The Mortgage Option Comparison Excel Template for First-Time Buyers helps users evaluate multiple loan offers by organizing interest rates, monthly payments, and loan terms in one clear spreadsheet. This tool simplifies complex financial data, making it easier to identify the most affordable and suitable mortgage option. Customizable fields allow first-time buyers to input their specific financial details for personalized comparisons.

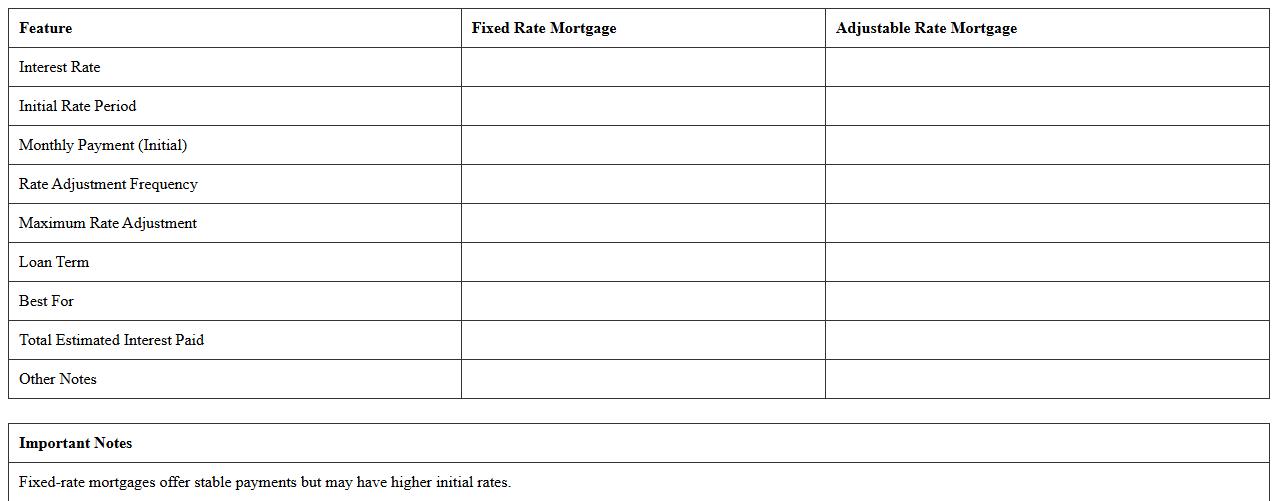

Fixed vs Adjustable Rate Mortgage Comparison Excel Template

A

Fixed vs Adjustable Rate Mortgage Comparison Excel Template is a financial tool designed to help borrowers analyze and compare the costs and benefits of fixed-rate and adjustable-rate mortgages. This template allows users to input loan amounts, interest rates, and terms to calculate monthly payments, total interest, and long-term savings for each mortgage type. It is useful for making informed decisions by providing a clear, side-by-side view of payment stability versus potential interest fluctuations.

