The Health Insurance Comparison Excel Template for Senior Citizens provides an easy-to-use tool to evaluate different health insurance plans tailored specifically for seniors. This template allows users to input various policy details, premiums, and coverage options, enabling clear side-by-side comparisons. It helps senior citizens make informed decisions by highlighting the most cost-effective and comprehensive insurance choices.

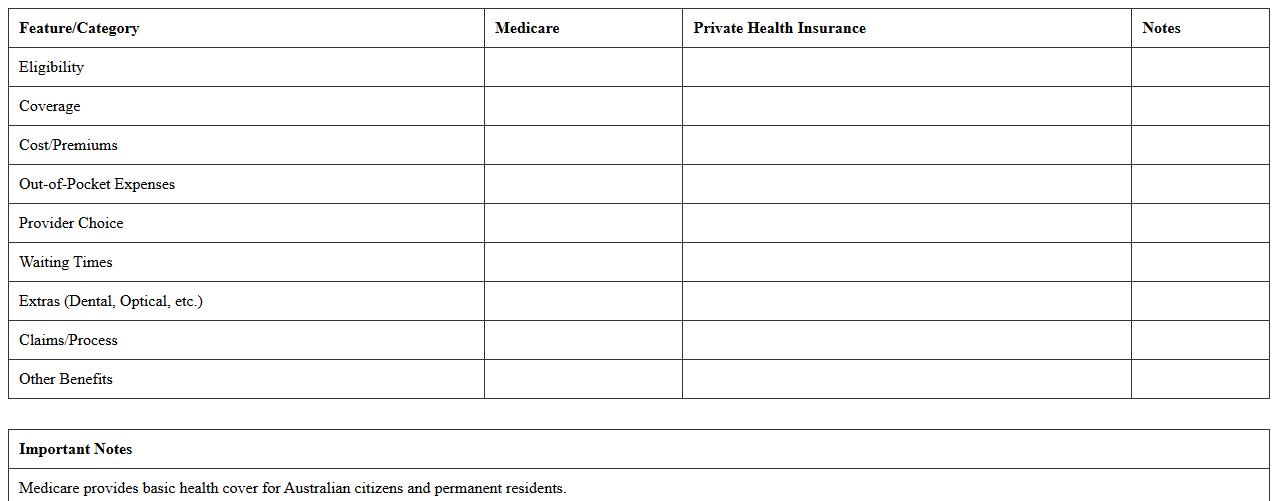

Medicare vs Private Health Insurance Comparison Template

The

Medicare vs Private Health Insurance Comparison Template document provides a clear, side-by-side analysis of key features, costs, and coverage options between public Medicare programs and private health insurance plans. This template is useful for individuals seeking to understand the trade-offs and make informed decisions based on factors like premiums, benefits, provider networks, and eligibility criteria. By presenting critical information in an organized format, it aids users in selecting the plan that best fits their healthcare needs and financial situation.

