The Health Insurance Comparison Excel Template for Freelancers simplifies evaluating multiple health plans by organizing premiums, deductibles, and coverage details in one clear spreadsheet. Freelancers can easily input their personal data to generate side-by-side comparisons, helping them make informed insurance decisions. This tool enhances financial planning by visually highlighting the most cost-effective and comprehensive options available.

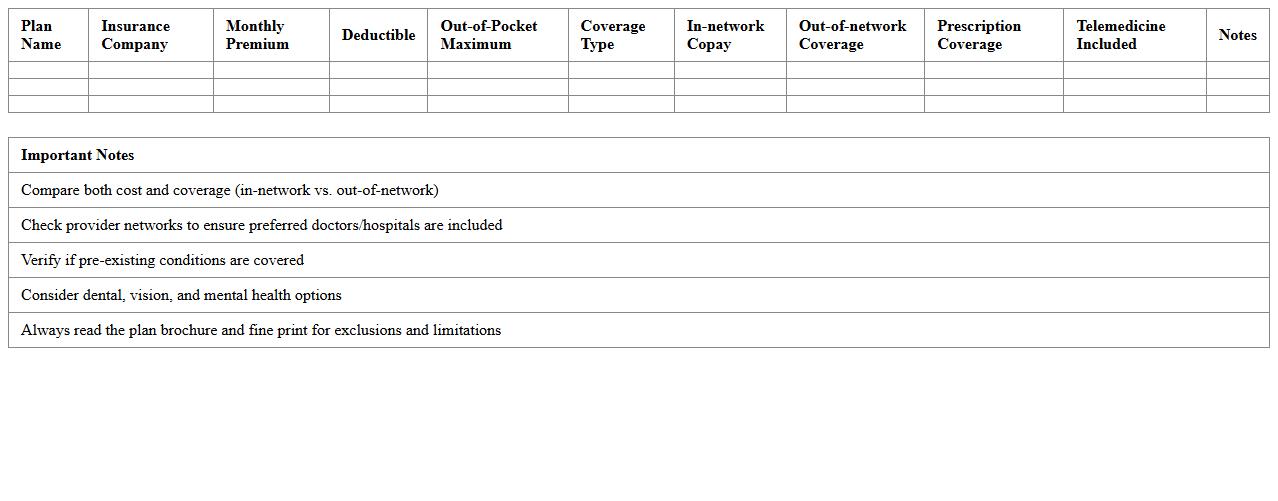

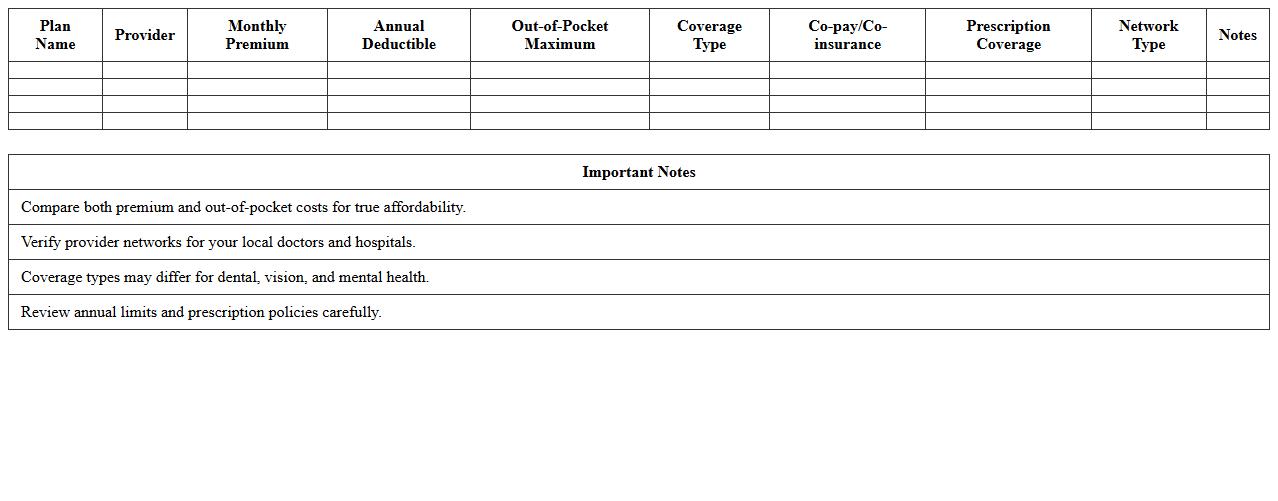

Freelancer Health Insurance Plan Comparison Worksheet

