The Financial Risk Assessment Excel Template for Small Business provides a comprehensive tool to identify, analyze, and mitigate potential financial threats. This template enables small business owners to input financial data, evaluate risks systematically, and develop strategies to protect their cash flow and assets. Customizable formulas and easy-to-use features make it ideal for timely decision-making and improving overall financial stability.

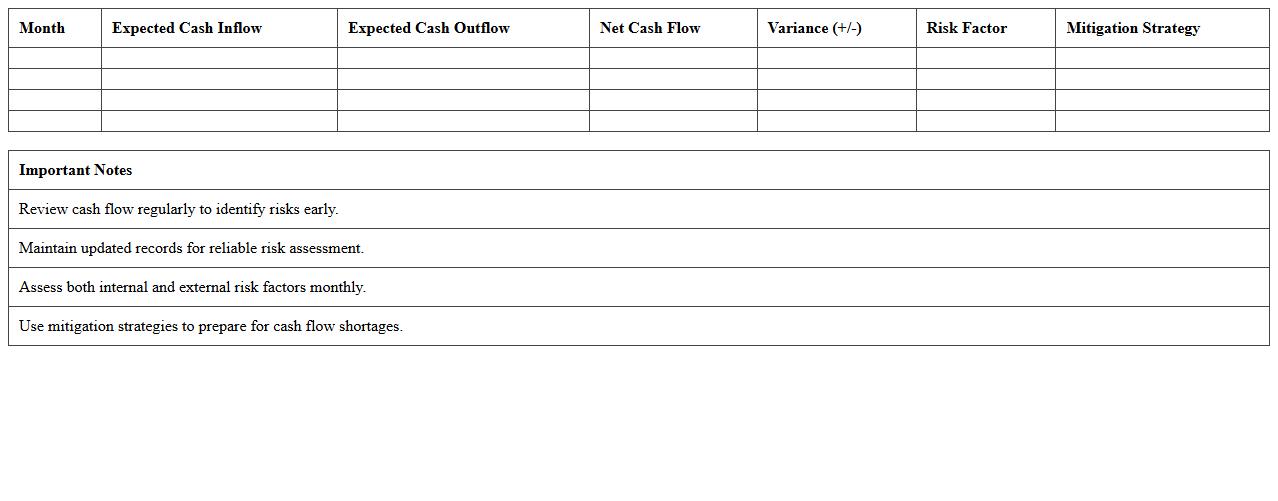

Cash Flow Risk Assessment Excel Template for Small Business

The

Cash Flow Risk Assessment Excel Template for small businesses is a dynamic tool designed to evaluate and predict potential financial risks by analyzing inflows and outflows of cash over time. It helps businesses identify periods of cash shortfall, enabling proactive management of expenses, investments, and financing needs. By providing clear visualizations and scenario analysis, this template supports informed decision-making to maintain liquidity and sustain business operations effectively.

