The Mortgage Rate Comparison Excel Template for Home Buyers allows users to easily analyze and compare different mortgage offers based on interest rates, loan terms, and monthly payments. This template streamlines decision-making by organizing key financial data in a clear, customizable spreadsheet. Home buyers can quickly identify the most cost-effective mortgage solution tailored to their budget and preferences.

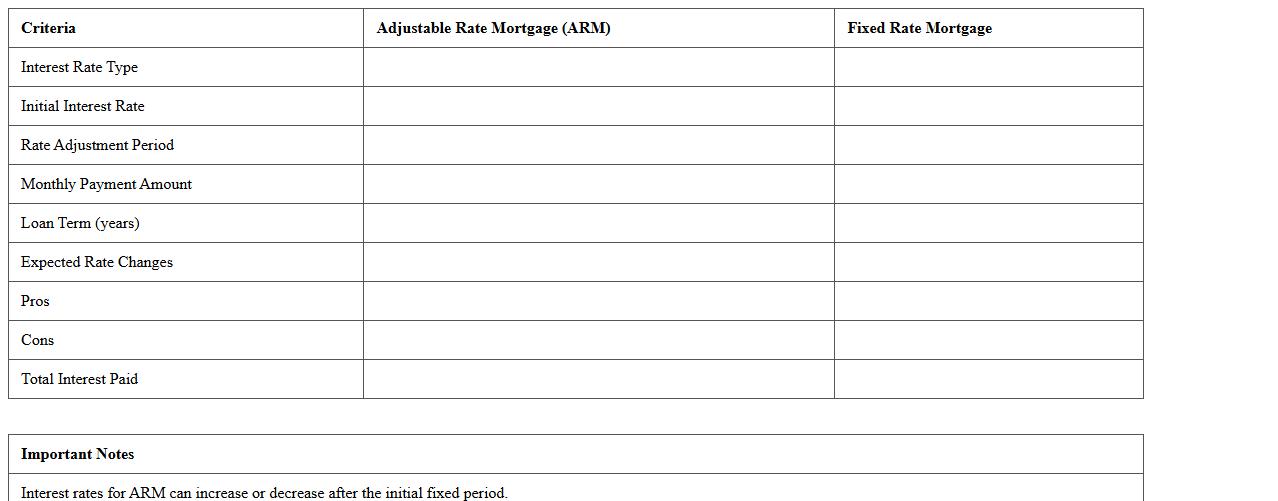

Adjustable vs Fixed Mortgage Rate Comparison Excel Template

The

Adjustable vs Fixed Mortgage Rate Comparison Excel Template is a financial tool designed to analyze and compare different mortgage rate options by calculating monthly payments, interest costs, and overall loan affordability. It enables users to input various loan terms, interest rates, and loan amounts to visualize the financial impact of adjustable and fixed mortgage rates side-by-side. This template helps homebuyers and real estate investors make informed decisions by clearly illustrating potential cost differences and long-term financial commitments.

