The Loan Option Comparison Excel Template for Home Buyers helps users evaluate multiple mortgage offers by organizing key loan details such as interest rates, terms, and monthly payments. This template simplifies decision-making by providing clear side-by-side comparisons that highlight the most cost-effective and suitable loan options. With built-in calculations and customizable fields, home buyers can confidently select the best financing plan tailored to their financial needs.

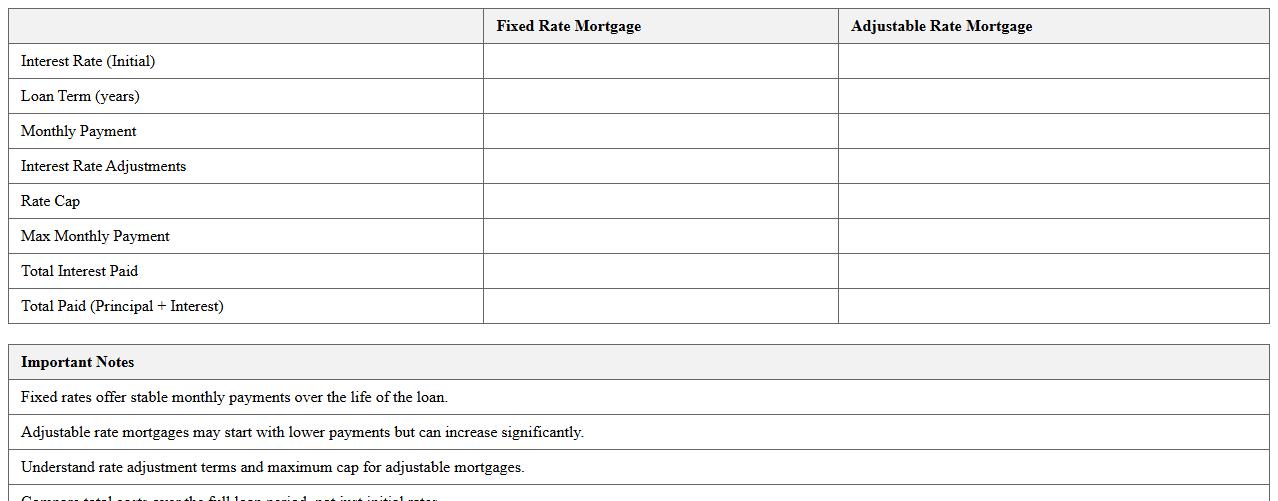

Fixed vs Adjustable Rate Mortgage Comparison Excel Sheet

A

Fixed vs Adjustable Rate Mortgage Comparison Excel Sheet document systematically compares the costs, interest rates, and payment schedules of fixed-rate and adjustable-rate mortgages. It helps users visualize potential savings and risks by calculating monthly payments, total interest, and loan balances over time. This tool supports informed decision-making by clearly illustrating which mortgage type aligns best with individual financial goals and market conditions.

