Asset Inventory Tracking Spreadsheet

An

Asset Inventory Tracking Spreadsheet is a detailed document used to record and monitor physical or digital assets within an organization, including information such as asset ID, description, location, and condition. This tool enhances asset management by providing real-time visibility, ensuring accurate auditing, and enabling efficient maintenance scheduling. Utilizing this spreadsheet helps reduce loss, optimize asset utilization, and supports informed decision-making for procurement and asset lifecycle planning.

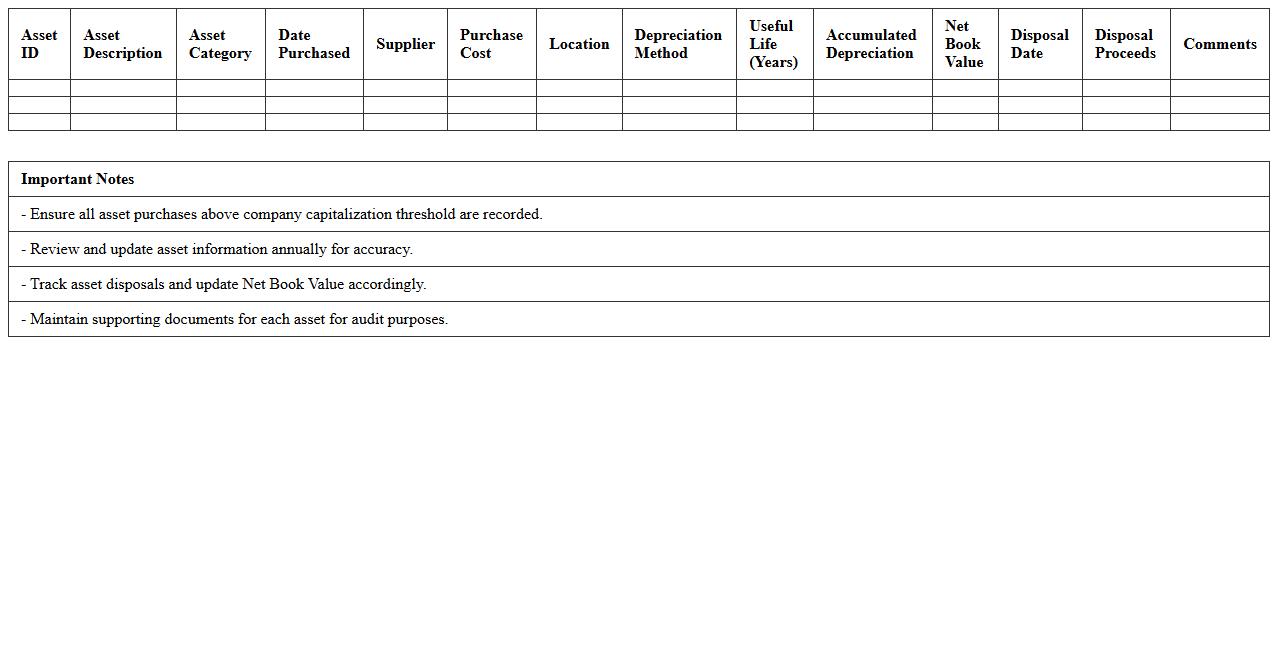

Fixed Asset Register for Small Companies

A

Fixed Asset Register is a detailed record of a company's tangible assets such as machinery, equipment, and vehicles, maintained to track asset ownership, depreciation, and valuation. For small companies, this document ensures accurate financial reporting, simplifies asset management, and aids in compliance with tax regulations. Maintaining an up-to-date Fixed Asset Register helps businesses optimize asset utilization and plan for future investments effectively.

