The Loan Repayment Calculation Excel Template for Small Businesses simplifies tracking and managing loan payments by providing a clear breakdown of principal, interest, and remaining balance. It allows small business owners to customize loan terms, payment schedules, and interest rates for accurate financial planning. This template enhances cash flow management and supports informed decision-making for timely loan repayments.

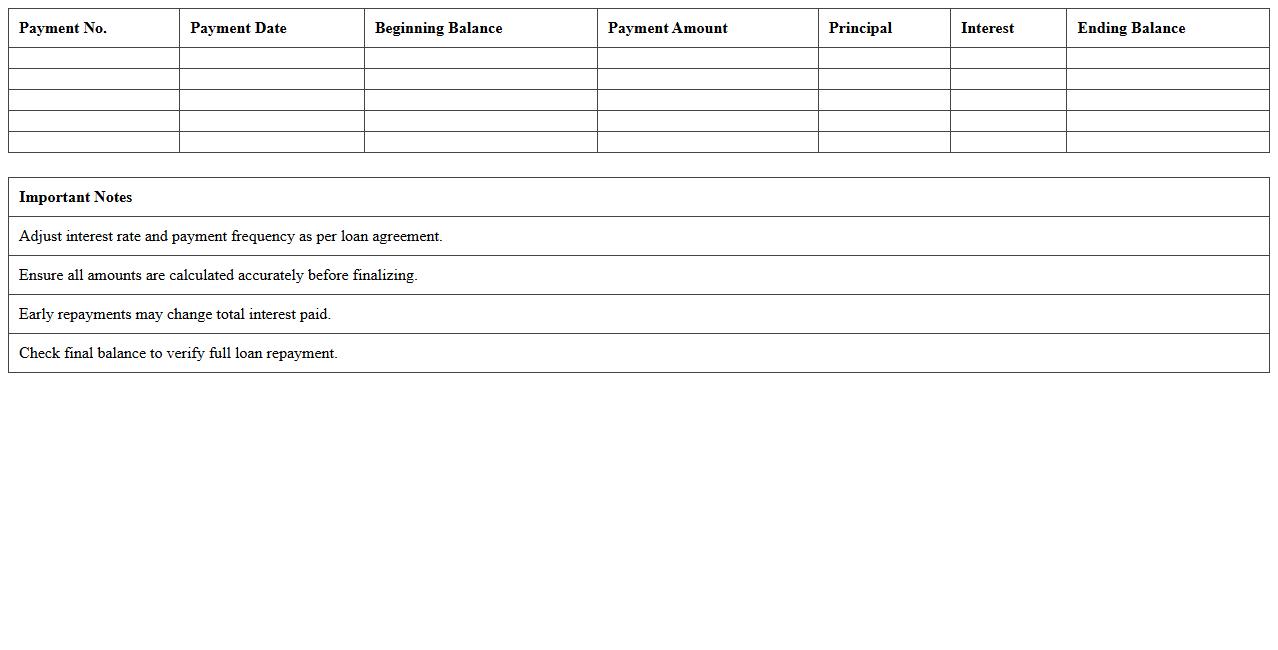

Simple Loan Repayment Schedule Excel Template

The

Simple Loan Repayment Schedule Excel Template is a structured spreadsheet designed to track loan payments, interest calculations, and remaining balances over time. It helps users organize repayment timelines clearly, ensuring accurate financial planning and budgeting. By automating calculations, it reduces errors and saves time while providing a comprehensive overview of loan obligations.

