The Insurance Plan Comparison Excel Template for Family Planning allows users to efficiently evaluate multiple insurance options side-by-side, highlighting coverage, premiums, and benefits tailored to family needs. This customizable template streamlines decision-making by organizing critical policy details and cost factors in an easy-to-read format. It supports families in selecting the best insurance plan that balances affordability and coverage for comprehensive protection.

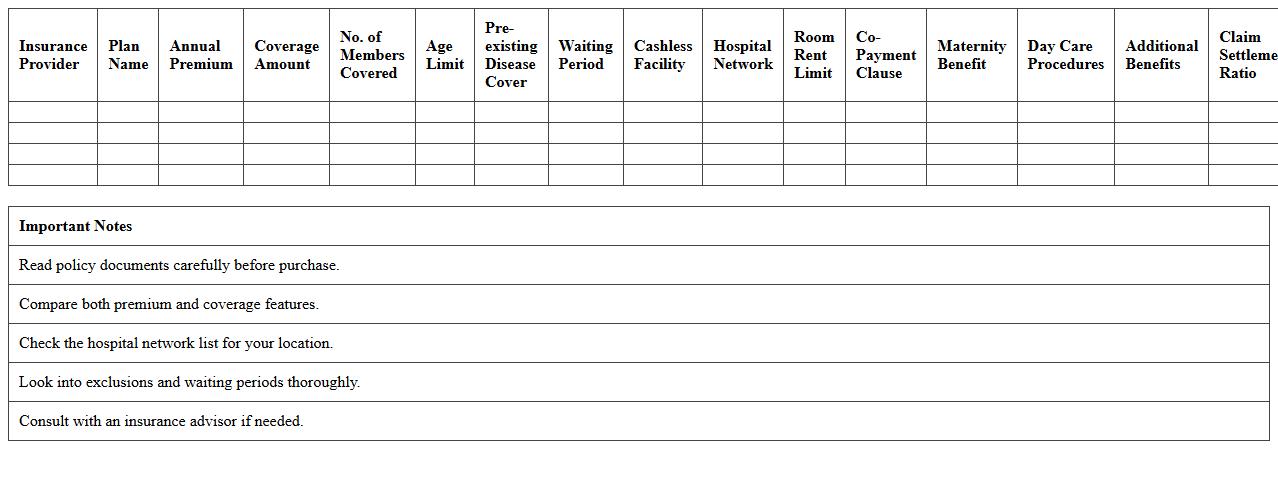

Family Insurance Plan Feature Comparison Spreadsheet

The

Family Insurance Plan Feature Comparison Spreadsheet document systematically organizes various insurance plan options, highlighting critical features such as coverage limits, premiums, deductibles, and rider benefits. This structured comparison enables families to make informed decisions by evaluating the strengths and weaknesses of each plan based on their specific needs. Utilizing this spreadsheet promotes transparency and efficiency, reducing the risk of selecting inappropriate coverage or overpaying for unnecessary benefits.