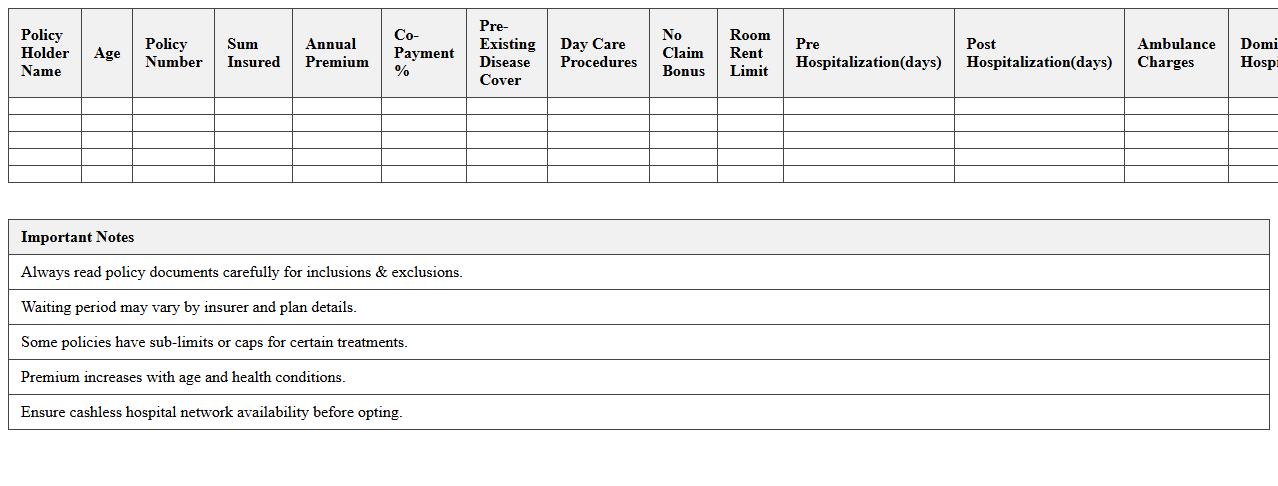

Senior Citizens Health Insurance Benefits Matrix Excel

The

Senior Citizens Health Insurance Benefits Matrix Excel document systematically organizes various health insurance plans and benefits tailored for elderly individuals, enabling easy comparison and understanding of coverage options. It helps users quickly identify the most relevant policies based on specific health needs, premiums, and claim procedures, optimizing decision-making for better financial and healthcare outcomes. This tool is essential for caregivers, healthcare professionals, and seniors seeking comprehensive insurance solutions under one accessible platform.

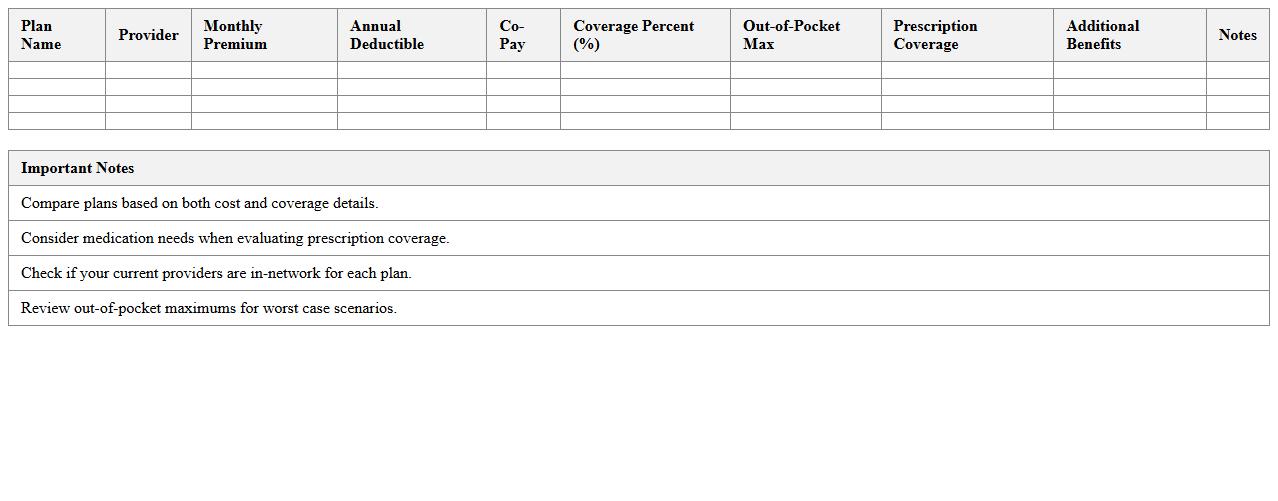

Elderly Health Plan Cost Comparison Spreadsheet

The

Elderly Health Plan Cost Comparison Spreadsheet is a tool designed to analyze and compare various health insurance plans tailored for seniors, highlighting premiums, deductibles, co-pays, and coverage benefits. This document helps users make informed decisions by clearly presenting cost differences, aiding in budget planning and ensuring optimal healthcare coverage. By using this spreadsheet, individuals and caregivers can efficiently evaluate multiple options to find the best value and protection for elderly healthcare needs.

Out-of-Pocket Expenses Tracker for Senior Health Policies

The

Out-of-Pocket Expenses Tracker for Senior Health Policies document is a comprehensive tool designed to help seniors monitor and manage their healthcare spending beyond insurance coverage. It systematically records expenses such as co-pays, prescription costs, and non-covered treatments, providing clear insights into personal financial commitments. This tracker aids in budgeting, ensuring seniors can accurately plan for medical costs and avoid unexpected financial burdens.

