The Investment Portfolio Comparison Excel Template for Stock Traders offers a comprehensive tool to analyze and compare multiple stock portfolios efficiently. It features customizable metrics, visual charts, and real-time data integration to help traders make informed decisions. This template streamlines portfolio management by providing clear insights into performance, risk, and diversification.

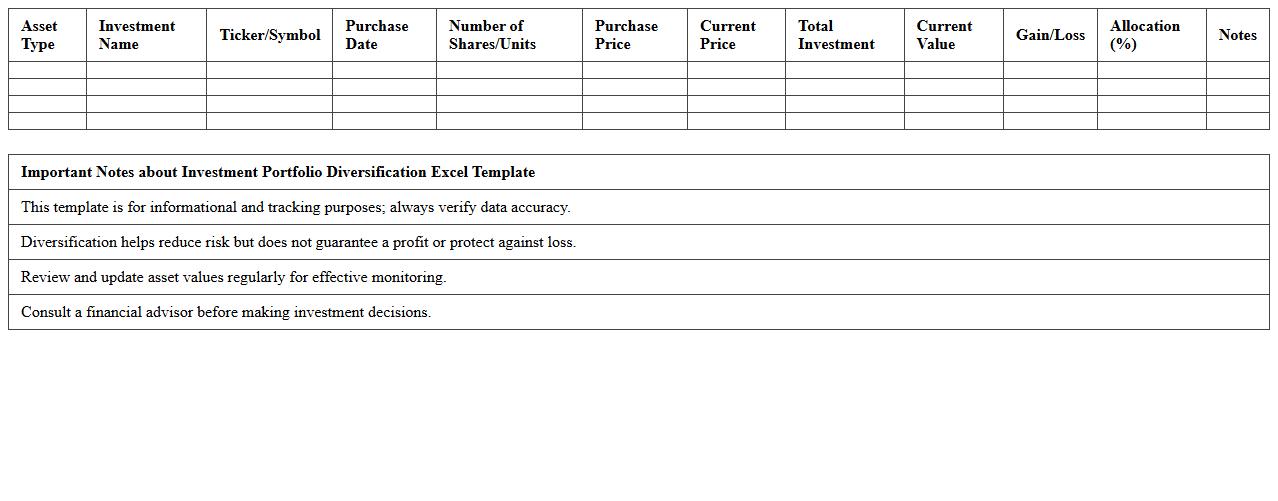

Investment Portfolio Diversification Excel Template

An

Investment Portfolio Diversification Excel Template is a structured spreadsheet designed to help investors allocate assets across various investment options to minimize risk and maximize returns. It provides detailed visualizations and automated calculations that track the distribution of stocks, bonds, and other securities, enabling users to balance their portfolios effectively. This tool simplifies complex portfolio management tasks, ensuring informed decision-making and enhancing financial planning efficiency.

