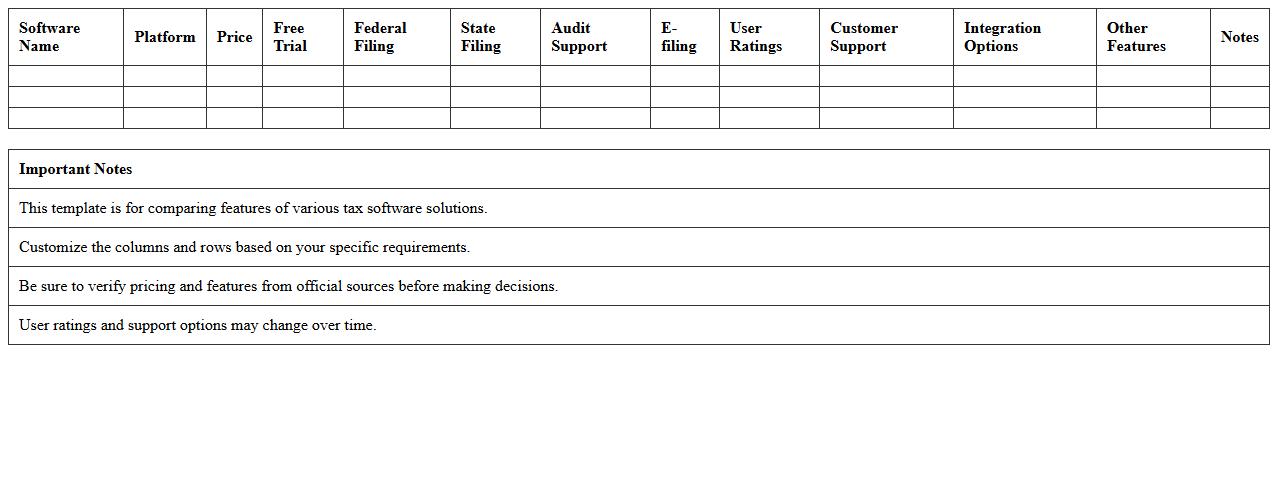

Tax Software Feature Comparison Matrix Excel Template

The

Tax Software Feature Comparison Matrix Excel Template document is a structured tool designed to evaluate and compare various tax software options based on features, pricing, and user ratings. It helps users make informed decisions by clearly identifying strengths and weaknesses of each software, streamlining the selection process for accurate tax filing and compliance. This template enhances efficiency and accuracy by consolidating critical information in one accessible format, reducing research time and improving budget allocation.

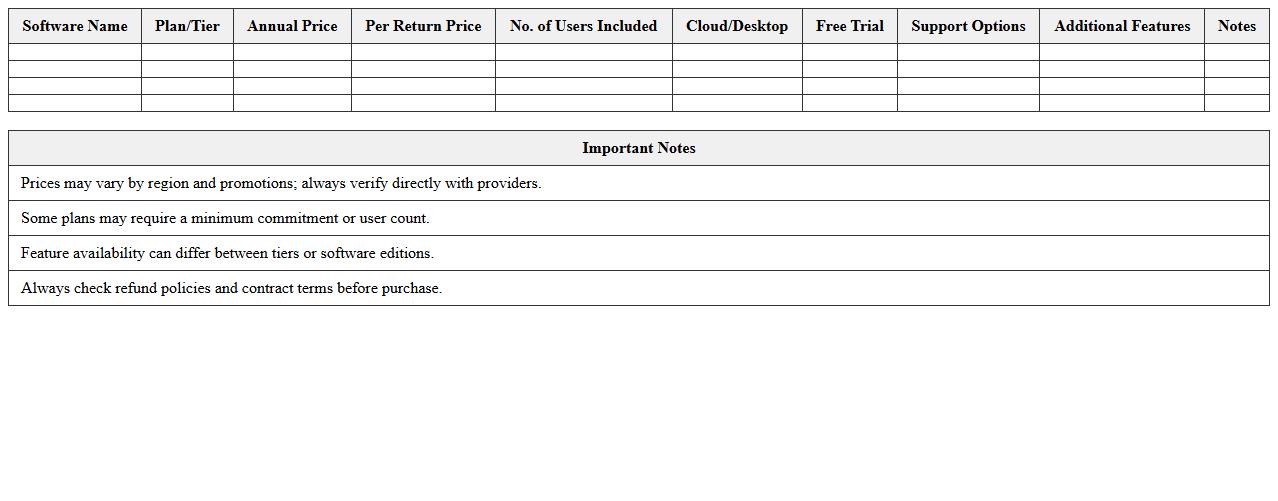

Accountants' Tax Software Pricing Comparison Spreadsheet

The

Accountants' Tax Software Pricing Comparison Spreadsheet is a comprehensive tool that catalogs and contrasts various tax software options based on pricing, features, and user ratings. This document enables accountants to make informed decisions by quickly identifying cost-effective solutions tailored to their specific needs. It streamlines the selection process, saving time and reducing the risk of overpaying for unnecessary features.