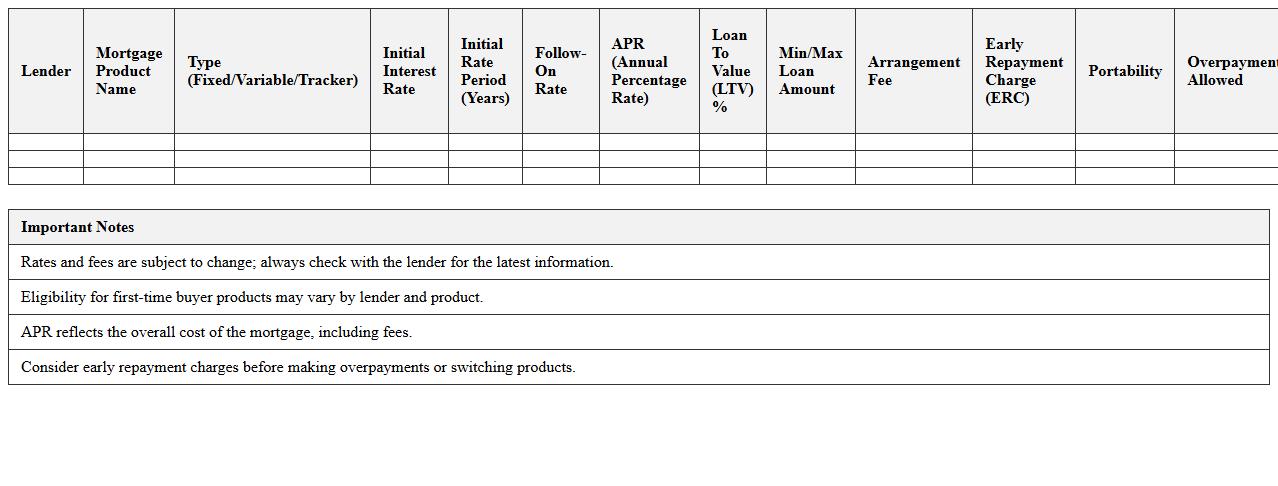

First-Time Buyer Mortgage Feature Analysis Spreadsheet

The

First-Time Buyer Mortgage Feature Analysis Spreadsheet is a comprehensive tool designed to compare various mortgage products by analyzing key features such as interest rates, repayment terms, fees, and eligibility criteria. It allows prospective buyers to make informed decisions by clearly outlining the advantages and disadvantages of each mortgage option tailored to first-time purchasers. This spreadsheet streamlines the evaluation process, saving time and ensuring users select the most suitable mortgage aligned with their financial situation.

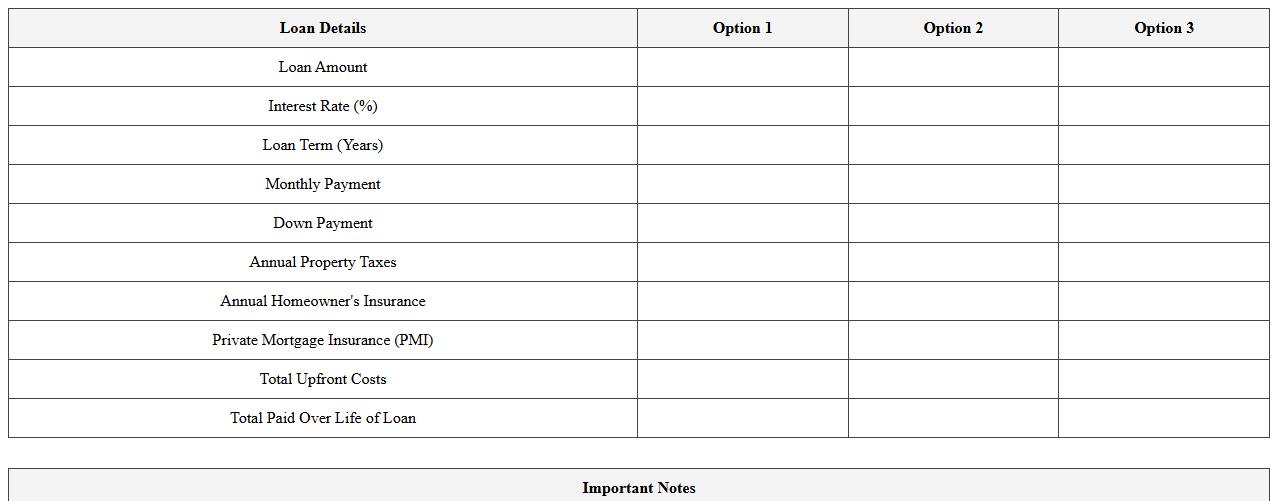

Loan Term Comparison Worksheet for New Homebuyers

The

Loan Term Comparison Worksheet for new homebuyers is a practical tool that outlines various mortgage options by comparing interest rates, loan durations, and monthly payments. This document helps prospective buyers assess the financial impact of different loan terms, making it easier to identify the most affordable and suitable mortgage plan. By clearly presenting these details, it supports informed decision-making and helps avoid unexpected costs over the life of the loan.