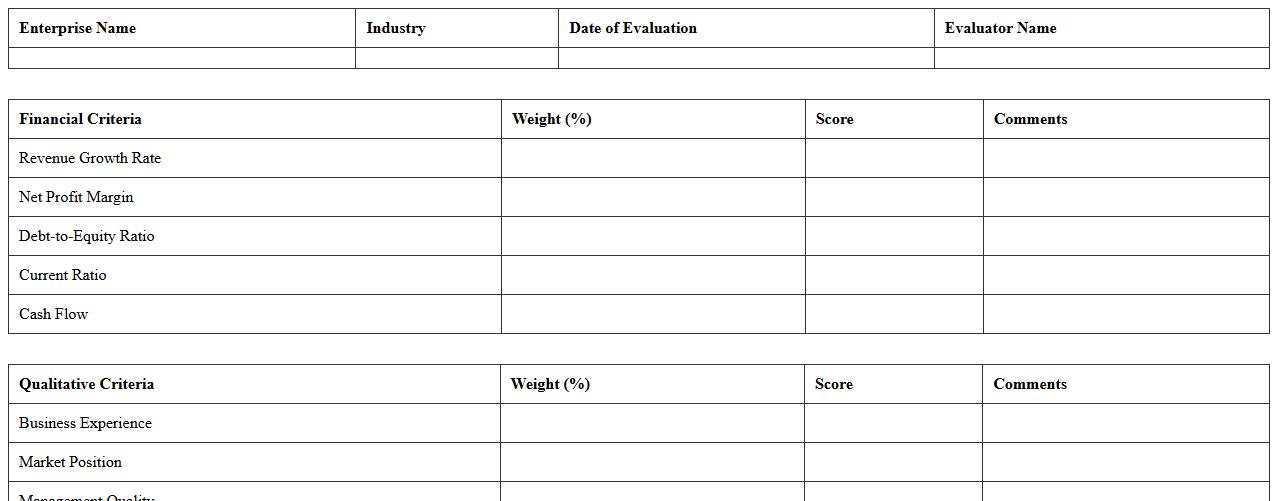

Credit Risk Evaluation Excel Sheet for Small Enterprises

A

Credit Risk Evaluation Excel Sheet for Small Enterprises is a detailed financial tool designed to assess the creditworthiness of small businesses by analyzing key financial metrics such as cash flow, debt levels, and repayment history. This document helps lenders and business owners systematically evaluate potential risk factors, enabling more informed decision-making regarding loan approvals and credit limits. It improves accuracy in predicting default probabilities, thereby reducing financial losses and promoting sustainable business growth.

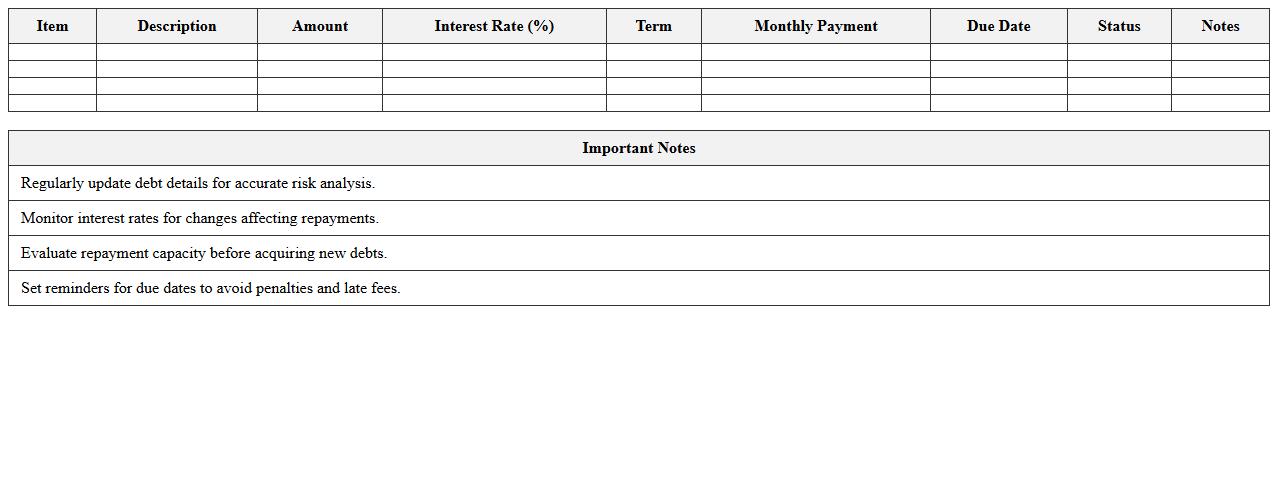

Debt Management Risk Analysis Excel Template for SMEs

The

Debt Management Risk Analysis Excel Template for SMEs is a strategic tool designed to assess and monitor financial liabilities, helping businesses identify potential risks associated with debt repayment and cash flow constraints. This template facilitates detailed analysis by organizing debt schedules, interest rates, and payment timelines to provide clear insights into debt servicing capacity. Utilizing this template enables SMEs to make informed decisions, optimize debt structures, and proactively manage financial risks to ensure sustainable growth.