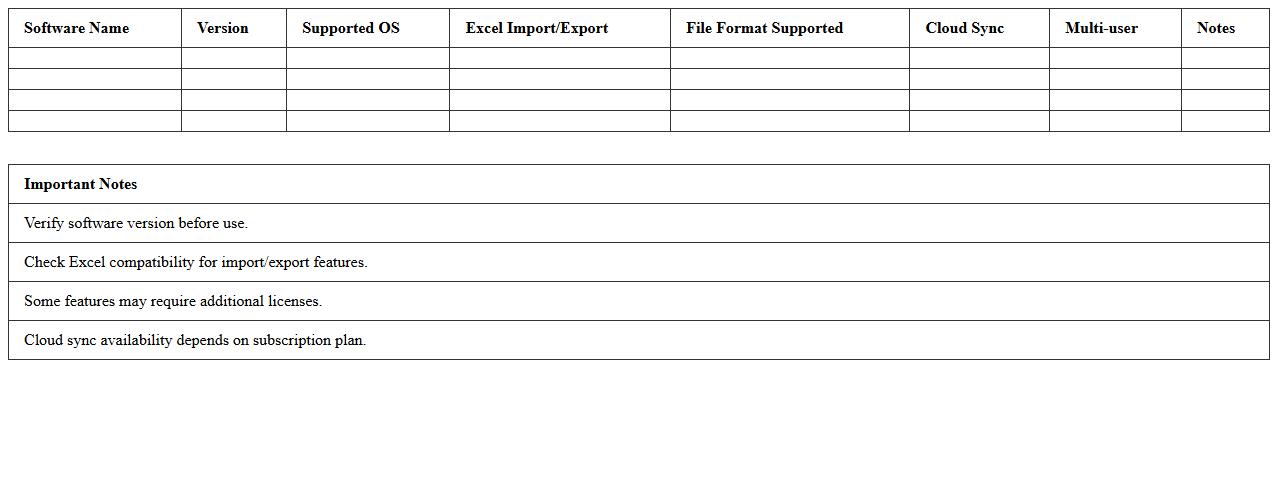

Tax Software Compatibility Checklist Excel Sheet

The

Tax Software Compatibility Checklist Excel Sheet document serves as a comprehensive tool to evaluate and ensure the seamless integration of various tax software with existing systems. It helps users identify compatibility issues, streamlining the selection process by comparing features, system requirements, and supported formats. This checklist optimizes tax preparation efficiency, reduces errors, and saves time by guiding users toward the most suitable software solutions.

