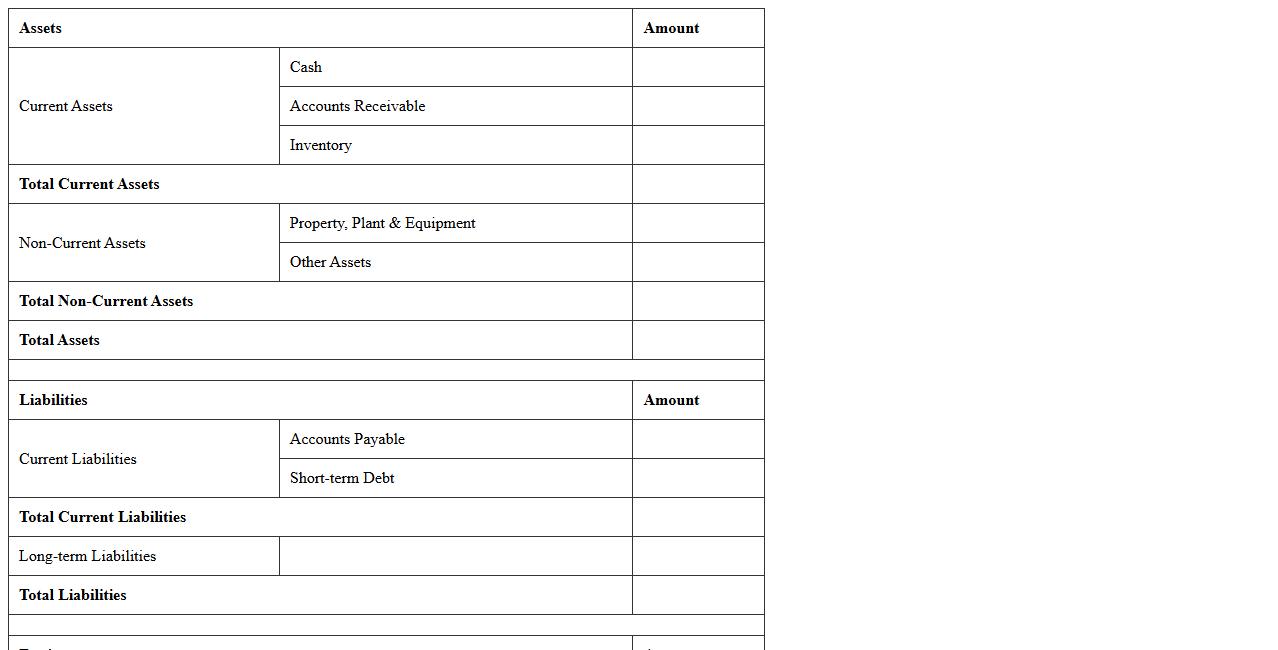

Startup Balance Sheet Summary Template

A

Startup Balance Sheet Summary Template document provides a clear snapshot of a startup's financial position by outlining assets, liabilities, and equity in one concise format. It is useful for tracking financial health, facilitating investor communication, and guiding strategic decision-making. Entrepreneurs and financial teams benefit from its organized structure to monitor cash flow, manage resources, and plan growth efficiently.

