The Compound Interest Calculation Excel Template for Investors simplifies the process of tracking and projecting investment growth over time. It allows investors to input principal amounts, interest rates, and compounding frequency to generate accurate forecasts. This tool enhances financial planning by providing clear, customizable charts and tables for better investment decisions.

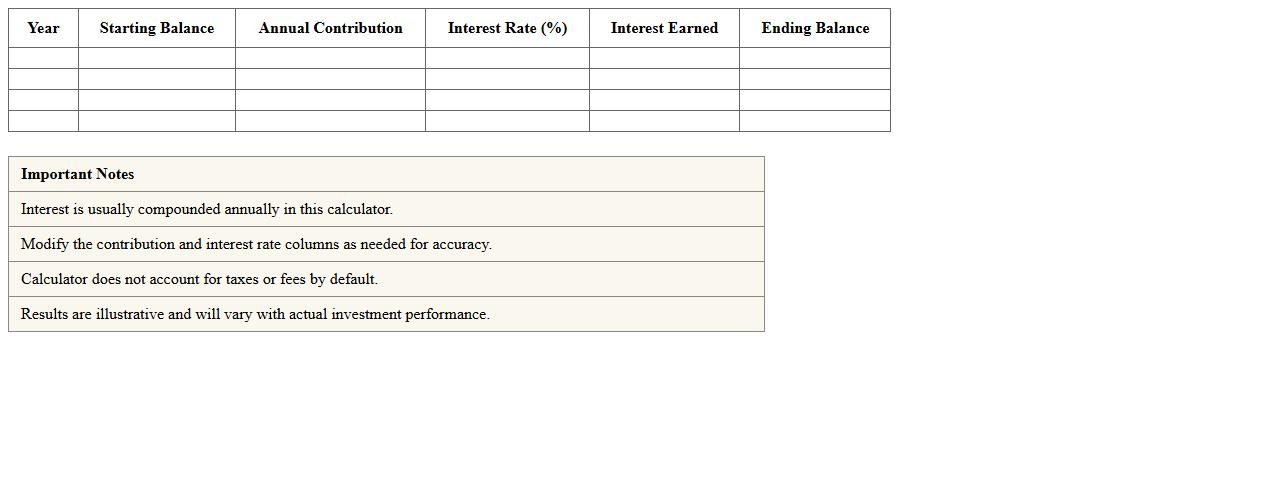

Monthly Compound Interest Tracker Excel Template

The

Monthly Compound Interest Tracker Excel Template is a powerful tool designed to calculate and monitor the growth of investments or savings with compound interest applied on a monthly basis. It allows users to input principal amounts, interest rates, and time periods to generate detailed reports on accumulated interest and total balances over time. This template is useful for personal finance management, enabling individuals to visualize financial growth and make informed decisions about their investments.

Yearly Investment Growth Calculator Spreadsheet

A

Yearly Investment Growth Calculator Spreadsheet is a dynamic tool designed to project the growth of investments over time by incorporating variables such as initial principal, annual contributions, interest rates, and compounding frequency. This calculator enables users to visualize potential financial outcomes, facilitating informed decision-making and strategic planning for long-term wealth accumulation. Utilizing such a spreadsheet helps investors optimize their portfolios, track progress against goals, and adjust their investment strategies based on projected returns and market conditions.

