The Dividend Statement Excel Template for Shareholder Reporting offers a streamlined and efficient way to track dividend payments and shareholder distributions. This customizable template simplifies financial reporting by organizing key data such as payment dates, amounts, and shareholder details in a clear, easy-to-read format. It enhances accuracy and transparency in communicating dividend information to stakeholders.

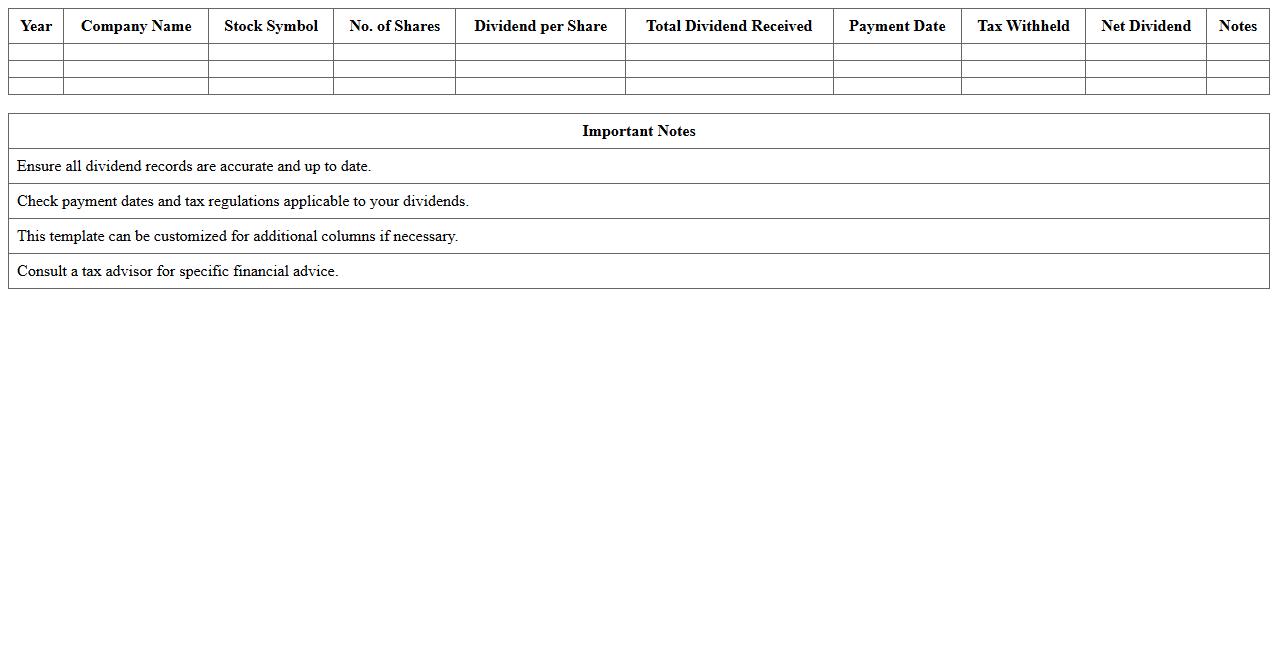

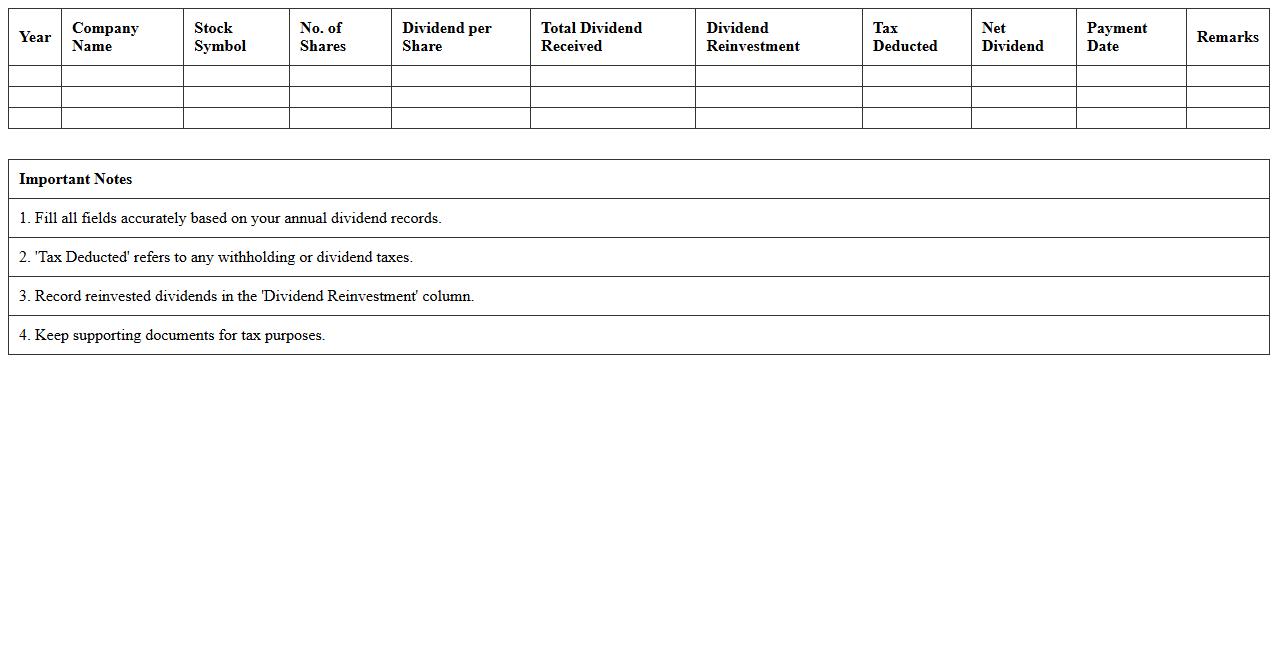

Annual Dividend Statement Excel Template

The

Annual Dividend Statement Excel Template is a structured document designed to record and track dividend payments received from investments over a fiscal year. It helps investors systematically organize dividend data, including payment dates, amounts, and sources, enhancing financial analysis and tax reporting accuracy. This template simplifies portfolio management by providing clear insights into dividend income trends and supports informed decision-making for future investments.

Quarterly Dividend Payout Tracker Spreadsheet

A

Quarterly Dividend Payout Tracker Spreadsheet is a tool designed to systematically record and monitor the dividend payments received from investments on a quarterly basis. This document helps investors analyze income trends, forecast future cash flows, and assess the performance of dividend-paying stocks or funds. By consolidating dividend data, it enhances decision-making and supports effective portfolio management.

