The Cash Register Excel Template for Nonprofits is designed to simplify financial tracking by recording daily transactions accurately. It helps organizations maintain transparency and accountability by organizing income and expenses in a structured format. This template is essential for nonprofits striving to manage funds efficiently and generate comprehensive financial reports.

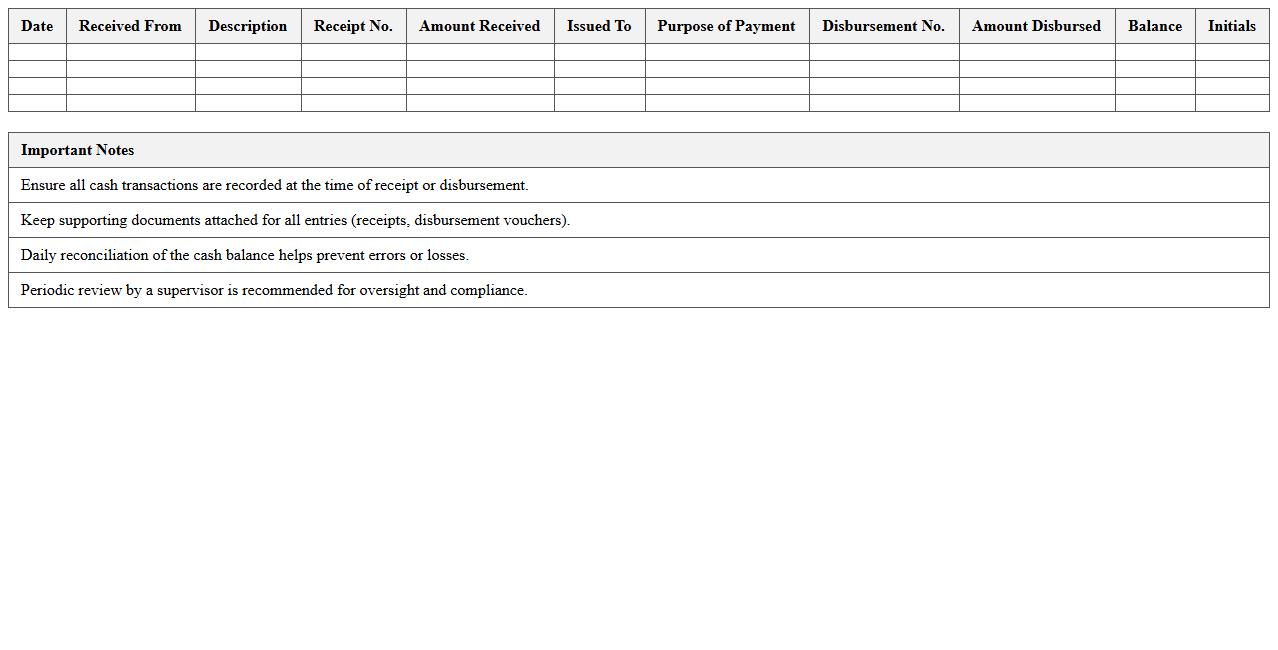

Daily Cash Log Sheet for Nonprofits

A

Daily Cash Log Sheet for Nonprofits is a crucial financial document used to record all cash transactions on a daily basis, ensuring accurate tracking of income and expenses. This log sheet helps maintain transparency and accountability by providing a clear, organized record for audits and financial reporting. Using this tool improves financial management, reduces errors, and supports compliance with nonprofit regulatory requirements.

