The Loan Amortization Calculation Excel Template for Small Business Owners simplifies financial planning by providing a clear breakdown of loan payments over time. It helps track principal and interest amounts, ensuring accurate budgeting and cash flow management. This template is essential for small business owners seeking to optimize loan repayment strategies.

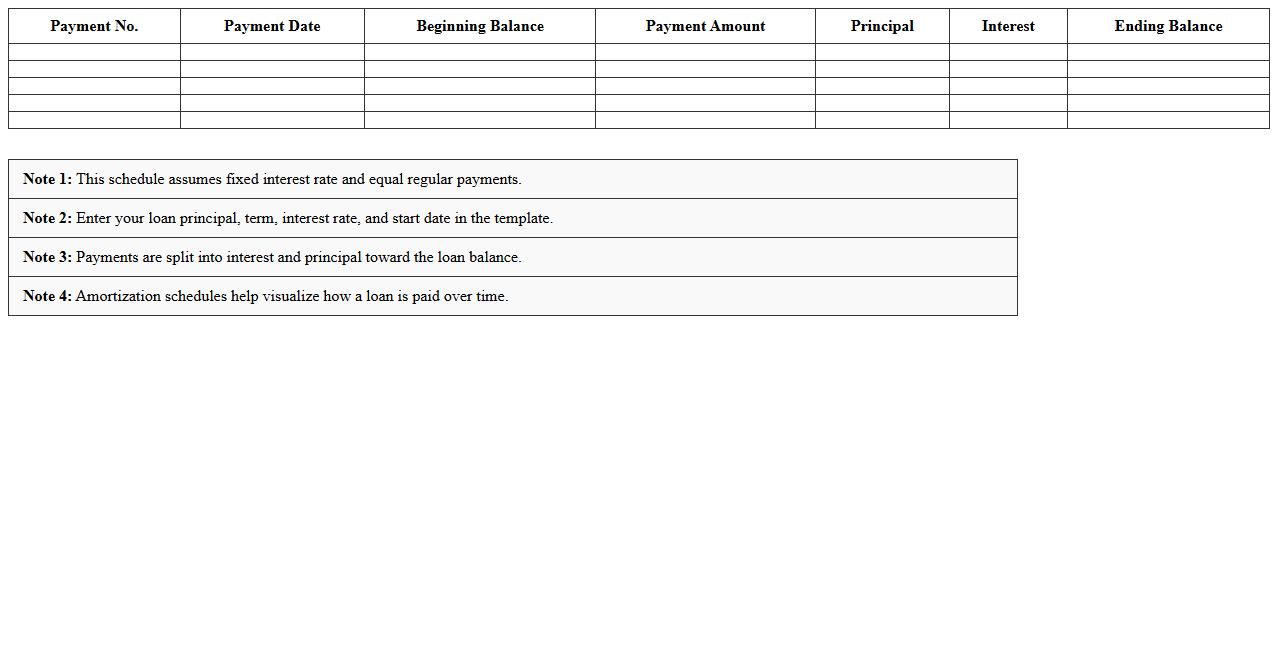

Simple Loan Amortization Schedule Excel Template

A

Simple Loan Amortization Schedule Excel Template is a spreadsheet tool designed to calculate and display periodic loan payments, detailing the breakdown of interest and principal over the life of the loan. It helps users track loan balances, understand payment timelines, and plan financial obligations accurately by automating complex calculations. This template is especially useful for borrowers, financial planners, and accountants aiming to improve budgeting and cash flow management.

Small Business Loan Repayment Tracker Spreadsheet

A

Small Business Loan Repayment Tracker Spreadsheet is a financial tool designed to systematically record and monitor loan payments, interest accrual, and outstanding balances. It helps business owners maintain a clear view of repayment schedules, ensuring timely payments and avoiding penalties. Using this spreadsheet optimizes cash flow management and supports better financial planning for sustainable business growth.

