The Financial Savings Plan Excel Template for Young Professionals offers a practical tool to track income, expenses, and saving goals with ease. It simplifies budgeting by providing customizable categories and automated calculations to help users optimize their financial habits. Designed for young professionals, this template enhances money management skills and promotes disciplined savings for future financial stability.

Monthly Expense Tracker for Young Professionals

The

Monthly Expense Tracker for Young Professionals is a detailed financial tool designed to monitor and categorize personal spending habits over a monthly period. It helps users gain a clear understanding of their income allocation, identify unnecessary expenses, and optimize budgeting strategies effectively. By maintaining accurate records, young professionals can improve financial discipline, achieve savings goals, and build a stronger foundation for long-term financial stability.

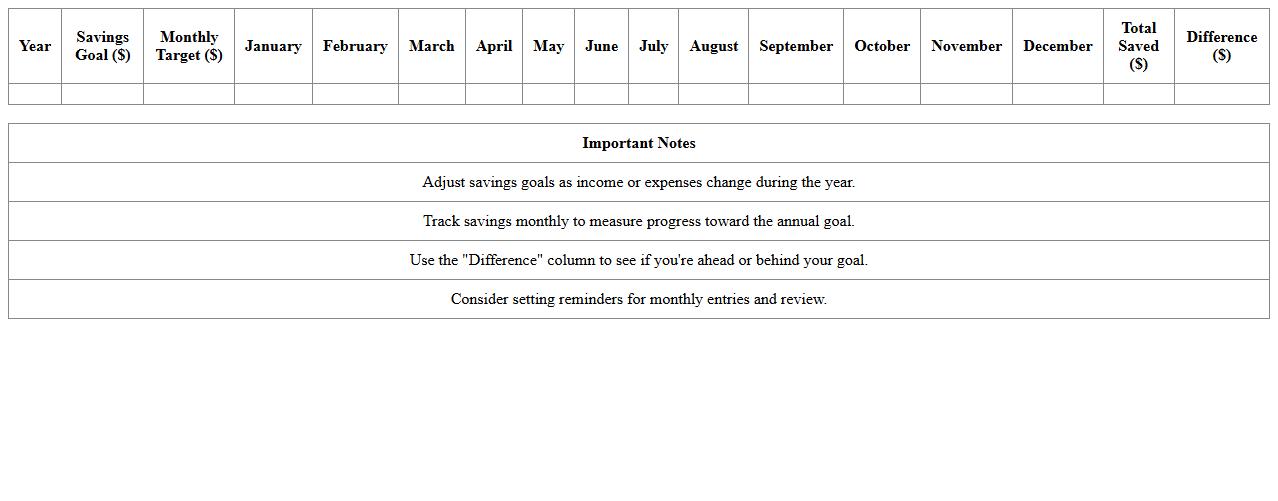

Annual Savings Goals Planner Spreadsheet

The

Annual Savings Goals Planner Spreadsheet is a structured document designed to help individuals set, track, and achieve their financial savings targets throughout the year. It allows users to break down annual savings goals into manageable monthly or weekly amounts, providing clear visualization of progress and adjustments as needed. This tool enhances financial discipline, promotes consistent saving habits, and supports budgeting by offering measurable milestones aligned with personal or family financial objectives.

