The Investment Portfolio Comparison Excel Template for Financial Advisors is a powerful tool designed to streamline portfolio analysis and client presentations. It enables financial advisors to efficiently compare multiple investment portfolios, highlighting key performance metrics and asset allocations in a clear, customizable format. This template enhances decision-making processes by offering accurate, side-by-side data visualization for better client communication and strategic planning.

Diversified Investment Portfolio Comparison Excel Template

A

Diversified Investment Portfolio Comparison Excel Template is a structured spreadsheet designed to analyze and compare multiple investment portfolios across various asset classes, risk levels, and returns. It enables investors to visualize performance metrics, allocation percentages, and historical data, facilitating informed decision-making for optimal portfolio balance. This template is useful for identifying diversification benefits, minimizing risk, and enhancing long-term financial growth strategies.

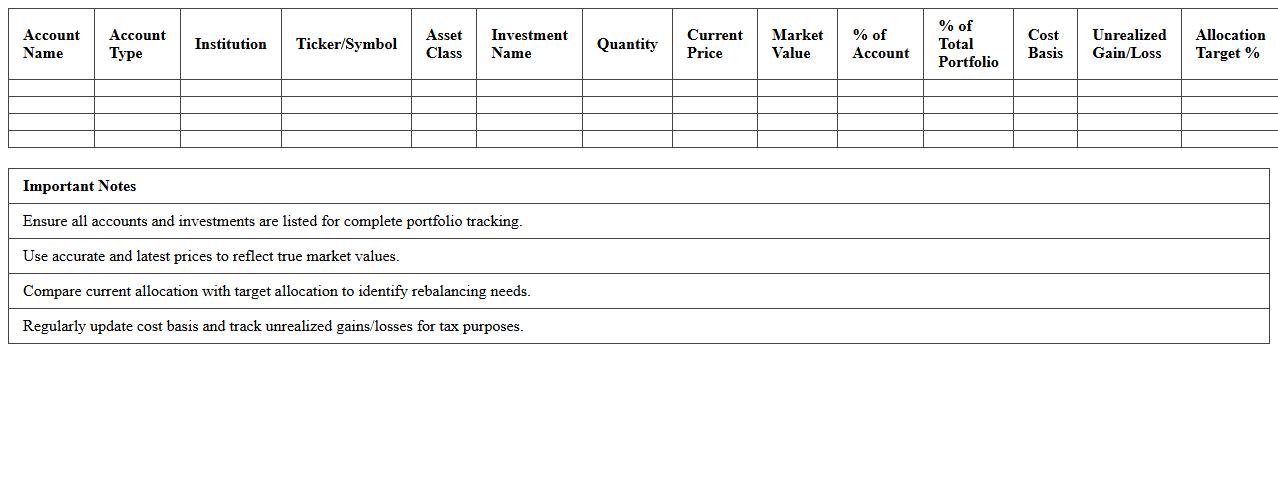

Multi-Account Investment Portfolio Analysis Spreadsheet

The

Multi-Account Investment Portfolio Analysis Spreadsheet is a comprehensive tool designed to consolidate and analyze investment data across various accounts in one place. It tracks portfolio performance, asset allocation, and risk metrics, enabling investors to make informed decisions based on real-time insights. By providing a clear overview of diverse holdings, this document helps optimize investment strategies and improve financial planning outcomes.