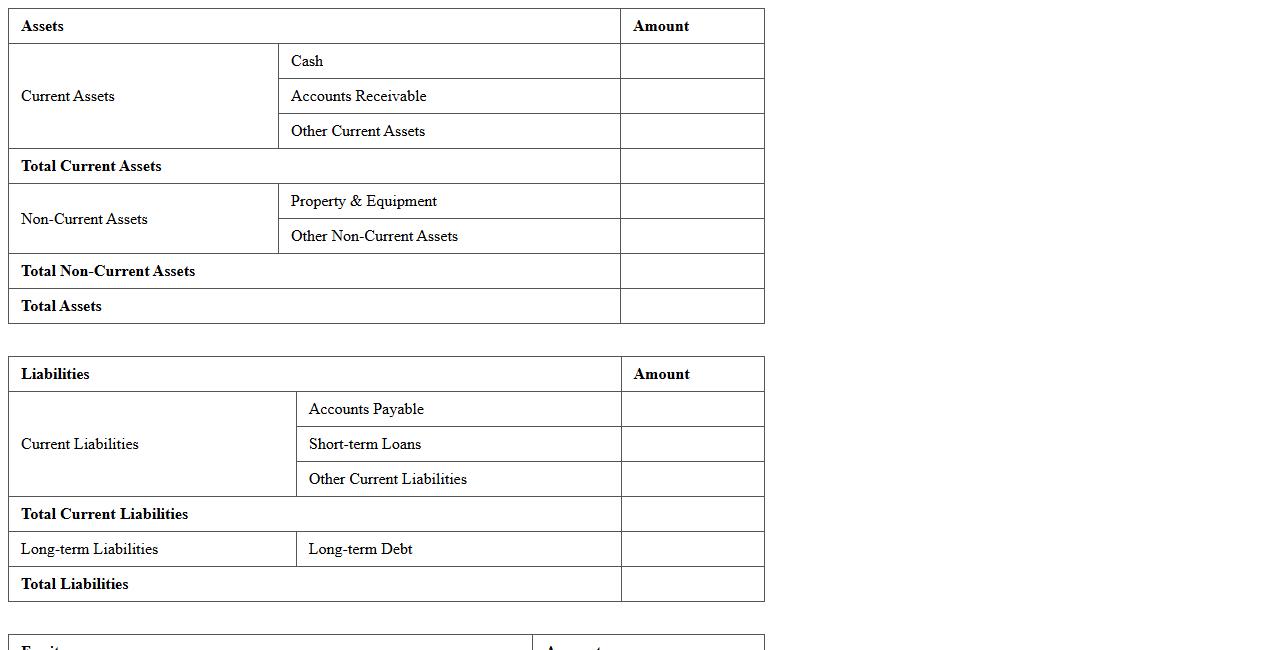

Early-Stage Business Balance Sheet Excel

An

Early-Stage Business Balance Sheet Excel document is a financial tool designed to capture a startup's assets, liabilities, and equity at a given point, helping entrepreneurs track their financial position accurately. It allows users to organize and analyze early financial data systematically, making it easier to recognize patterns, assess cash flow, and make informed decisions. This document supports strategic planning by offering clear insights into financial health, crucial for securing funding and managing growth effectively.