The

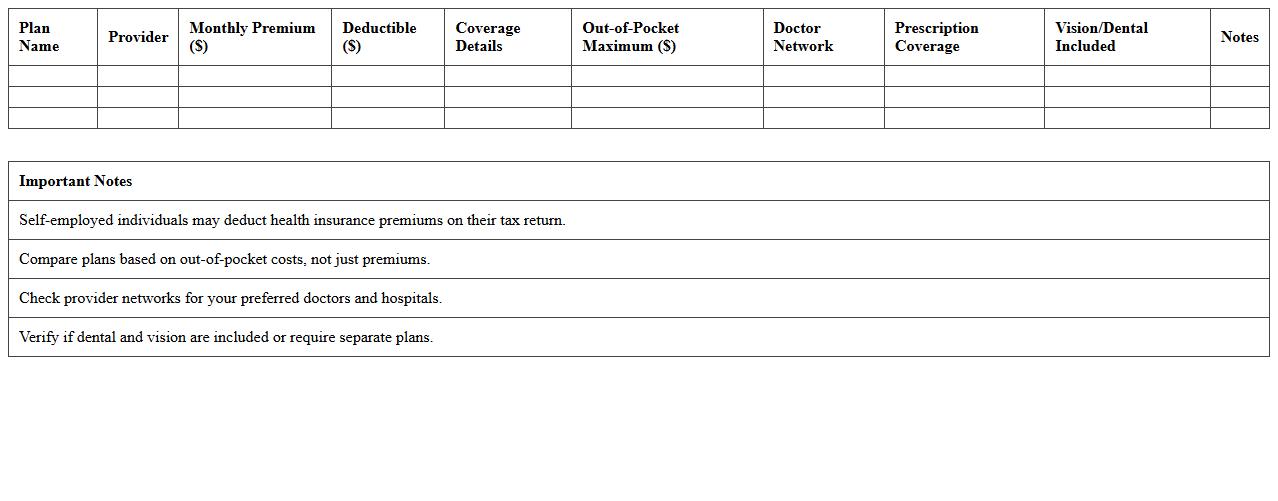

Freelancer Health Insurance Plan Comparison Worksheet is a structured document designed to help independent contractors evaluate various health insurance options side-by-side. It organizes critical plan details such as premiums, deductibles, coverage benefits, and network providers, enabling informed decision-making for securing adequate health coverage. Utilizing this worksheet streamlines the selection process, ensuring freelancers choose plans that best fit their healthcare needs and budget constraints.

