The Investment Option Comparison Excel Template for Financial Advisors is a powerful tool designed to streamline the analysis of multiple investment opportunities. It enables advisors to input, compare, and evaluate key financial metrics such as returns, risks, and fees in a clear, organized format. This template enhances decision-making efficiency by providing customizable charts and summary reports tailored to client needs.

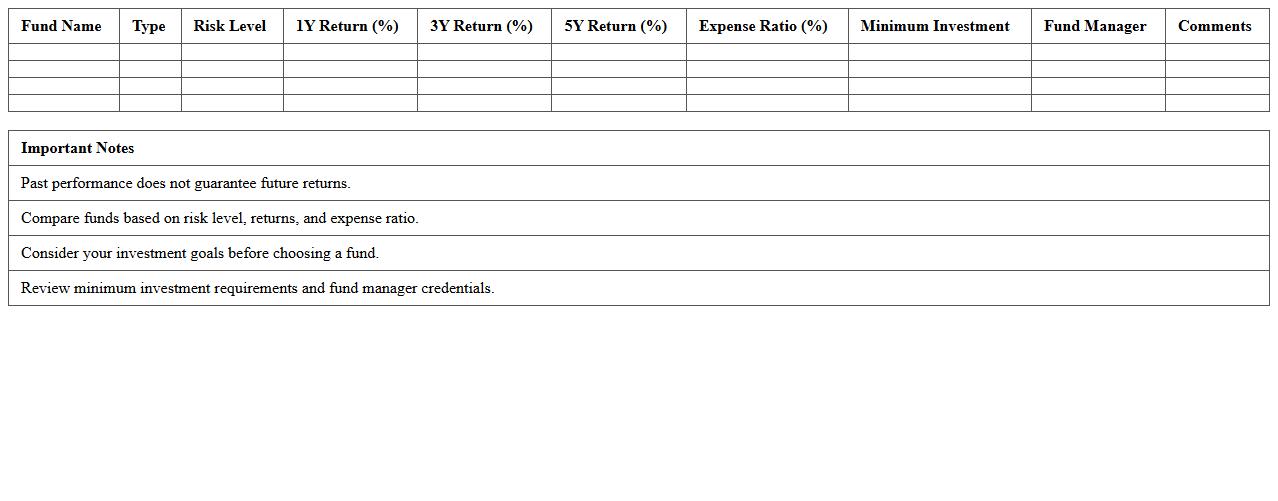

Mutual Fund Investment Comparison Excel Template

The

Mutual Fund Investment Comparison Excel Template is a powerful tool designed to analyze and compare multiple mutual fund options based on key performance metrics such as returns, risk, expense ratios, and historical data. This document enables investors to make informed decisions by visualizing and contrasting fund characteristics in a clear, organized manner, simplifying complex data evaluation processes. Utilizing this template helps optimize investment portfolios by identifying funds that align with specific financial goals and risk tolerance.

