The Mortgage Payment Calculation Excel Template for First-Time Homebuyers simplifies budgeting by allowing users to input loan amount, interest rate, and term to generate accurate monthly payment estimates. This user-friendly tool helps first-time buyers understand their financial commitments and plan accordingly without complex calculations. It also provides amortization schedules that break down principal and interest payments over the life of the loan.

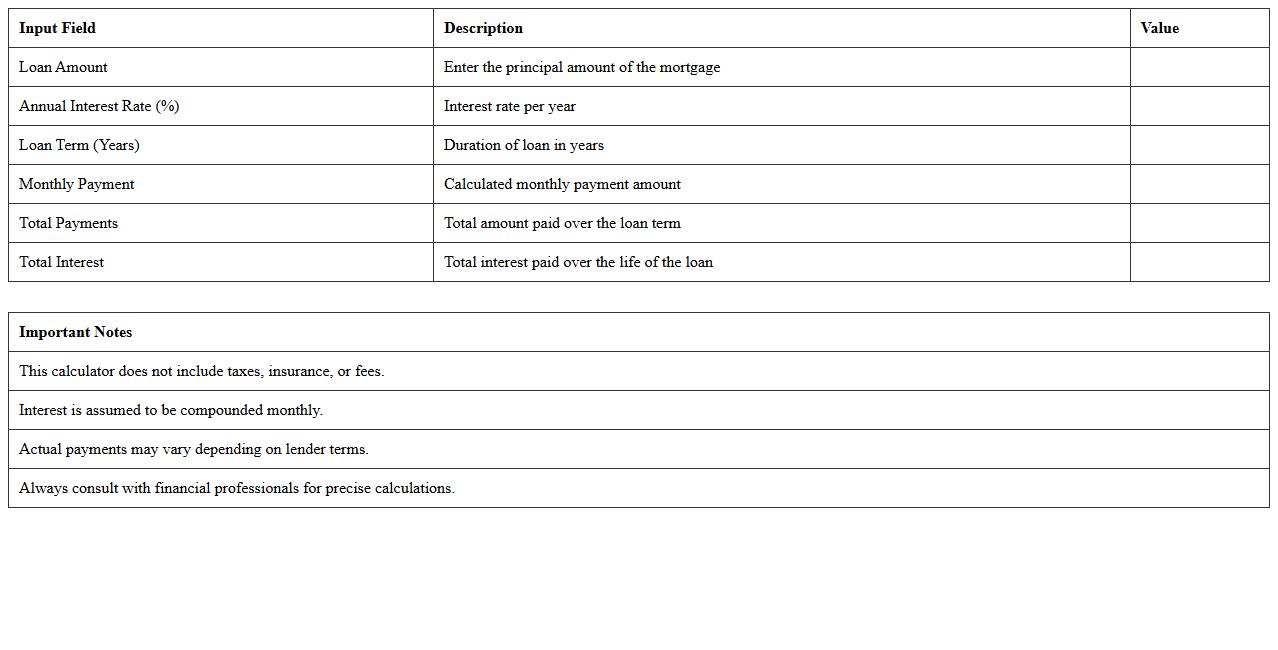

Simple Mortgage Payment Calculator Spreadsheet

A

Simple Mortgage Payment Calculator Spreadsheet is a digital tool designed to help users estimate their monthly mortgage payments by inputting loan amount, interest rate, and loan term. This spreadsheet simplifies complex financial calculations, enabling better budgeting and financial planning. It is useful for potential homeowners, real estate investors, and financial advisors to quickly assess affordability and make informed decisions.

