The Insurance Plan Comparison Excel Template for Small Businesses helps entrepreneurs easily evaluate multiple insurance options side by side, highlighting costs, coverage details, and benefits. This tool simplifies decision-making by organizing critical data in a clear, customizable spreadsheet format tailored to small business needs. It enhances financial planning by providing a transparent overview of insurance plans to ensure the best value and protection.

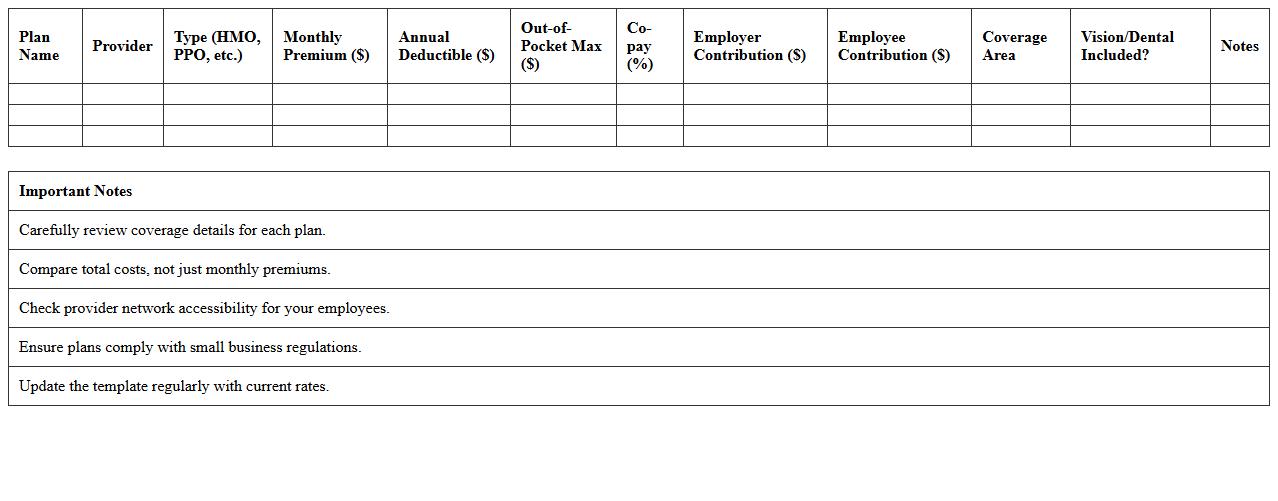

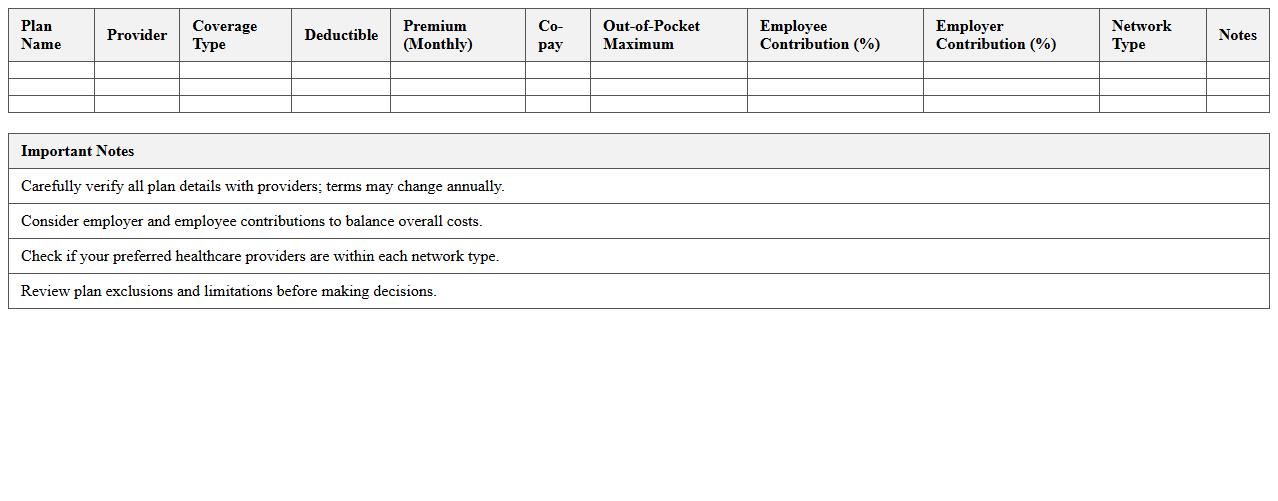

Health Insurance Comparison Excel Template for Small Businesses

The

Health Insurance Comparison Excel Template for Small Businesses is a structured spreadsheet designed to evaluate multiple health insurance plans side by side, highlighting premiums, coverage options, deductibles, and co-pays. This tool streamlines the decision-making process for small business