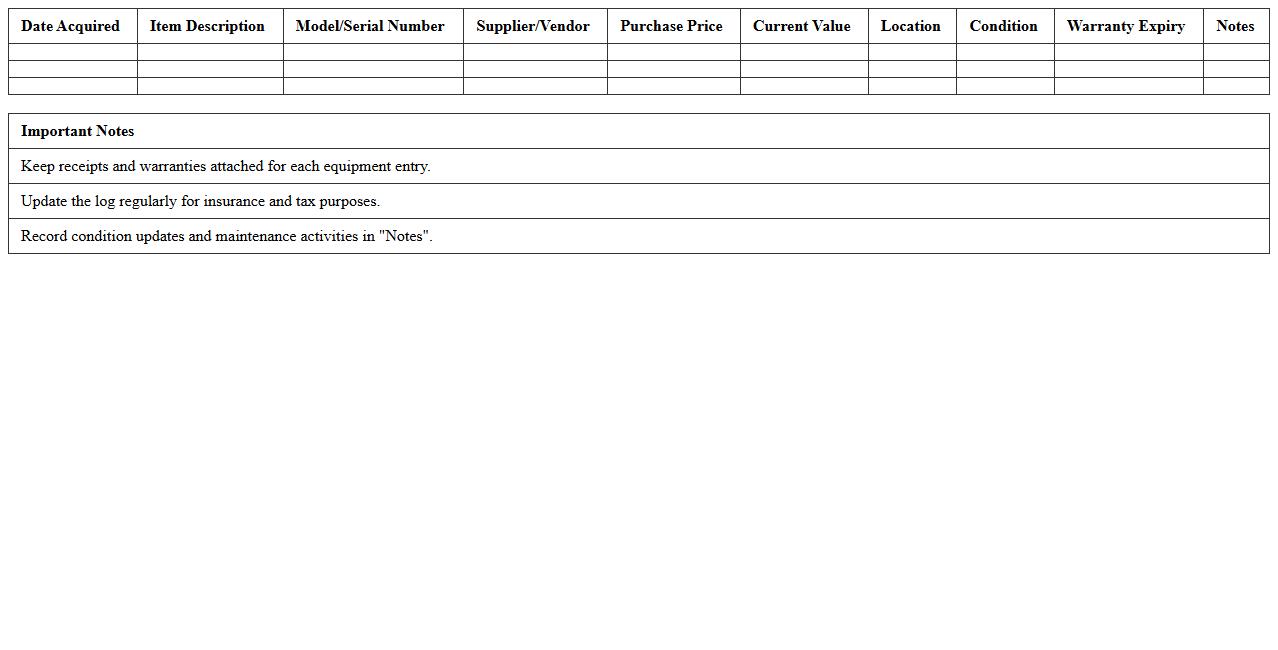

Small Business Equipment Log Excel

A

Small Business Equipment Log Excel document is a structured spreadsheet designed to track and manage all business assets, including purchase dates, maintenance schedules, and depreciation values. It helps small businesses maintain accurate records, streamline equipment management, and support financial reporting and tax compliance. Using this log improves resource allocation and ensures timely equipment servicing, enhancing operational efficiency.