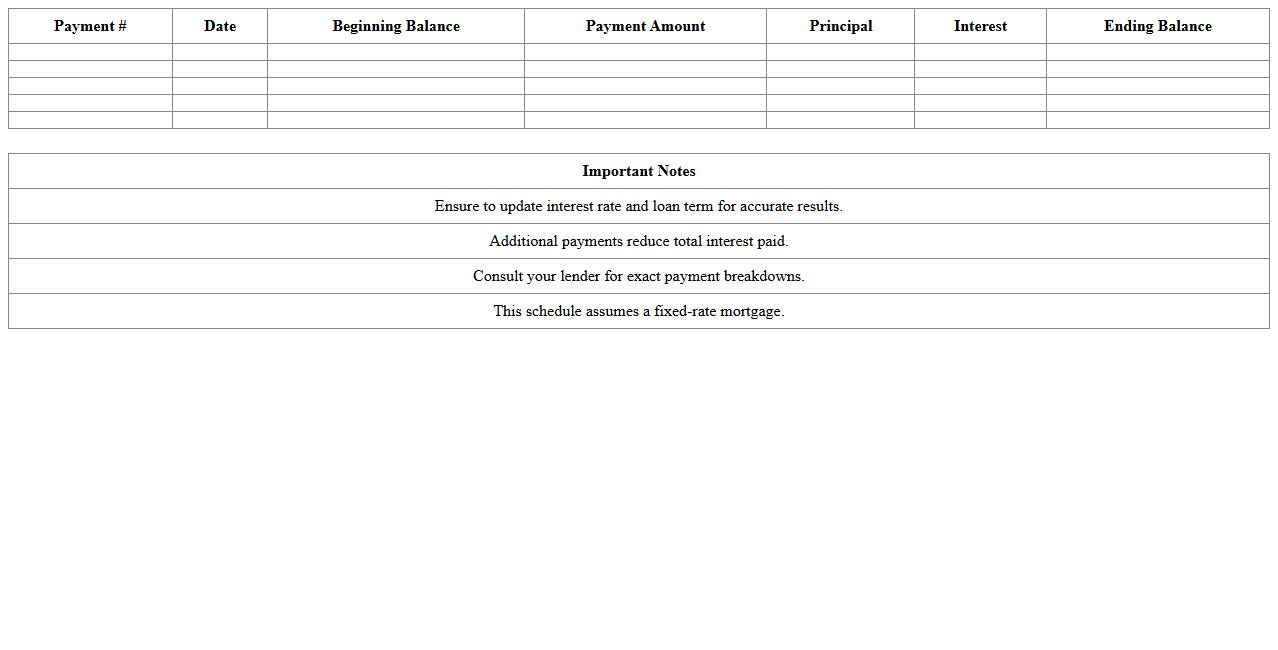

First-Time Homebuyer Amortization Schedule Template

A

First-Time Homebuyer Amortization Schedule Template is a detailed financial document that outlines the breakdown of each mortgage payment, showing the portion that goes toward principal and interest over time. This template helps first-time buyers understand their repayment plan, track loan progress, and forecast future payments accurately. It is useful for budgeting, managing finances, and making informed decisions about loan refinancing or early repayment.