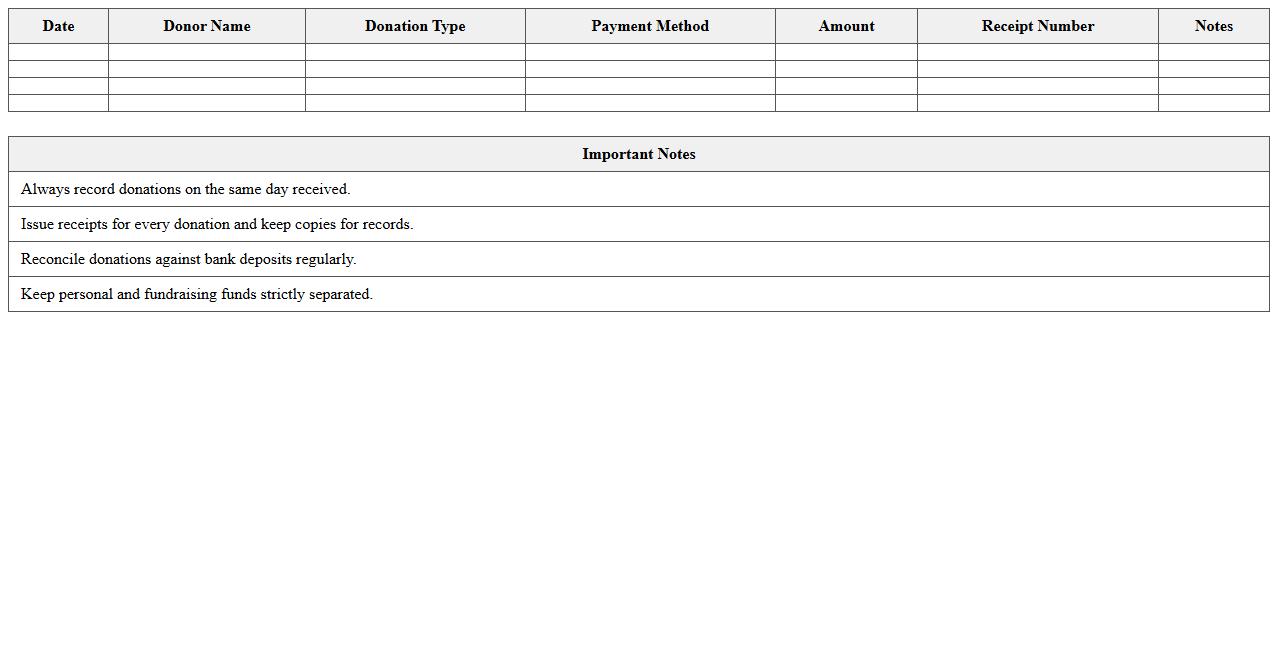

Donation Transaction Tracker Excel

The

Donation Transaction Tracker Excel document is a detailed spreadsheet designed to record and monitor all donation transactions systematically. It helps users efficiently organize donor information, track donation amounts, dates, and payment methods, ensuring transparency and accurate financial reporting. This tool is essential for nonprofits and fundraisers to maintain accountability, manage funds effectively, and prepare reports for stakeholders or tax purposes.

Nonprofit Fundraising Cash Register Template

The

Nonprofit Fundraising Cash Register Template document is a structured tool designed to record and track cash transactions during fundraising events, ensuring accuracy and transparency. It helps organizations maintain organized financial records, simplifies donation tracking, and supports accountability for donors and regulatory compliance. Utilizing this template enhances efficiency in managing funds and provides clear documentation for audit purposes.