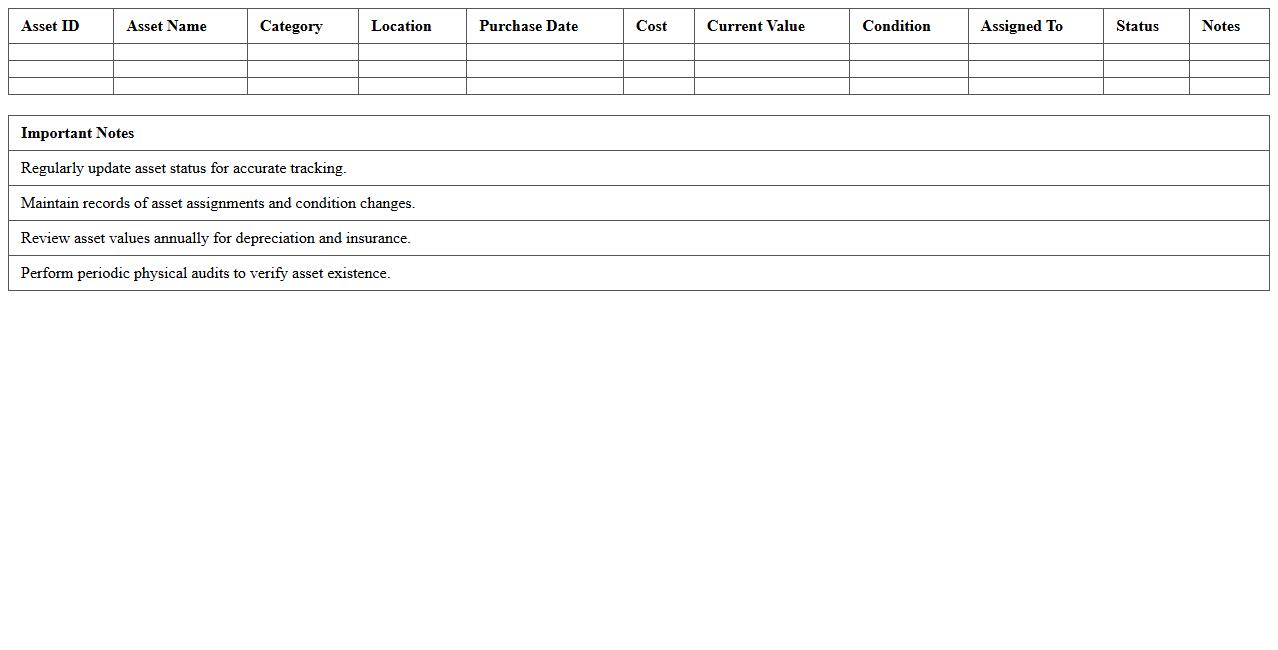

Company Asset Management Sheet

A

Company Asset Management Sheet is a detailed document that records and tracks all physical and intangible assets owned by a company, including equipment, machinery, software licenses, and intellectual property. This sheet helps in maintaining accurate asset inventories, monitoring asset usage, scheduling maintenance, and managing depreciation for financial reporting. By providing organized asset information, it enhances decision-making, supports budgeting processes, and ensures compliance with accounting standards.

Basic Asset Tracking Template Excel

The

Basic Asset Tracking Template Excel is a pre-designed spreadsheet that helps organizations systematically record and monitor their physical assets such as equipment, furniture, and electronics. This template enables users to maintain accurate asset information including purchase date, value, location, and maintenance schedules, ensuring improved accountability and easy retrieval of data. Utilizing this tool enhances inventory management efficiency, reduces asset loss, and supports maintenance planning for long-term cost savings.

