The Loan Offer Comparison Excel Template for First-Time Borrowers simplifies evaluating multiple loan options by organizing interest rates, repayment terms, and fees in one place. This tool helps users make informed decisions by clearly displaying the total cost and monthly payments for each loan offer. Designed for ease of use, it empowers first-time borrowers to confidently choose the best loan suited to their financial needs.

Personal Loan Offer Comparison Spreadsheet for New Borrowers

A

Personal Loan Offer Comparison Spreadsheet for new borrowers is a detailed tool that consolidates various loan options, including interest rates, repayment terms, fees, and lender details into an easy-to-read format. It enables borrowers to systematically compare and evaluate multiple loan offers, helping them identify the most affordable and suitable loan based on their financial situation. This document aids in making informed borrowing decisions by highlighting key loan features and minimizing the risk of hidden costs or unfavorable terms.

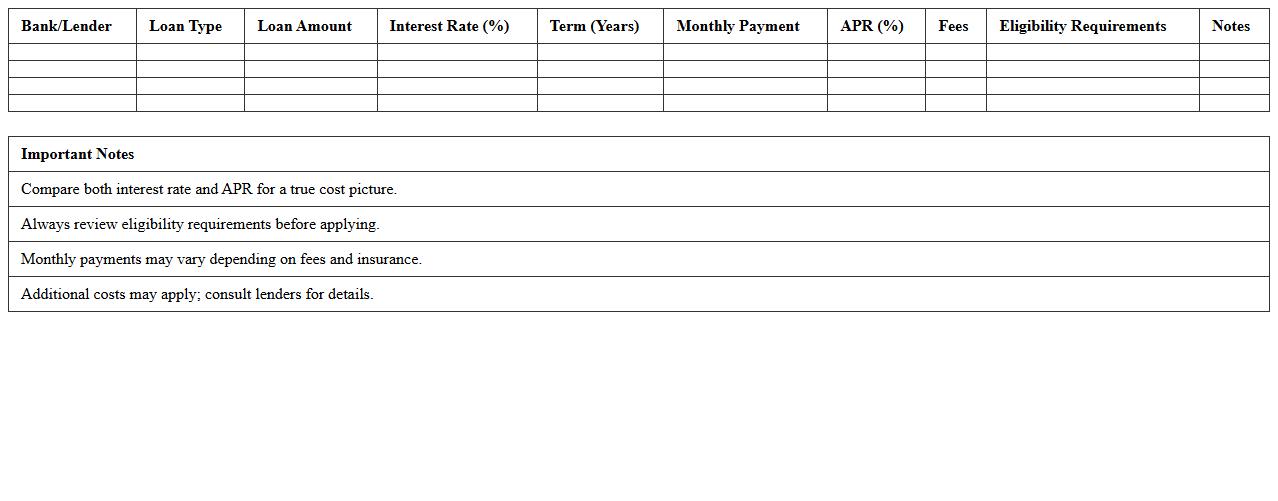

First-Time Borrower Loan Rate Comparison Excel Sheet

The

First-Time Borrower Loan Rate Comparison Excel Sheet is a comprehensive tool designed to systematically compare various loan options available to new borrowers by compiling interest rates, loan terms, fees, and repayment schedules in one place. This document enables users to quickly identify the most cost-effective and suitable loan offers, facilitating informed financial decisions and improving loan affordability. By organizing and analyzing multiple loan products side by side, it reduces the risk of overlooking important loan details and helps optimize borrowing strategies.