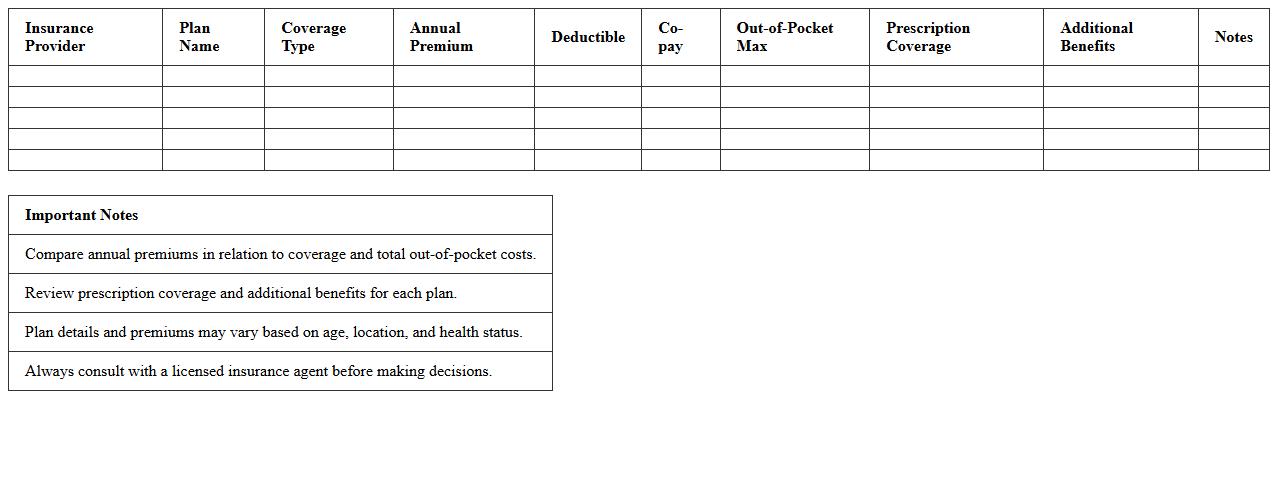

Annual Premium Comparison Sheet for Senior Insurance Plans

An

Annual Premium Comparison Sheet for Senior Insurance Plans is a detailed document that outlines and compares the yearly cost of various insurance policies tailored specifically for seniors. This sheet allows users to evaluate multiple plans side-by-side, considering factors like coverage benefits, premium amounts, and policy terms to make informed decisions. It proves useful by simplifying complex insurance options, helping seniors or their caregivers choose the most cost-effective and comprehensive coverage that fits their healthcare needs and budget.