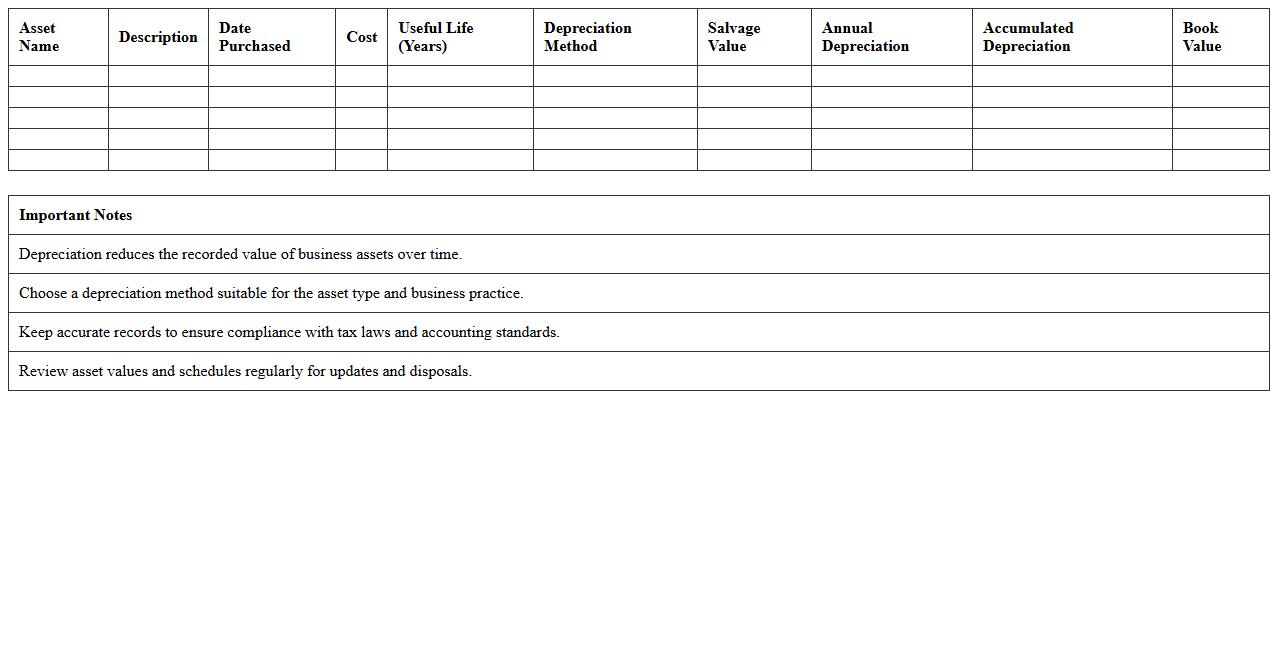

Depreciation Schedule for Business Assets

A

Depreciation Schedule for business assets is a detailed record that outlines the depreciation expense of each asset over its useful life, reflecting the gradual reduction in value. This document helps businesses accurately track asset value for financial reporting, tax deductions, and budgeting purposes. Maintaining an up-to-date depreciation schedule ensures compliance with accounting standards and optimizes tax benefits by properly allocating expenses.

Small Office Asset List Template

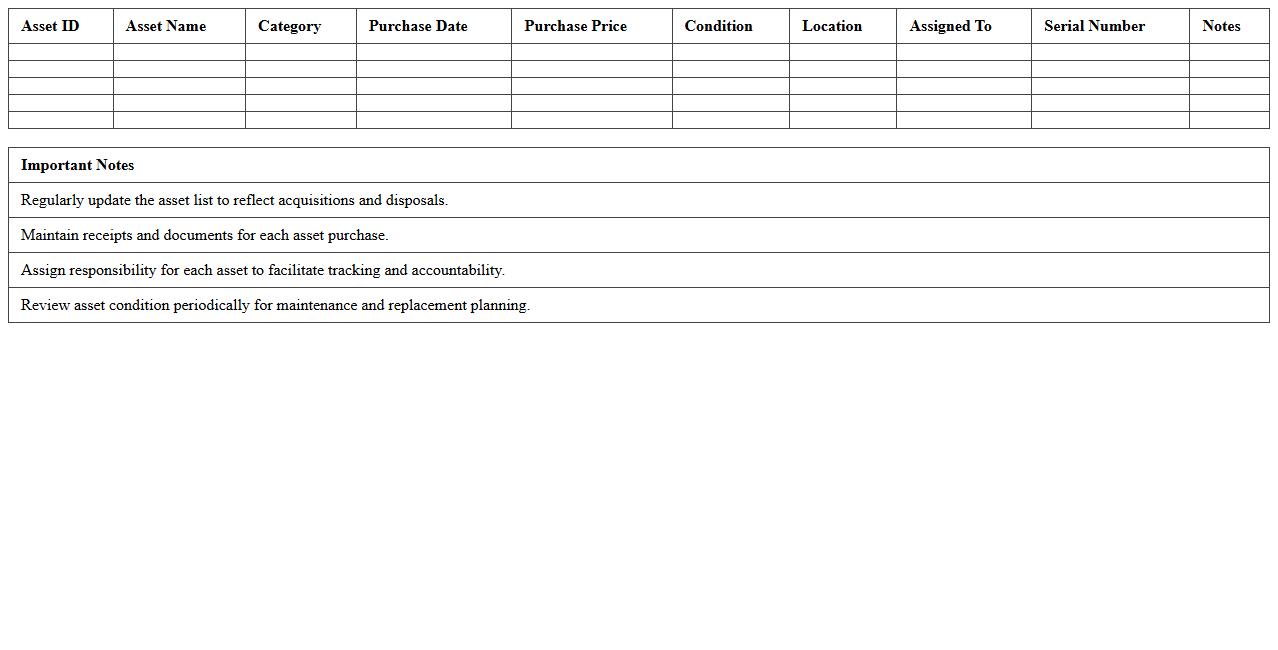

A

Small Office Asset List Template is a structured document used to record and manage all physical and digital assets within a small office environment. It helps track important details such as asset identification numbers, purchase dates, current value, and maintenance schedules, ensuring efficient asset management and accountability. This template improves inventory accuracy, supports budgeting decisions, and facilitates timely asset audits or replacements.

