The Loan Comparison Excel Template for Personal Finance helps users analyze and compare multiple loan options by calculating interest rates, monthly payments, and total costs. This tool enables informed decisions by visually presenting data and highlighting key differences between loans. Its user-friendly format simplifies complex financial calculations for better personal finance management.

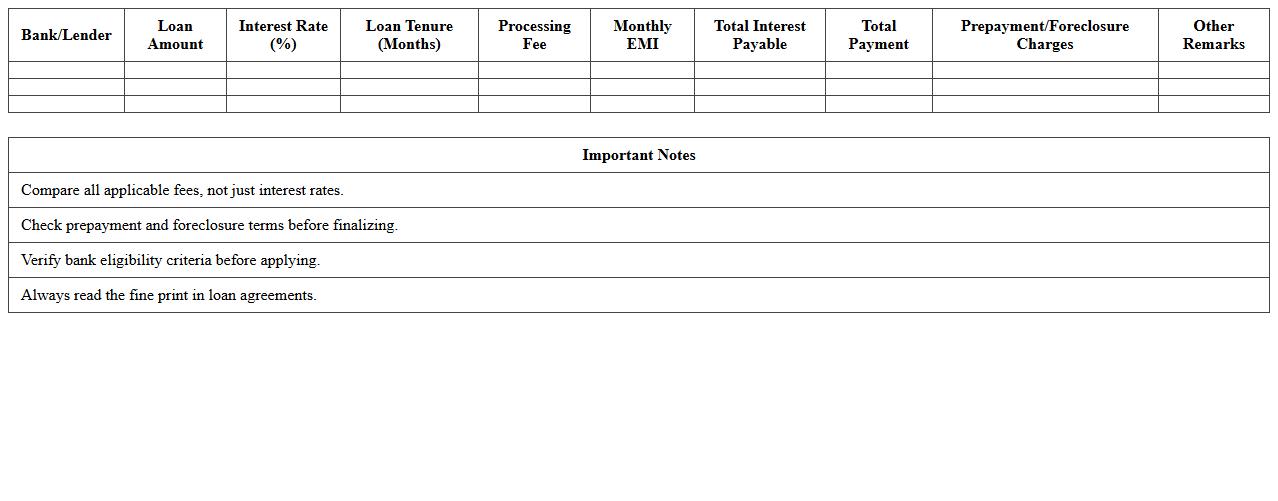

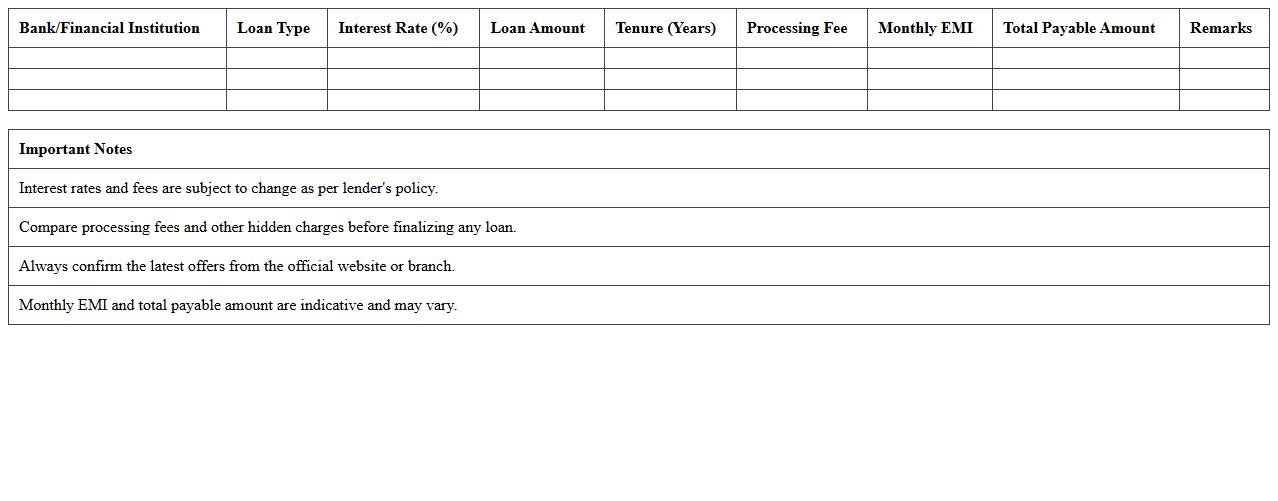

Personal Loan Comparison Excel Template

A

Personal Loan Comparison Excel Template is a structured spreadsheet designed to help users evaluate multiple personal loan options side-by-side, tracking key factors such as interest rates, loan terms, monthly payments, and total repayment amounts. It simplifies decision-making by providing