The Financial KPI Dashboard Excel Template for Startups offers a streamlined way to track key financial metrics such as revenue, expenses, and cash flow in real-time. This customizable Excel tool simplifies data visualization and helps startups make informed decisions by highlighting critical performance indicators. It enhances financial planning by providing clear insights into growth potential and operational efficiency.

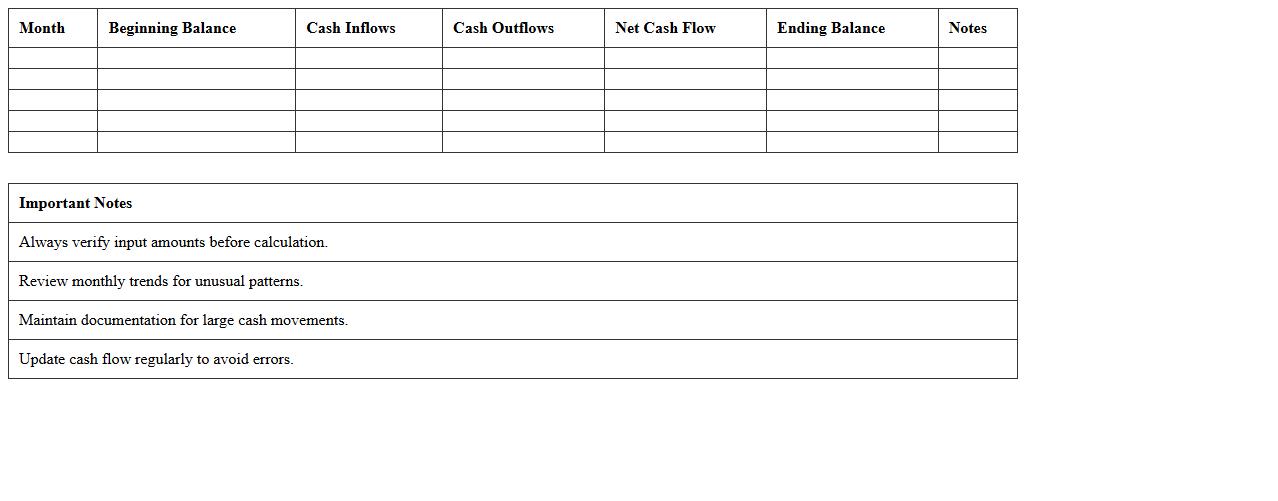

Monthly Revenue Tracker Excel Template

The

Monthly Revenue Tracker Excel Template is a structured spreadsheet designed to monitor and analyze monthly income streams efficiently. It enables businesses and individuals to record revenue sources, track growth trends, and identify financial patterns for informed decision-making. Utilizing this template enhances financial organization, supports budgeting accuracy, and facilitates performance comparisons across different periods.

Cash Flow Analysis Dashboard Excel Template

The

Cash Flow Analysis Dashboard Excel Template is a comprehensive tool designed to track, visualize, and analyze cash inflows and outflows in real-time, enabling better financial decision-making. By consolidating financial data into clear charts and summaries, it helps identify trends, forecast cash positions, and manage liquidity effectively. This template is essential for businesses seeking to optimize cash management and ensure financial stability.