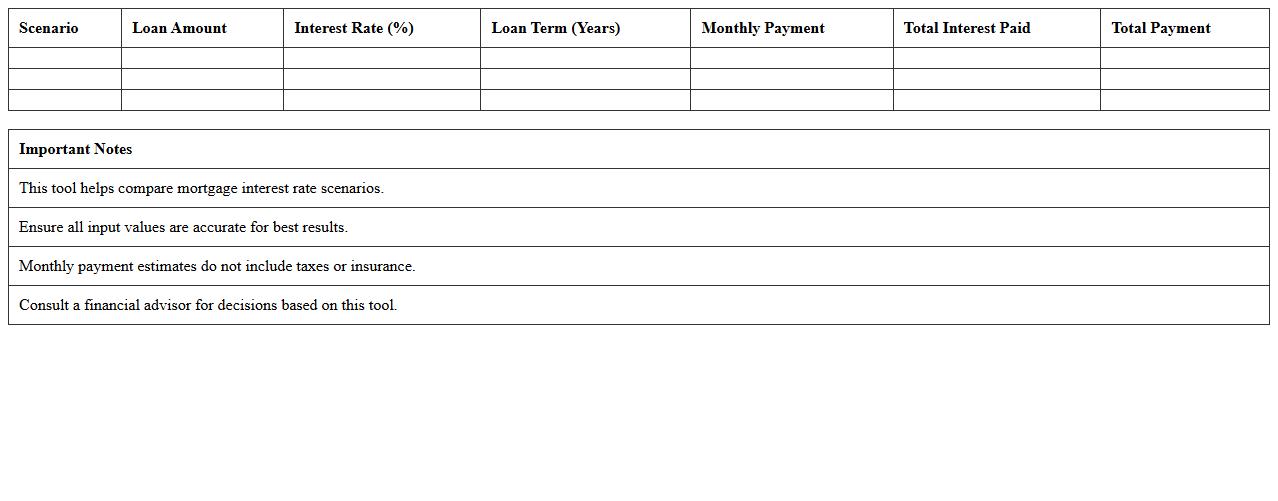

Mortgage Interest Rate Scenarios Excel Tool

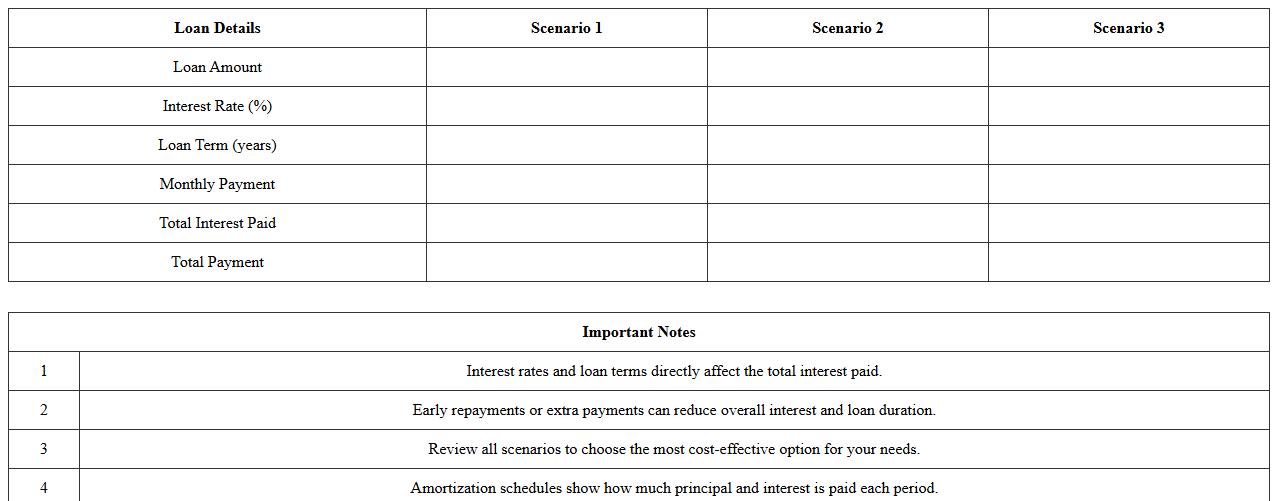

The

Mortgage Interest Rate Scenarios Excel Tool document is designed to analyze and compare various mortgage interest rate scenarios, enabling users to forecast potential monthly payments and total loan costs under different conditions. It helps borrowers and financial planners make informed decisions by providing clear calculations based on adjustable interest rates, loan terms, and principal amounts. This tool is essential for evaluating the financial impact of fluctuating mortgage rates and optimizing loan repayment strategies.