a clear, organized view of loan offers, enabling users to identify the most cost-effective and suitable borrowing option. This tool enhances financial planning and ensures informed borrowing choices by visualizing comparisons and highlighting potential savings.

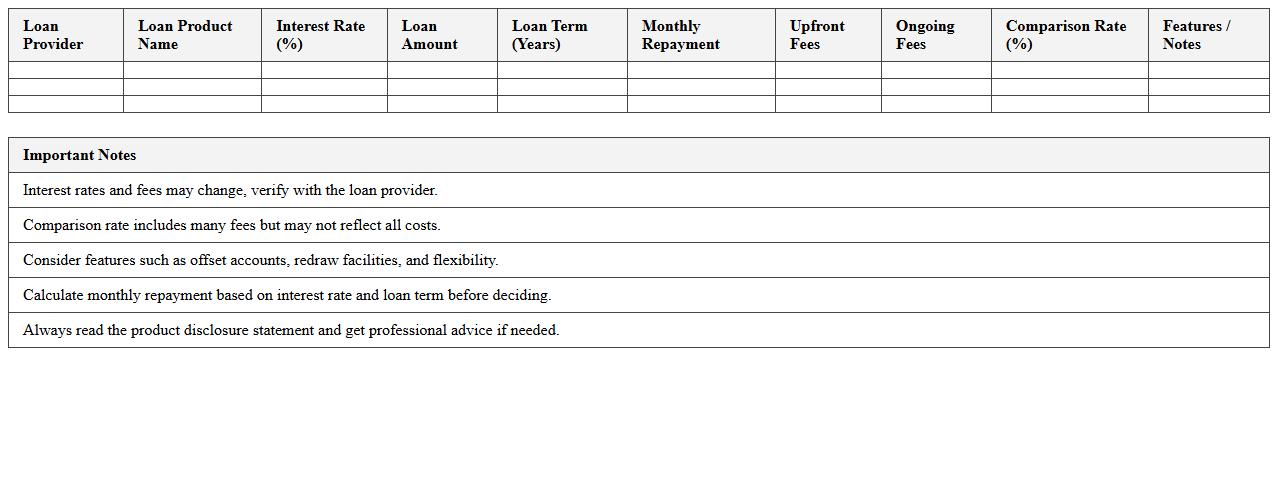

Home Loan Comparison Spreadsheet

A

Home Loan Comparison Spreadsheet is a tool designed to organize and evaluate various mortgage options based on interest rates, loan terms, monthly payments, and additional fees. It helps users make informed decisions by providing a clear visual representation of potential financial impacts from different lenders. By comparing critical factors side-by-side, it simplifies the process of selecting the most cost-effective and suitable home loan for individual needs.