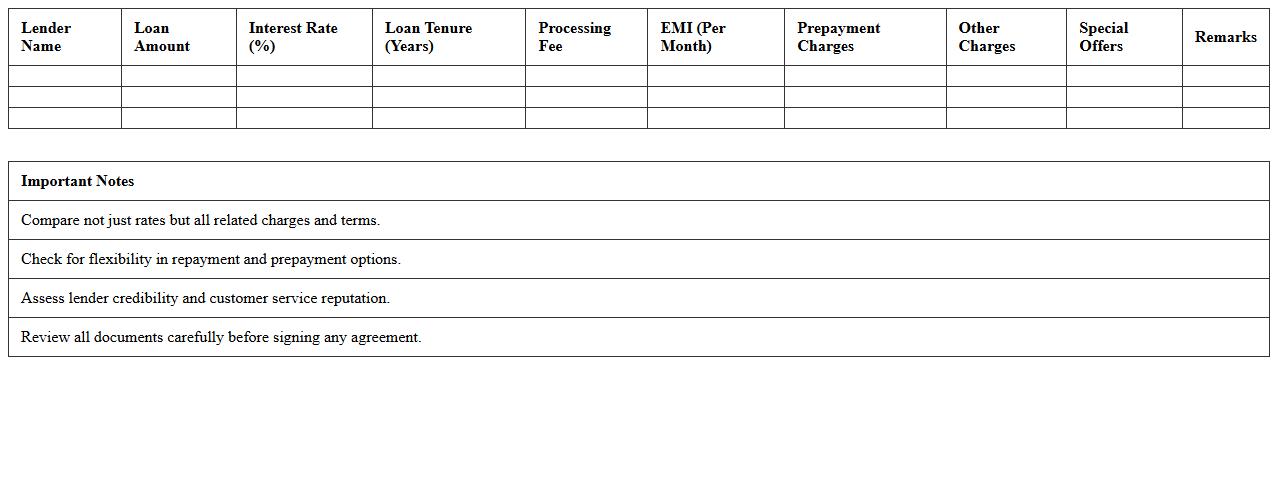

Home Loan Offer Analysis Template for Beginners

The

Home Loan Offer Analysis Template for beginners is a structured document designed to compare and evaluate various loan options based on interest rates, tenure, EMI amounts, and processing fees. It simplifies complex financial details, enabling users to make well-informed decisions when selecting the most cost-effective and suitable home loan product. By providing a clear comparison framework, it helps reduce confusion and ensures a transparent understanding of loan terms and benefits.

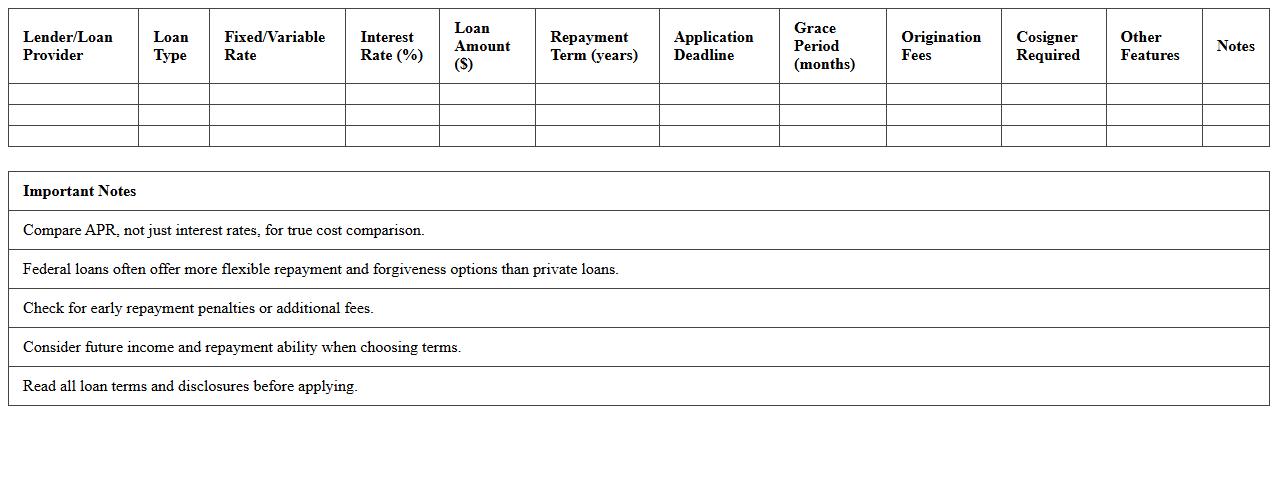

Student Loan Comparison Table for First-Time Applicants

The

Student Loan Comparison Table for First-Time Applicants is a detailed resource that outlines various loan options, interest rates, repayment terms, and eligibility criteria in a clear, structured format. It helps prospective borrowers quickly evaluate and contrast different financial products, enabling informed decisions based on cost, benefits, and conditions suited to their unique needs. By simplifying complex loan information, the table reduces confusion and empowers students to select the most advantageous funding option for their education.

