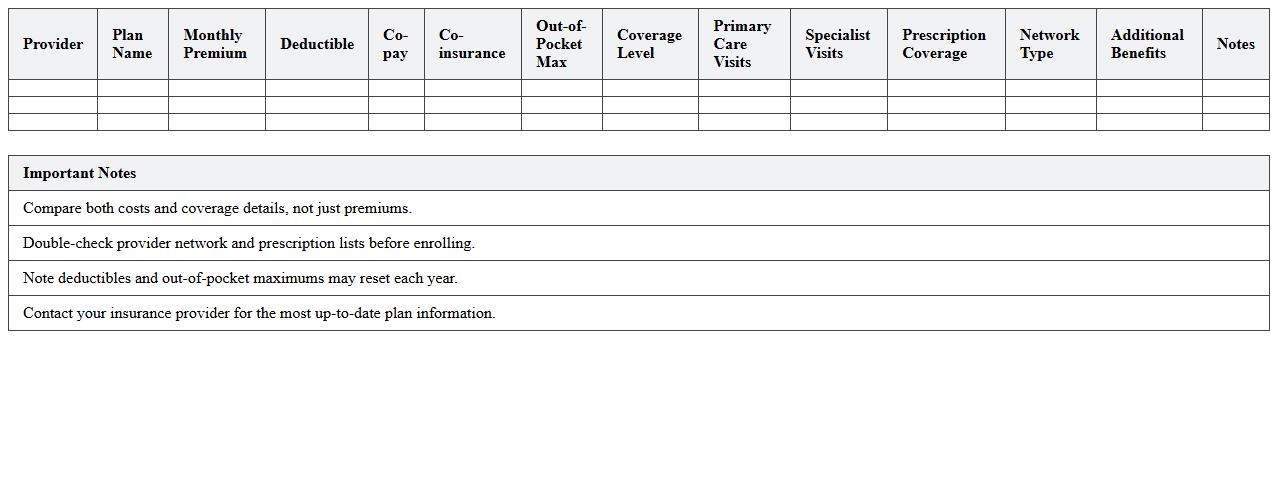

Individual Health Insurance Comparison Spreadsheet

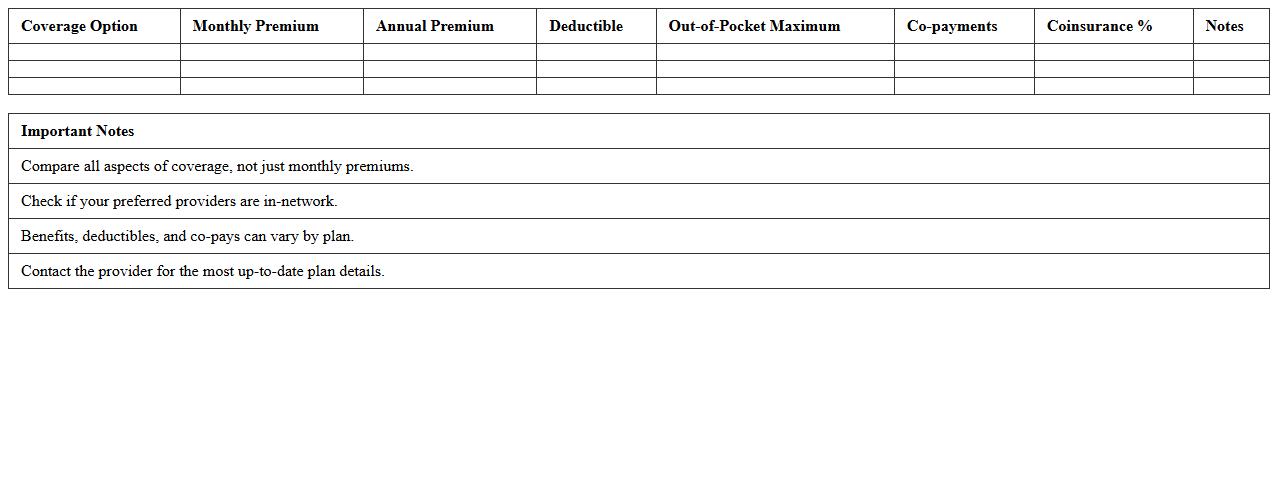

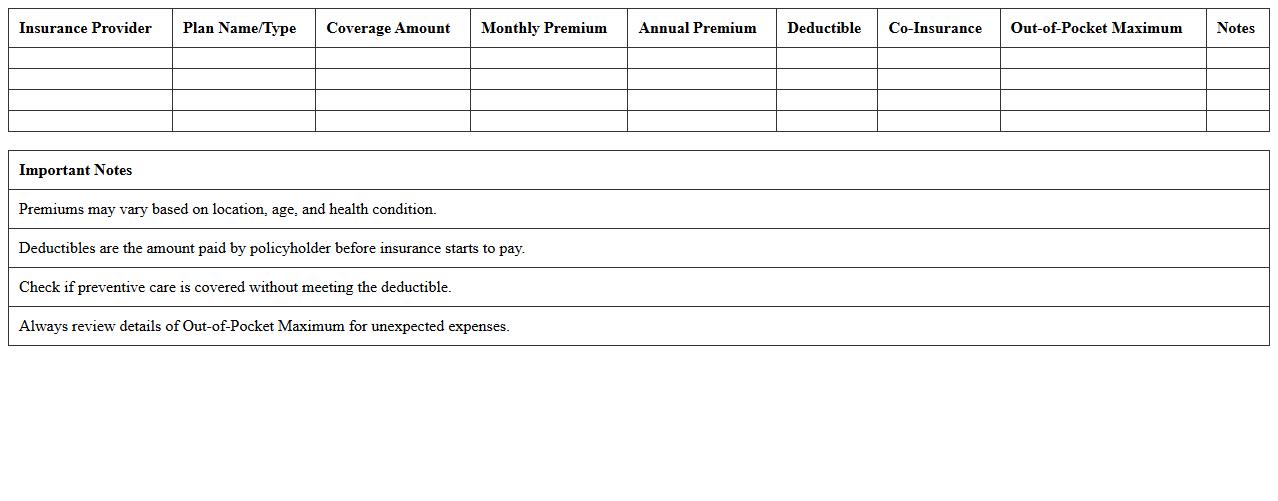

An

Individual Health Insurance Comparison Spreadsheet is a detailed tool designed to organize, analyze, and compare various health insurance plans based on premiums, coverage options, deductibles, and co-pays. This document streamlines decision-making by presenting all critical plan details in a clear, side-by-side format, allowing users to easily identify the best policies that meet their specific health needs and budget constraints. Utilizing such a spreadsheet reduces the risk of overlooking key benefits or hidden costs, ensuring more informed and cost-effective healthcare coverage choices.

