The Debt Repayment Plan Excel Template for Young Professionals offers a user-friendly tool designed to help manage and track debt payments efficiently. This template enables clear visualization of debt balances, interest rates, and payment schedules, empowering young professionals to create effective strategies for reducing their debt. With customizable features, it simplifies goal setting and progress monitoring for a financially stable future.

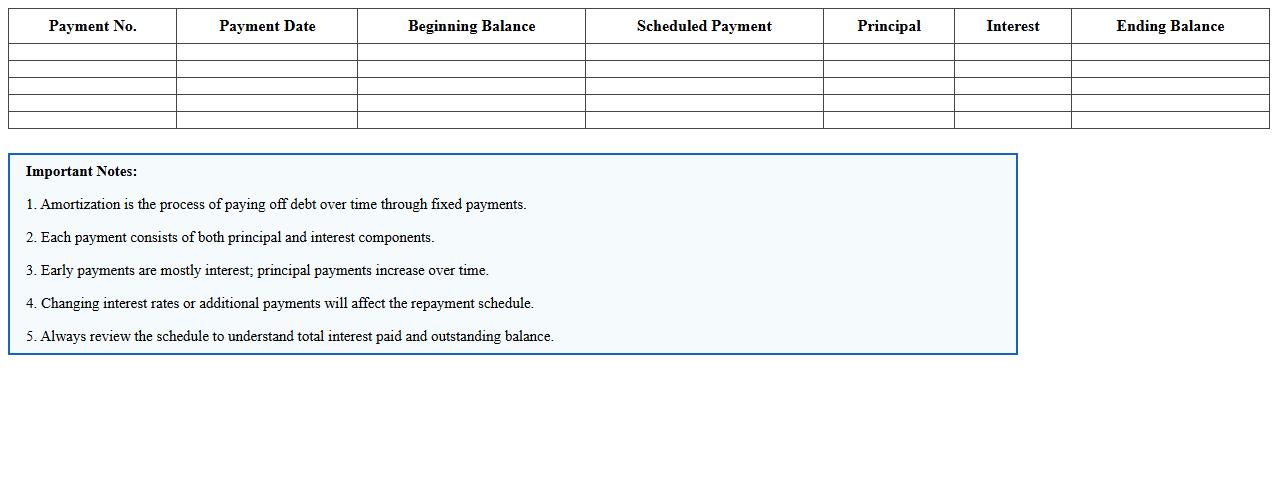

Student Loan Debt Repayment Tracker Excel

A

Student Loan Debt Repayment Tracker Excel document helps individuals organize and monitor their loan payments systematically. It provides clear insights into principal balances, interest rates, and payment schedules, enabling users to manage repayment efficiently and avoid missed deadlines. This tool supports informed financial planning by visualizing progress and forecasting payoff dates.

Credit Card Payoff Schedule Spreadsheet

A

Credit Card Payoff Schedule Spreadsheet is a financial tool that organizes payment amounts, due dates, and interest calculations to help users systematically reduce credit card debt. It allows individuals to visualize their payoff timeline, track progress, and optimize payments to minimize interest costs and pay off balances faster. Using this spreadsheet enhances budgeting accuracy and supports better financial decision-making by clearly outlining debt elimination strategies.