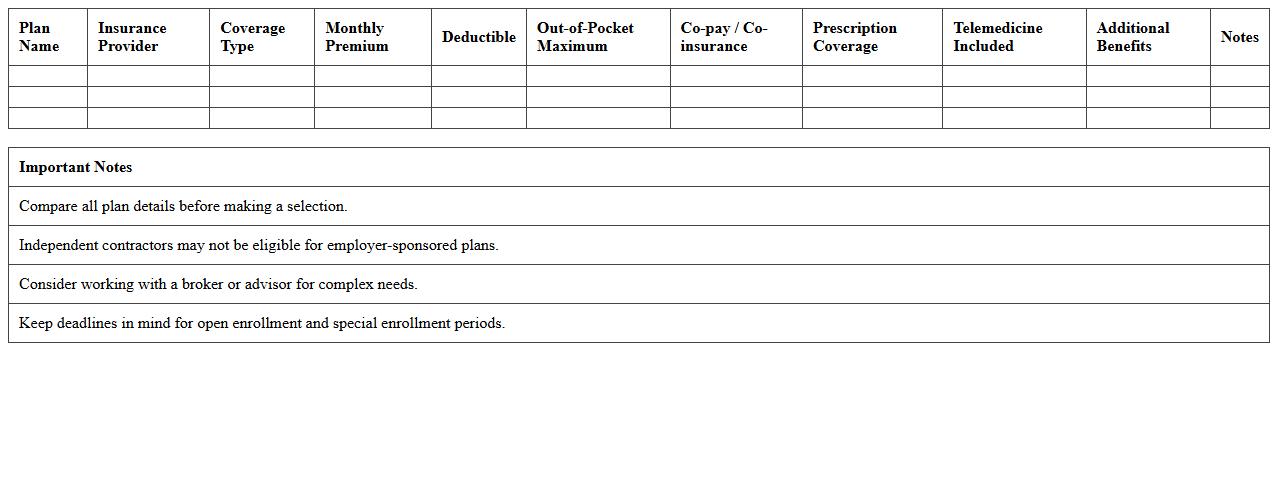

Independent Contractor Medical Coverage Comparison Sheet

The

Independent Contractor Medical Coverage Comparison Sheet is a detailed document that outlines and contrasts various medical insurance plans available to independent contractors. It helps users evaluate the coverage options, premiums, deductibles, and benefits side-by-side, enabling informed decisions based on individual healthcare needs and budgets. This tool streamlines the selection process, ensuring independent contractors secure the most suitable and cost-effective medical coverage.

Self-Employed Health Insurance Options Tracker

The

Self-Employed Health Insurance Options Tracker document systematically organizes and compares various health insurance plans tailored for self-employed individuals. By providing detailed information on premiums, coverage benefits, deductibles, and eligibility criteria, it enables users to make informed decisions that align with their financial and healthcare needs. This tool simplifies the complex landscape of health insurance, ensuring self-employed professionals can efficiently select the best plan for their unique situation.

