The Financial Product Comparison Excel Template for Small Businesses simplifies evaluating various financial options by organizing key details such as interest rates, fees, and terms in one easy-to-use spreadsheet. Small business owners can quickly analyze and compare products like loans, credit cards, and investment options to make informed decisions. This template enhances financial planning efficiency and helps businesses choose the best product suited to their unique needs.

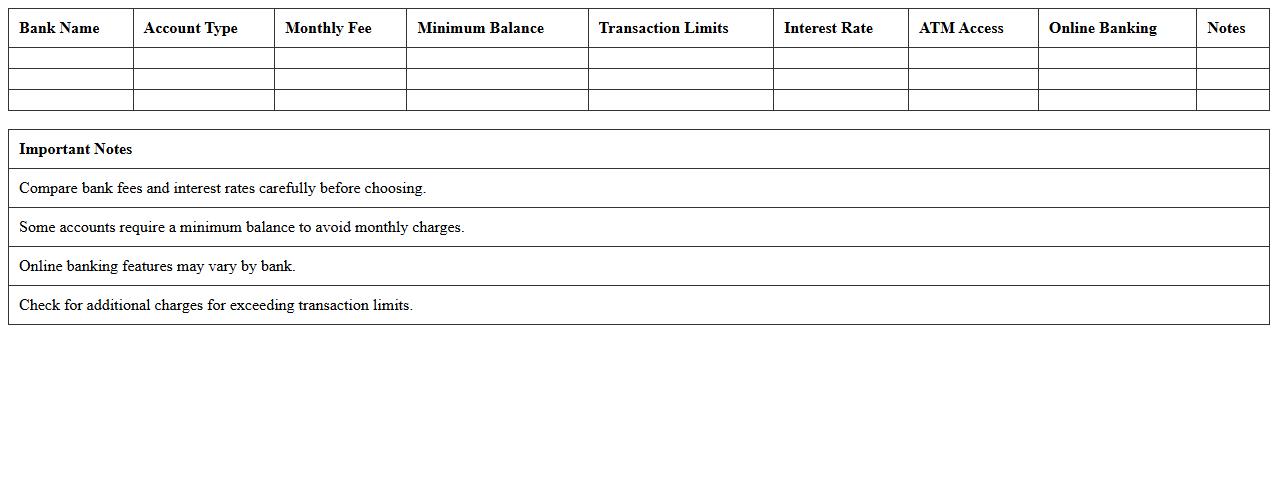

Business Bank Account Comparison Excel Template

A

Business Bank Account Comparison Excel Template document is a structured spreadsheet designed to evaluate and contrast various business bank accounts based on criteria such as fees, interest rates, transaction limits, and available services. This tool enables entrepreneurs and financial managers to make informed decisions by clearly presenting essential data, facilitating a comprehensive analysis of banking options. It simplifies the process of selecting the most cost-effective and suitable account tailored to specific business needs, promoting better financial management and operational efficiency.