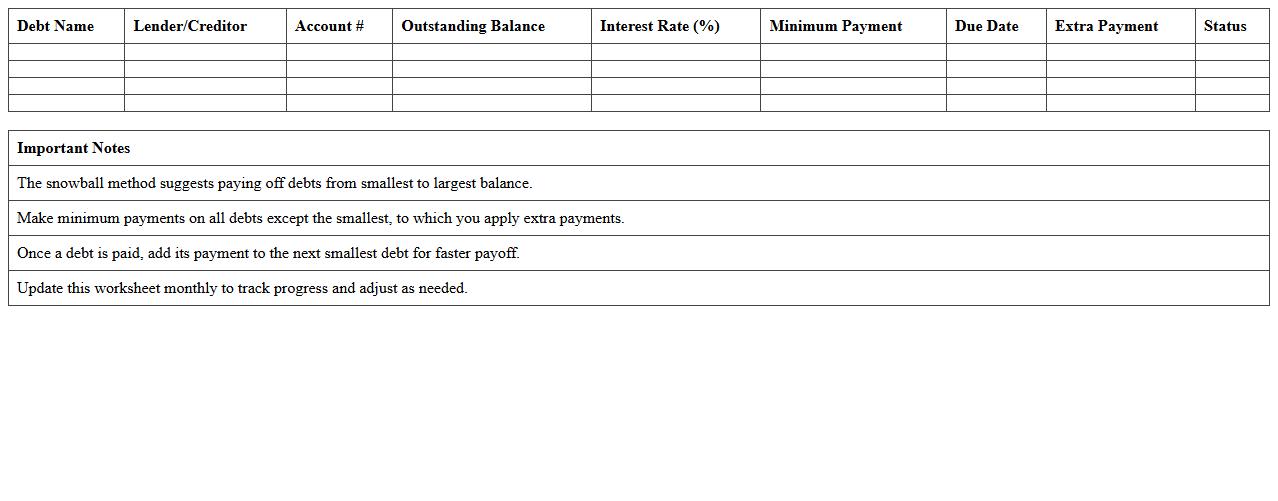

Personalized Debt Snowball Excel Worksheet

The

Personalized Debt Snowball Excel Worksheet is a financial tool designed to help users organize and accelerate their debt repayment process by listing all debts from smallest to largest balance. It provides a clear visual plan for tracking payments, prioritizing debts, and calculating payoff timelines, enhancing motivation and financial discipline. This worksheet simplifies complex debt management strategies, making it easier to reduce overall debt and improve credit health efficiently.

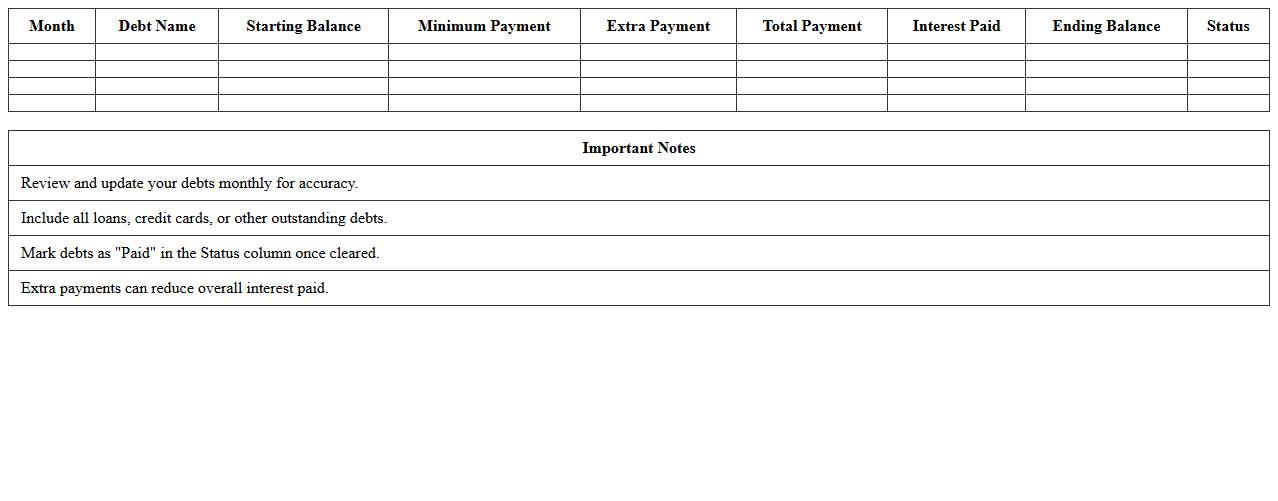

Monthly Debt Reduction Planner Template

The

Monthly Debt Reduction Planner Template document is a structured financial tool designed to help individuals systematically track and manage their debt repayments each month. It enables users to visualize their outstanding balances, prioritize high-interest debts, and monitor progress towards becoming debt-free, promoting accountability and effective budgeting. By organizing payment schedules and reducing overall debt strategically, this template supports improved credit health and long-term financial stability.