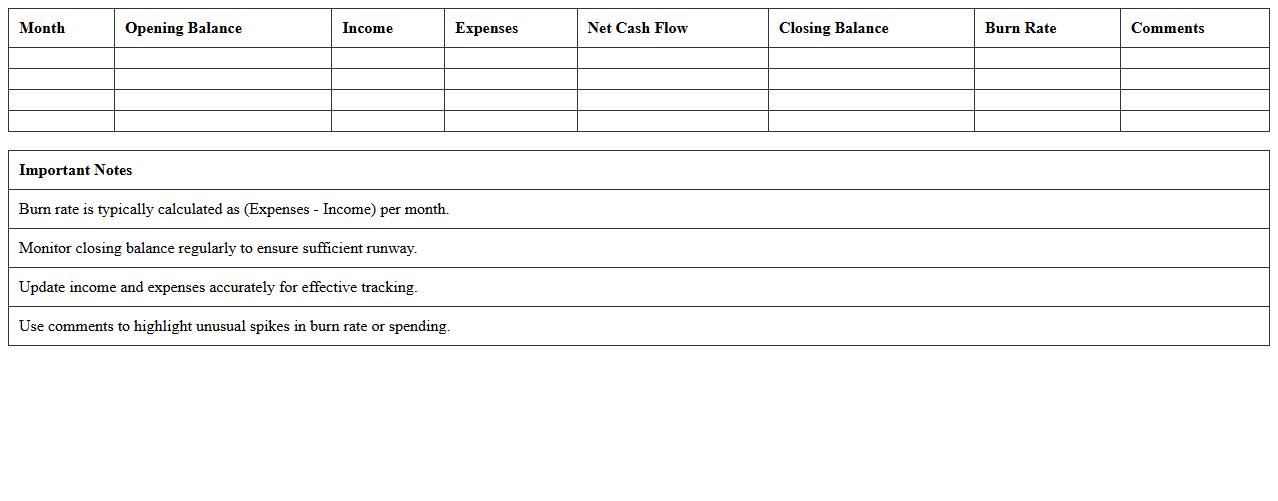

Burn Rate Monitoring Spreadsheet

The

Burn Rate Monitoring Spreadsheet is a financial tool designed to track the rate at which a company spends its available capital over time. It provides real-time insights into cash flow, enabling businesses to forecast runway and make informed budgeting decisions. By regularly updating this spreadsheet, organizations can prevent overspending and maintain financial stability during growth or project phases.

Startup Gross Margin Tracker Excel Sheet

The

Startup Gross Margin Tracker Excel Sheet document is a financial tool designed to help startups efficiently monitor and analyze their gross margin metrics. It provides a structured format to input revenue, cost of goods sold (COGS), and calculate gross profit percentages, enabling businesses to track profitability trends over time. This tracker is useful for identifying cost-saving opportunities, improving pricing strategies, and making informed financial decisions to support sustainable growth.

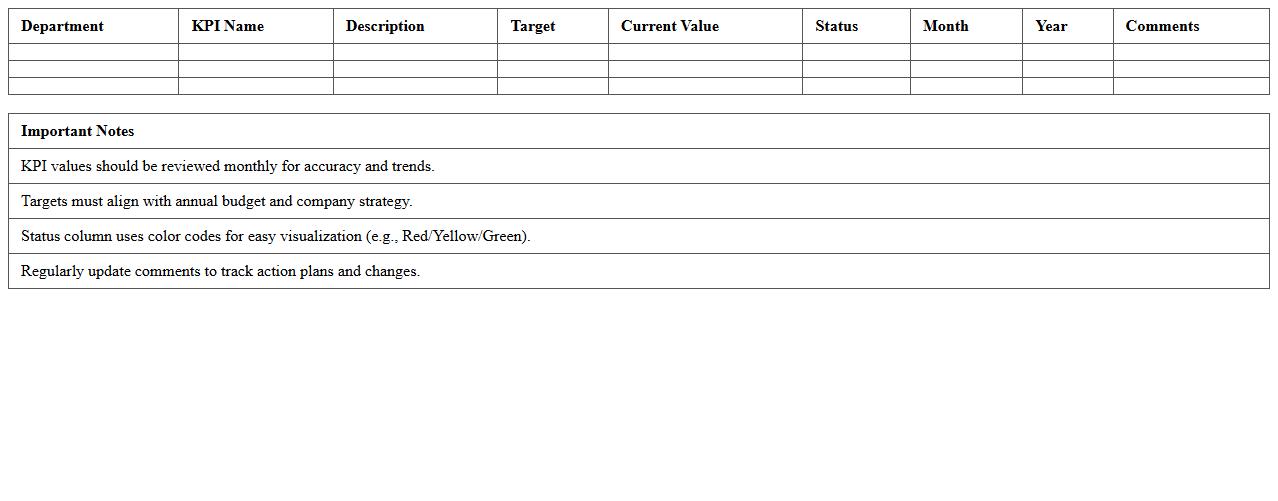

Operational Expenses KPI Dashboard

An

Operational Expenses KPI Dashboard document consolidates and visualizes key performance indicators related to a company's operational costs, enabling real-time tracking of budget adherence and efficiency. It provides actionable insights into expense patterns, helping organizations identify cost-saving opportunities and optimize resource allocation. By monitoring critical metrics such as overhead costs, variable expenses, and departmental spending, businesses can improve financial management and support strategic decision-making.