Asset and Liability Risk Tracking Excel Template

The

Asset and Liability Risk Tracking Excel Template document is a powerful financial tool designed to monitor and manage the exposure of assets and liabilities within an organization. By systematically organizing relevant data, it enables accurate tracking of risk factors such as market fluctuations, credit exposure, and liquidity constraints, helping to prevent potential financial losses. Utilizing this template enhances decision-making efficiency and supports proactive risk mitigation strategies essential for maintaining financial stability.

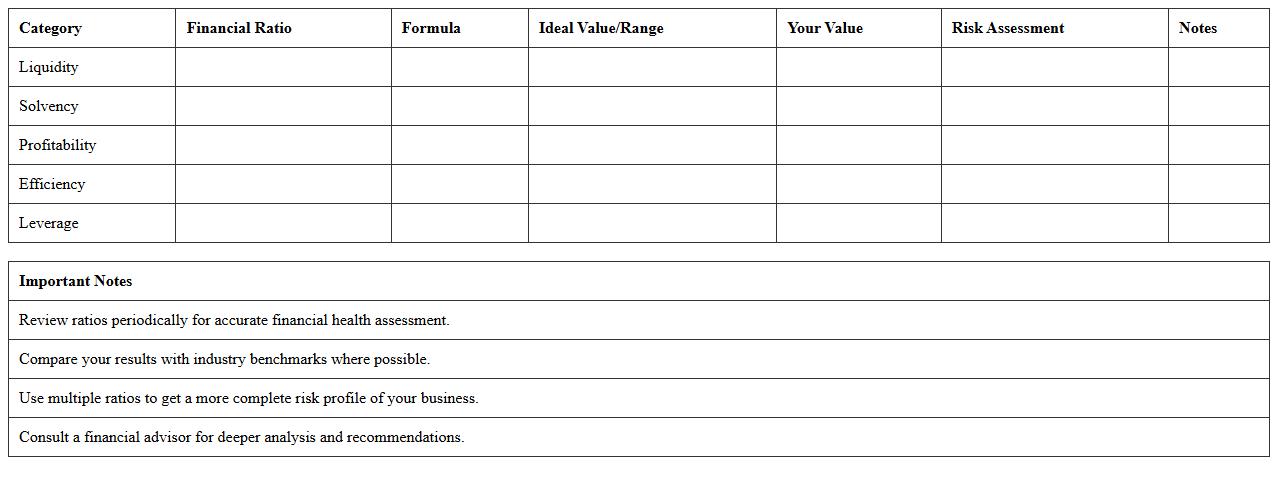

Financial Ratio Risk Assessment Spreadsheet for Small Firms

The

Financial Ratio Risk Assessment Spreadsheet for Small Firms is a tool designed to analyze key financial ratios to evaluate the risk profile of small businesses effectively. It enables users to monitor liquidity, profitability, solvency, and efficiency metrics, providing crucial insights for informed decision-making and risk management. By systematically organizing and interpreting financial data, this spreadsheet helps identify potential financial vulnerabilities and supports strategic planning for sustainable growth.