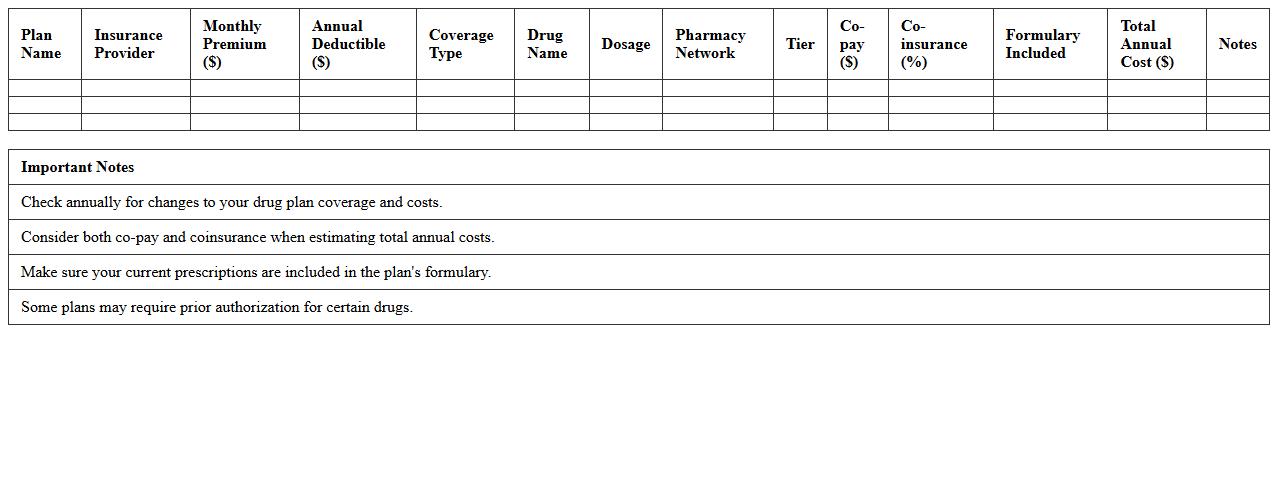

Prescription Drug Coverage Analysis Excel for Seniors

The

Prescription Drug Coverage Analysis Excel for Seniors document is a comprehensive tool designed to help seniors evaluate and compare various prescription drug plans based on coverage, cost, and formulary details. By organizing data such as drug prices, copayments, and coverage tiers, it enables users to make informed decisions and optimize their healthcare expenses. This analysis enhances seniors' ability to select the most cost-effective and beneficial prescription drug plan tailored to their specific medication needs.

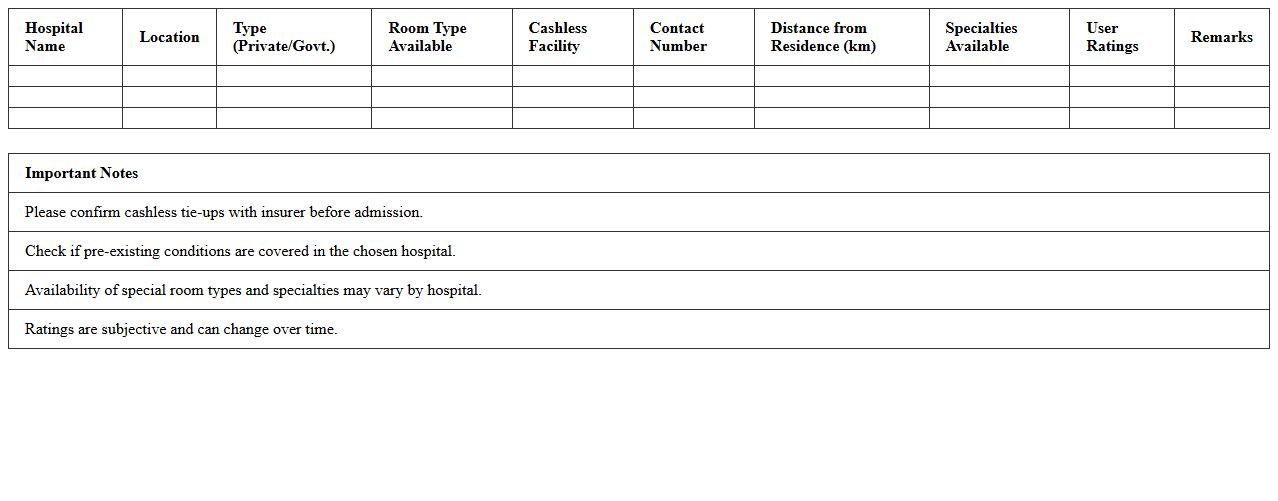

Network Hospitals Comparison Chart for Senior Insurance

A

Network Hospitals Comparison Chart for senior insurance documents presents a detailed overview of hospitals included in various insurance provider networks, highlighting factors such as hospital location, specialties, and patient reviews. This chart helps seniors and their families make informed decisions by comparing coverage options and ensuring access to preferred healthcare facilities within the policy's network. It simplifies the process of choosing insurance plans that maximize benefits while minimizing out-of-pocket expenses for medical treatments.