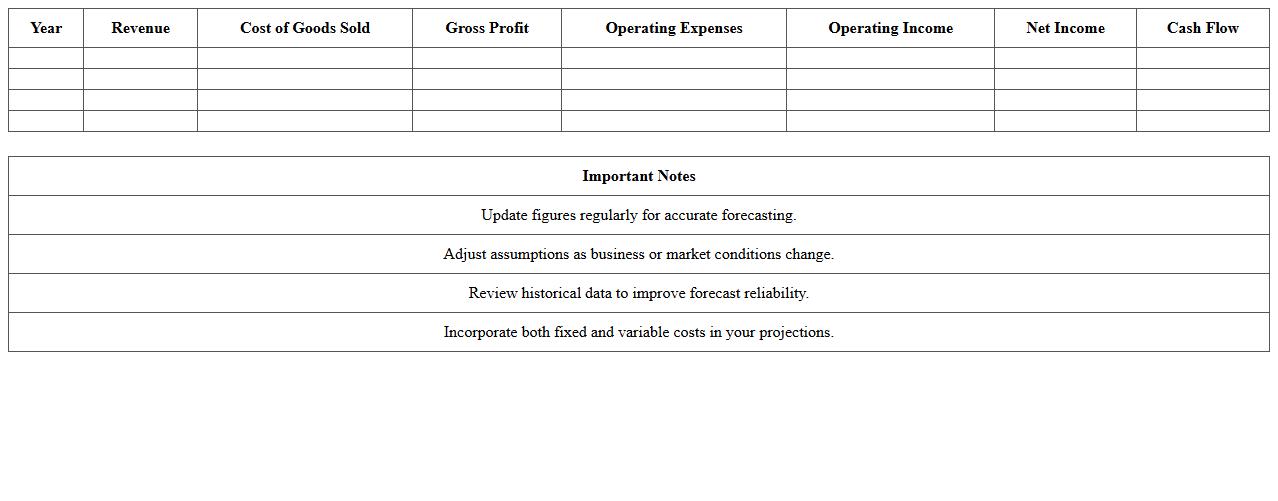

Financial Forecasting Model Excel Template

A

Financial Forecasting Model Excel Template document is a structured spreadsheet designed to project future financial performance using historical data and assumptions about growth, expenses, and market trends. It is useful for budgeting, investment analysis, and strategic planning by providing clear visualizations and scenario analysis to support informed decision-making. Businesses leverage this tool to anticipate cash flow, profitability, and resource allocation accurately, enhancing financial stability and goal achievement.

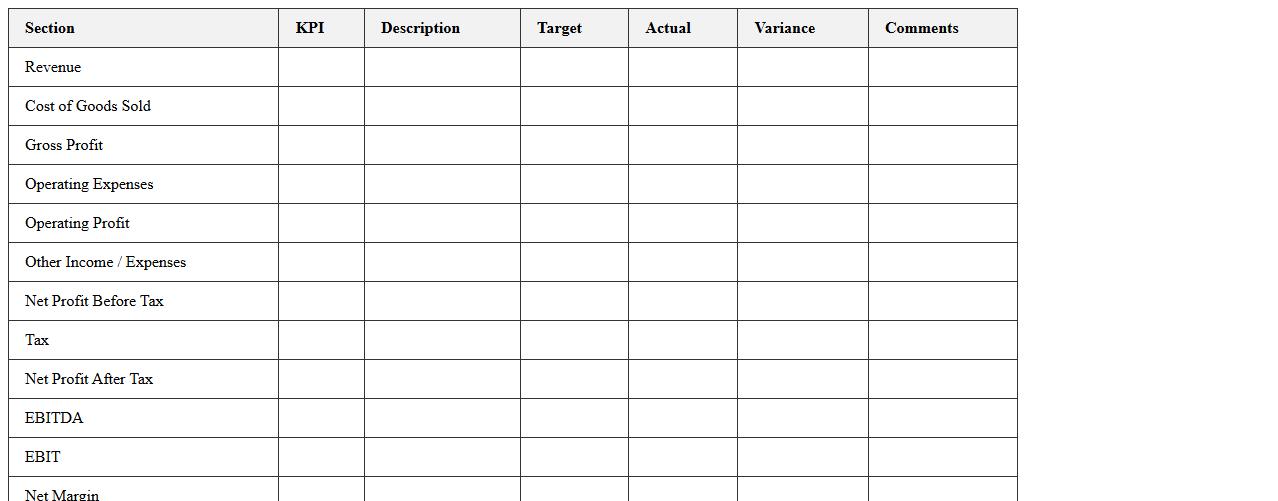

Profit and Loss Statement KPI Template

A

Profit and Loss Statement KPI Template document organizes key financial metrics to track income, expenses, and net profit over a specific period. It helps businesses monitor financial performance, identify trends, and make informed decisions to improve profitability. By streamlining data analysis, this template enhances accuracy and efficiency in financial reporting and strategic planning.