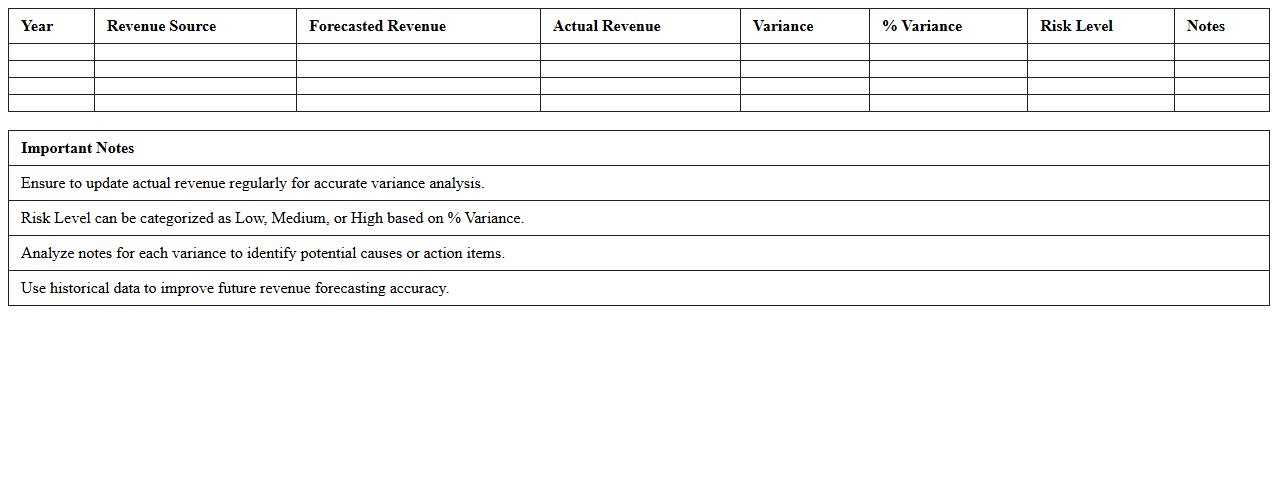

Revenue Volatility Risk Assessment Excel Template

The

Revenue Volatility Risk Assessment Excel Template is a specialized tool designed to analyze fluctuations in revenue streams by quantifying risks associated with market changes, sales instability, and economic factors. It enables businesses to visualize revenue volatility through data-driven charts and statistical models, facilitating proactive financial planning and risk management. By using this template, companies can identify potential revenue threats early, optimize budgeting, and enhance decision-making processes to maintain financial stability.

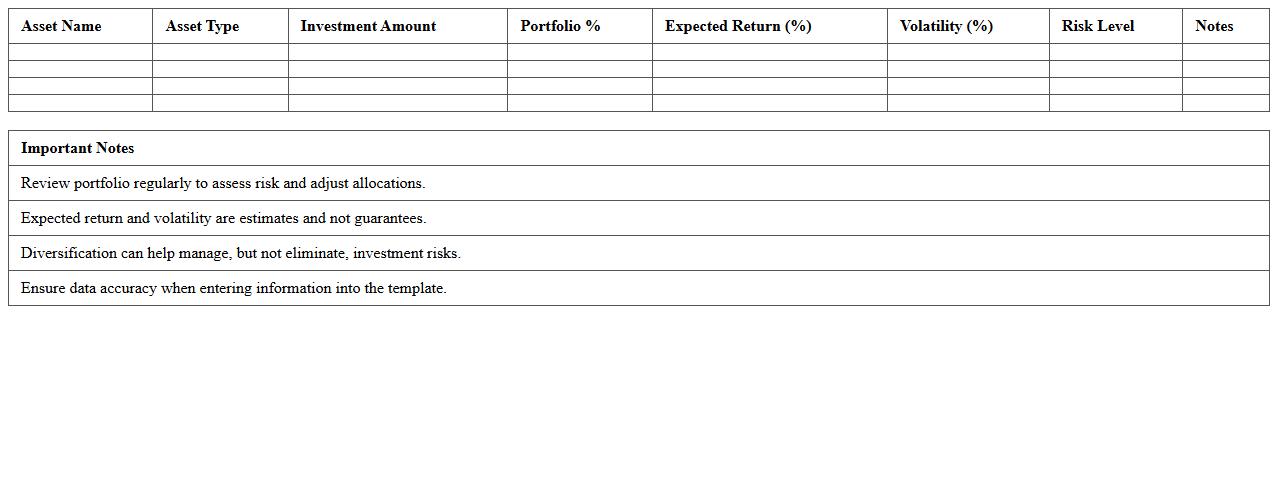

Investment Portfolio Risk Analysis Excel Template for Small Business

The

Investment Portfolio Risk Analysis Excel Template for small businesses provides a structured framework to evaluate the potential risks associated with various investment options. It utilizes quantitative data, including asset volatility, correlation, and expected returns, to calculate risk metrics like standard deviation and value at risk (VaR). This comprehensive analysis helps small business owners make informed decisions, optimize asset allocation, and minimize potential financial losses.