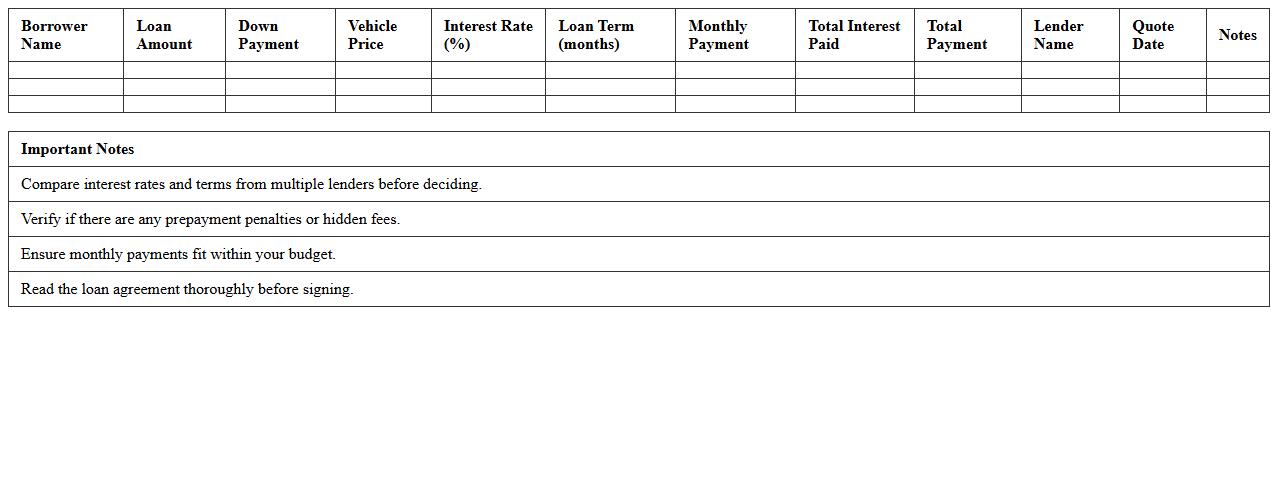

Auto Loan Quote Evaluation Spreadsheet for New Borrowers

The

Auto Loan Quote Evaluation Spreadsheet for new borrowers is a comprehensive tool designed to compare multiple loan offers by analyzing interest rates, loan terms, monthly payments, and total costs. It helps borrowers make informed decisions by clearly outlining the financial impact of each loan option, ensuring transparency and better budgeting. This document is essential for simplifying the complex evaluation process, saving time, and helping users select the most cost-effective and suitable auto loan.

Mortgage Loan Offer Tracker for First-Time Buyers

The

Mortgage Loan Offer Tracker for First-Time Buyers document helps organize and compare different mortgage offers by recording interest rates, loan terms, monthly payments, and lender conditions in one place. It enables first-time buyers to make informed decisions by clearly displaying the advantages and disadvantages of each offer. This tool simplifies the mortgage selection process, reducing confusion and ensuring better financial planning.

