The Financial Recovery Plan Excel Template for Freelancers is designed to help independent professionals track income, expenses, and savings goals efficiently. This customizable tool enables users to create detailed budgets and monitor cash flow, ensuring better financial stability during challenging periods. Its intuitive layout simplifies complex financial data, empowering freelancers to make informed decisions and accelerate their recovery process.

Freelance Income Tracker Spreadsheet

A

Freelance Income Tracker Spreadsheet is a digital tool designed to help freelancers record and monitor their earnings from various clients and projects. This document simplifies financial management by organizing income data, tracking payment dates, and categorizing revenue streams, which enhances budgeting accuracy and tax preparation. Using this spreadsheet leads to better cash flow insights and ensures timely invoicing, contributing to improved freelance business efficiency.

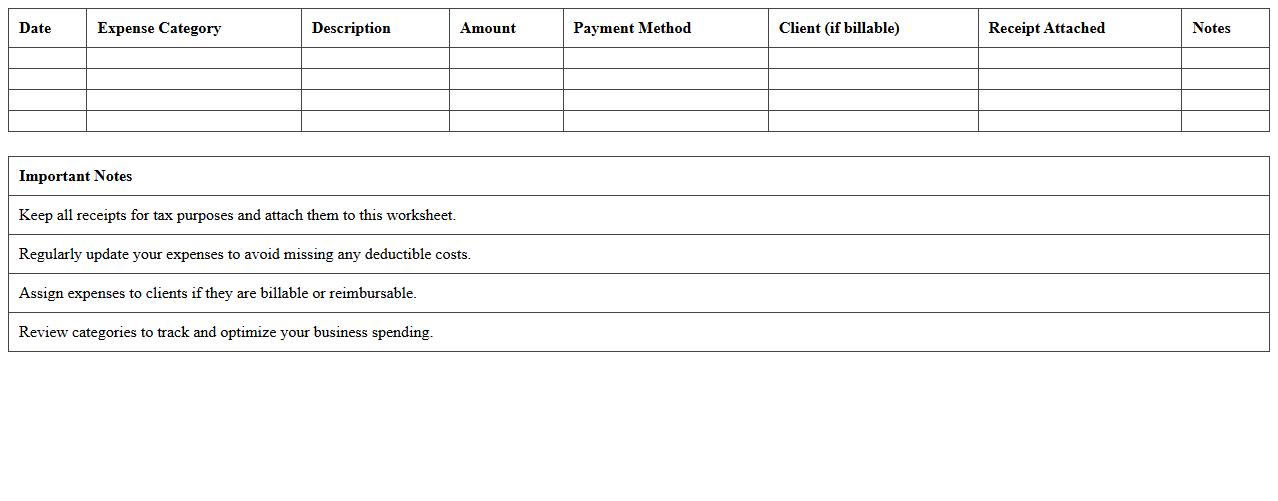

Expense Management Worksheet for Freelancers

An

Expense Management Worksheet for Freelancers is a detailed document that helps track and organize all business-related expenses efficiently. It ensures accurate record-keeping, simplifies tax reporting, and aids in budgeting by categorizing costs like software subscriptions, equipment, and travel. Using this worksheet promotes financial clarity, enabling freelancers to monitor spending patterns and maximize deductibles for improved profitability.