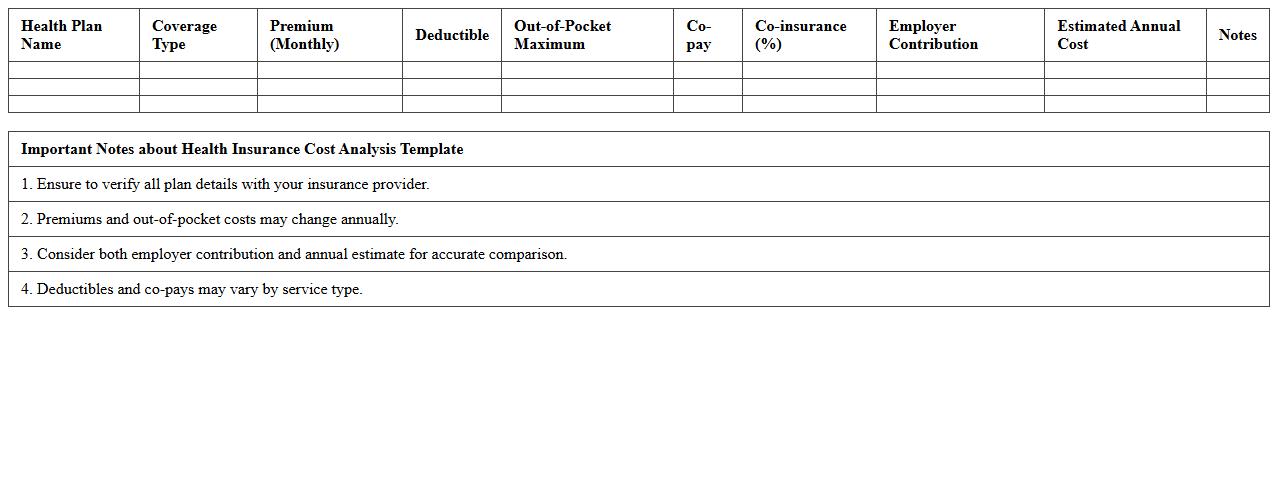

Health Insurance Cost Analysis Excel Template

The

Health Insurance Cost Analysis Excel Template document is a structured tool designed to track, compare, and analyze various health insurance expenses efficiently. It helps users identify cost-saving opportunities by providing detailed visuals and breakdowns of premiums, copayments, deductibles, and out-of-pocket maximums. By organizing data clearly, it supports informed decision-making to optimize health insurance plans and manage healthcare budgets effectively.