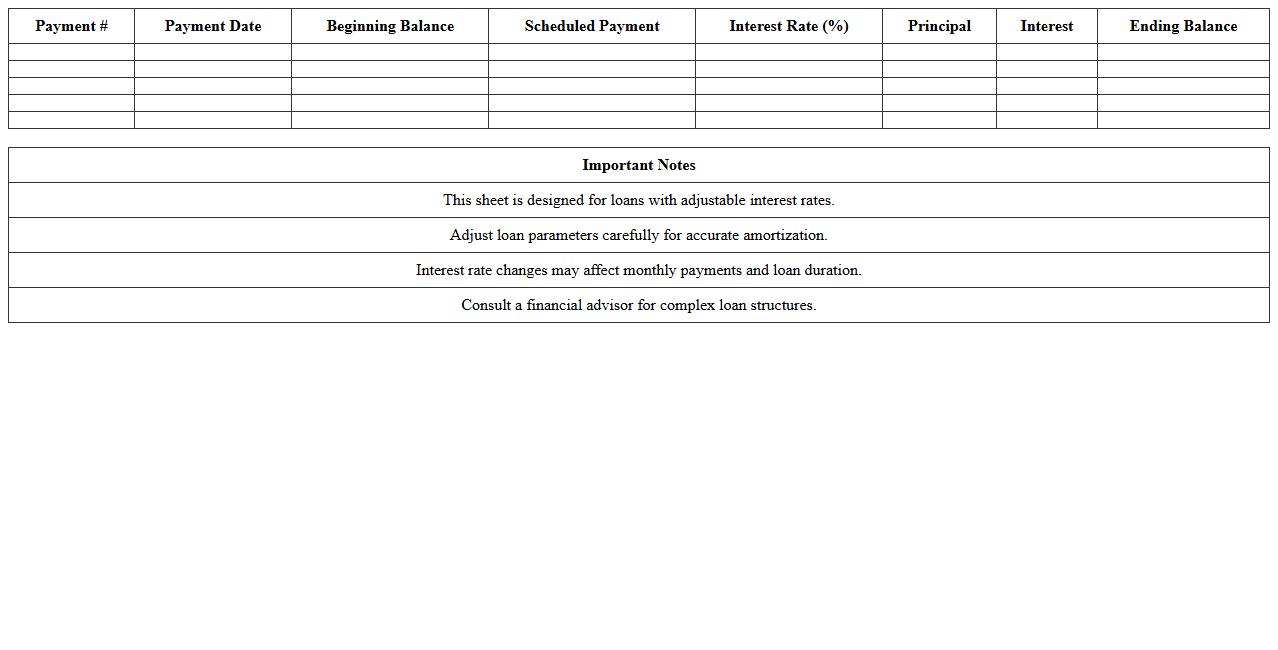

Adjustable Interest Loan Amortization Excel Sheet

An

Adjustable Interest Loan Amortization Excel Sheet is a financial tool designed to calculate and display the repayment schedule for loans with variable interest rates, showing how payments fluctuate over time. It helps users track principal and interest components, providing clear insights into changes in monthly installments and outstanding balances as interest rates adjust. This document is essential for borrowers and financial planners seeking to manage and forecast loan costs accurately under adjustable rate conditions.