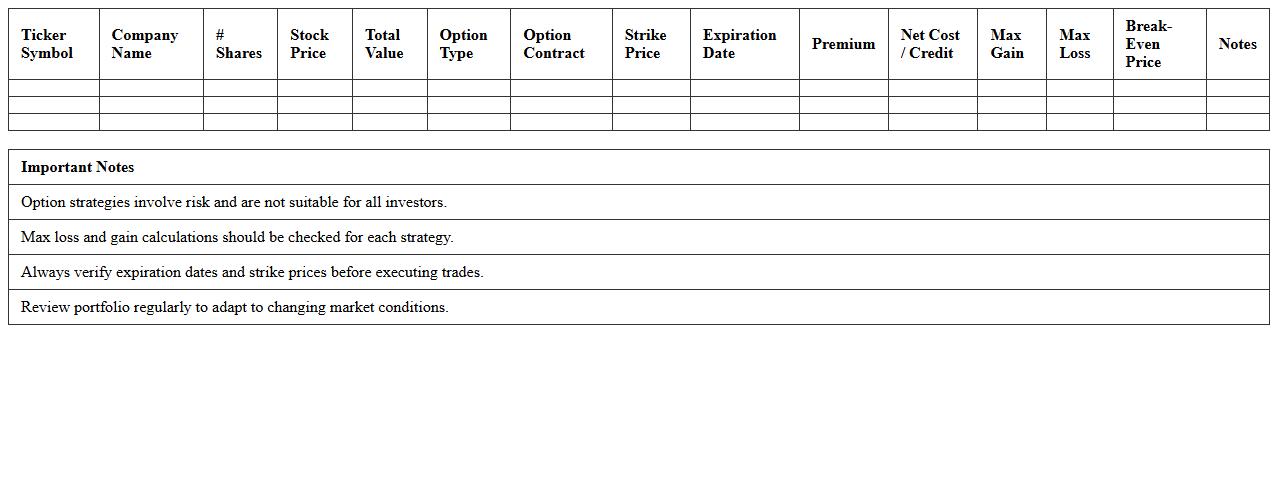

Stock Portfolio Option Analysis Spreadsheet

A

Stock Portfolio Option Analysis Spreadsheet is a comprehensive tool designed to track, analyze, and optimize options trading within a stock portfolio. It helps investors evaluate potential risks and rewards by calculating metrics such as delta, gamma, theta, and implied volatility for each option position. This spreadsheet enables informed decision-making by providing clear visuals and real-time updates, maximizing investment returns while minimizing exposure to market fluctuations.

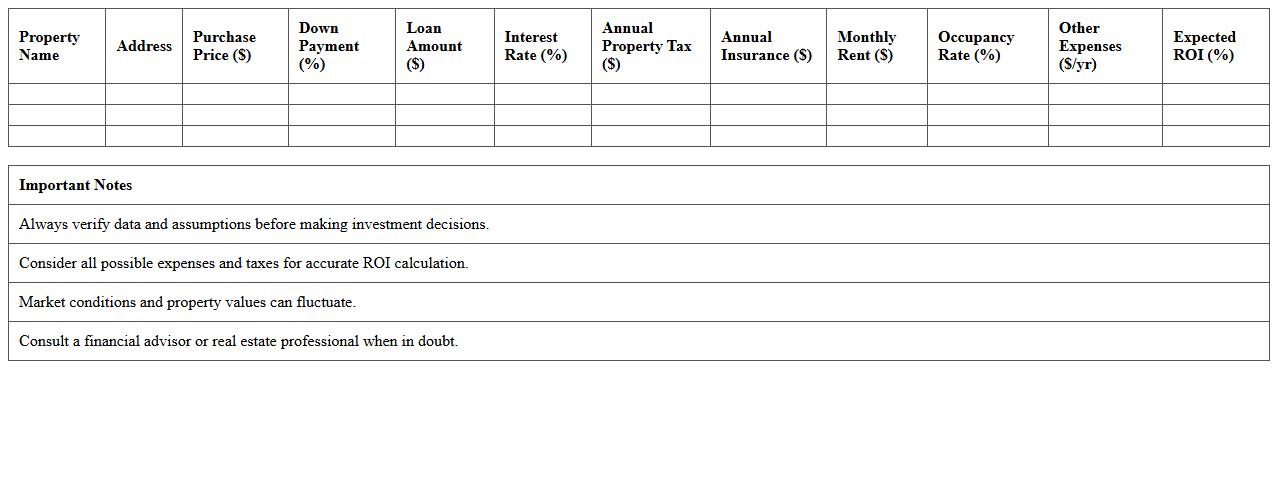

Real Estate Investment Comparison Excel Template

A

Real Estate Investment Comparison Excel Template is a powerful tool designed to analyze and compare multiple property investment options by organizing key financial metrics such as purchase price, rental income, expenses, and ROI. It helps investors make informed decisions by providing a clear visual representation of cash flow projections, capitalization rates, and net present value across different investments. Using this template simplifies complex calculations, enables side-by-side property comparisons, and enhances strategic planning for maximizing real estate portfolio returns.