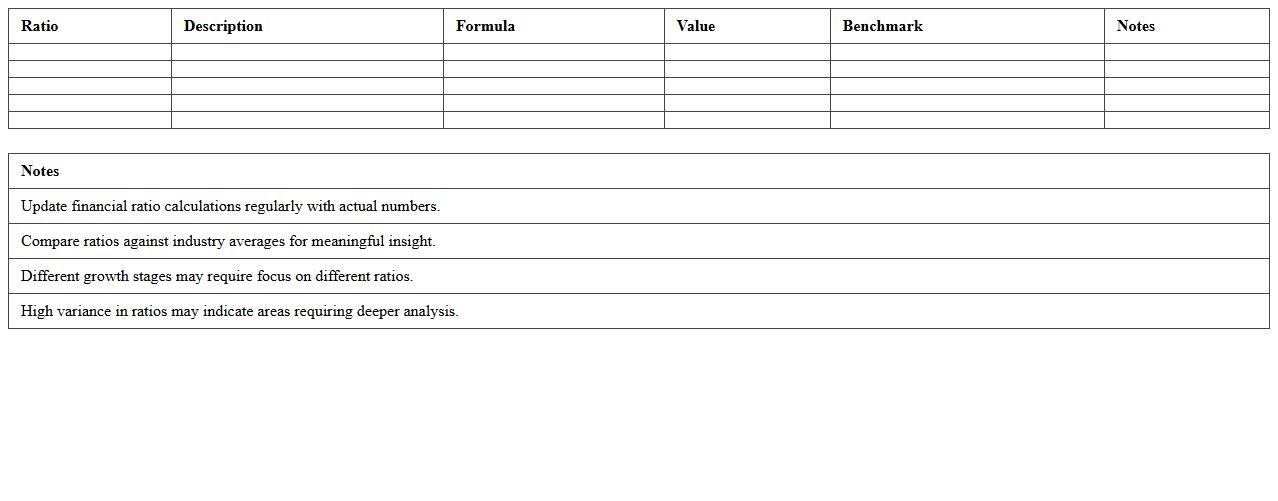

Startup Financial Ratios Excel Dashboard

The

Startup Financial Ratios Excel Dashboard is a comprehensive tool designed to analyze key financial metrics such as liquidity, profitability, and solvency ratios in one centralized spreadsheet. It enables entrepreneurs and investors to quickly assess the financial health and performance trends of a startup, facilitating data-driven decision-making. By visualizing ratios like current ratio, gross margin, and debt-to-equity, this dashboard helps identify strengths and weaknesses, supporting strategic planning and resource allocation.

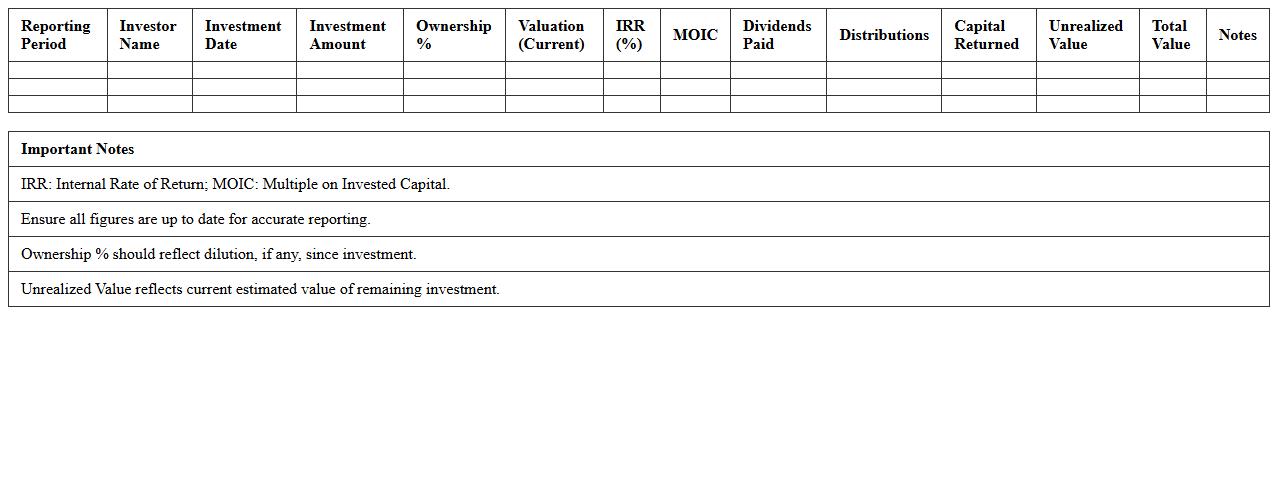

Investor Metrics Reporting Spreadsheet

The

Investor Metrics Reporting Spreadsheet is a comprehensive tool designed to track and analyze key financial and performance indicators for investors, enabling data-driven decision-making. It consolidates metrics such as ROI, cash flow, capitalization rates, and equity multiples in a structured format, facilitating clear insights into investment performance. This document enhances transparency and efficiency by streamlining reporting processes and allowing timely adjustments to investment strategies.