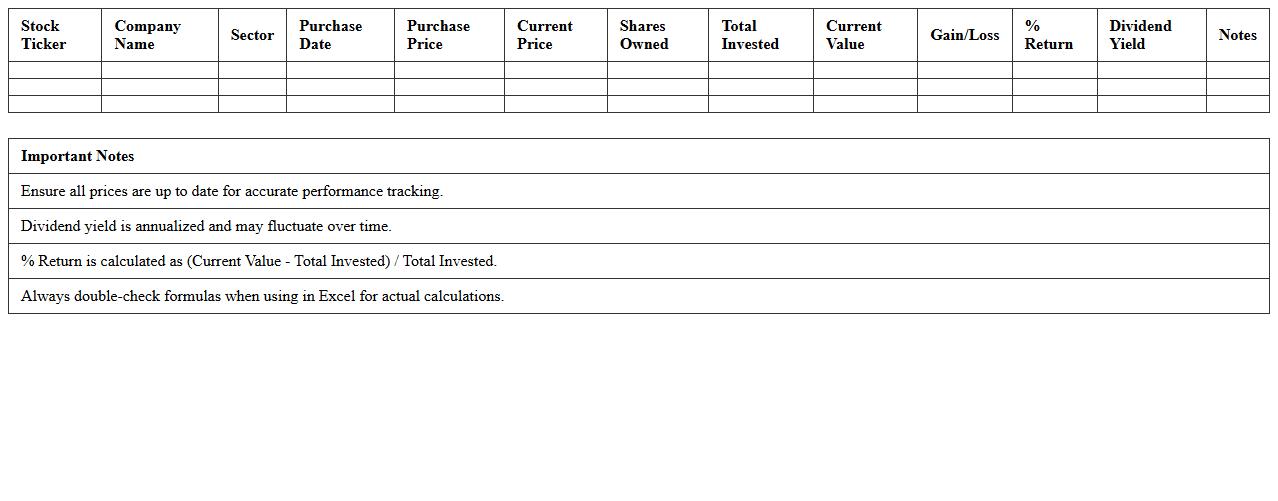

Stock Performance Comparison Spreadsheet

A

Stock Performance Comparison Spreadsheet is a document designed to track and analyze the historical and current performance of various stocks side by side. It allows investors to evaluate metrics such as price changes, dividend yields, and market trends, facilitating informed decision-making. By presenting data in an organized format, this tool helps identify the best-performing stocks and optimize portfolio management strategies.

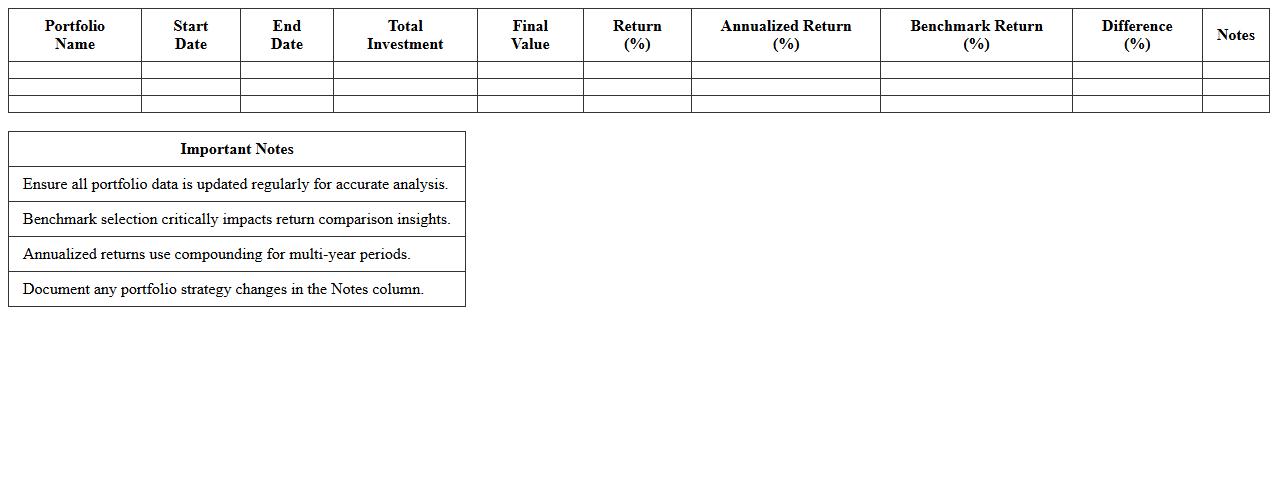

Multi-Portfolio Returns Analysis Template

The

Multi-Portfolio Returns Analysis Template is a comprehensive document designed to evaluate and compare the performance of multiple investment portfolios simultaneously. It streamlines data consolidation, enabling investors and financial analysts to identify trends, measure risk-adjusted returns, and optimize asset allocation across diverse portfolios. This template enhances decision-making by providing clear insights into portfolio efficiency and helping to maximize overall investment returns.

Equity Holdings Side-by-Side Tracker

The

Equity Holdings Side-by-Side Tracker document is a comprehensive tool that allows investors and portfolio managers to compare multiple equity holdings simultaneously. It provides detailed data such as purchase price, current market value, percentage gains or losses, and dividend yields, enabling better investment decisions. This document is essential for monitoring portfolio performance, identifying diversification opportunities, and ensuring alignment with investment goals.