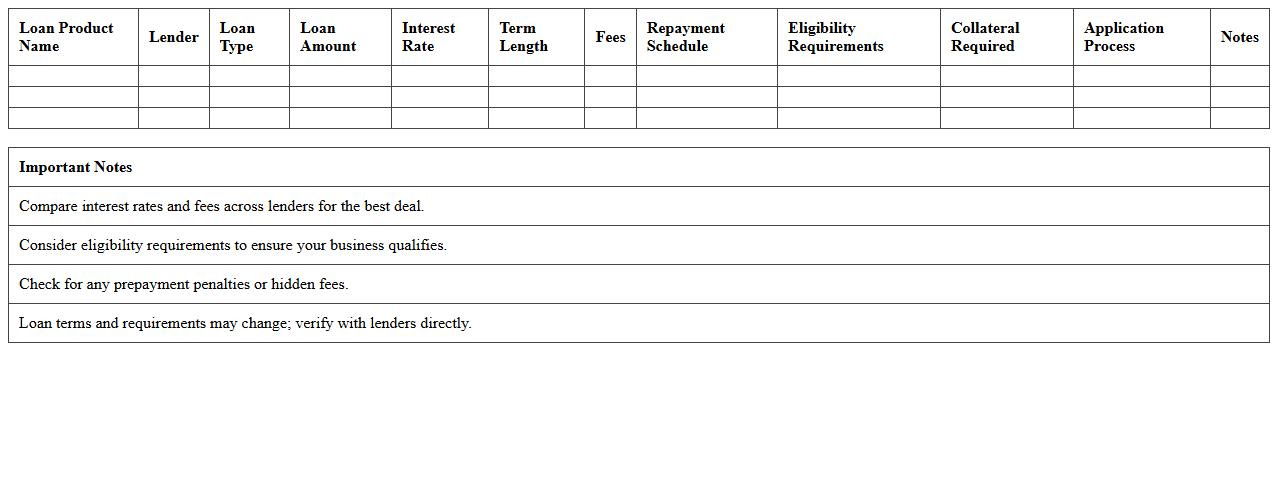

Small Business Loan Product Comparison Spreadsheet

A

Small Business Loan Product Comparison Spreadsheet is a detailed document that organizes and contrasts various loan options based on interest rates, repayment terms, fees, and eligibility requirements. It enables small business owners to analyze multiple financial products side-by-side, facilitating informed decisions tailored to their specific cash flow and growth needs. Utilizing this tool helps businesses secure optimal financing, minimizing costs and maximizing capital efficiency.

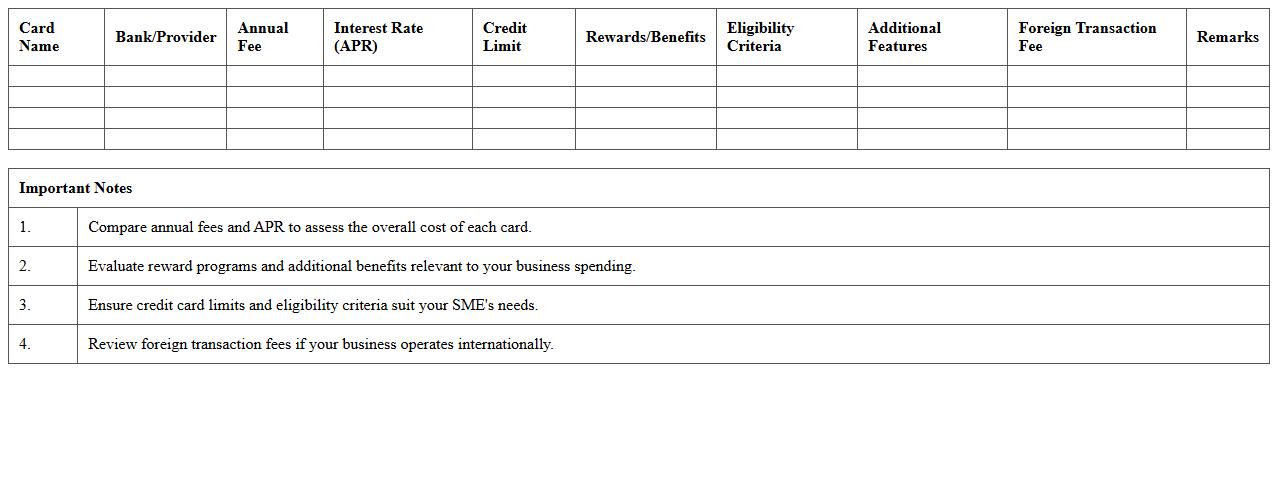

Credit Card Comparison Excel Sheet for SMEs

A

Credit Card Comparison Excel Sheet for SMEs is a detailed tool designed to evaluate and contrast various credit card options based on factors like interest rates, fees, credit limits, and rewards programs specifically tailored for small and medium-sized enterprises. This document enables businesses to make informed financial decisions by clearly highlighting the costs and benefits associated with each credit card, ensuring optimal cash flow management and expense tracking. By streamlining the selection process, it helps SMEs maximize credit benefits while minimizing unnecessary charges.

