The Financial Investment Plan Excel Template for Retirees offers a user-friendly tool to track and manage retirement funds effectively. It allows retirees to organize assets, project growth, and optimize income streams for long-term financial security. This template supports informed decision-making with customizable charts and comprehensive investment summaries.

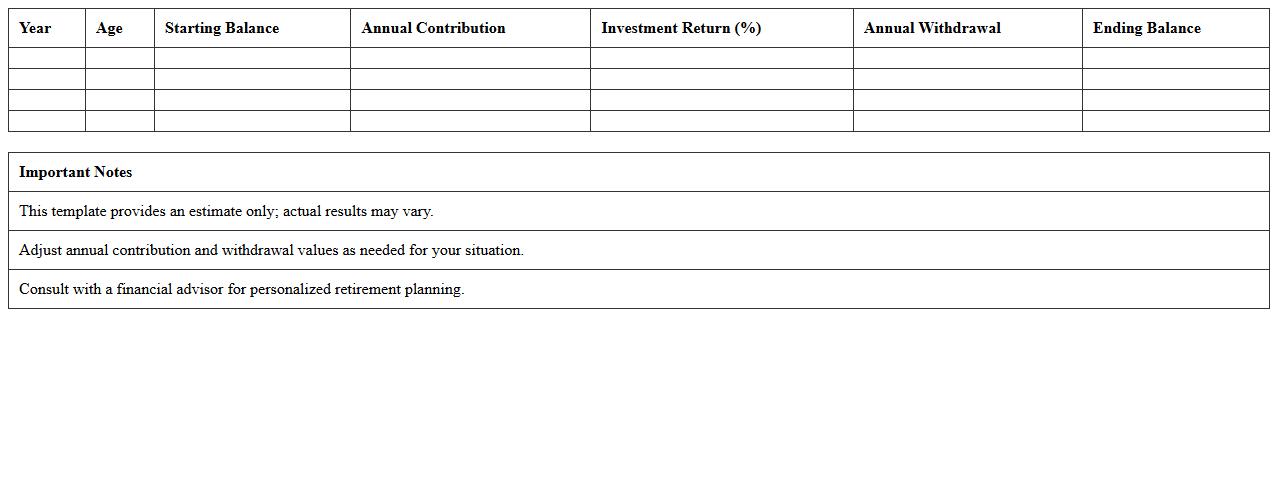

Retirement Income Projection Excel Template

A

Retirement Income Projection Excel Template is a financial planning tool designed to estimate future income streams during retirement based on current savings, expected returns, and withdrawal rates. It helps users visualize potential financial outcomes, enabling better decision-making for savings, investments, and budgeting to ensure sufficient funds throughout retirement. By providing customizable inputs and detailed projections, this template supports long-term retirement security and effective financial management.

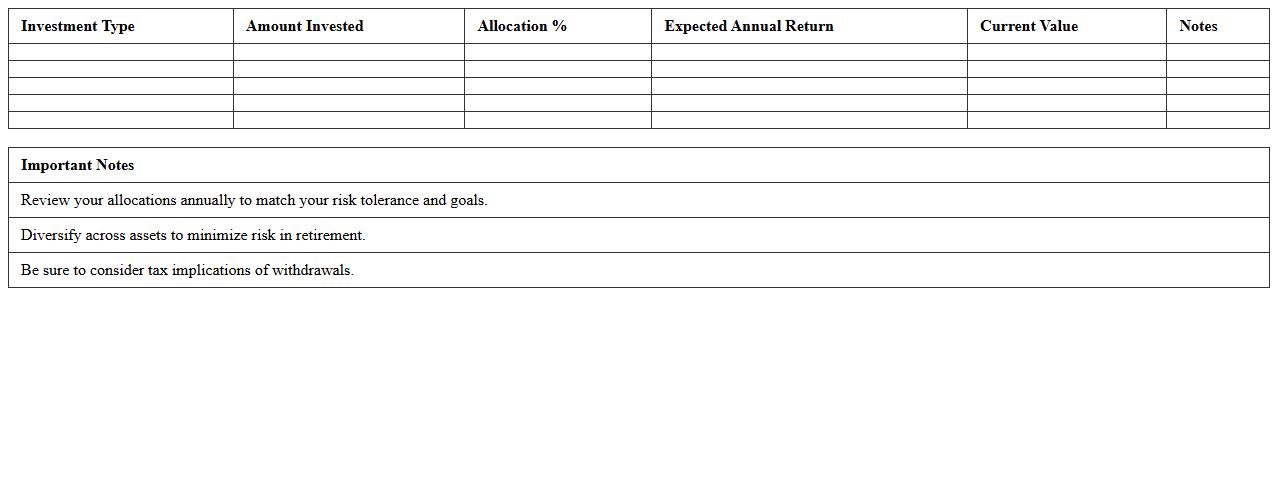

Post-Retirement Investment Allocation Spreadsheet

A

Post-Retirement Investment Allocation Spreadsheet is a financial planning tool designed to help retirees strategically distribute their investment portfolio to ensure steady income throughout retirement. It allows users to track asset classes such as stocks, bonds, and cash equivalents, optimizing for risk tolerance and income needs. By visualizing allocation percentages and projected growth, this spreadsheet aids in making informed decisions to maximize returns while preserving capital during retirement years.