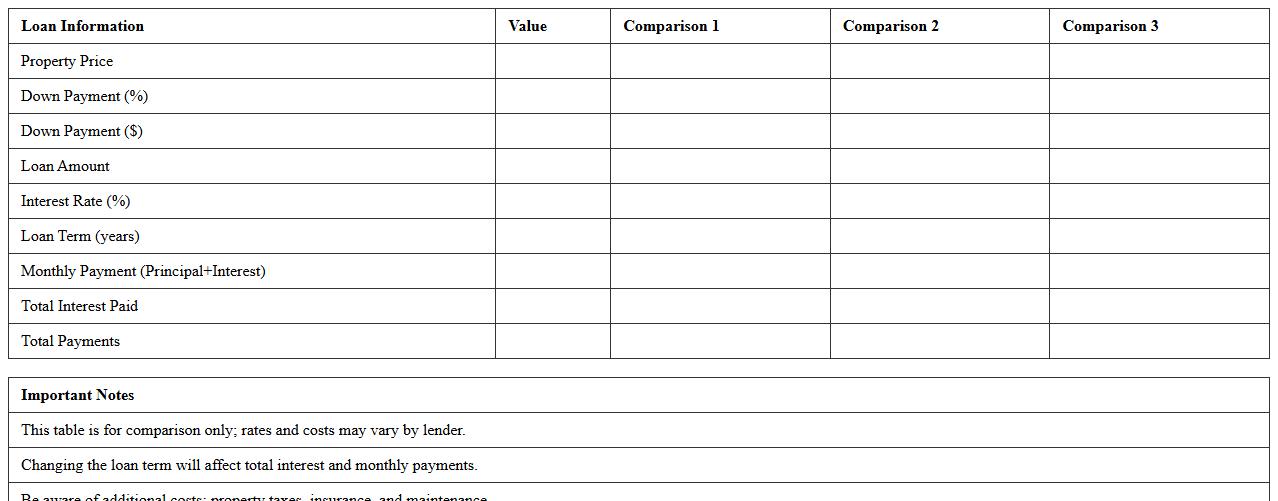

Loan Term Analysis Spreadsheet for Home Buyers

A

Loan Term Analysis Spreadsheet for Home Buyers is a detailed financial tool designed to help prospective buyers compare different mortgage options by analyzing interest rates, loan durations, and repayment schedules. This spreadsheet enables users to estimate monthly payments, total interest costs, and overall affordability, facilitating informed decision-making. By organizing complex loan data into an accessible format, it simplifies evaluating long-term financial commitments associated with purchasing a home.

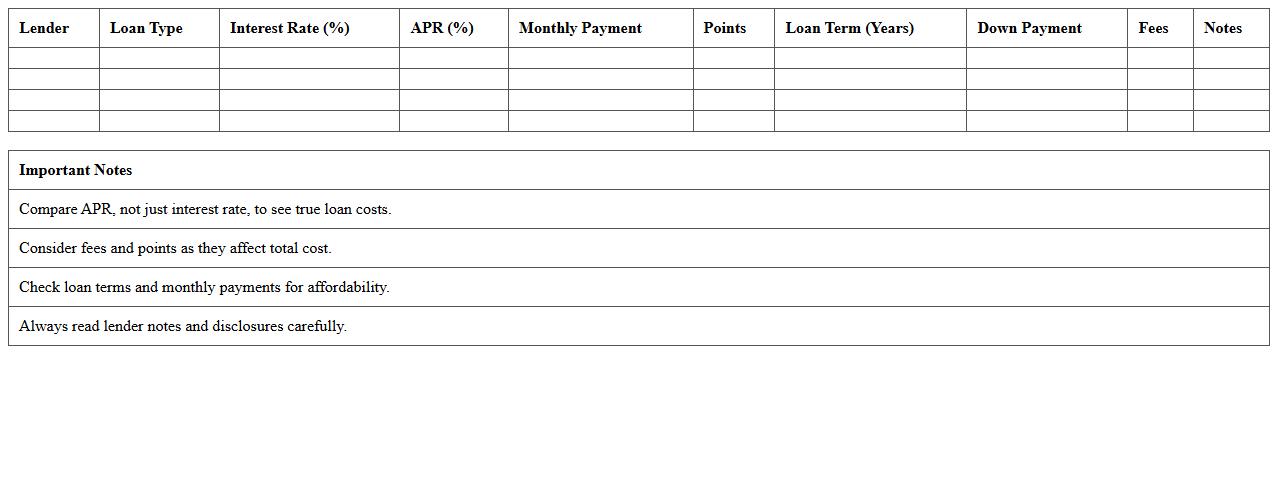

Mortgage Rate Comparison Matrix Template

A

Mortgage Rate Comparison Matrix Template document organizes various mortgage rates, terms, and lender conditions into a clear, easy-to-compare format. It helps potential borrowers evaluate different loan options side-by-side, considering interest rates, fees, and repayment periods to make informed financial decisions. This template streamlines the decision-making process by highlighting key differences and potential savings across multiple mortgage offers.