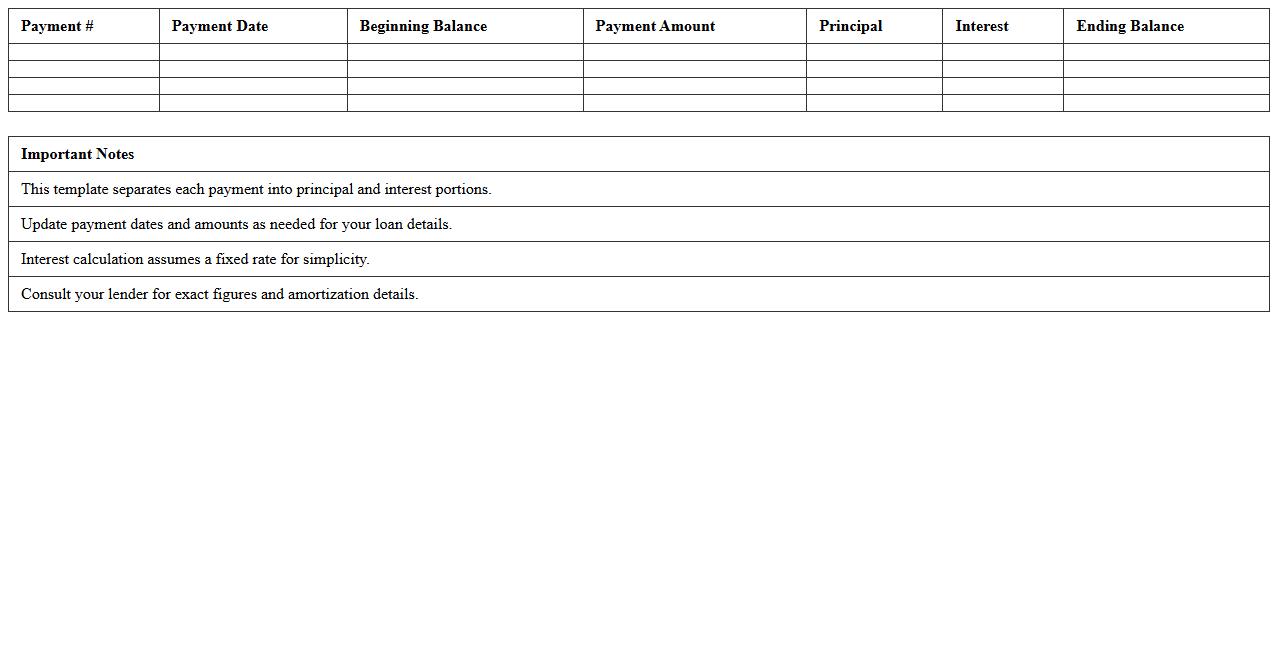

Principal and Interest Loan Breakdown Excel Template

The

Principal and Interest Loan Breakdown Excel Template is a detailed spreadsheet designed to calculate and display the monthly distribution of loan payments between principal and interest over the loan term. This document helps users easily track loan amortization schedules, allowing for accurate financial planning and budget management by showing how each payment affects the outstanding loan balance. It is useful for borrowers, lenders, and financial analysts to visualize payment structures, forecast interest expenses, and optimize loan repayment strategies.