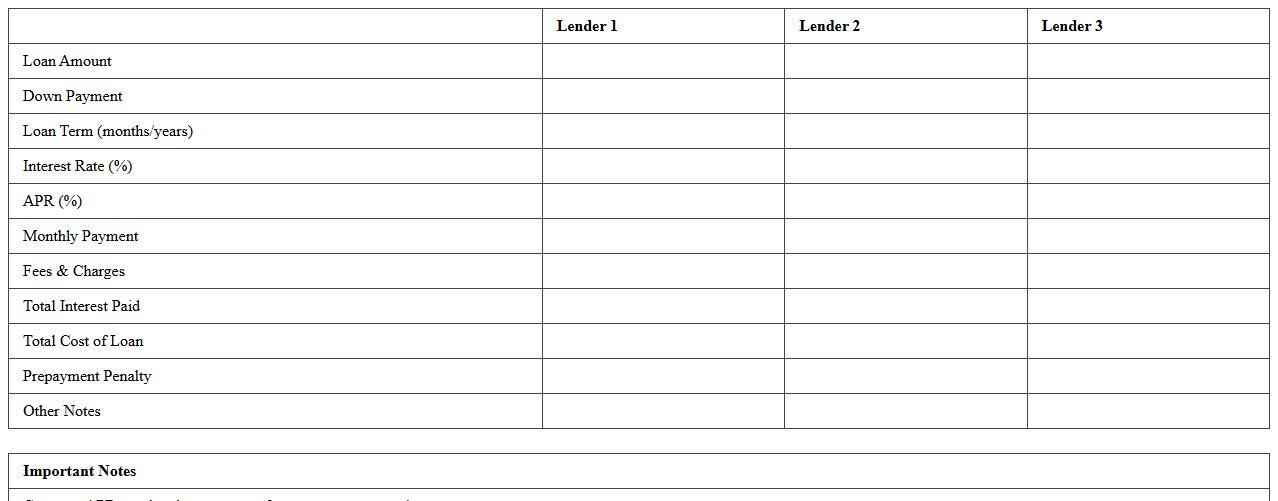

Auto Loan Comparison Worksheet

An

Auto Loan Comparison Worksheet is a structured document that helps individuals evaluate multiple auto loan offers by organizing key details such as interest rates, loan terms, monthly payments, and fees. This worksheet enables borrowers to make informed decisions by clearly displaying differences and similarities between loan options, ensuring the selection of the most cost-effective and suitable financing plan. Using this tool minimizes financial risk and enhances budgeting accuracy when purchasing a vehicle.

