The Loan Rate Comparison Excel Template for Homebuyers simplifies the process of evaluating multiple mortgage options by organizing interest rates, loan terms, and monthly payments in a clear, easy-to-use format. This template helps homebuyers make informed decisions by highlighting the most cost-effective loan choices based on personalized financial data. Using this tool can save time and enhance budgeting accuracy during the home purchasing process.

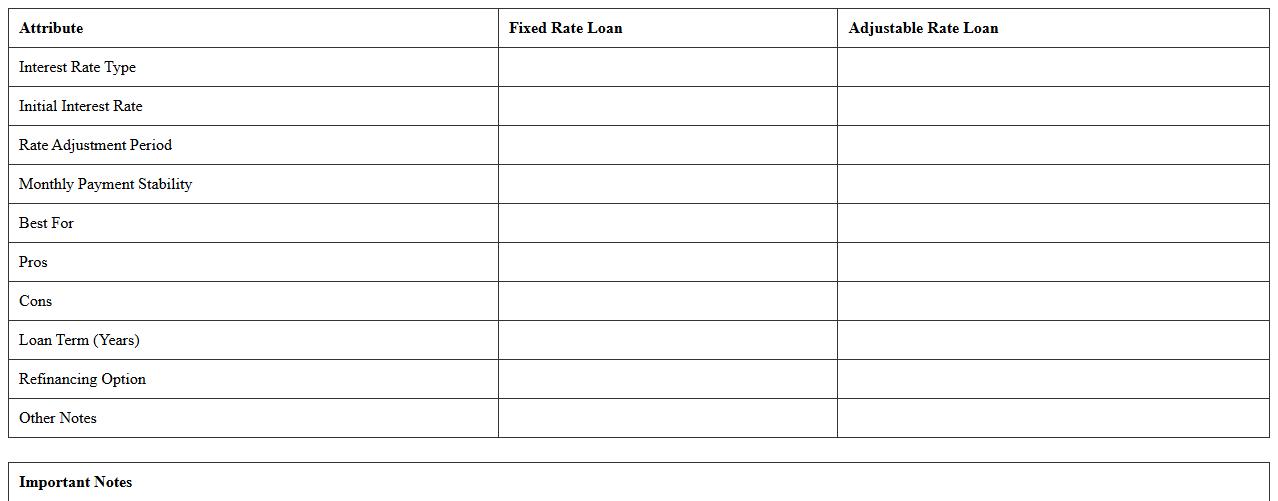

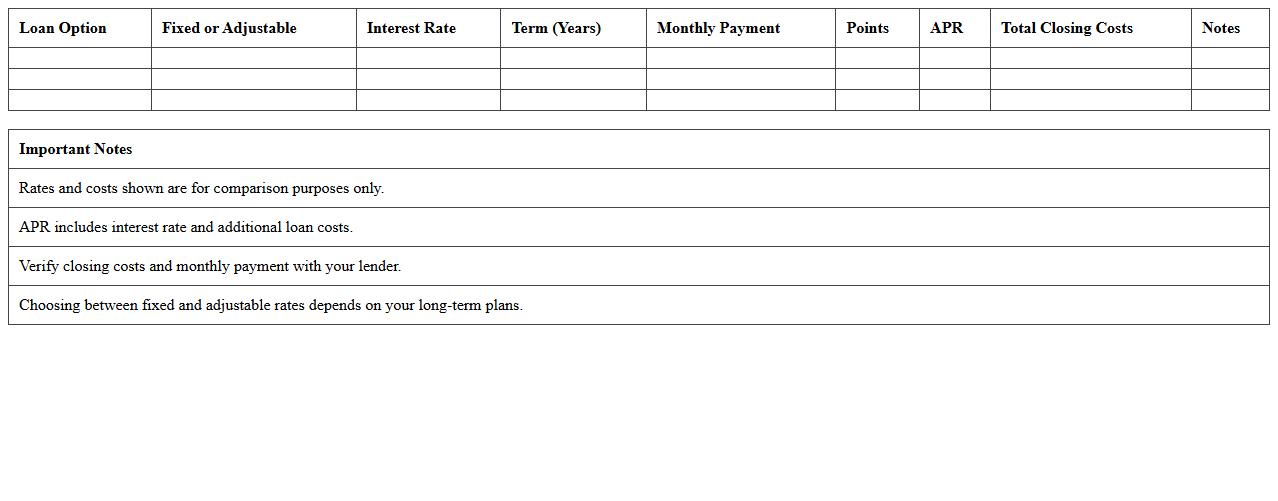

Fixed vs Adjustable Loan Rate Comparison Sheet

A

Fixed vs Adjustable Loan Rate Comparison Sheet is a detailed document that outlines the differences between fixed interest rates and adjustable interest rates on loans. It helps borrowers clearly see the potential costs, risks, and payment stability associated with each loan type, enabling informed financial decisions. This sheet is useful for comparing loan options side-by-side, ensuring borrowers select the most suitable loan structure based on their budget and market conditions.

