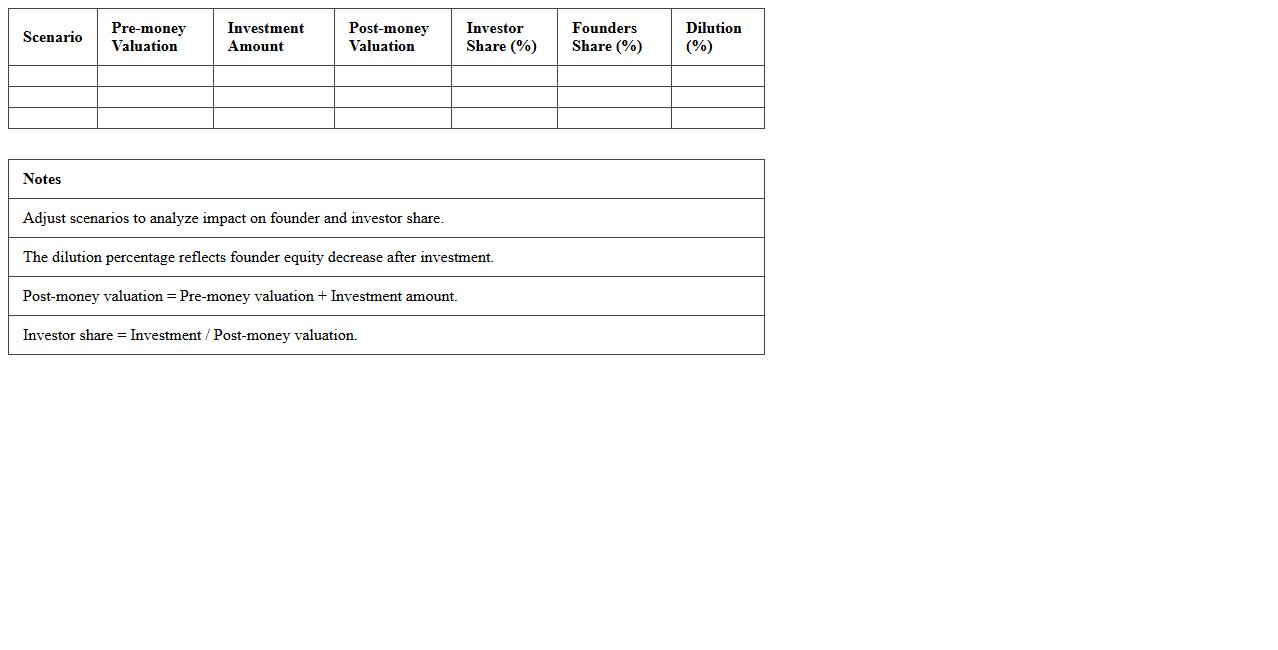

Investor Share and Dilution Sensitivity Excel Template

The

Investor Share and Dilution Sensitivity Excel Template is a powerful financial tool designed to analyze equity ownership and the impact of dilution on investor shares during funding rounds. It helps startups and investors model various scenarios, visualize changes in ownership percentages, and assess the effects of new investments or stock issuances on existing shareholders. This template enhances decision-making by providing clear insights into ownership structure and potential dilution risks, ensuring better strategic planning for capital raising.

How to automate pre and post-money valuation calculations in a dilution Excel template?

To automate pre and post-money valuation calculations in Excel, start by inputting the investment amount and ownership percentage for each funding round. Use formulas like =Investment Amount / Ownership Percentage for pre-money valuation and add the investment to calculate post-money valuation. Automating these steps streamlines updating your dilution model after each round.

What advanced Excel functions best model multiple funding rounds dilution for cap tables?

Advanced functions such as INDEX, MATCH, and INDIRECT enable dynamic referencing of multiple funding rounds in cap tables. Additionally, the use of array formulas and SUMPRODUCT help accurately aggregate ownership stakes and dilution effects. Together, these functions create flexible models that update seamlessly with new investor data.

How to visually track founder equity loss after each investment round in Excel?

Implement charts like stacked bar or waterfall charts to visually display founder equity loss through successive investment rounds. Link chart data directly to equity calculations in your dilution template for real-time updates. Clear visualization helps founders easily understand the impact of dilution on their ownership stake.

Which formulas accurately calculate option pool impact on dilution in Excel sheets?

To calculate the option pool's impact on dilution, first determine the pre-money valuation adjusted for option pool creation or expansion. Use formulas that factor option shares as part of total shares, such as =Option Pool Shares / (Total Shares + Option Pool Shares). This ensures dilution effects from the option pool are precisely reflected in ownership percentages.

How to simulate various SAFE note conversion scenarios in an Excel dilution model?

Simulate SAFE note conversions by setting up parameter inputs for discount rates, valuation caps, and conversion triggers. Use IF statements combined with MIN or MAX functions to choose the most favorable conversion price for note holders. This approach allows you to model multiple SAFE scenarios and their dilution implications effectively.

More Calculation Excel Templates