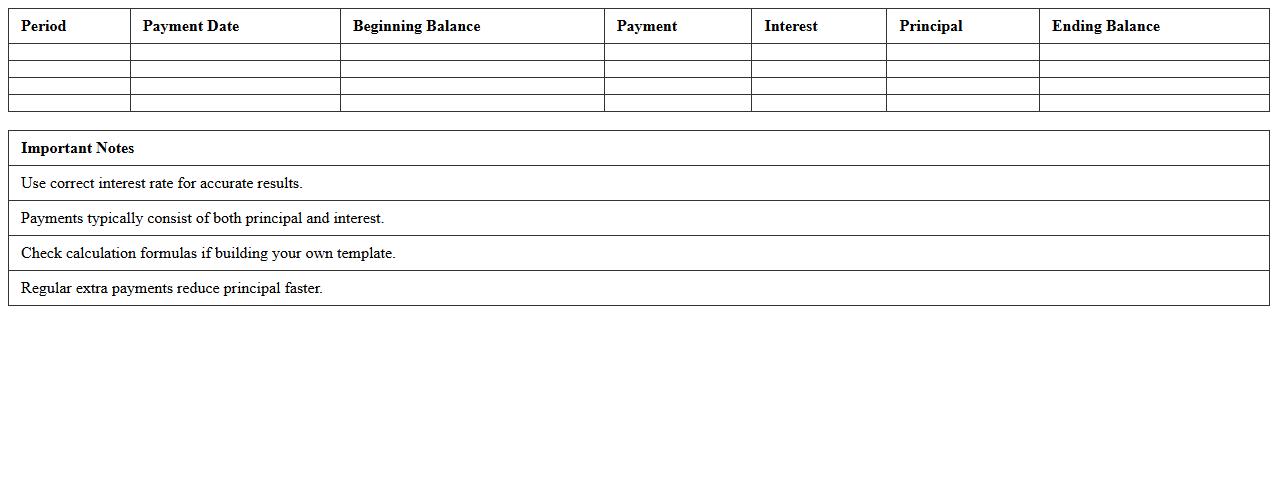

Compound Interest Amortization Table Excel

A

Compound Interest Amortization Table Excel document systematically displays the breakdown of loan payments over time, showing both principal and interest components calculated using compound interest formulas. This tool helps users visualize the gradual reduction of loan balance while accounting for interest accrual compounded periodically, providing clarity on payment schedules and total interest costs. It is useful for personal financial planning, mortgage analysis, and loan management by offering precise insights into repayment timelines and interest savings.

Variable Rate Compound Interest Tracker Sheet

A

Variable Rate Compound Interest Tracker Sheet is a financial tool designed to monitor and calculate interest on investments or loans with fluctuating rates over time. It helps users accurately track how different interest rates impact the growth of their principal amount by applying compound interest formulas for each period. This sheet is useful for budgeting, forecasting investment returns, and making informed decisions based on dynamic interest conditions.

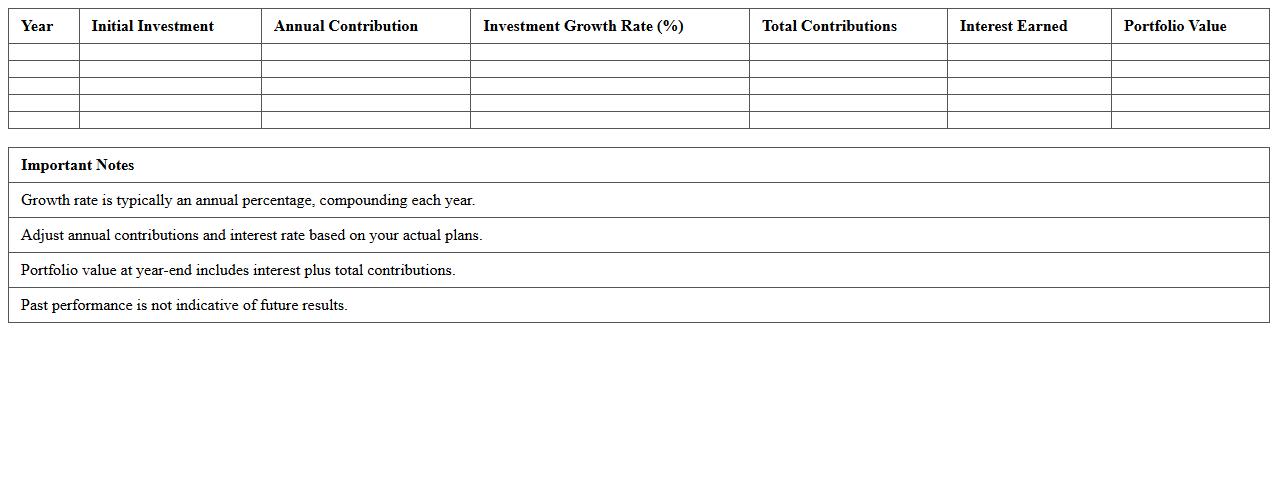

Investment Portfolio Compound Growth Excel

An

Investment Portfolio Compound Growth Excel document is a financial tool designed to calculate and visualize the exponential growth of investments over time by applying compound interest formulas. This spreadsheet enables users to input various parameters such as initial investment, periodic contributions, interest rates, and time horizons, providing a clear projection of portfolio value growth. It is useful for investors to make informed decisions, track progress, and optimize strategies to maximize long-term returns efficiently.