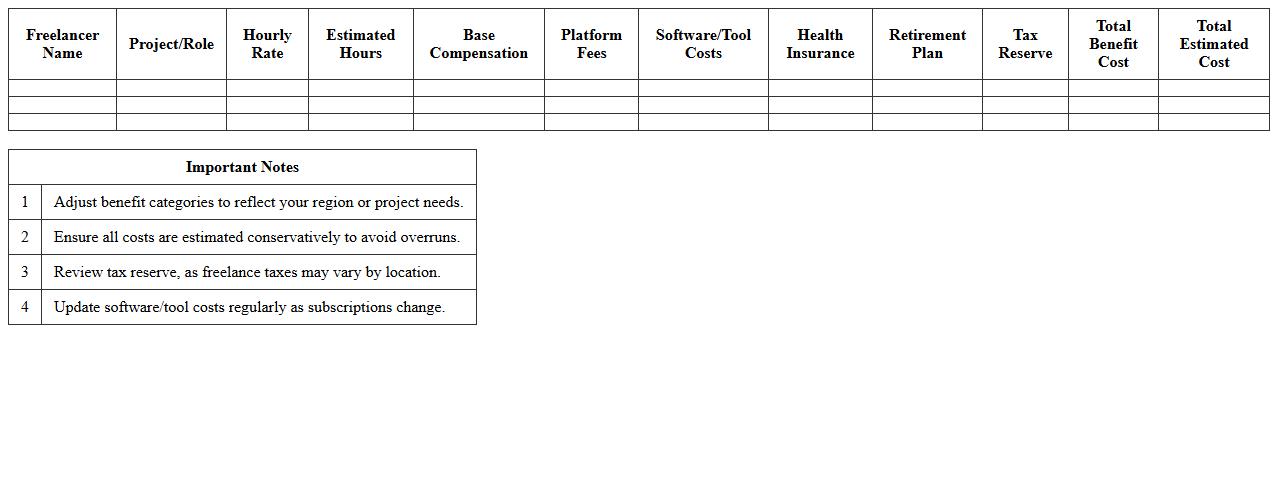

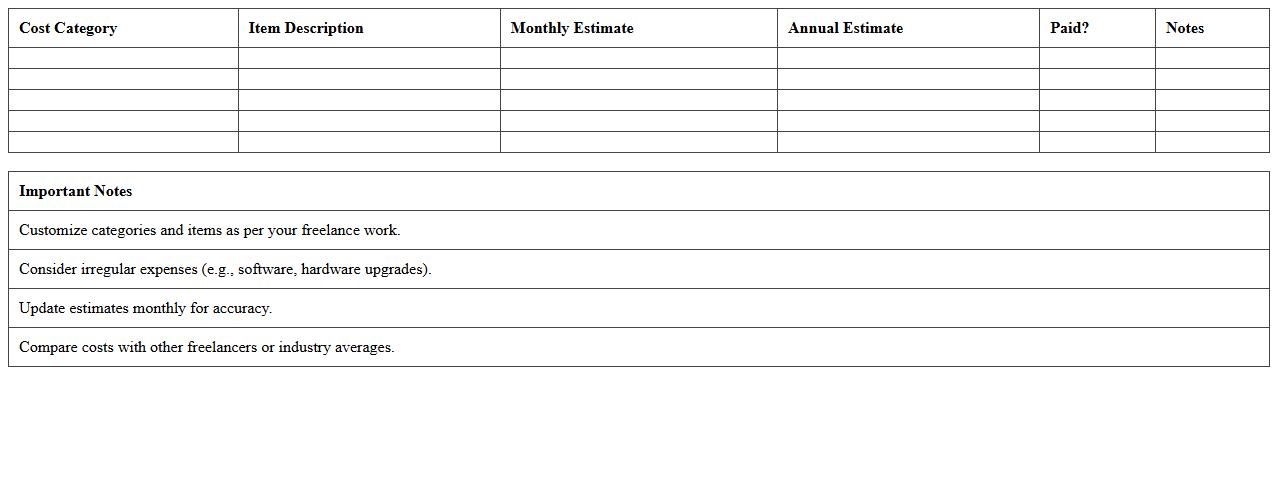

Freelancer Benefit Cost Analysis Excel Template

The

Freelancer Benefit Cost Analysis Excel Template is a structured spreadsheet designed to help freelancers evaluate the financial viability of their projects by comparing anticipated benefits against associated costs. This tool allows users to input detailed income streams and expense categories, facilitating clear visualization of profit margins and investment returns. Utilizing this template enhances decision-making by providing accurate cost-benefit insights, ultimately improving financial planning and project prioritization for freelancers.