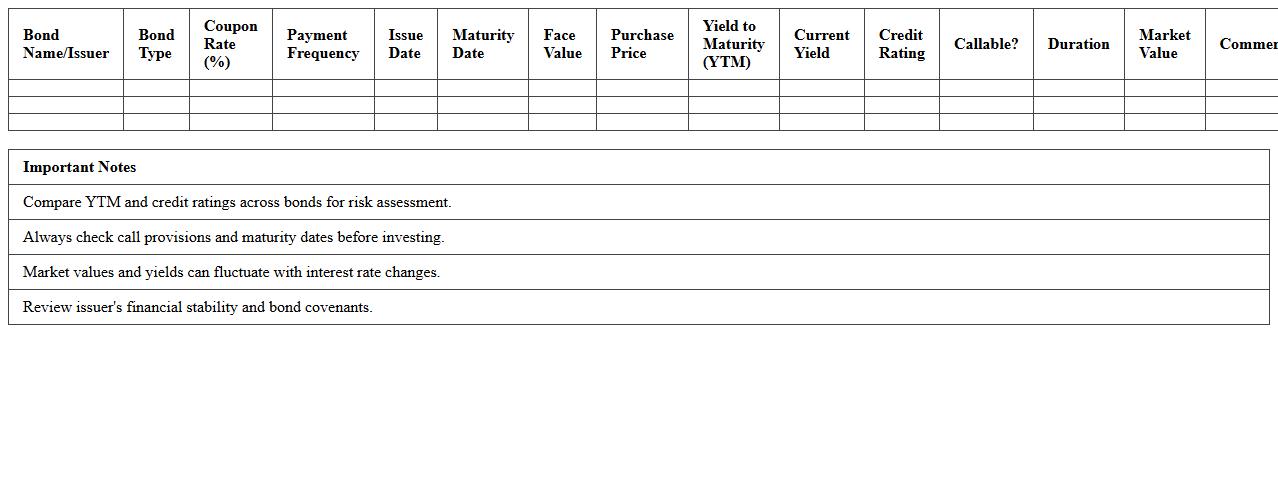

Bond Investment Analysis and Comparison Sheet

A

Bond Investment Analysis and Comparison Sheet is a detailed document that organizes key financial metrics and performance indicators of various bonds, such as yield, maturity, credit rating, and coupon rate. This tool enables investors to systematically evaluate and contrast multiple bond options, facilitating informed decision-making based on risk, return, and investment goals. By providing clear, comparable data, it enhances portfolio management and helps optimize fixed-income investment strategies.