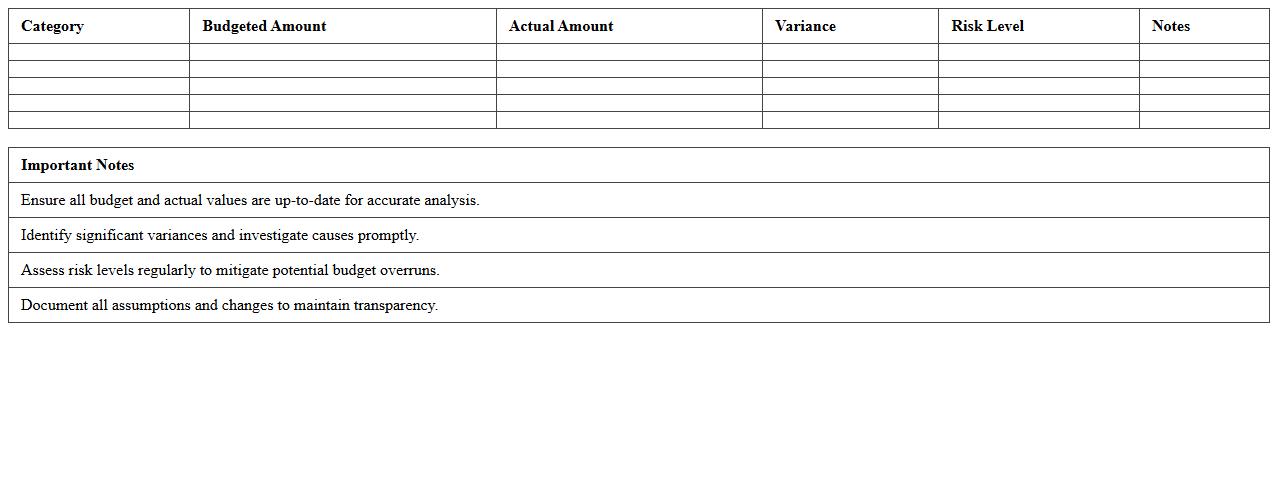

Budget Variance Risk Assessment Excel Spreadsheet

A

Budget Variance Risk Assessment Excel Spreadsheet document is a tool designed to track and analyze differences between projected and actual budget figures, helping identify financial risks early. It facilitates systematic evaluation of budget deviations, enabling stakeholders to take corrective actions and improve financial planning accuracy. By providing clear visualizations and detailed variance reports, this spreadsheet enhances decision-making and supports effective resource allocation.

