The Credit Card Offer Comparison Excel Template for finance bloggers streamlines the process of evaluating multiple credit card deals by organizing key details like interest rates, rewards, and fees in one place. This customizable template boosts content quality and efficiency, enabling bloggers to present clear, data-driven comparisons to their audience. Its user-friendly design supports better decision-making and enhances reader trust through transparent financial analysis.

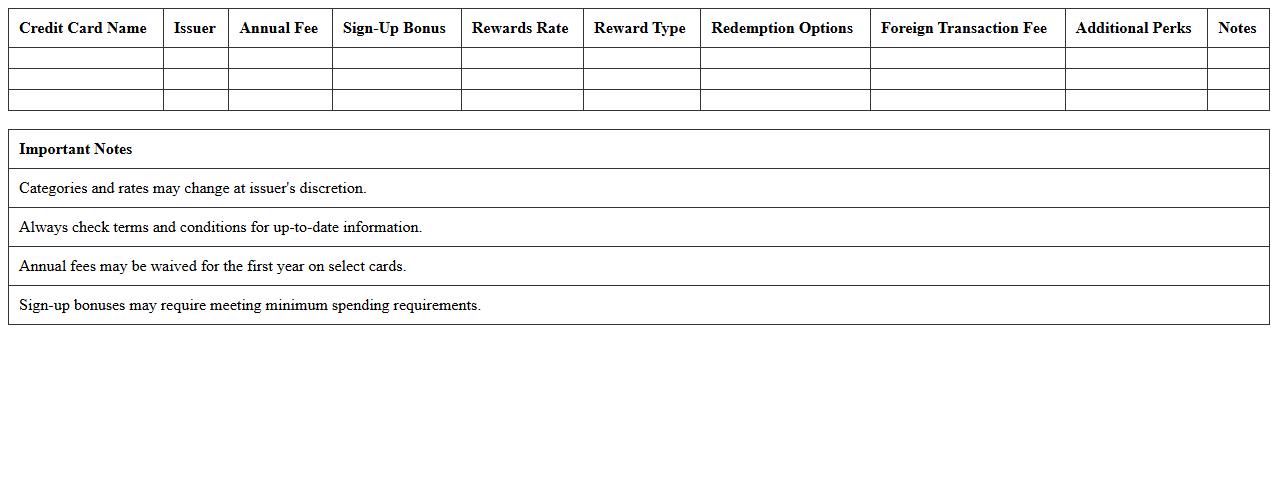

Best Credit Card Rewards Comparison Excel Template

The

Best Credit Card Rewards Comparison Excel Template document is a comprehensive tool designed to analyze and compare various credit card rewards programs efficiently. It allows users to input key data such as reward rates, annual fees, and redemption options, enabling clear visualization and informed decision-making. This template helps maximize financial benefits by identifying the most advantageous credit card based on personalized spending habits and reward preferences.