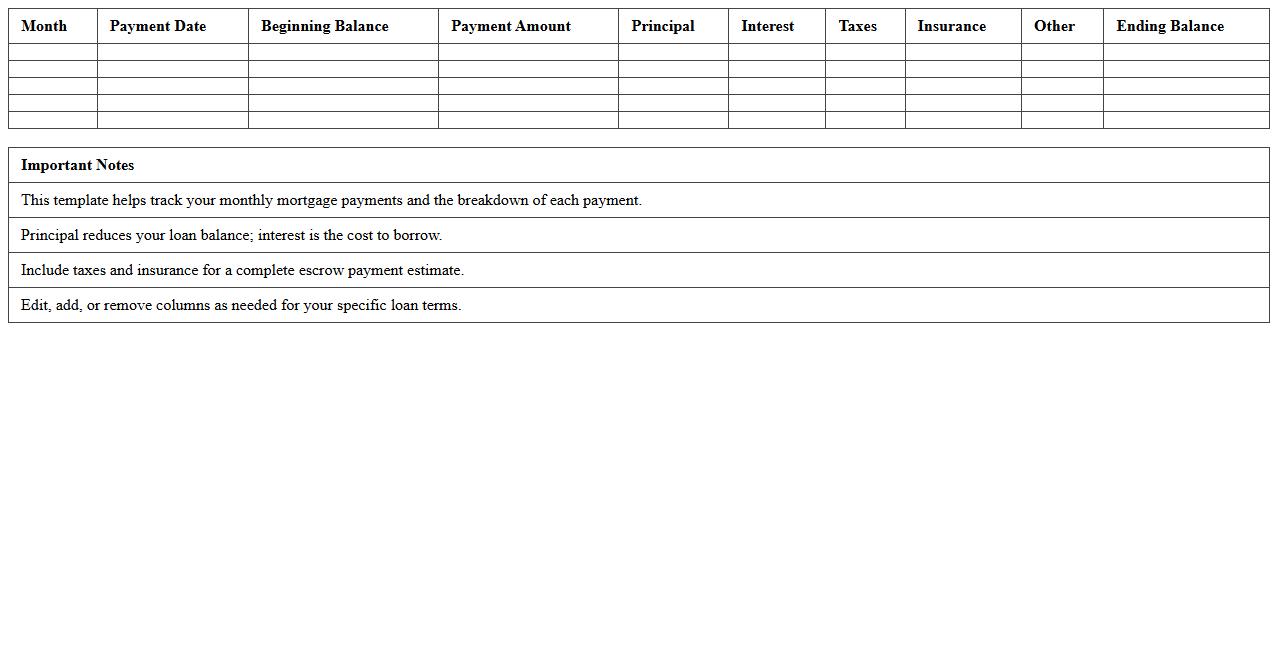

Monthly Mortgage Payment Breakdown Excel Sheet

A

Monthly Mortgage Payment Breakdown Excel Sheet document provides a detailed analysis of principal, interest, taxes, and insurance components in each mortgage payment. This tool helps homeowners track the allocation of their payments over time, facilitating better financial planning and budget management. By visualizing amortization schedules, users can make informed decisions about refinancing or extra payments to reduce loan duration and interest costs.

Home Loan Principal & Interest Tracker

A

Home Loan Principal & Interest Tracker document helps borrowers monitor the repayment progress of their mortgage by detailing the amounts paid toward the principal and the interest over time. It enables users to visualize how much of their monthly payments reduce the loan balance versus the cost of borrowing, aiding in effective financial planning and loan management. This tracking tool is useful for identifying opportunities to make additional principal payments that can shorten the loan tenure and reduce overall interest expenses.