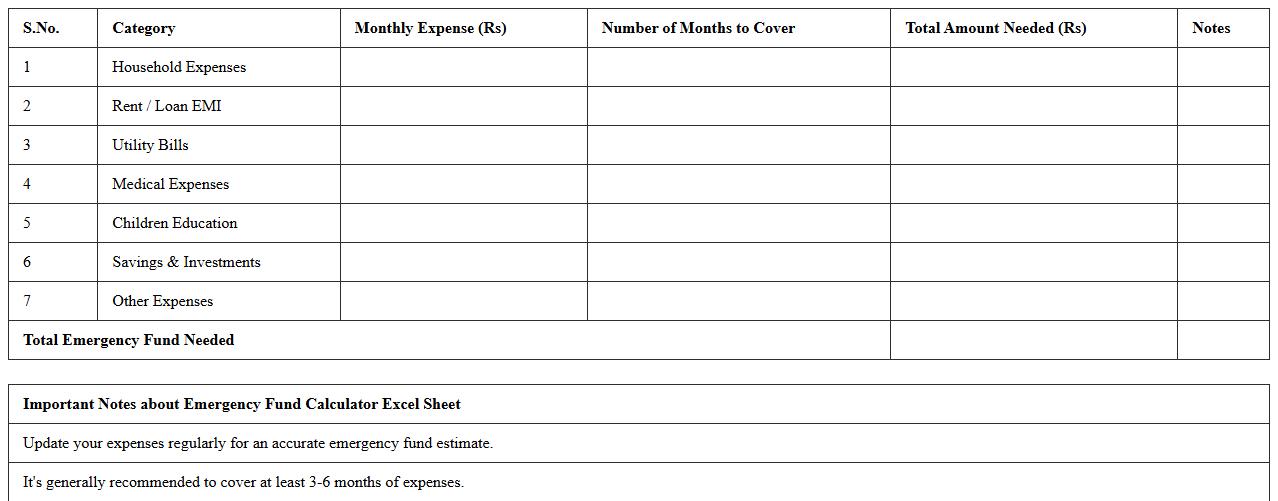

Emergency Fund Calculator Excel Sheet

An

Emergency Fund Calculator Excel Sheet is a financial tool designed to help individuals accurately estimate the amount of money needed to cover unexpected expenses or income loss. By inputting variables such as monthly expenses, income stability, and desired safety net duration, users can create a personalized savings goal that enhances financial security. This document streamlines emergency fund planning, promoting smarter budgeting decisions and reducing financial stress during unforeseen events.

Investment Portfolio Tracker for Beginners

An

Investment Portfolio Tracker for beginners is a comprehensive document designed to help new investors monitor and manage their investments effectively. It organizes critical financial data such as asset allocation, performance metrics, and risk assessment in a clear, easy-to-understand format. This tool enhances decision-making, allowing users to optimize returns and stay aligned with their financial goals.

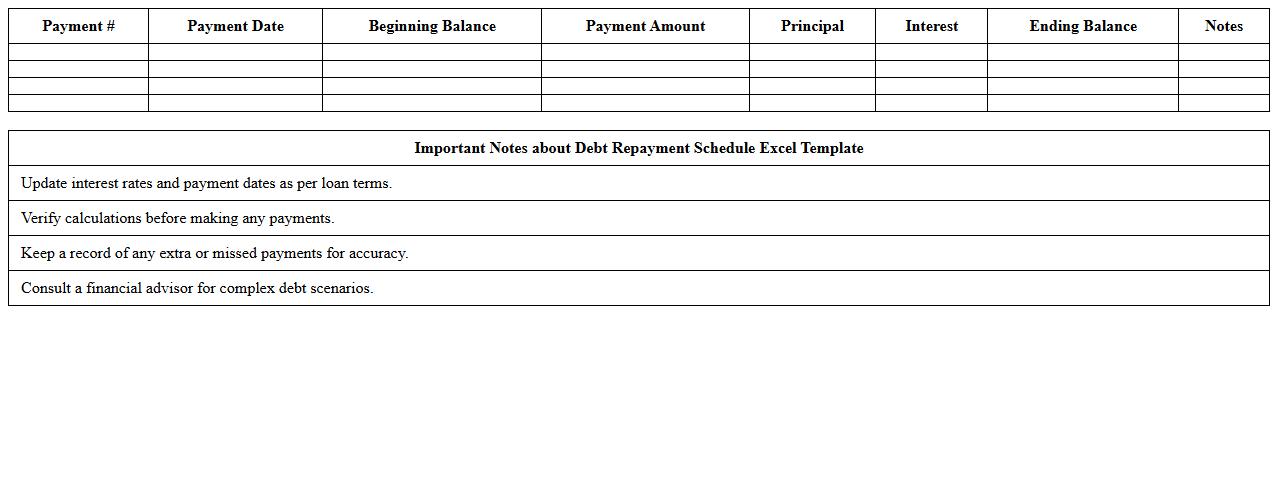

Debt Repayment Schedule Excel Template

A

Debt Repayment Schedule Excel Template is a structured spreadsheet designed to help individuals and businesses systematically track and manage their debt obligations over time. This template typically includes fields for loan amounts, interest rates, payment dates, and outstanding balances, enabling precise calculation of repayment installments. Using this tool improves financial planning by providing clear visibility of payment timelines and ensuring adherence to debt repayment plans, ultimately aiding in avoiding late fees and reducing financial stress.