owners by organizing complex health insurance data into clear, comparative categories, enabling cost-effective and informed choices. Utilizing this template helps optimize employee benefits while managing budget constraints efficiently.

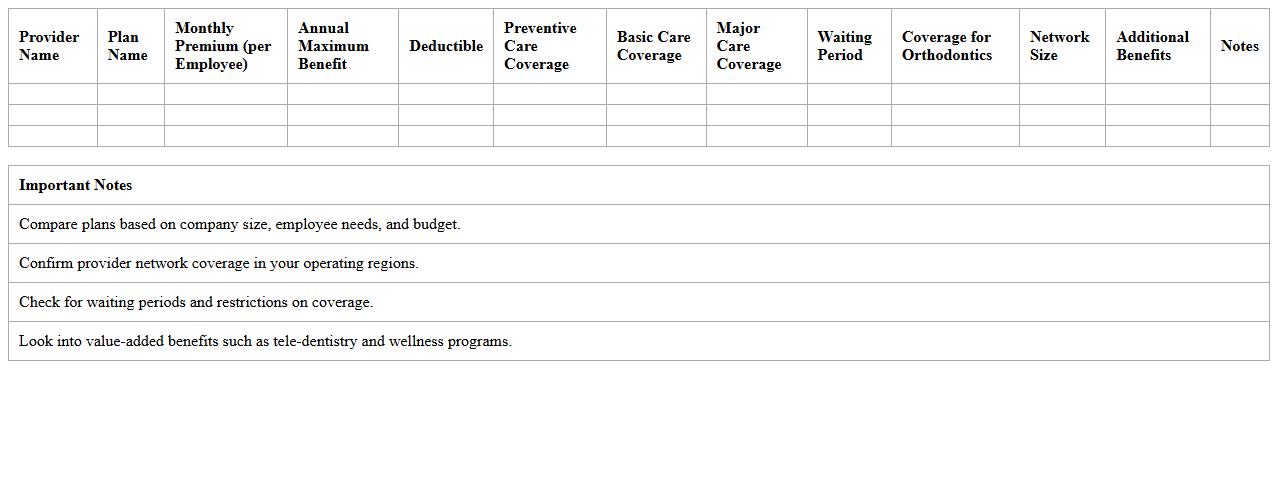

Dental Insurance Comparison Spreadsheet for SMEs

A

Dental Insurance Comparison Spreadsheet for SMEs is a detailed tool designed to evaluate various dental insurance plans side-by-side, highlighting coverage options, premium costs, deductibles, and network providers. This document helps small and medium-sized enterprises make informed decisions by simplifying complex insurance data into an easily understandable format, ensuring cost-effective and comprehensive dental benefits for employees. Utilizing this spreadsheet enhances budget management while promoting employee satisfaction through tailored dental coverage choices.