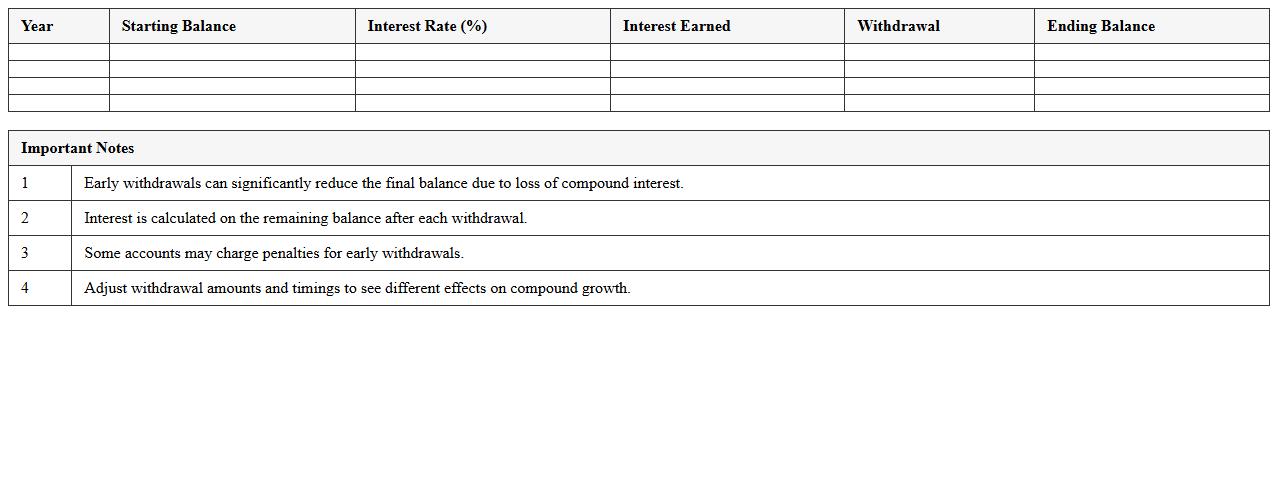

Early Withdrawal Effect Compound Interest Template

The

Early Withdrawal Effect Compound Interest Template document is designed to analyze the impact of withdrawing funds prematurely from an investment or savings account that earns compound interest. It helps users quantify the reduction in future returns due to early withdrawals, demonstrating how compounding growth is affected over time. This template is useful for investors and financial planners to make informed decisions about the timing of withdrawals and to understand the long-term consequences on investment growth.