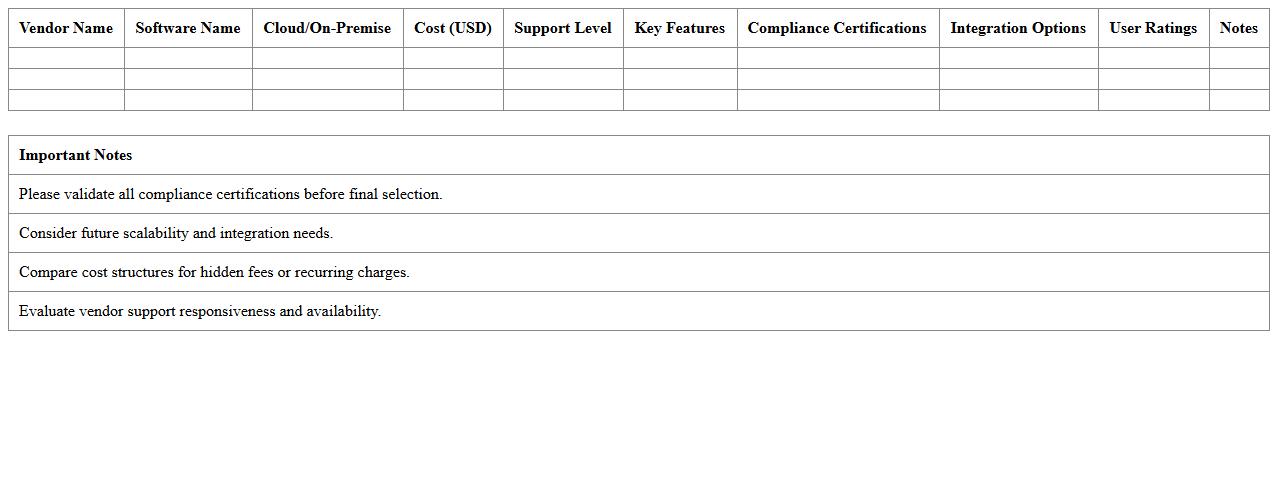

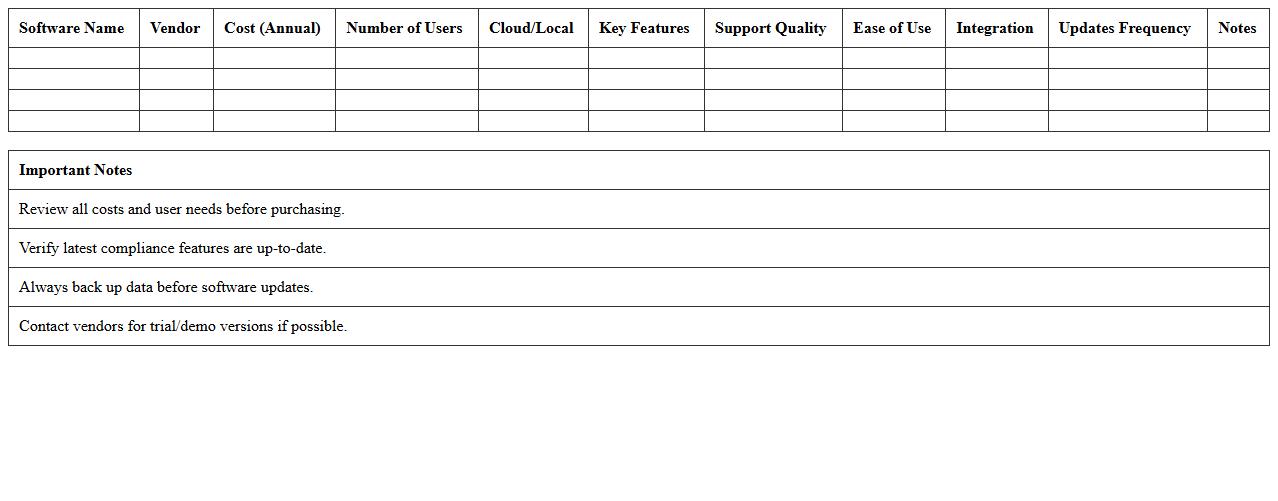

Tax Software Vendor Evaluation Excel Template

The

Tax Software Vendor Evaluation Excel Template document provides a structured framework for comparing and assessing various tax software vendors based on criteria such as pricing, features, support, and compliance. Its organized layout allows users to systematically score and rank vendors, facilitating informed decision-making in selecting the best software solution for tax management needs. This tool enhances efficiency by consolidating key data points in one place, reducing the risk of overlooking critical vendor capabilities or limitations.