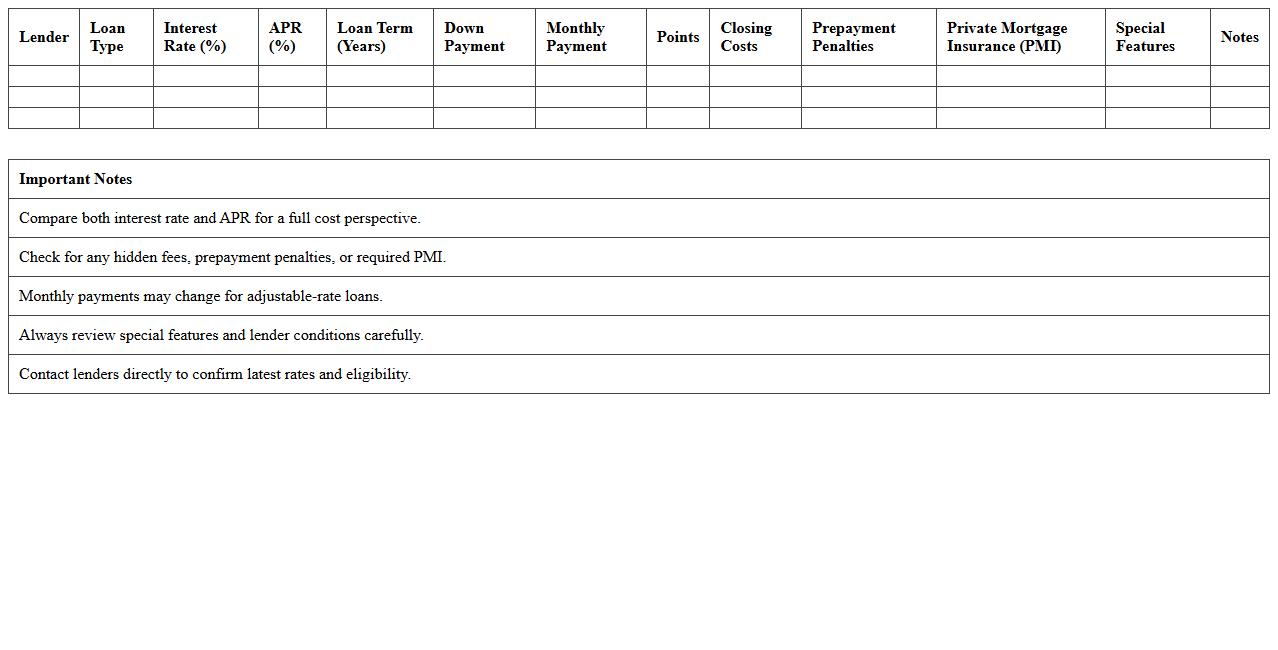

Basic Mortgage Comparison Chart for New Buyers

The

Basic Mortgage Comparison Chart for new buyers is a structured tool that outlines various mortgage options, highlighting key features such as interest rates, loan terms, and payment schedules. This document enables prospective homeowners to easily compare and analyze different mortgage plans, aiding in informed decision-making. It reduces confusion by presenting essential loan data side-by-side, ensuring clarity on financial commitments before purchasing a property.