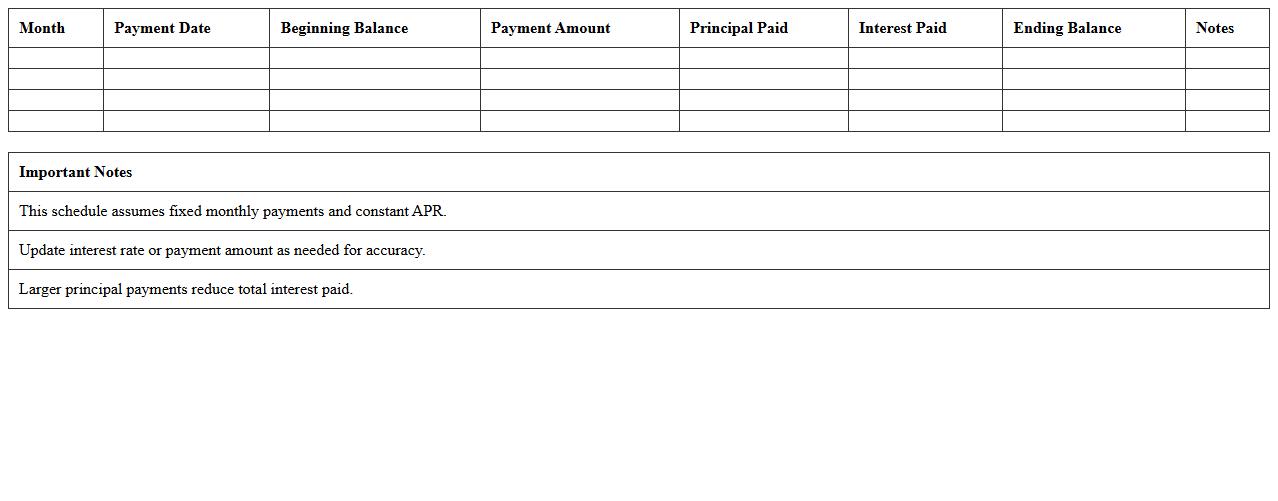

Loan Amortization and Repayment Plan Excel

A

Loan Amortization and Repayment Plan Excel document is a detailed spreadsheet that calculates the schedule of loan payments over time, breaking down each installment into principal and interest components. It helps borrowers visualize how payments reduce the outstanding balance and estimate total interest paid throughout the loan term. This tool is essential for financial planning, enabling users to manage budgets, compare loan options, and avoid missed payments.

Simple Debt Avalanche Tracking Sheet

A

Simple Debt Avalanche Tracking Sheet is a financial tool designed to help users systematically organize and prioritize their debt repayments by focusing on the highest interest rates first. This method accelerates debt elimination by minimizing interest payments and improving overall financial efficiency. Using this sheet enables better budgeting, clear visualization of debt progress, and fosters disciplined repayment strategies leading to faster financial freedom.

Consolidated Debt Tracker for Graduates

The

Consolidated Debt Tracker for Graduates is a comprehensive document that compiles all student loan obligations into a single, organized record. It allows graduates to monitor their total debt, track payment schedules, and manage multiple loans effectively. By providing a clear overview of outstanding balances and interest rates, it helps users stay informed and make strategic financial decisions to reduce debt efficiently.