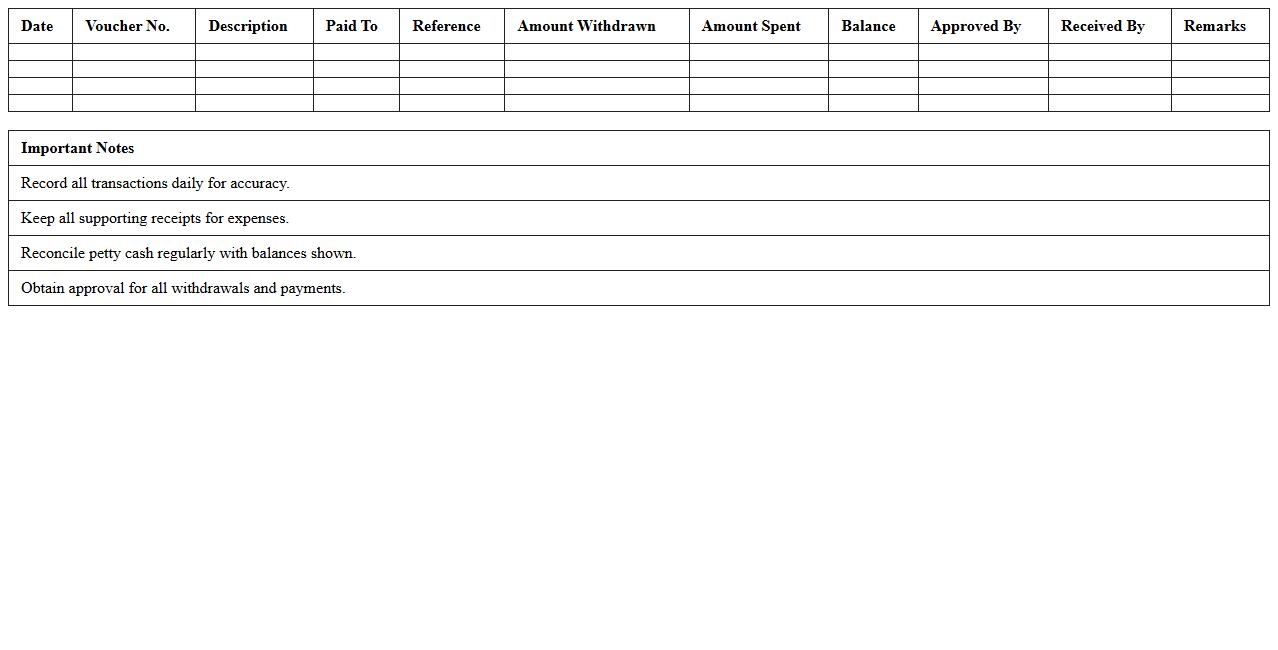

Petty Cash Management Spreadsheet

A

Petty Cash Management Spreadsheet document is a tool designed to track small cash expenses within an organization systematically. It helps maintain accurate records of petty cash inflows and outflows, ensuring transparency and preventing mismanagement. By using this spreadsheet, businesses can streamline their expense monitoring, simplify reconciliation processes, and maintain budget control efficiently.