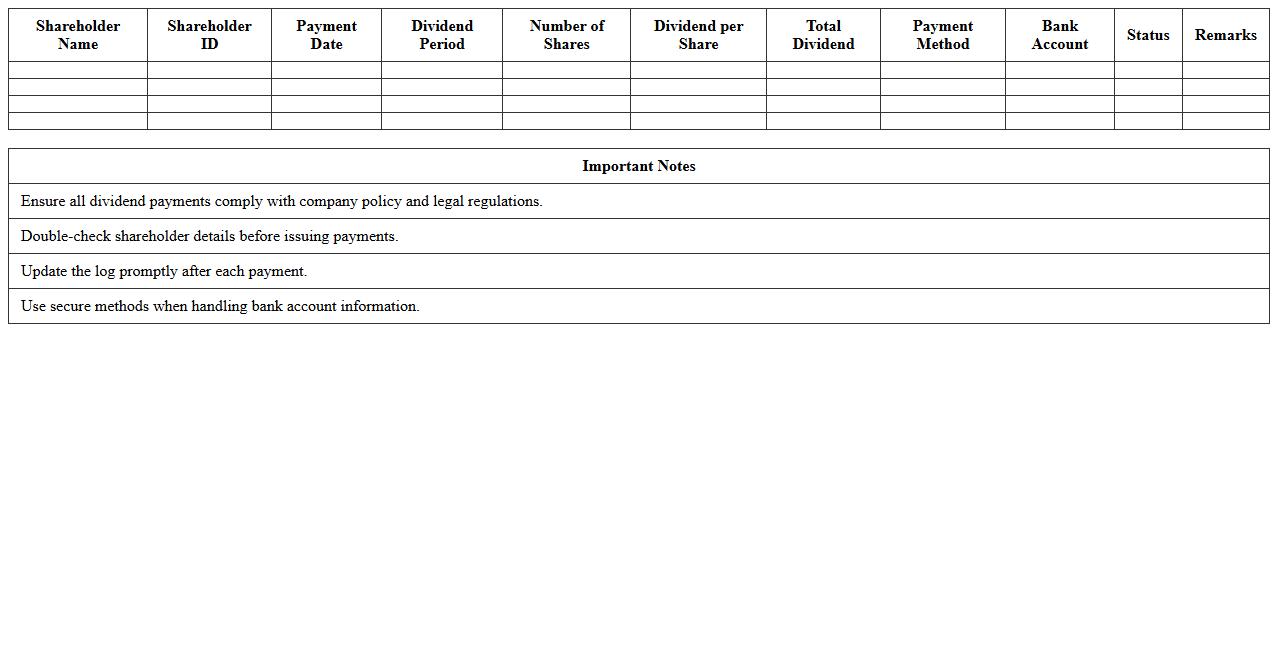

Shareholder Dividend Payment Log

The

Shareholder Dividend Payment Log document records all dividend payments made to shareholders, including payment dates, amounts, and recipient details. This log is essential for maintaining accurate financial records, ensuring transparency in dividend distribution, and facilitating audits or shareholder inquiries. It helps businesses track dividend payouts effectively, supporting compliance with corporate governance and tax reporting requirements.