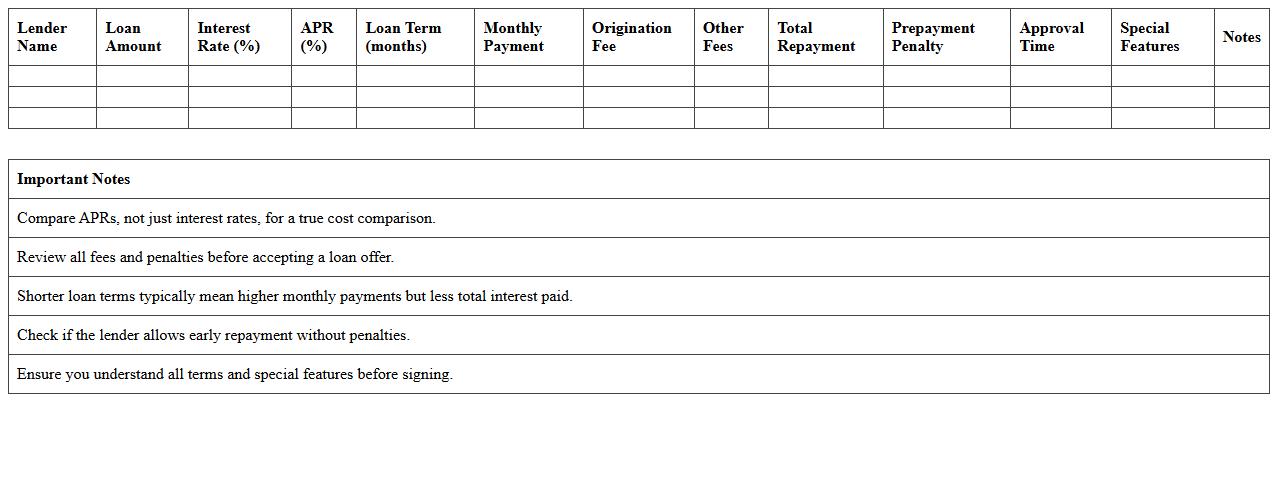

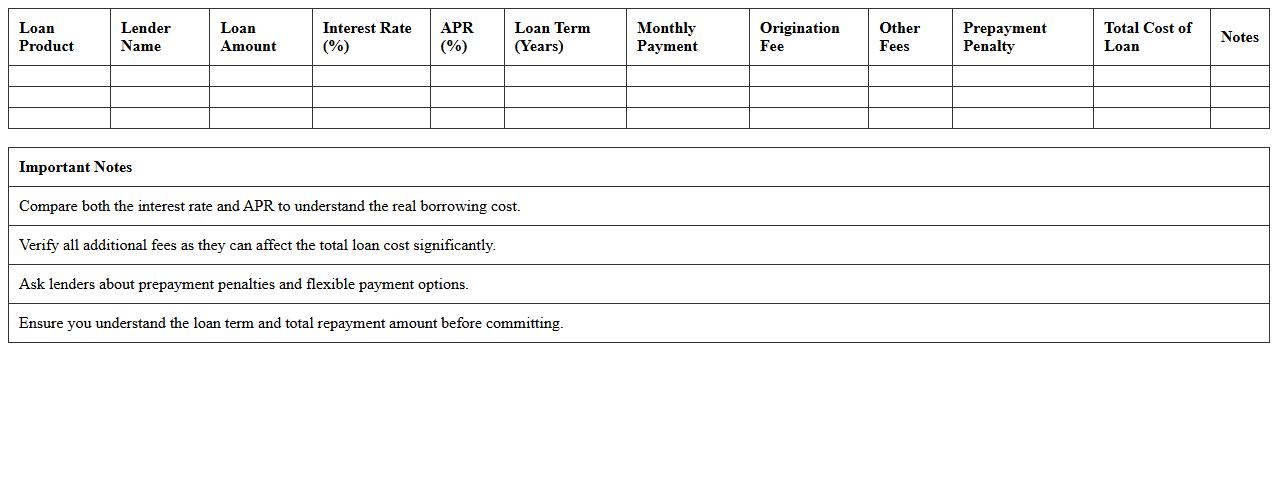

Loan Terms & Fees Comparison Sheet for First-Time Borrowers

The

Loan Terms & Fees Comparison Sheet for First-Time Borrowers is a detailed document that outlines various loan offers, highlighting interest rates, repayment schedules, origination fees, and other associated costs. This sheet allows borrowers to directly compare key loan features, ensuring they select the most cost-effective and suitable financing option. By providing clear and organized data, it empowers first-time borrowers to make informed decisions and avoid hidden fees or unfavorable terms.