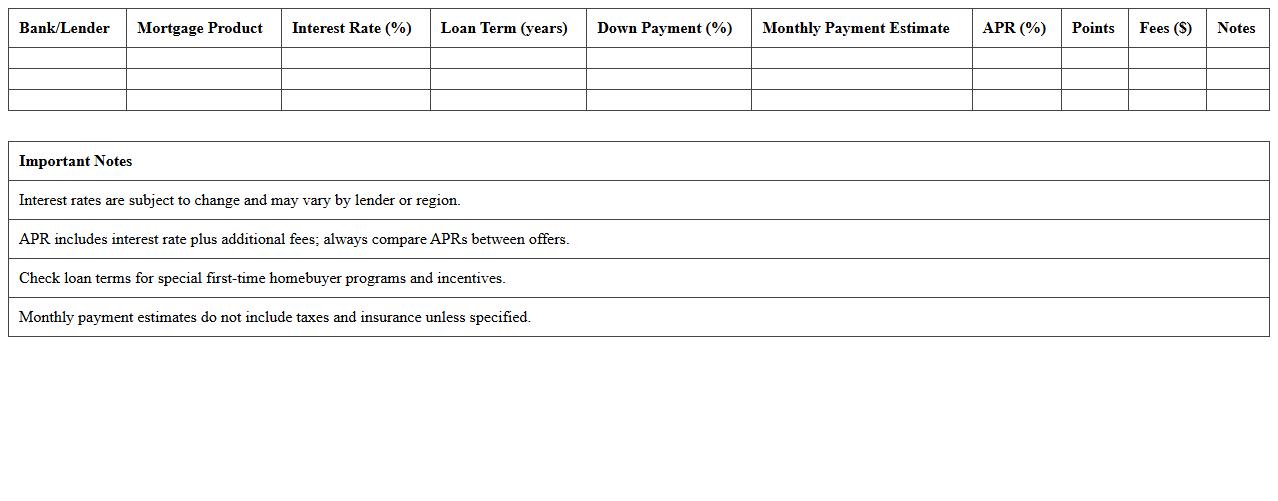

First-Time Homebuyer Mortgage Rate Analysis Excel

The

First-Time Homebuyer Mortgage Rate Analysis Excel document is a comprehensive tool designed to compare and assess various mortgage rates tailored specifically for first-time homebuyers. It enables users to input loan details, interest rates, and term lengths to calculate monthly payments and total interest costs, facilitating informed financial decisions. By providing clear rate comparisons and amortization schedules, the document helps prospective buyers identify the most cost-effective mortgage options for their unique financial situations.

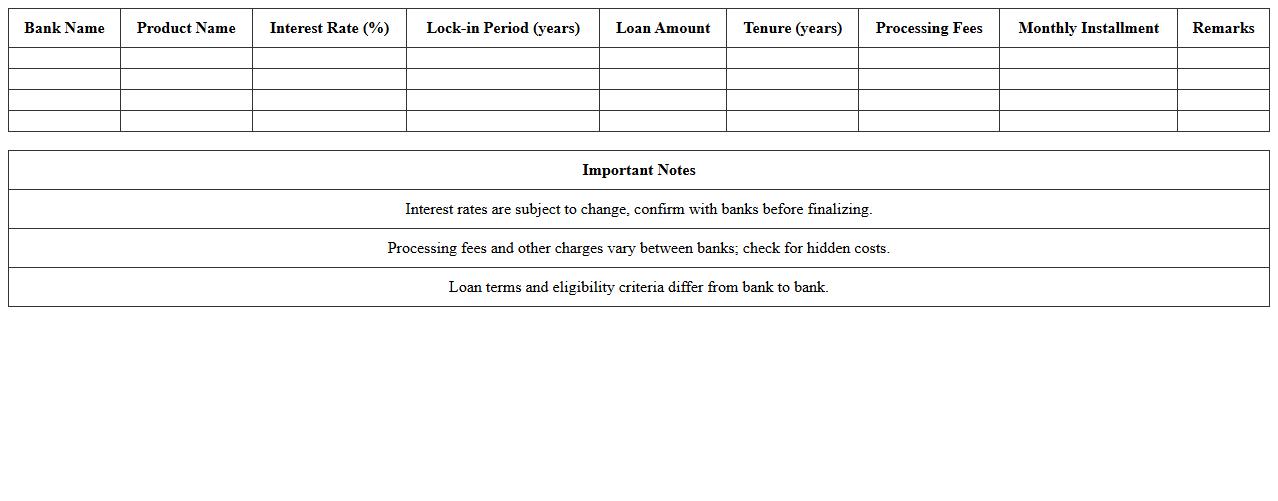

Bank-to-Bank Mortgage Rate Comparison Spreadsheet

A

Bank-to-Bank Mortgage Rate Comparison Spreadsheet is a document that organizes and compares interest rates, loan terms, and fees offered by various banks for mortgage products. This tool enables users to analyze differences in mortgage rates efficiently, helping them identify the most cost-effective loan option. By consolidating key financial data in one place, it simplifies decision-making and enhances financial planning for homebuyers.

