The Personal Financial Statement Excel Template for Loan Applications simplifies organizing assets, liabilities, income, and expenses to present a clear financial picture. This user-friendly spreadsheet helps borrowers provide lenders with accurate and detailed financial data, increasing the chances of loan approval. Customized formulas and structured layouts ensure efficient data entry and comprehensive analysis.

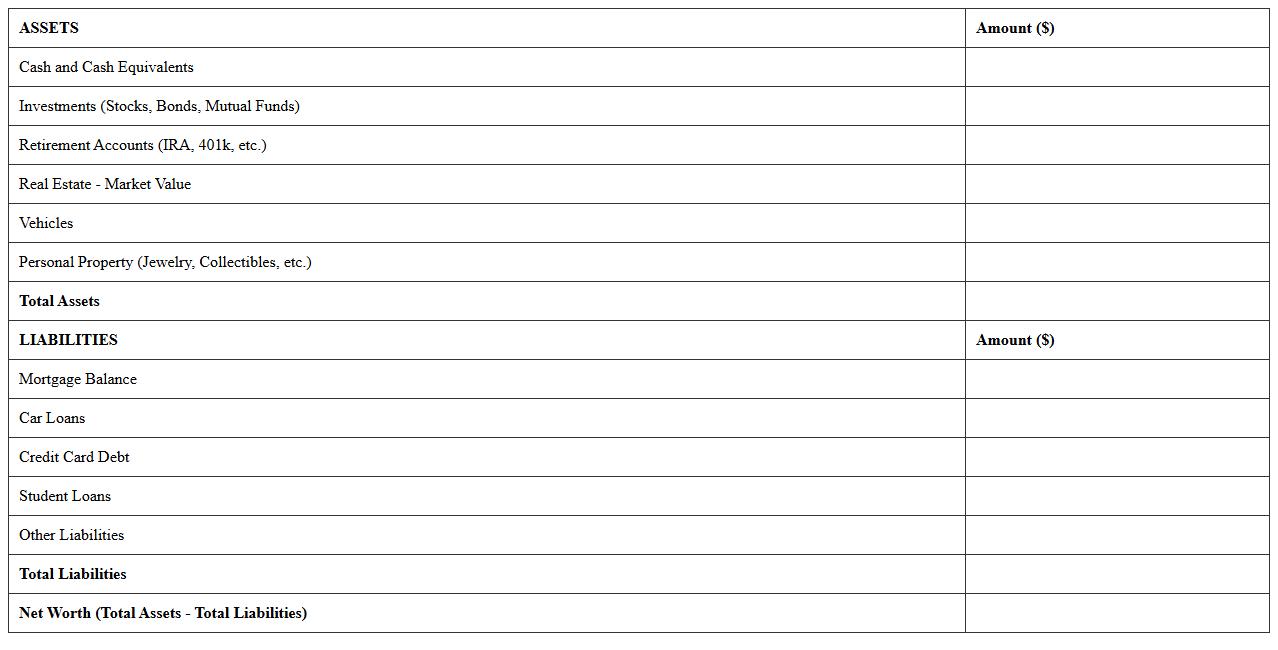

Personal Net Worth Statement Excel Template

A

Personal Net Worth Statement Excel Template is a structured spreadsheet designed to help individuals calculate and track their assets, liabilities, and overall financial position. This document organizes financial data clearly, enabling users to monitor their net worth over time and make informed investment or budgeting decisions. Utilizing such a template enhances financial planning by providing a comprehensive snapshot of personal wealth in an easily updateable format.