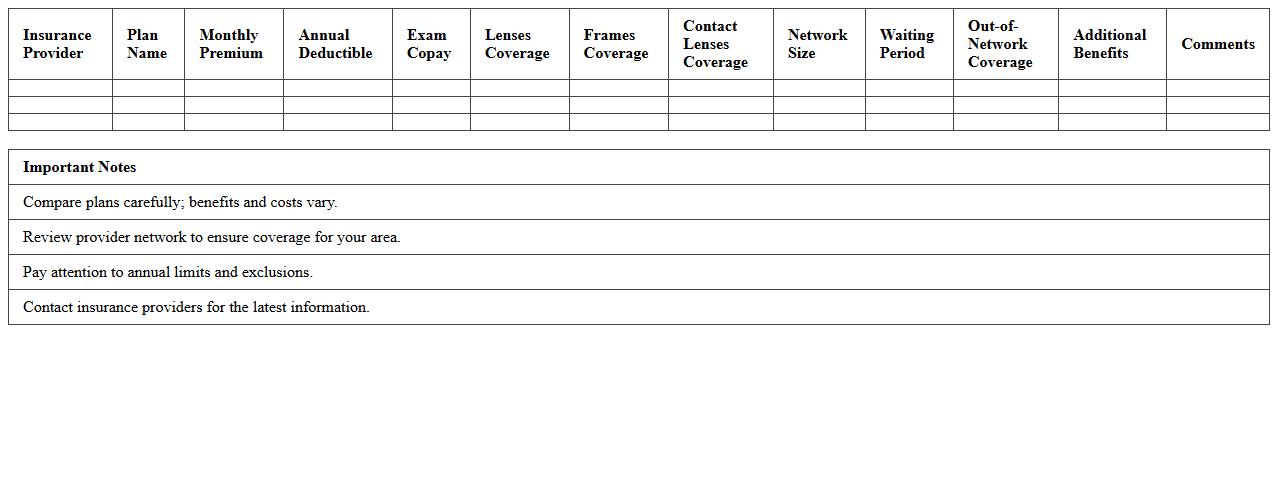

Vision Insurance Plan Comparison Excel Template SMB

The

Vision Insurance Plan Comparison Excel Template SMB document is a structured spreadsheet designed to help small and medium-sized businesses evaluate various vision insurance options side-by-side. It organizes plan details such as coverage limits, co-pay amounts, network providers, and premium costs, enabling clear analysis for informed decision-making. Utilizing this template streamlines the selection process, ensuring the best value and appropriate coverage for employees' vision care needs.