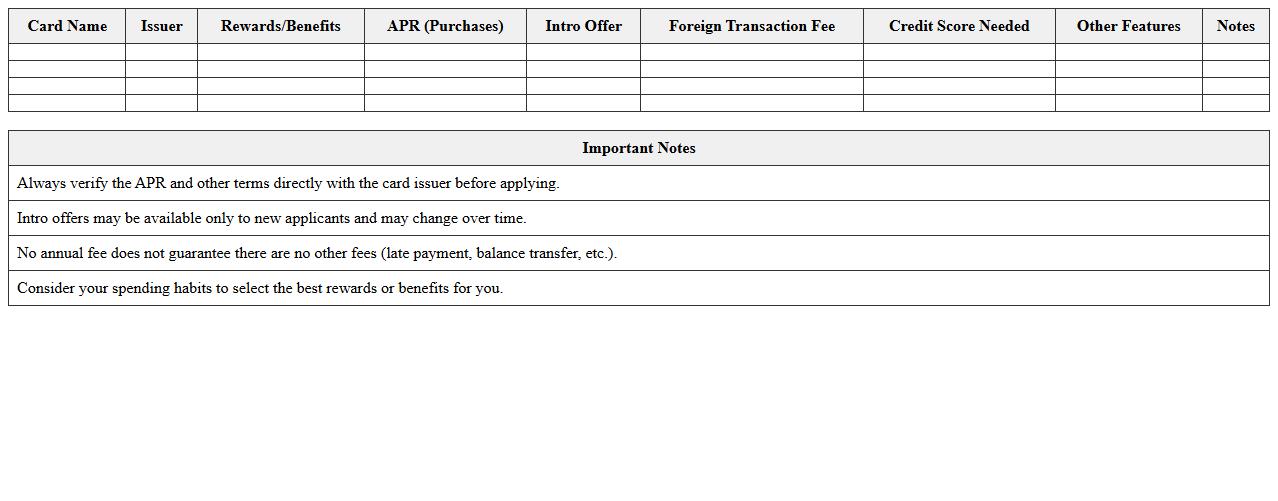

No Annual Fee Credit Card Comparison Spreadsheet

A

No Annual Fee Credit Card Comparison Spreadsheet is a detailed document that organizes various credit card options without annual fees, highlighting key features such as interest rates, reward programs, and additional benefits. This spreadsheet enables users to effortlessly evaluate and contrast multiple cards based on factors like cashback offers, introductory APR periods, and foreign transaction fees. By consolidating this data, it simplifies decision-making, helping consumers select the most advantageous credit card tailored to their financial needs.

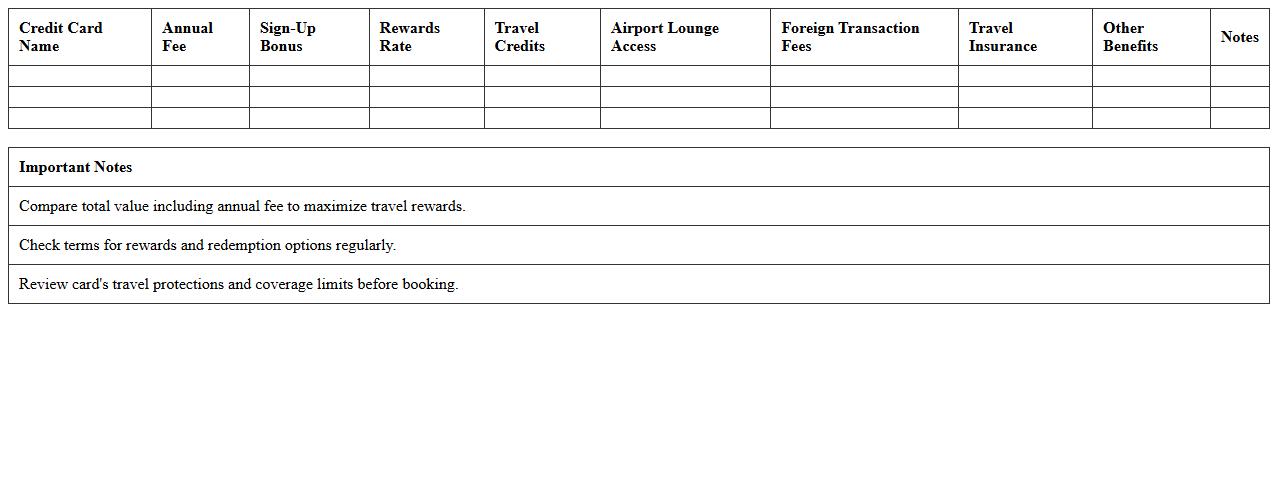

Travel Credit Card Benefits Analysis Template

A

Travel Credit Card Benefits Analysis Template document systematically organizes and compares the rewards, perks, fees, and interest rates of various travel credit cards. It helps users identify the most cost-effective options and maximize travel-related savings such as airline miles, hotel points, and travel insurance. By providing clear, side-by-side evaluations, the template simplifies decision-making and ensures travelers select cards that best align with their spending habits and travel goals.