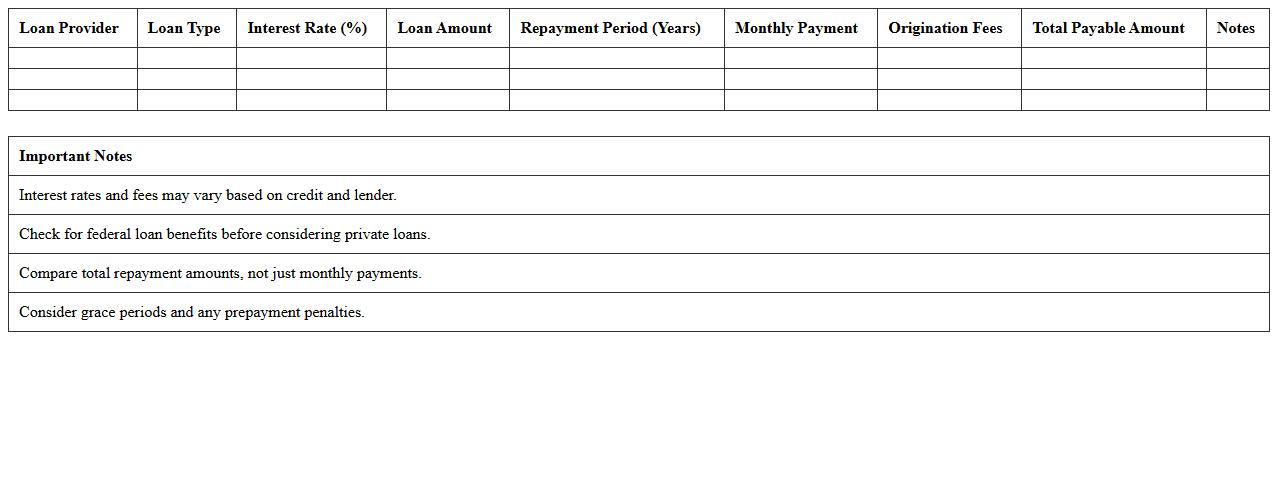

Student Loan Comparison Excel Sheet

A

Student Loan Comparison Excel Sheet is a detailed spreadsheet designed to help individuals evaluate various student loan options by organizing key data such as interest rates, repayment terms, and total costs. This document enables users to make informed decisions by providing a clear, side-by-side comparison of loan offers, simplifying the complex financial variables involved. Utilizing this tool helps optimize financial planning and ensures borrowers select the most favorable loan tailored to their repayment capacity and educational investment goals.

Loan Interest Rate Comparison Template

A

Loan Interest Rate Comparison Template document organizes and displays various loan offers by comparing interest rates, fees, and loan terms in a clear, structured format. It helps users make informed decisions by highlighting the most cost-effective loan options based on current market data. This template streamlines financial planning, ensuring borrowers select loans with the best interest rates to minimize repayment costs.

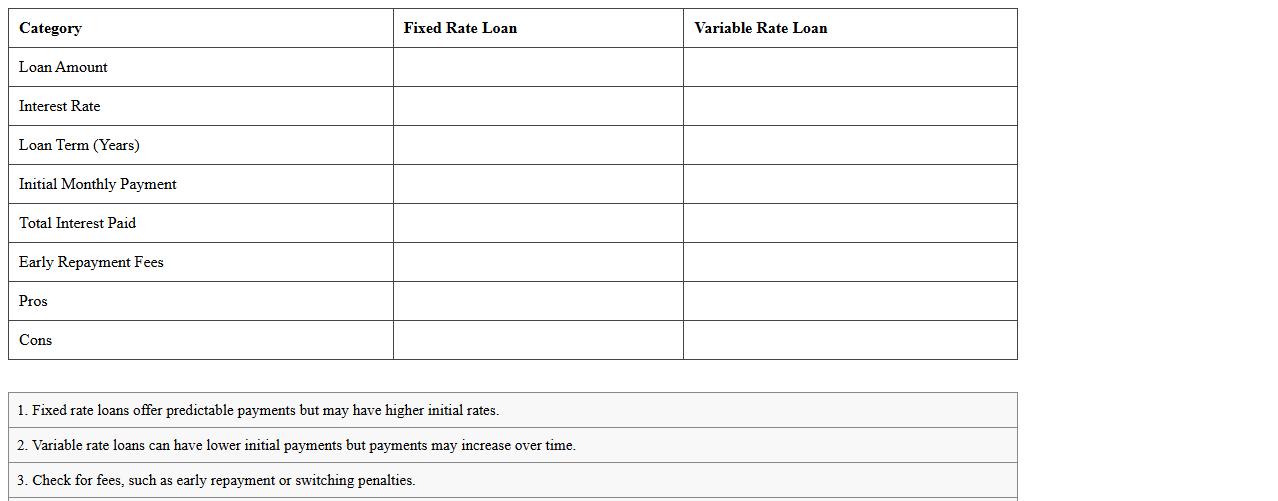

Fixed vs Variable Loan Comparison Excel

The

Fixed vs Variable Loan Comparison Excel document is a financial tool designed to analyze and compare loan repayment options by calculating interest rates, monthly payments, and total costs for both fixed and variable loans. It helps users make informed decisions by clearly presenting how interest fluctuations impact loan affordability over time. This tool is essential for evaluating long-term financial commitment and optimizing loan choices based on individual risk tolerance and market conditions.