Asset Maintenance Record Spreadsheet

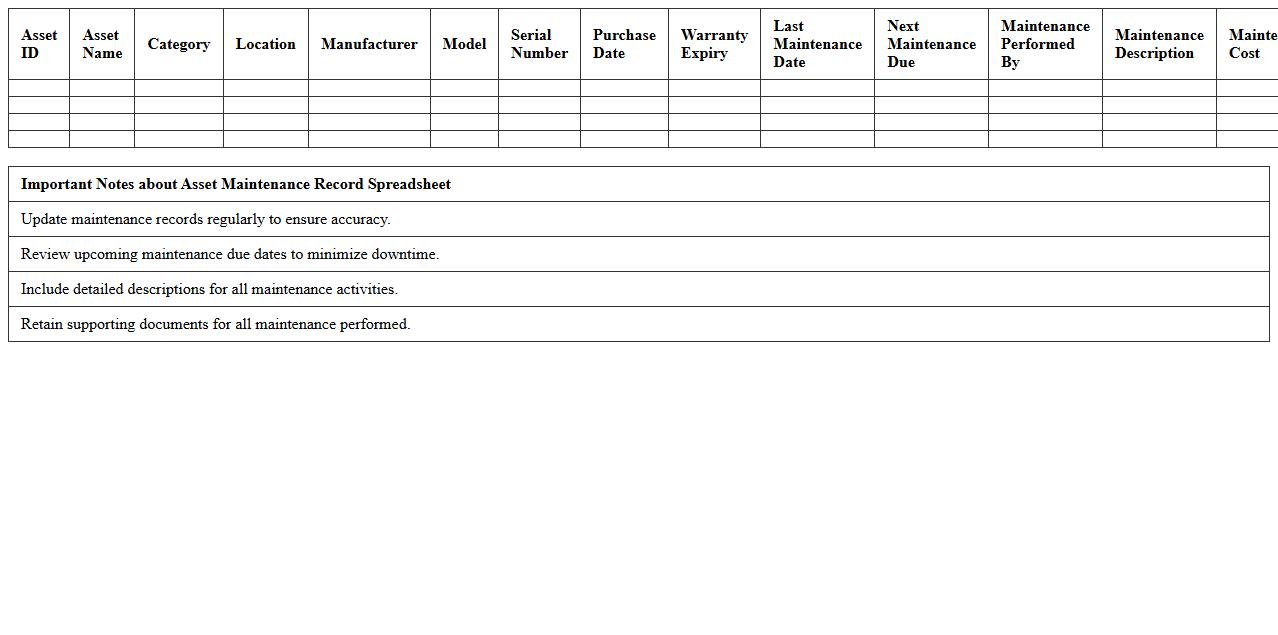

An

Asset Maintenance Record Spreadsheet is a detailed document used to systematically track and manage the maintenance schedules, history, and costs of physical assets. It helps organizations improve asset performance, ensure timely servicing, and reduce unexpected downtime by providing an organized ledger of maintenance activities and timelines. Utilizing this spreadsheet enhances decision-making, budgeting accuracy, and overall asset lifecycle management.

Simple Asset Allocation Tracker

A

Simple Asset Allocation Tracker document is a tool designed to monitor and manage investment portfolios by categorizing assets into classes such as stocks, bonds, and cash. It helps investors maintain a balanced portfolio aligned with their financial goals, risk tolerance, and market conditions. This tracker simplifies decision-making by providing clear insights into asset distribution, ensuring diversified investments and better risk management.