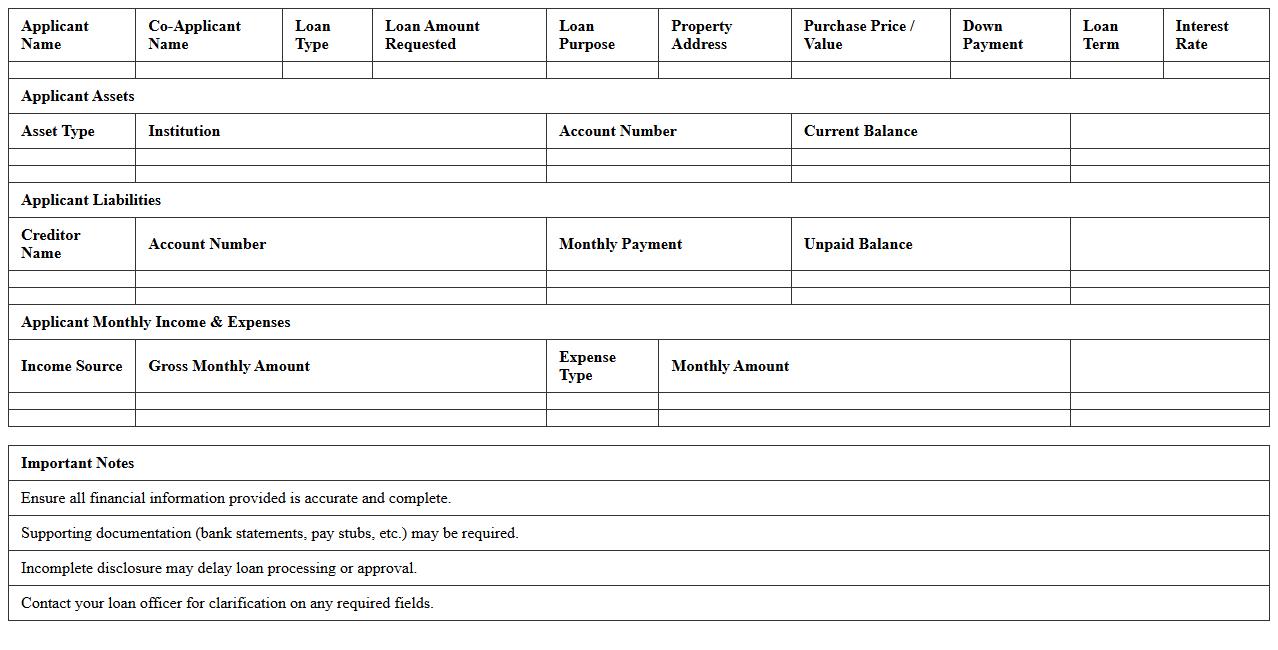

Loan Application Financial Disclosure Spreadsheet

A

Loan Application Financial Disclosure Spreadsheet is a detailed document that organizes and presents an applicant's financial information, including income, expenses, assets, and liabilities. This spreadsheet aids lenders in assessing the borrower's creditworthiness and ability to repay the loan accurately. By providing clear and structured financial data, it streamlines the loan approval process and minimizes potential errors or omissions.