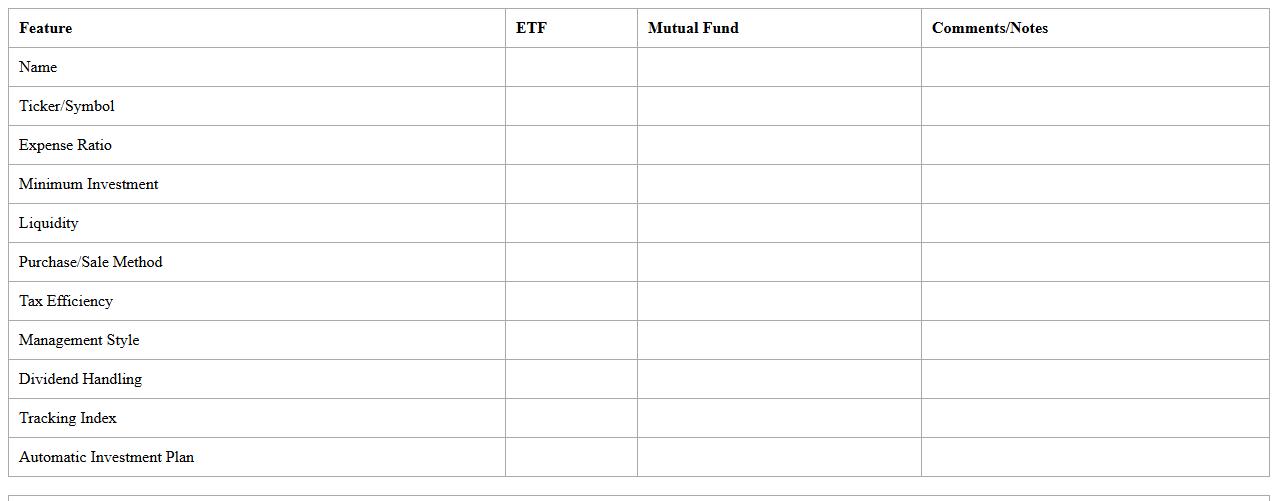

ETF vs Mutual Fund Comparison Excel Template

The

ETF vs Mutual Fund Comparison Excel Template is a structured document designed to analyze and compare key financial metrics, performance, fees, and investment strategies of ETFs and mutual funds side by side. This template helps investors make informed decisions by clearly presenting data such as expense ratios, historical returns, liquidity, and risk factors in an organized format. Using this comparison tool enhances portfolio management efficiency and supports strategic asset allocation aligned with individual investment goals.

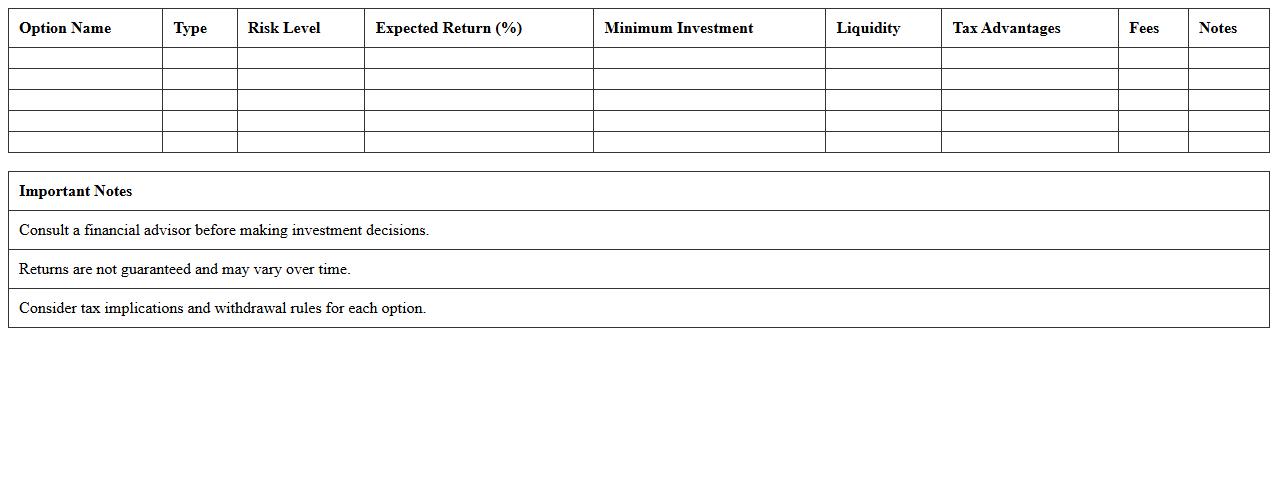

Retirement Investment Options Comparison Spreadsheet

A

Retirement Investment Options Comparison Spreadsheet is a systematic tool designed to evaluate and contrast different retirement investment vehicles such as 401(k)s, IRAs, annuities, and mutual funds. By organizing key factors like risk levels, expected returns, fees, and tax implications in one place, it helps investors make informed decisions tailored to their financial goals and timelines. This spreadsheet is instrumental in optimizing retirement portfolios by simplifying complex data, enhancing clarity, and promoting strategic investment choices.