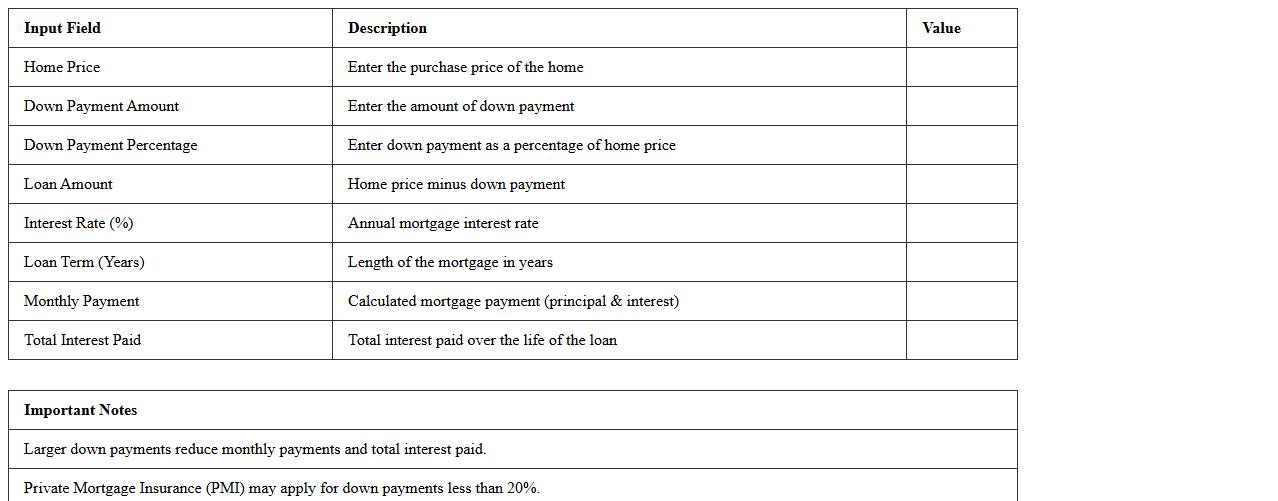

Down Payment Impact Mortgage Calculator Template

The

Down Payment Impact Mortgage Calculator Template document helps users accurately assess how different down payment amounts influence their mortgage payments, interest costs, and loan terms. By inputting various down payment percentages, borrowers can clearly visualize the financial impact on monthly installments and overall loan affordability. This tool is essential for effective budgeting and making informed decisions when planning home purchases or refinances.