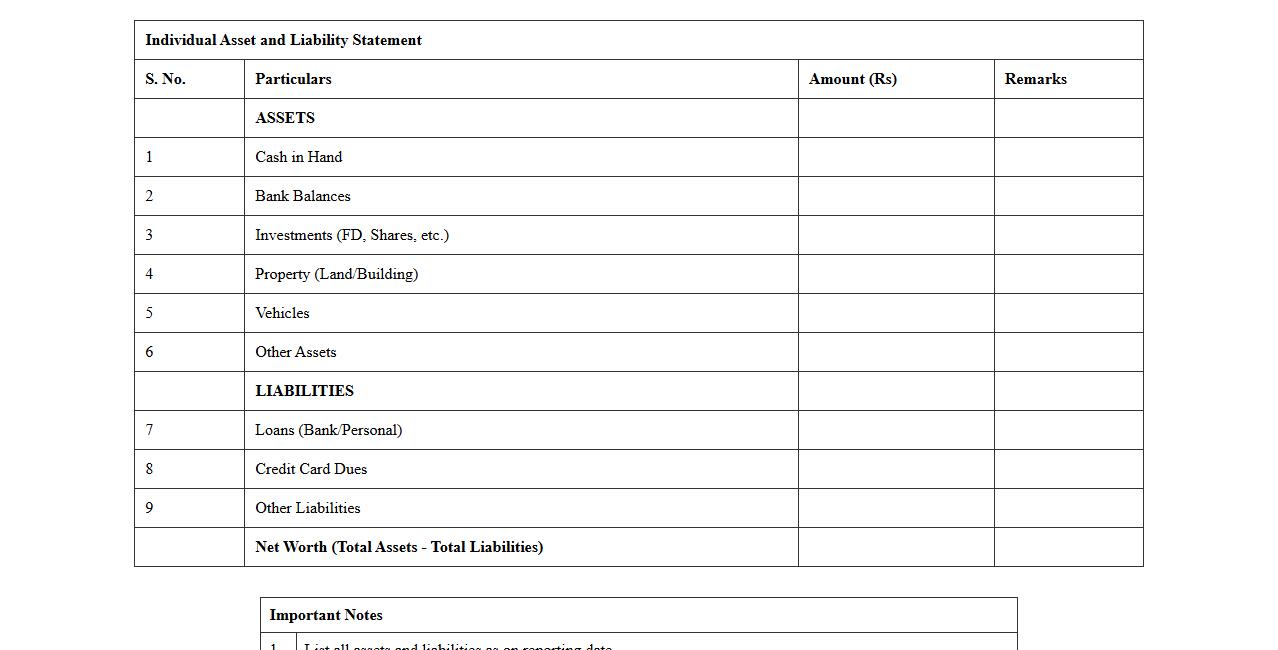

Individual Asset and Liability Statement Excel

An

Individual Asset and Liability Statement Excel document systematically records personal financial information, detailing assets such as property, investments, and cash, alongside liabilities like loans and credit card debts. This tool helps users gain a clear overview of their net worth by calculating the difference between total assets and liabilities, enabling better financial planning and decision-making. By using this Excel statement, individuals can monitor changes in their financial status over time and identify opportunities for debt reduction or asset growth.

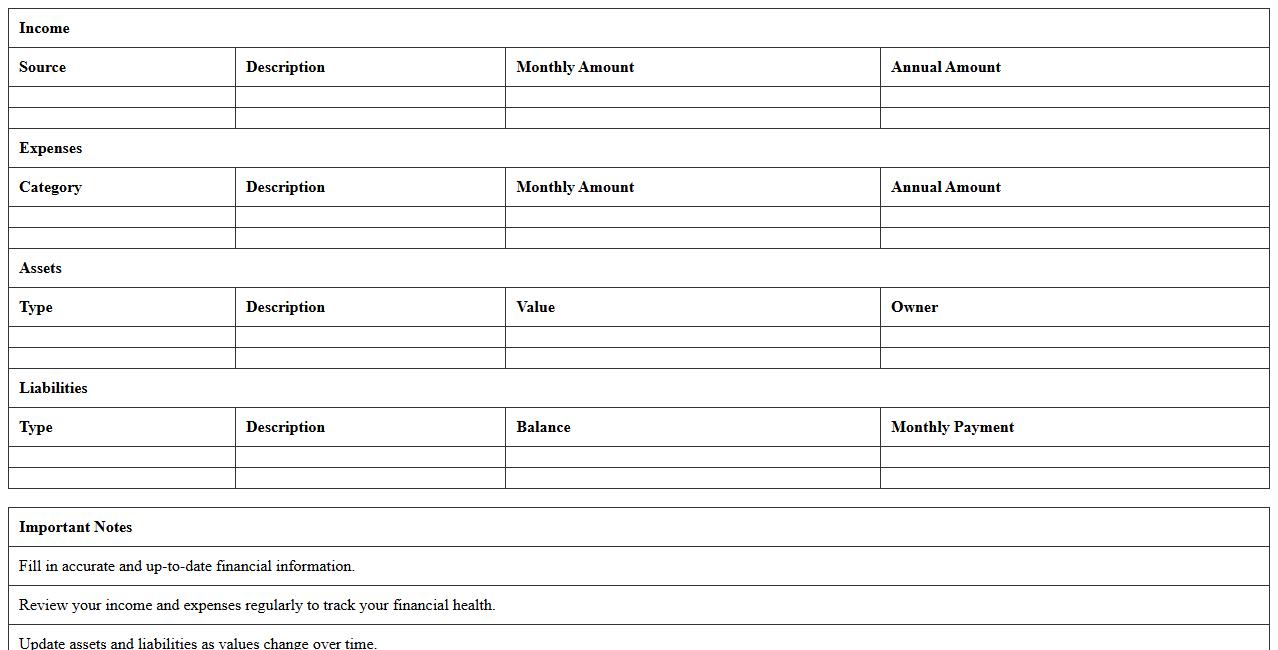

Detailed Personal Finance Statement Excel Sheet

A

Detailed Personal Finance Statement Excel Sheet is a comprehensive spreadsheet designed to track income, expenses, assets, and liabilities in one organized format. It helps users gain clear insights into their financial health, facilitates budgeting, and aids in setting and monitoring financial goals. This document enhances decision-making by providing a detailed overview of cash flow and net worth, promoting better money management.