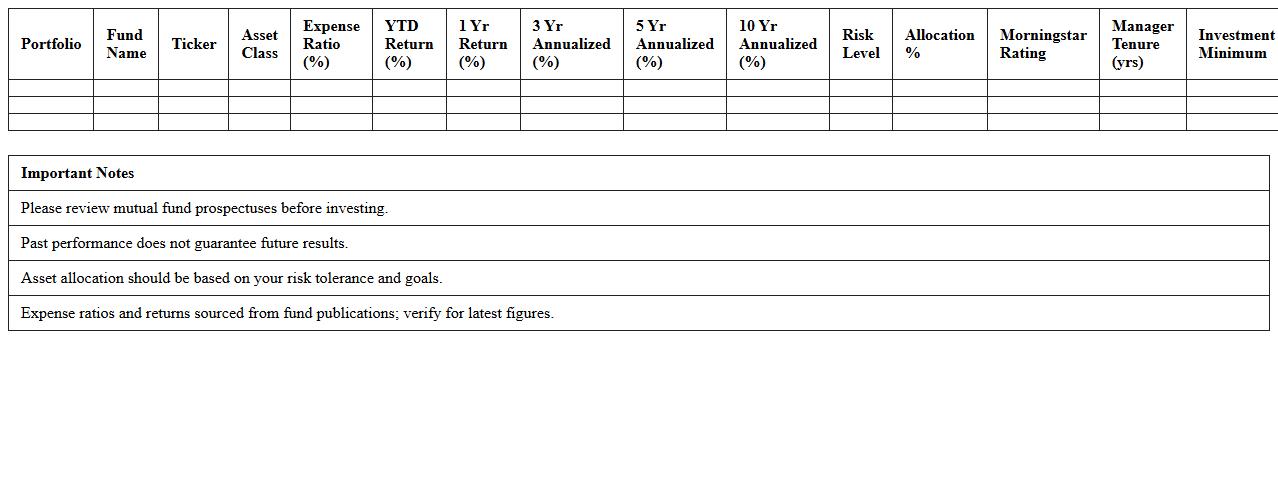

Side-by-Side Mutual Fund Portfolio Evaluation Template

The

Side-by-Side Mutual Fund Portfolio Evaluation Template is a tool designed to compare multiple mutual funds simultaneously, allowing investors to analyze performance metrics, risk factors, and fees in a clear, organized format. It helps users identify the best investment options by presenting comprehensive data such as returns, asset allocation, and volatility side by side. This template streamlines decision-making and enhances portfolio management by offering a detailed, comparative overview of mutual fund choices.

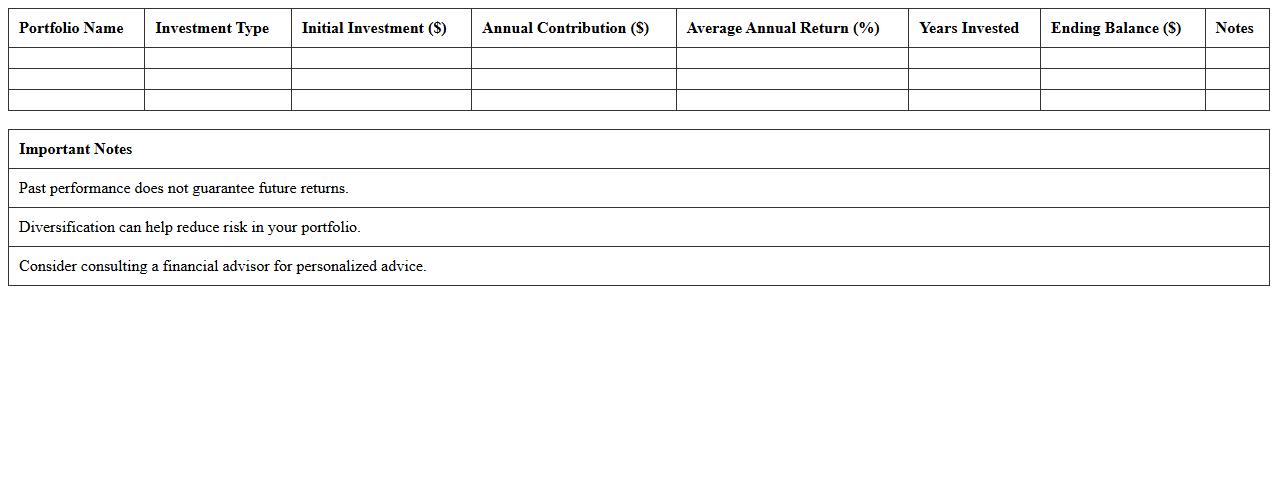

Retirement Investment Portfolio Performance Comparison Excel

A

Retirement Investment Portfolio Performance Comparison Excel document allows users to track and analyze the growth and returns of various retirement investment options over time. It provides a clear, organized way to compare asset allocation, risk levels, and performance metrics, helping investors make informed decisions to maximize their retirement savings. This tool is essential for evaluating investment strategies, identifying underperforming assets, and optimizing portfolio adjustments for long-term financial security.