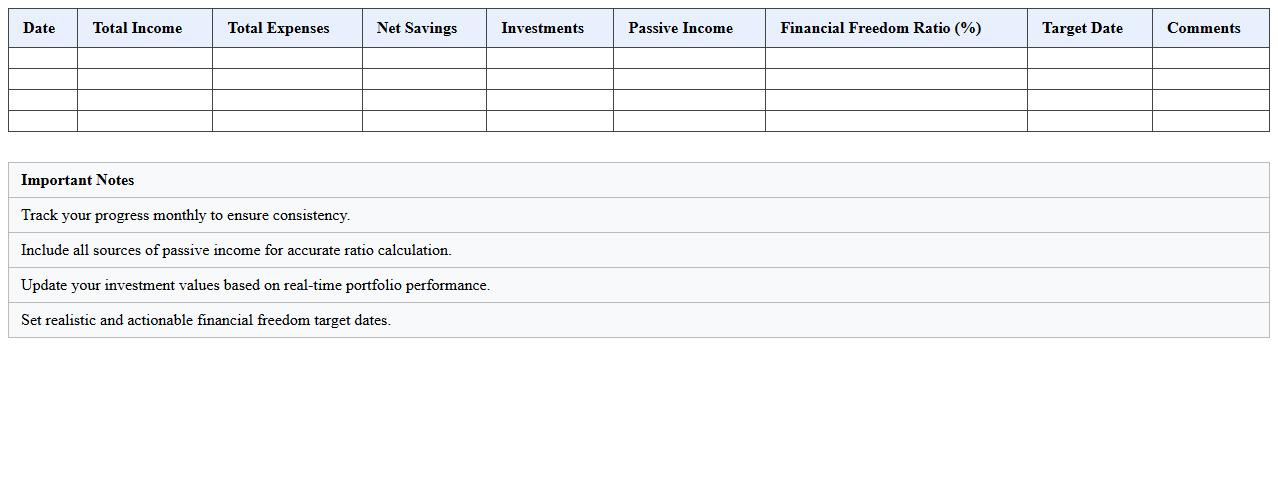

Financial Freedom Progress Dashboard Excel

The

Financial Freedom Progress Dashboard Excel document is a powerful tool designed to track and visualize your journey toward achieving financial independence. It consolidates income, expenses, savings, investments, and debt data into interactive charts and graphs, providing clear insights into your current financial status and growth trends. This dashboard enables informed decision-making by highlighting areas for improvement and helping to set realistic financial goals.

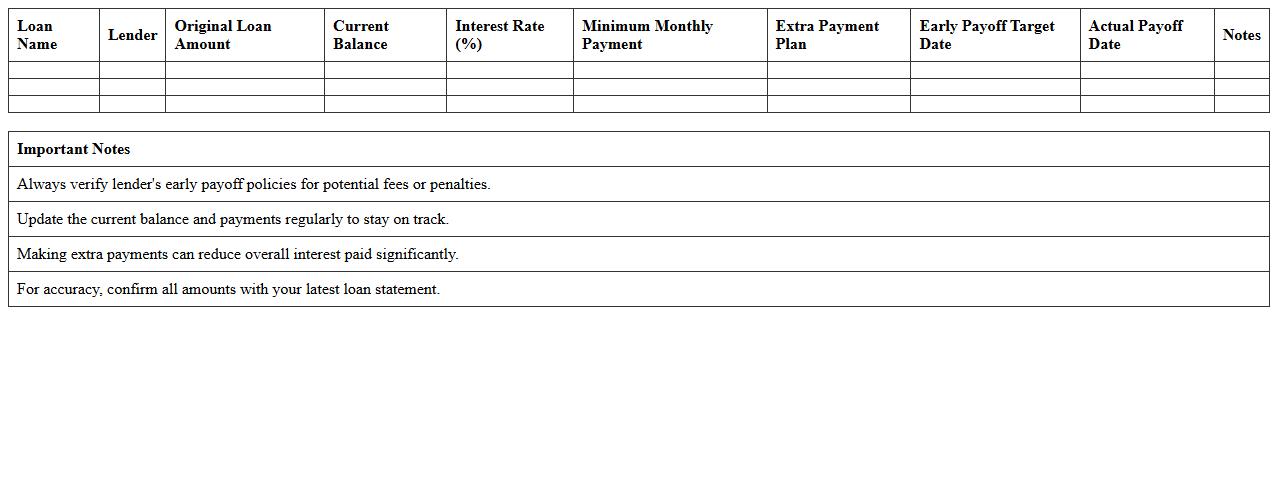

Early Loan Payoff Goal Setting Spreadsheet

The

Early Loan Payoff Goal Setting Spreadsheet is a financial tool designed to help users track and plan accelerated loan repayments by calculating payoff timelines, interest savings, and payment strategies. It allows individuals to set specific payoff targets, monitor progress, and adjust payments dynamically to achieve debt freedom faster. This spreadsheet improves financial discipline and clarity, making it easier to manage loan obligations and reduce overall interest costs effectively.