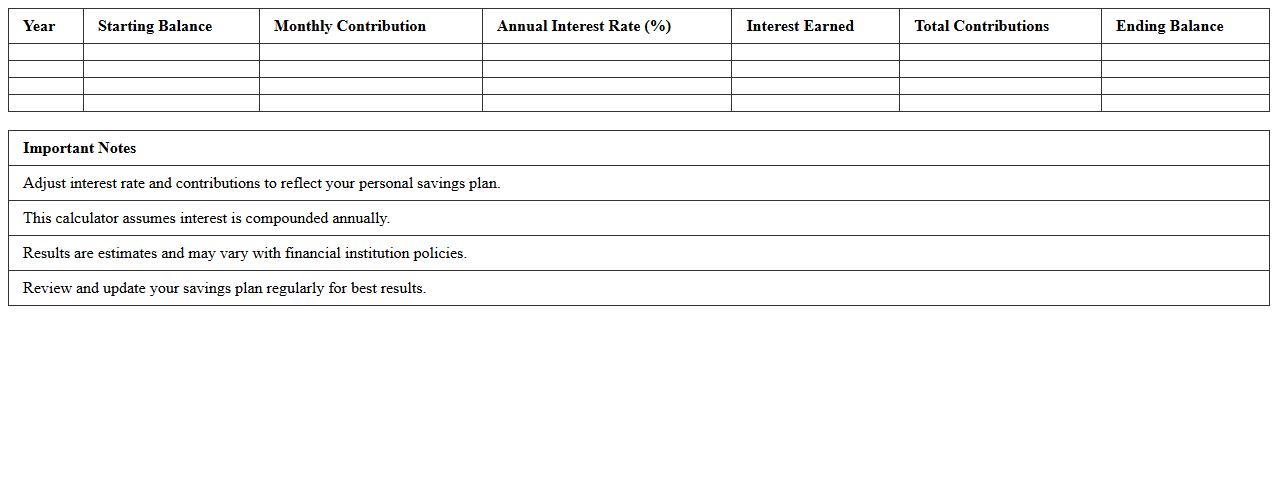

Automated Savings Projection Calculator

The

Automated Savings Projection Calculator document provides a detailed framework for estimating future savings based on current contributions, interest rates, and investment duration. It enables users to make informed financial decisions by projecting potential growth and identifying optimal saving strategies. This tool enhances budget planning and long-term financial goal setting by offering accurate, data-driven forecasts.

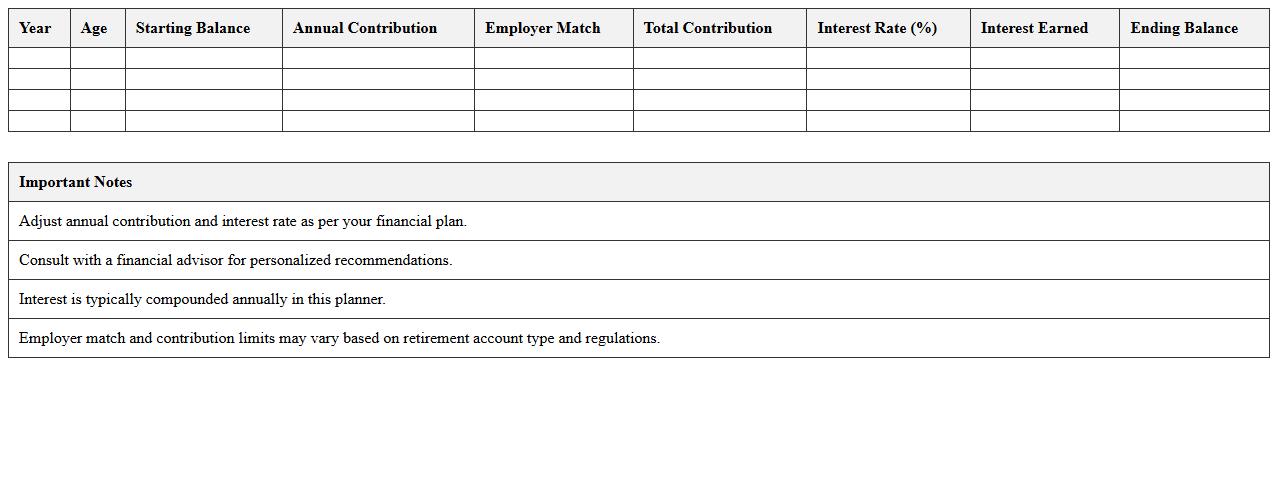

Retirement Savings Growth Planner

The

Retirement Savings Growth Planner document is a detailed financial tool designed to track and project the growth of retirement funds over time, incorporating variables such as contributions, interest rates, and inflation. It helps individuals visualize their savings trajectory and make informed decisions to optimize their retirement income. By providing clear, data-driven insights, this planner supports strategic adjustments that enhance long-term financial security.