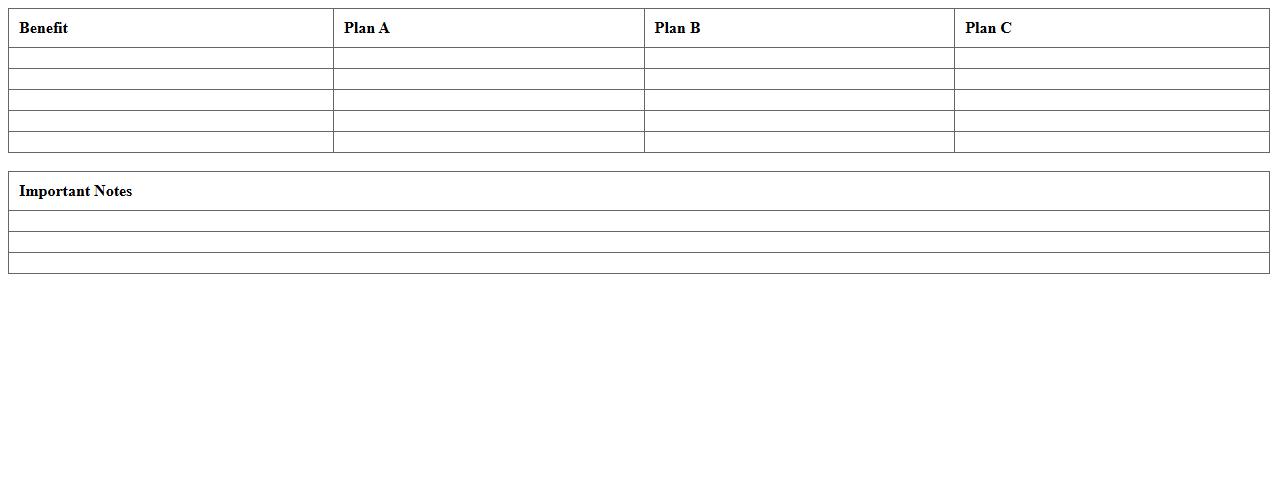

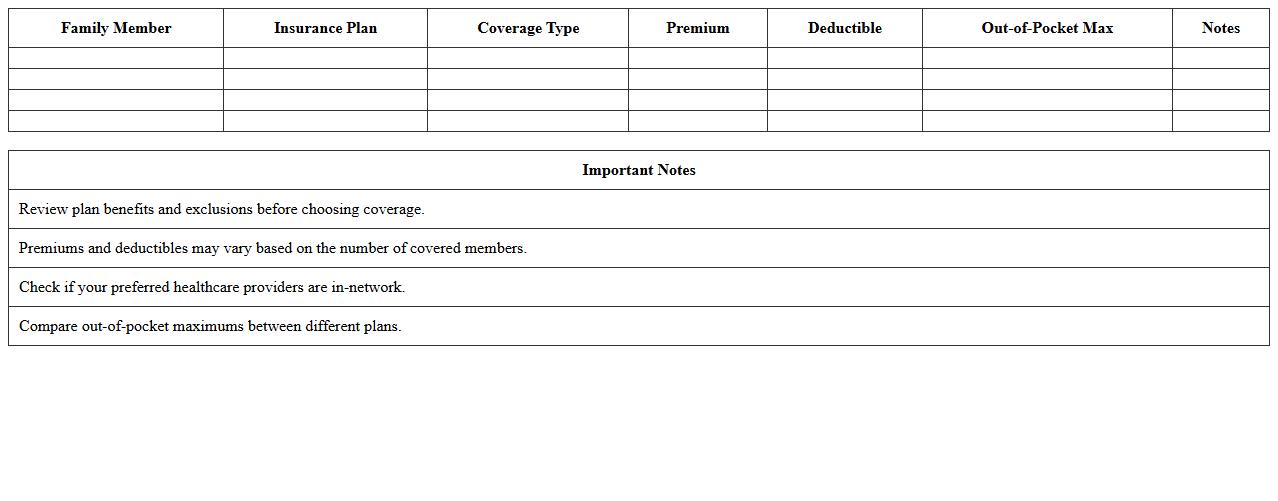

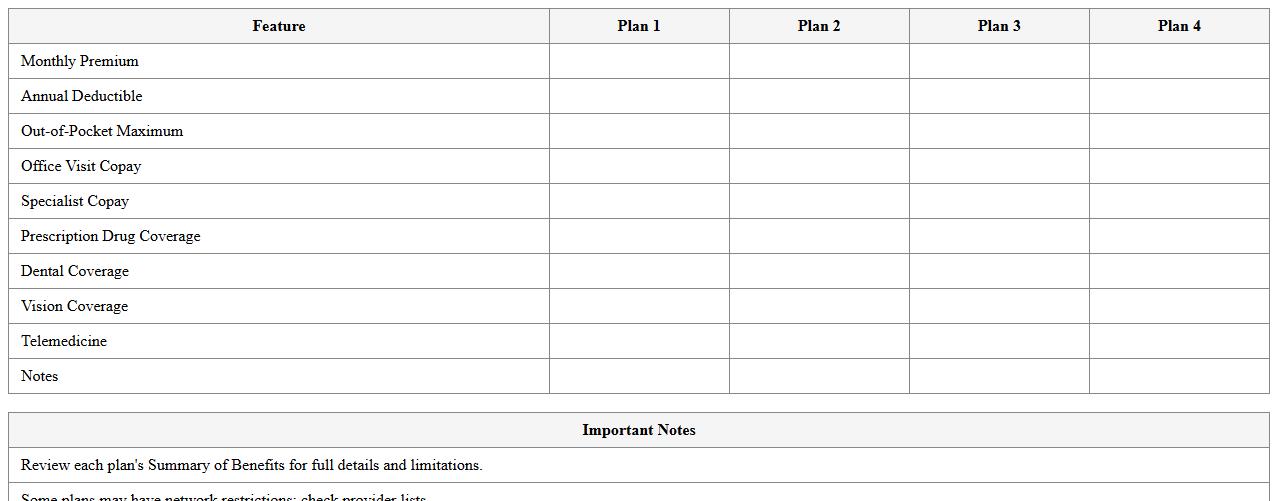

Family Plan Benefits Comparison Chart

A

Family Plan Benefits Comparison Chart outlines and contrasts the features, costs, and coverage options of various family insurance plans or service packages in a clear, organized format. This document helps users easily identify the best plan tailored to their family's unique needs by highlighting key differences in premiums, coverage limits, and included benefits. Utilizing this chart saves time and enhances decision-making accuracy by providing a side-by-side evaluation of available family plan options.