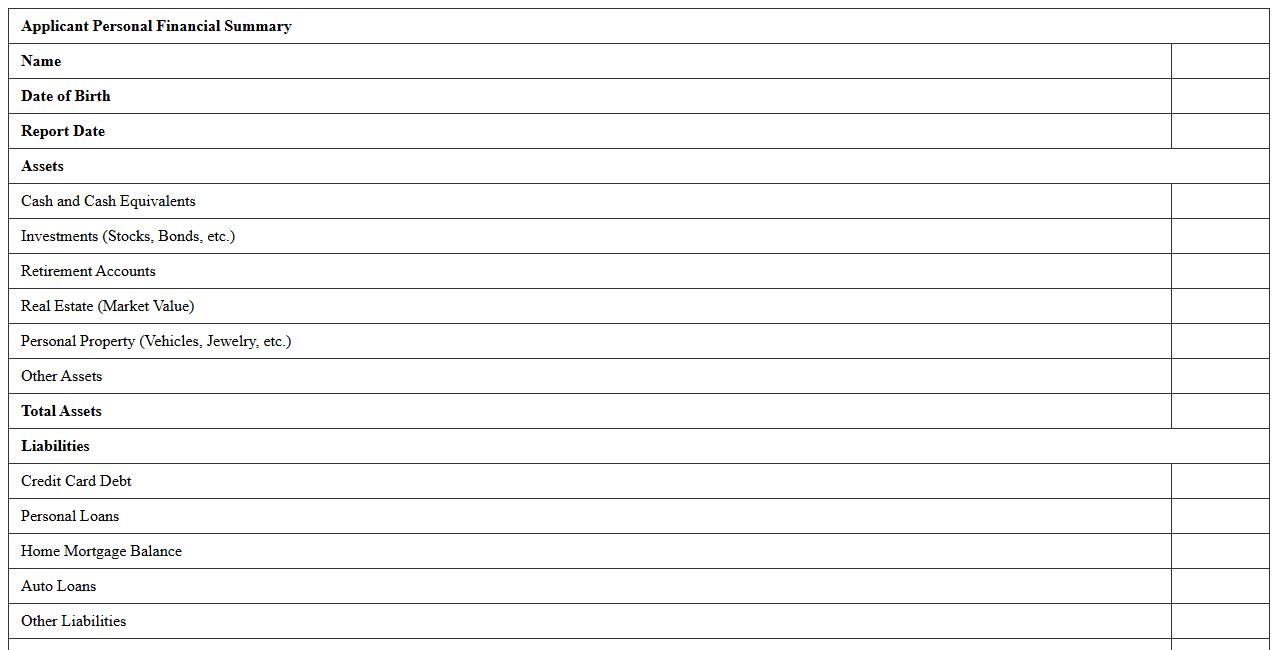

Applicant Personal Financial Summary Template

An

Applicant Personal Financial Summary Template is a structured document that organizes an individual's financial information, including assets, liabilities, income, and expenses. This template enables clear assessment of financial standing, which is essential for loan applications, credit evaluations, or personal financial planning. Using this document helps streamline decision-making by providing detailed, accurate financial data in a concise format.