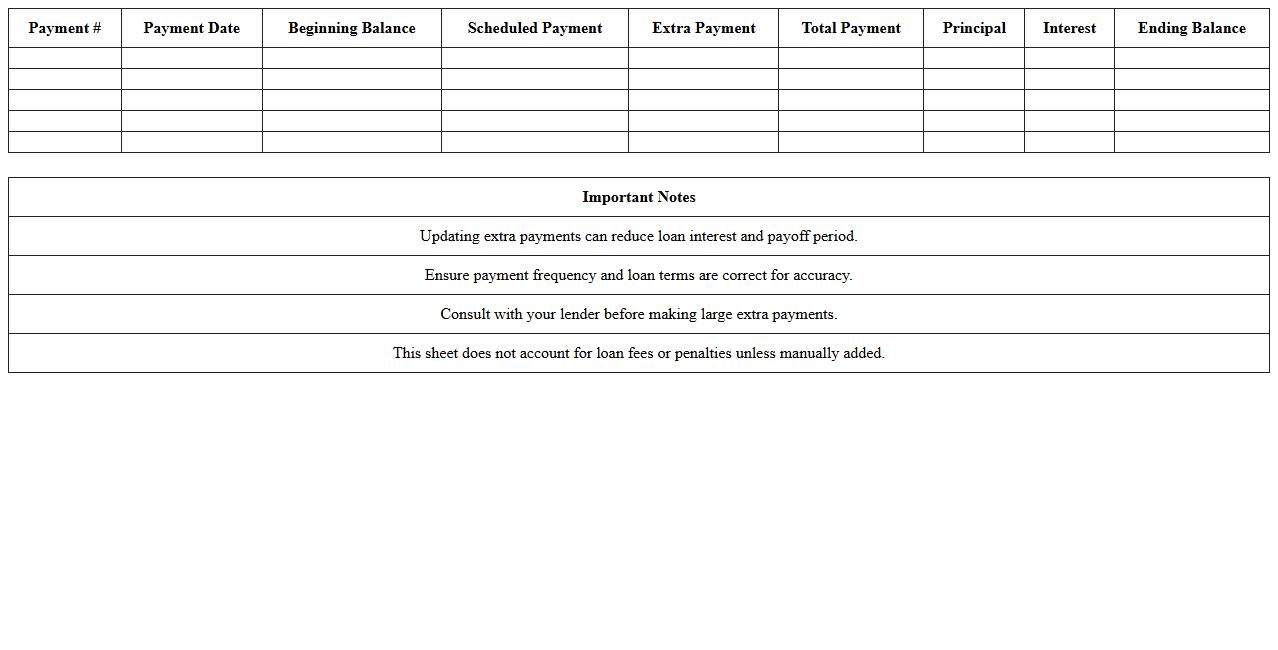

Extra Payment Loan Amortization Calculator Excel

An

Extra Payment Loan Amortization Calculator Excel document allows users to input loan details and additional payments to visualize the impact on loan duration and interest savings. It helps borrowers understand how making extra payments can reduce the principal balance faster, leading to lower total interest costs and an earlier payoff date. This tool is essential for effective financial planning and optimizing loan repayment strategies.

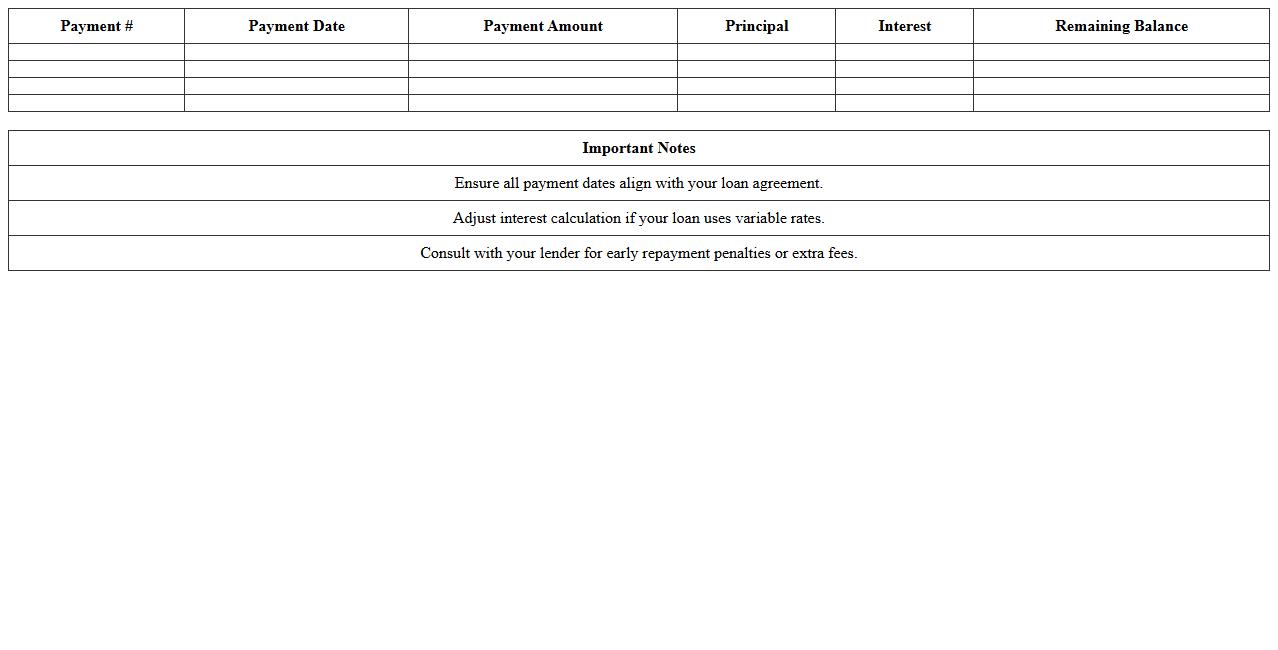

Commercial Loan Payment Schedule Excel Template

The

Commercial Loan Payment Schedule Excel Template is a structured spreadsheet designed to track and calculate loan repayments, interest, and principal amounts over the loan term. It allows users to monitor payment dates, outstanding balances, and total interest paid efficiently, ensuring accurate financial planning and budgeting. This template is essential for businesses and borrowers aiming to manage commercial loans transparently and avoid payment errors.