Goal-Based Compound Interest Planner Spreadsheet

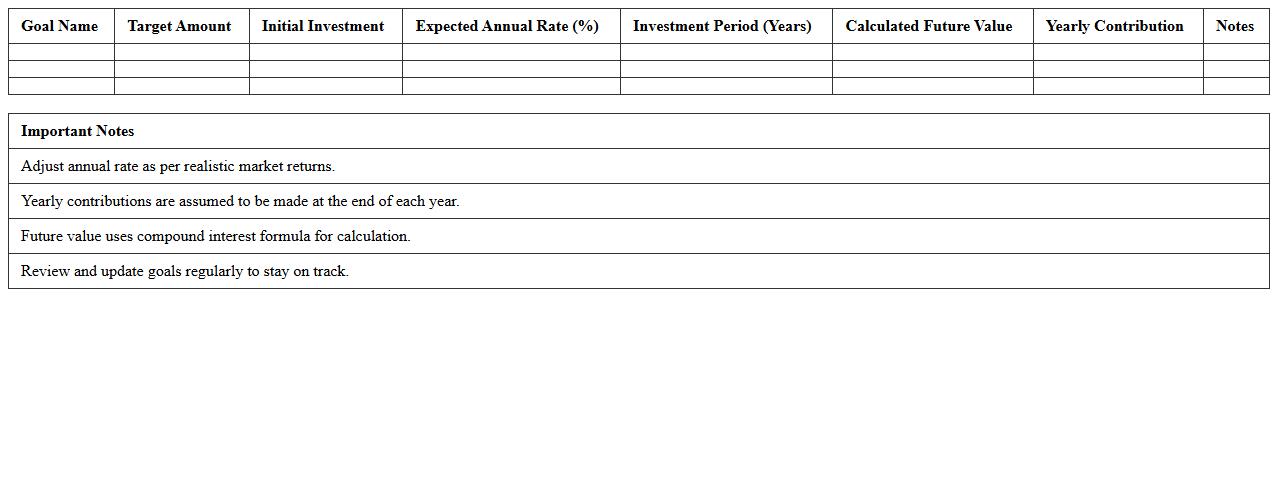

A

Goal-Based Compound Interest Planner Spreadsheet is a financial tool designed to help individuals or businesses project the growth of investments by calculating compound interest over time based on specific savings goals. This spreadsheet allows users to input variables such as initial investment, contribution frequency, interest rate, and time horizon to visualize how their funds can accumulate, making it easier to plan for future financial objectives like retirement, education, or large purchases. By offering clear projections and easy adjustments, the planner enhances informed decision-making and effective wealth management.

Reinvestment Frequency Compound Interest Tracker

The

Reinvestment Frequency Compound Interest Tracker document monitors how often interest earnings are reinvested to maximize growth potential. By accurately tracking reinvestment intervals, it helps investors understand the impact of compounding on their portfolio returns over time. This tool is essential for optimizing investment strategies and making informed financial decisions.

Visual Compound Interest Projection Excel Sheet

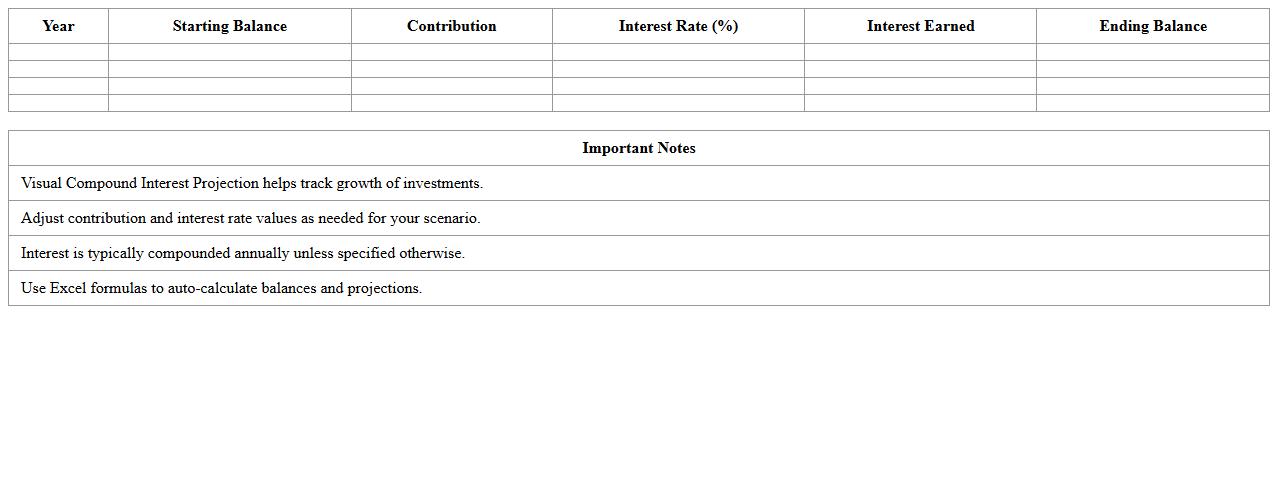

The

Visual Compound Interest Projection Excel Sheet document is a powerful tool that graphically displays the growth of investments over time by calculating compound interest. It helps users easily understand the impact of interest rates, contribution frequency, and investment duration on their savings. This visual aid is essential for financial planning, enabling informed decisions to maximize wealth accumulation efficiently.