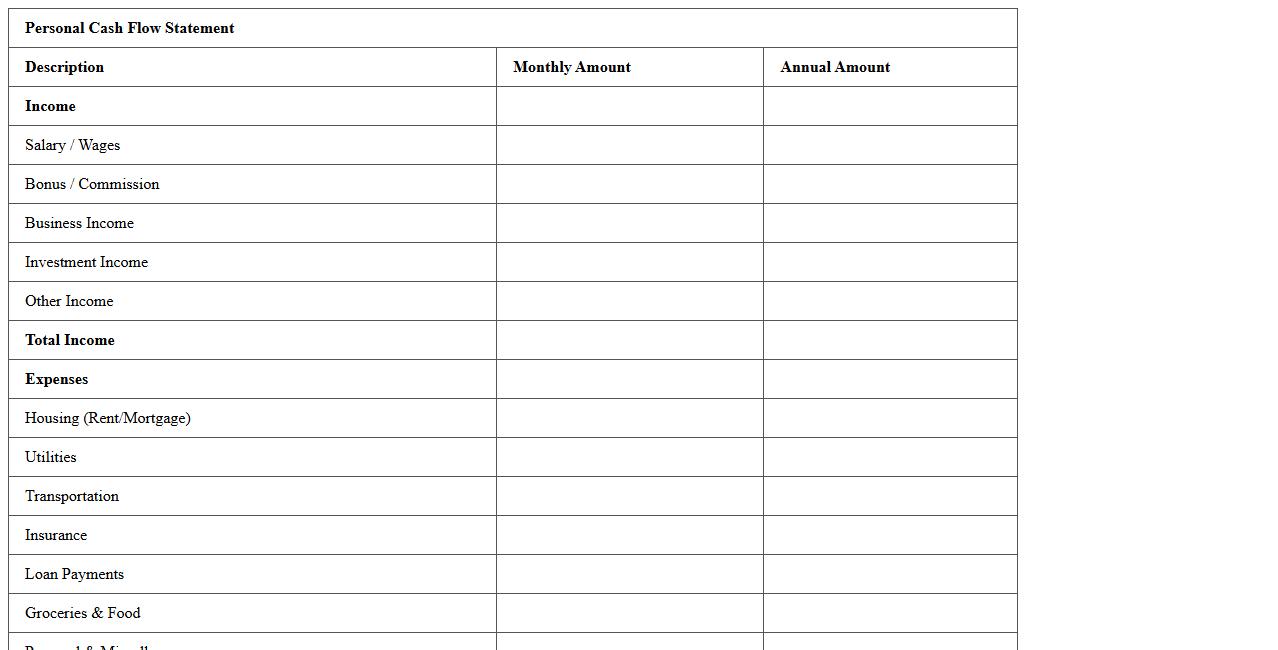

Personal Cash Flow Statement for Loan Application

A

Personal Cash Flow Statement for loan application is a detailed financial document that outlines an individual's income sources and expenses over a specified period. It is useful for lenders to assess the borrower's ability to generate sufficient cash flow to meet loan repayment obligations. This statement helps identify financial stability, ensuring informed decisions for loan approval and appropriate credit limits.