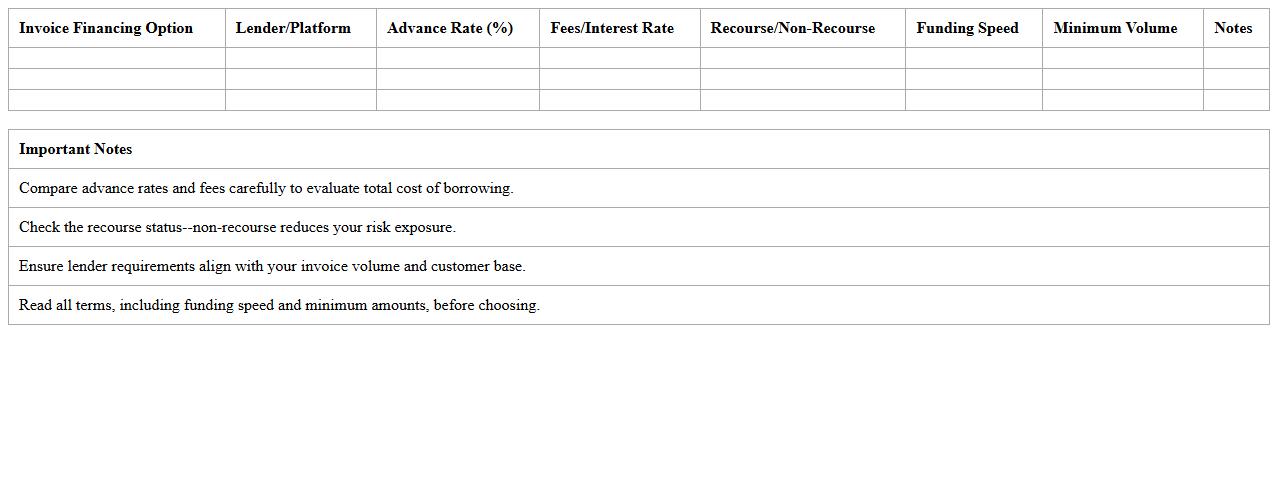

Invoice Financing Options Comparison Excel Template

Invoice Financing Options Comparison Excel Template is a powerful tool designed to help businesses evaluate and compare various

invoice financing solutions efficiently. By organizing key data such as interest rates, fees, repayment terms, and advance percentages, this template enables informed decision-making to select the most cost-effective financing option. It streamlines financial analysis, saves time, and maximizes cash flow management for improved business operations.