Time Horizon Compound Interest Comparison Template

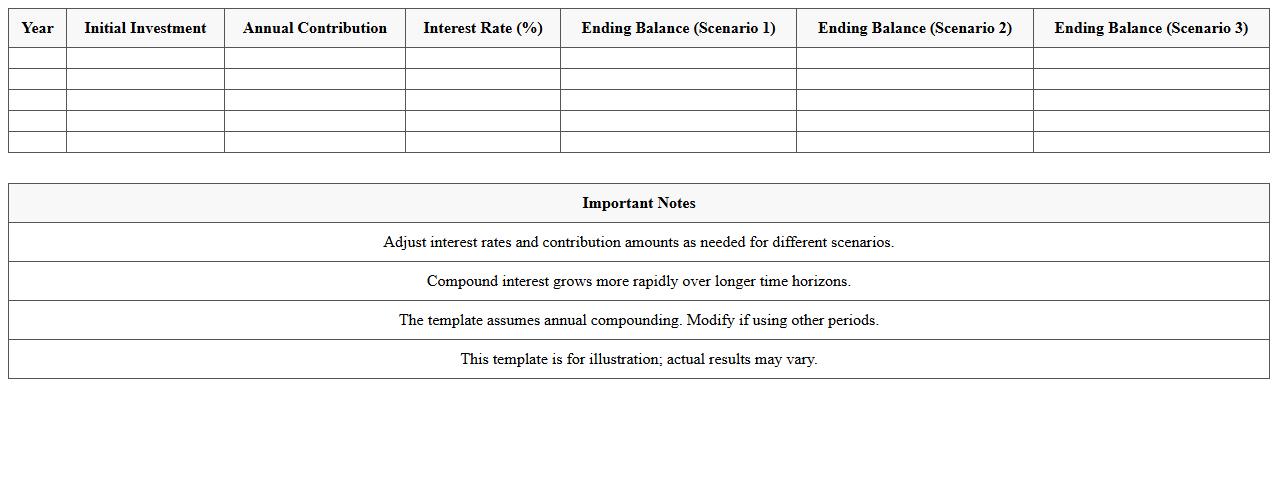

The

Time Horizon Compound Interest Comparison Template document is a tool designed to analyze and compare the growth of investments over varying time periods using compound interest calculations. It allows users to input different principal amounts, interest rates, and compounding frequencies to visualize potential financial outcomes clearly. This template is useful for making informed investment decisions by highlighting how time horizons impact the accumulation of wealth.

How do I automate quarterly compounding in an Excel compound interest template for investors?

To automate quarterly compounding in Excel, use the formula involving the interest rate divided by 4 and multiply the number of periods by 4. Apply the formula =P*(1+r/4)^(4*t), where P is the principal, r is the annual interest rate, and t is the time in years. This ensures the interest compounds exactly every quarter without manual adjustments.

What Excel formula best tracks reinvested interest for monthly investment schedules?

The best formula to track reinvested interest for monthly investments is the compound interest formula with monthly compounding: =P*(1+r/12)^(12*t). This formula updates interest monthly and automatically includes previously earned interest. Combining it with monthly contributions provides an accurate schedule of reinvested returns over time.

How can I visualize compound interest growth using dynamic charts in Excel?

Dynamic charts in Excel can visualize compound interest growth by linking chart data ranges to formulas calculating future investment values. Use an interactive line or area chart to dynamically show growth based on user inputs like interest rate or duration. Incorporating slicers or dropdowns makes the charts responsive to different investment scenarios.

Which Excel functions help compare simple vs. compound interest scenarios for investment analysis?

Excel functions like FV(), PMT(), and customized formulas can effectively compare simple and compound interest scenarios. Use FV(rate, nper, pmt, pv, type) for compound interest and a straightforward calculation (P*r*t) for simple interest. This side-by-side comparison aids investors in understanding the impact of interest compounding over time.

How do I set up variable interest rates for step-up investments in an investor's compound interest letter?

To implement variable interest rates in Excel, use a lookup table combined with the INDEX and MATCH functions reflecting rate changes over time. Apply conditional formulas to modify the rate depending on the investment period or milestones. This flexible setup allows the compound interest letter to accurately represent step-up interest plans dynamically.

More Calculation Excel Templates