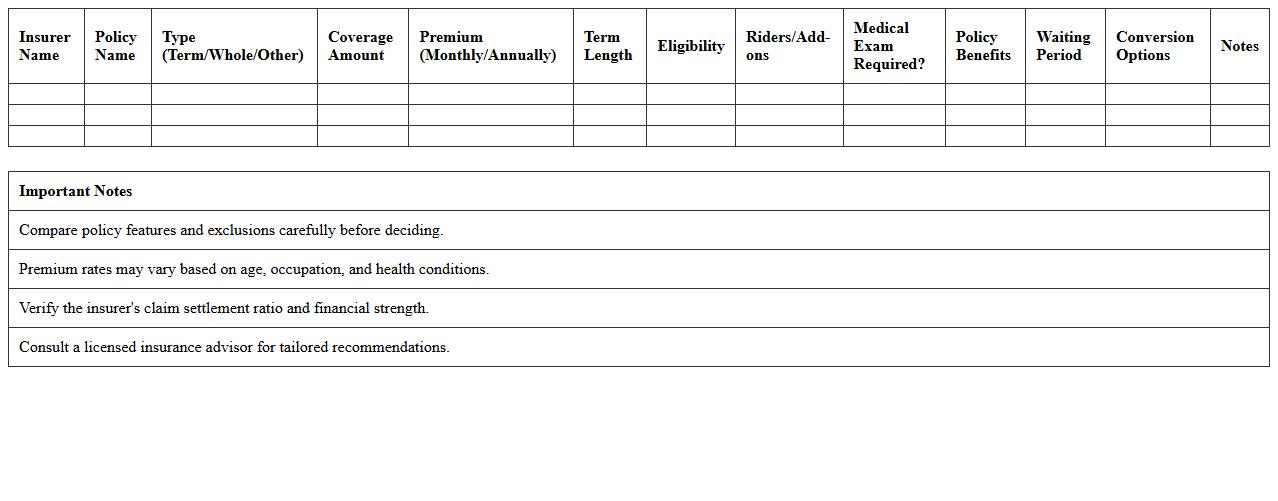

Life Insurance Policy Comparison Sheet for Small Businesses

A

Life Insurance Policy Comparison Sheet for Small Businesses is a structured document that outlines and contrasts various life insurance plans tailored for small business owners. It highlights critical factors such as premium costs, coverage amounts, policy terms, and additional benefits, enabling informed decision-making. This tool helps small businesses select the most cost-effective and comprehensive life insurance options to protect their financial interests and ensure business continuity.

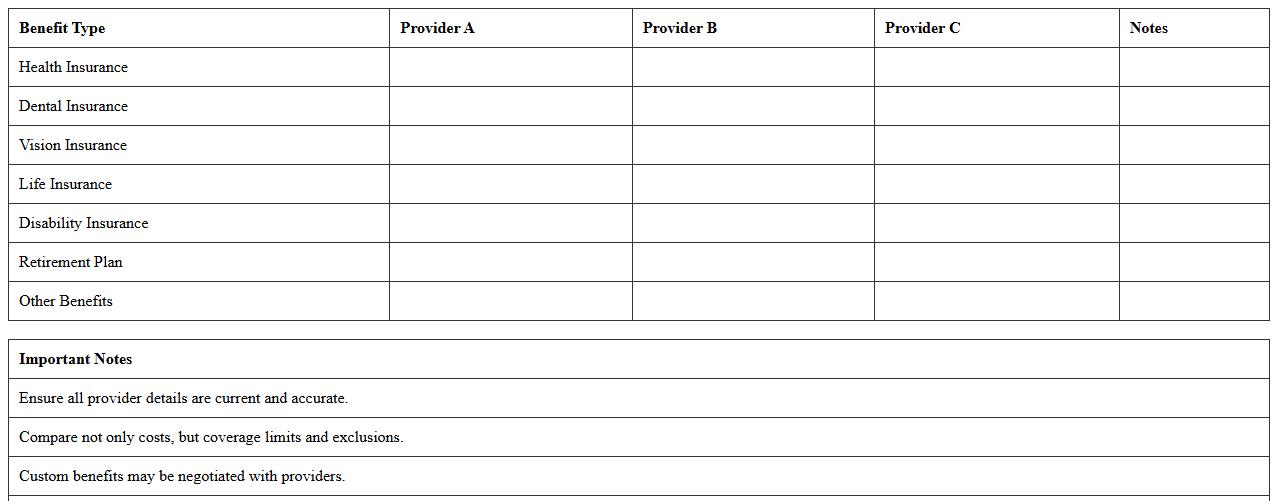

Employee Benefits Insurance Comparison Excel Template

The

Employee Benefits Insurance Comparison Excel Template document is a structured tool designed to systematically compare various employee insurance plans, including health, dental, vision, and life coverage. This template helps businesses analyze cost, coverage details, and provider options side-by-side, enabling informed decision-making to optimize employee benefits packages. Utilizing this template reduces time spent on manual comparisons and ensures a clear, data-driven approach to selecting the most suitable insurance plans for employee well-being and budget efficiency.

Group Insurance Plan Comparison Spreadsheet for Small Employers

A

Group Insurance Plan Comparison Spreadsheet for small employers is a comprehensive tool designed to evaluate and contrast various employee insurance options based on premiums, coverage benefits, deductibles, and provider networks. This document simplifies decision-making by presenting complex plan details in a clear, side-by-side format, enabling employers to identify the most cost-effective and suitable insurance packages for their workforce. It enhances budgeting accuracy and ensures compliance with industry standards, ultimately assisting small businesses in providing optimal health benefits while managing expenses effectively.