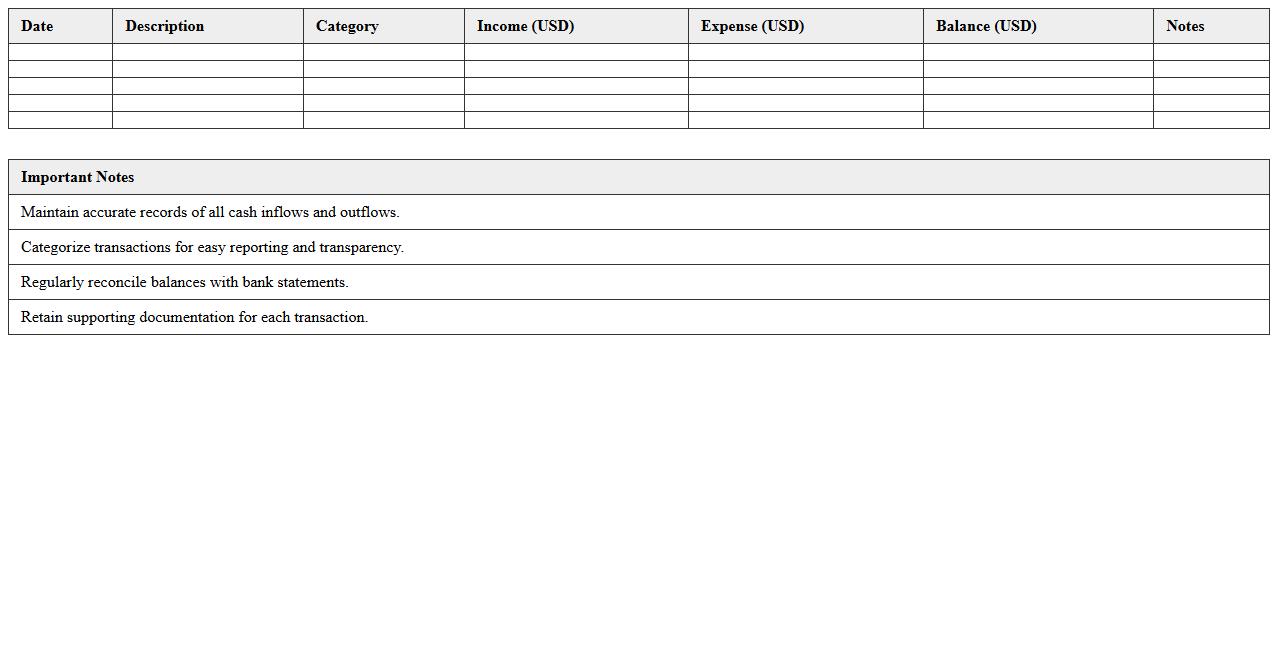

Cash Flow Record for Charitable Organizations

A

Cash Flow Record for Charitable Organizations is a detailed financial document that tracks the inflow and outflow of cash within a nonprofit entity. It provides transparency and accountability by documenting donations received, grants, expenses, and other financial transactions essential for regulatory compliance and auditing purposes. This record helps organizations maintain financial stability, plan budgets effectively, and demonstrate proper fund management to stakeholders and donors.

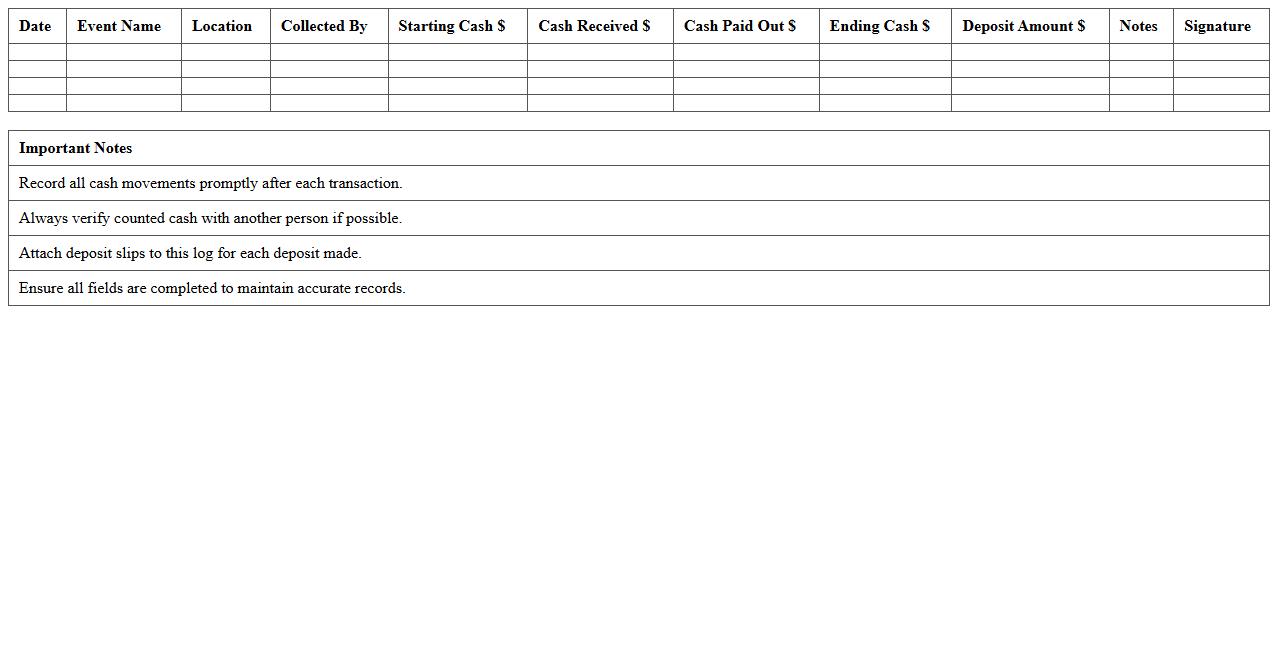

Event Cash Collection Log Excel

The

Event Cash Collection Log Excel document is a structured spreadsheet used to record and track all cash transactions during an event. It helps in maintaining accurate financial records, ensuring accountability, and simplifying reconciliation processes by itemizing each cash inflow with details like date, amount, and source. This log improves financial transparency, aids in budget management, and provides a clear audit trail for event organizers and stakeholders.