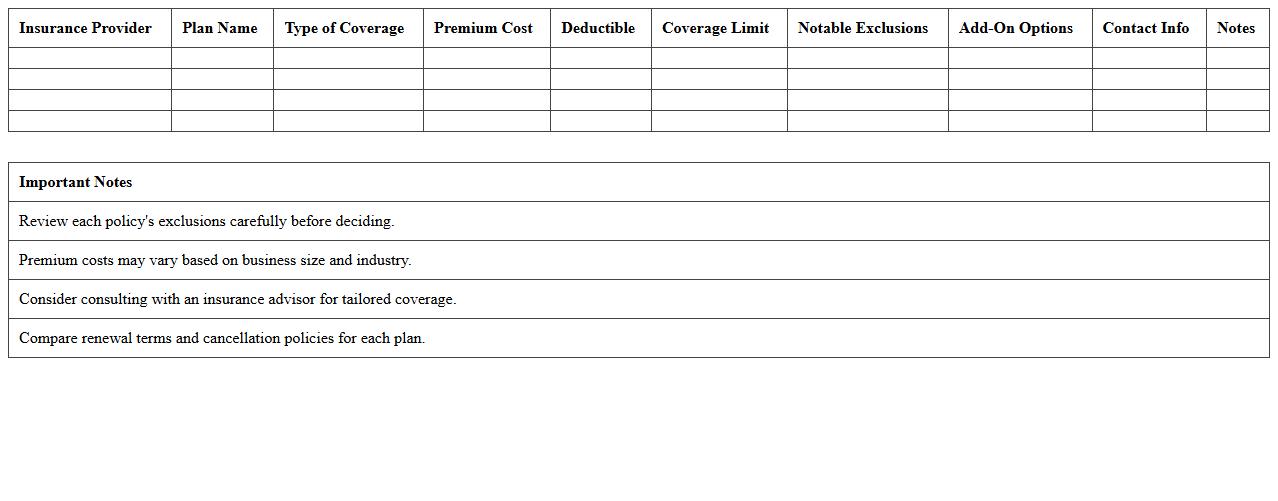

Business Insurance Plan Comparison Worksheet

A

Business Insurance Plan Comparison Worksheet is a structured document that helps businesses evaluate multiple insurance policies by comparing coverage details, premiums, deductibles, and exclusions side by side. It enables informed decision-making by highlighting the strengths and weaknesses of each insurance plan, ensuring that the selected policy aligns with the company's specific risks and financial goals. This tool streamlines the assessment process, saving time and minimizing the risk of overlooking critical policy components.

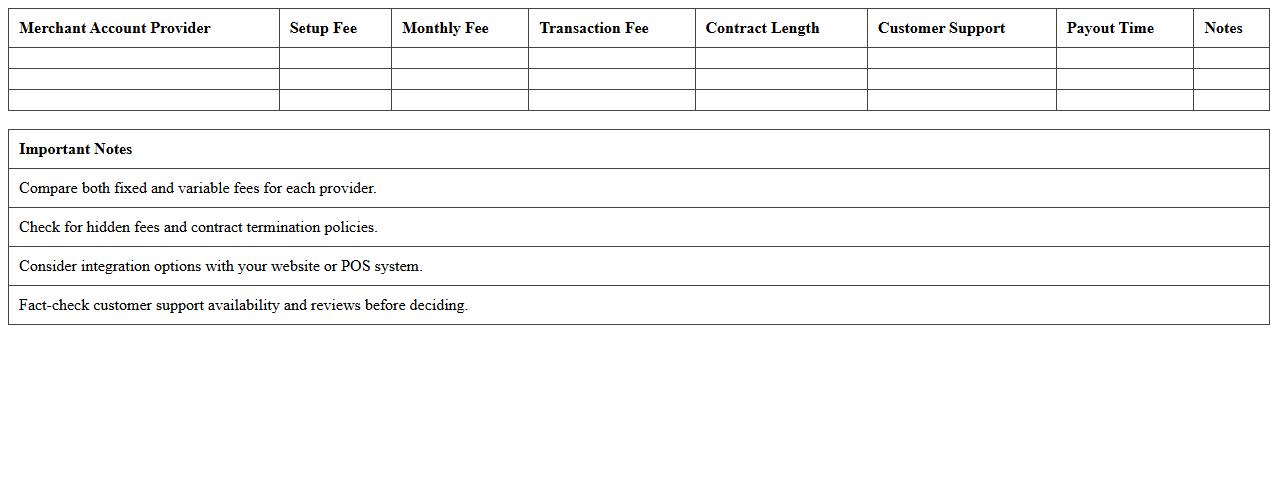

Merchant Account Provider Comparison Excel Template

The

Merchant Account Provider Comparison Excel Template is a detailed spreadsheet designed to evaluate and contrast various merchant account providers based on fees, transaction rates, contract terms, and additional services. This tool streamlines decision-making by organizing critical data points into clear categories, enabling businesses to identify the most cost-effective and feature-rich option tailored to their payment processing needs. Utilizing this template saves time and reduces errors in analysis, ensuring a well-informed selection that supports financial efficiency and operational growth.