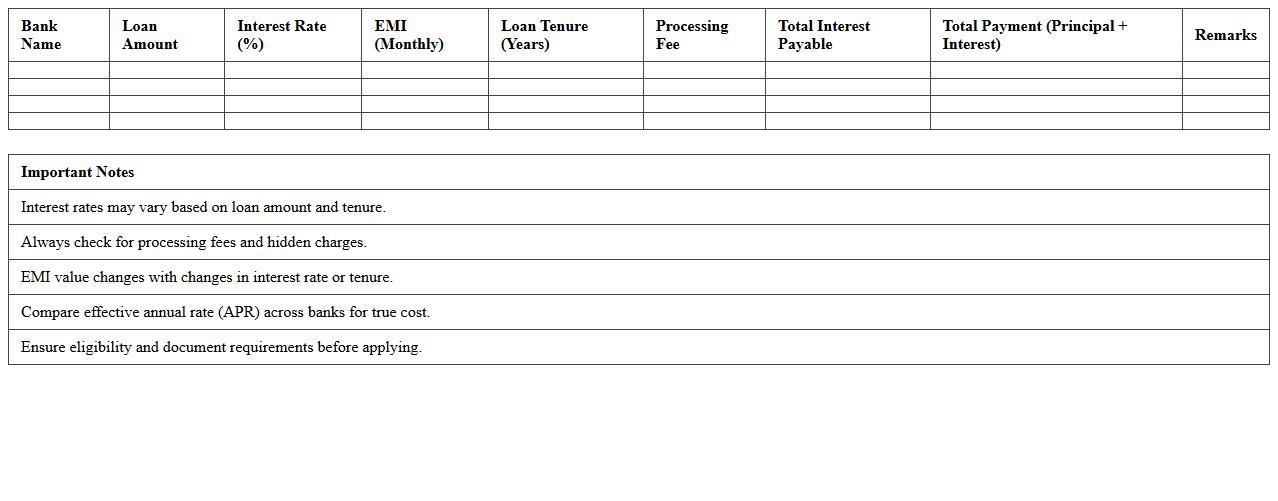

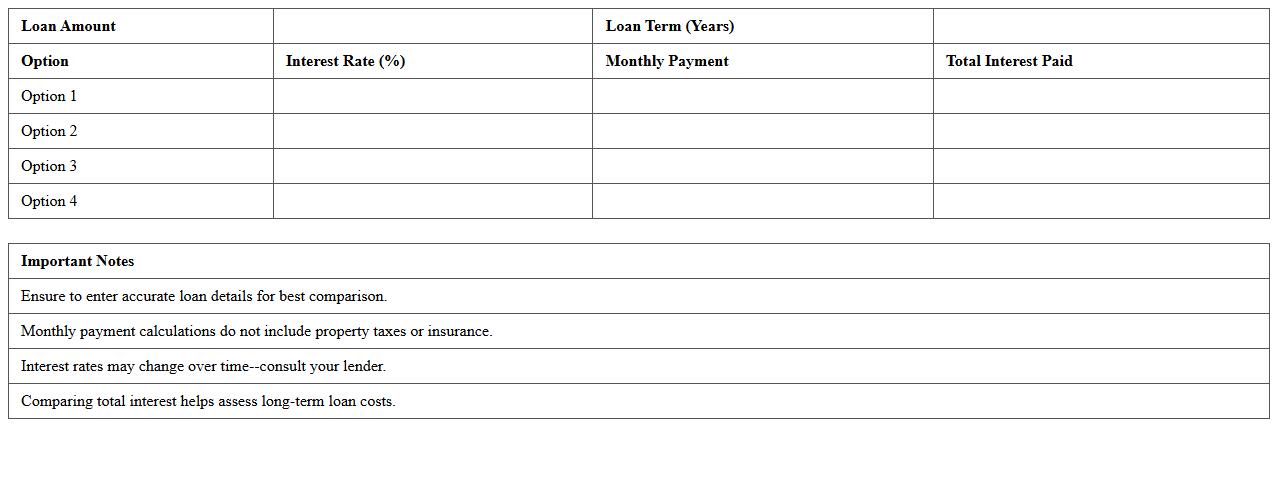

Home Loan Interest Rate Analysis Spreadsheet

A

Home Loan Interest Rate Analysis Spreadsheet is a comprehensive tool designed to compare and evaluate different home loan interest rates from various lenders. It helps users calculate monthly payments, total interest paid, and amortization schedules, enabling informed decisions when selecting the best mortgage option. This spreadsheet streamlines financial planning, ensuring optimal loan affordability and savings over the loan tenure.