Low Interest Rate Credit Card Comparison Sheet

A

Low Interest Rate Credit Card Comparison Sheet document systematically organizes key features such as APR rates, fees, and rewards across multiple credit card options, enabling consumers to make well-informed financial decisions. It helps users identify cards with the lowest interest rates to minimize borrowing costs and manage debt more effectively. This tool is especially useful for individuals seeking to reduce interest expenses or transfer balances without compromising benefits.

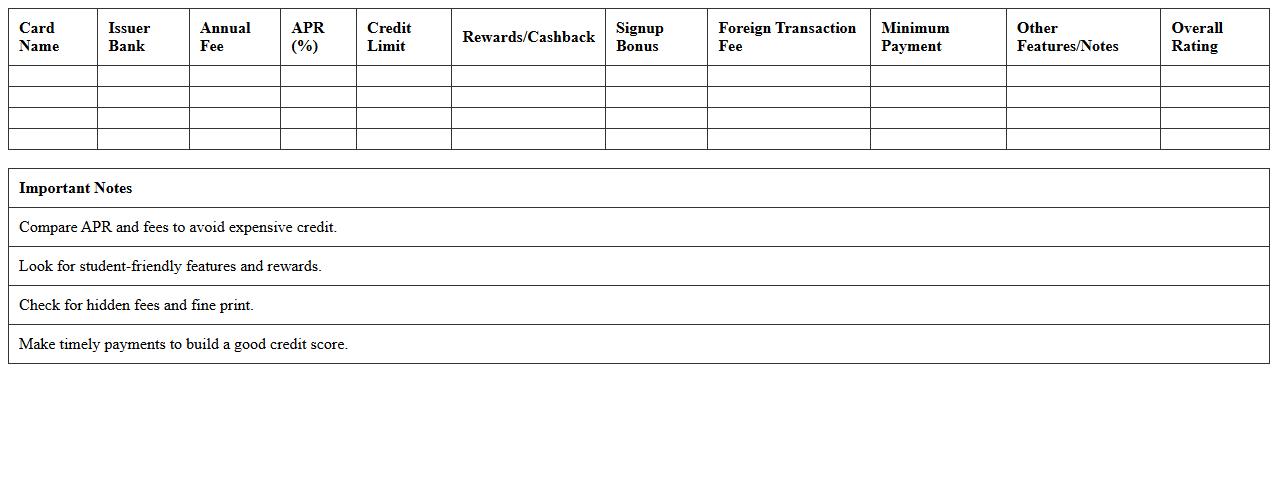

Student Credit Card Offer Evaluation Excel

The

Student Credit Card Offer Evaluation Excel document is a comprehensive tool designed to compare various student credit card offers based on interest rates, fees, rewards, and credit limits. It helps users make informed decisions by organizing and analyzing key features, ensuring that students select the most cost-effective and beneficial credit card. This document streamlines the evaluation process, saving time and enhancing financial literacy for students managing their first credit accounts.