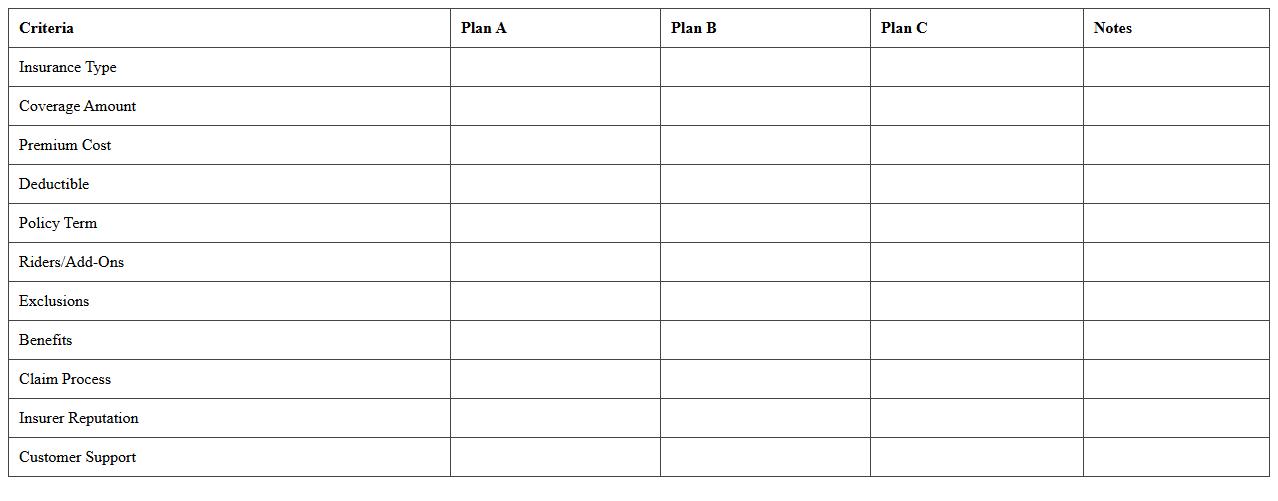

Personal Insurance Plan Evaluation Template

A

Personal Insurance Plan Evaluation Template is a structured document designed to assess and compare various insurance policies based on coverage, premiums, benefits, and exclusions. It helps individuals systematically analyze their current plans or potential options to ensure they meet their financial protection needs and personal circumstances. Using this template minimizes risks of underinsurance or overpayment by providing clear, organized insights for informed decision-making.