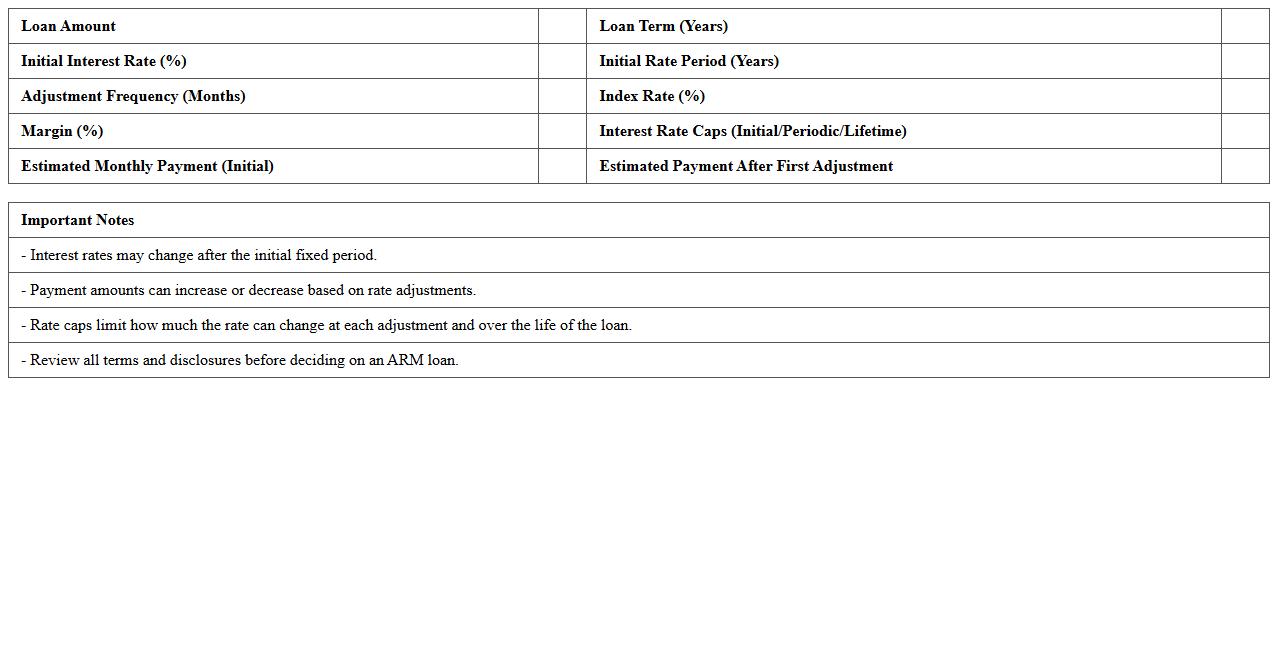

Adjustable Rate Mortgage Estimator Excel

An

Adjustable Rate Mortgage Estimator Excel document is a financial tool designed to calculate and project the fluctuating interest rates and monthly payments of adjustable-rate mortgages (ARMs). It helps homeowners and potential buyers understand how changes in the index rate and margin can affect their mortgage costs over time, enabling better budgeting and informed decision-making. By providing visual charts and detailed amortization schedules, this estimator simplifies complex calculations and enhances mortgage planning accuracy.

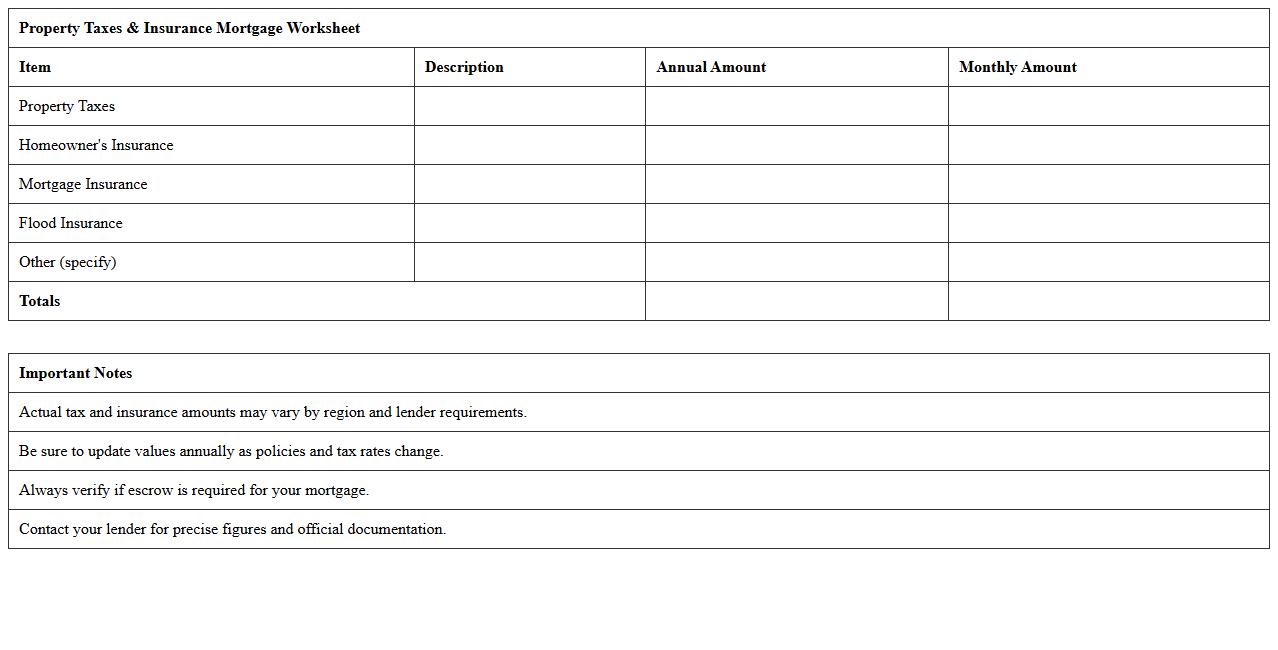

Property Taxes & Insurance Mortgage Worksheet

The

Property Taxes & Insurance Mortgage Worksheet is a detailed financial tool that helps homeowners estimate and organize their monthly mortgage expenses by including property taxes and insurance costs. This worksheet allows users to accurately budget for all homeownership-related payments, ensuring there are no surprises in mortgage affordability. By providing a clear breakdown of these fees, it aids in effective financial planning and loan qualification processes.