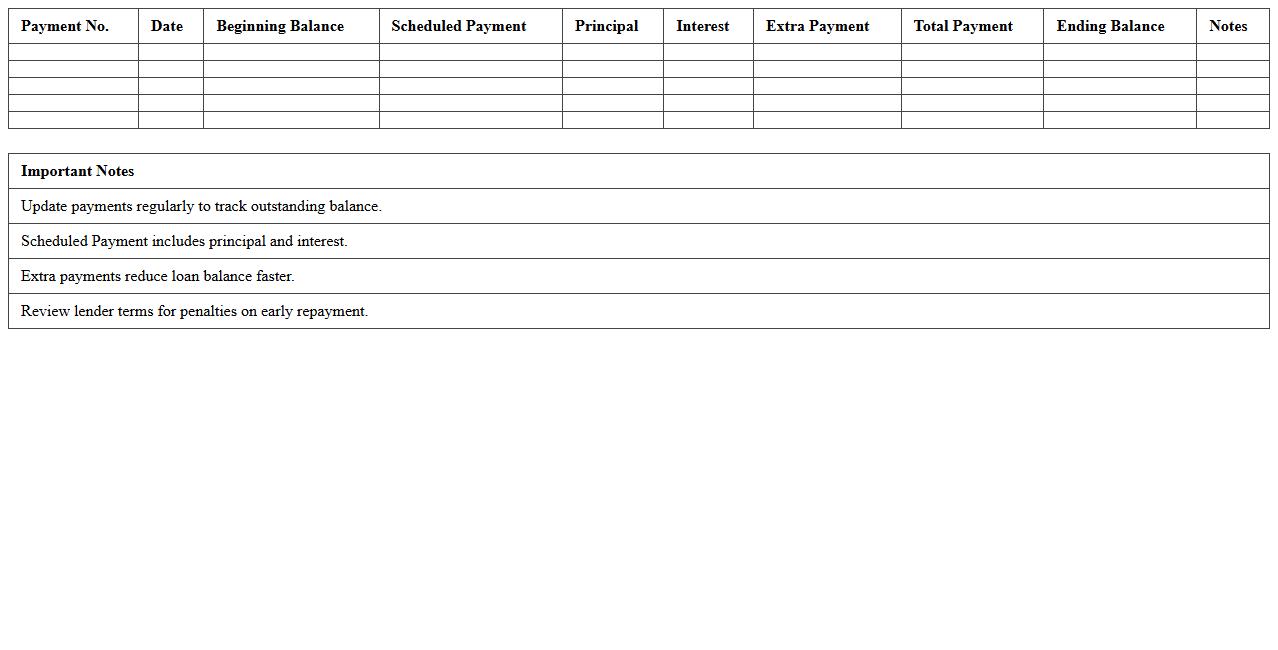

Small Business Loan Amortization Tracker

A

Small Business Loan Amortization Tracker document outlines the detailed schedule of loan repayments, showing principal and interest amounts for each payment period. This tracker helps business owners monitor outstanding balances, manage cash flow efficiently, and plan future financial commitments by providing clear visibility into loan repayment progress. Using this document reduces the risk of missed payments and supports strategic decision-making in small business finance management.