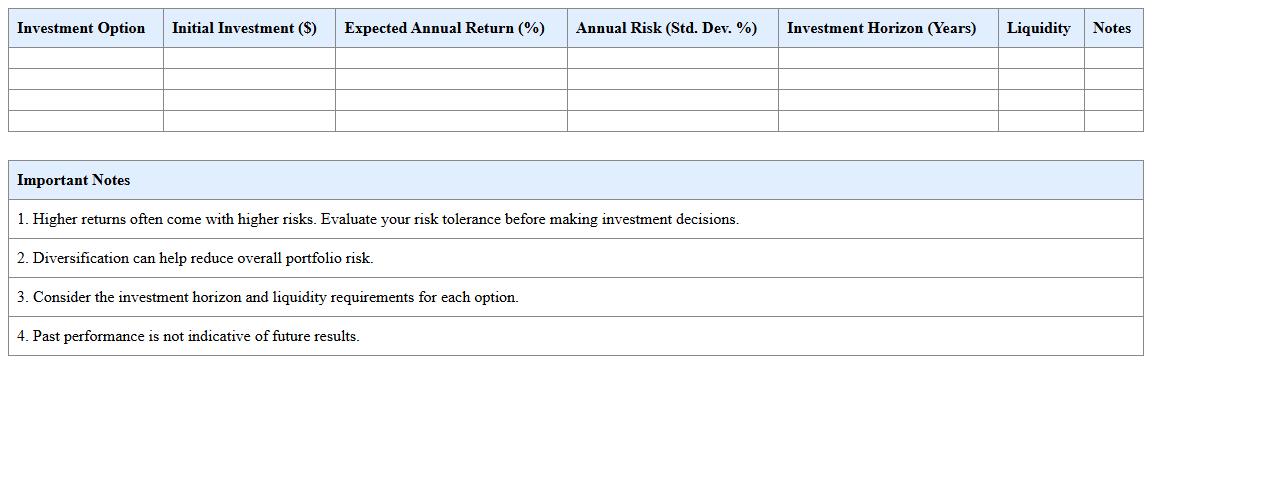

Risk-Return Investment Option Analysis Workbook

The

Risk-Return Investment Option Analysis Workbook is a comprehensive document designed to evaluate various investment options by analyzing their potential risks and expected returns. It helps investors make informed decisions by systematically comparing the performance metrics and volatility of different assets. This workbook is useful for optimizing portfolio allocation, balancing risk tolerance, and maximizing investment outcomes over time.