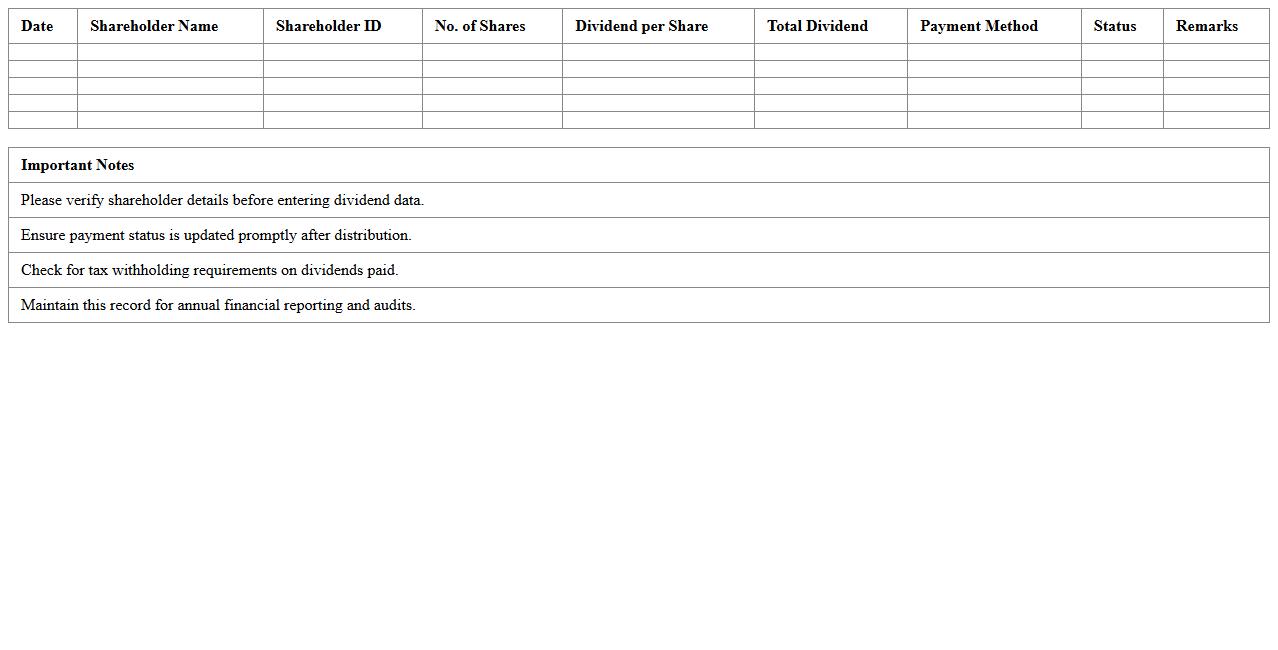

Dividend Distribution Record Sheet

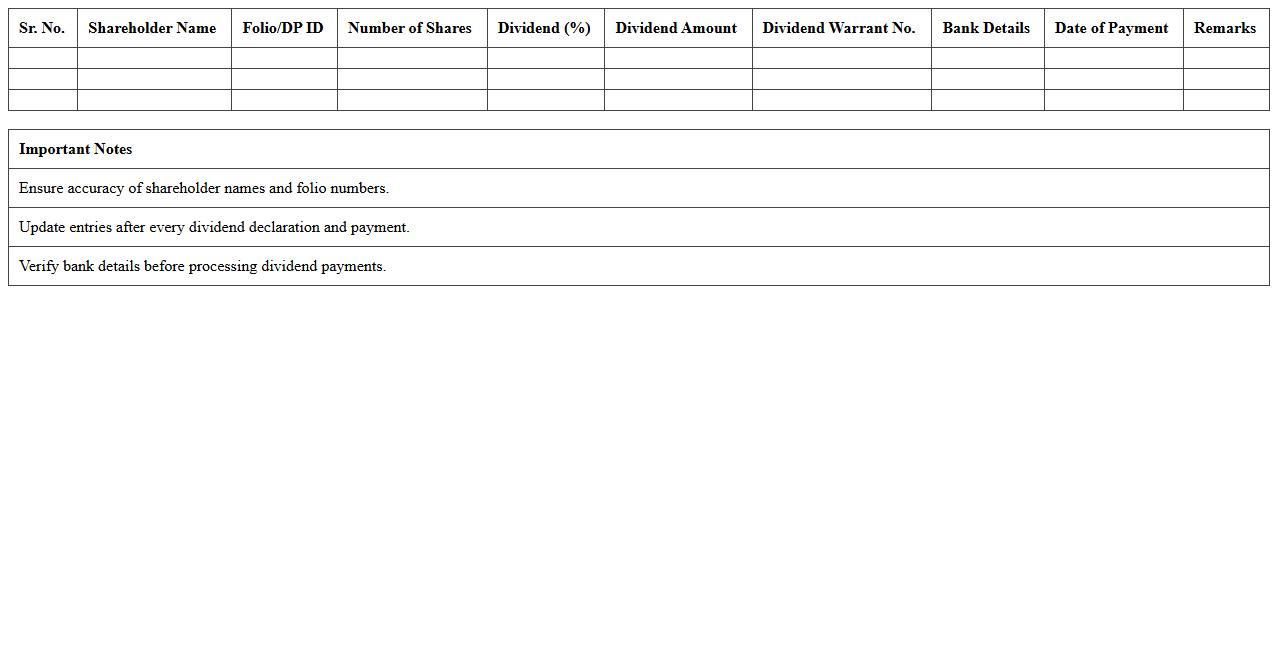

A

Dividend Distribution Record Sheet is a document that systematically records the details of dividend payments made to shareholders, including shareholding patterns, dividend amounts, payment dates, and related financial data. This sheet is crucial for maintaining accurate financial records, ensuring compliance with corporate governance standards, and facilitating transparent communication with investors. It helps companies track dividend disbursements efficiently, support audit processes, and analyze shareholder value distribution over time.