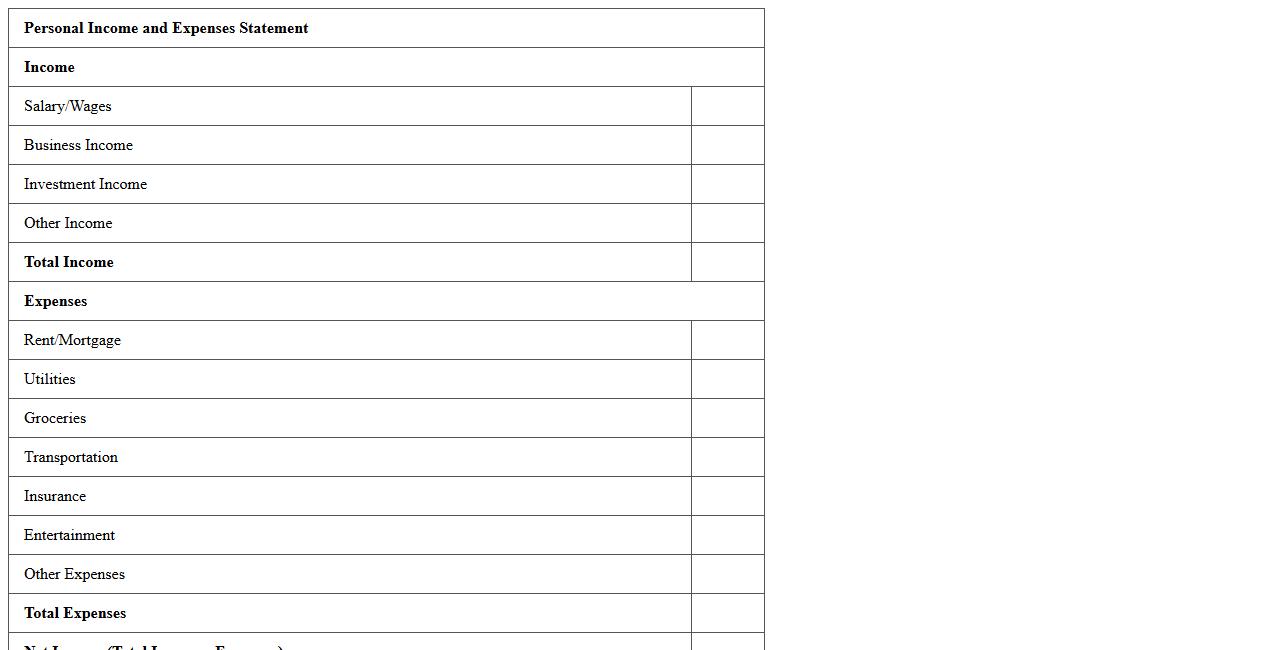

Personal Income and Expenses Statement Excel

A

Personal Income and Expenses Statement Excel document is a detailed spreadsheet used to track and categorize individual earnings and expenditures over a specific period. It helps users analyze cash flow, identify spending patterns, and create realistic budgets to enhance financial discipline. Utilizing this tool improves money management, supports informed financial decisions, and can aid in achieving savings and investment goals.

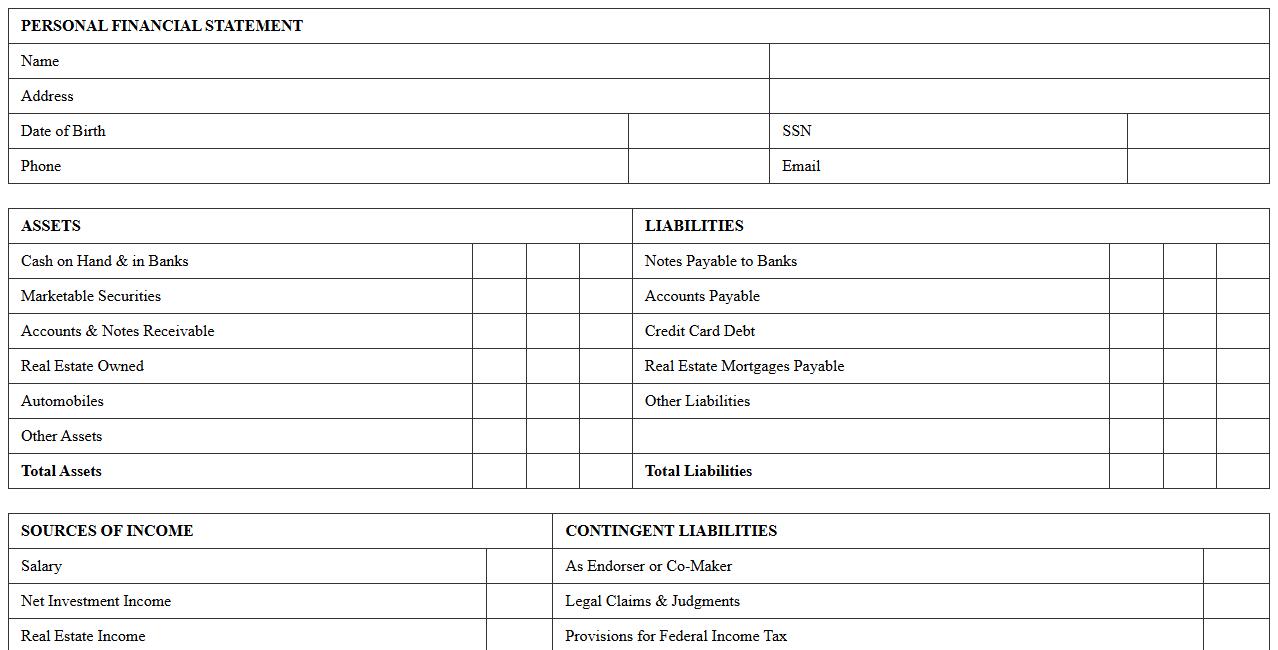

Bank Loan Personal Financial Statement Template

A

Bank Loan Personal Financial Statement Template is a structured document that outlines an individual's assets, liabilities, income, and expenses to provide a clear picture of their financial health. This template is crucial when applying for bank loans, as lenders use it to assess creditworthiness and repayment capacity. Utilizing this document helps borrowers organize financial information efficiently, increasing the likelihood of loan approval and informed financial planning.