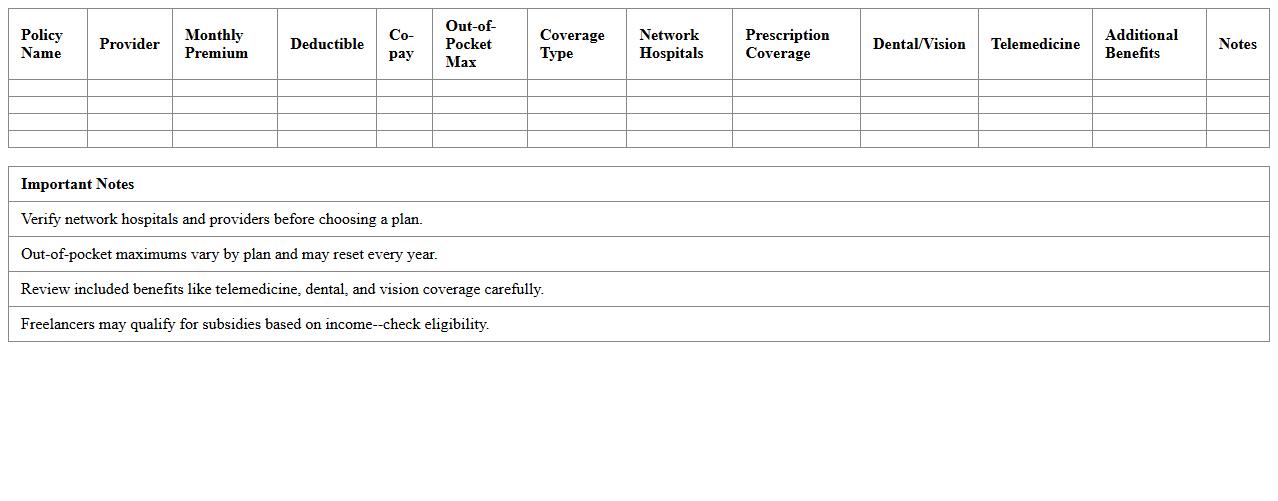

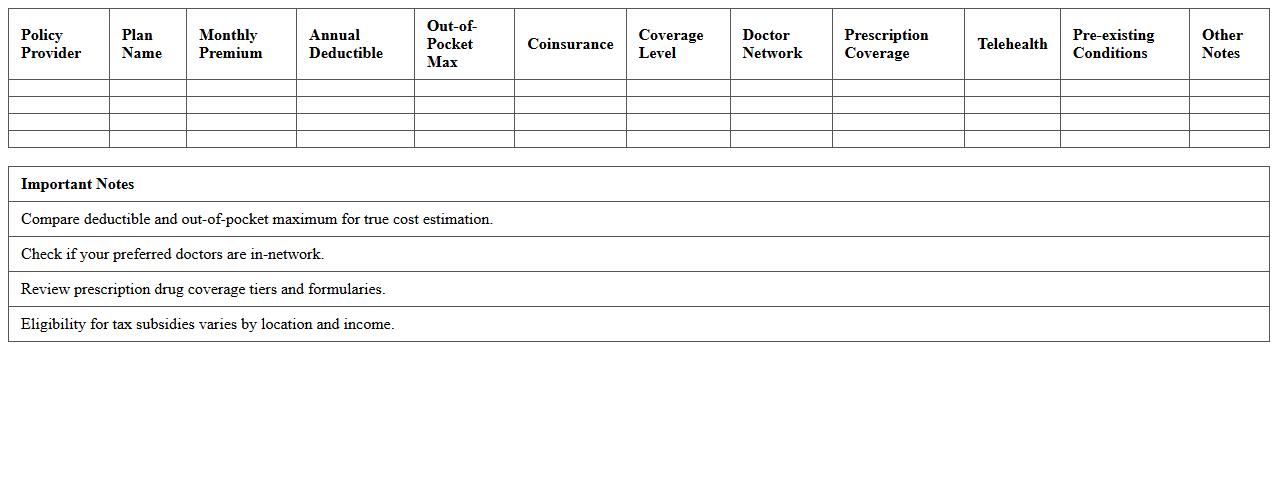

Health Policy Feature Comparison Spreadsheet for Freelancers

The

Health Policy Feature Comparison Spreadsheet for Freelancers is a comprehensive tool designed to evaluate and contrast various health insurance plans tailored specifically for independent contractors. It organizes key policy attributes such as coverage limits, premium costs, deductibles, and provider networks into a clear, side-by-side format, enabling freelancers to make informed, cost-effective decisions. By streamlining the comparison process, this document helps freelancers identify the best health insurance options that align with their unique financial and healthcare needs.