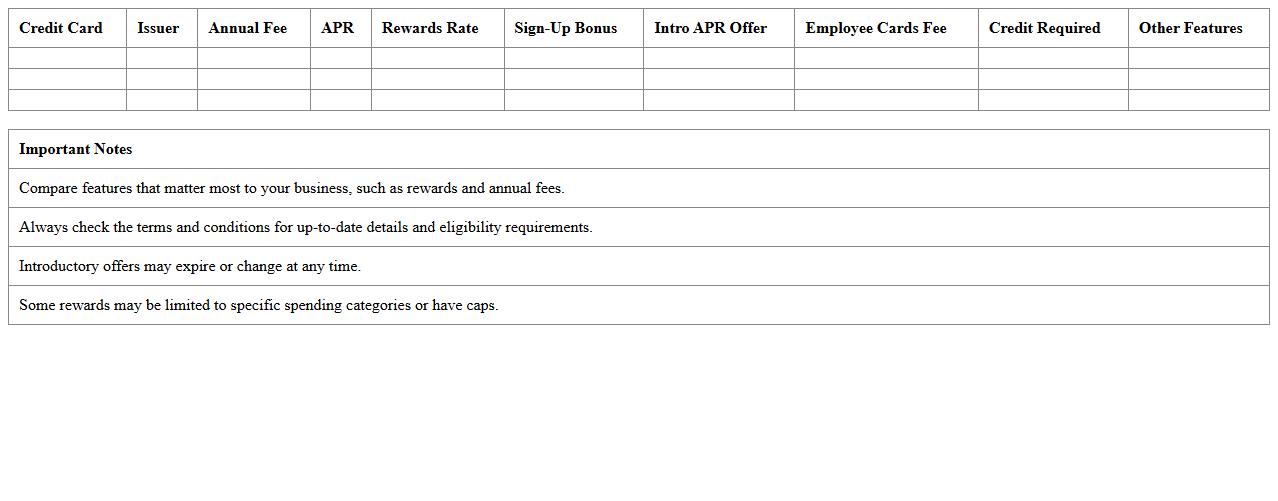

Small Business Credit Card Features Comparison Template

A

Small Business Credit Card Features Comparison Template is a structured document designed to systematically evaluate and contrast the key attributes of various small business credit cards, including interest rates, rewards programs, fees, and credit limits. This template enables business owners to make informed financial decisions by clearly highlighting the benefits and drawbacks of each card option tailored to their specific needs. Utilizing this comparison template enhances strategic financial planning, optimizes expense management, and helps maximize credit card benefits for small business growth.

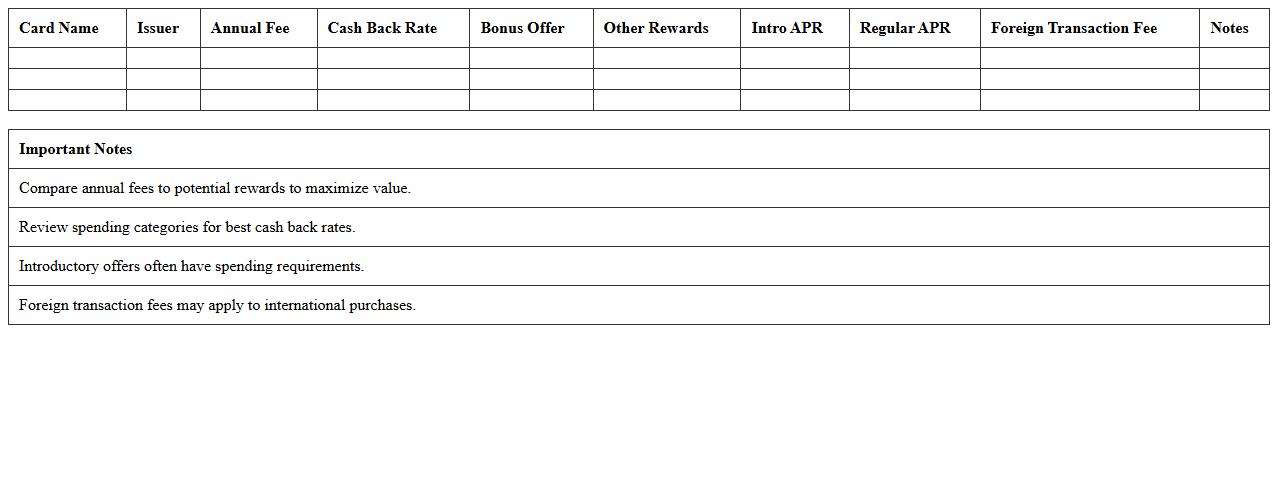

Cash Back Credit Card Comparison Excel

The

Cash Back Credit Card Comparison Excel document is a detailed spreadsheet designed to evaluate various cash back credit cards based on criteria such as reward rates, annual fees, and spending categories. It allows users to systematically compare benefits and costs, helping identify the card that offers the highest returns for their spending habits. This tool is valuable for maximizing financial rewards and making informed credit card choices without manually researching multiple options.