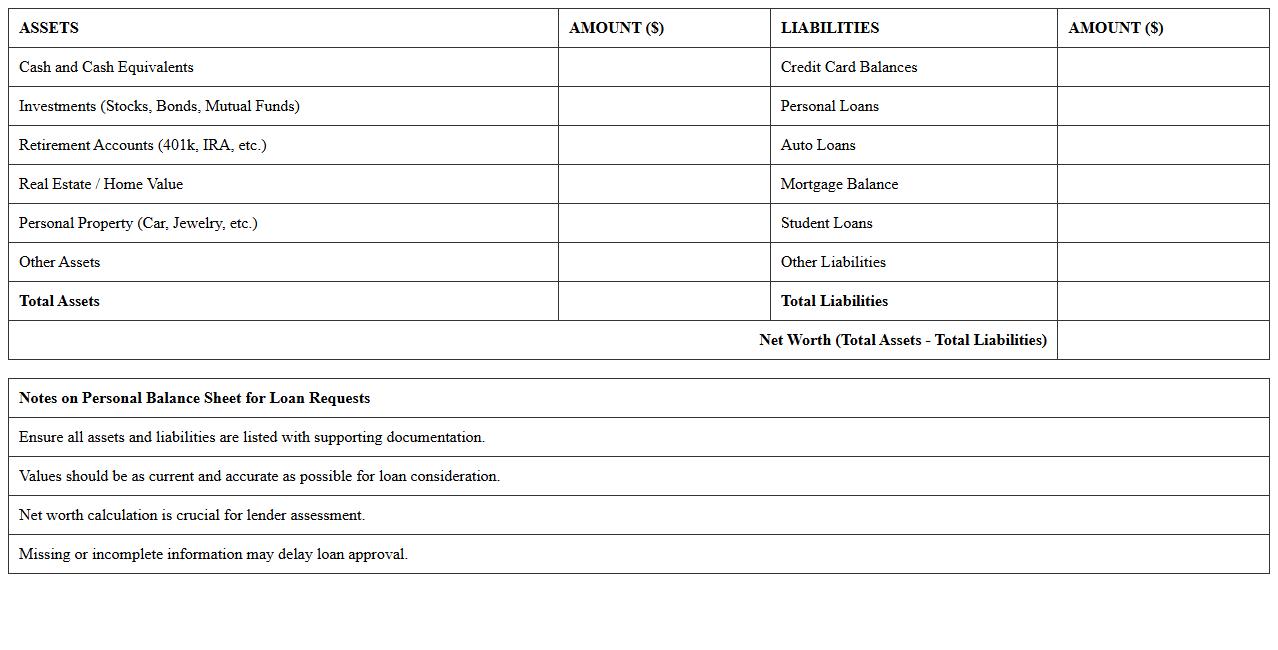

Personal Balance Sheet Excel for Loan Requests

A

Personal Balance Sheet Excel for Loan Requests is a financial document that captures an individual's assets, liabilities, and net worth in a structured spreadsheet format. It helps lenders assess the borrower's financial health by providing a clear snapshot of their ability to repay a loan. This organized record supports informed decision-making during loan application processes and enhances the chances of obtaining favorable loan terms.