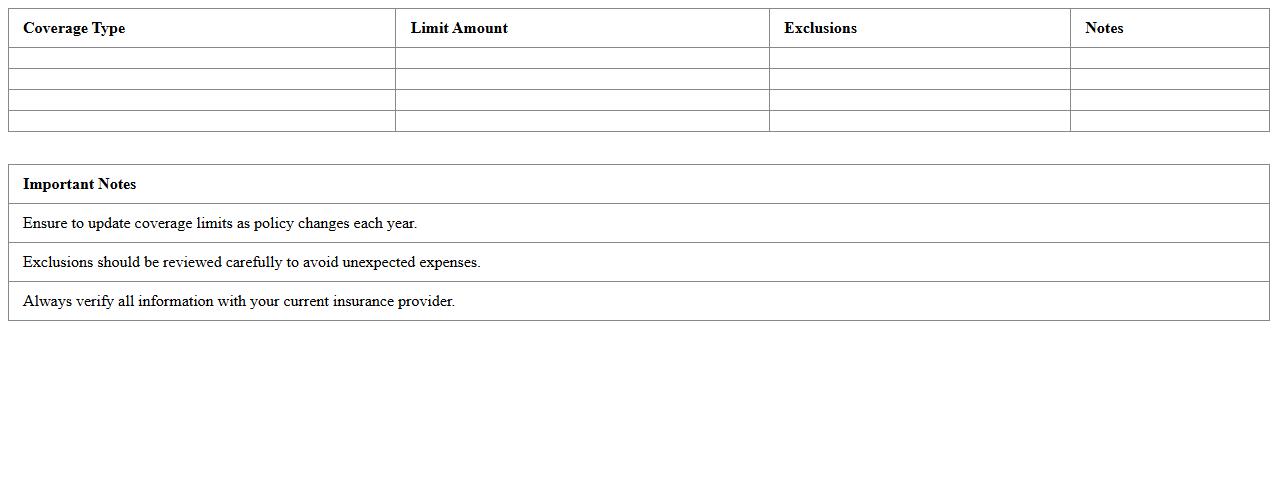

Coverage Limits and Exclusions Excel Template for Seniors

The

Coverage Limits and Exclusions Excel Template for Seniors is a detailed spreadsheet designed to help seniors track and understand the maximum benefits and specific exclusions in their insurance policies. This template organizes complex insurance data into clear categories, making it easier to compare coverage limits across different plans and identify any conditions or treatments that are not covered. It is useful for seniors to make informed decisions about their healthcare options and avoid unexpected out-of-pocket expenses.

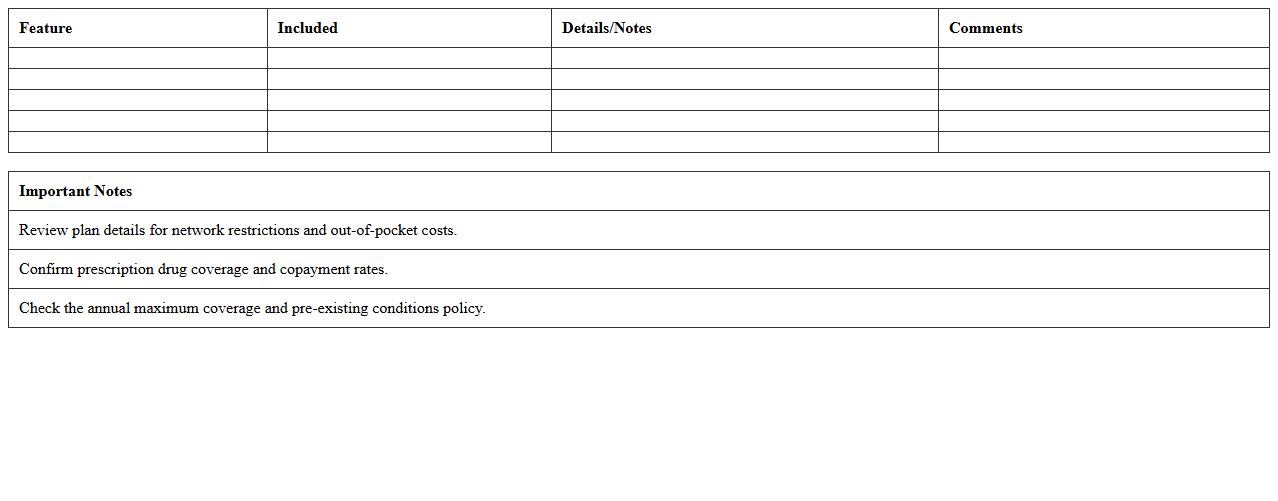

Senior Health Insurance Plan Features Checklist

A

Senior Health Insurance Plan Features Checklist document provides a detailed comparison of policy benefits, coverage limits, premiums, and co-payment options tailored for senior citizens. It helps users systematically evaluate and select the most suitable health insurance plan by highlighting essential features like pre-existing condition coverage, prescription drug benefits, and annual wellness visits. This checklist ensures informed decision-making, saving time and reducing confusion when choosing senior-specific health insurance options.