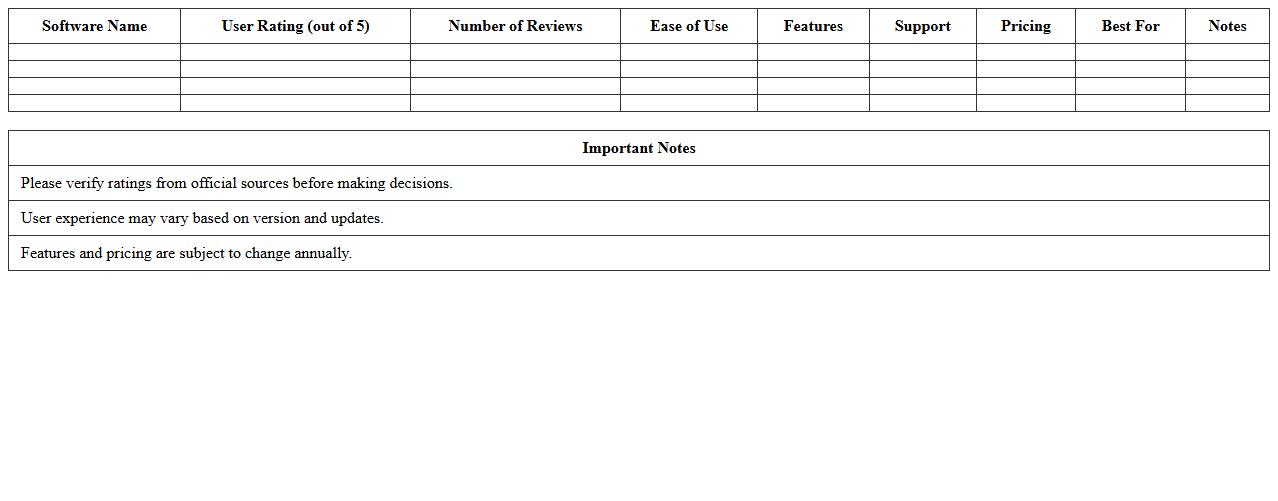

Tax Software User Ratings Comparison Table Excel

The

Tax Software User Ratings Comparison Table Excel document compiles and organizes user feedback on various tax preparation programs, allowing for a clear and structured comparison of features, pricing, ease of use, and customer satisfaction. This tool enables users to make informed decisions by providing a side-by-side evaluation based on aggregated ratings, reducing the time spent on research. Small businesses, accountants, and individuals benefit from this resource by selecting the most suitable tax software tailored to their specific needs and budget.

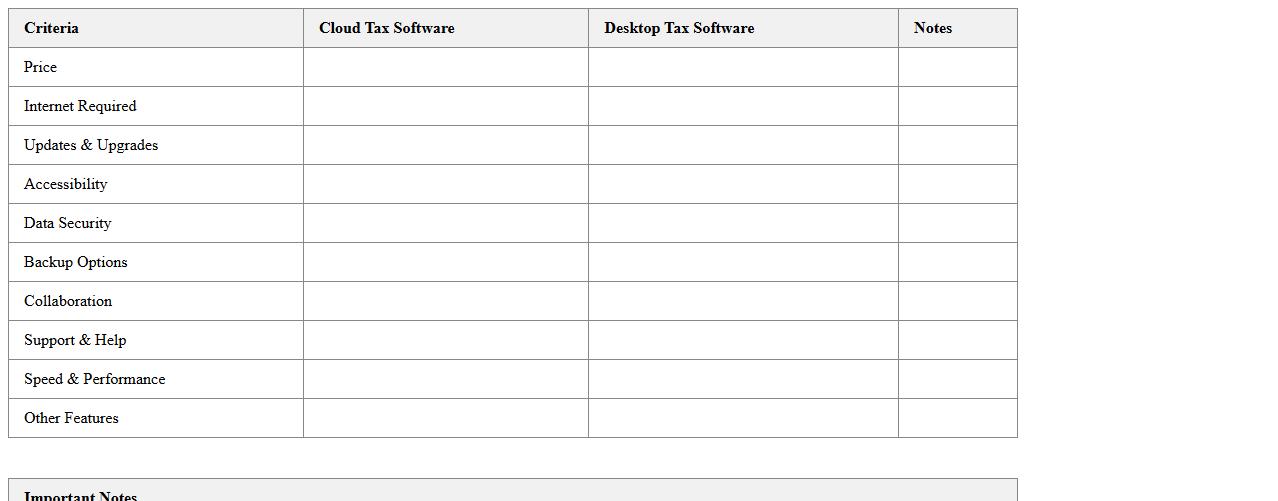

Cloud vs Desktop Tax Software Comparison Worksheet

The

Cloud vs Desktop Tax Software Comparison Worksheet document systematically outlines the features, benefits, and limitations of cloud-based and desktop tax software solutions. It helps users evaluate key aspects such as accessibility, security, cost, and software updates to make informed decisions based on their specific tax preparation needs. This worksheet is a valuable tool for streamlining software selection, ensuring efficiency and compliance in tax management processes.