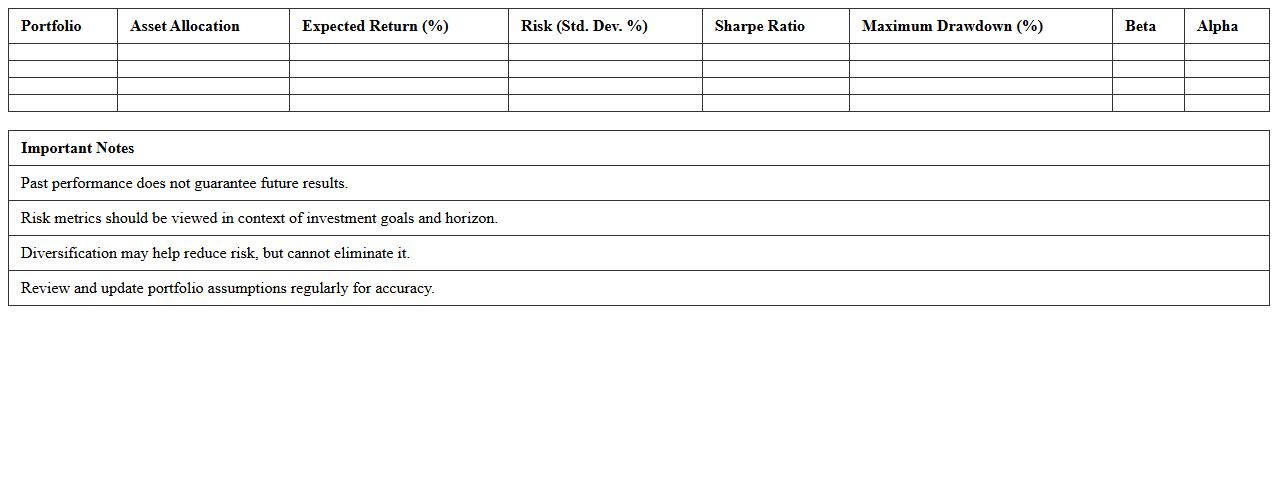

Portfolio Risk vs Reward Comparison Sheet

A

Portfolio Risk vs Reward Comparison Sheet document systematically evaluates the potential returns of various investment options against their associated risks, helping investors make informed decisions. It presents quantitative metrics such as expected return, volatility, and Sharpe ratio in a clear and concise format for easy comparison. This tool is essential for optimizing asset allocation, balancing risk tolerance, and maximizing overall portfolio performance.

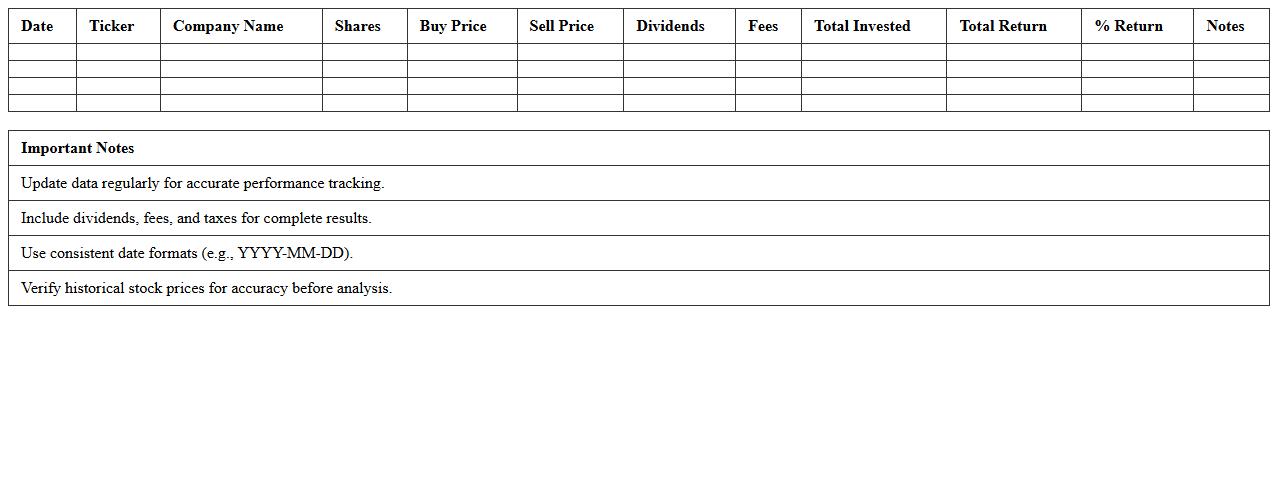

Historical Stock Portfolio Performance Template

A

Historical Stock Portfolio Performance Template document systematically tracks and analyzes past investment returns, helping investors evaluate the effectiveness of their stock selections over time. This template typically includes metrics such as historical prices, dividend yields, and portfolio growth percentages, enabling users to identify trends and make data-driven decisions. By providing a clear overview of portfolio performance, it enhances risk management and supports strategic planning for future investments.