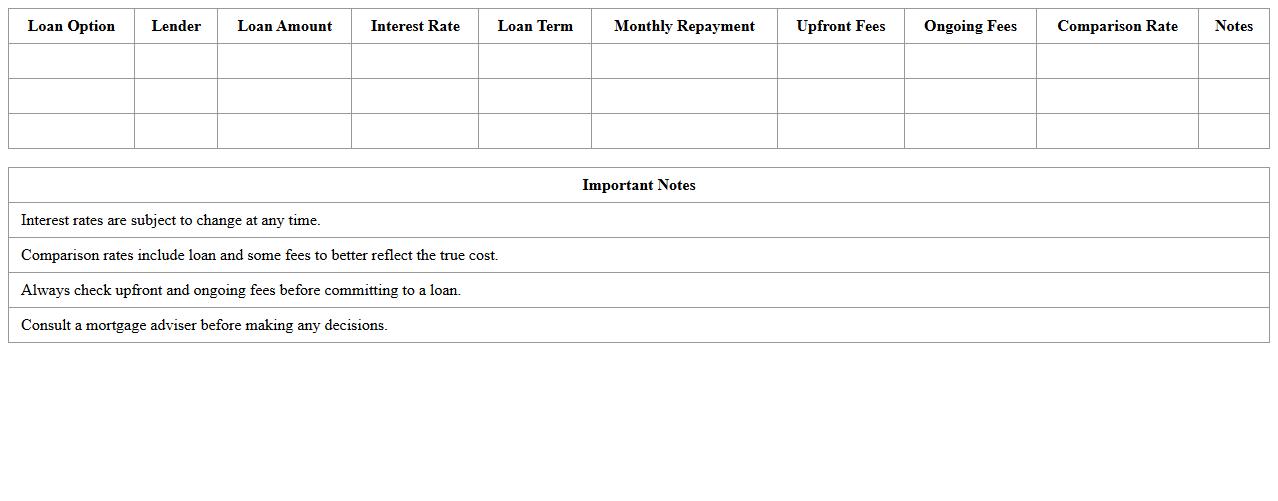

Mortgage Lender Rate Comparison Tracker

The

Mortgage Lender Rate Comparison Tracker document compiles current interest rates, fees, and loan terms from multiple lenders, enabling borrowers to evaluate options effectively. By providing a clear overview of varying mortgage offers, it helps users identify the most competitive rates tailored to their financial profile and borrowing needs. This tool enhances decision-making by simplifying complex data into actionable insights, ultimately saving time and money during the home financing process.