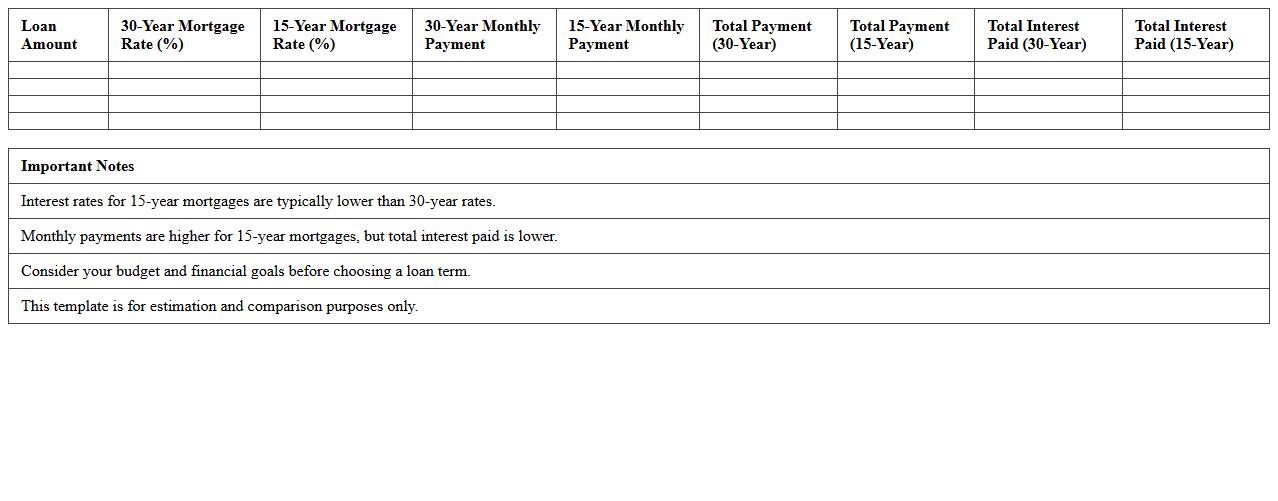

30-Year vs 15-Year Mortgage Rate Comparison Excel Sheet

The

30-Year vs 15-Year Mortgage Rate Comparison Excel Sheet allows users to analyze and compare the financial impact of different mortgage terms by inputting variables such as interest rates, loan amounts, and payment schedules. This document helps homeowners and buyers visualize monthly payments, total interest costs, and loan duration differences, enabling more informed decisions on mortgage planning. By presenting complex data in a clear format, it aids in evaluating long-term savings and affordability between 30-year and 15-year mortgage options.

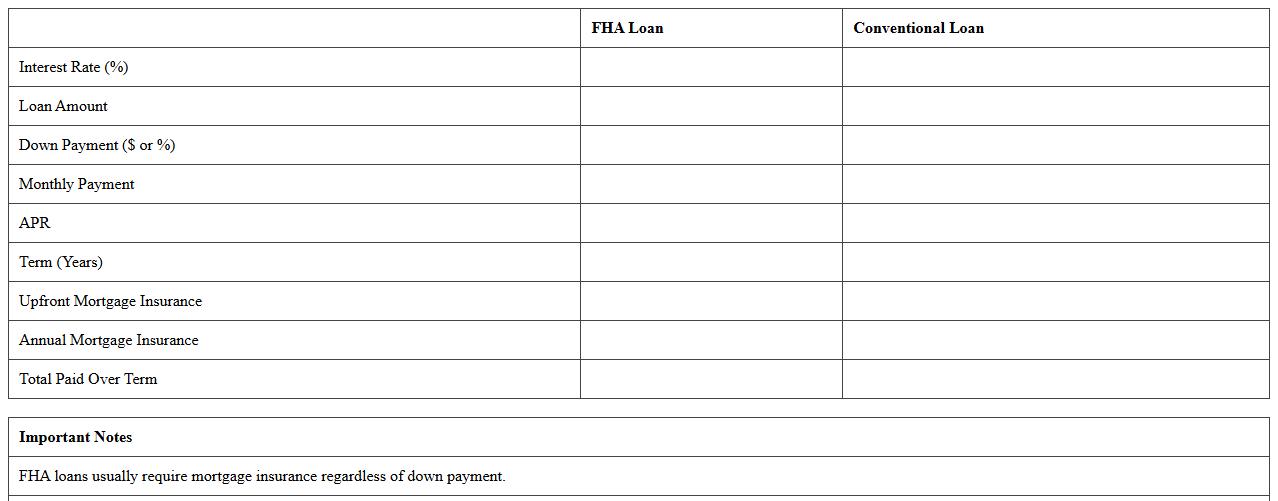

FHA vs Conventional Loan Rate Comparison Excel Template

The

FHA vs Conventional Loan Rate Comparison Excel Template document provides a detailed side-by-side analysis of interest rates, monthly payments, and total loan costs for Federal Housing Administration and conventional loans. It is useful for homeowners, homebuyers, and real estate professionals to quickly evaluate which loan type offers better financial benefits based on current market rates and personalized loan terms. This template simplifies complex calculations, enabling informed decisions that optimize borrowing costs and long-term investment value.