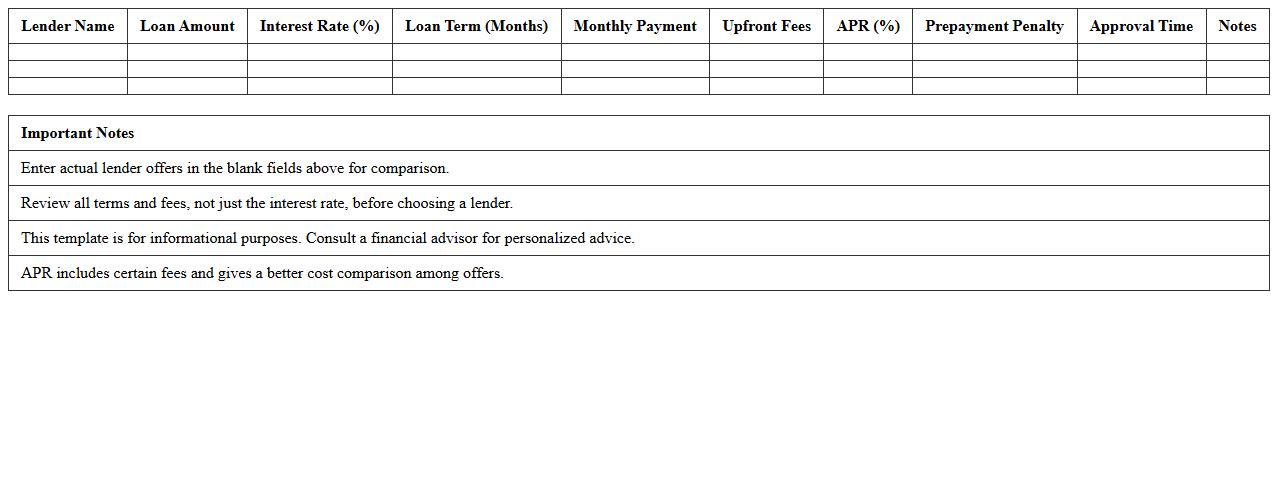

Side-by-Side Lender Offer Excel Template for New Loan Applicants

The

Side-by-Side Lender Offer Excel Template for new loan applicants is a powerful tool designed to compare multiple loan offers simultaneously, highlighting key terms such as interest rates, repayment periods, fees, and total costs. This template streamlines decision-making by presenting all critical financial data in a clear, organized format, enabling applicants to evaluate the best loan option based on accurate side-by-side comparisons. It saves time, reduces errors, and increases transparency when selecting the most advantageous loan offer.

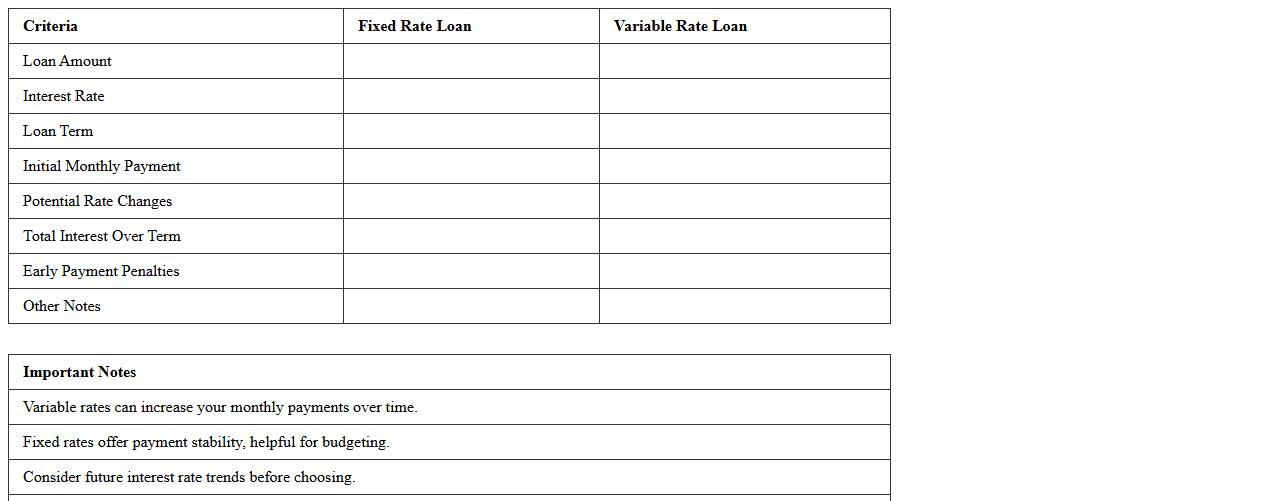

Fixed vs Variable Loan Rate Comparison Sheet for First-Time Borrowers

A

Fixed vs Variable Loan Rate Comparison Sheet for first-time borrowers clearly outlines the differences between fixed and variable interest rates, helping users understand the cost implications and payment stability over time. This document enables borrowers to make informed decisions by comparing monthly repayments, total interest paid, and potential risks associated with fluctuating rates. By using this comparison sheet, individuals can select a loan type that best aligns with their financial goals and risk tolerance.