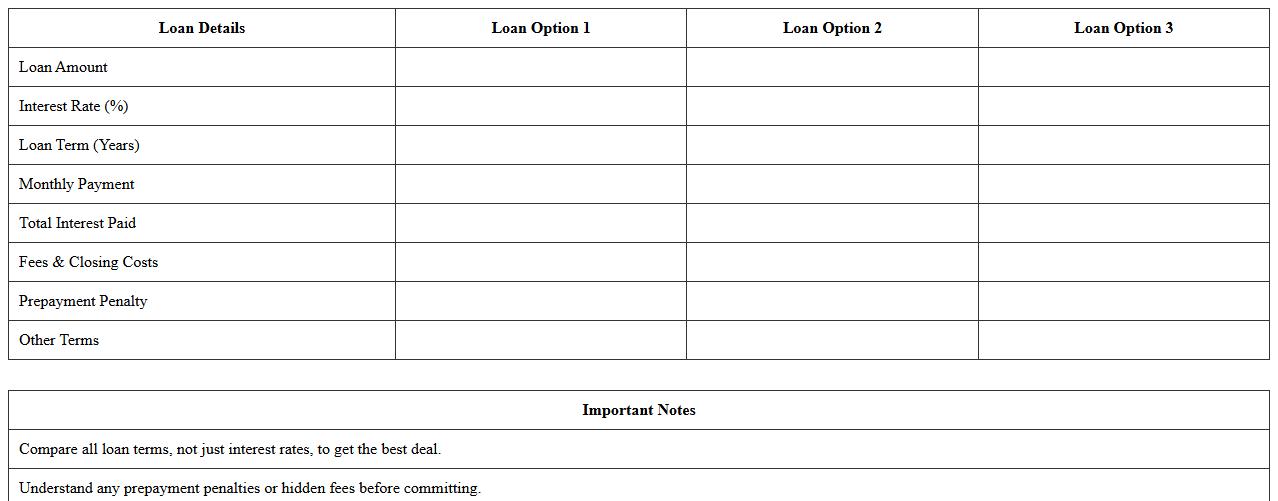

Loan Terms and Rate Evaluation Worksheet

The

Loan Terms and Rate Evaluation Worksheet is a structured document designed to compare key financial aspects of various loan offers, including interest rates, repayment periods, fees, and penalties. It helps borrowers analyze and contrast different loan terms methodically, ensuring informed decision-making when selecting the most cost-effective and suitable loan option. Using this worksheet facilitates transparent evaluation, reduces financial risks, and supports the selection of loans aligned with individual financial goals.

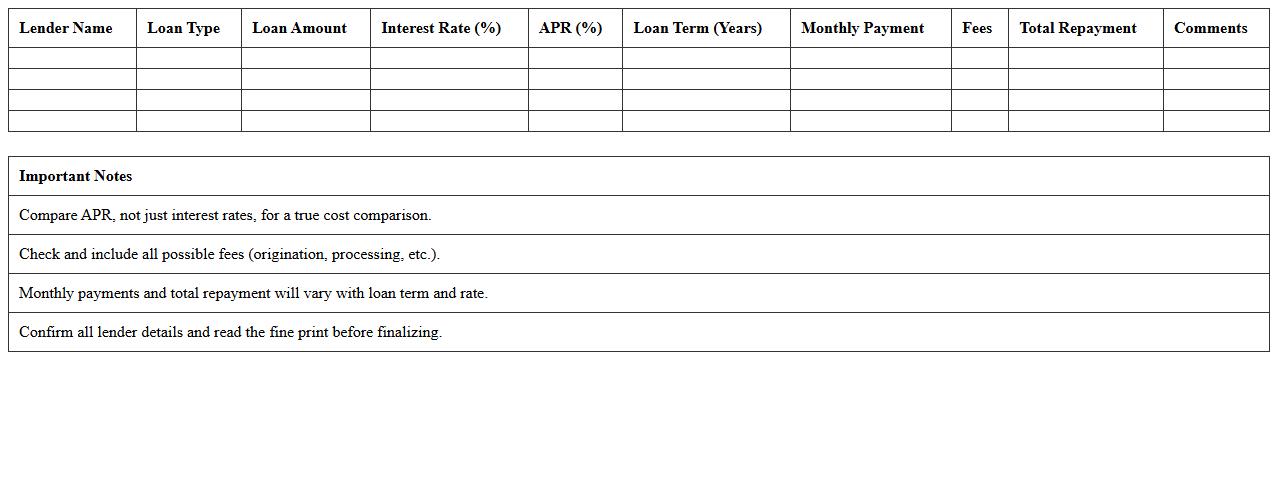

Multi-Lender Loan Rate Comparison Table

A

Multi-Lender Loan Rate Comparison Table is a document that consolidates loan interest rates from various lenders into a single, easy-to-read format. This table helps borrowers quickly evaluate and compare different loan options, enabling informed financial decisions by highlighting variations in terms, fees, and repayment schedules. By using this comparison tool, individuals and businesses can identify the most cost-effective borrowing solutions and negotiate better loan conditions.