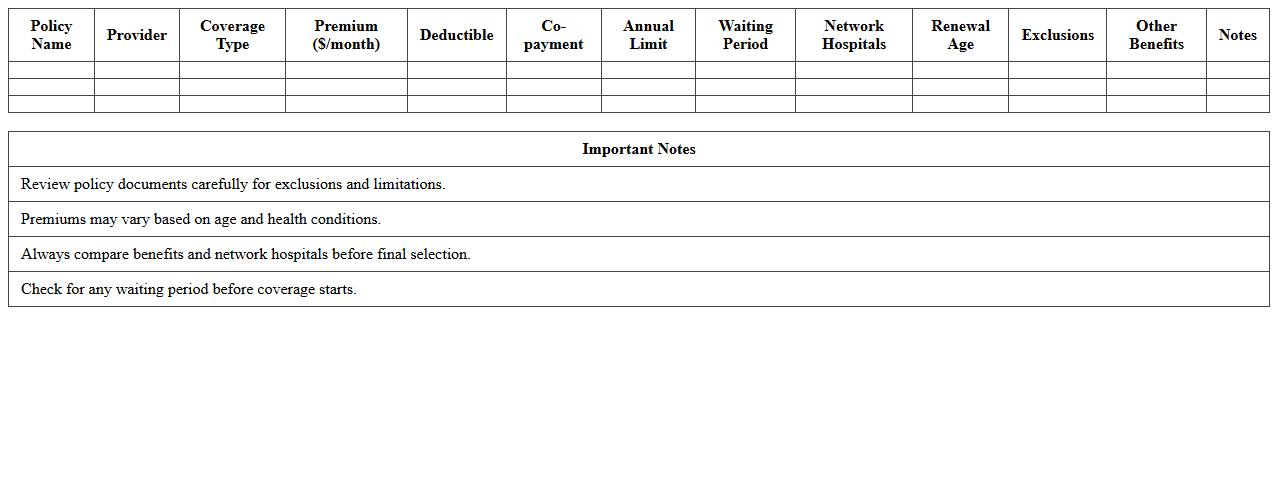

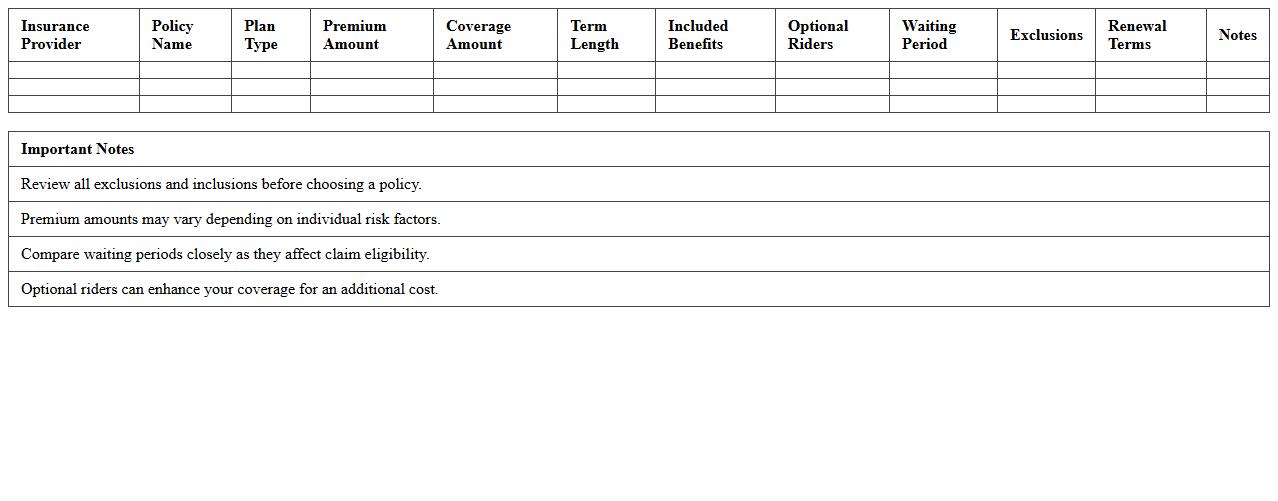

Private Insurance Policy Comparison Excel Sheet

A

Private Insurance Policy Comparison Excel Sheet is a structured document designed to analyze and contrast various insurance plans by listing their coverage details, premiums, deductibles, and benefits side by side. This tool enables users to make informed decisions by visually identifying the best policy that meets their specific needs, budget, and risk preferences. Utilizing such a sheet saves time, reduces errors, and enhances clarity when navigating complex insurance options.