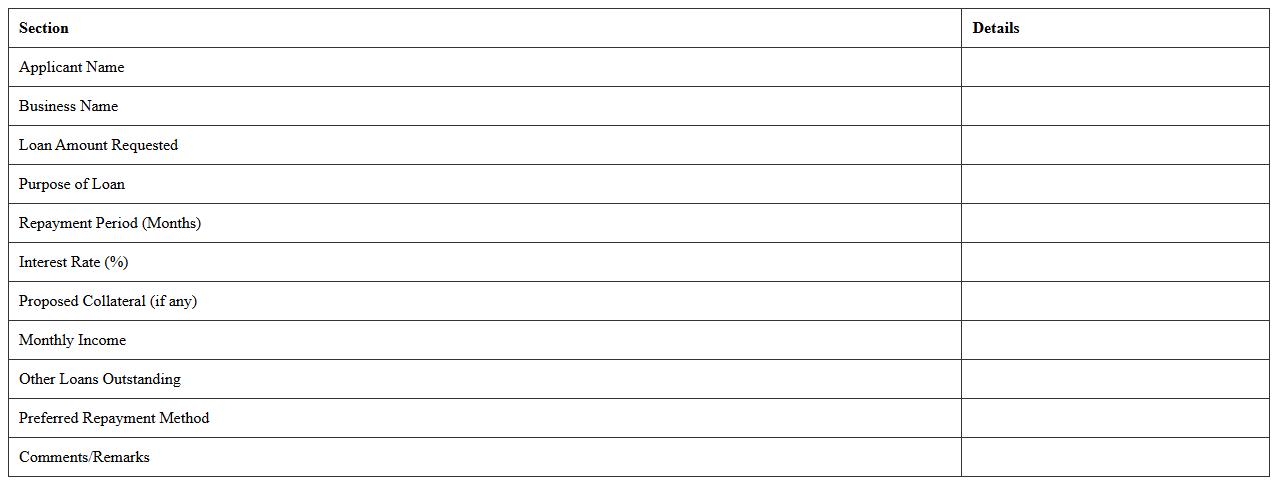

Loan Proposal Summary Excel for First-Time Loan Seekers

The

Loan Proposal Summary Excel for first-time loan seekers is a comprehensive tool designed to organize and present key financial information and loan details clearly. It helps users consolidate income, expenses, loan requirements, and repayment plans into an easy-to-understand format that improves communication with lenders. This document enhances the loan application process by providing a structured summary that supports informed decision-making and increases approval chances.

What key formulas can automate interest rate comparisons in the Loan Offer Comparison Excel sheet?

To automate interest rate comparisons, use the RATE function to calculate the effective interest rate for each loan. The PMT function helps determine monthly payments based on different loan terms and interest rates. Combining IF and conditional formulas can highlight the best rates dynamically.

How can first-time borrowers highlight loan terms with conditional formatting in Excel?

First-time borrowers can utilize conditional formatting to emphasize important loan terms such as interest rates above a certain threshold or longer payment durations. Setting rules that flag high fees or less favorable terms makes it easier to spot unfavorable offers. Color scales and icon sets enhance visual clarity for quick decision-making.

Which columns are essential for tracking hidden fees in loan offers?

Essential columns for tracking hidden fees include Origination Fee, Prepayment Penalty, Late Payment Fee, and Other Charges. Adding a Total Fees column sums these fees to give a clear cost overview. This transparency prevents surprises and aids in comprehensive loan cost comparison.

What Excel chart best visualizes monthly payment differences across lenders?

A clustered column chart is ideal for visualizing monthly payment differences across multiple lenders. This chart format clearly compares payment amounts side by side, making it easy to identify the most affordable option. Pairing the chart with data labels improves readability.

How to customize the Loan Offer Comparison Excel template for variable-rate loans?

Customize the template by adding columns for initial rate, adjustment frequency, and caps when analyzing variable-rate loans. Use formulas to project future rates based on the index plus margin, incorporating potential rate increases. This approach provides a realistic estimate of loan costs over time.

More Comparison Excel Templates