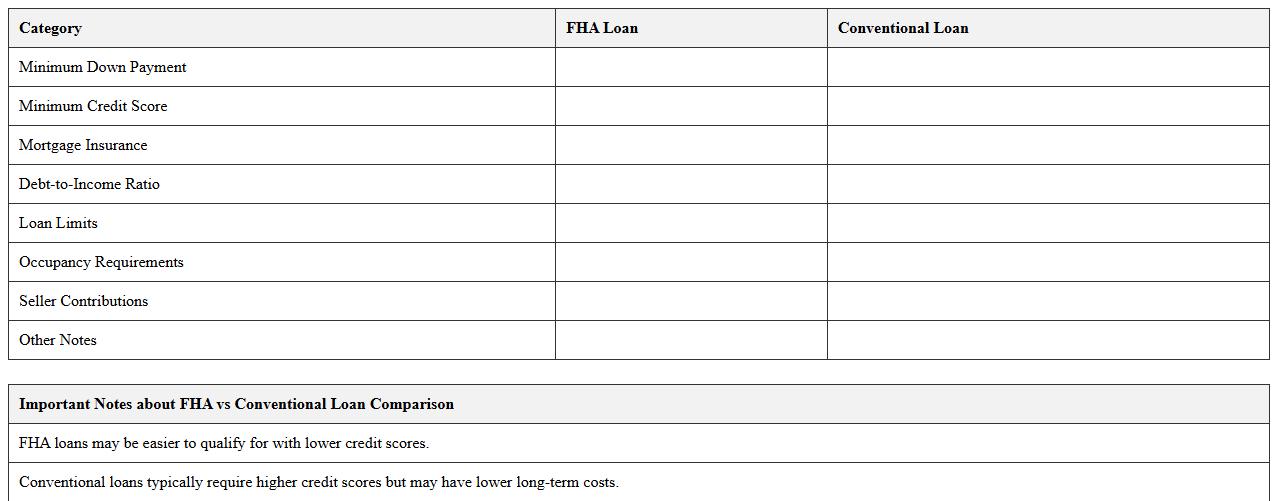

FHA vs Conventional Loan Comparison Spreadsheet

A

FHA vs Conventional Loan Comparison Spreadsheet is a tool designed to clearly outline the differences between Federal Housing Administration (FHA) loans and conventional mortgage loans, including interest rates, down payment requirements, credit score criteria, and mortgage insurance costs. This document helps potential homebuyers or real estate professionals quickly analyze loan options side-by-side, making it easier to identify the most cost-effective and suitable financing choice based on personal financial situations. Using this spreadsheet streamlines decision-making by providing detailed, organized data that highlights key loan features and long-term financial implications.