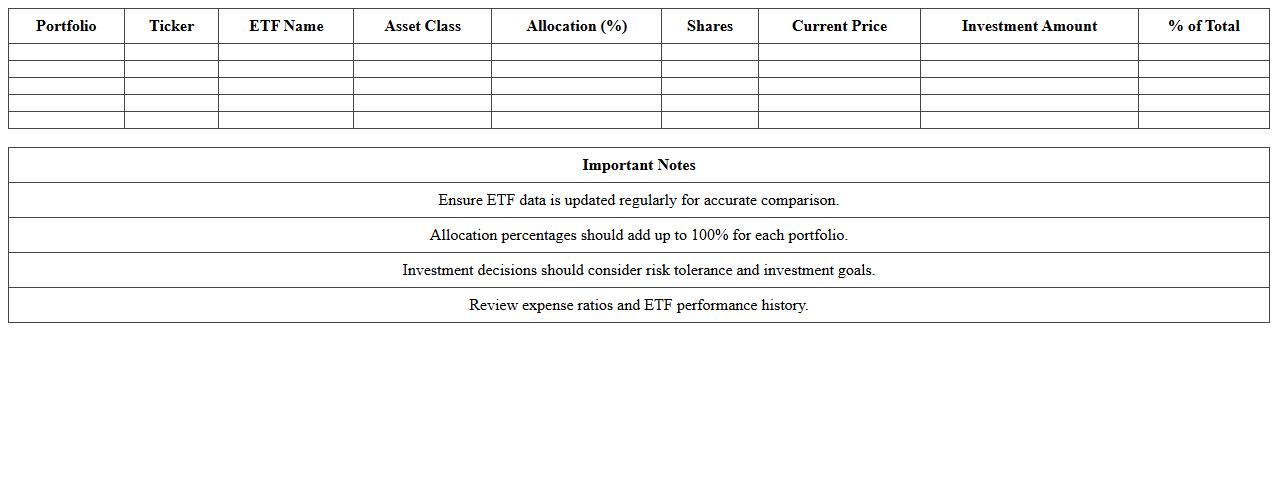

ETF Portfolio Allocation Comparison Dashboard

The

ETF Portfolio Allocation Comparison Dashboard document provides a detailed analysis of various ETF portfolios, breaking down asset classes, sector weightings, and geographic exposures. It enables investors to visually compare risk-return profiles and diversification strategies, facilitating more informed decision-making. This tool is essential for optimizing investment allocations, assessing portfolio overlaps, and identifying potential gaps in market coverage.