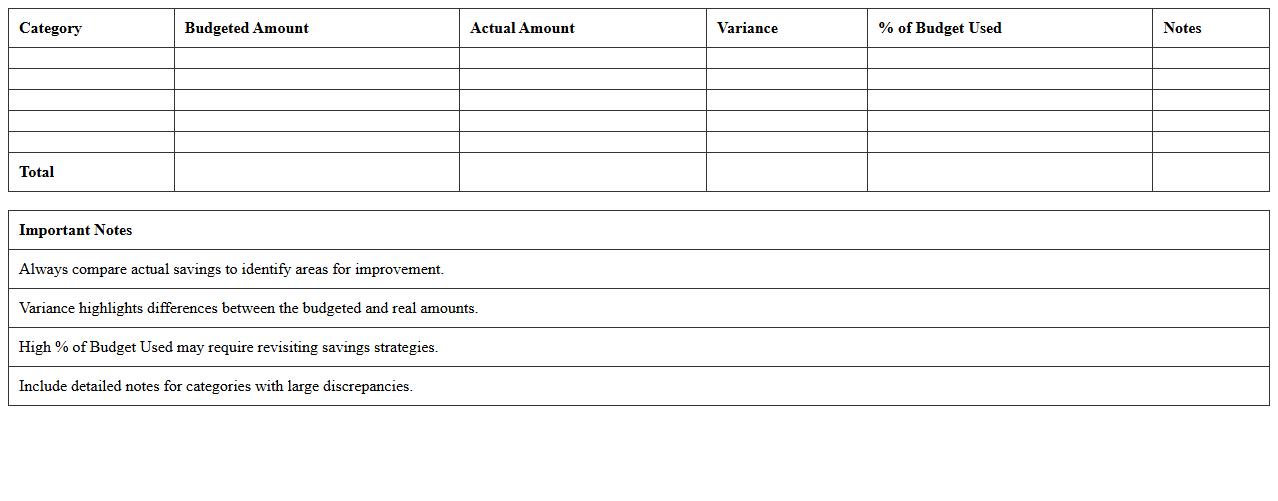

Budget vs Actual Savings Comparison Sheet

A

Budget vs Actual Savings Comparison Sheet is a financial document used to track and compare planned savings against actual savings over a specified period. It provides critical insights into spending habits, identifies discrepancies, and helps in adjusting future budgets to achieve financial goals more effectively. By regularly reviewing this comparison, individuals and businesses can enhance financial discipline and optimize resource allocation for better savings outcomes.

High-Yield Savings Account Tracker

A

High-Yield Savings Account Tracker document is a tool used to monitor and manage the interest rates, balances, and performance of multiple high-yield savings accounts in one place. It helps users compare returns, track growth over time, and optimize their savings strategy by identifying the best accounts for maximizing earnings. By maintaining accurate records, individuals can make informed decisions to increase their passive income efficiently.

Side Hustle Income and Savings Tracker

The

Side Hustle Income and Savings Tracker document is a comprehensive tool designed to monitor extra earnings and manage savings effectively. It helps individuals organize their side income streams, track earnings over time, and plan savings goals strategically. By using this tracker, users can gain clear insights into their financial progress and improve budgeting decisions for additional income sources.

How can conditional formatting highlight overspending in the Financial Savings Plan Excel?

Conditional formatting in Excel applies color codes to cells based on spending limits, making it easy to spot overspending. You can set rules where expenses exceeding the budget are highlighted in red, drawing immediate attention. This visual cue helps users manage their finances proactively by avoiding budget breaches.

What formulas best track monthly saving goals for young professionals?

Using the SUMIF formula allows aggregation of monthly deposits towards savings goals efficiently. The IF function can track whether targets are met by comparing actual savings against goals. Combined with DATEDIF, these formulas offer precise progress tracking over time.

Which charts visualize emergency fund growth in a Savings Plan Excel?

Line charts are ideal for visualizing the steady growth of an emergency fund over time. Area charts can also illustrate cumulative savings, emphasizing the amount accumulated. Both chart types provide clear insights into the progress and trends of the emergency fund.

How does the template calculate interest from different savings accounts?

The template uses formulas incorporating principal, interest rate, and time to compute accrued interest for each account type. It often applies the compound interest formula to reflect realistic growth scenarios. This ensures accurate tracking of interest earnings across diverse savings plans.

What Excel pivot tables reveal spending patterns in a young professional's budget?

Pivot tables organize spending data by categories, dates, and amounts, highlighting where funds are allocated. They help identify trends such as frequently overspent categories or fluctuating expenses over months. This analytical tool is crucial for optimizing the budget management process.

More Plan Excel Templates