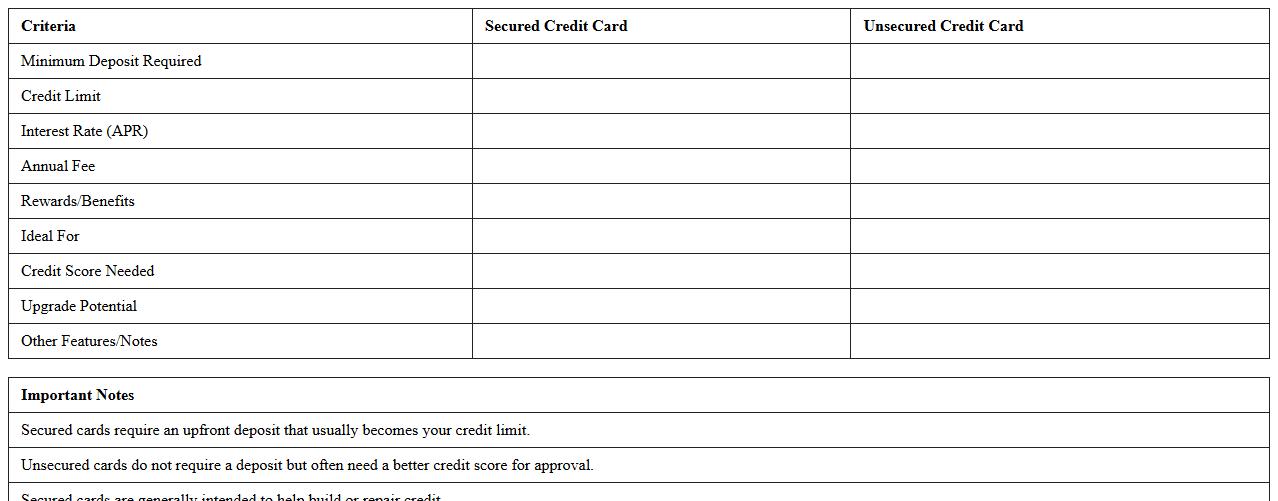

Secured vs. Unsecured Credit Card Analysis Sheet

A

Secured vs. Unsecured Credit Card Analysis Sheet is a detailed comparison tool that outlines the key features, benefits, and drawbacks of secured and unsecured credit cards. It helps users evaluate factors such as credit limits, interest rates, fees, and eligibility requirements to make informed financial decisions. By clearly presenting this information, the document aids in selecting the best credit card option based on individual credit profiles and financial goals.