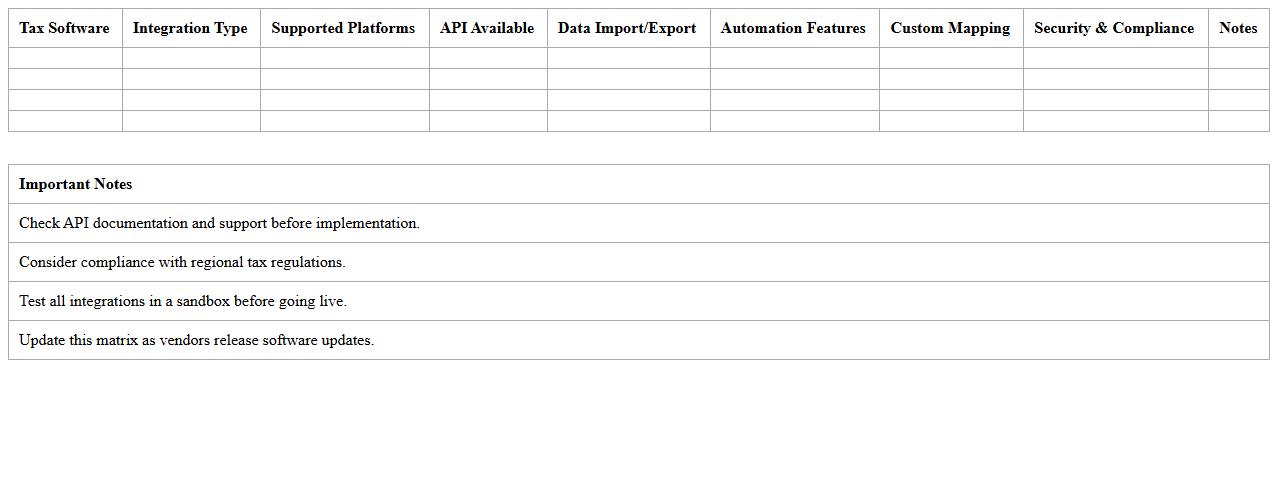

Tax Software Integration Capabilities Excel Matrix

The

Tax Software Integration Capabilities Excel Matrix document systematically compares various tax software solutions based on their ability to integrate with other financial systems, enhancing accuracy and efficiency in tax processes. This matrix helps users identify compatible software options that streamline data transfer, reduce manual entry errors, and improve overall workflow. By providing a clear overview of integration features, it supports informed decision-making for selecting tax software tailored to specific business needs.

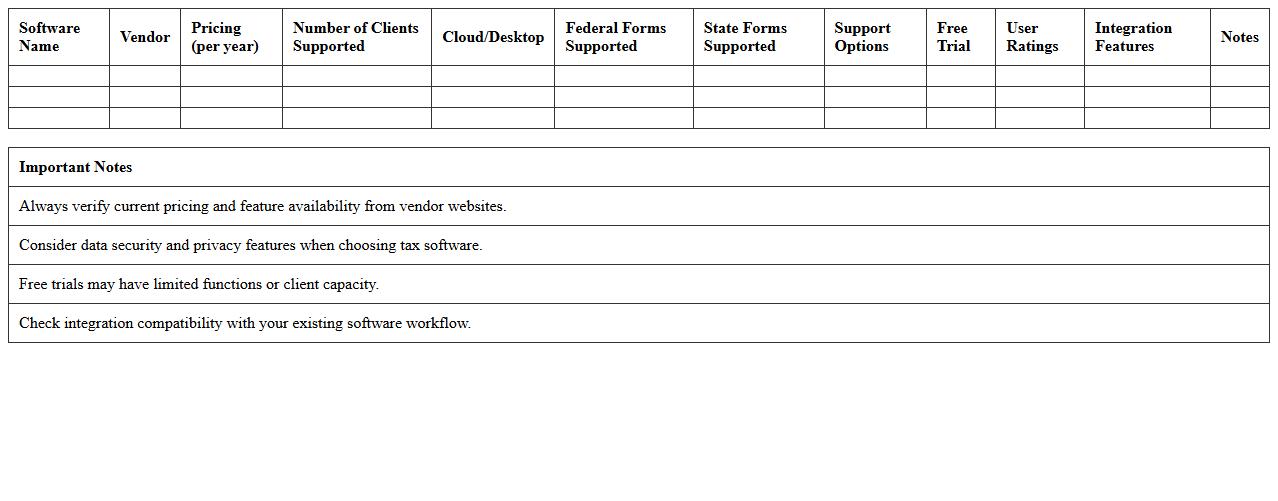

Multi-Client Tax Software Comparison Excel Sheet

The

Multi-Client Tax Software Comparison Excel Sheet document systematically evaluates various tax software options by detailing features, pricing, user ratings, and compliance capabilities across multiple clients. This tool is essential for tax professionals and firms seeking to identify the most efficient, cost-effective, and compliant software solutions tailored to diverse client needs. By consolidating critical information into one accessible format, it streamlines decision-making and enhances the accuracy of software selection processes.