Multi-Loan Amortization Tracker Excel Sheet

The

Multi-Loan Amortization Tracker Excel Sheet is a comprehensive financial tool designed to manage and monitor multiple loan schedules simultaneously. It provides detailed insights into payment timelines, outstanding balances, interest calculations, and principal amounts for each loan, enabling precise tracking and efficient debt management. This document is useful for individuals and businesses seeking to optimize loan repayments, avoid missed payments, and maintain a clear overview of their financial obligations in one organized place.

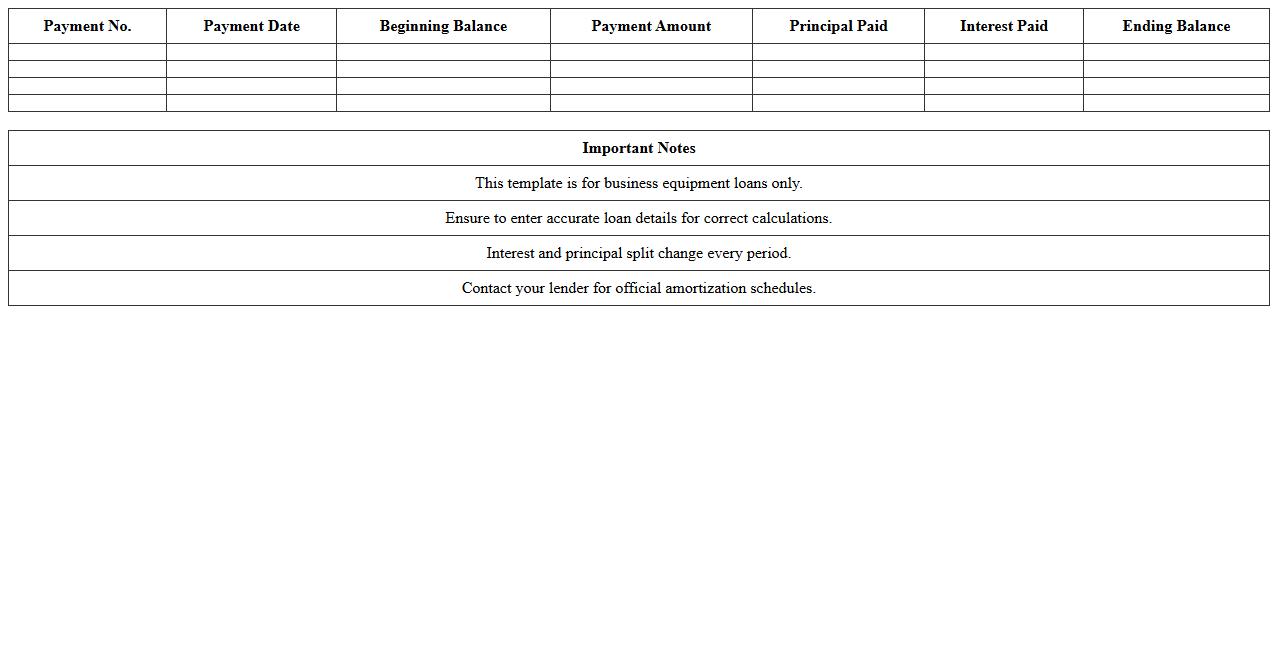

Business Equipment Loan Amortization Excel Template

The

Business Equipment Loan Amortization Excel Template is a specialized spreadsheet designed to calculate and schedule loan repayments for business equipment purchases. It provides detailed insights into principal and interest breakdowns, enabling accurate financial planning and budget management. Utilizing this template helps businesses track payment progress, forecast cash flow, and optimize loan terms efficiently.