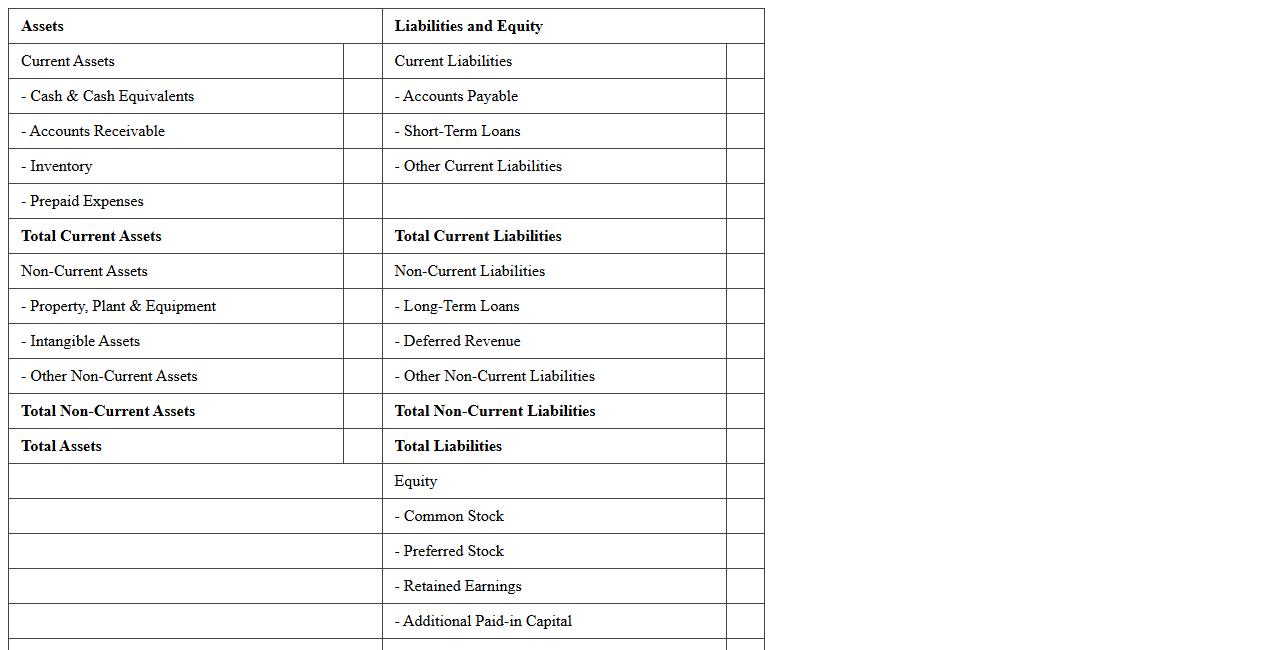

Simple Startup Balance Sheet Spreadsheet

The Simple Startup Balance Sheet Spreadsheet document is a financial tool designed to organize and display a startup's assets, liabilities, and equity clearly and concisely. It provides entrepreneurs with immediate insights into their company's financial health, enabling informed decision-making and effective resource allocation. Using this

balance sheet spreadsheet helps track financial progress, prepare for investor presentations, and ensure regulatory compliance.