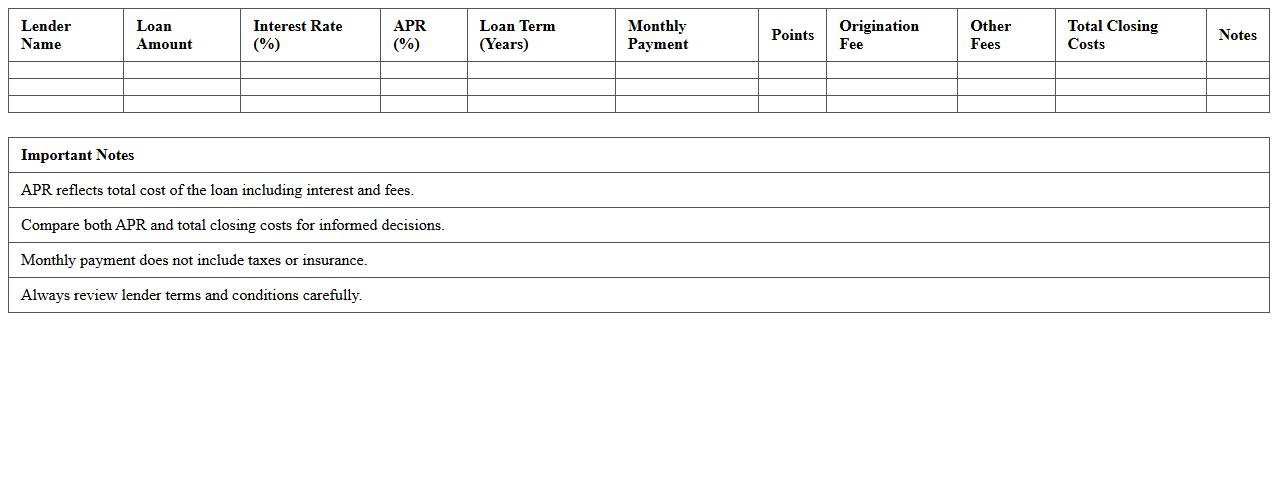

Mortgage Lender Rate Offers Tracking Spreadsheet

A

Mortgage Lender Rate Offers Tracking Spreadsheet is a detailed document designed to organize, compare, and monitor various mortgage interest rates and loan offers from multiple lenders. This tool helps users identify the most competitive mortgage rates, track changes over time, and make informed decisions on loan selection. By consolidating lender offers in one place, it streamlines the mortgage evaluation process and enhances financial planning accuracy.