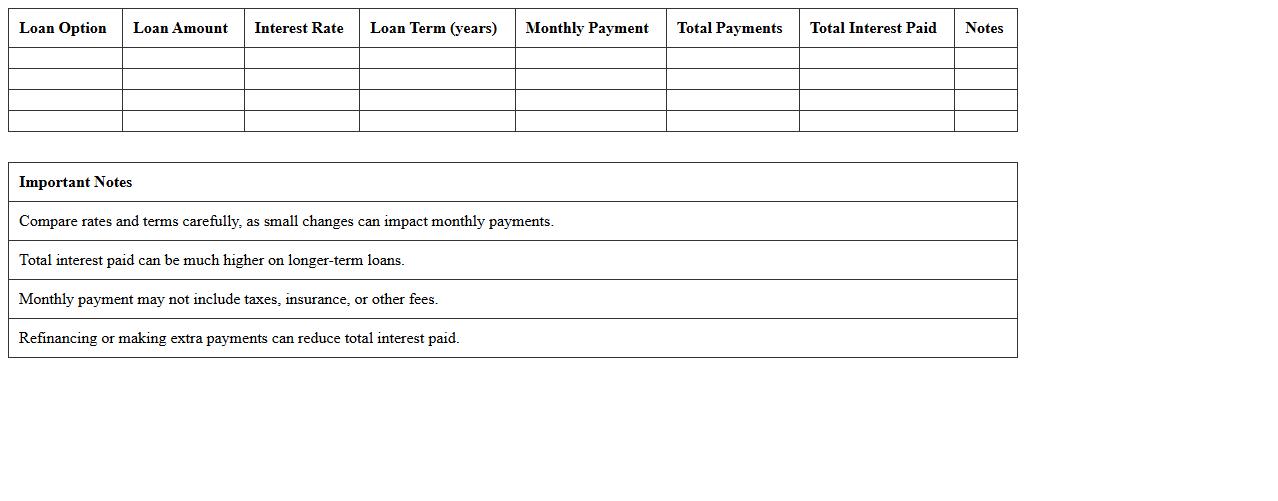

Monthly Payment Comparison Template for Mortgages

The

Monthly Payment Comparison Template for Mortgages is a valuable tool designed to help borrowers analyze different mortgage options by comparing monthly payment amounts across various loan terms, interest rates, and down payment scenarios. This template provides a clear, side-by-side comparison that simplifies decision-making, empowering users to choose the most affordable and suitable mortgage plan based on accurate financial data. By using this document, individuals can better manage their budget and avoid unexpected payment burdens, ensuring a more informed and confident home financing process.

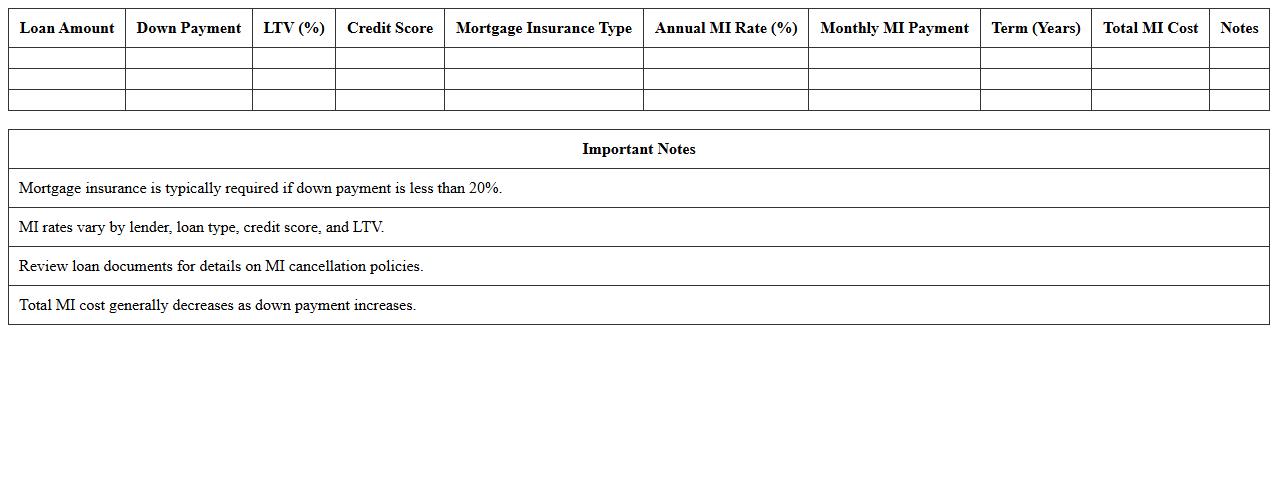

Mortgage Insurance Cost Evaluation Excel Sheet

The

Mortgage Insurance Cost Evaluation Excel Sheet is a powerful tool designed to calculate and compare different mortgage insurance premiums based on loan amount, loan-to-value ratio, and interest rates. It helps users analyze potential insurance costs, enabling informed decisions when selecting mortgage options or planning budgets. This document streamlines cost assessment, ensuring transparency and financial clarity during the home financing process.

Amortization Schedule Comparison for First-Time Buyers

An

Amortization Schedule Comparison for First-Time Buyers document outlines different loan repayment plans, detailing principal and interest payments over time. It helps buyers understand the total cost of various mortgage options by comparing payment timelines and interest accruals. This comparison empowers first-time buyers to select the most cost-effective loan strategy, ensuring better financial planning and long-term savings.