Nonprofit Expense and Cash Receipt Tracker

A

Nonprofit Expense and Cash Receipt Tracker document is a financial tool designed to systematically record and monitor all expenditures and incoming cash receipts within a nonprofit organization. It ensures accurate bookkeeping, aids in budgeting, and provides transparency for audits and donor reporting. Maintaining this tracker helps nonprofits manage funds efficiently, ensuring compliance with regulatory requirements and strengthening financial accountability.

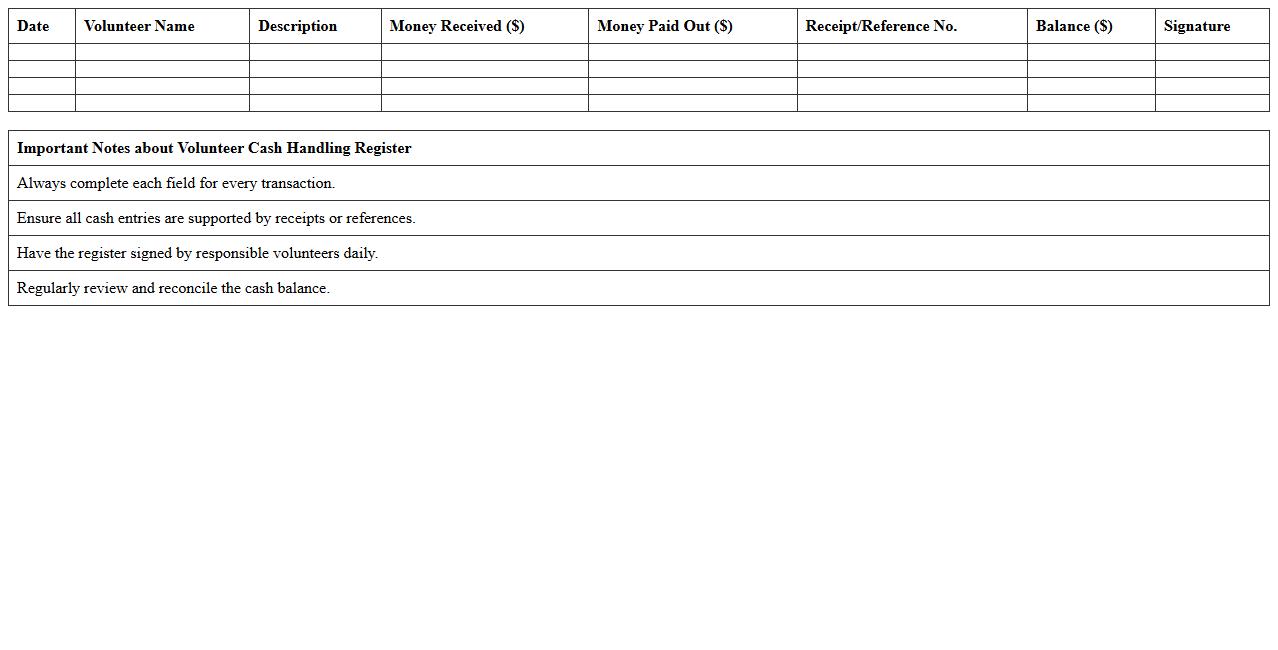

Volunteer Cash Handling Register

The

Volunteer Cash Handling Register document is a crucial tool for tracking and managing cash transactions conducted by volunteers during events or organizational activities. It ensures transparency by recording details such as amounts received, disbursed, and the purpose of each transaction, thereby minimizing errors and preventing misuse of funds. This register helps maintain accurate financial records, supports accountability, and aids in efficient auditing and reporting processes within nonprofit organizations or community projects.