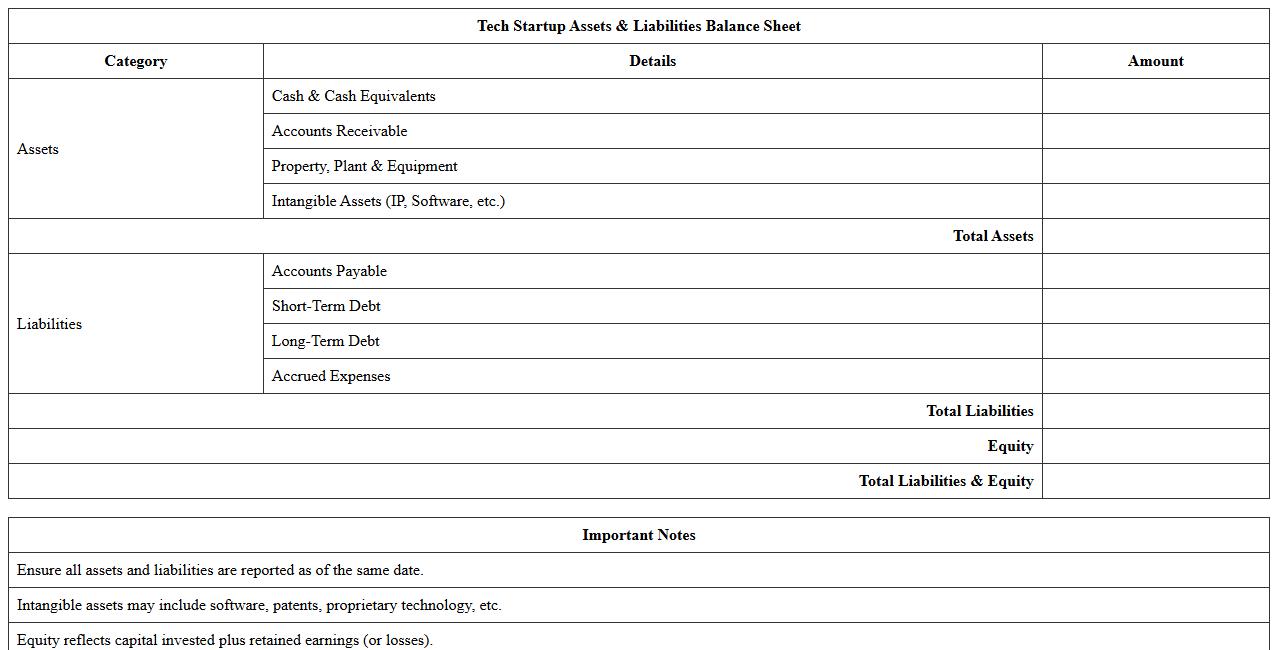

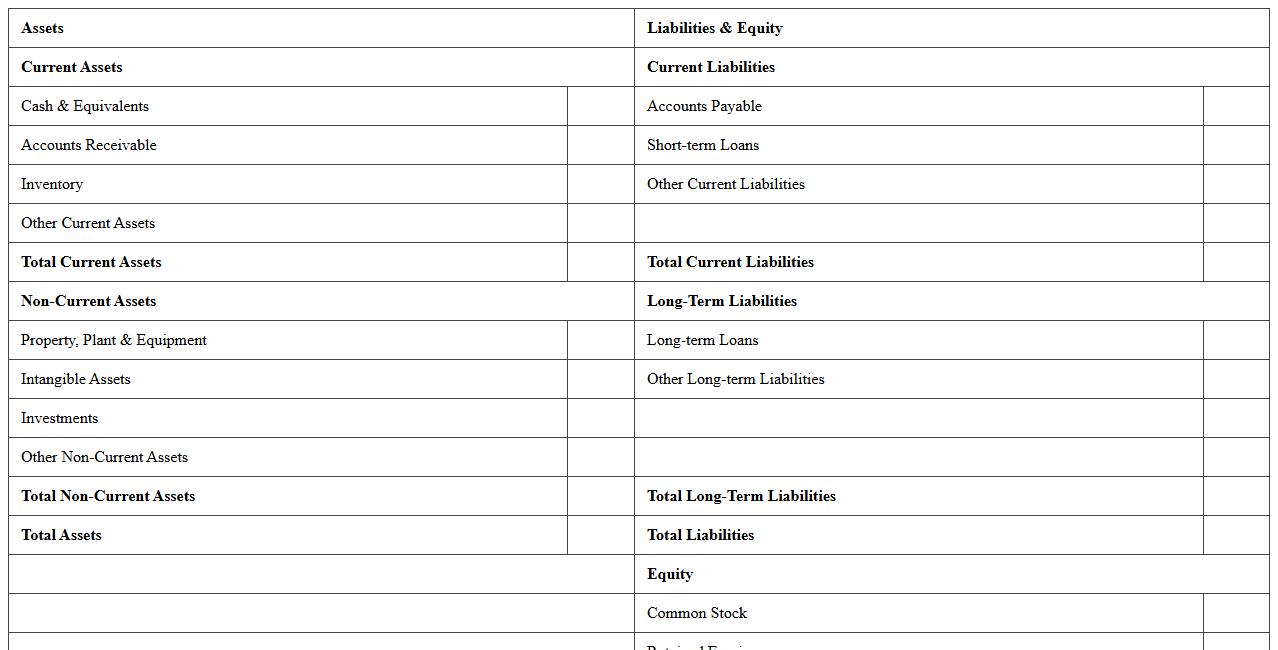

Tech Startup Assets & Liabilities Balance Sheet

A

Tech Startup Assets & Liabilities Balance Sheet document provides a detailed snapshot of a startup's financial position by listing its assets, liabilities, and equity at a specific point in time. This statement helps founders and investors understand the company's financial health, making it easier to assess cash flow stability, debt levels, and resource allocation. It is crucial for strategic decision-making, fundraising efforts, and ensuring regulatory compliance in the tech startup ecosystem.

Monthly Balance Sheet Tracker for Startups

The

Monthly Balance Sheet Tracker for Startups is a financial document that systematically records assets, liabilities, and equity each month, providing a clear picture of a startup's financial health over time. It helps founders and investors monitor cash flow, assess growth trajectories, and identify potential financial risks early. Using this tracker supports informed decision-making and ensures accurate financial reporting for strategic planning and fundraising efforts.