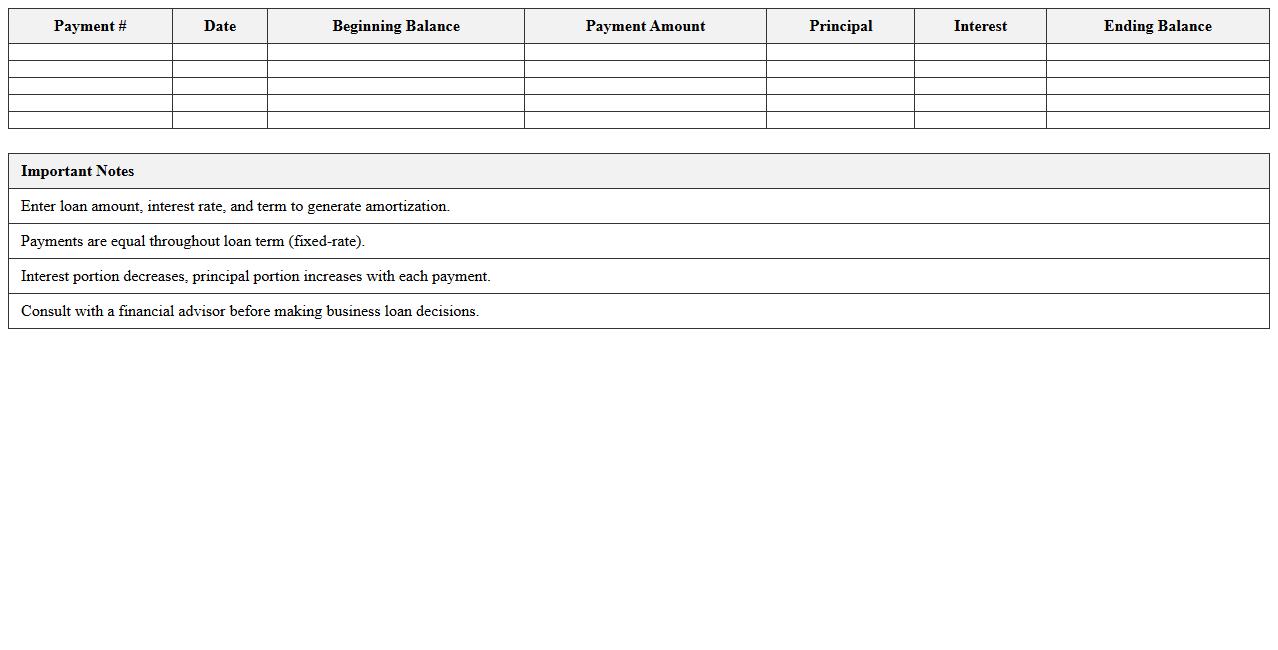

Fixed-Rate Business Loan Amortization Excel Spreadsheet

A

Fixed-Rate Business Loan Amortization Excel Spreadsheet is a financial tool designed to calculate and display the repayment schedule of a business loan with a constant interest rate over time. It provides detailed insights into each payment's principal and interest components, enabling precise budgeting and cash flow management. This spreadsheet is useful for business owners to forecast loan costs, plan repayments, and ensure timely debt servicing, enhancing financial decision-making.