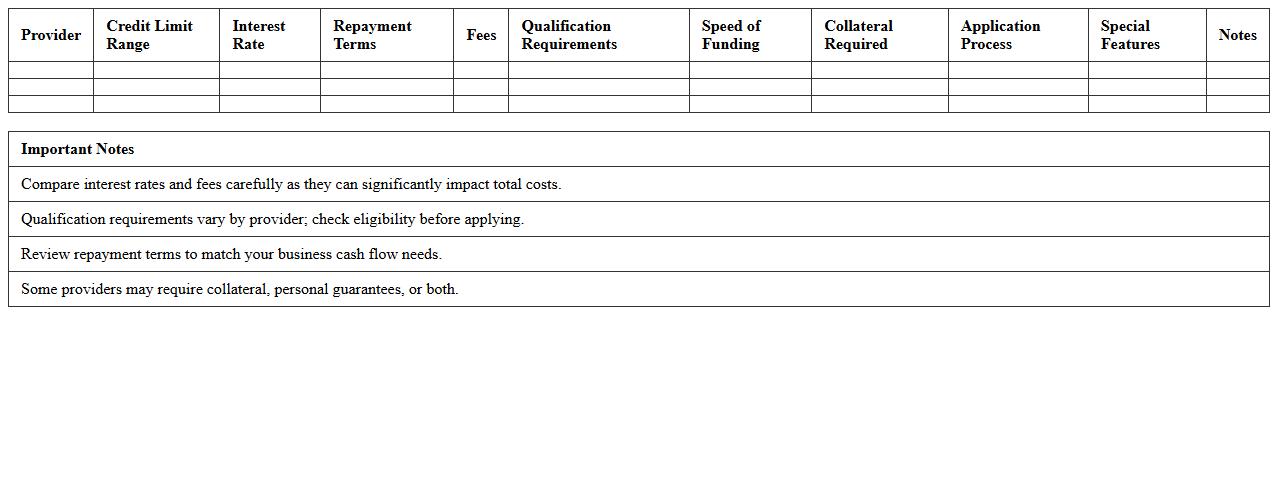

Business Line of Credit Product Comparison Spreadsheet

A

Business Line of Credit Product Comparison Spreadsheet is a comprehensive tool that consolidates key details about various business line of credit offers, such as interest rates, credit limits, repayment terms, and fees. This document enables businesses to efficiently evaluate multiple financing options side-by-side, facilitating informed decision-making tailored to their financial needs. By organizing critical data in one accessible format, it helps identify the most cost-effective and flexible credit products to support operational cash flow and growth.