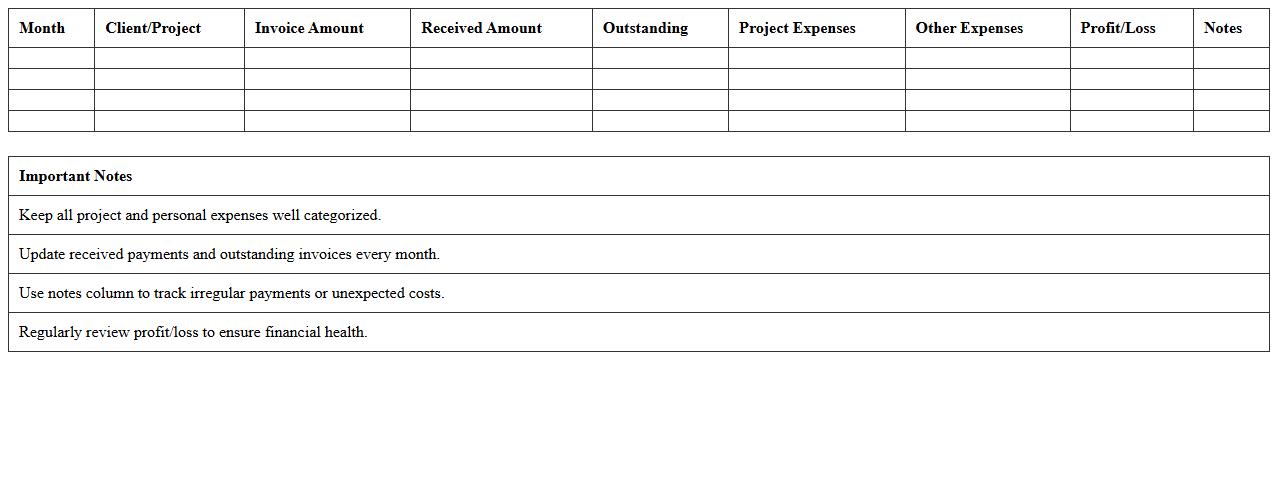

Freelancer Budget Planning Excel Sheet

A

Freelancer Budget Planning Excel Sheet is a structured financial tool designed to help freelancers track income, expenses, and project costs efficiently. This document enables better cash flow management, accurate invoicing, and informed decision-making by providing clear visibility into earnings and expenditures. Using this sheet ensures freelancers can maintain financial stability and optimize their budgeting for sustainable business growth.

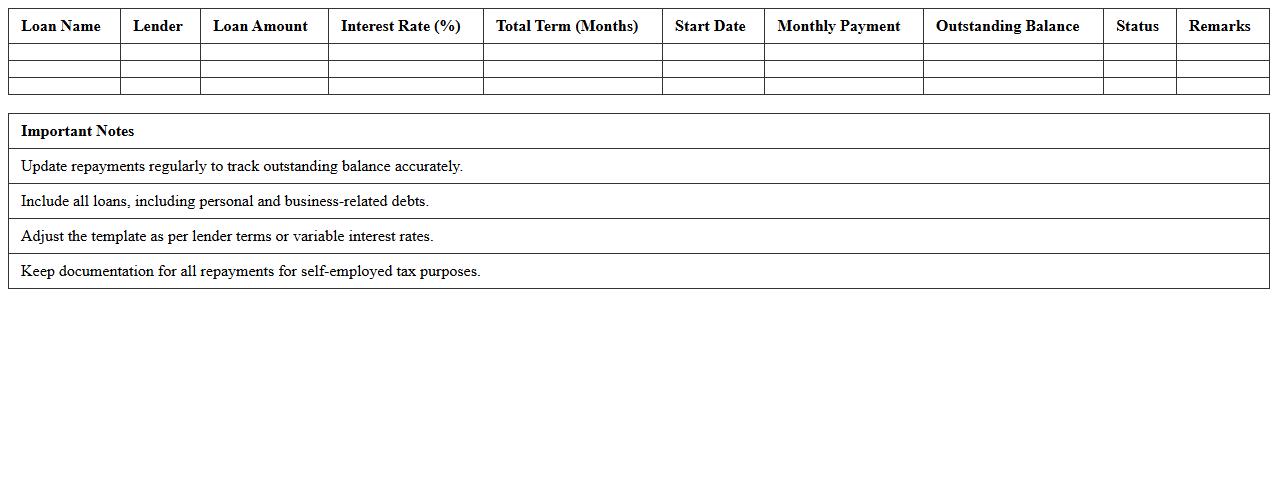

Debt Repayment Schedule Template for Self-Employed

A

Debt Repayment Schedule Template for Self-Employed document organizes and tracks outstanding debts, repayment amounts, due dates, and interest rates specifically tailored for freelancers and business owners. It helps manage cash flow effectively, ensures timely payments, and prevents missed deadlines that could impact credit scores or financial stability. Using this template improves financial planning by providing a clear overview of obligations and supports strategic decision-making in debt reduction.