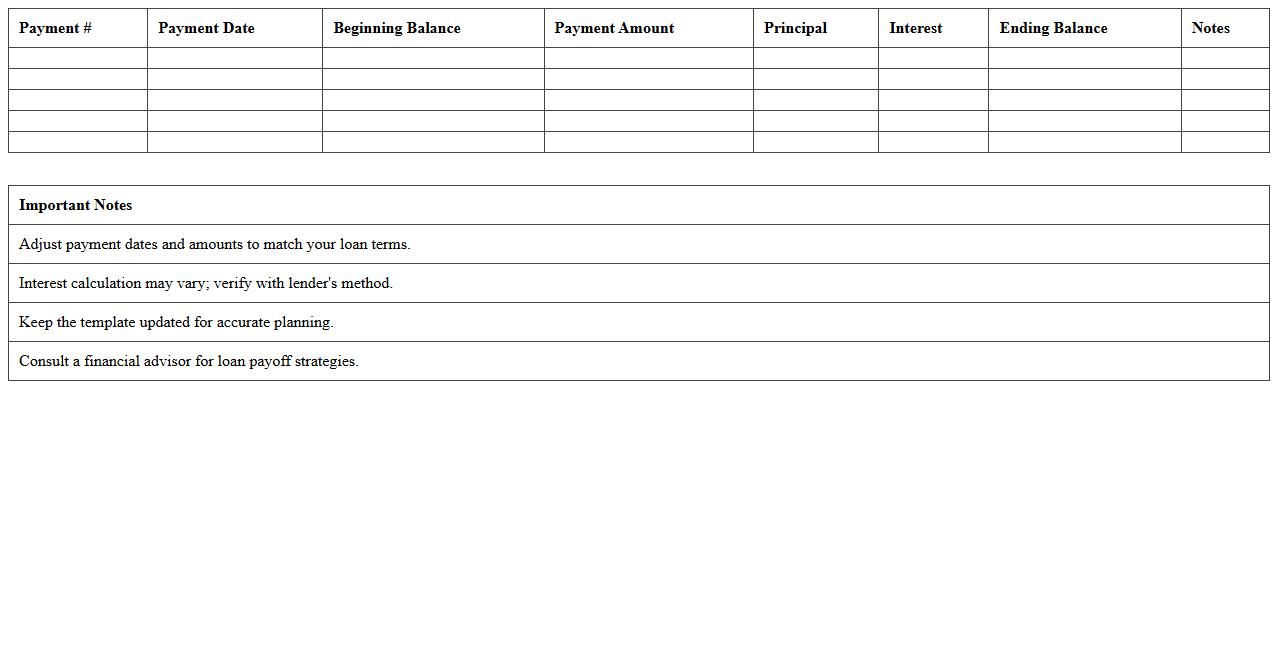

Business Loan Payment Calendar Spreadsheet

A

Business Loan Payment Calendar Spreadsheet is a structured document that tracks loan repayment schedules, including due dates, amounts, and interest rates. It helps businesses manage cash flow efficiently by providing a clear overview of upcoming payments and avoiding late fees. This tool is essential for maintaining financial discipline and ensuring timely compliance with loan agreements.

Excel Template for Small Business Loan Repayment Planner

An

Excel Template for Small Business Loan Repayment Planner is a structured spreadsheet designed to track and manage loan repayment schedules efficiently. It helps small business owners forecast payment dates, calculate interest, and monitor outstanding balances to ensure timely repayments. This tool enhances financial planning, reduces errors, and supports better cash flow management by providing clear visual summaries and customizable payment scenarios.

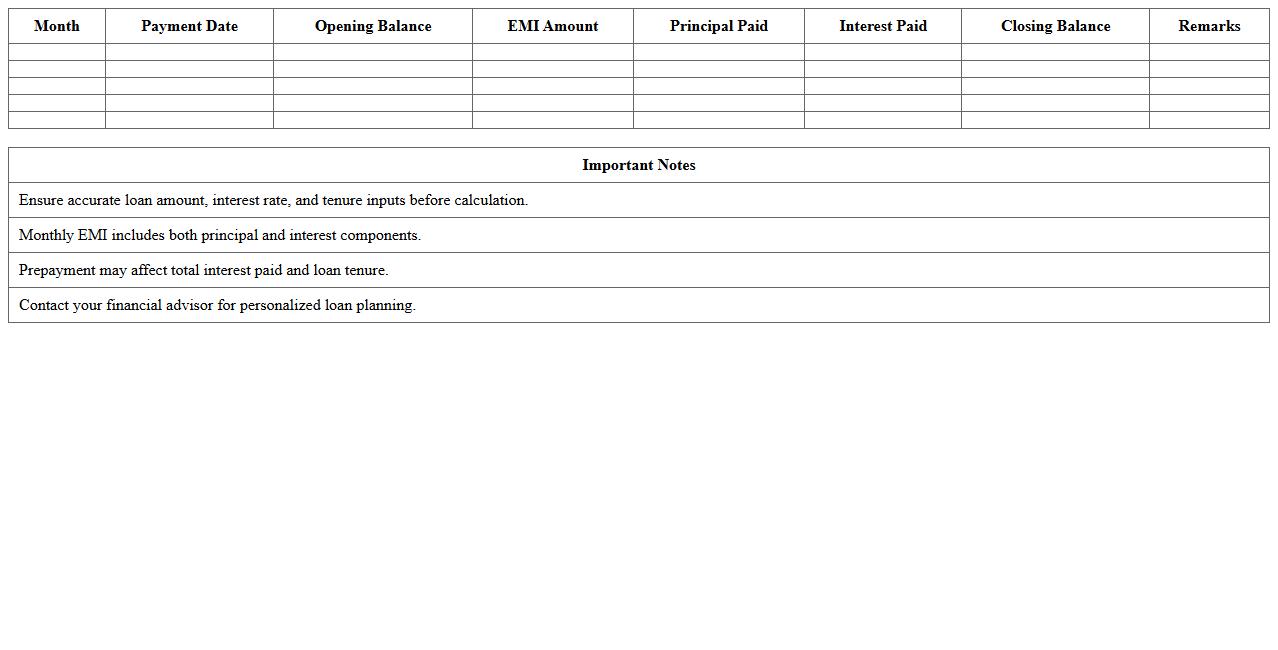

Monthly Installment Tracker for Business Loans

A

Monthly Installment Tracker for Business Loans document systematically records each loan payment, including principal and interest amounts, payment dates, and remaining balances. This tool helps businesses maintain accurate financial records, ensure timely payments, and manage cash flow effectively, preventing missed or late installments that could impact credit scores. By providing a clear overview of repayment progress, it supports better budgeting and financial planning for sustained business growth.