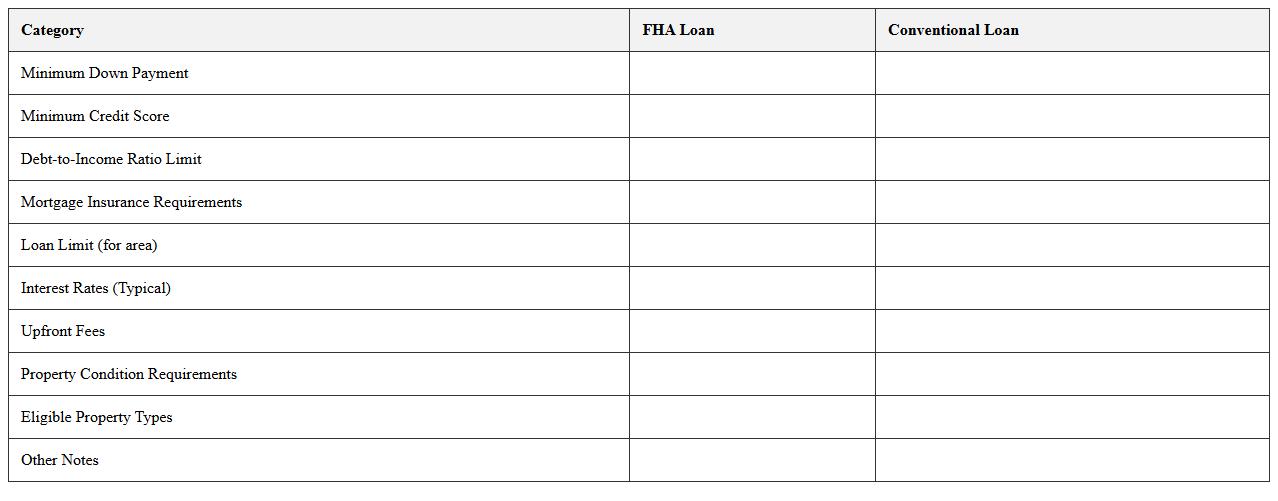

FHA vs Conventional Loan Comparison Worksheet

The

FHA vs Conventional Loan Comparison Worksheet is a document designed to outline key differences between Federal Housing Administration (FHA) loans and conventional loans, including interest rates, down payment requirements, mortgage insurance, and credit score criteria. This worksheet helps prospective homebuyers evaluate which loan option aligns better with their financial situation and long-term goals by presenting clear, side-by-side comparisons. Using this tool improves decision-making by simplifying complex mortgage details into an easy-to-understand format, ultimately aiding in selecting the most cost-effective and suitable financing option.