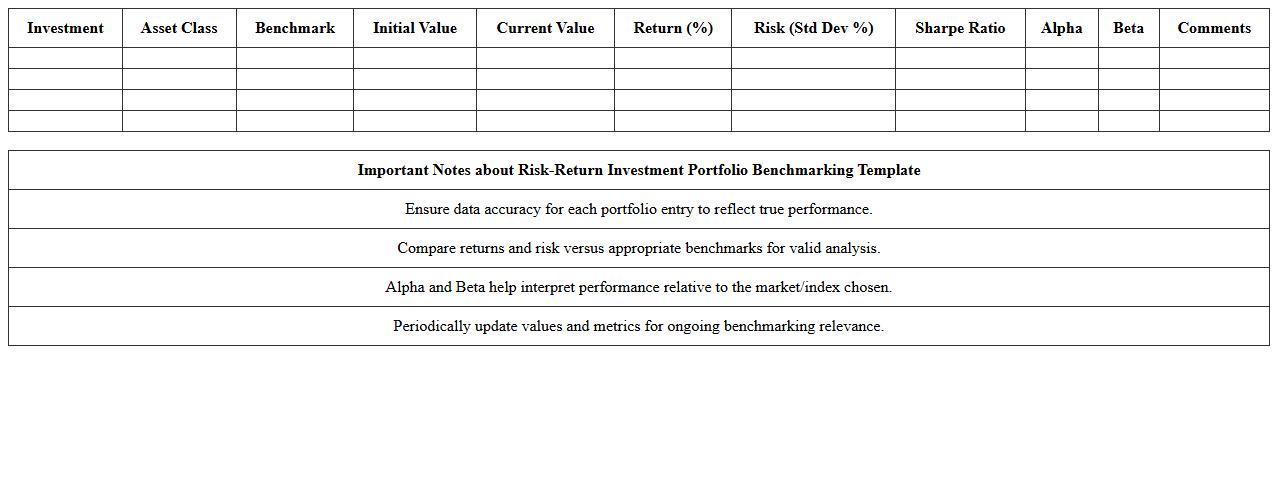

Risk-Return Investment Portfolio Benchmarking Template

The

Risk-Return Investment Portfolio Benchmarking Template is a comprehensive tool designed to evaluate and compare the performance of an investment portfolio against relevant market benchmarks by analyzing both risk and return metrics. It enables investors to identify portfolio strengths and weaknesses, optimize asset allocation, and make data-driven decisions that align with their financial goals and risk tolerance. By providing a clear visualization of risk-adjusted returns, this template enhances portfolio management efficiency and supports long-term investment success.

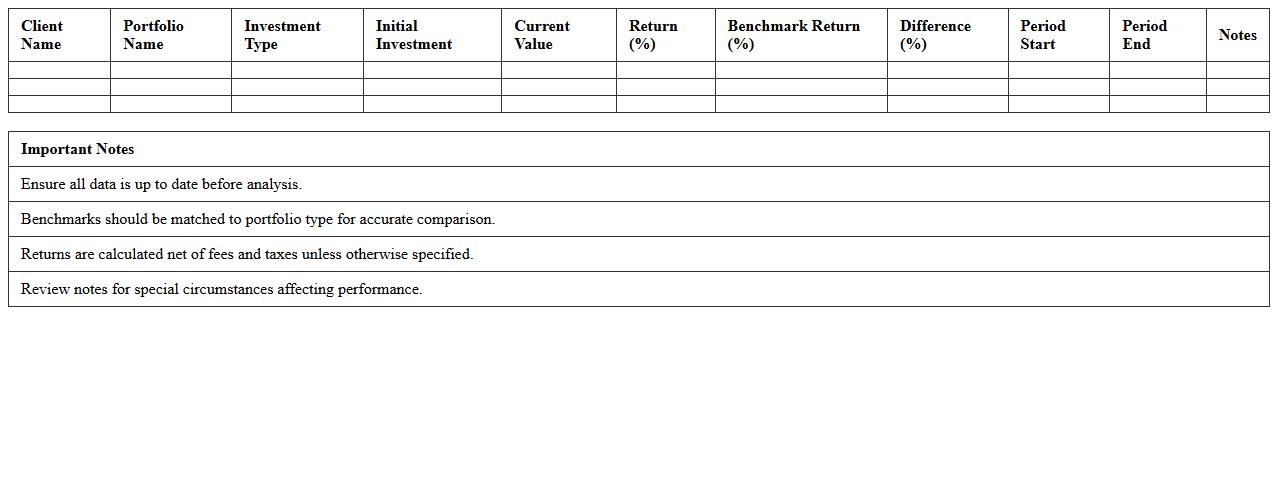

Client Investment Portfolio Returns Comparison Sheet

The

Client Investment Portfolio Returns Comparison Sheet is a detailed document that tracks and compares the performance of various client investment portfolios over specific periods. It provides critical insights into portfolio returns, allowing for effective benchmarking against market indices and peer portfolios to identify strengths and areas for improvement. This tool is essential for making informed investment decisions, optimizing portfolio strategies, and enhancing client communication by clearly demonstrating portfolio performance trends.