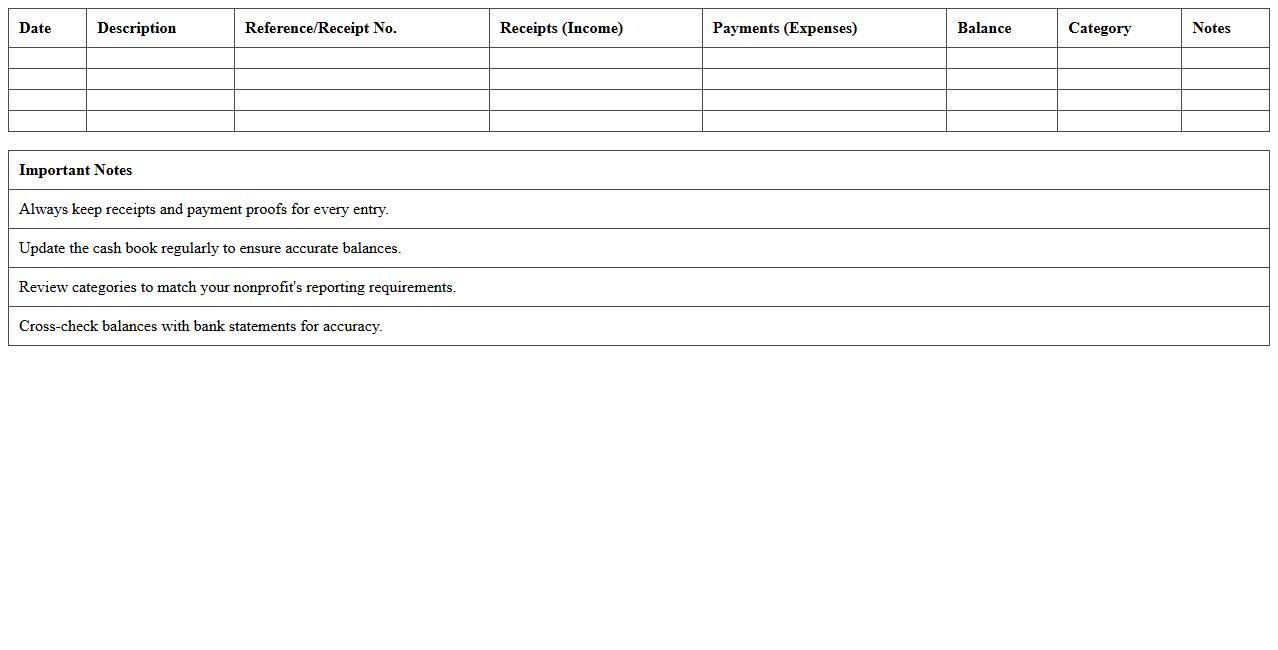

Simple Nonprofit Cash Book Template

The

Simple Nonprofit Cash Book Template document is a structured tool designed to track and manage cash transactions for nonprofit organizations efficiently. It provides clear records of income and expenses, ensuring accurate financial oversight and facilitating transparency for audits and reporting. Using this template helps nonprofits maintain organized accounts, improve budgeting, and ensure compliance with financial regulations.