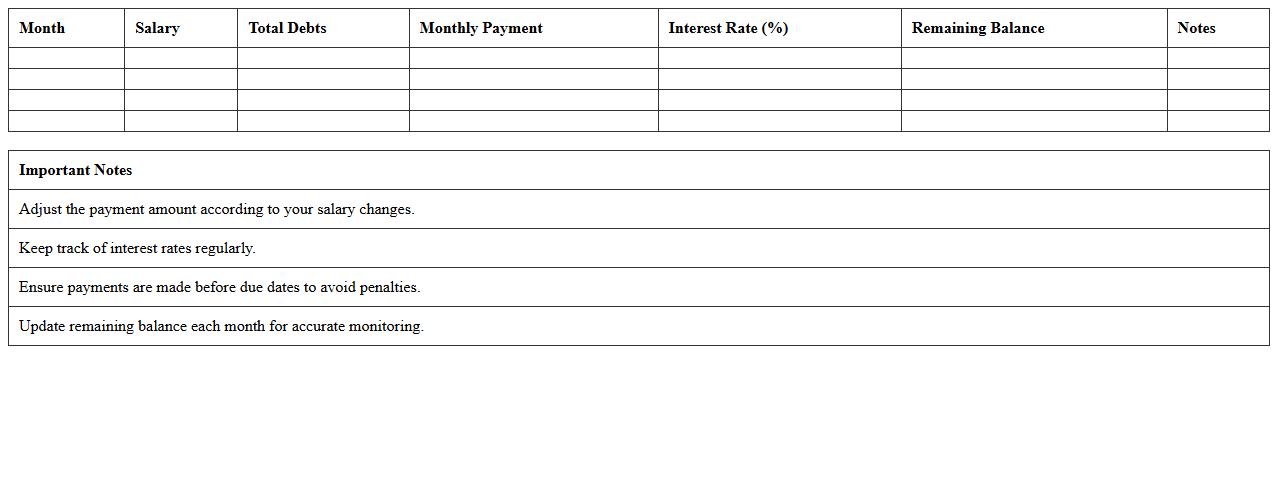

Salary-Based Debt Management Plan Template

A

Salary-Based Debt Management Plan Template is a structured document that outlines a clear repayment strategy aligned with an individual's monthly income. It helps users create manageable payment schedules by prioritizing debts based on salary, ensuring timely settlements while avoiding financial strain. This template is essential for maintaining financial discipline and accelerating debt clearance effectively.

How can I customize a Debt Repayment Plan Excel template for multiple student loans?

To customize a Debt Repayment Plan Excel template for multiple student loans, begin by adding separate rows or columns for each loan. Ensure each loan's principal, interest rate, and payment schedule are clearly defined. Use filters or drop-down menus to easily navigate between different loans.

What Excel formulas automate interest tracking in a debt repayment spreadsheet?

The IPMT function is essential for calculating the interest portion of each payment in a debt repayment plan. Combine this with the PMT formula to determine total monthly payment amounts. Using these formulas consistently helps automate accurate interest tracking throughout the loan term.

How do I visually highlight upcoming due dates in my Debt Repayment Plan Excel sheet?

Apply conditional formatting rules to highlight due dates that are approaching within a specified timeframe. Set colors to change automatically when the due date is less than a week away or overdue. This visual cue helps prioritize payments and avoid late fees.

Which Excel charts best display debt reduction progress for young professionals?

Line charts effectively track debt balance changes over time, showing progress clearly. Alternatively, stacked bar charts can compare multiple loans simultaneously. Both chart types provide intuitive visual insights ideal for young professionals managing diverse debts.

How can I integrate side income tracking into my debt repayment Excel plan?

Create an additional worksheet dedicated to logging side income sources and amounts regularly. Link this data to your main repayment plan to adjust payment amounts dynamically. This integration enables better budgeting and accelerates debt payoff strategies.

More Plan Excel Templates