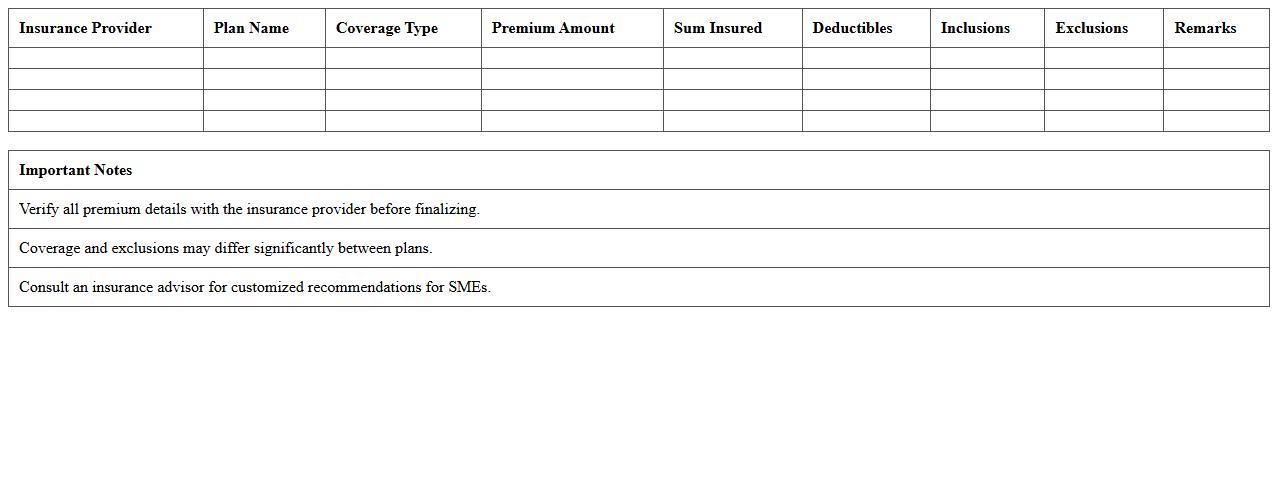

Insurance Premium Comparison Table Excel Template SMEs

The

Insurance Premium Comparison Table Excel Template for SMEs is a structured spreadsheet designed to help small and medium-sized enterprises analyze and compare various insurance premium options efficiently. It consolidates multiple insurance quotes, coverage details, and payment terms in one place, enabling businesses to make informed decisions based on cost-effectiveness and coverage suitability. This tool streamlines the selection process, reduces administrative effort, and ensures SMEs secure optimal insurance coverage tailored to their unique needs.