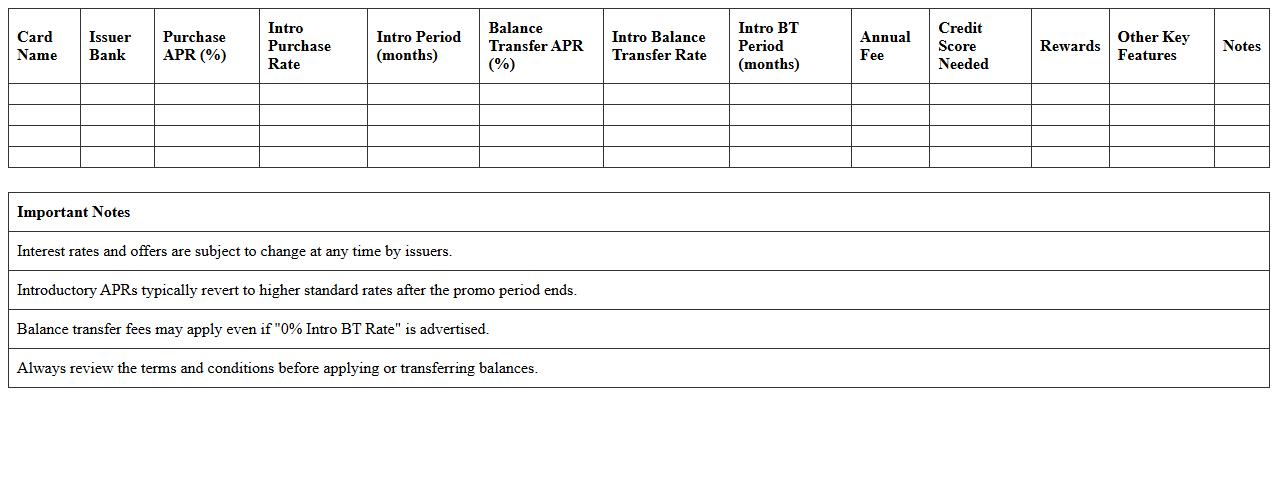

Balance Transfer Credit Card Comparison Template

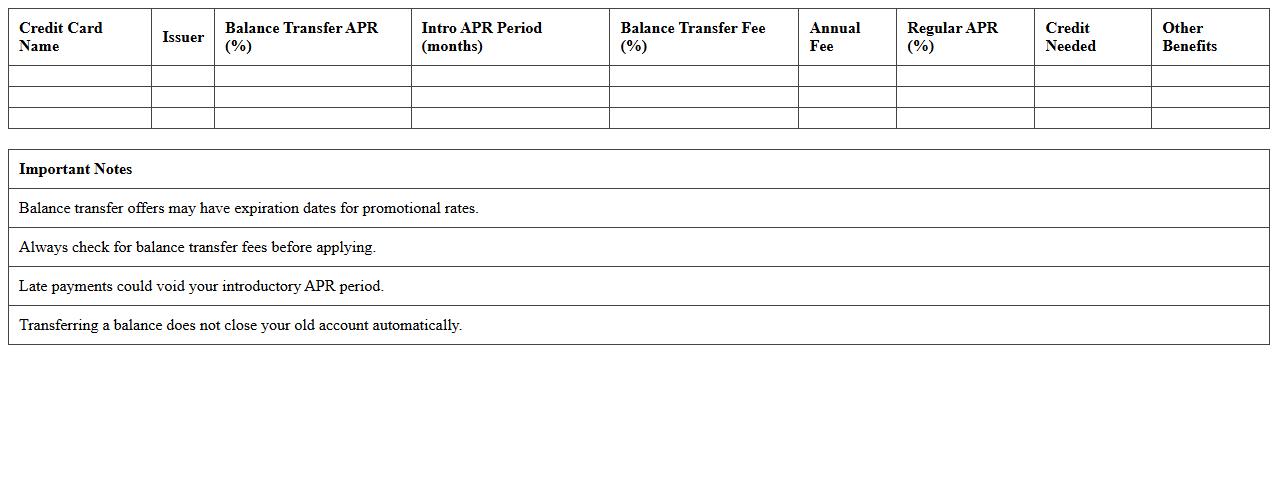

A

Balance Transfer Credit Card Comparison Template document serves as a structured tool to evaluate various credit card offers based on interest rates, fees, and promotional periods for transferring balances. This template helps users identify the most cost-effective options to minimize debt repayment costs and manage finances efficiently. By systematically comparing key features of different cards, it empowers consumers to make informed decisions tailored to their financial goals.