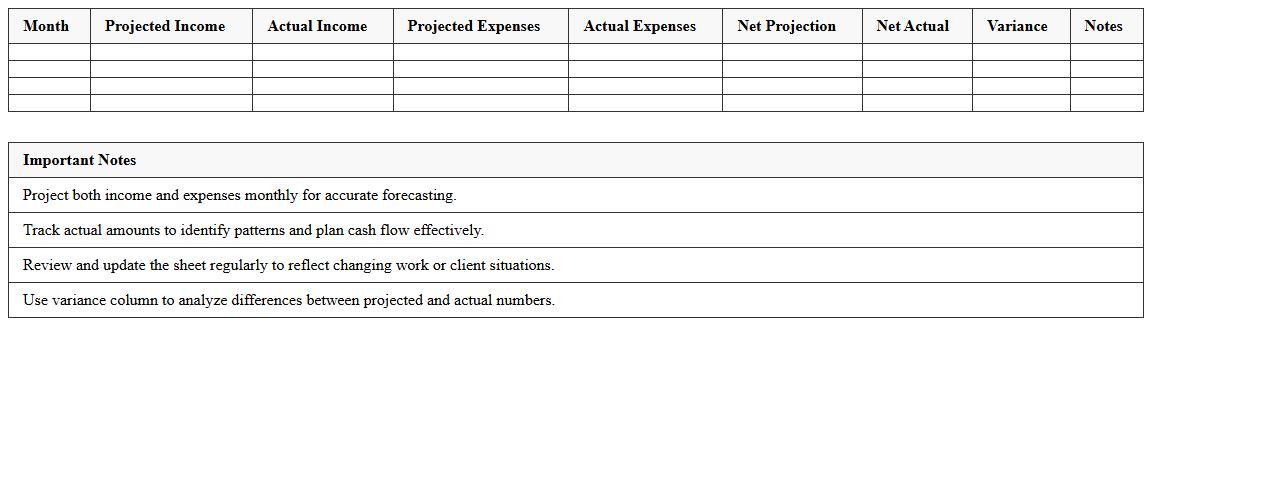

Cash Flow Projection Sheet for Freelancers

A

Cash Flow Projection Sheet for Freelancers is a financial tool that helps track expected income and expenses over a specific period, enabling better budget management and planning. This document allows freelancers to forecast cash inflows from clients and outflows such as bills, taxes, and business expenses, ensuring sufficient funds are available to cover costs. It is useful for identifying potential cash shortages early, improving financial stability and decision-making for independent professionals.

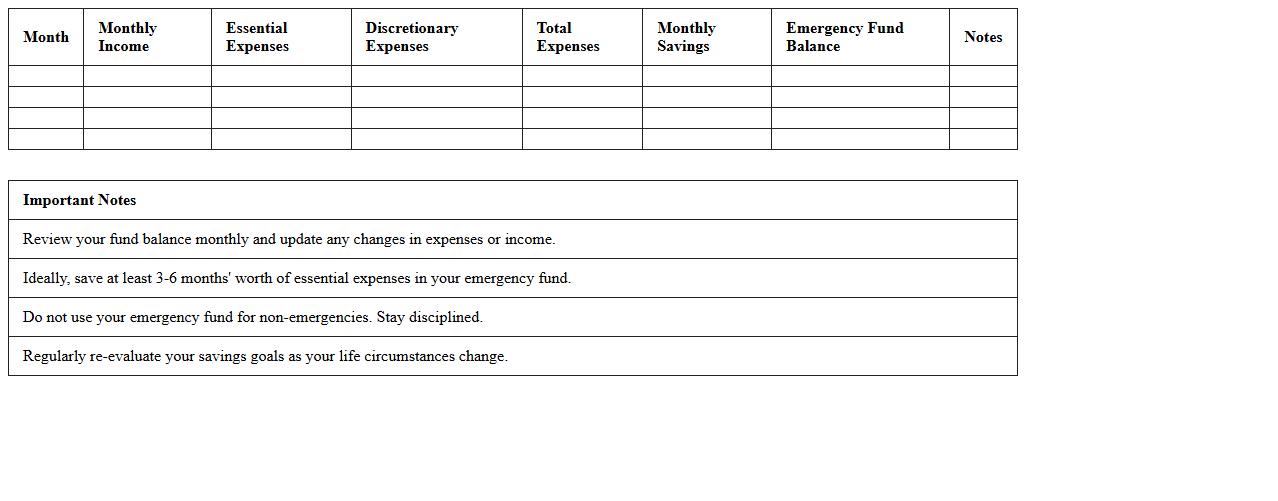

Emergency Fund Planning Spreadsheet

An

Emergency Fund Planning Spreadsheet is a financial tool designed to help individuals systematically calculate and track the amount needed to cover unexpected expenses, such as medical emergencies, job loss, or urgent repairs. This document organizes income, monthly expenses, and savings goals, allowing users to visualize their progress toward building a secure financial buffer. Utilizing this spreadsheet enhances financial preparedness, reduces stress during unforeseen events, and promotes disciplined saving habits.