Accountants’ Annual Tax Software Review Spreadsheet

The

Accountants' Annual Tax Software Review Spreadsheet document systematically compares features, pricing, and compliance updates of various tax software tools, helping professionals select the most effective solution for their needs. It streamlines decision-making by consolidating critical data on software performance, user feedback, and regulatory compatibility in one accessible format. This resource enhances accuracy and efficiency in tax filing, reduces the risk of errors, and supports compliance with current tax laws.

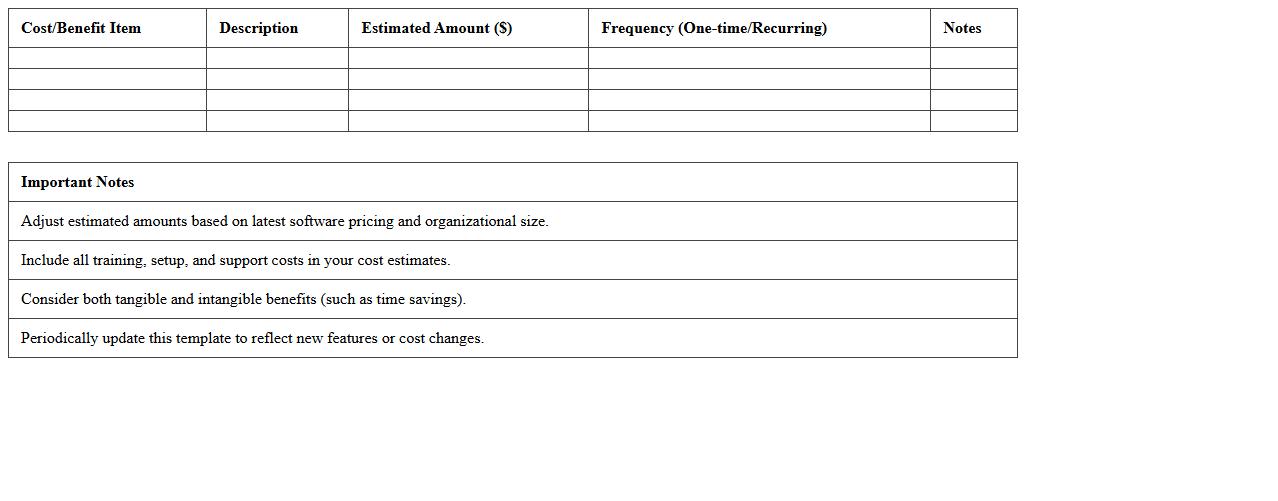

Tax Software Cost-Benefit Analysis Excel Template

The

Tax Software Cost-Benefit Analysis Excel Template document is a structured tool designed to evaluate and compare the financial advantages and expenses associated with different tax software options. It streamlines decision-making by organizing data on software costs, potential savings, and efficiency gains in a clear, easy-to-use spreadsheet format. This template helps businesses and individuals make informed choices, ensuring optimal investment in tax software based on quantitative analysis.

Tax Software Platforms Included in the Excel Comparison for Accountants

The Excel comparison features a wide range of tax software platforms trusted by accountants globally. It highlights popular tools that offer comprehensive tax preparation and filing solutions. This ensures accountants can easily identify software that matches their specific needs and client demands.

Multi-Currency Support Evaluation in the Tax Software Comparison

The Excel sheet thoroughly evaluates multi-currency support across different tax software options. This is essential for accountants handling international clients or transactions. The comparison helps users select software that efficiently manages currency conversions and taxation complexities.

Integration Features with Accounting Platforms in the Comparison

Integration capabilities with major accounting platforms are clearly listed in the Excel comparison. This allows accountants to choose tax software that seamlessly connects with their existing accounting systems. These integrations streamline workflows and improve data accuracy across platforms.

Bulk Client Management Functionalities in the Tax Software Comparison

The comparison includes detailed information on bulk client management features available in the tax software. This function is crucial for accountants managing large client portfolios. It facilitates efficient data handling and reduces time-consuming administrative tasks.

Pricing Structure by User/License Detailed in the Excel Document

The Excel document provides an in-depth overview of the pricing structure for each tax software platform by user or license. This enables accountants to evaluate costs relative to their team size and usage requirements. Transparent pricing details support informed decision-making and budget planning.