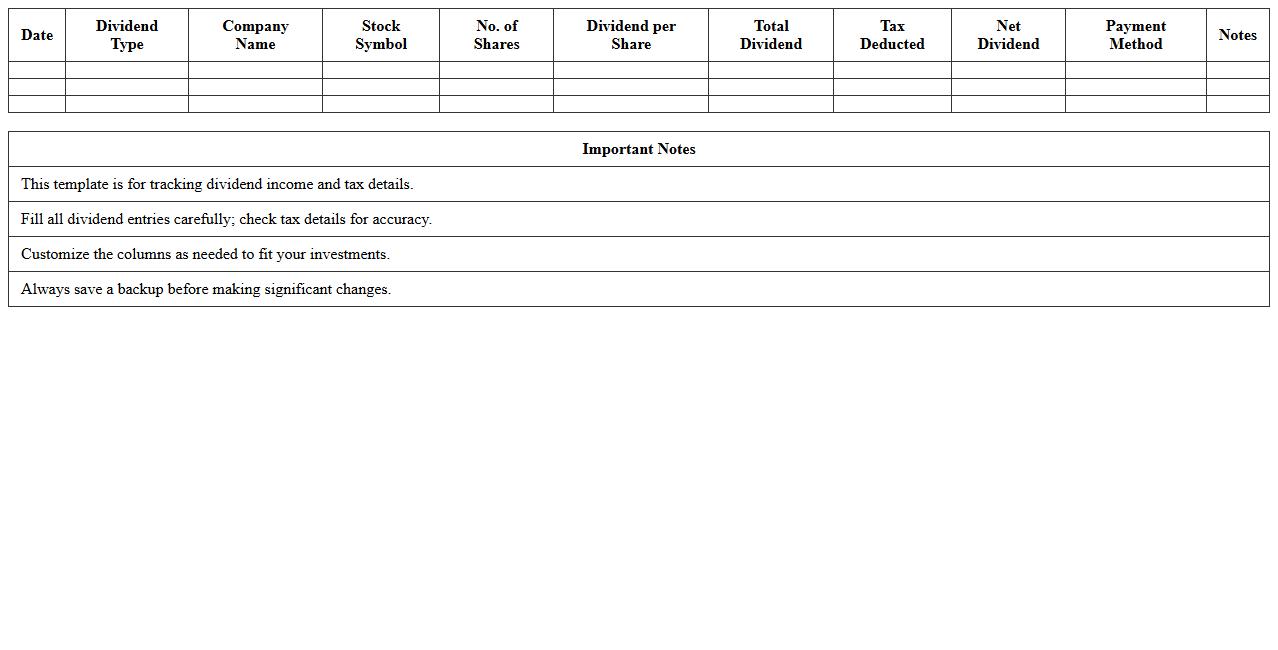

Detailed Dividend Statement Excel Template

A

Detailed Dividend Statement Excel Template is a structured spreadsheet designed to track and calculate dividend payouts from various investments. It consolidates dividend payment data, including dates, amounts, stock details, and tax information, enabling accurate record-keeping and financial analysis. This template is useful for investors and financial managers to monitor income streams, optimize tax planning, and make informed decisions based on precise dividend histories.