Pre-Revenue Startup Balance Sheet Format

A

Pre-Revenue Startup Balance Sheet Format document provides a structured financial snapshot of a startup before it begins generating revenue, detailing assets, liabilities, and equity. This format helps entrepreneurs and investors assess the startup's financial position, manage resources effectively, and plan for future capital needs. It is essential for securing funding, tracking financial health, and making informed business decisions in the early stages.

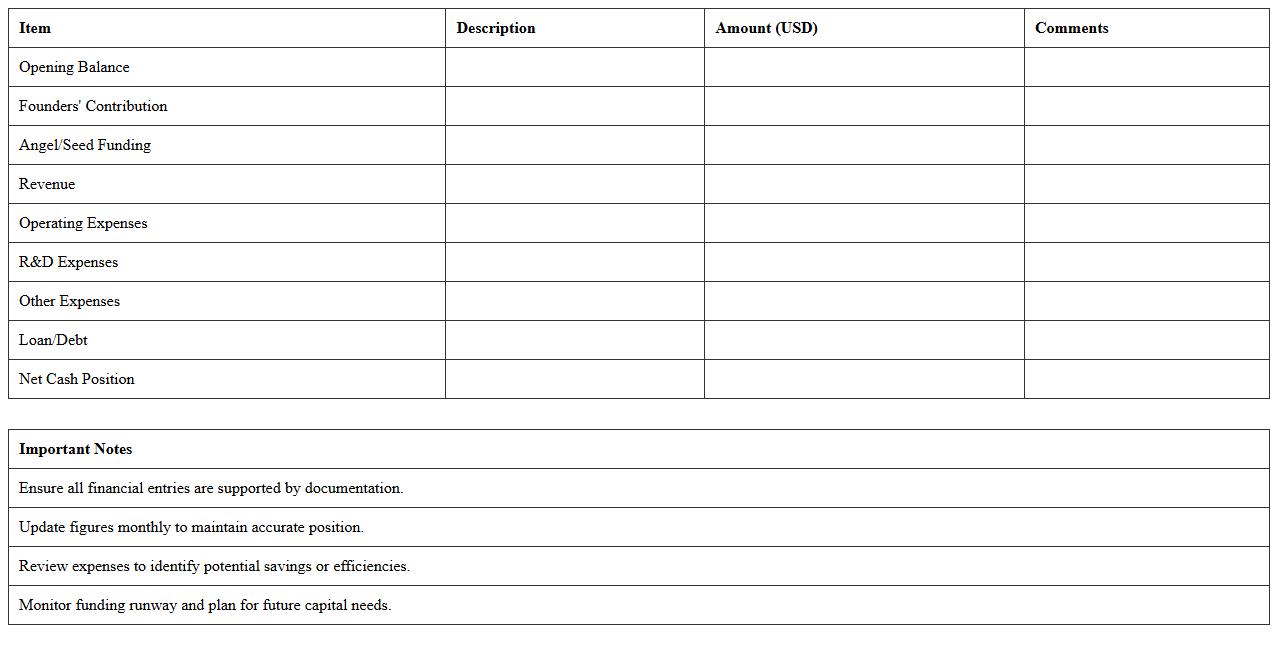

Founders' Startup Financial Position Excel

The

Founders' Startup Financial Position Excel document is a comprehensive tool designed to track and analyze a startup's financial status, including assets, liabilities, and equity. It provides founders with clear insights into cash flow, funding sources, and financial health, enabling better decision-making and strategic planning. This document is essential for managing budgets, preparing for investor meetings, and ensuring long-term sustainability of the business.