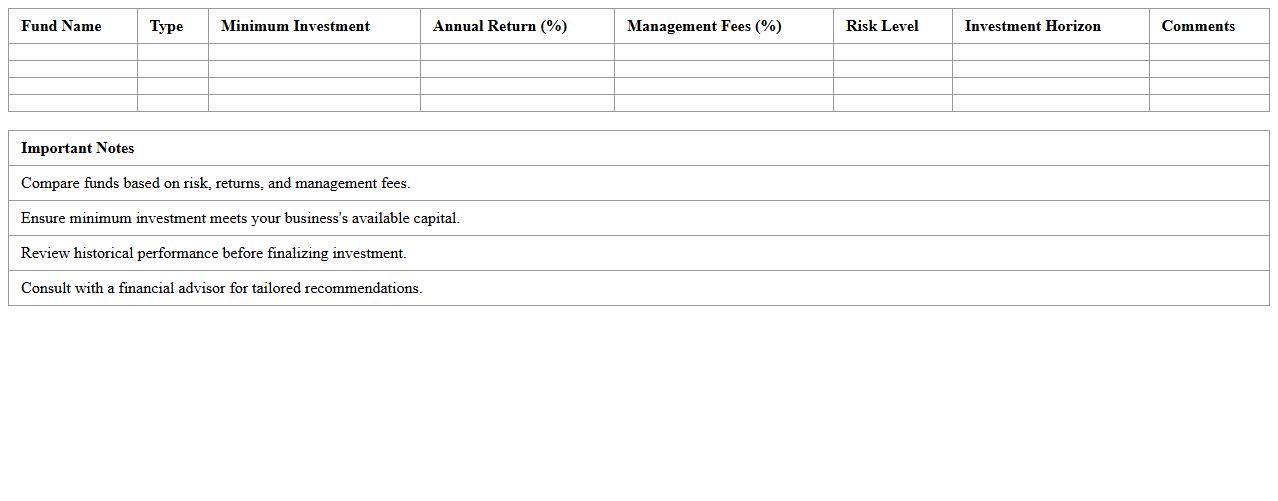

Investment Fund Comparison Excel Template for Small Businesses

The

Investment Fund Comparison Excel Template for small businesses is a structured spreadsheet designed to evaluate and analyze various investment fund options based on key financial metrics such as returns, risk levels, fees, and investment periods. It helps business owners make informed decisions by providing a clear, side-by-side comparison of potential funds, enabling efficient allocation of capital toward the most suitable investments. This tool enhances financial planning accuracy and supports strategic growth by simplifying complex investment data into actionable insights.

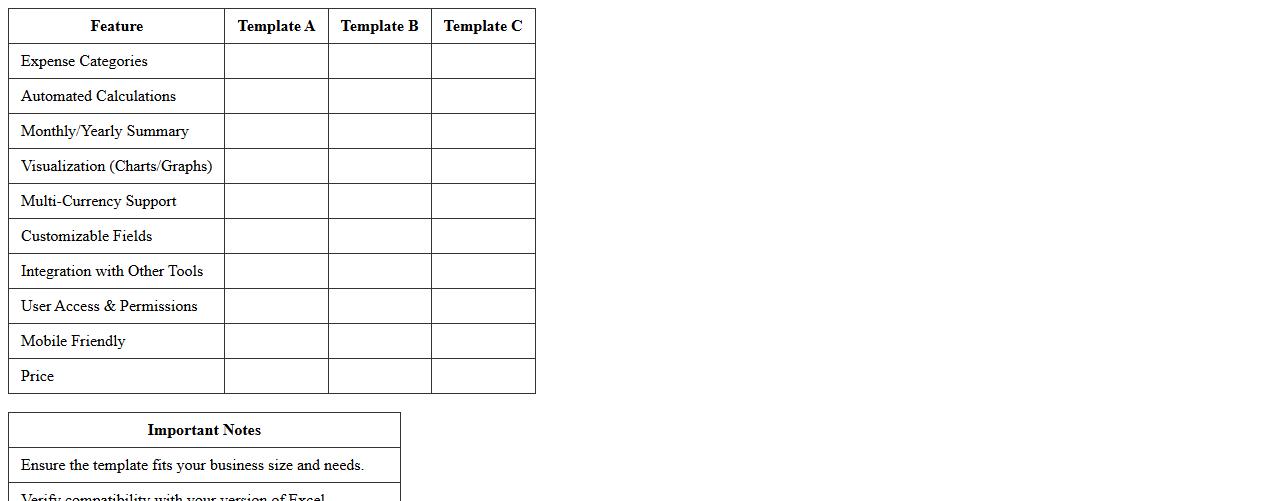

Expense Management Tool Comparison Excel Template

The

Expense Management Tool Comparison Excel Template document serves as a structured framework to evaluate and compare various expense management software based on features, pricing, and user ratings. It enables businesses to make informed decisions by clearly highlighting cost-saving opportunities and functional benefits of each tool. This template streamlines the selection process, ensuring optimized budget allocation and improved financial oversight.