Asset Disposal Record Excel Sheet

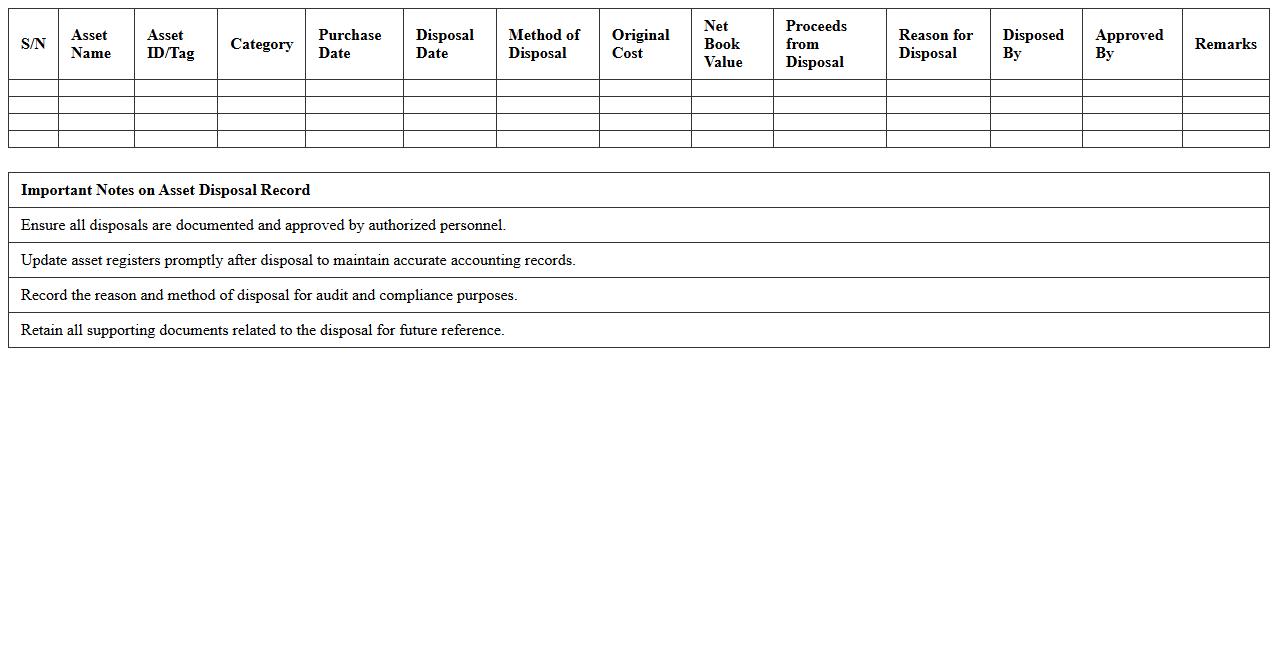

An

Asset Disposal Record Excel Sheet is a structured document used to track and document the disposal process of company assets, including details such as asset ID, disposal date, reason for disposal, and final value. This tool helps organizations maintain accurate records for auditing, compliance, and financial reporting purposes. It streamlines asset management by providing clear visibility into asset lifecycle termination, aiding in informed decision-making and regulatory adherence.

How can Asset Register Excel templates track depreciation for small business assets?

Asset Register Excel templates utilize depreciation formulas such as straight-line or reducing balance to automatically calculate asset value loss over time. These templates allow businesses to input asset purchase dates and useful life, enabling automatic tracking of accumulated depreciation. This streamlined process ensures small businesses can maintain accurate asset values and financial records.

What formulas automate asset value updates in an Asset Register Excel sheet?

Common Excel formulas like =IF, =SUM, and =VLOOKUP help update asset values dynamically upon changes in depreciation or asset status. The use of DATE functions combined with depreciation calculations ensures real-time adjustment of book value. These formulas reduce manual errors and increase the reliability of asset data management.

How can asset categories be customized in Asset Register Excel for small businesses?

Small businesses can customize asset categories by creating drop-down lists or using data validation to classify assets efficiently. Categories can be tailored to match specific business needs, such as machinery, vehicles, or office equipment, improving asset organization and reporting. This customization enhances tracking precision and facilitates easier filtering during audits.

What security features protect sensitive asset data in Excel registers?

Excel registers can utilize password protection and worksheet locking to secure sensitive asset information from unauthorized access. Additionally, encryption options in Excel provide an extra layer of data protection. These security measures ensure that sensitive business asset data remains confidential and compliant with data regulations.

How does Asset Register Excel assist in annual audit preparation for small enterprises?

Asset Register Excel templates provide a comprehensive overview of all assets, including purchase details, depreciation, and current values, simplifying audit documentation. The organized structure and automated calculations facilitate quick access to accurate asset data during audits. This preparation helps small enterprises ensure compliance and reduces audit-related stress.