Small Enterprise Loan Interest & Principal Calculator

A

Small Enterprise Loan Interest & Principal Calculator document is a financial tool designed to accurately compute the interest and principal repayment amounts for business loans. This calculator helps entrepreneurs plan their loan repayments by breaking down monthly installments into interest and principal components, ensuring precise budgeting and cash flow management. Using this document reduces the risk of miscalculating payments and supports informed decision-making for loan management and financial forecasting.

Business Loan Balance Reduction Tracker Template

A

Business Loan Balance Reduction Tracker Template is a structured document designed to monitor and manage the repayment progress of business loans by recording principal amounts, interest rates, payments made, and remaining balances. This template helps businesses maintain clear visibility over their financial obligations, enabling more effective cash flow management and strategic planning to reduce debt faster. It serves as a vital tool for financial accountability and ensures timely loan repayments, ultimately improving creditworthiness and financial stability.

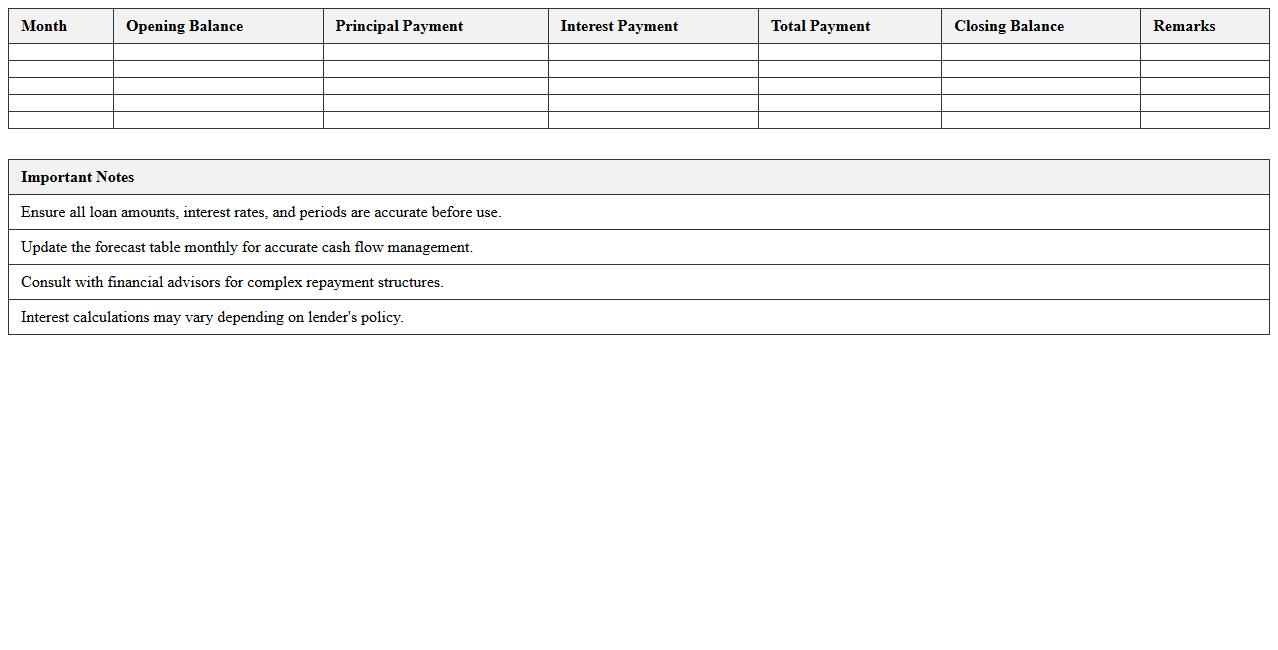

Loan Repayment Forecast Excel Sheet for SMEs

A

Loan Repayment Forecast Excel Sheet for SMEs is a tool that helps small and medium-sized enterprises project their future loan payments, including principal and interest amounts. It enables businesses to plan cash flow effectively by outlining payment schedules, interest rates, and loan terms in a clear, organized format. This document is crucial for managing financial obligations, ensuring timely repayments, and maintaining a healthy credit profile.