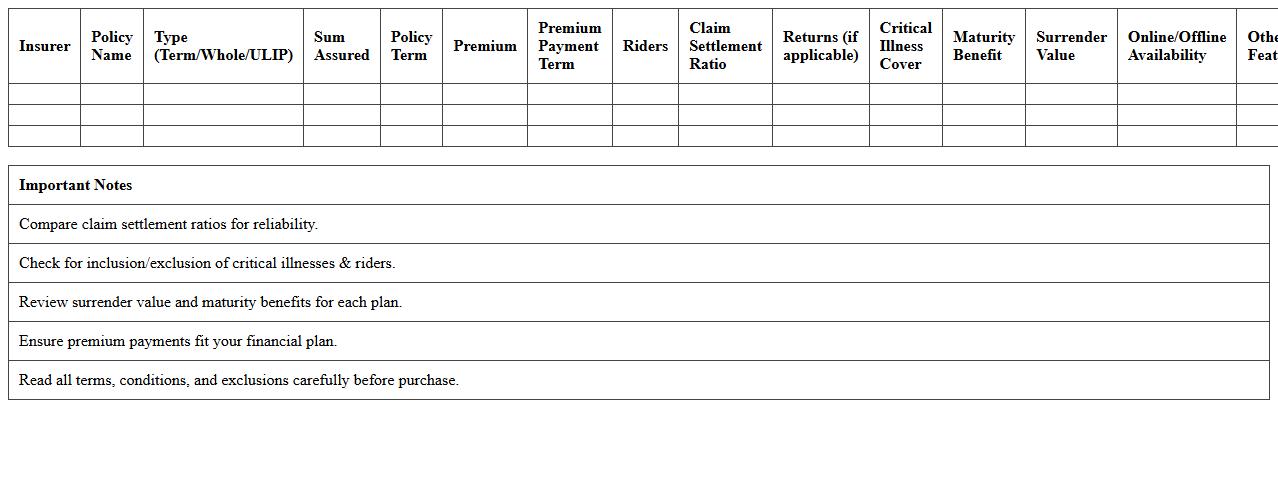

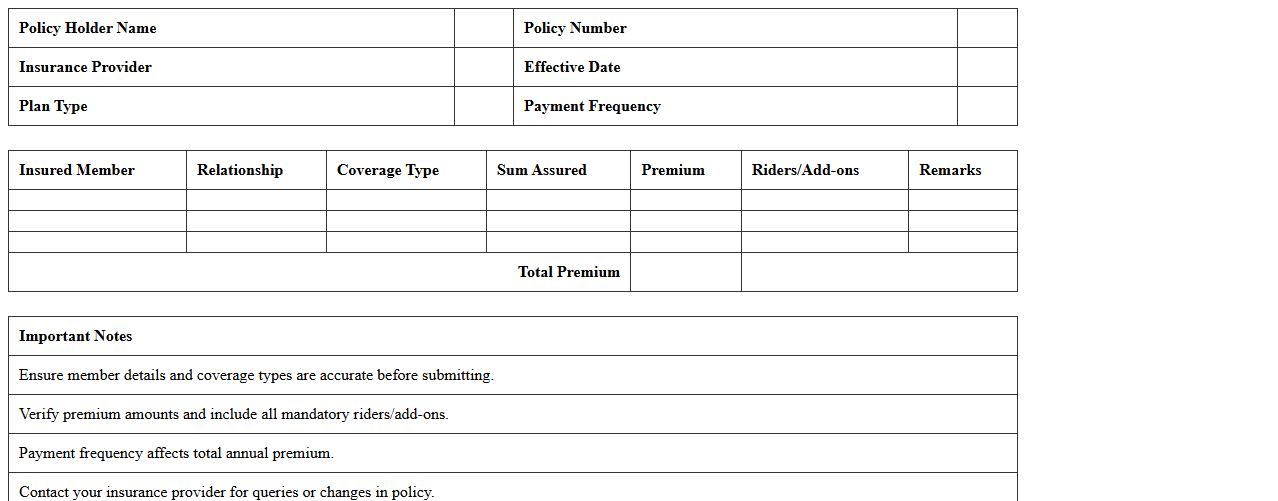

Life Insurance Policy Comparison Sheet

A

Life Insurance Policy Comparison Sheet is a detailed document that outlines various life insurance plans side-by-side, highlighting key features such as premium costs, coverage amounts, policy terms, riders, and claim settlement ratios. This comparison enables individuals to make informed decisions by clearly visualizing differences and benefits of each policy option tailored to their financial goals and risk tolerance. Utilizing this tool ensures better financial planning and maximizes the value derived from life insurance investments.

Family Insurance Coverage Options Matrix

The

Family Insurance Coverage Options Matrix document provides a structured overview of various insurance plans available for families, detailing coverage types, benefits, and cost implications. It helps families compare options efficiently, ensuring informed decisions about health, life, and disability insurance based on specific needs. This matrix serves as a valuable tool for understanding policy features and maximizing insurance benefits while managing expenses.