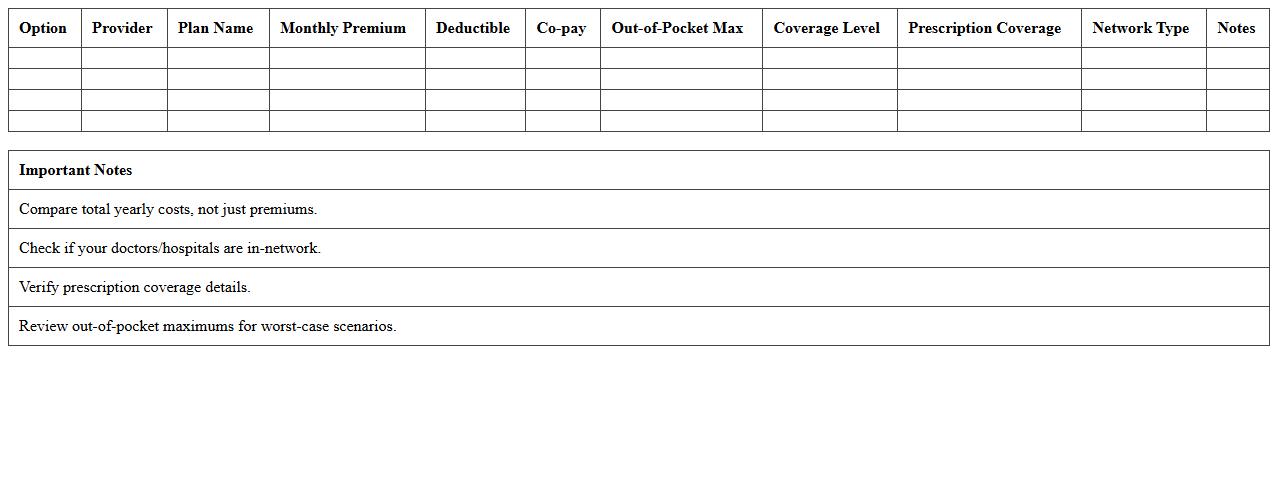

Medical Insurance Options Analysis Worksheet

The

Medical Insurance Options Analysis Worksheet is a structured document designed to compare various health insurance plans based on coverage, premiums, deductibles, and out-of-pocket costs. It helps individuals and organizations make informed decisions by clearly outlining the benefits and limitations of each option, ensuring that the chosen plan meets specific healthcare needs and budget constraints. Using this worksheet enhances the ability to select the most cost-effective and comprehensive medical insurance coverage.

Individual Coverage Cost Comparison Table

The

Individual Coverage Cost Comparison Table document provides a detailed overview of premium rates, coverage options, and out-of-pocket costs for various health insurance plans available to individuals. It is a valuable tool for comparing different insurance policies based on pricing, benefits, and coverage limits, helping consumers make informed decisions. This comparison table simplifies the process of selecting the best plan by highlighting key cost factors and coverage features side-by-side.