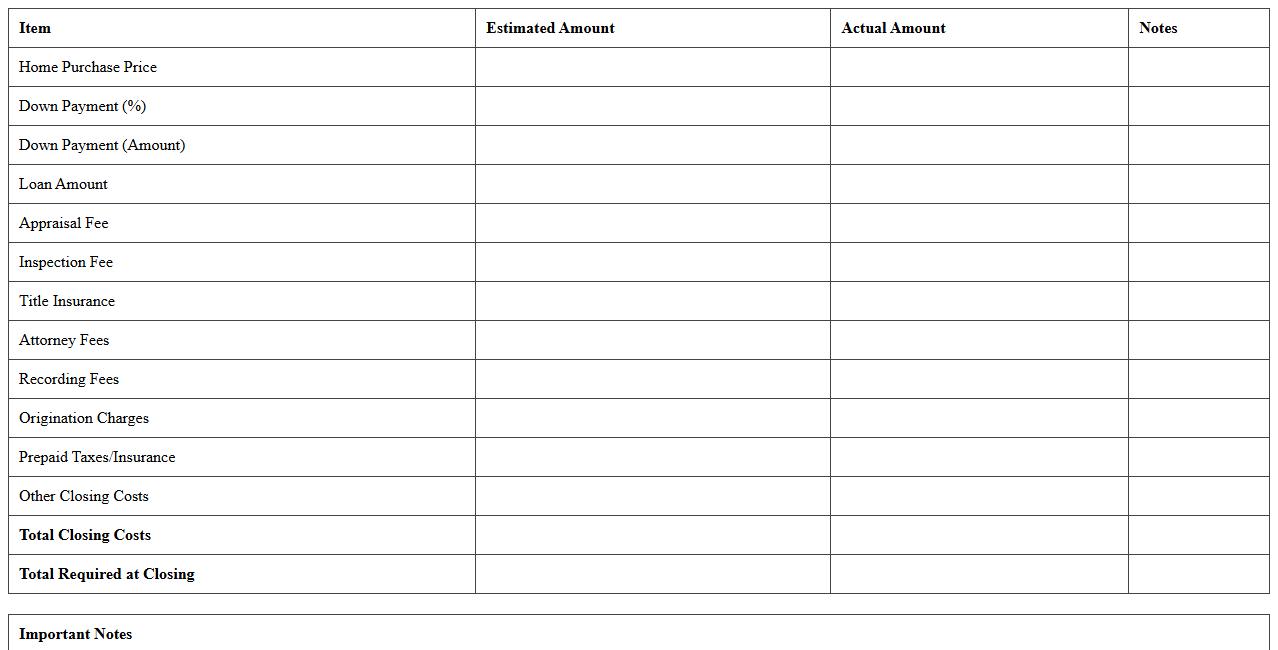

Down Payment and Closing Costs Planner Template

A

Down Payment and Closing Costs Planner Template is a financial tool designed to help individuals accurately estimate and organize the funds needed for a home purchase. It breaks down essential expenses such as the down payment amount, lender fees, taxes, and other closing costs, providing a clear overview of total upfront costs. Using this template enhances budgeting precision and ensures buyers are financially prepared for the home-buying process.