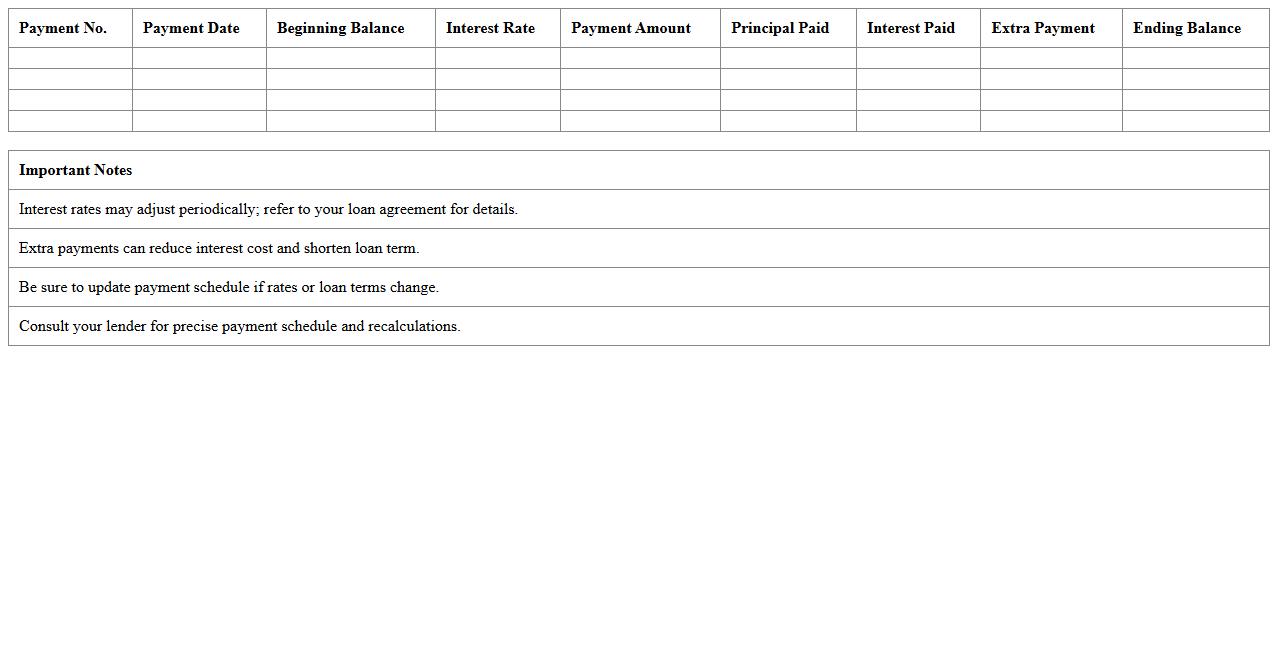

Adjustable Loan Payment Breakdown Excel Template

The

Adjustable Loan Payment Breakdown Excel Template is a comprehensive spreadsheet designed to help users calculate and visualize loan payments, including principal, interest, and remaining balance. It allows for easy adjustments of interest rates, loan terms, and payment amounts to see how changes impact monthly payments and overall loan costs. This tool is invaluable for financial planning, enabling users to manage debt more effectively and make informed decisions about loan repayment strategies.