Pension & Annuity Tracking Excel Sheet

A

Pension & Annuity Tracking Excel Sheet is a structured document designed to monitor and manage pension disbursements and annuity payments efficiently. It allows users to record payment schedules, track received amounts, and calculate future benefits, ensuring accurate financial planning and transparency. This tool is useful for both individuals and financial advisors to stay organized and make informed decisions regarding retirement income management.

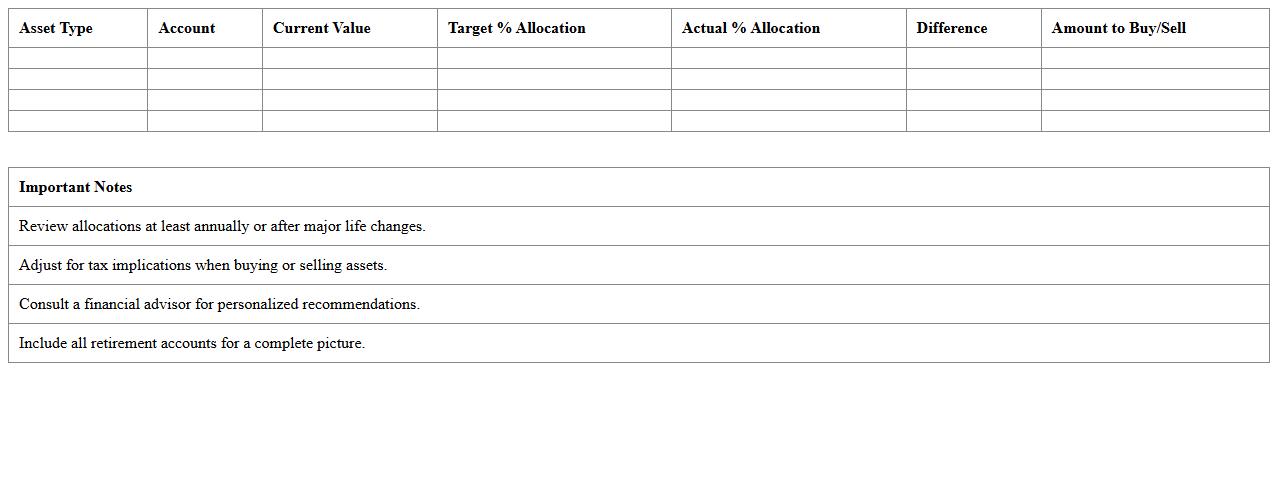

Retiree Asset Allocation Rebalancing Template

The

Retiree Asset Allocation Rebalancing Template is a strategic tool designed to help retirees systematically adjust their investment portfolios to maintain an optimal balance between risk and returns. This document provides a structured framework for evaluating asset classes, tracking portfolio performance, and making informed adjustments based on market fluctuations and personal financial goals. It is useful for ensuring sustained income stability and preserving capital throughout retirement by aligning investments with evolving financial needs.