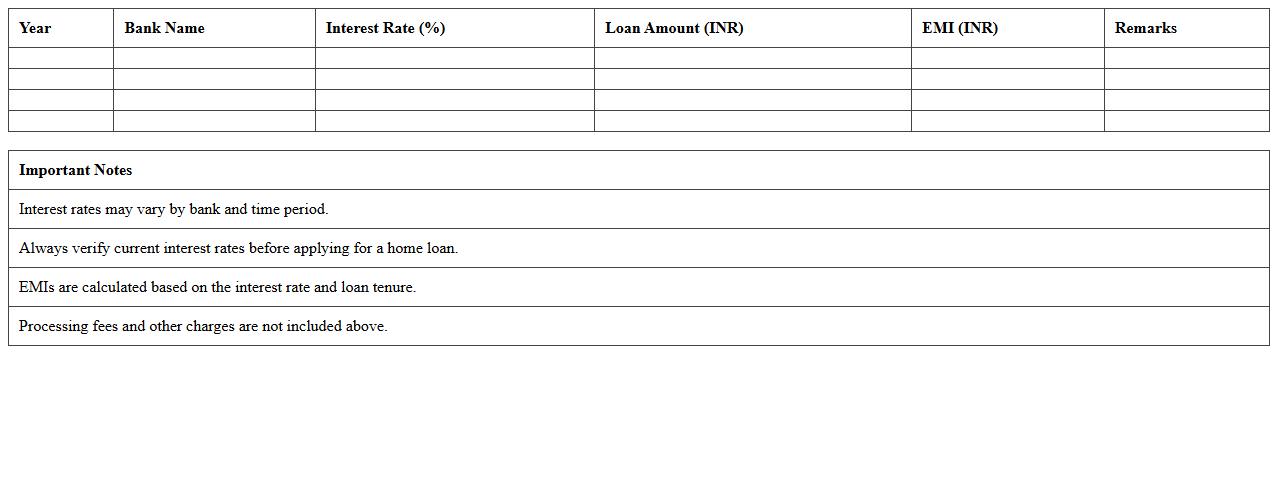

Home Loan Interest Rate Historical Comparison Excel

The

Home Loan Interest Rate Historical Comparison Excel document provides a detailed record of interest rate trends over time, allowing users to analyze fluctuations and patterns across different periods. This tool is essential for prospective homebuyers and financial analysts to make informed decisions by comparing past and current rates, helping to identify the most favorable borrowing conditions. It also aids in forecasting future interest rate movements and understanding the impact of economic changes on home loan costs.

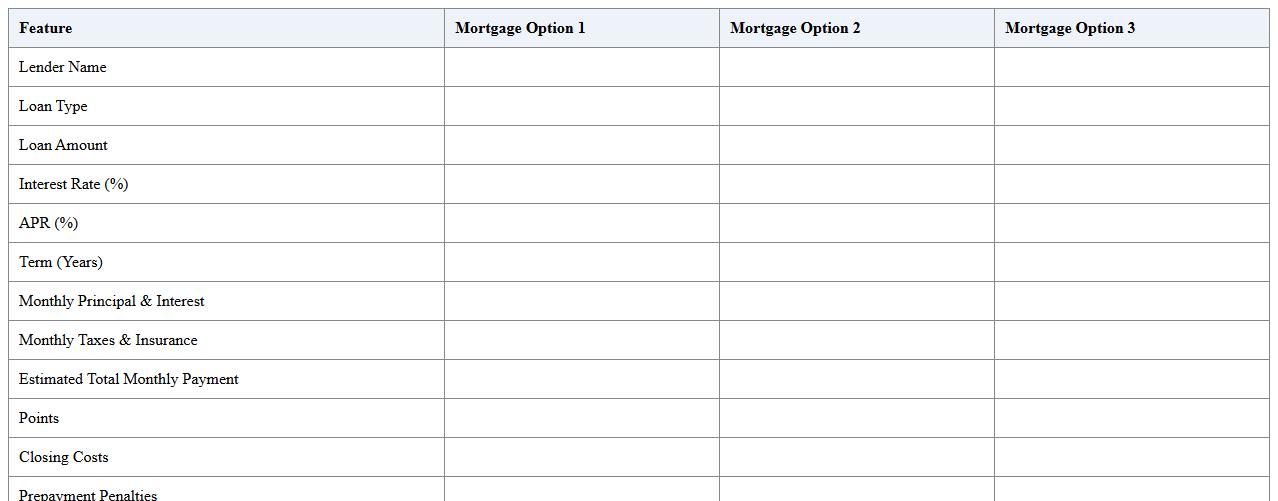

Side-by-Side Mortgage Option Comparison Excel Template

The

Side-by-Side Mortgage Option Comparison Excel Template document allows users to systematically evaluate multiple mortgage offers by comparing key factors such as interest rates, loan terms, monthly payments, and total costs in a single, organized spreadsheet. This tool enables borrowers to make informed financial decisions by clearly visualizing differences and potential savings among mortgage options. It streamlines the decision-making process, reduces confusion, and helps users select the most cost-effective and suitable mortgage plan based on their individual needs.

Refinancing Mortgage Rate Comparison Excel Sheet

A

Refinancing Mortgage Rate Comparison Excel Sheet is a structured tool designed to analyze and compare various mortgage refinancing options by inputting different interest rates, loan terms, and monthly payments. This document helps users identify the most cost-effective refinancing plan by calculating potential savings, interest costs, and payment schedules side-by-side. Utilizing this comparison sheet enables informed decision-making, ensuring optimal financial outcomes when selecting or negotiating mortgage refinancing options.