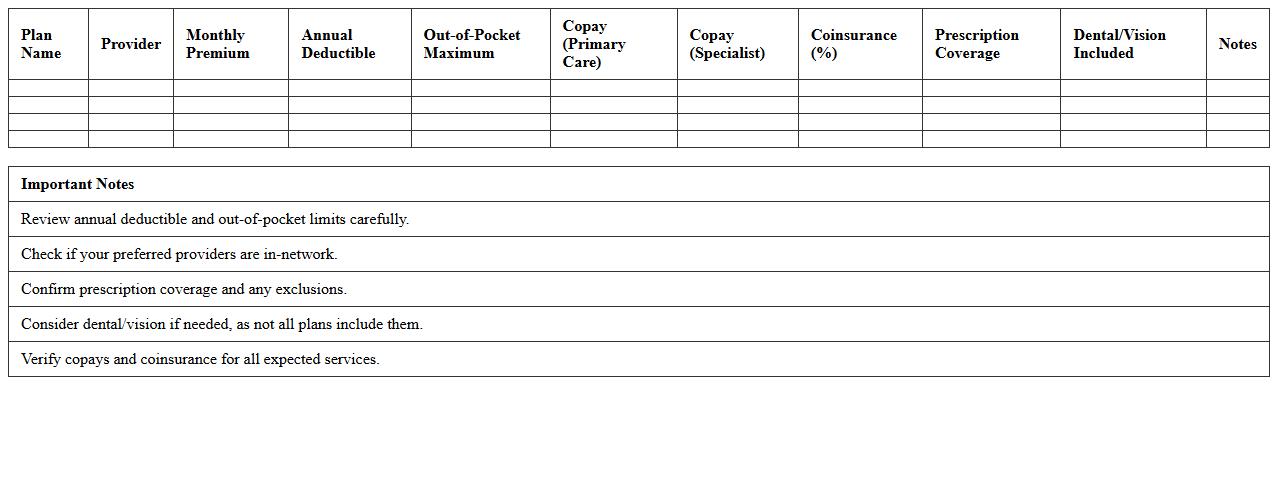

Medical Insurance Plan Evaluation Workbook

The

Medical Insurance Plan Evaluation Workbook is a comprehensive tool designed to compare and analyze various health insurance plans based on coverage options, premiums, deductibles, and out-of-pocket costs. This document allows users to systematically assess plan features, helping to identify the most cost-effective and beneficial insurance policies tailored to individual or family needs. Utilizing this workbook facilitates informed decision-making, ensuring better financial planning and access to appropriate medical services.

Family Policy Premium Breakdown Template

The

Family Policy Premium Breakdown Template is a structured document that details the cost components of a family's insurance policy premiums, including base rates, riders, and discounts. It enables clear visualization and comparison of premium charges, facilitating informed decision-making and budget planning for families. This template is essential for tracking changes in premiums over time and ensuring transparency in insurance coverage costs.

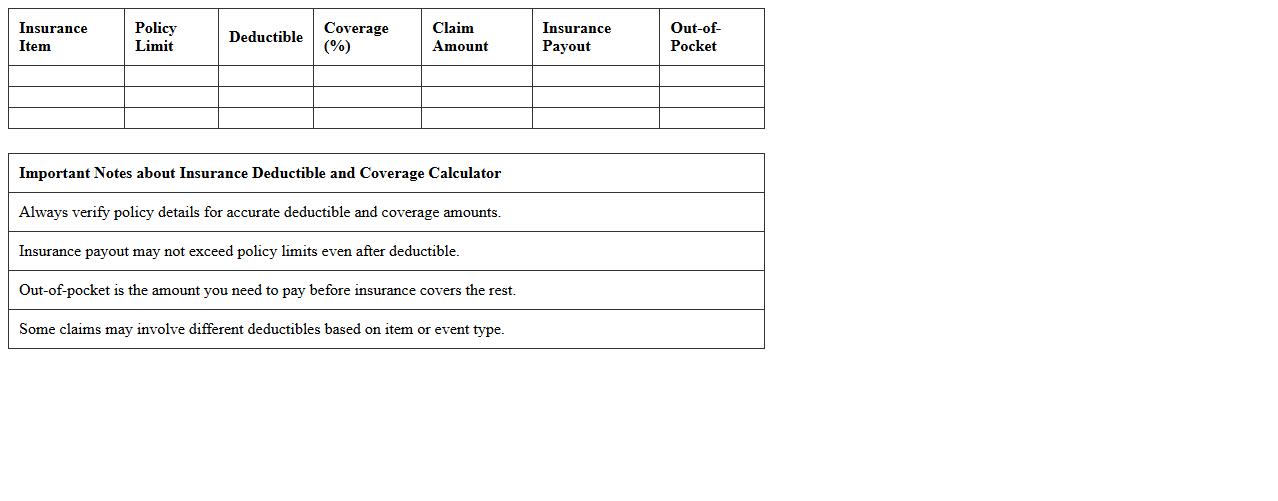

Insurance Deductible and Coverage Calculator

The

Insurance Deductible and Coverage Calculator document helps individuals estimate out-of-pocket costs by calculating deductible amounts alongside potential insurance coverage. This tool enables users to make informed decisions by comparing different insurance plans and understanding financial responsibilities. By providing clear insights into coverage limits and deductibles, it enhances budgeting and risk management for policyholders.