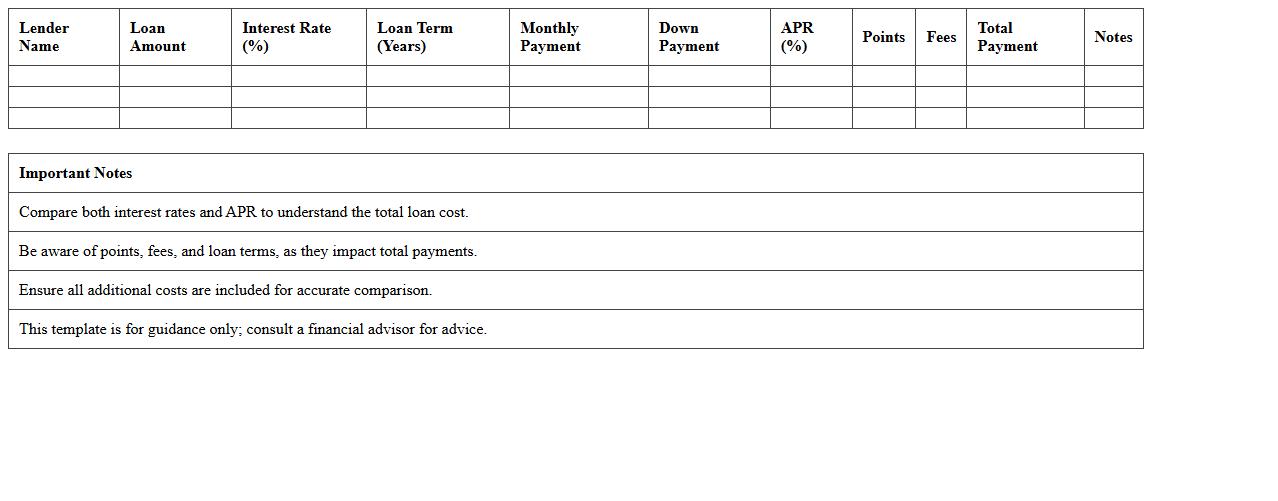

Mortgage Comparison Excel Template

A

Mortgage Comparison Excel Template is a valuable tool designed to simplify the evaluation of various mortgage options by organizing key financial data such as interest rates, loan terms, monthly payments, and total costs. It enables users to input different loan offers and instantly compare their long-term affordability and benefits, improving decision-making accuracy. This template is especially useful for prospective homebuyers and financial planners seeking to find the most cost-effective mortgage solution tailored to their budget and financial goals.