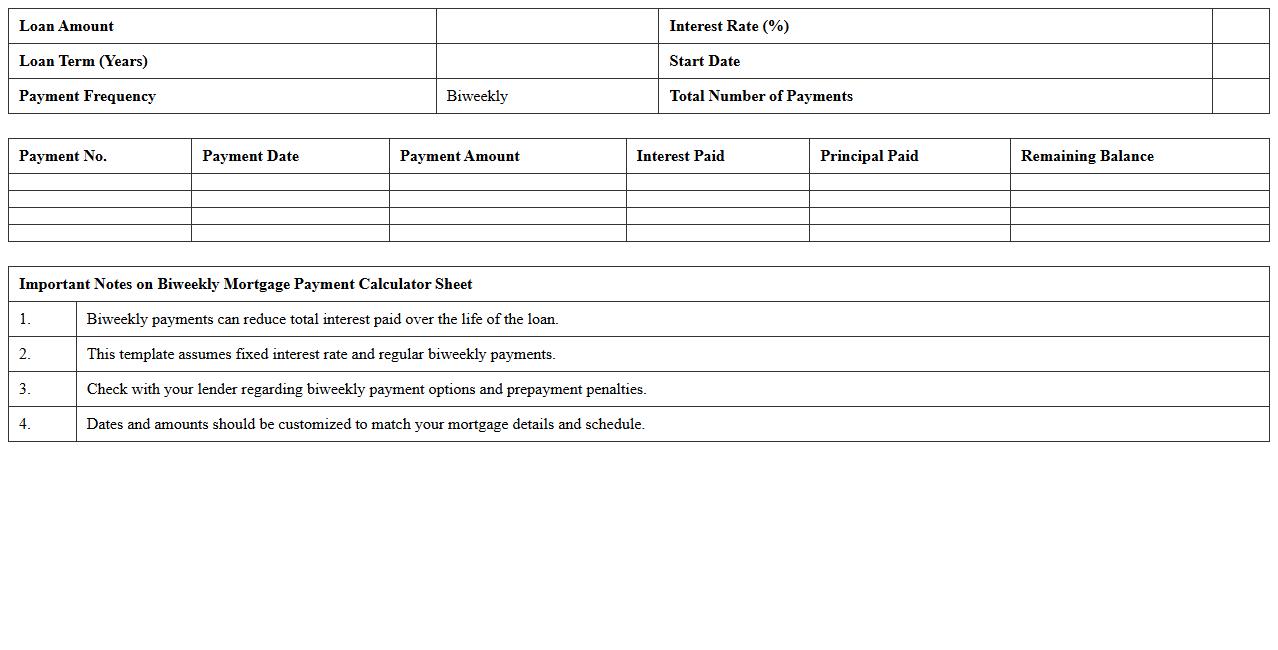

Biweekly Mortgage Payment Calculator Sheet

A

Biweekly Mortgage Payment Calculator Sheet document helps homeowners calculate the impact of making payments every two weeks instead of monthly, enabling faster loan payoff and interest savings. By breaking down payment schedules, it provides clear insights into reducing mortgage term and total interest paid over the life of the loan. This tool empowers borrowers to create a strategic payment plan, improving financial management and long-term savings.