Side-by-Side Family Plan Comparison Spreadsheet

The

Side-by-Side Family Plan Comparison Spreadsheet document organizes key features, costs, and benefits of multiple family plans in a clear, tabular format. It helps users easily evaluate and contrast different options, enabling informed decisions based on coverage, price, and add-ons. This tool streamlines the selection process by consolidating all relevant data into one accessible resource.

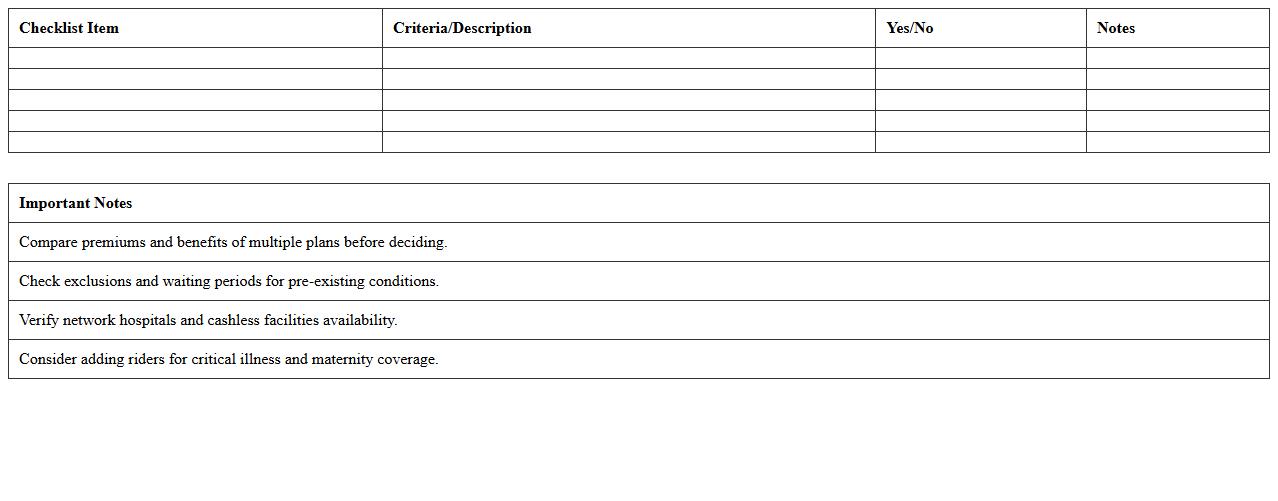

Family Health Insurance Selection Checklist Excel

The

Family Health Insurance Selection Checklist Excel document is a structured tool designed to compare and evaluate various health insurance plans based on coverage, premiums, deductibles, and network providers. It allows individuals and families to organize critical data and make informed decisions by highlighting key factors such as benefits, exclusions, and claim processes. This checklist streamlines the selection process, ensuring comprehensive analysis and aiding in choosing the most suitable health insurance plan for your family's needs.

Which data columns should be included for effective family insurance plan comparisons?

Include Plan Name, Monthly Premium, and Deductibles to evaluate the core cost factors. Coverage details like Out-of-Pocket Maximum and Co-payments offer insight into potential expenses. Additionally, columns for Benefits such as pediatric dental and maternity coverage ensure comprehensive comparisons.

How can Excel formulas automate premium and coverage calculations for various family sizes?

Use the SUMPRODUCT formula to calculate total premiums based on individual and dependent rates. Implement IF statements to adjust coverage amounts dynamically for different family sizes. Nesting these formulas allows seamless automation of cost projections without manual recalculations.

What conditional formatting highlights the most cost-effective family insurance options?

Apply color scales to highlight lower premiums and deductibles in green for easy visual identification. Use data bars to compare out-of-pocket maximums across plans. Additionally, set rules to emphasize plans with the best overall value using a combination of premium, coverage, and benefits criteria.

How do you visualize out-of-pocket maximums and deductibles for different family members in Excel charts?

Create stacked bar charts to display deductible and out-of-pocket maximum values side by side by family member. Use different colors for each expense type to improve clarity. Adding data labels enhances the chart's ability to communicate precise cost breakdowns effectively.

What filters best identify plans with pediatric dental or maternity benefits in a comparison sheet?

Implement checkbox filtersFILTER function to dynamically show only plans that include these key benefits. Combining these filters improves decision-making by narrowing down plans tailored to family health needs.

More Comparison Excel Templates