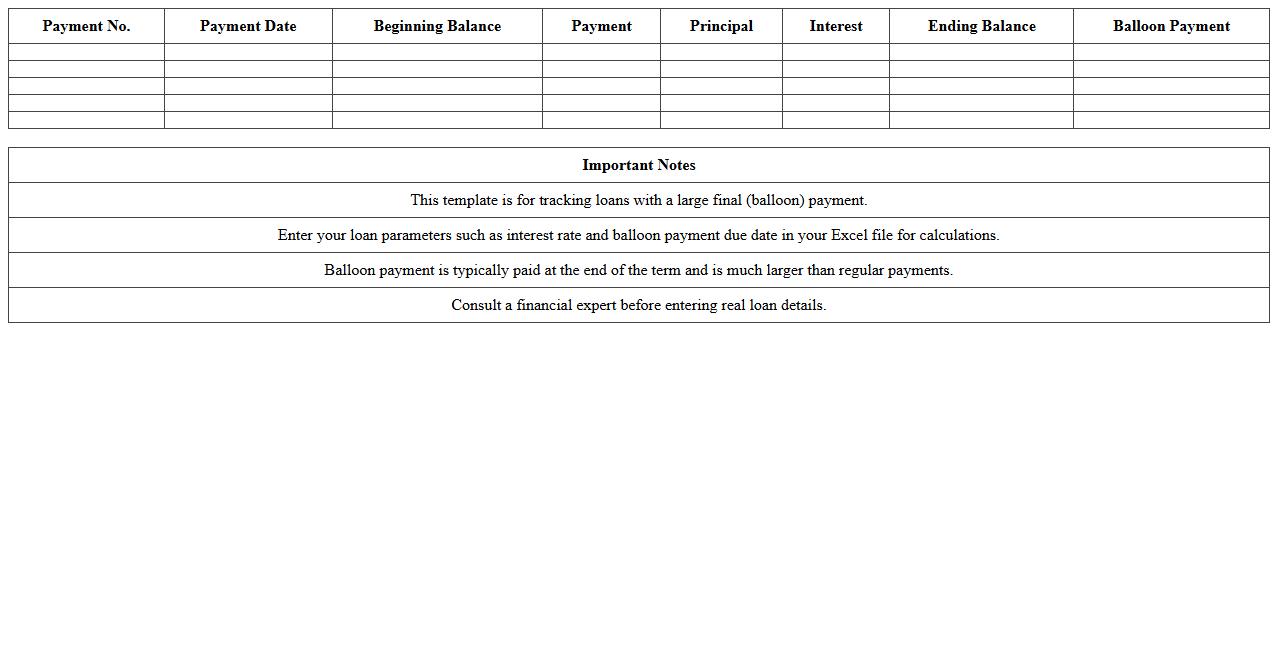

Balloon Payment Loan Amortization Excel Template

A

Balloon Payment Loan Amortization Excel Template is a spreadsheet designed to calculate and display the repayment schedule for loans with a large final payment, known as the balloon payment. It helps users understand the breakdown of principal and interest payments over the loan term, highlighting the remaining balance due at the end. This template is useful for financial planning, ensuring borrowers are aware of payment timelines and can prepare for the large final payment effectively.

How can I automate principal and interest breakdowns monthly in my Excel loan amortization sheet?

To automate the principal and interest breakdowns monthly, you can use the IPMT and PPMT functions in Excel. These functions calculate interest and principal portions respectively for each payment period within the loan term. Set these formulas alongside your payment dates to generate an automated breakdown per month.

What Excel formula best handles extra loan repayments in the amortization schedule?

The best way to incorporate extra loan repayments is by adjusting the loan balance and recalculating interest using a SUMPRODUCT or customized amortization formula. Adding extra payments as a separate column allows the formula to subtract this amount from the remaining principal before computing the next period's interest. This dynamic adjustment keeps the projection up to date.

How do I create a dynamic loan summary dashboard for multiple loans in one Excel workbook?

To create a dynamic loan summary dashboard, use Excel features such as PivotTables, slicers, and dynamic named ranges. Combine data from multiple loan sheets into a summary sheet, then apply charts and conditional formatting for visualization. This approach allows interactive updates when loan details change.

Which conditional formatting highlights overdue payments in my loan amortization table?

Use conditional formatting rules with a formula like =AND(TODAY()>DueDateCell, PaymentStatusCell="Unpaid") to highlight overdue payments. This formula checks if the current date exceeds the due date and if payment is marked unpaid. Apply a distinctive fill color to make overdue entries stand out.

How can small business owners track remaining loan balance projections graphically in Excel?

Small business owners can visualize remaining loan balance projections by creating line or bar charts based on the amortization schedule's remaining balance column. Use dynamic chart ranges linked to payment periods for automatic updates. This graphical representation simplifies monitoring loan payoff progress over time.

More Calculation Excel Templates