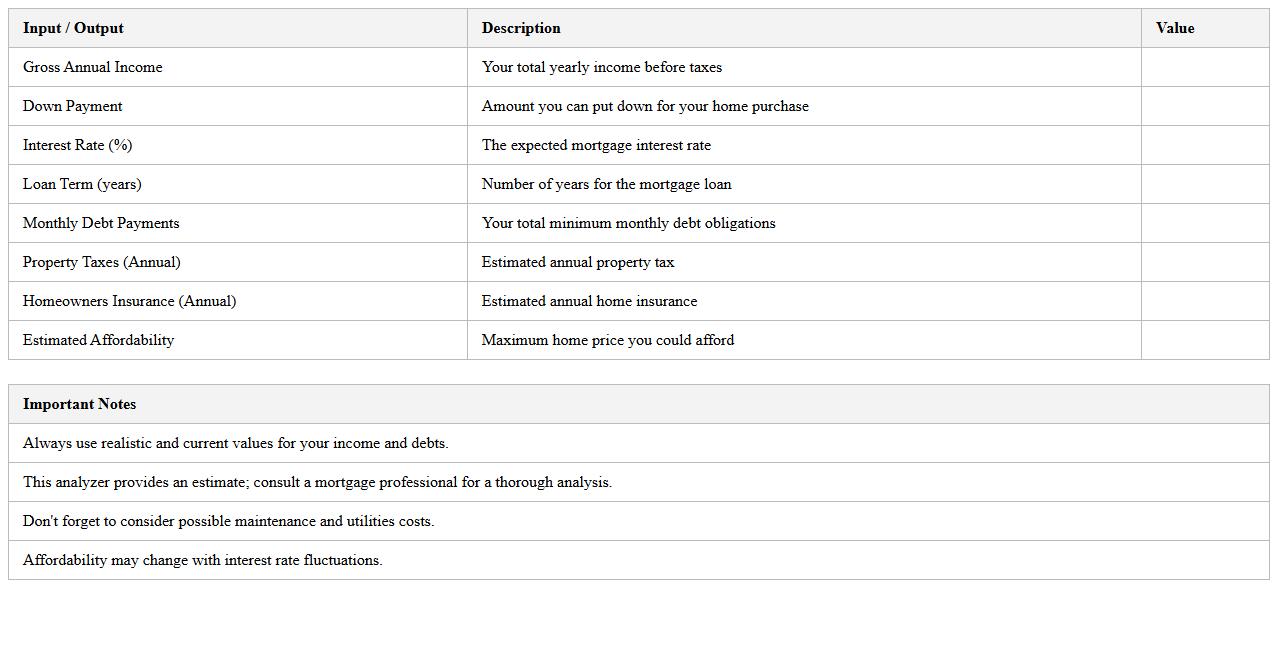

Mortgage Affordability Analyzer for First-Time Buyers

The

Mortgage Affordability Analyzer for First-Time Buyers is a comprehensive tool designed to evaluate an individual's financial capacity to purchase a home by assessing income, expenses, credit score, and debt levels. It helps users understand realistic mortgage options and monthly payment thresholds, enabling informed decisions and preventing overextension. By providing detailed insights into affordability, this document simplifies budgeting and supports successful homeownership planning.

How to set up PMI (Private Mortgage Insurance) calculations in a mortgage payment Excel sheet?

Setting up PMI calculations requires you to input the loan amount, PMI rate, and loan term in Excel. Use the formula =LoanAmount * PMI_Rate / 12 to calculate the monthly PMI premium. Add this premium to your monthly mortgage payment to reflect the total payment accurately.

What Excel formula accurately splits principal and interest in each monthly mortgage payment?

To split principal and interest, use the IPMT and PPMT functions in Excel. These formulas calculate the interest portion with =IPMT(rate, period, nper, pv) and the principal portion with =PPMT(rate, period, nper, pv). Ensure the rate and periods match your loan terms for precise monthly breakdowns.

How to automate extra payment scenarios and their impact on total interest paid in Excel?

To automate extra payments, create an input for additional monthly amounts and add it to your principal payment calculation. Use a dynamic table to recalculate loan balance and interest reduction after each payment. This approach provides a clear visual and numerical representation of interest savings over time.

Which Excel chart best visualizes amortization schedules for first-time homebuyers?

The stacked area chart is ideal for visualizing amortization schedules, showing the split between principal and interest over time. It helps users easily understand how each payment contributes to loan payoff. This chart type highlights the decreasing interest portion and increasing principal proportion clearly.

How to include property tax and homeowners insurance in total monthly payment calculation?

Include property tax and homeowners insurance by dividing their annual amounts by 12 and adding the result to your monthly mortgage payment. Use a formula like =MonthlyMortgage + PropertyTax/12 + Insurance/12. This gives a comprehensive view of total monthly housing costs in your Excel sheet.

More Calculation Excel Templates