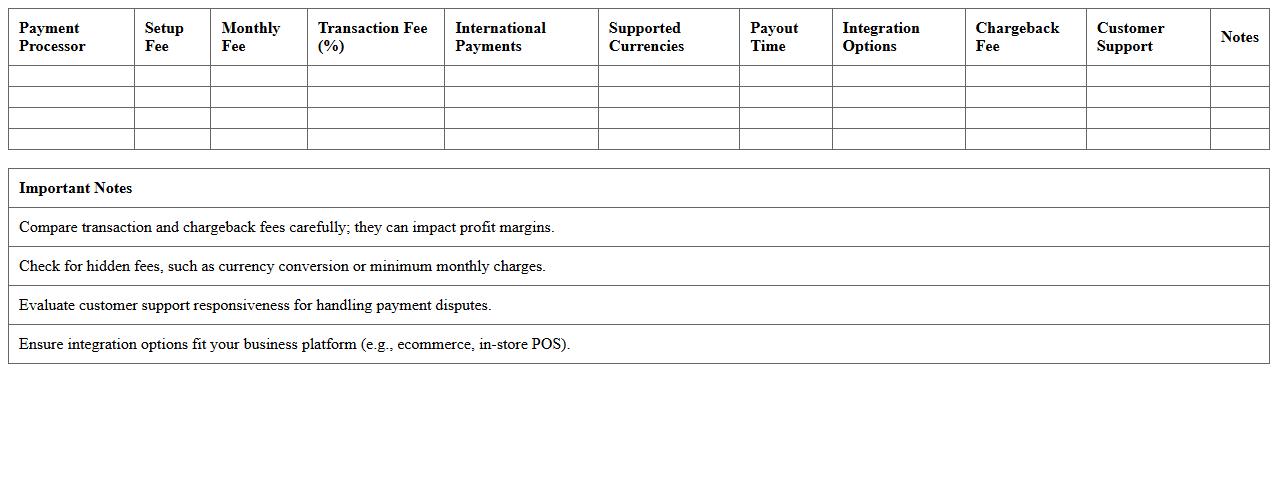

Business Payment Processor Comparison Excel Spreadsheet

A

Business Payment Processor Comparison Excel Spreadsheet document provides a structured and detailed overview of various payment processing services, including transaction fees, supported payment methods, processing speeds, and security features. This tool enables businesses to analyze and compare multiple payment processors side-by-side, facilitating informed decisions that optimize payment efficiency and cost management. By consolidating key data in one place, the spreadsheet streamlines vendor evaluation and supports strategic financial planning.

What specific formulas optimize interest rate comparisons in small business financial products?

Using the PMT function in Excel helps calculate monthly payments based on interest rates, loan term, and principal amount, optimizing comparison. The RATE function determines the effective interest rate over a specific period, making rates comparable among products. Incorporating NPER and FV functions allows for dynamic modeling of payments and future values, enhancing the analysis.

How can VBA automate monthly fee tracking across multiple financial products?

VBA macros can be written to loop through financial product data, summing up monthly fees automatically to save time. Creating event-driven macros lets you update fee totals anytime the dataset changes, ensuring real-time accuracy. Additionally, VBA can generate custom reports highlighting monthly expenditures per product efficiently.

Which conditional formatting best highlights cost-saving opportunities in the Excel sheet?

Using color scales helps visually distinguish lower fees and rates as potential savings in financial data. Applying icon sets with arrows or checkmarks can quickly flag the most favorable cost metrics. Custom rules that highlight values below average monthly fees or interest rates emphasize actionable cost-saving insights effectively.

How do you structure data validation for product terms and eligibility criteria?

Set data validation lists for product terms such as loan duration or payment frequencies to ensure consistent entries. Use custom formulas within validation rules to enforce eligibility criteria based on user inputs or thresholds. Data validation combined with informative input messages reduces errors and maintains data integrity.

What pivot table layouts summarize total projected costs per provider most effectively?

Organizing pivot tables with providers as rows and cost components as values aggregates expenses clearly. Including filters for product types or terms allows for segmented analysis tailored to specific needs. Adding calculated fields for total projected costs gives a comprehensive summary at a glance.

More Comparison Excel Templates