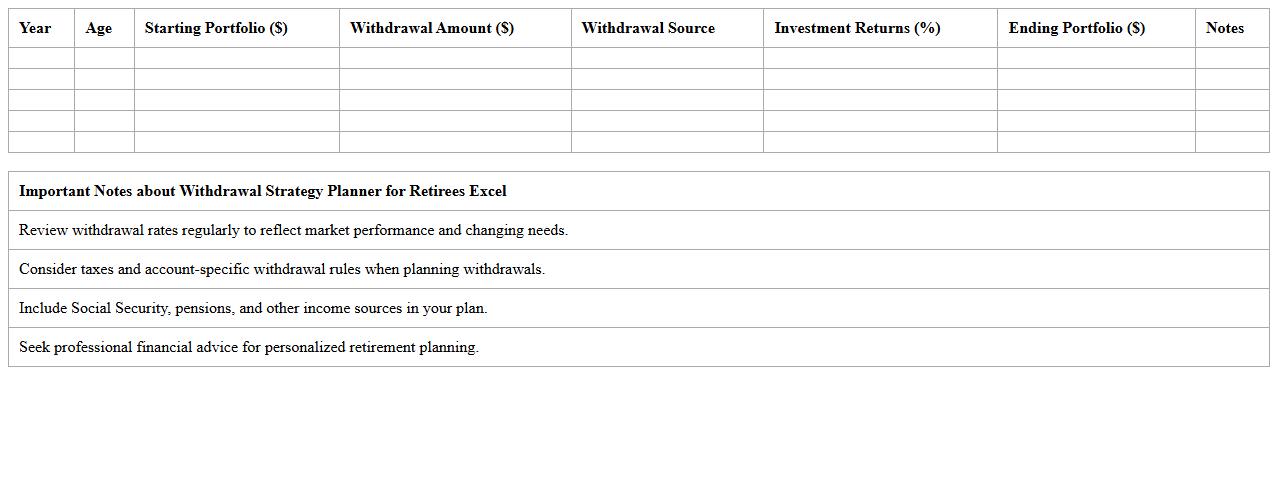

Withdrawal Strategy Planner for Retirees Excel

The

Withdrawal Strategy Planner for Retirees Excel document is a financial tool designed to help retirees systematically manage their retirement savings by creating customized withdrawal plans. It allows users to model various scenarios, track income sources, and optimize their withdrawal rates to ensure funds last throughout retirement. This planner enhances decision-making by providing clear projections and helping to minimize the risk of depleting savings prematurely.

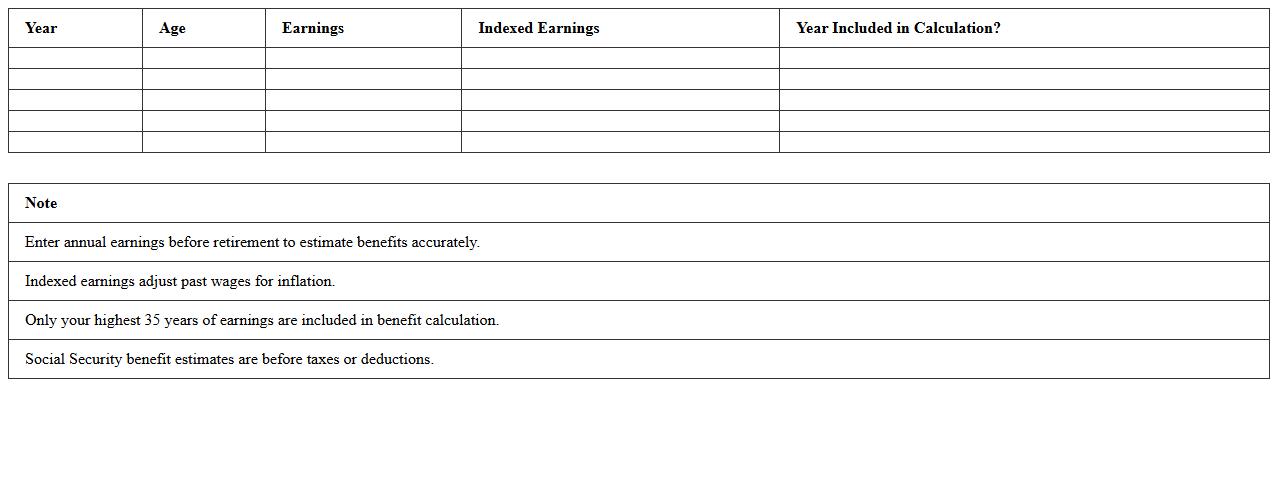

Social Security Benefit Estimator Spreadsheet

The Social Security Benefit Estimator Spreadsheet is a tool that calculates your estimated retirement, disability, or survivor benefits based on your earnings history and projected work years. This

spreadsheet helps users plan for future financial needs by providing personalized benefit estimates, allowing for more accurate retirement planning. Utilizing this document ensures better understanding of potential Social Security income, aiding in informed decision-making about retirement timing and financial security.