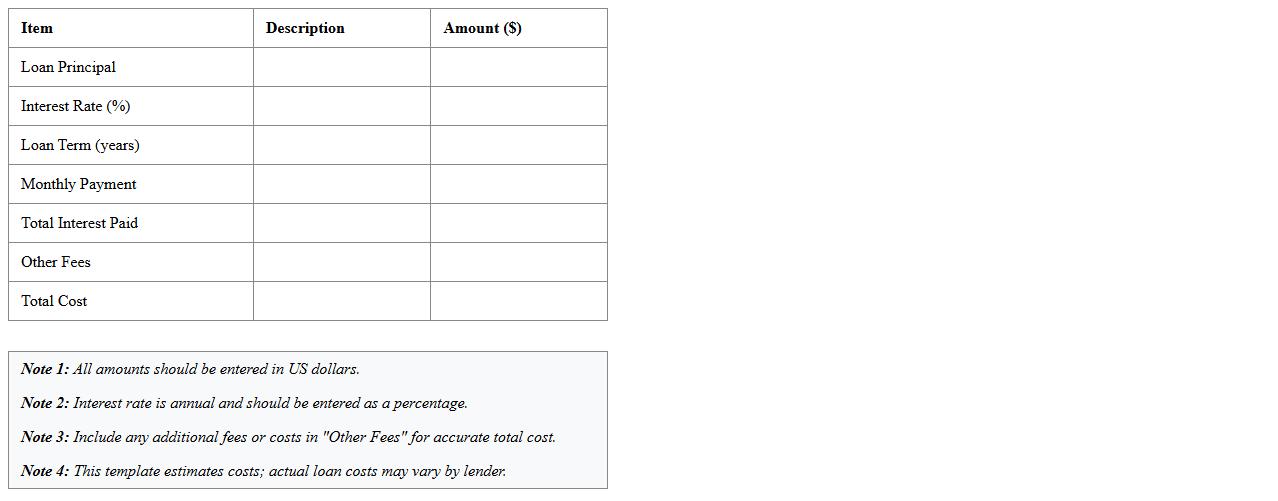

Total Loan Cost Breakdown Excel Template

The

Total Loan Cost Breakdown Excel Template is a detailed financial tool designed to itemize all expenses associated with a loan, including principal, interest, fees, and other charges. It helps users clearly visualize the total cost of a loan over its entire term, enabling better budgeting and financial decision-making. This template is particularly useful for borrowers, financial analysts, and advisors who need an organized, transparent view of loan obligations to compare offers and manage repayment strategies effectively.

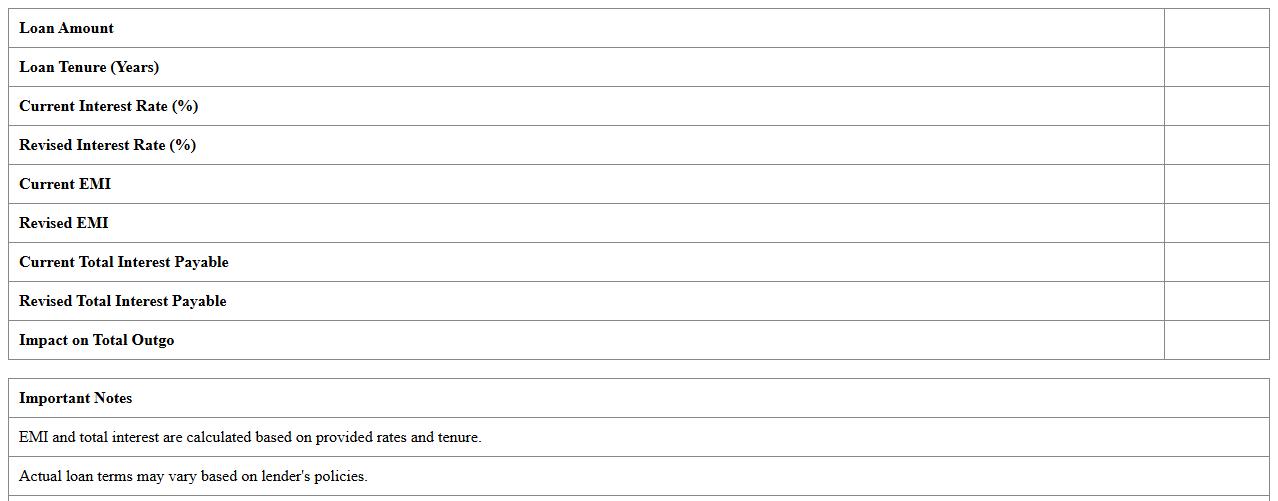

Interest Rate Impact Calculator for Home Loans

The

Interest Rate Impact Calculator for home loans is a financial tool designed to estimate how fluctuations in interest rates affect your monthly mortgage payments and overall loan cost. It provides borrowers with a clear understanding of the potential changes in repayment amounts when interest rates rise or fall. This calculator helps users make informed decisions by comparing different scenarios, optimizing budgeting, and evaluating loan affordability.