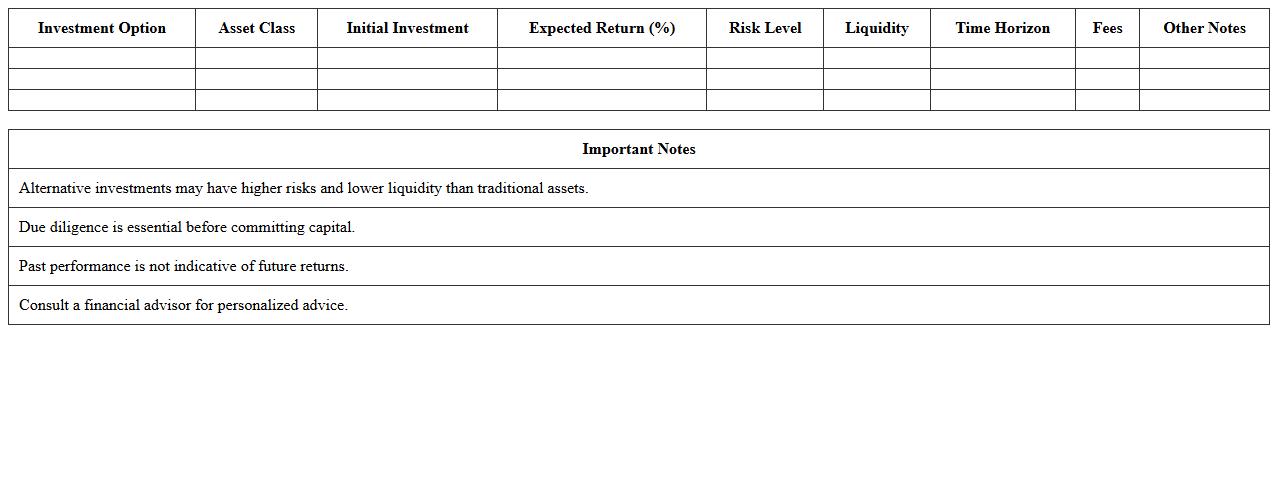

Alternative Investment Comparison Excel Template

The

Alternative Investment Comparison Excel Template document is a powerful tool designed to analyze and evaluate multiple alternative investment options side by side. It provides customizable fields for key financial metrics such as ROI, risk factors, and liquidity, enabling more informed decision-making. This template enhances clarity by presenting complex data visually, facilitating strategic investment planning and portfolio diversification.

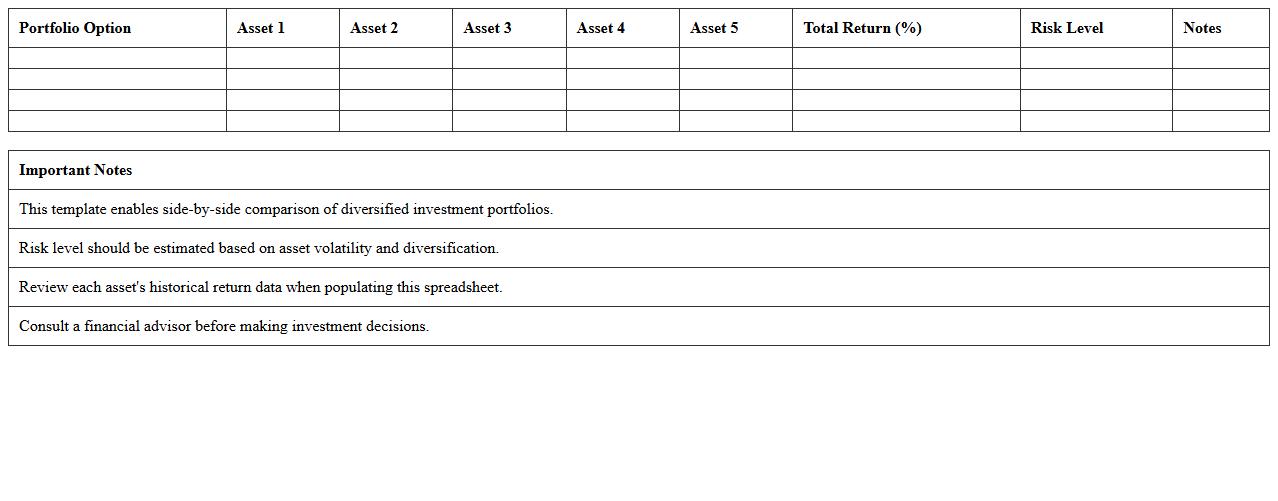

Diversified Portfolio Option Comparison Spreadsheet

The

Diversified Portfolio Option Comparison Spreadsheet is a structured tool designed to evaluate multiple investment options by analyzing various asset classes, risk levels, and expected returns. It helps investors visualize and compare the performance and diversification benefits of different portfolio combinations in one place. This document facilitates informed decision-making by enabling users to balance risk and reward according to their financial goals and market conditions.