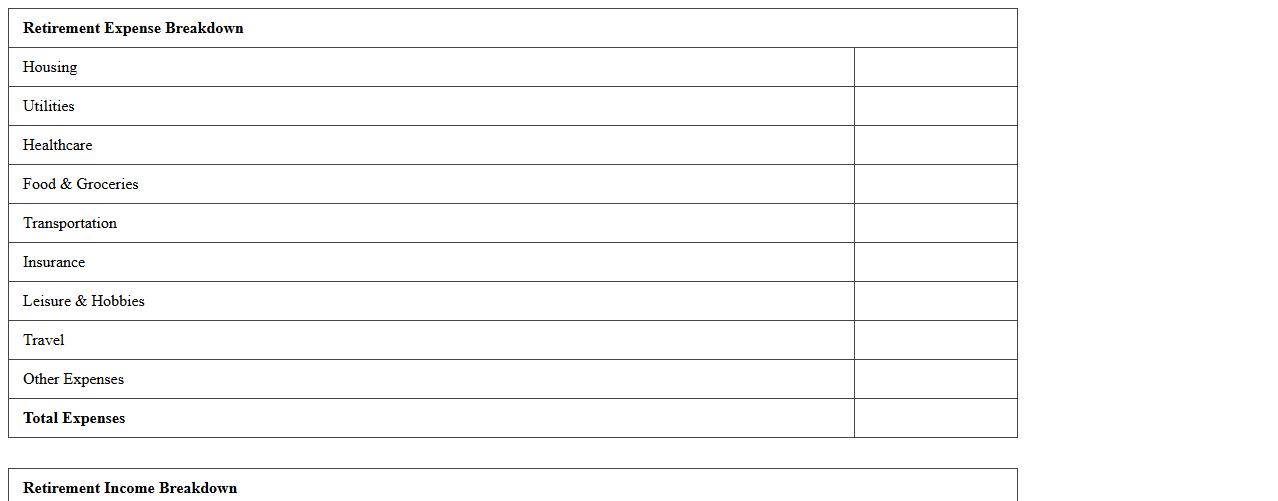

Retirement Expense & Income Breakdown Template

The

Retirement Expense & Income Breakdown Template is a structured document designed to help individuals track and manage their post-retirement finances by categorizing income sources and expenses. It provides a clear overview of monthly and yearly cash flows, enabling better budgeting and ensuring that retirement funds last throughout the retirement period. Using this template allows retirees to identify spending patterns, forecast future financial needs, and make informed decisions about saving and investment adjustments.

Long-Term Investment Growth Tracker for Retirees

The

Long-Term Investment Growth Tracker for retirees is a detailed financial document designed to monitor and project the performance of retirement portfolios over extended periods. It helps retirees visualize growth trends, assess asset allocation effectiveness, and make informed decisions to optimize income streams throughout retirement. By tracking key investment metrics and market fluctuations, this tool ensures sustained financial security and aids in maintaining purchasing power against inflation.

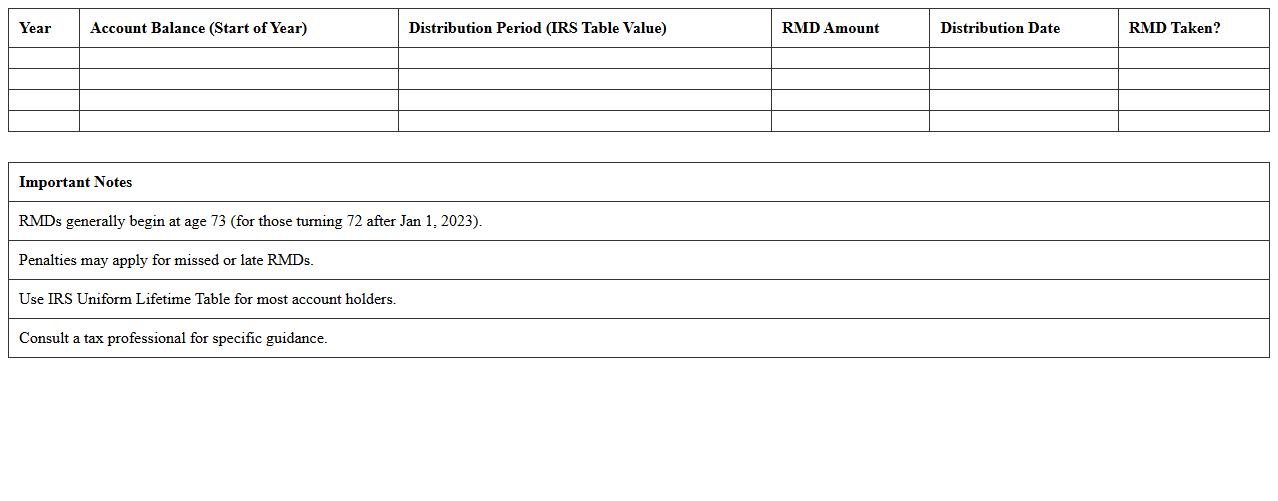

Required Minimum Distribution (RMD) Calculator Excel

A

Required Minimum Distribution (RMD) Calculator in Excel is a tool designed to estimate the minimum amount an individual must withdraw annually from retirement accounts like IRAs or 401(k)s, as mandated by IRS regulations starting at age 73. This calculator automates complex RMD formulas by incorporating factors such as account balance, age, and life expectancy tables to ensure accurate, compliant withdrawals. Utilizing this Excel document helps prevent costly tax penalties and facilitates efficient retirement planning by providing clear guidance on the precise withdrawal requirements each year.