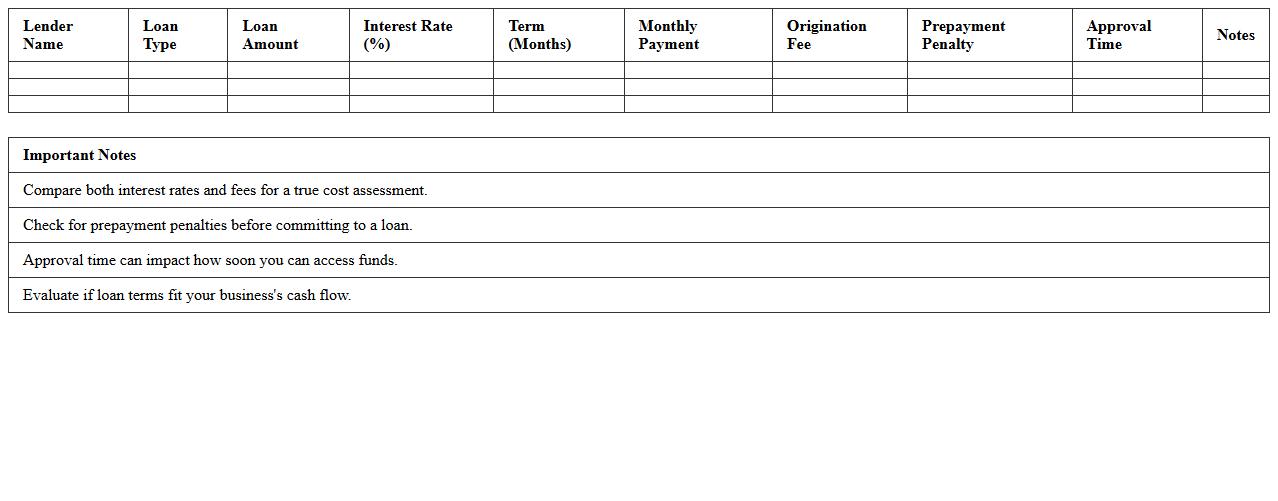

Small Business Loan Comparison Spreadsheet

A

Small Business Loan Comparison Spreadsheet document organizes various loan options by interest rates, repayment terms, fees, and lender requirements, enabling clear and side-by-side analysis. This tool empowers entrepreneurs to make informed decisions by highlighting key financial differences and potential savings. Using such a spreadsheet helps streamline the loan selection process, reducing confusion and improving financial planning accuracy.

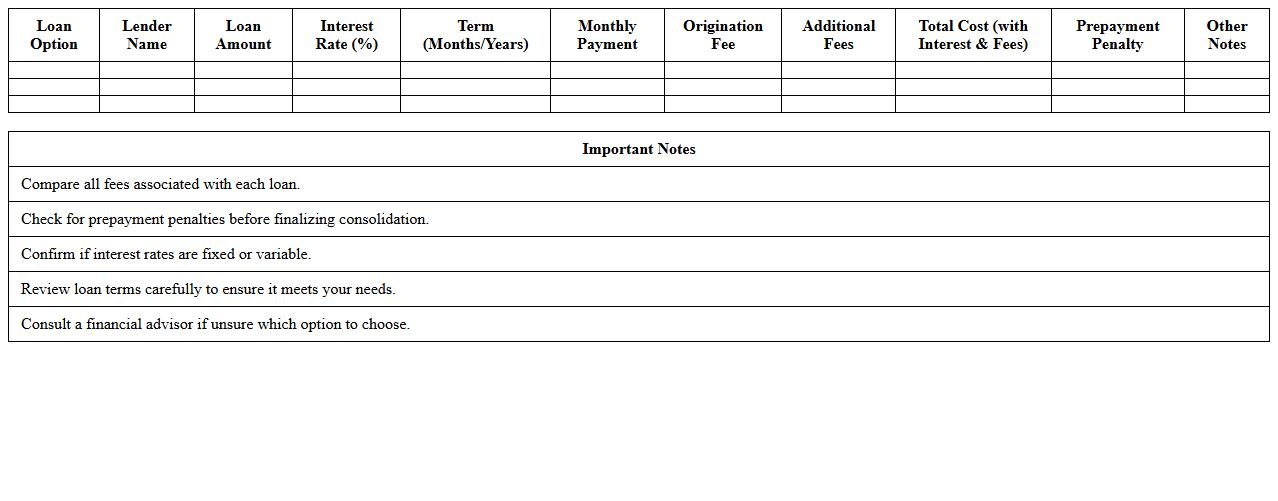

Consolidation Loan Comparison Sheet

A

Consolidation Loan Comparison Sheet is a detailed document that organizes and contrasts various loan options based on interest rates, repayment terms, fees, and loan amounts. It helps borrowers make informed decisions by clearly presenting key financial metrics across multiple lenders or loan products. Using this comparison sheet streamlines the loan selection process, reduces confusion, and aids in finding the most cost-effective consolidation loan tailored to individual financial needs.