Homebuyer Mortgage Rate Choice Matrix

The

Homebuyer Mortgage Rate Choice Matrix document provides a comparative analysis of available mortgage rates tailored for prospective homebuyers, highlighting variations in interest rates, loan terms, and payment options. This matrix is useful for identifying the most cost-effective and suitable mortgage solutions, enabling buyers to make informed financial decisions that align with their budget and long-term goals. Accessing this document reduces uncertainty and enhances transparency in the mortgage selection process.

Mortgage Payment & Rate Comparison Calculator

A

Mortgage Payment & Rate Comparison Calculator document provides an efficient tool to estimate monthly mortgage payments by inputting variables such as loan amount, interest rate, and loan term. It enables users to compare different mortgage rates and terms side-by-side, helping identify the most cost-effective option tailored to their financial situation. This tool is essential for making informed decisions that can save thousands over the life of a loan by understanding payment breakdowns and interest costs upfront.

Home Loan Option Rate Summary Sheet

A

Home Loan Option Rate Summary Sheet is a detailed document that outlines various home loan interest rates, fees, and repayment options offered by lenders. It helps borrowers compare different loan products efficiently, enabling informed decisions to secure the best mortgage terms. This summary sheet is invaluable for understanding potential costs, interest savings, and repayment flexibility before committing to a home loan.

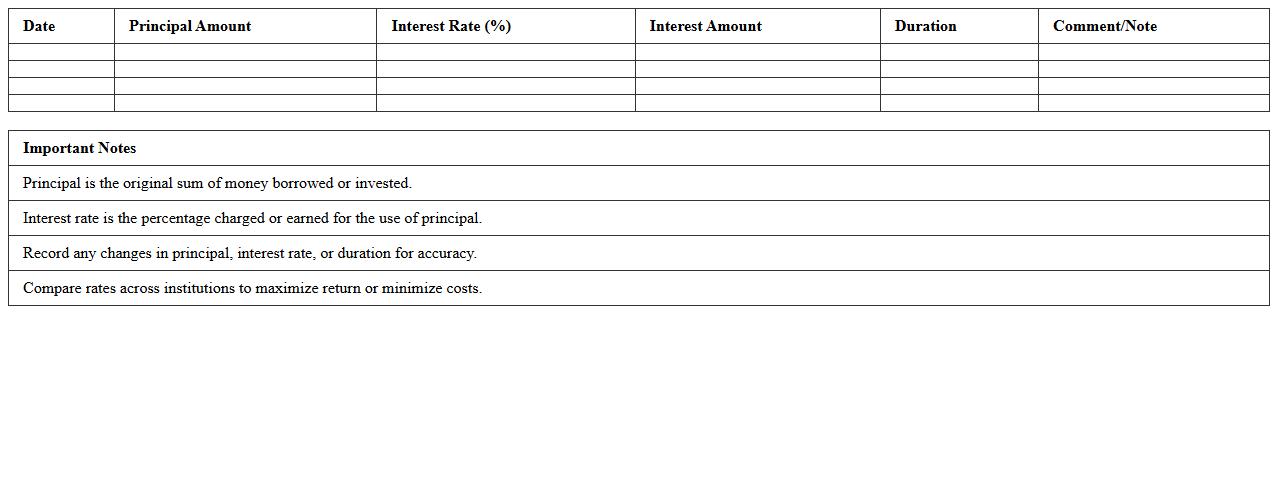

Principal, Interest, and Rate Comparison Log

A

Principal, Interest, and Rate Comparison Log document records the principal amounts, interest rates, and payment details for various loan options, enabling clear side-by-side analysis. It helps borrowers identify the most cost-effective loan by comparing total interest payable and rate fluctuations over time. This log is essential for making informed financial decisions and optimizing loan repayment strategies.