Credit Card Introductory APR Offer Comparison Spreadsheet

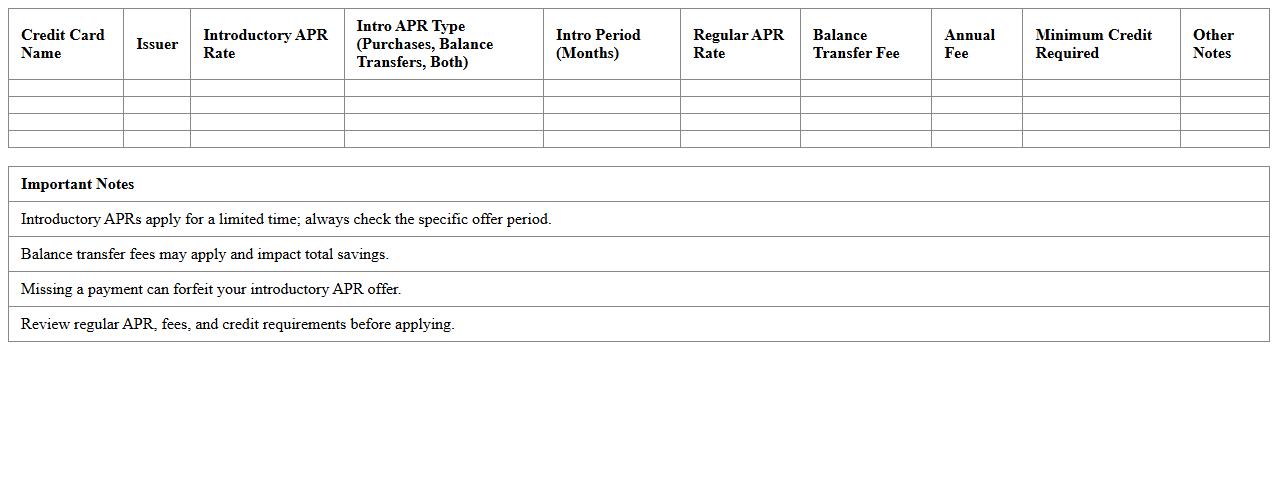

A

Credit Card Introductory APR Offer Comparison Spreadsheet is a tool designed to organize and compare the initial annual percentage rates (APR) offered by various credit cards, helping users identify the most cost-effective options during promotional periods. This spreadsheet typically includes essential data such as the length of the introductory period, the standard APR that follows, and any fees associated with the cards, enabling informed financial decisions. By systematically comparing these offers, individuals can minimize interest expenses and maximize credit card benefits based on their spending habits and repayment plans.

What advanced Excel formulas best compare APR rates in credit card offer spreadsheets?

INDEX-MATCH combined with MIN or MAX functions effectively identify the best APR rates in credit card offer spreadsheets. Using ARRAY FORMULAS enables comparison across multiple columns for different APR types, such as purchase, balance transfer, and cash advance rates. Leveraging IFERROR helps manage missing or inconsistent data for cleaner analysis results.

How can conditional formatting highlight no-annual-fee cards in a Credit Card Offer Comparison Excel?

Conditional formatting rules can be set to highlight cells containing "No Annual Fee" or "$0" in the annual fee column. Using a CUSTOM FORMULA like =ISNUMBER(SEARCH("no annual fee", A1)) applies visual cues such as background color or bold text. This makes it easier to quickly spot no-annual-fee cards without manually scanning the data.

Which Excel features enable dynamic cashback category rankings for finance blog readers?

PIVOT TABLES combined with slicers allow readers to filter and rank cashback categories dynamically. Using DYNAMIC ARRAYS like SORT and FILTER functions creates an auto-updating list of top cashback categories. Additionally, DATA VALIDATION improves interactivity by enabling readers to select specific spending categories.

How should balance transfer duration be visually represented in a credit card comparison sheet?

BARCHARTS or SPARKLINES within cells visually show balance transfer periods, making duration comparisons intuitive. Using conditional formatting color scales emphasizes longer or shorter durations at a glance. This method helps users quickly evaluate promotional transfer offers alongside other credit card features.

What template structure optimizes SEO for downloadable credit card comparison Excel files?

The template should include CLEAR, KEYWORD-RICH HEADINGS that match common search queries related to credit cards and APR. Incorporating ALT TEXT for embedded charts and detailed metadata enhances file discoverability. Embedding a user-friendly SUMMARY sheet with explanatory notes further boosts SEO by adding valuable content for indexing.

More Comparison Excel Templates