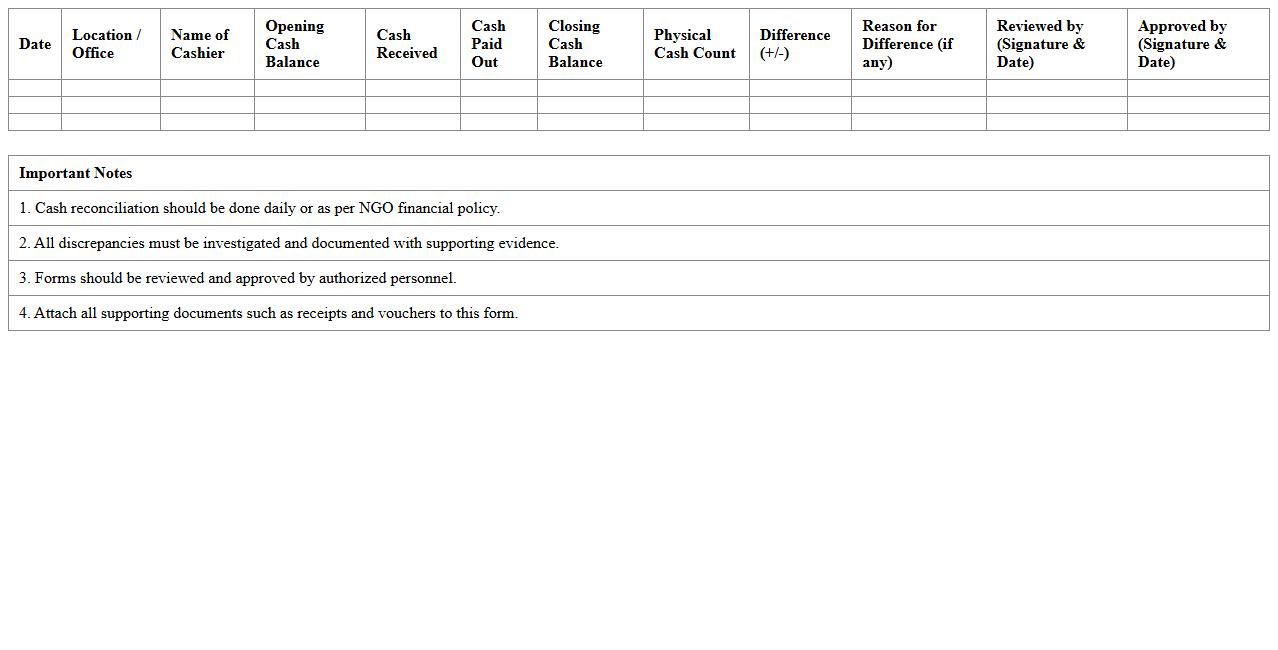

Cash Reconciliation Form for NGOs Excel

The

Cash Reconciliation Form for NGOs Excel document is a vital tool used to systematically track and verify cash transactions against the recorded financial data. It ensures accuracy in financial reporting by identifying discrepancies between cash on hand and ledger entries, enhancing transparency and accountability within non-governmental organizations. Utilizing this form helps NGOs maintain compliance with donor requirements and improves effective financial management.

How can Cash Register Excel templates be customized for nonprofit grant tracking?

Cash Register Excel templates can be customized by adding specific columns for grant name, funder, and grant period. Integrating dropdown lists for grant categories ensures consistent data entry. Additionally, conditional formatting highlights expenses related to each individual grant for easier tracking.

What features should a nonprofit prioritize in a Cash Register Excel letter for donor receipts?

Nonprofits should prioritize including donor name, donation date, and exact amount in donor receipt letters. Clear descriptions of donation purpose and necessary tax information are essential. Auto-filled fields from the Excel register improve accuracy and efficiency in receipt generation.

How does the Cash Register Excel sheet support restricted vs. unrestricted funds documentation?

The sheet can include separate columns or tabs for restricted and unrestricted funds to clearly differentiate income sources. Data validation rules prevent misclassification of fund types. Regular reports generated from the sheet help maintain transparency in fund usage.

What Excel formulas best automate expense categorization for nonprofit reporting?

Using the IF and VLOOKUP functions can automate categorization based on predefined criteria. The SUMIF formula aggregates expenses by category for streamlined reporting. Combining these formulas reduces manual entry and increases accuracy in financial summaries.

How do you document in-kind donations within a nonprofit Cash Register Excel system?

In-kind donations should be recorded with details such as donor information, item description, and estimated fair market value. Adding a separate category or tab for in-kind gifts ensures they are tracked distinctly. Proper documentation supports accurate reporting and donor acknowledgment.

More Register Excel Templates