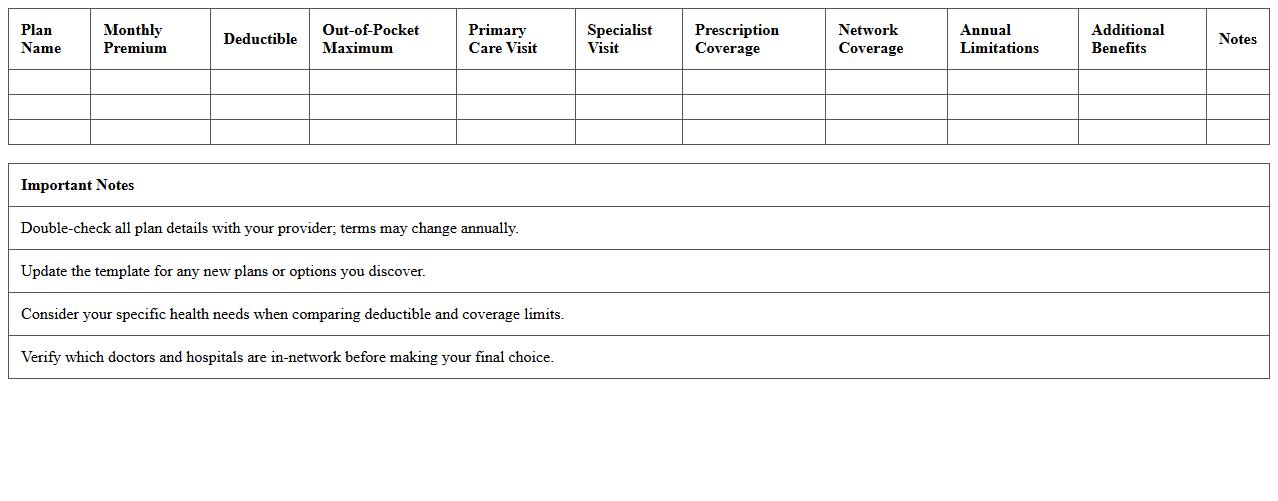

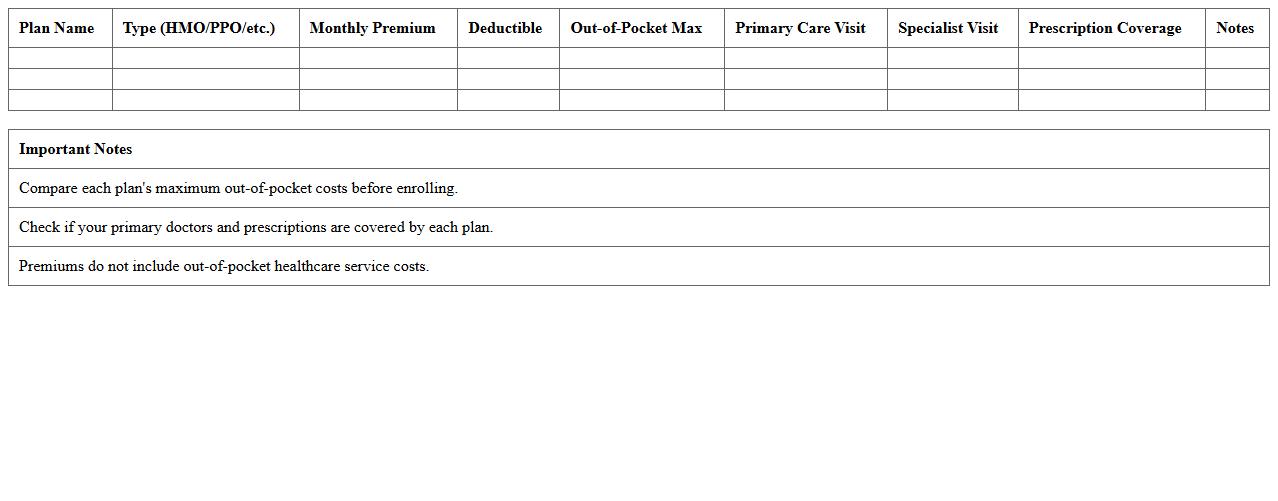

Excel Template for Comparing Health Insurance Plans

The

Excel Template for Comparing Health Insurance Plans is a structured spreadsheet designed to simplify the evaluation of different health insurance options by organizing key data such as premiums, deductibles, copayments, coverage limits, and provider networks in one place. This tool helps users make informed decisions by providing a clear, side-by-side comparison, allowing for quick identification of the most cost-effective and comprehensive insurance plan that fits their needs. By streamlining the comparison process, it reduces the complexity and time involved in assessing multiple plans, enhancing financial planning and healthcare management.

Personal Insurance Benefits Comparison Chart

A

Personal Insurance Benefits Comparison Chart is a detailed document that outlines and contrasts the features, coverage options, premiums, and exclusions of various personal insurance policies side-by-side. It helps individuals quickly evaluate different insurance plans, enabling informed decisions about which policy best suits their financial needs and risk protection goals. By simplifying complex policy details into an easy-to-understand format, this chart saves time and reduces confusion when selecting the most comprehensive and cost-effective insurance coverage.