Dividend History Report Spreadsheet

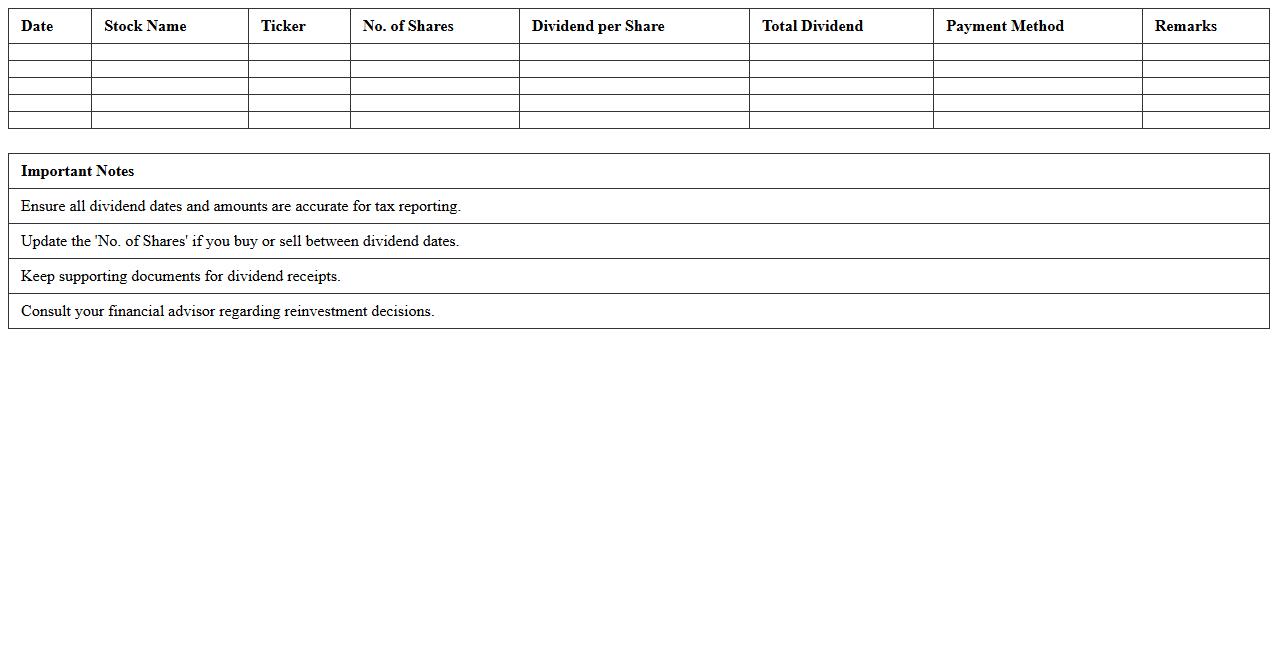

A

Dividend History Report Spreadsheet is a detailed document that tracks the dividend payments made by a company over time, including dates, amounts, and types of dividends. This spreadsheet is useful for investors to analyze dividend trends, assess the reliability of income streams, and make informed decisions about stock investments. By consolidating dividend data in one place, it enhances financial planning and supports the evaluation of a company's dividend growth and payout consistency.

Dividend Summary Sheet for Shareholders

A

Dividend Summary Sheet for shareholders provides a detailed overview of all dividend payments made to an investor, including payment dates, amounts, and relevant tax information. This document helps shareholders track their income from investments, verify payment accuracy, and manage tax reporting efficiently. It is an essential financial record for monitoring shareholder returns and facilitating transparent communication between the company and its investors.

Yearly Dividend Statement Template

A

Yearly Dividend Statement Template is a structured document that summarizes the dividends paid to shareholders over a fiscal year, detailing payment dates, amounts, and relevant tax information. It helps investors and companies maintain clear records for financial analysis, tax reporting, and compliance with regulatory requirements. Using this template streamlines dividend tracking and enhances transparency in shareholder communications.