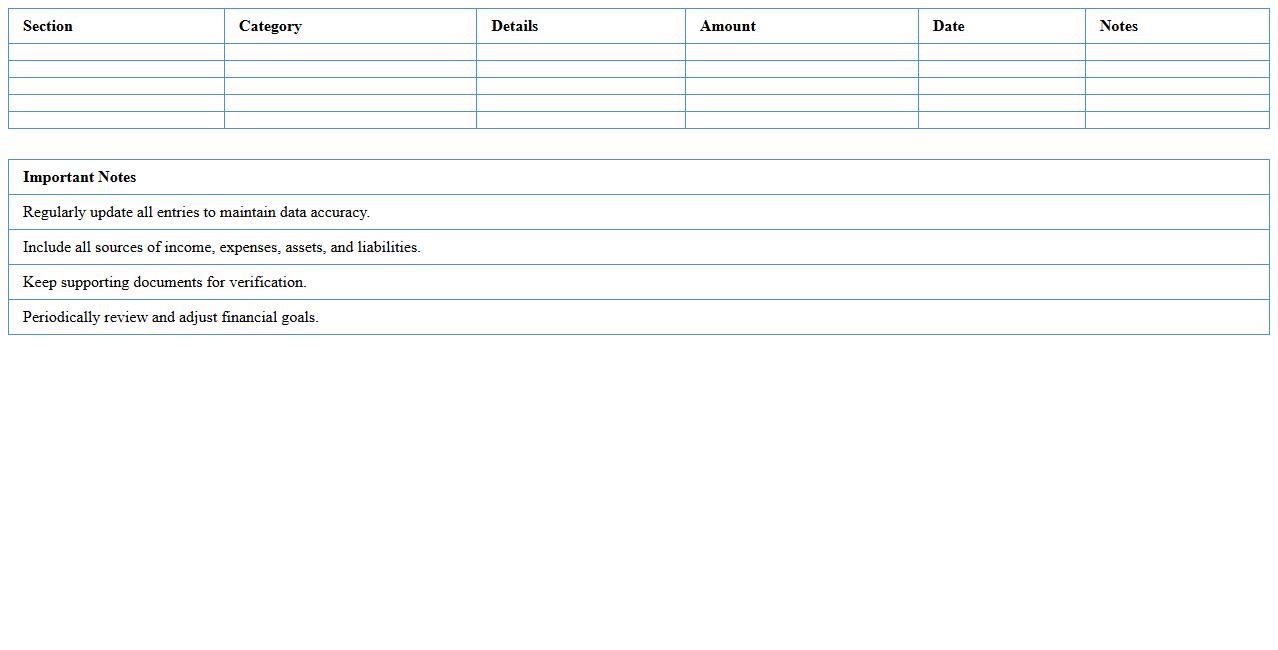

Comprehensive Personal Financial Data Excel Sheet

A

Comprehensive Personal Financial Data Excel Sheet document is a detailed tool designed to organize and track all aspects of an individual's financial information, including income, expenses, assets, liabilities, and investment portfolios. It helps users visualize their cash flow, manage budgets effectively, and identify areas for potential savings or debt reduction. This structured financial overview supports smarter decision-making and long-term financial planning.

Which Excel formulas best automate net worth calculations in a Personal Financial Statement for loan approval?

The SUM formula is essential to automatically total assets and liabilities, providing a clear snapshot of net worth. Use =SUM(assets_range)-SUM(liabilities_range) to calculate net worth precisely. Incorporating IFERROR helps prevent errors from empty or incorrect data entries, ensuring accuracy.

How should contingent liabilities be itemized in an Excel Personal Financial Statement for lenders' review?

Contingent liabilities should be clearly listed in a dedicated section with descriptions and estimated amounts. Using columns for type, description, and potential amount enables easy review and transparency. Applying data validation ensures that all entries follow a consistent format for lender evaluation.

What data validation rules optimize input accuracy in loan application financial statement templates?

Implementing data validation with dropdown lists restricts inputs to predefined categories, reducing errors. Setting rules like number ranges (e.g., no negative asset values) enforces logical consistency throughout the financial statement. Use mandatory required fields validation to ensure all critical information is entered before submission.

How can asset depreciation be represented in Excel for a more accurate Personal Financial Statement?

Asset depreciation can be modeled using formulas like SLN (Straight-Line Depreciation) to allocate expense evenly over time. Including a column to calculate accumulated depreciation deducts value correctly from the asset's book worth. This approach creates a realistic net asset value, improving financial accuracy for loan approval.

What privacy protections are essential when sharing an Excel-based Personal Financial Statement with loan officers?

Apply password protection to prevent unauthorized access to sensitive financial data. Use Excel's cell locking to restrict editing of key formulas and personal information. Additionally, consider encrypting the file for enhanced security before sharing with loan officers via email or secure platforms.

More Statement Excel Templates