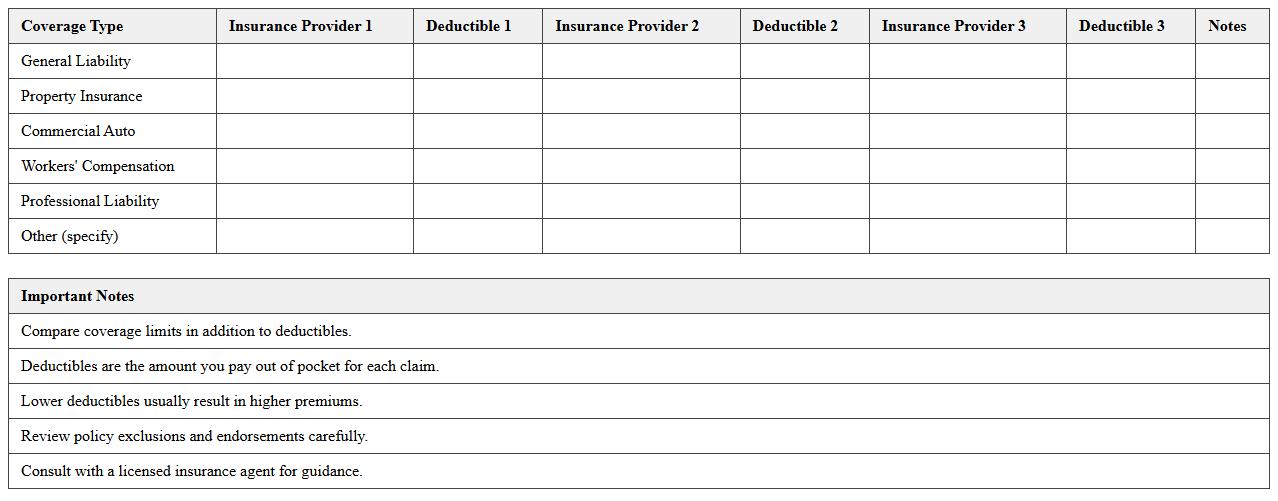

Small Business Insurance Deductible Comparison Worksheet

A

Small Business Insurance Deductible Comparison Worksheet is a tool designed to systematically evaluate various deductible options across multiple insurance policies. It helps small business owners understand the financial impact of different deductible levels on premium costs and potential out-of-pocket expenses, enabling informed decision-making. By comparing deductibles side-by-side, this worksheet aids in selecting the most cost-effective insurance plan tailored to business risk tolerance and budget constraints.

Insurance Coverage Features Comparison Excel Sheet SMB

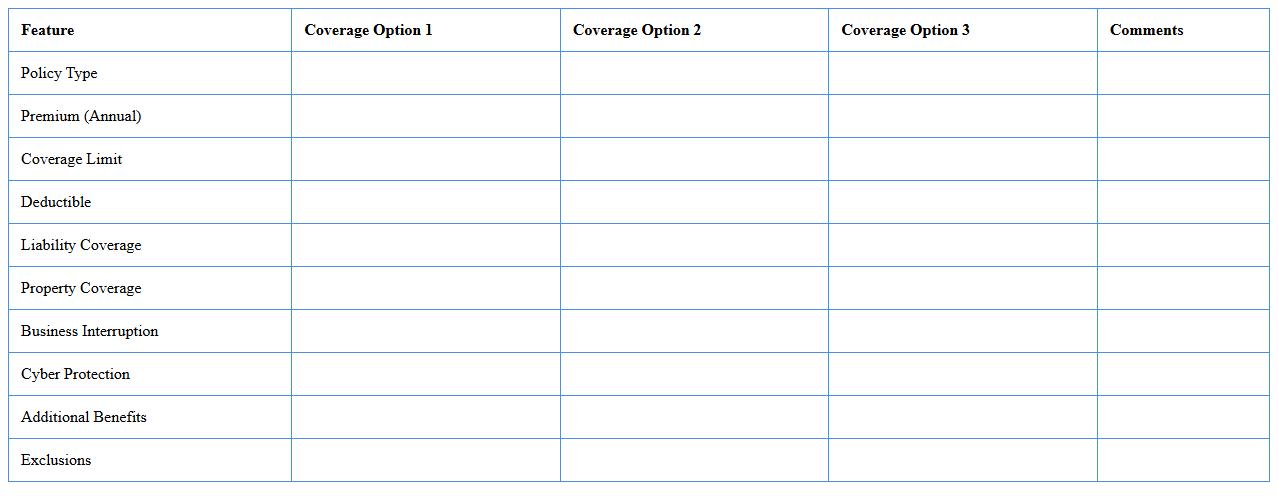

The

Insurance Coverage Features Comparison Excel Sheet SMB document systematically organizes and compares various insurance policy features tailored for small and medium businesses, allowing users to quickly evaluate coverage options based on critical factors like premium costs, coverage limits, and exclusions. This tool enhances decision-making by presenting clear side-by-side analyses of different insurance providers, helping businesses identify the best fit for their specific risk management needs. By streamlining policy comparisons, it saves time and ensures that companies select comprehensive insurance coverage that aligns with their operational requirements.