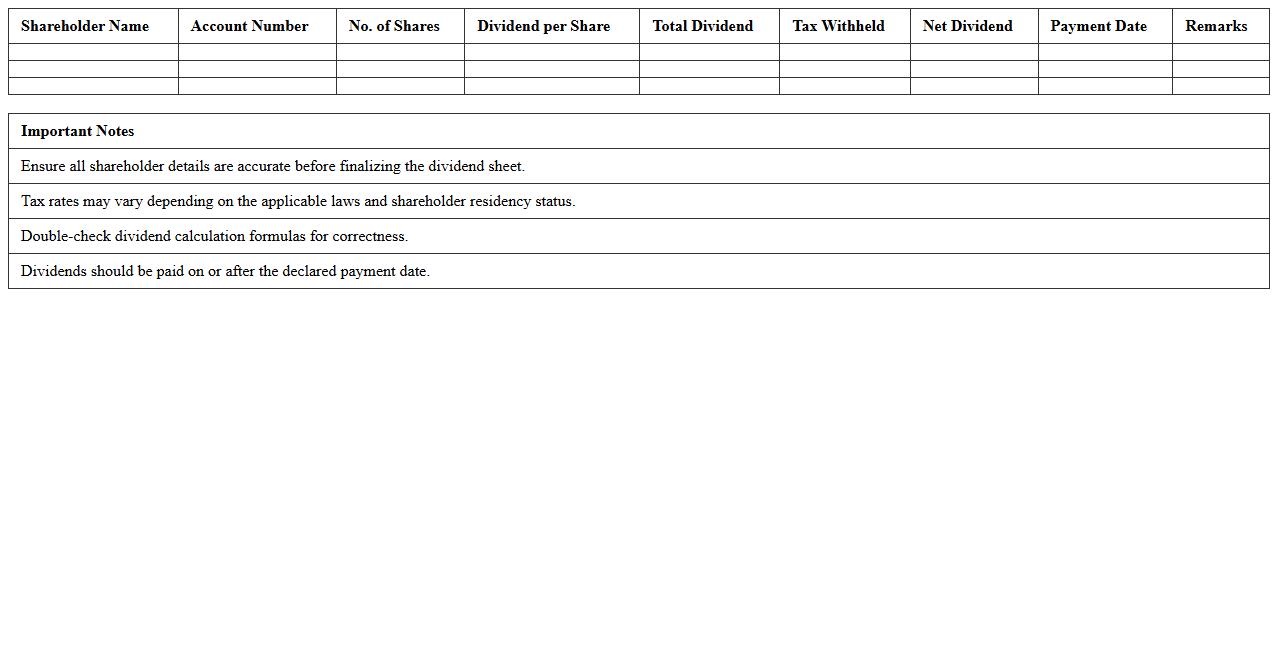

Shareholder Dividend Register Excel

A

Shareholder Dividend Register Excel document is a structured spreadsheet used to record and track dividend payments made to shareholders, detailing names, shares held, dividend amounts, and payment dates. This tool enhances financial transparency, facilitates accurate dividend distribution, and simplifies auditing processes for companies. Maintaining this register ensures compliance with regulatory requirements and supports effective shareholder communication.