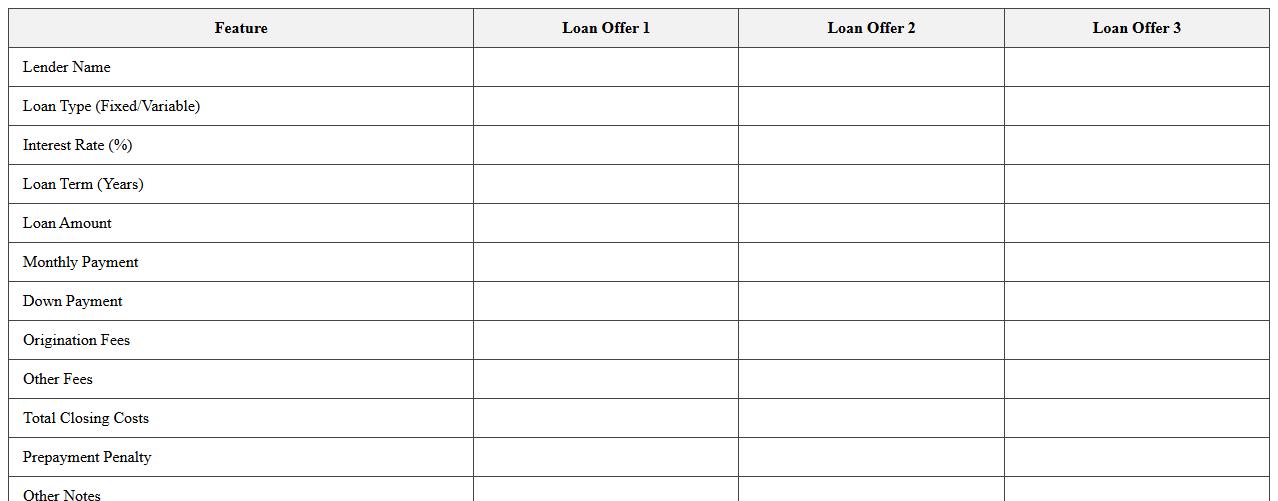

Side-by-Side Home Loan Offer Comparison Excel

The

Side-by-Side Home Loan Offer Comparison Excel document allows users to systematically evaluate multiple mortgage offers by comparing interest rates, loan terms, fees, and monthly payments in one organized spreadsheet. It helps borrowers make informed decisions by providing a clear visual representation of key loan details, highlighting differences that impact overall cost and affordability. This tool streamlines the home loan selection process, ensuring users choose the best financial option tailored to their needs.