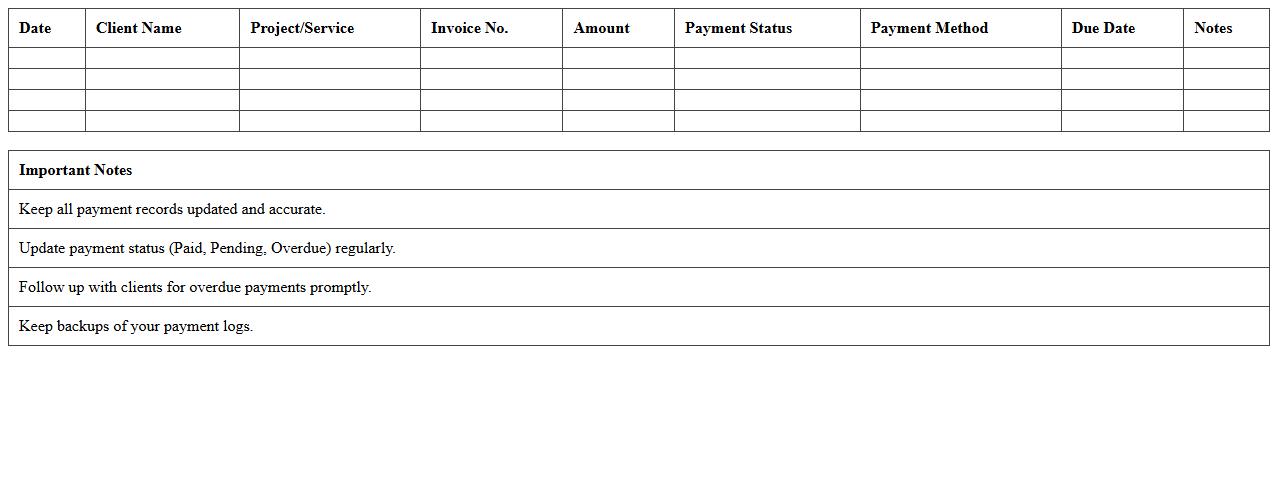

Freelance Client Payment Log Template

A

Freelance Client Payment Log Template document is a structured record-keeping tool designed to track payments received from freelance clients, including payment dates, amounts, and project details. This template enhances financial organization, simplifies invoicing verification, and ensures accurate income reporting for tax and budgeting purposes. Using a payment log reduces errors in payment tracking and helps freelancers maintain transparency and professionalism in client transactions.

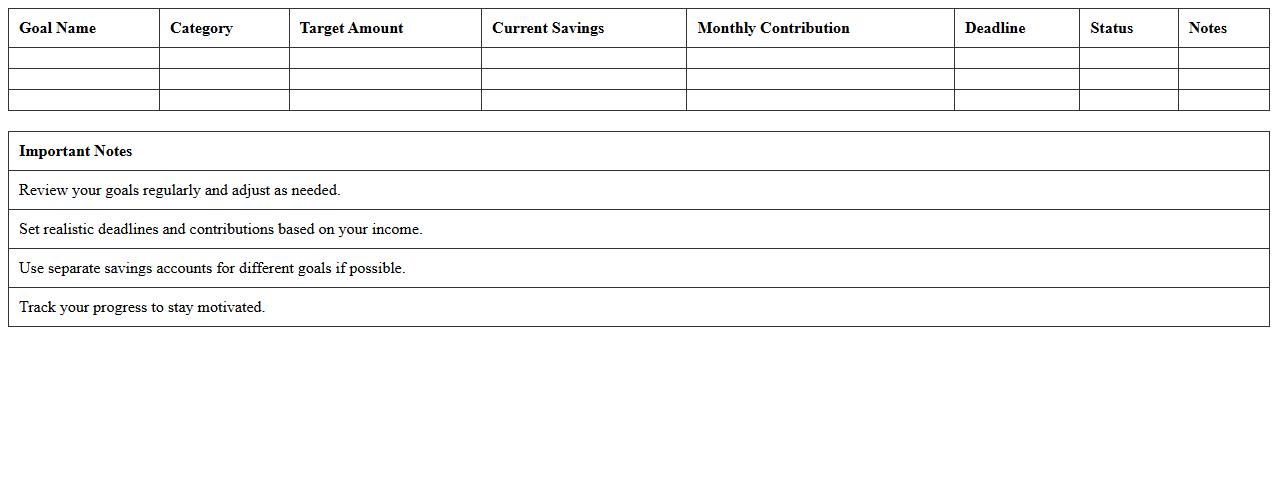

Financial Goal Setting Excel for Freelancers

The

Financial Goal Setting Excel for Freelancers document is a structured spreadsheet designed to help freelancers track income, expenses, and savings targets efficiently. It allows users to set realistic financial objectives, monitor cash flow, and analyze trends to improve budgeting accuracy. Utilizing this Excel tool enhances financial planning by providing clear visualizations and actionable insights tailored specifically for freelance work.