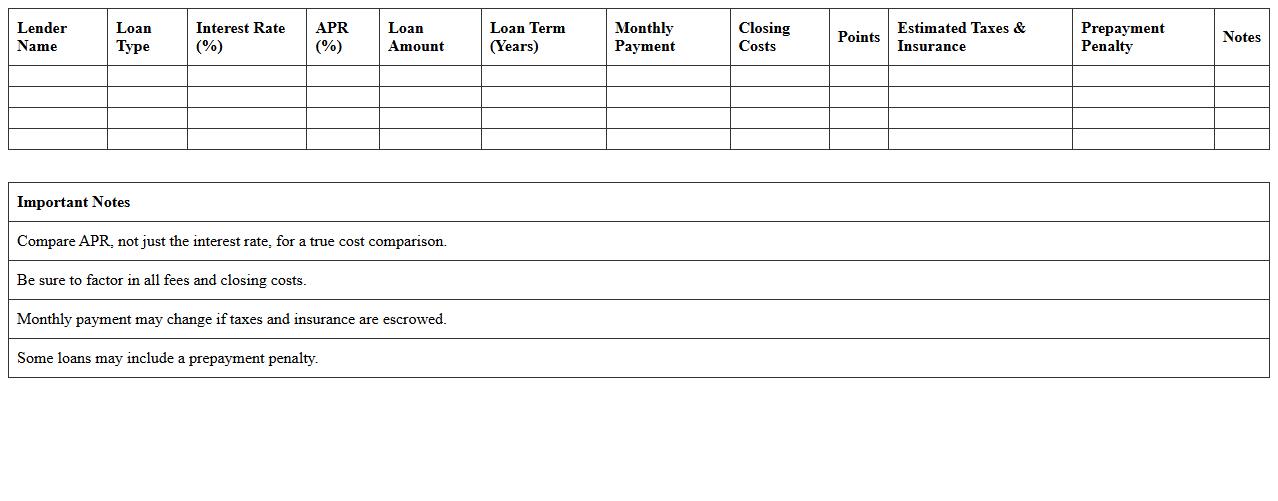

Annual Percentage Rate (APR) Mortgage Comparison Excel Template

An

Annual Percentage Rate (APR) Mortgage Comparison Excel Template document allows users to systematically compare mortgage offers by calculating and displaying the APR for each loan option, including interest rates, fees, and loan terms. This template helps borrowers make informed decisions by providing a clear and detailed view of the true cost of different mortgages, enabling better financial planning. Using this tool improves transparency and simplifies the complex process of evaluating multiple mortgage proposals.

How can I customize the Mortgage Rate Comparison Excel to include adjustable-rate mortgages (ARMs) options?

To incorporate adjustable-rate mortgages (ARMs) into your Excel sheet, add fields for initial fixed-rate period, adjustment intervals, and index rates. Use formulas to calculate changes in interest rates based on index fluctuations and caps. Include dynamic charts to illustrate potential rate changes over time for better decision-making.

What advanced Excel formulas best automate PMI and property tax calculations in my mortgage comparison sheet?

Utilize the IF function to automate Private Mortgage Insurance (PMI) by checking if down payments are below 20%. Apply VLOOKUP or INDEX-MATCH for varying property tax rates by region. Integrate SUMPRODUCT to calculate accurate tax and PMI amounts automatically within payment schedules.

How do I integrate real-time lender data into my Mortgage Rate Comparison Excel for up-to-date rates?

Use Excel's Power Query to connect and import live data feeds from lender websites or APIs. Automate data refresh to ensure your mortgage rates remain current without manual updates. Additionally, embed web scraping tools or VBA scripts for custom real-time data extraction if API access is unavailable.

Which mortgage comparison metrics should be prioritized for first-time home buyers in my spreadsheet?

Focus on essential metrics like APR (Annual Percentage Rate), monthly payment affordability, and total loan cost. Highlight down payment requirements and closing costs to help first-time buyers manage initial expenses. Provide visual aids comparing fixed vs adjustable rates to clarify long-term financial impact.

What are the best Excel layout templates for visually comparing closing costs across multiple lenders?

Choose templates with side-by-side comparison tables and conditional formatting to highlight the lowest fees. Incorporate bar charts or heat maps to quickly visualize variations in lender closing costs. Use pivot tables to summarize and filter diverse cost components for streamlined lender analysis.

More Comparison Excel Templates