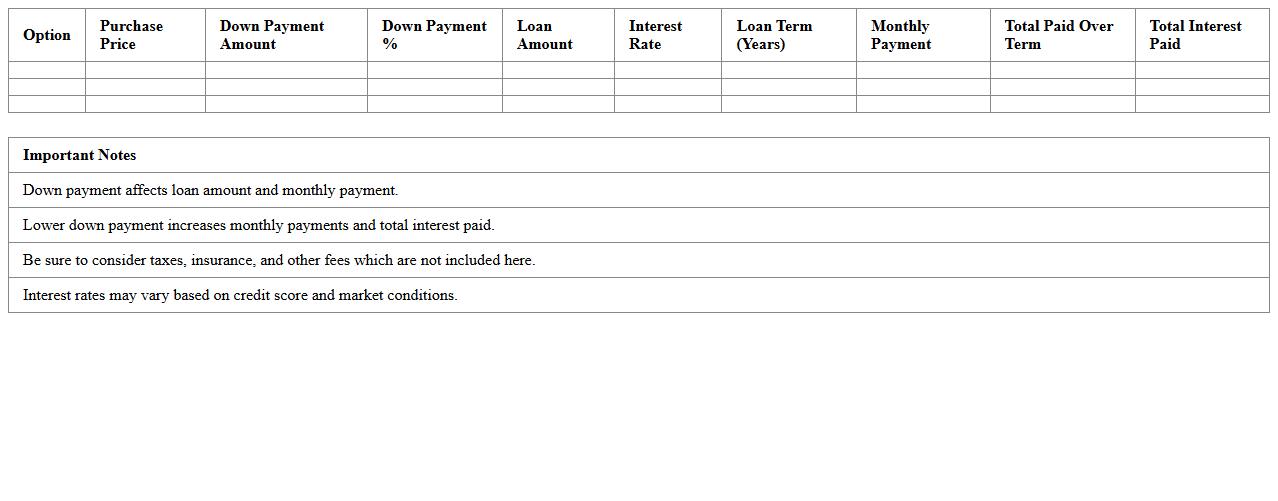

Down Payment and Monthly Payment Comparison Template

The

Down Payment and Monthly Payment Comparison Template document allows users to systematically evaluate different financing options by comparing initial down payments against recurring monthly payments. This template helps in identifying the most cost-effective payment plan, ensuring better financial planning and budgeting. It simplifies complex financial decisions by presenting clear and organized data, making it easier to select the best loan or purchase agreement.

Amortization Schedule Comparison Spreadsheet

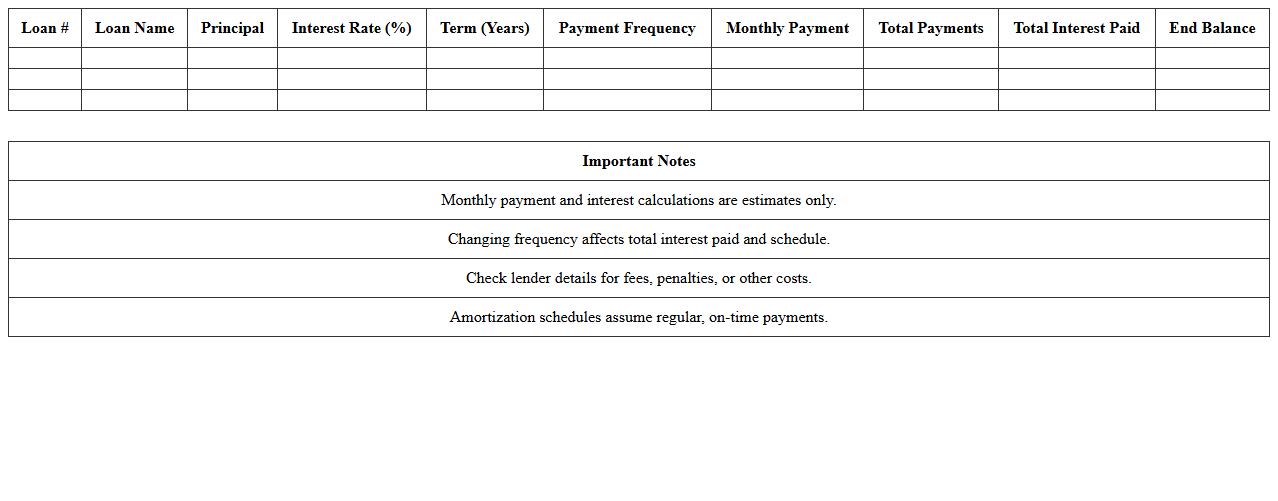

An

Amortization Schedule Comparison Spreadsheet is a detailed document that outlines multiple loan repayment plans, displaying principal and interest payments over time side-by-side. This tool is essential for evaluating different loan options, enabling users to identify the most cost-effective repayment strategy by comparing total interest paid and loan duration. By using this spreadsheet, borrowers can make informed financial decisions and optimize their loan management for better budgeting and savings.