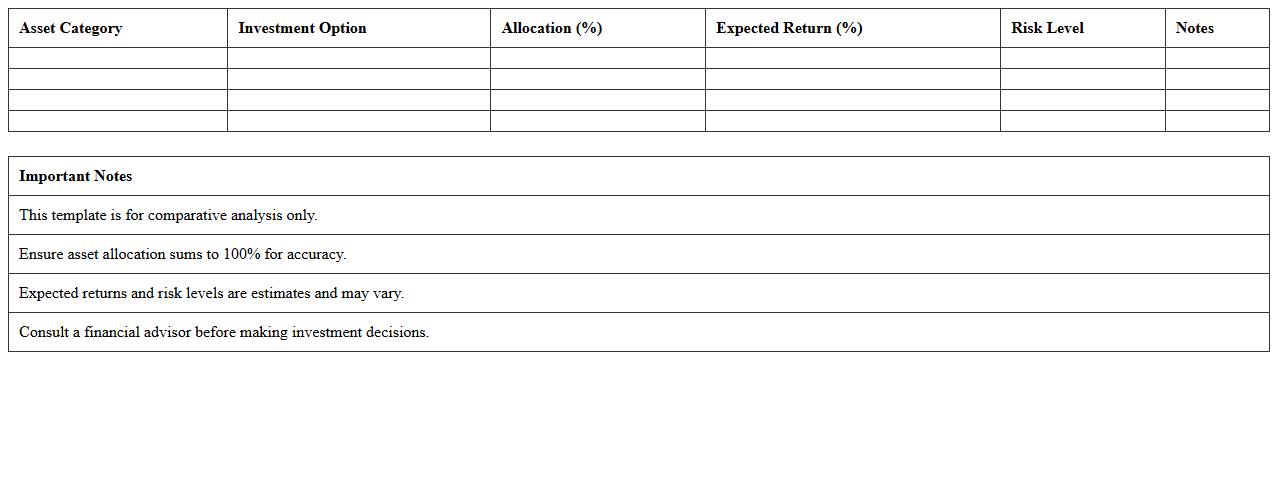

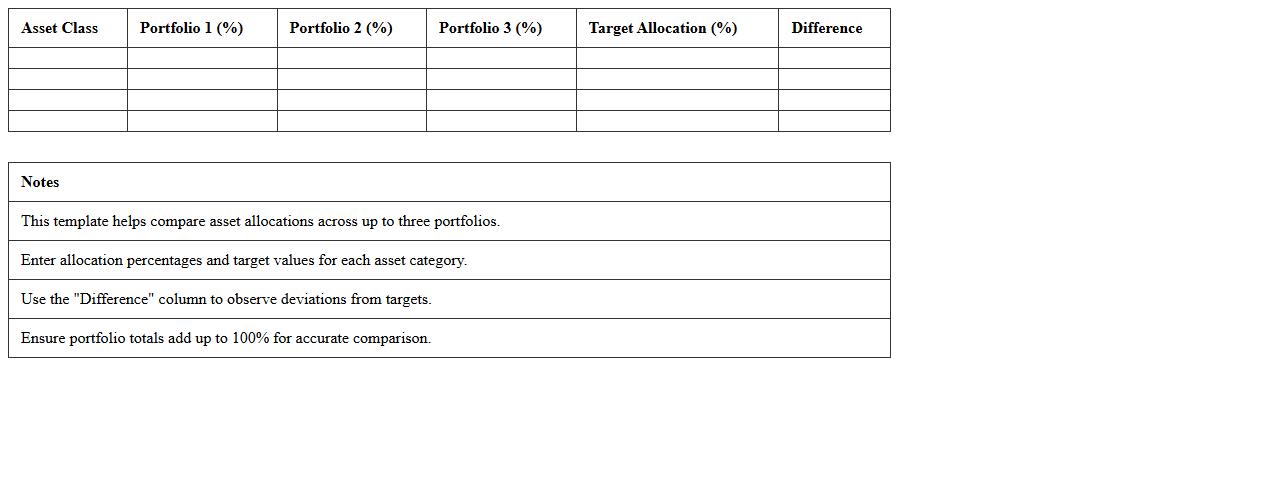

Portfolio Asset Allocation Comparison Excel Template

The

Portfolio Asset Allocation Comparison Excel Template is a specialized financial tool designed to analyze and compare different investment portfolios based on asset allocation percentages. It helps investors visualize diversification across asset classes such as stocks, bonds, and cash, enabling better risk management and informed decision-making. This template streamlines portfolio assessment by providing clear graphical representations and side-by-side comparisons, enhancing investment strategy optimization and financial planning efficiency.