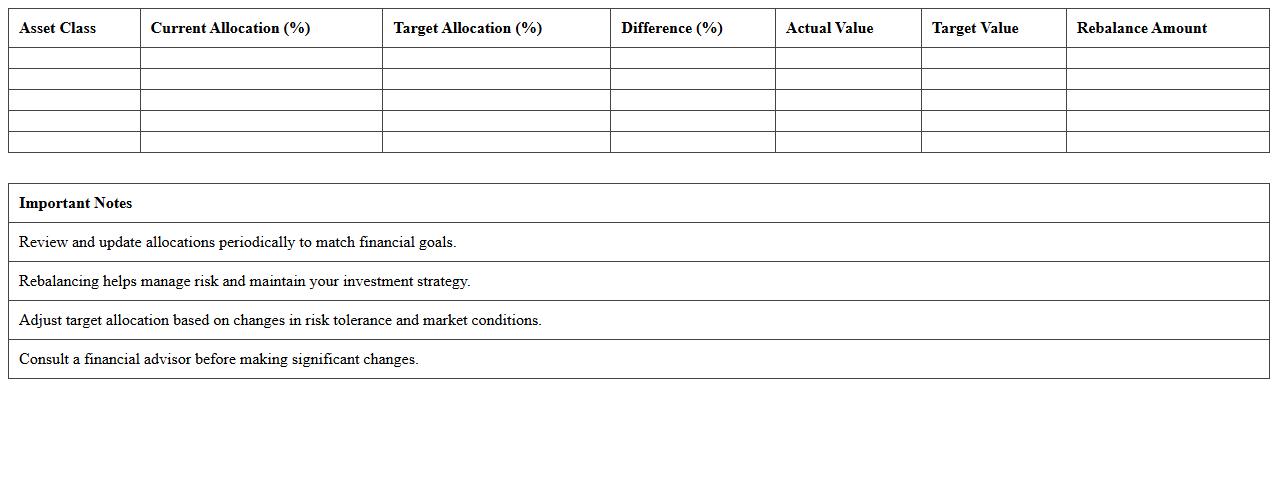

Asset Allocation Comparison Excel Sheet

An

Asset Allocation Comparison Excel Sheet is a structured spreadsheet tool designed to analyze and compare different investment portfolio allocations across various asset classes such as stocks, bonds, and cash. It enables investors to visualize diversification, assess risk levels, and optimize portfolio performance by identifying the best allocation strategy tailored to financial goals. This document is essential for making informed investment decisions, tracking portfolio changes over time, and ensuring alignment with desired risk tolerance and return expectations.