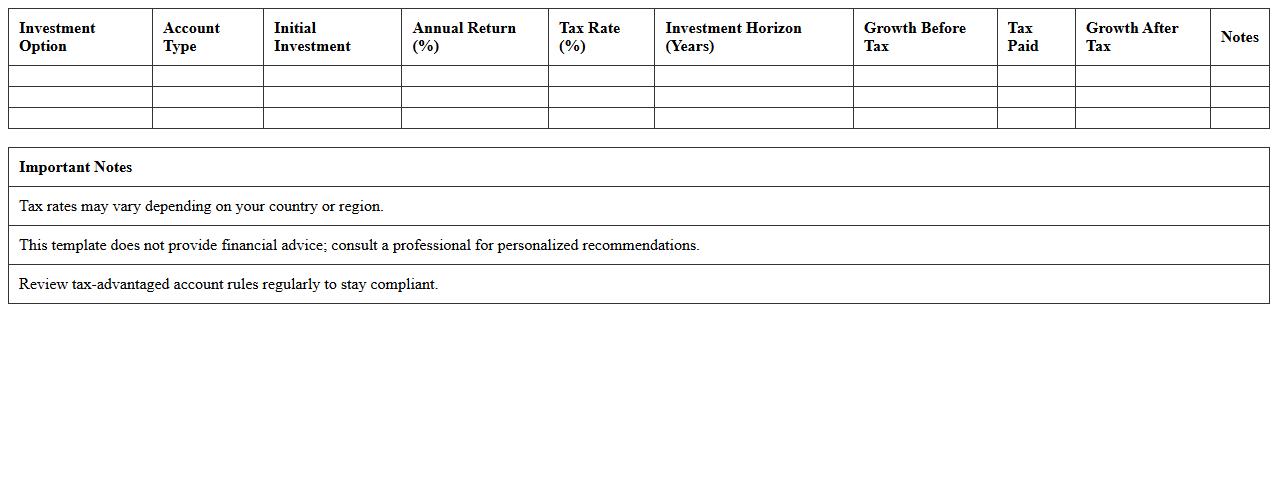

Tax-Efficient Investment Comparison Excel Template

The

Tax-Efficient Investment Comparison Excel Template is a powerful tool designed to analyze and compare various investment options based on their tax implications, helping investors maximize after-tax returns. It systematically calculates tax effects on dividends, capital gains, and interest income, enabling users to identify the most tax-advantageous portfolios. This template supports informed decision-making by clearly presenting complex tax scenarios in an easy-to-understand format, ideal for optimizing investment strategies.

What key metrics should be included in an Investment Option Comparison Excel for high-net-worth clients?

An Investment Option Comparison Excel for high-net-worth clients should include key metrics such as expected return, risk level (standard deviation), and liquidity. Additionally, metrics like fee structure, tax implications, and past performance should be incorporated for a holistic view. Including a risk-adjusted return metric such as the Sharpe Ratio further enhances decision-making.

How can financial advisors automate risk assessment within the comparison spreadsheet?

Financial advisors can automate risk assessment by embedding Excel formulas that calculate volatility and beta using historical price data. Utilizing conditional formatting can visually alert advisors to high-risk investments instantly. Integrating VBA scripts allows for dynamic, real-time recalculations as new data is inputted.

Which Excel functions best visualize portfolio diversification across multiple investment options?

Excel functions like SUMPRODUCT and INDEX-MATCH are vital for calculating allocation percentages across investments. Creating dynamic charts such as pie charts and stacked bar charts helps in visually representing portfolio diversification effectively. PivotTables coupled with slicers allow for interactive, user-friendly analysis of diversification data.

How can compliance disclosures be integrated into the Investment Comparison Excel template?

Compliance disclosures can be integrated by adding dedicated sections with locked cells containing regulatory text that updates automatically via linked external sources or databases. Data validation ensures that disclosures conform to the latest regulatory requirements, minimizing risk. Additionally, embedding audit trails and timestamps can help maintain a compliant record of all investor communications.

What methods can track and compare historical returns in a dynamic dashboard for advisors?

Using dynamic range names and OFFSET functions allows for automated updating of historical return data within dashboards. Combining these with charting tools like line graphs and sparklines provides clear visual comparisons over time. Incorporating slicers and filters enables advisors to customize views across different periods or investment categories dynamically.

More Comparison Excel Templates