Side-by-Side Mortgage Options Analysis Spreadsheet

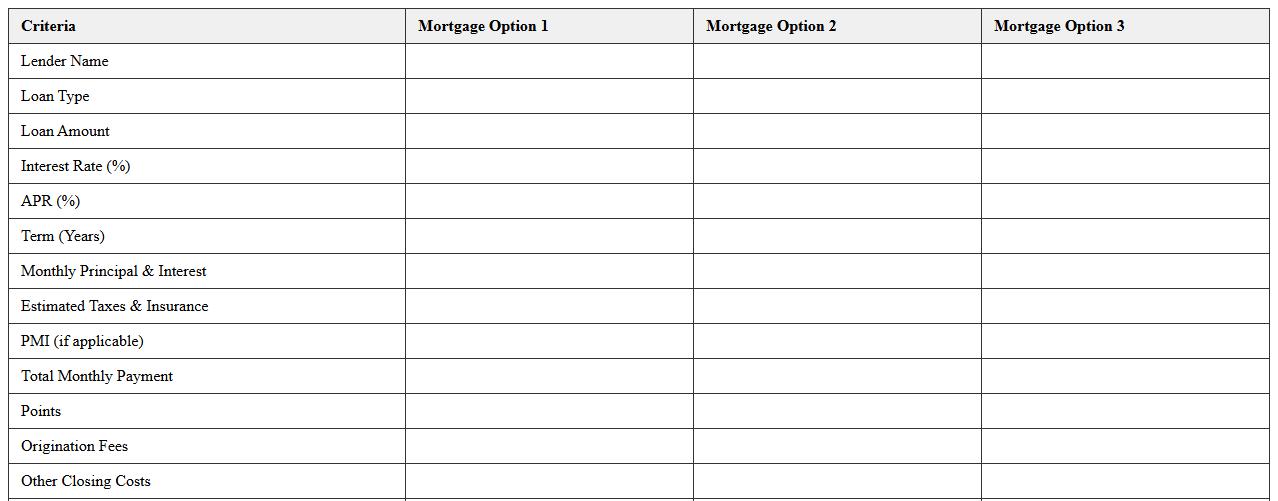

The

Side-by-Side Mortgage Options Analysis Spreadsheet is a comprehensive tool designed to compare multiple mortgage plans by outlining key factors such as interest rates, loan terms, monthly payments, and total costs. It enables users to visualize and analyze differences between options clearly, helping to identify the most cost-effective and suitable mortgage for their financial situation. This document is valuable for making informed decisions, optimizing loan choices, and saving money over the life of the mortgage.

Which Excel formulas best compare fixed vs. variable mortgage rates for first-time buyers?

The PMT function is essential for calculating monthly payments for both fixed and variable mortgage rates. To compare, use IF statements to switch between rate scenarios based on your input. Additionally, the NPV function can help analyze the total cost over the loan period for each mortgage type.

How can Excel automate monthly payment calculations for different mortgage options?

Excel automates monthly payments primarily through the PMT formula, requiring loan amount, interest rate, and term. By setting up dynamic input cells and referencing them in formulas, you enable easy updates for multiple options. This method streamlines comparison and adjustment across various mortgage scenarios effectively.

What conditional formatting highlights the lowest total mortgage cost in the spreadsheet?

Using Excel's Conditional Formatting Rules, select the mortgage cost cells and apply the "Lowest Value" rule. This visually emphasizes the entry with the minimum total cost by changing its fill or font color. This technique aids quick identification of the most affordable mortgage option at a glance.

How to create a customizable amortization schedule for multiple loan scenarios in Excel?

Develop a template with input cells for loan amount, interest rate, term, and start date to customize your amortization schedule. Use formulas to compute monthly interest, principal payments, and remaining balance, copying rows for the loan term length. Incorporate dropdown menus or input fields for switching between scenarios easily.

Which Excel chart type most clearly visualizes principal vs. interest over time for first-time buyers?

The stacked column chart effectively displays principal and interest components side by side each month. This format allows first-time buyers to see how payments split and evolve over time visually. It enhances understanding of loan payoff dynamics by showing both elements cumulatively.

More Comparison Excel Templates