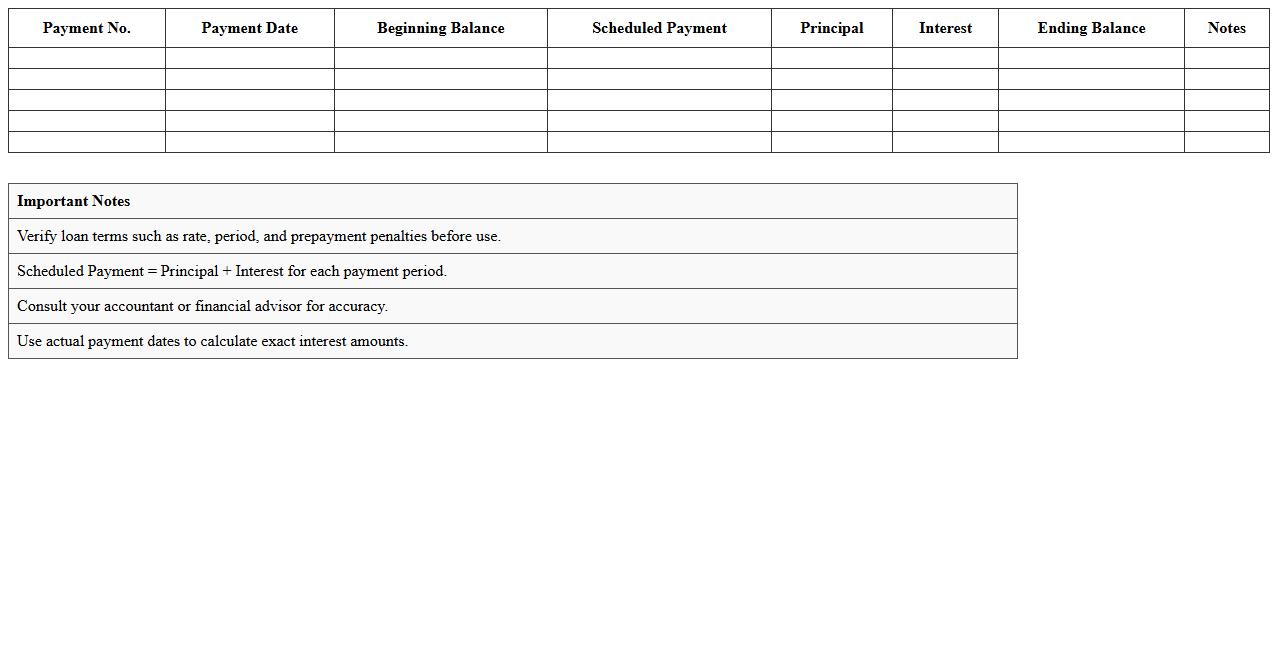

Business Loan Principal and Interest Schedule Worksheet

A

Business Loan Principal and Interest Schedule Worksheet is a detailed document that outlines the repayment plan for a business loan, breaking down each payment into principal and interest components over the loan term. This worksheet is essential for tracking payment amounts, due dates, and how much of each payment reduces the loan balance versus interest expenses. It enables businesses to manage cash flow effectively, plan for future expenses, and maintain accurate financial records for loan servicing and accounting purposes.

What Excel formulas optimize loan amortization schedules for small business repayments?

The PMT formula is essential for calculating periodic loan payments based on interest rates, loan terms, and principal amounts. Combining PMT with IPMT and PPMT formulas enables precise breakdowns of interest and principal components of each payment. Using these formulas together helps small businesses create accurate and optimized loan amortization schedules for effective repayment tracking.

How can small businesses automate late fee calculations in Excel loan spreadsheets?

Small businesses can use the IF function to check if payments are past due dates and apply a specified late fee accordingly. The DATEDIF function can calculate the number of days overdue to scale late fees based on delay length. Automating late fee calculations with these Excel formulas reduces manual errors and ensures consistent enforcement of repayment terms.

What Excel templates track variable interest rates for small business loans?

Excel templates designed for variable interest rate tracking typically include linked fields for interest rates that update based on benchmark indices, such as LIBOR or prime rate. They utilize dynamic formulas like INDEX and MATCH to pull corresponding rates over time into loan schedules. These templates allow small businesses to monitor how rate fluctuations affect loan balances and payment amounts.

How do you forecast cash flow impact of loan repayments in Excel for SMBs?

Forecasting cash flow impact involves integrating loan payment schedules into broader cash flow models using Excel's SUMIF and FORECAST functions. This approach helps project future outflows related to loan repayments and assess their effect on operational liquidity. Small businesses can optimize budgeting and strategic planning by visualizing the timing and magnitude of repayments within cash flow statements.

What are best practices for reconciling loan payment records in Excel for small businesses?

Best practices include maintaining a centralized ledger with consistent payment entries and cross-referencing them against bank statements using VLOOKUP or XLOOKUP. Regular reconciliation helps identify discrepancies early and ensures accurate financial reporting. Employing data validation rules further enhances data integrity in loan repayment tracking sheets.

More Calculation Excel Templates