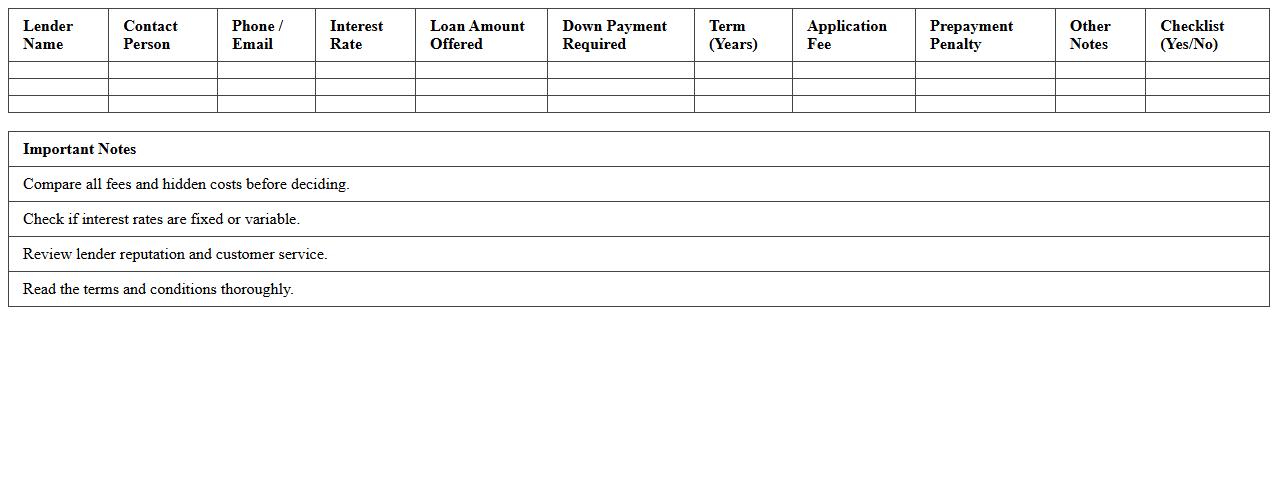

Home Loan Lender Options Excel Checklist

The

Home Loan Lender Options Excel Checklist document systematically organizes and compares various home loan lenders, highlighting interest rates, fees, loan terms, and eligibility criteria. This tool simplifies decision-making by providing a clear side-by-side analysis of multiple lending options, enabling users to identify the most cost-effective and suitable mortgage solutions. By consolidating critical loan details into an easy-to-navigate spreadsheet, it streamlines the mortgage selection process and improves financial planning accuracy.

Which columns in the Loan Option Comparison Excel are most critical for first-time home buyers to review?

For first-time home buyers, the most critical columns typically include the interest rate, monthly payment, and loan term. These provide a clear overview of the cost and duration of each loan option. Additionally, columns detailing closing costs and total loan cost are essential for budgeting.

How can the Excel sheet visually highlight differences in interest rates between loan products?

The Excel sheet can utilize conditional formatting to visually emphasize interest rate differences. By assigning color scales or data bars to the interest rate column, users can quickly identify the most and least favorable rates. This approach enhances comparison efficiency and decision-making.

What formula best calculates total loan cost over the life of the mortgage in the comparison template?

The SUMPRODUCT formula combined with monthly payment and total months is ideal for calculating total loan cost. Specifically, multiplying the monthly payment by the loan term in months gives the total repayment amount. Adding upfront costs like closing fees yields the complete loan cost.

Does the Excel sheet account for variable vs. fixed interest rates in loan scenarios?

Advanced Excel templates often include separate columns or toggles to differentiate variable and fixed interest rates. This distinction allows users to model how fluctuating rates might impact payments over time. It helps in comparing stability against potential cost savings.

Can the document automatically update estimated monthly payments if home price inputs change?

Yes, by linking the monthly payment calculation to the home price input cell, the Excel sheet can automatically recalculate payments. This dynamic updating uses formulas referencing the principal amount derived from the home price minus any down payment. It ensures accurate monthly estimates as variables change.

More Comparison Excel Templates