Comprehensive Loan Rate Comparison Dashboard

The

Comprehensive Loan Rate Comparison Dashboard document consolidates various loan options, interest rates, and terms into a single, easy-to-analyze interface, enabling users to quickly assess and compare different lending opportunities. By providing clear visualization and up-to-date data from multiple financial institutions, it helps borrowers make informed decisions that optimize their borrowing costs and financial planning. This tool is essential for consumers seeking transparency and efficiency in loan selection, ultimately enhancing financial literacy and saving money.

How can I automate interest rate updates in a Loan Rate Comparison Excel for homebuyers?

To automate interest rate updates, you can use Excel's Power Query feature to fetch real-time data from financial websites or APIs. Another approach is to embed web queries that refresh rates upon opening your workbook. Setting up a dynamic link ensures the latest interest rates are always displayed, reducing manual input errors.

What formulas best compare total loan costs by lender in the spreadsheet?

Use the PMT function to calculate monthly payments based on principal, interest rate, and loan term. To find the total cost, multiply the payment by the number of payments, then add upfront fees for each lender. The SUM and IF functions help aggregate and compare these results efficiently.

How to visually highlight the lowest APR in an Excel rate comparison table?

Apply Conditional Formatting with a rule that highlights the minimum value in the APR column. Choose a distinct fill color or font style for better visibility. This technique automatically adjusts as data changes, ensuring the lowest APR stands out instantly.

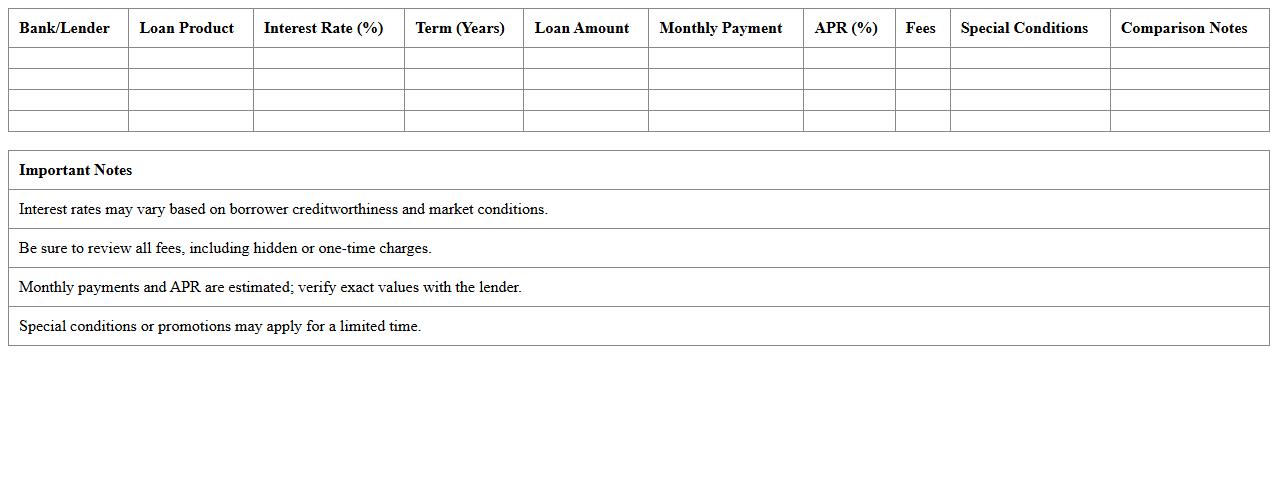

Which columns are essential for a comprehensive home loan comparison sheet?

A robust sheet should include columns for Loan Amount, Interest Rate, Loan Term, Monthly Payment, APR, and Fees. Adding fields for Loan Type and Lender Name improves clarity. These columns cover all key aspects needed for informed comparisons.

How to include adjustable-rate mortgages (ARM) scenarios in the Excel document?

Create separate columns to input the initial fixed-rate period, adjustment intervals, and index plus margin values. Use formulas to model payment changes over time, reflecting possible rate fluctuations. This setup allows homeowners to forecast ARM impacts accurately across different scenarios.

More Comparison Excel Templates