Investment Product Performance Comparison Spreadsheet

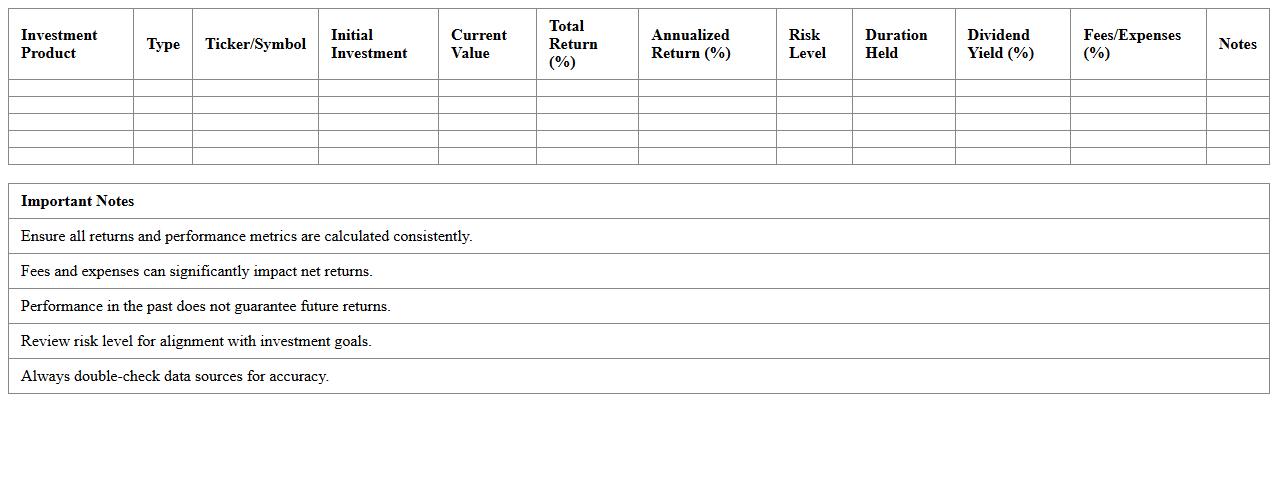

An

Investment Product Performance Comparison Spreadsheet is a detailed tool designed to analyze and evaluate various investment options by comparing key metrics such as returns, risk levels, fees, and duration. It helps investors make informed decisions by providing a clear, side-by-side view of how different investment products perform over time. Using this spreadsheet enhances portfolio optimization and risk management, leading to more strategic investment choices aligned with financial goals.

Portfolio Growth & Performance Tracker for Financial Advisors

The

Portfolio Growth & Performance Tracker for Financial Advisors is a comprehensive document designed to monitor and analyze investment portfolios over time. It provides detailed insights into asset allocation, returns, risk metrics, and benchmark comparisons, enabling advisors to make informed decisions and demonstrate value to clients. Utilizing this tracker helps optimize portfolio management, identify growth opportunities, and ensure alignment with clients' financial goals.

Which Excel formulas can best automate risk-adjusted return comparisons between client portfolios?

Using Excel formulas like the Sharpe Ratio, calculated as (Return - Risk-Free Rate) / Standard Deviation, can effectively automate risk-adjusted return comparisons. The AVERAGE, STDEV.P, and SUMPRODUCT functions help calculate portfolio returns and volatility. Additionally, incorporating the IF function allows for dynamic comparisons and conditional output across multiple client portfolios.

How can conditional formatting highlight underperforming assets in the investment portfolio worksheet?

Conditional formatting can be used to visually emphasize assets that fall below a predefined performance threshold, such as specific return percentages or risk metrics. By applying color scales, icon sets, or data bars, underperforming assets become quickly identifiable within the worksheet. This enhances portfolio management by enabling quick decisions based on visual cues embedded directly in the data.

What pivot table structures enable quick benchmarking of allocation strategies across portfolios?

Organizing pivot tables with portfolio names as rows and asset classes or allocation percentages as columns facilitates easy benchmarking of allocation strategies. Adding filters for date ranges or performance measures helps refine insights quickly. Using calculated fields within pivot tables can further automate the comparison of allocation efficiency across multiple client portfolios.

How can integration with real-time market data improve the accuracy of portfolio comparison dashboards?

Integrating real-time market data enhances portfolio dashboards by providing the most current valuations and performance metrics. This reduces reliance on outdated figures and improves the precision of risk and return analytics. Excel's data connection tools and APIs enable automatic updates, ensuring portfolio comparisons reflect market conditions instantly.

Which Excel plugins or add-ins best support compliance reporting for financial advisors using portfolio comparison tools?

Excel add-ins like Power BI, XLSTAT, and financial compliance-focused tools such as Compliance.ai support robust compliance reporting. These plugins streamline regulatory data gathering, automate report generation, and enhance audit trail capabilities for financial advisors. Incorporating these tools within portfolio comparison workflows ensures adherence to industry standards while maintaining data accuracy.

More Comparison Excel Templates