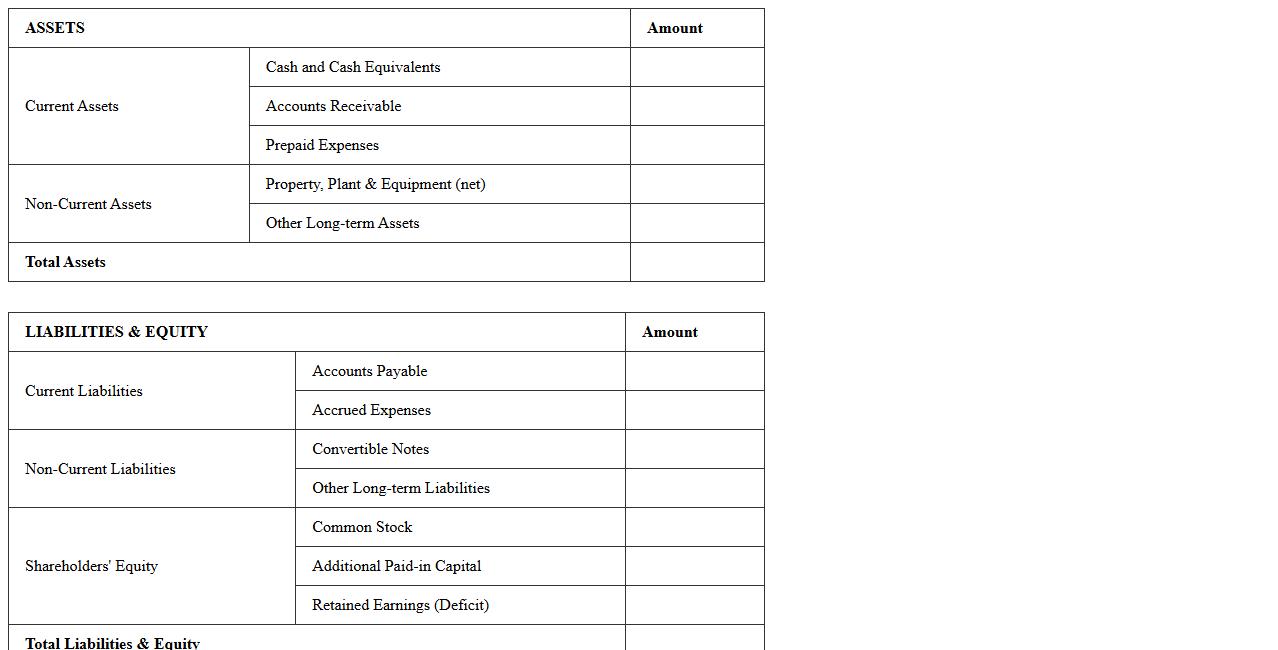

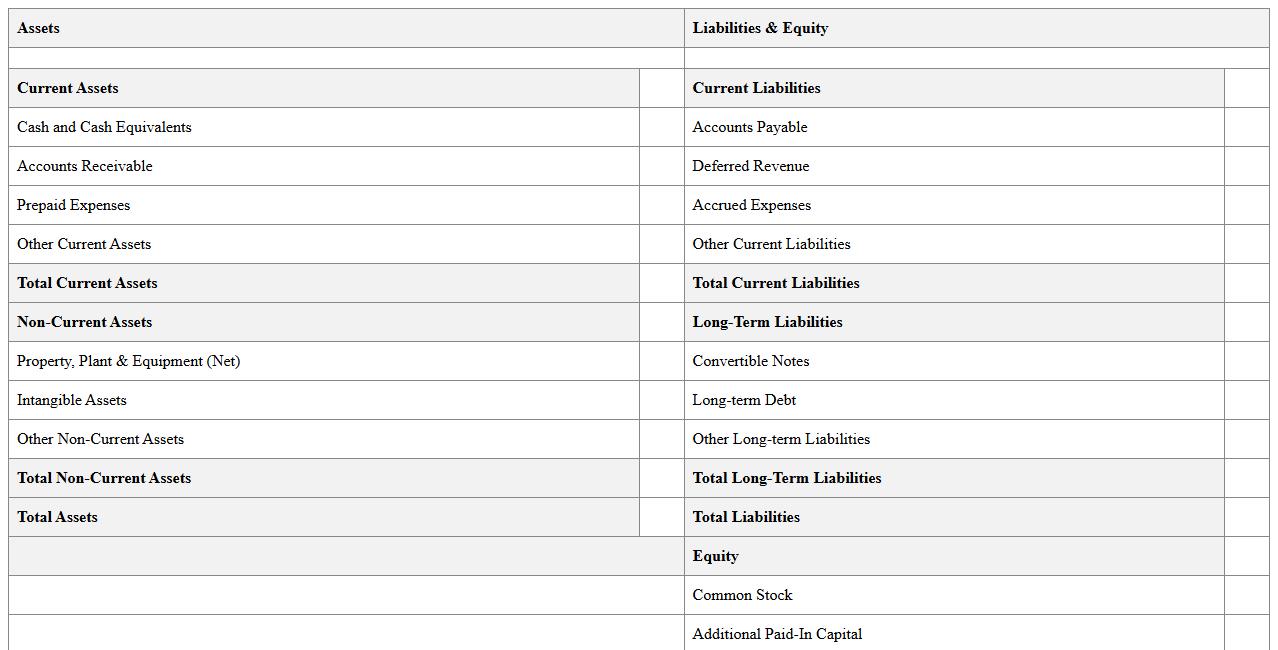

SaaS Startup Balance Sheet Statement

A

SaaS Startup Balance Sheet Statement is a financial document that provides a snapshot of a SaaS company's assets, liabilities, and shareholders' equity at a specific point in time. It is essential for tracking the company's financial health, helping investors and management assess liquidity, solvency, and operational efficiency. This statement supports strategic decision-making by highlighting the startup's ability to meet short-term obligations and fund growth initiatives.

Investor-Ready Startup Balance Sheet Template

A

Investor-Ready Startup Balance Sheet Template is a structured financial document designed to present a clear snapshot of a startup's assets, liabilities, and equity, tailored specifically for potential investors. This template helps entrepreneurs organize financial data accurately, enabling them to communicate their company's financial health and stability effectively to attract funding. It streamlines the due diligence process by providing investors with standardized, easily interpretable financial information critical for making investment decisions.

Year-End Startup Balance Sheet Excel Sheet

A

Year-End Startup Balance Sheet Excel Sheet document is a financial tool that summarizes a startup's assets, liabilities, and equity at the end of the fiscal year. It provides a clear snapshot of the company's financial position, enabling founders and investors to assess financial health, make informed decisions, and plan for future growth. Using this Excel sheet enhances accuracy, simplifies data management, and facilitates the preparation of financial reports for stakeholders.

How do startups categorize founder equity in a Balance Sheet Statement Excel template?