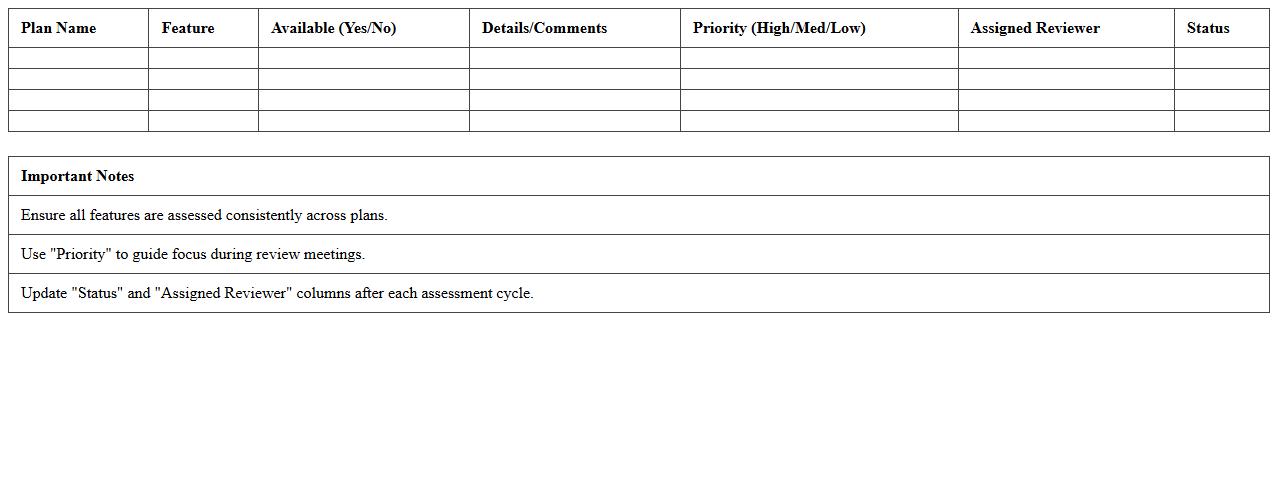

Individual Plan Features Assessment Spreadsheet

The

Individual Plan Features Assessment Spreadsheet is a comprehensive tool designed to evaluate and compare various personal plans based on specific criteria and features. It allows users to systematically analyze options such as insurance policies, retirement plans, or service subscriptions, ensuring informed decision-making by highlighting differences in coverage, benefits, costs, and limitations. This document enhances clarity and organization, making it easier to select the most suitable plan aligned with individual needs and financial goals.

Insurance Premiums and Deductibles Comparison Sheet

An

Insurance Premiums and Deductibles Comparison Sheet is a detailed document that outlines and contrasts the costs associated with various insurance policies, including the upfront premiums and the out-of-pocket deductibles. This sheet allows individuals and businesses to evaluate multiple insurance options side by side, making it easier to identify the most cost-effective and suitable plan based on their financial situation and coverage needs. By providing clear comparisons, the document helps users make informed decisions that balance monthly expenses with potential out-of-pocket costs in the event of a claim.

Health Plan Options Side-by-Side Excel Template

The

Health Plan Options Side-by-Side Excel Template is a comprehensive tool designed to compare multiple health insurance plans by organizing key features such as coverage benefits, premiums, deductibles, and copayments in a clear, structured format. This template helps users easily evaluate different health plans, enabling informed decisions tailored to their healthcare needs and budget constraints. By visually presenting detailed comparisons, it streamlines the selection process and reduces the risk of overlooking critical plan details.

What custom formulas are used to automate premium difference calculations in Excel?

Custom formulas in Excel typically utilize IF, VLOOKUP, and SUMPRODUCT functions to automate premium difference calculations. These formulas compare various plan premiums and output the difference dynamically based on user input. The use of named ranges and structured references further enhances formula accuracy and readability.

How does the sheet handle varying deductible and copay structures for multiple plans?

The sheet manages varying deductible and copay structures by incorporating conditional logic within formulas to account for each plan's unique settings. It often uses lookup tables to map deductible and copay values effectively across plans. This ensures automatic adjustments in total costs based on the specific deductible and copay amounts for each plan.

Can users filter or sort individual plans by network coverage or specific benefits?

Users can filter and sort plans using built-in Excel filter and sort functions applied to columns representing network coverage and specific benefits. Advanced filters or slicers may be implemented for easier plan comparison. This interactivity allows users to quickly identify plans that meet their network and benefit criteria.

Does the document include built-in visualizations for plan cost comparison?

Yes, the document often contains built-in visualizations such as bar charts, pie charts, or conditional formatting heat maps for intuitive plan cost comparison. These visual aids help users instantly grasp differences in premiums and out-of-pocket expenses. Dashboards may be embedded to provide a comprehensive graphical overview of various plan metrics.

Are there fields for entering age or health conditions to dynamically adjust plan costs?

The Excel sheet usually includes input fields for age and health conditions that dynamically influence plan premium calculations. Formulas adjust costs based on these demographic and health-related variables to provide personalized plan estimates. This feature enhances the accuracy and relevance of plan recommendations for individual users.