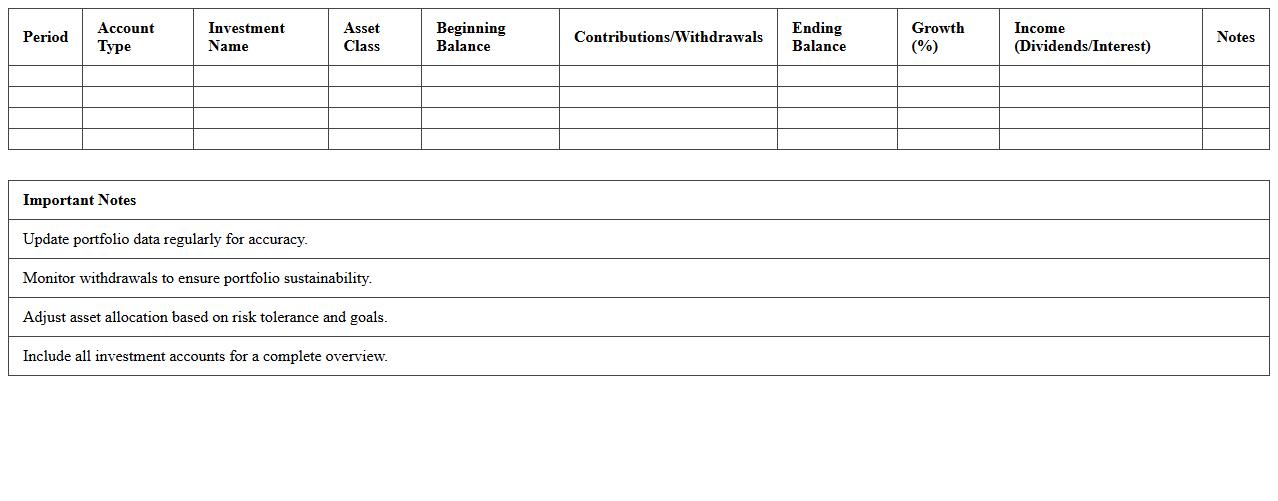

Retiree Portfolio Performance Monitoring Template

The

Retiree Portfolio Performance Monitoring Template is a comprehensive tool designed to track and analyze the financial performance of retirement investment portfolios over time. It helps retirees and financial advisors assess asset allocation, monitor returns, and identify risks to maintain financial stability throughout retirement. By providing clear visualizations and customizable metrics, this template enables informed decisions to optimize income and preserve capital effectively.

How to automate retirement income projections in a Financial Investment Plan Excel sheet?

To automate retirement income projections in Excel, use dynamic formulas linked to your investment returns and withdrawal rates. Incorporate the PMT and FV functions to calculate expected income streams over time. Utilizing Excel's Data Tables feature allows for sensitivity analysis on variables like interest rates and life expectancy.

What custom asset allocation formulas are best for retirees in Excel?

Custom asset allocation formulas for retirees should prioritize risk reduction and income stability. Use weighted average formulas combining stocks, bonds, and cash allocations based on age and risk tolerance. Implementing IF statements can dynamically adjust the portfolio mix according to the retiree's timeline and market conditions.

How to track tax-efficient withdrawals for retirees using Excel documentation?

Tracking tax-efficient withdrawals in Excel requires categorizing income sources by tax treatment, such as taxable, tax-deferred, and tax-free. Use formulas to calculate tax liabilities and optimize withdrawal order to minimize taxes over retirement. Incorporating a withdrawal schedule sheet with linked tax brackets improves accuracy and planning.

Which Excel templates best visualize portfolio rebalancing for retirees?

The best Excel templates for portfolio rebalancing visualization include pie charts and bar charts linked to portfolio allocations. Templates that feature conditional formatting highlight when asset classes deviate from target percentages. Look for models with adjustable timeline sliders to simulate periodic rebalancing effects on the portfolio.

How to integrate inflation-adjusted expense forecasts in a retirement investment Excel plan?

Integrate inflation-adjusted expense forecasts by linking expense categories to a dedicated inflation rate cell updated annually. Use formulas to increase projected costs by a set inflation percentage each year, ensuring realistic budget planning. Embedding dashboards with trendlines helps visualize the long-term impact of inflation on retirement expenses.

More Plan Excel Templates