Startups typically categorize founder equity under the shareholders' equity section in the balance sheet Excel template. This includes common stock, additional paid-in capital, and retained earnings. Proper categorization ensures clear representation of ownership stakes and capital contributions.

What Excel formulas track convertible notes in a startup's balance sheet?

Excel formulas like SUMIFS and IF statements help track convertible notes by calculating outstanding balances and interest accruals. Dynamic referencing can monitor conversion triggers and maturity dates. This ensures accurate tracking of liabilities and potential equity conversion.

How to automate deferred revenue entries for SaaS startups in Excel balance sheets?

Automating deferred revenue involves using DATE and IF functions to allocate revenue recognition over subscription periods. Pivot tables and dynamic ranges help update deferred revenue balances systematically. This maintains compliance with revenue recognition standards and improves financial forecasting.

What supporting schedules are essential for startup balance sheet audits in Excel?

Key supporting schedules include accounts receivable aging, fixed asset registers, and equity rollforward schedules. These schedules provide detailed backup for balance sheet line items and facilitate audit verification. Organized Excel worksheets enhance transparency and audit readiness.

How to dynamically link bank reconciliation data in a startup's Balance Sheet Excel file?

Dynamically linking bank reconciliation requires Excel cell references and named ranges to sync transaction data automatically. Using formulas like VLOOKUP or INDEX-MATCH ensures updated balances reflect real-time cash positions. This integration reduces errors and streamlines cash flow management.