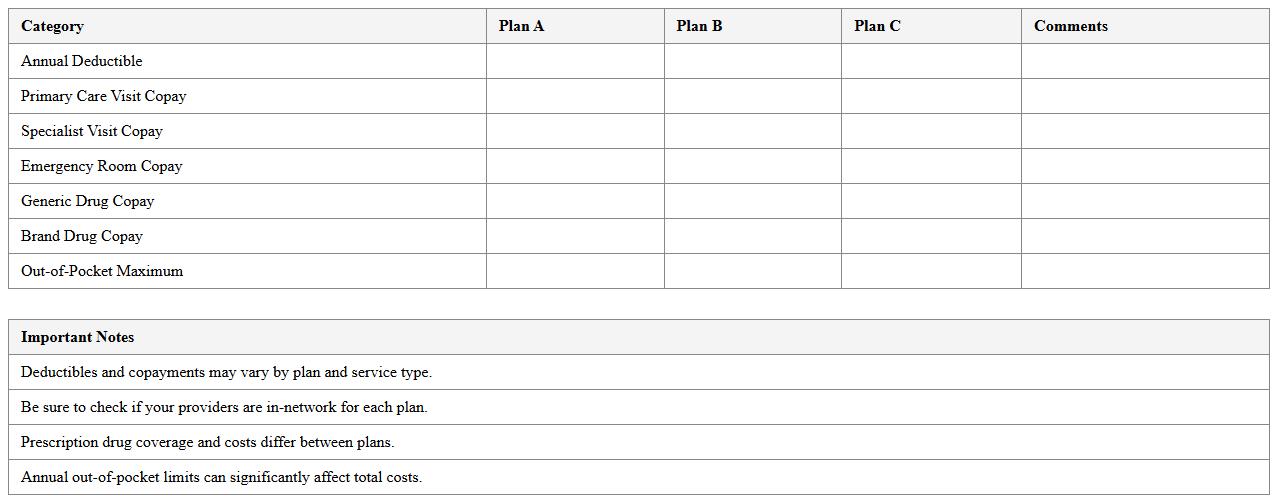

Deductibles and Copayments Comparison Sheet for Seniors

The

Deductibles and Copayments Comparison Sheet for Seniors is a detailed document that outlines various healthcare plan options, focusing specifically on cost-sharing features such as deductibles and copayments. This sheet helps seniors easily compare out-of-pocket expenses, enabling them to make informed decisions about which insurance plans best fit their medical and financial needs. By presenting clear, organized data, it reduces the complexity of understanding healthcare costs and supports seniors in managing their healthcare budgets effectively.

What Excel formulas best compare premium costs for senior health insurance plans?

The SUMIFS formula is ideal for summing premium costs based on specific criteria such as plan type or coverage level. Using VLOOKUP or XLOOKUP allows quick comparison of premiums across different insurance providers. Additionally, IF statements help evaluate if one plan's premium is higher or lower than another for easier decision-making.

How to track annual out-of-pocket limits in a health insurance comparison spreadsheet?

Tracking annual out-of-pocket limits is simplified using SHEET references to consolidate data from multiple plans into one summary. The MAX function can highlight the highest out-of-pocket limit across plans for quick review. Inserting a DATA VALIDATION dropdown enables selection of different years or scenarios to see corresponding out-of-pocket values.

Which features in Excel help visualize prescription coverage differences for seniors?

Conditional formatting enables visual differentiation of prescription coverage by highlighting cost ranges or coverage levels. Creating PivotTables summarizes prescription benefits by plan, easing comparative analysis. The use of Charts such as bar graphs or line charts displays coverage patterns clearly across different senior health plans.

How to automate alerts for plan changes using conditional formatting in health insurance Excel sheets?

Conditional formatting rules based on formulas like IF or NOT EQUAL TO detect changes in plan values such as premiums or deductibles. Setting color-coded alerts draws immediate attention to any modifications in a plan's terms. This automation simplifies monitoring by visually signaling when an update occurs, ensuring seniors stay informed.

What columns are essential for comparing deductible and copay details for senior citizens in Excel?

Include separate columns for Individual Deductible and Family Deductible to capture all potential out-of-pocket scenarios. Additionally, columns for Primary Care Copay and Specialist Copay offer a granular view of service costs. It is also important to have a column for Coinsurance Percentage to provide a complete picture of financial responsibility.

More Comparison Excel Templates