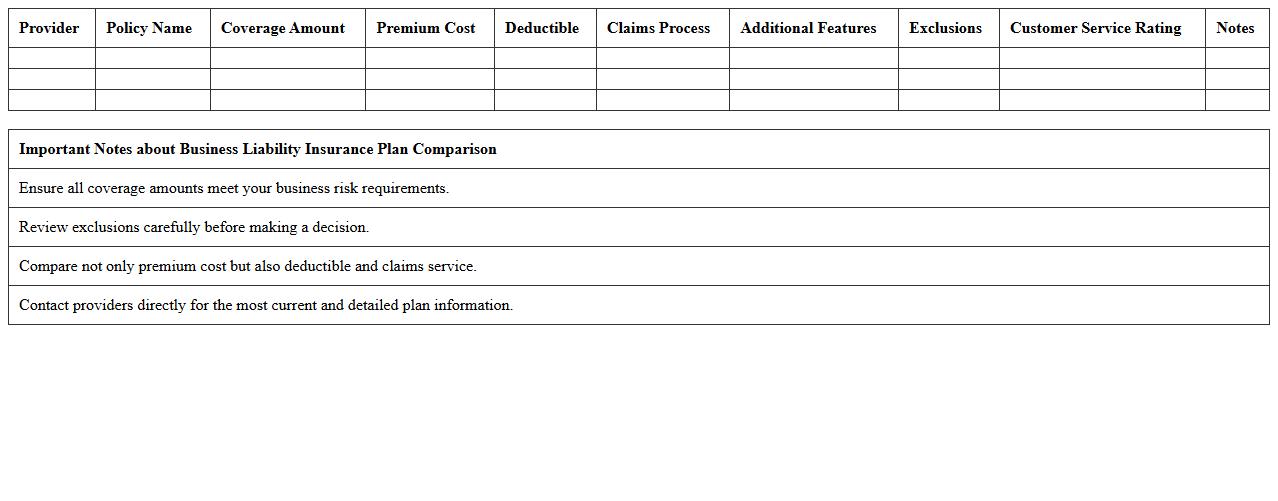

Business Liability Insurance Plan Comparison Template Excel

A

Business Liability Insurance Plan Comparison Template Excel document serves as a structured tool to analyze multiple insurance policies side by side, highlighting coverage limits, exclusions, premiums, and deductibles. It enables businesses to make informed decisions by easily identifying the best match for their specific risk exposures and financial constraints. This template streamlines the evaluation process, reducing time spent on manual comparison and increasing accuracy in selecting optimal liability coverage.

What Excel formulas best automate premium cost comparisons across multiple insurance plans?

The SUMIF and VLOOKUP formulas are essential for comparing premiums across multiple insurance plans by aggregating costs based on specific criteria. Using INDEX MATCH provides more flexibility and accuracy when pulling premium data from large tables. Additionally, the IF function helps automate decision-making processes by comparing premiums and highlighting the most cost-effective options.

How can small businesses track deductible differences using conditional formatting in Excel?

Small businesses can use conditional formatting to visually differentiate deductible amounts by setting color scales that highlight higher and lower values effectively. Applying rules like data bars or color scales emphasizes deductible differences, making it easier to identify more affordable options. This method also allows businesses to instantly spot plans with favorable deductible structures at a glance.

Which pivot table metrics should be included for out-of-pocket maximums in insurance plan comparison?

Pivot tables should include average out-of-pocket maximums, minimum, and maximum values to provide a comprehensive view of various insurance plans. Grouping data by plan type or coverage tier enables a detailed comparative analysis of financial exposure. Including counts of plans within certain out-of-pocket ranges can further aid in identifying beneficial options.

How to incorporate network provider availability data in an insurance comparison Excel sheet?

Network provider availability can be integrated using a lookup table that lists providers alongside insurance plans, connected via VLOOKUP or INDEX MATCH. Conditional formatting can flag whether preferred providers are included within each plan's network. Adding filters or slicers allows for dynamic sorting and enhanced comparison of network coverage across plans.

What Excel chart types most effectively visualize coverage tiers for small business insurance options?

Stacked bar charts and clustered column charts are highly effective for visualizing different coverage tiers across multiple insurance plans simultaneously. These charts clearly display the relative size and distribution of coverage components such as premiums, deductibles, and out-of-pocket costs. Using combo charts can also combine coverage layers with cost metrics, enhancing decision-making clarity.

More Comparison Excel Templates