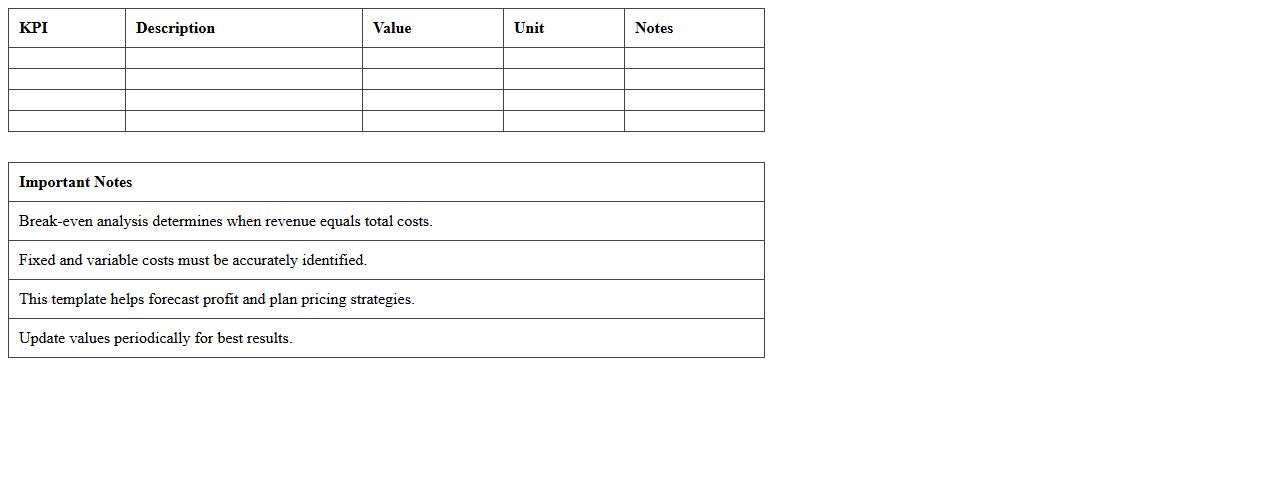

Break-Even Analysis KPI Excel Template

The

Break-Even Analysis KPI Excel Template document is a tool designed to calculate the exact point at which total revenues equal total costs, indicating no net loss or gain. It helps businesses identify the minimum sales volume required to cover fixed and variable expenses, assisting in pricing strategy and cost control. Using this template improves financial planning accuracy and supports decision-making to enhance profitability.

What are the essential KPI metrics included in a financial dashboard for early-stage startups?

Essential KPI metrics for early-stage startups include Monthly Recurring Revenue (MRR), which tracks consistent income growth. Tracking Customer Acquisition Cost (CAC) helps startups measure the efficiency of their marketing efforts. Additionally, monitoring the Burn Rate is critical to understand cash outflows and runway duration.

How can the Excel dashboard automate monthly cash runway projections?

The Excel dashboard automates monthly cash runway projections by using dynamic formulas that calculate current cash balance against monthly expenses. It updates projections based on real-time inputs from income and spending data. This automation allows startups to predict how many months they can operate before needing additional funding.

What formulas track investor funding milestones in the dashboard?

Formulas such as SUMIF and VLOOKUP are used to aggregate investment amounts tied to specific dates or milestones. Conditional formatting can highlight when funding thresholds are achieved. These formulas ensure accurate tracking of total capital raised and timing of investor contributions.

How does the template visualize burn rate trends for startup founders?

The dashboard uses line charts and bar graphs to visually represent monthly burn rate trends over time. This graphical view helps founders quickly assess if spending is increasing or decreasing. Color coding enhances clarity by signaling critical burn rate levels that impact cash runway.

What startup-specific expenses are pre-set in the KPI Excel financial dashboard?

Pre-set expenses typically include salaries and payroll taxes, marketing costs, rent, and software subscriptions. These categories cover the most common overheads that early-stage startups incur. Customizable fields allow founders to add additional expenses specific to their business model.

More Dashboard Excel Templates