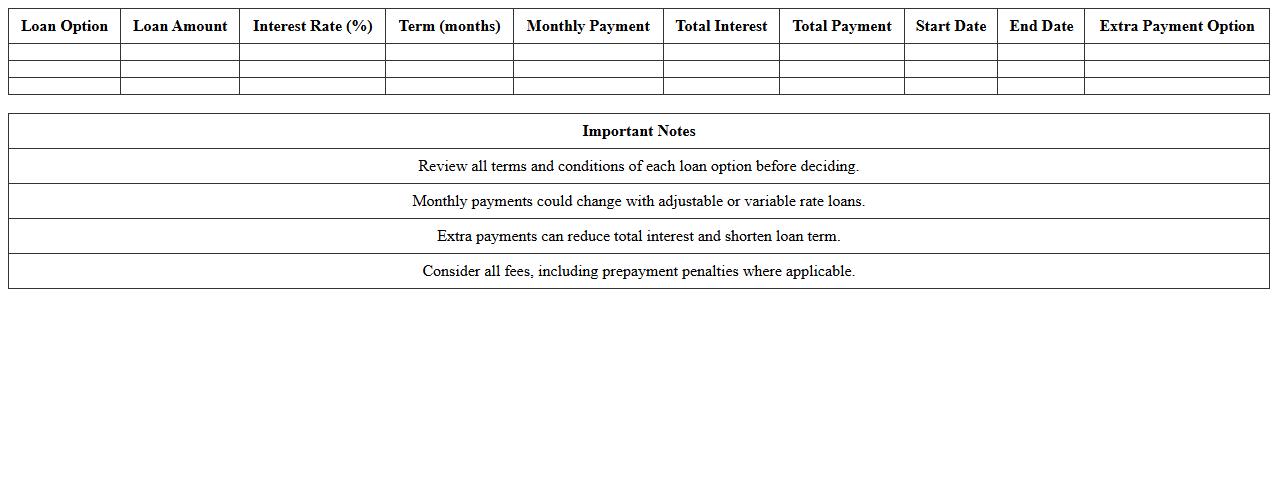

Loan Repayment Schedule Comparison Template

A

Loan Repayment Schedule Comparison Template is a structured document that organizes and displays multiple loan repayment plans side by side, allowing for easy analysis of payment amounts, interest rates, and loan terms. This tool helps borrowers identify the most cost-effective and manageable repayment option by comparing key financial details at a glance. Using such a template can optimize financial planning, minimize interest expenses, and improve overall loan management decisions.

What specific Excel formulas best automate interest rate comparisons for personal loans?

Using the PMT function in Excel can automate the calculation of monthly loan payments based on the interest rate, loan amount, and term. The RATE function helps determine the effective interest rate when given specific loan details. Additionally, formulas like IPMT and PPMT allow detailed comparisons of interest versus principal payments over time, helping pinpoint the best loan options.

How can conditional formatting highlight the lowest total repayment in a loan comparison spreadsheet?

Conditional formatting can be applied using a formula that identifies the minimum total repayment amount across loan options, automatically highlighting the best deal. By selecting the repayment column and using the "Use a formula to determine which cells to format" option, Excel highlights the lowest value dynamically. This visual aid simplifies decision-making by quickly showcasing the most cost-effective loan.

What loan amortization templates in Excel are most accurate for personal finance tracking?

The most accurate loan amortization templates feature comprehensive columns for payment date, principal, interest, and remaining balance, ensuring detailed tracking. Templates like the Excel built-in amortization schedule or downloadable options from reputable financial sites offer reliable calculations. These templates often incorporate variable interest rates and extra payments, enhancing personal finance management precision.

How can Excel macros streamline the process of updating loan offer details in a comparison worksheet?

Excel macros automate repetitive tasks such as refreshing interest rates, loan amounts, and payment terms across worksheets. By recording a macro or writing VBA code, users can update multiple loan offers in seconds, improving efficiency and minimizing errors. This automation is especially useful when managing numerous loan options or frequent rate changes.

What data validation rules help prevent input errors in personal loan comparison Excel sheets?

Implementing data validation rules like restricting input to numeric values within realistic ranges prevents erroneous loan data entries. Dropdown lists for selecting loan terms and interest rates eliminate typos and ensure consistent inputs. Additionally, setting error alerts for invalid inputs maintains data integrity within loan comparison models.

More Comparison Excel Templates