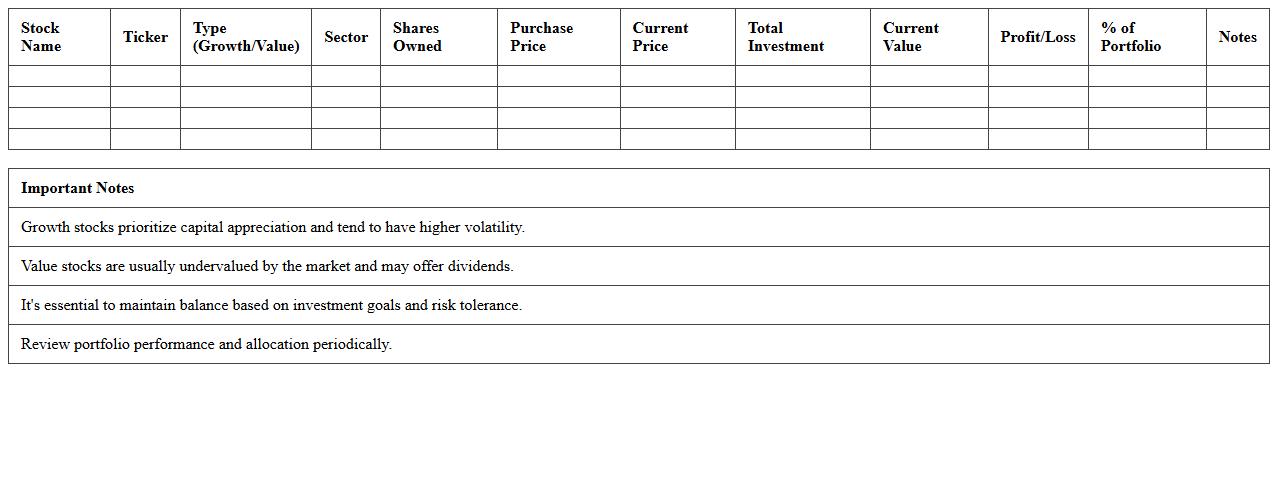

Growth vs Value Stocks Portfolio Template

The

Growth vs Value Stocks Portfolio Template document is a strategic tool designed to help investors analyze and balance their investments between growth stocks, which typically exhibit higher potential returns with greater risk, and value stocks, known for their stability and undervalued price points. This template facilitates the comparison of key financial metrics such as P/E ratios, dividend yields, and earnings growth, enabling users to make informed decisions tailored to their risk tolerance and investment goals. By organizing data effectively, it enhances portfolio diversification and supports long-term wealth management strategies.

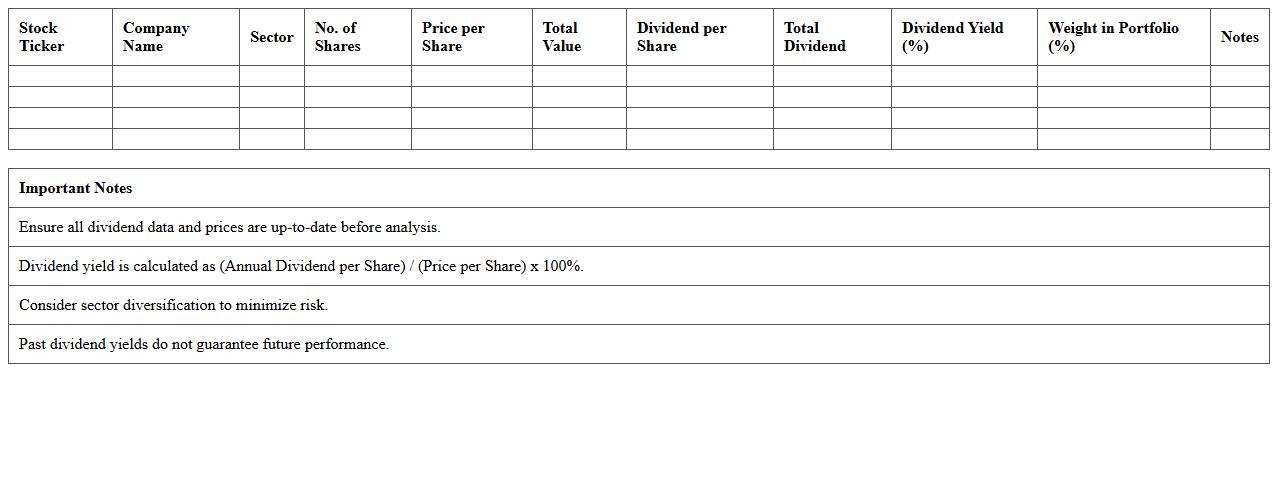

Dividend Yield Portfolio Comparison Spreadsheet

A

Dividend Yield Portfolio Comparison Spreadsheet document enables investors to analyze and compare the dividend yields of multiple stocks within their portfolio, helping to identify the most profitable income-generating assets. It consolidates key data such as dividend percentages, payout frequencies, and stock prices, allowing for easy tracking and informed decision-making. This tool is valuable for optimizing portfolio income, managing risk, and enhancing long-term financial growth.