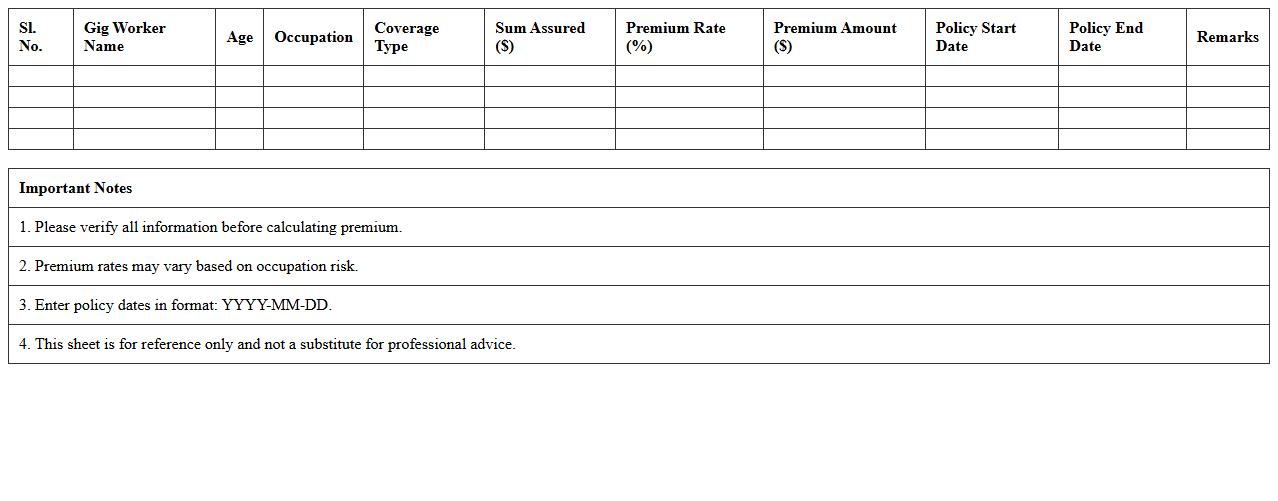

Gig Worker Insurance Premium Calculator Sheet

The

Gig Worker Insurance Premium Calculator Sheet document is a tool designed to estimate insurance premiums specifically for gig economy workers by analyzing variables such as income, coverage type, and risk factors. It helps users quickly determine the most cost-effective insurance options tailored to their freelance or contract work lifestyle. By providing clear premium calculations, this sheet aids gig workers in budgeting for necessary insurance coverage without overpaying.

Freelance Health Plan Coverage Analyzer Table

The

Freelance Health Plan Coverage Analyzer Table document systematically compares various health insurance options tailored specifically for freelancers, highlighting differences in premiums, coverage benefits, and out-of-pocket costs. This structured analysis enables freelancers to make informed decisions based on their unique healthcare needs and financial situations. Access to detailed, side-by-side plan information reduces confusion and streamlines the selection process, ultimately improving financial planning and health security.

Out-of-Pocket Costs Comparison for Freelancers Excel

The

Out-of-Pocket Costs Comparison for Freelancers Excel document is a practical tool designed to track and analyze personal expenses related to freelance projects, helping users manage financial outflows with accuracy. It allows freelancers to categorize costs, compare different project expenses, and identify areas for potential savings, thus improving overall budget management. By maintaining a detailed record, freelancers can optimize their spending, set realistic rates, and increase profitability through informed financial decisions.

Freelancer Healthcare Policy Detail Comparison Sheet

The Freelancer Healthcare Policy Detail Comparison Sheet is a

comprehensive tool designed to systematically evaluate various healthcare plans available for freelancers. It provides a detailed breakdown of coverage options, premiums, deductibles, and benefits, allowing users to make informed decisions based on their unique healthcare needs. This document helps save time and money by clearly highlighting the differences and advantages of each policy, ensuring optimal healthcare selection.

Self-Employed Health Insurance Plan Evaluation Template

The

Self-Employed Health Insurance Plan Evaluation Template document is a structured tool designed to help individuals who run their own businesses systematically assess various health insurance options. It provides a clear framework for comparing plan benefits, premiums, deductibles, and coverage limits to make informed decisions tailored to specific healthcare needs and budget constraints. This template streamlines the evaluation process, reducing complexity and ensuring self-employed individuals select the most cost-effective and comprehensive insurance plan available.

Which Excel formulas best automate premium and deductible comparisons for freelancers?

Using SUMIFS and VLOOKUP formulas allows for precise automation of premium and deductible comparisons in Excel. The SUMIFS function aggregates premium costs based on multiple criteria, simplifying cost analysis. Meanwhile, VLOOKUP efficiently retrieves deductible information linked to specific insurance plans.

How to categorize freelancers' specific healthcare needs within the health insurance comparison sheet?

Create distinct columns for pre-existing conditions, preferred providers, and required services to categorize healthcare needs. Using data validation dropdowns ensures standardized entries and easy filtering. This structured approach enhances personalized insurance recommendations for freelancers.

What custom filters can quickly highlight out-of-pocket maximums in the document?

Implement custom filters using conditional formatting that highlights rows where out-of-pocket maximums exceed a set threshold. Utilize Excel's Filter by Color feature once the rule is applied for quick visual identification. This technique accelerates the review process for cost impact assessment.

How to integrate insurer network coverage maps into the Excel for quick reference?

Embed hyperlinks to insurer network maps within cells for immediate access to coverage details. Use the Insert > Shapes feature to add clickable icons linked to PDF or web map sources. This integration streamlines network verification directly from the comparison sheet.

What columns are essential for tracking freelance income impact on insurance eligibility?

Include columns for monthly income, hours worked, and income fluctuations to monitor insurance eligibility criteria. Adding a column for qualifying thresholds helps flag freelancers nearing eligibility limits. Such data facilitates informed decision-making regarding plan selection.

More Comparison Excel Templates