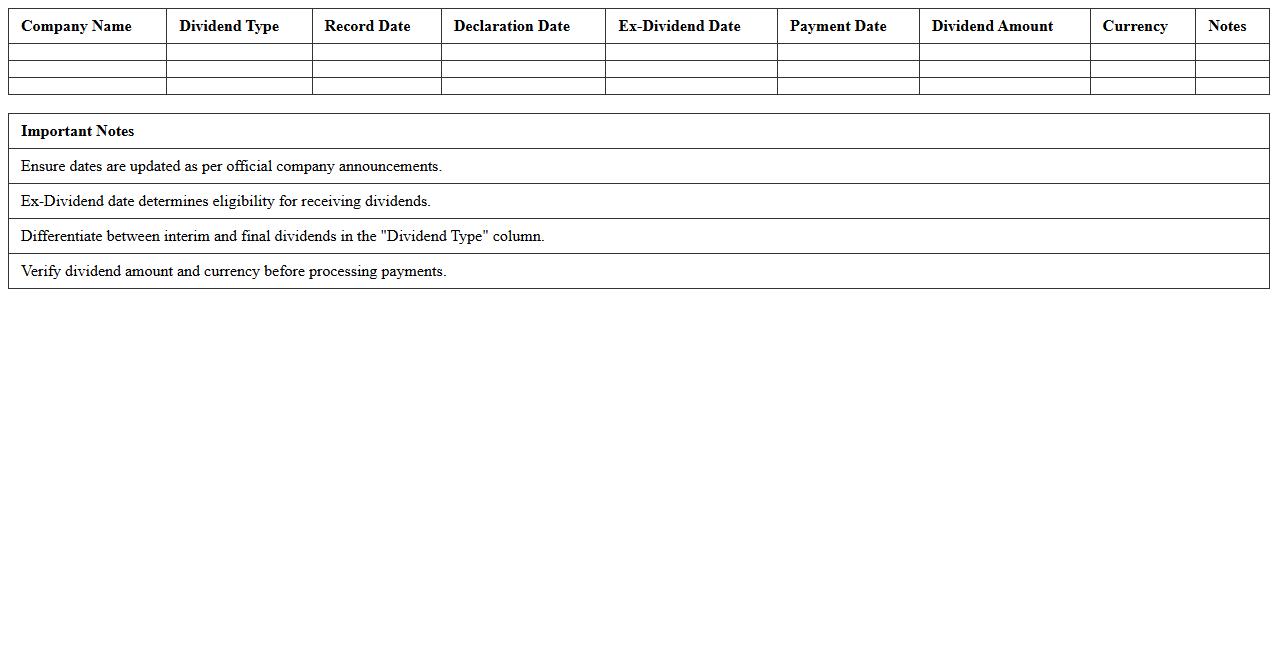

Dividend Declaration & Payment Schedule Template

A

Dividend Declaration & Payment Schedule Template document outlines the timeline and details for declaring and distributing dividends to shareholders, ensuring clarity and transparency in corporate financial activities. It helps companies systematically plan dividend announcements, record declaration dates, payment dates, and amounts, enhancing accuracy in financial reporting and compliance. Utilizing this template improves communication with investors and supports efficient cash flow management by aligning dividend payments with corporate policies and legal requirements.

How to automate dividend calculation formulas in Excel for multiple shareholders?

To automate dividend calculations for multiple shareholders, use Excel formulas such as SUMPRODUCT to multiply shares by dividend rates. Set up a dynamic table with shareholder names, shares held, and dividend per share for easy updates. Incorporate absolute and relative cell references to streamline the formula application across rows efficiently.

Which Excel functions best track dividend reinvestments per shareholder?

Tracking dividend reinvestments is optimal with functions like SUMIFS to aggregate dividends per shareholder over time. Use VLOOKUP or INDEX-MATCH to pull historical reinvestment data for accuracy. Additionally, integrate tables with dates and dividend amounts to automate cumulative reinvestment calculations.

What are effective ways to protect confidential shareholder data in Excel reports?

Protecting confidential data in Excel requires employing features like password protection and worksheet locking. Utilize the "Protect Sheet" and "Protect Workbook" functionalities to restrict unauthorized access. Always encrypt files and consider limiting data exposure by creating separate workbooks for sensitive information.

How to format Excel Dividend Statements for regulatory compliance?

Ensure dividend statements meet regulatory compliance by including all mandatory fields such as shareholder ID, dividend amount, and payment date. Use clear headers and standardized date and currency formats for transparency. Implement data validation rules to maintain accuracy and prevent erroneous entries on statements.

How to generate personalized dividend summary letters for each shareholder using Mail Merge in Excel?

Generate personalized dividend summary letters by linking Excel data with Word via Mail Merge. Prepare a clean dataset with shareholder details and dividend info, then create a Word template with merge fields for customization. This approach allows bulk generation of tailored letters efficiently, improving communication and record-keeping.

More Statement Excel Templates