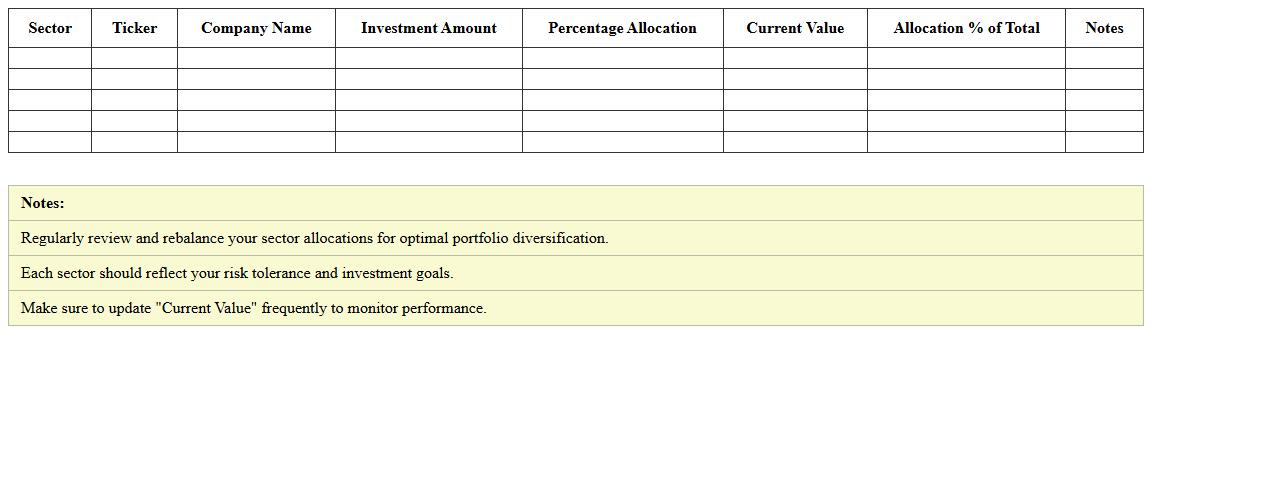

Sector Allocation Investment Portfolio Matrix

The

Sector Allocation Investment Portfolio Matrix is a strategic tool that categorizes investments across various economic sectors to optimize diversification and risk management. By visually mapping the weight and performance of different sectors in a portfolio, it helps investors identify over- or under-exposure and adjust their holdings accordingly. This matrix enhances decision-making by providing clear insights into sector trends, correlations, and potential growth opportunities.

What advanced Excel formulas optimize stock performance comparison in investment portfolios?

To compare stock performance effectively, use formulas like INDEX MATCH to dynamically retrieve data. The XIRR function calculates the internal rate of return for irregular cash flows, providing precise ROI measurement. Combining ARRAYFORMULAS with FILTER enhances dynamic portfolio comparisons across multiple stocks and dates.

How can you automate real-time stock data updates in Excel portfolio worksheets?

Excel's Data Types feature connects to live stock prices for automatic updates. Using Power Query allows you to import and refresh real-time data from web sources or APIs seamlessly. Additionally, leveraging VBA macros can automate scheduled refreshes, ensuring your portfolio data stays current without manual intervention.

Which visualization charts best highlight portfolio sector weightings in Excel?

Pie charts provide a clear, concise view of sector weight distributions within a portfolio. Treemap charts offer a hierarchical display that effectively showcases the relative sizes of sectors and sub-sectors. For trend analysis, stacked bar charts allow visualization of sector weight changes over time, aiding in strategic decisions.

How do you use conditional formatting to flag underperforming assets in Excel?

Apply conditional formatting rules based on thresholds like negative returns or prices below target values. Using color scales instantly visualizes performance gradients, highlighting assets that need attention. Additionally, setting icon sets (e.g., arrows or warning signs) allows quick identification of underperforming stocks in your portfolio.

What Excel plugins integrate with broker APIs for direct portfolio imports?

Plugins like XLQ connect Excel directly to broker accounts, pulling live portfolio data and transactions. Quandl offers comprehensive financial data integration, accessible through Excel add-ins tailored for investment analysis. Furthermore, Data Stream and Bloomberg Excel Add-In support real-time data synchronization with brokerage APIs for enhanced reporting.

More Comparison Excel Templates