Invoice Tracker Spreadsheet for Freelancing

An

Invoice Tracker Spreadsheet for Freelancing is a digital tool designed to organize and monitor payments, invoice statuses, and client details efficiently. It helps freelancers maintain accurate financial records, ensuring timely follow-ups on unpaid invoices and simplifying tax preparation. By centralizing invoice information, this spreadsheet enhances cash flow management and improves overall financial planning.

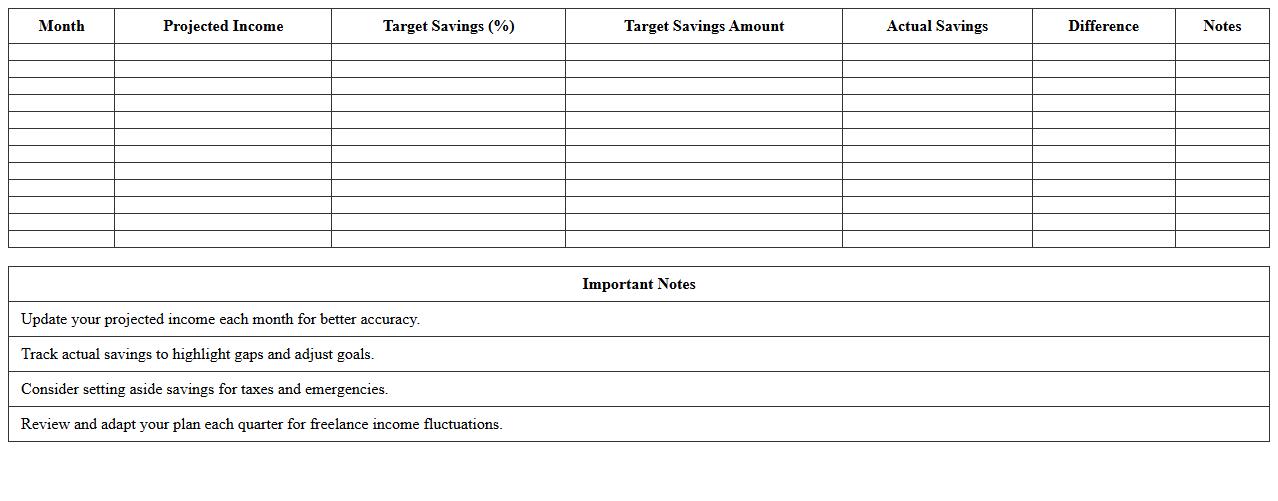

Monthly Savings Plan Template for Freelancers

A

Monthly Savings Plan Template for Freelancers is a structured document designed to help independent professionals systematically allocate their income towards savings each month. This template categorizes expenses, tracks earnings, and sets clear savings goals tailored to fluctuating freelance income, promoting financial stability. Using this plan enhances budget management, reduces financial stress, and ensures consistent progress toward long-term financial objectives.

How to track irregular freelance income in a Financial Recovery Plan Excel template?

To track irregular freelance income, create a dedicated income sheet within your Excel template. Input all earnings with corresponding dates and project potential future income based on past trends. Use Excel's SUMIF or FILTER functions to aggregate income over specific periods accurately.

What Excel formulas help automate debt reduction strategies for freelancers?

Excel formulas like PMT and CUMIPMT automate debt repayment calculations by predicting payment amounts and interest over time. The IF statement can prioritize debt payments depending on balances or interest rates. Using these formulas helps freelancers efficiently plan and adjust debt reduction strategies.

Which expense categories are essential for freelancers' financial recovery plans?

Essential expense categories include business expenses, personal living costs, and irregular or emergency outlays. Categorizing expenses clearly supports accurate budgeting and identifying areas for cost reduction. Including taxes and savings contributions is also critical to avoid surprises and foster recovery.

How to project variable monthly savings for freelancers using Excel?

Project variable monthly savings by linking income projections with planned expenses in your Excel template. Use dynamic formulas like =MAX and =MIN to account for income fluctuations and adjust savings goals accordingly. This approach ensures your savings plan stays realistic despite irregular earnings.

What visual Excel tools best highlight financial progress for freelancers?

Visual tools such as line charts, pivot tables, and conditional formatting effectively illustrate income, expenses, and debt reduction trends. Dashboards combining these elements provide an at-a-glance snapshot of financial progress. Utilizing Excel's visual features enhances motivation and enables better decision-making.

More Plan Excel Templates