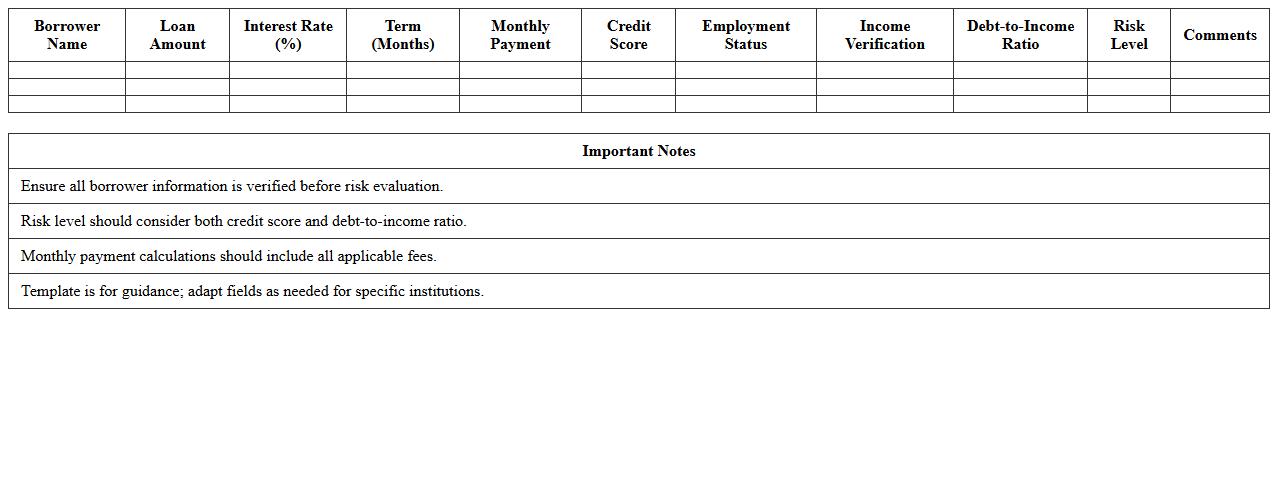

Loan Repayment Risk Evaluation Excel Template

The

Loan Repayment Risk Evaluation Excel Template is a comprehensive tool designed to assess the likelihood of a borrower defaulting on loan repayments by analyzing financial data and credit history. It enables lenders and financial analysts to quantify risk factors, generate risk scores, and make informed decisions based on borrower profiles and repayment capacity. This template streamlines the evaluation process, reduces human error, and enhances accuracy in risk assessment for better loan management and portfolio quality.

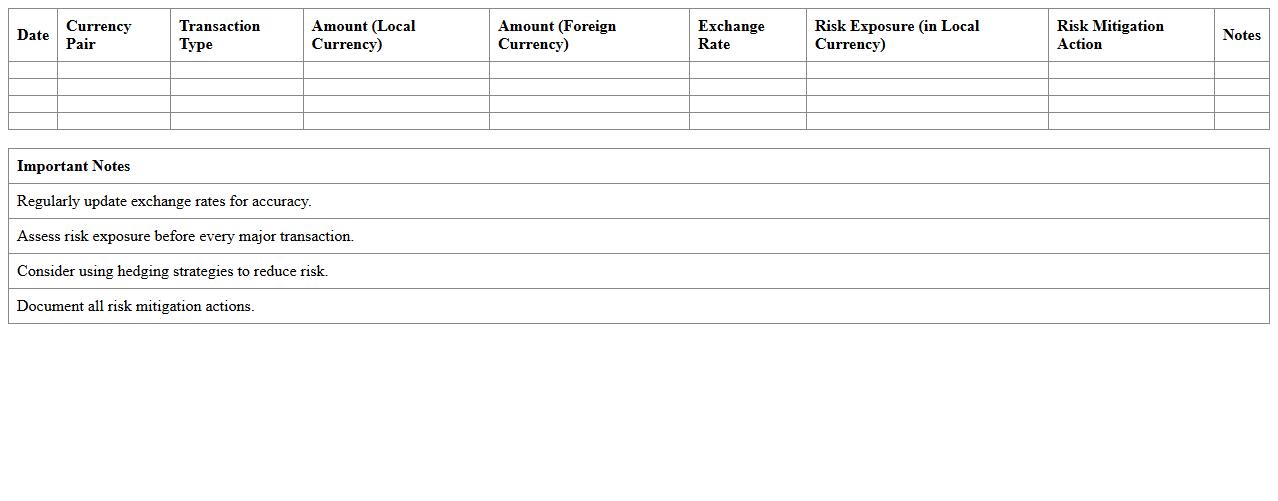

Currency Exchange Rate Risk Assessment Excel Sheet for Microbusiness

A

Currency Exchange Rate Risk Assessment Excel Sheet for Microbusiness is a financial tool designed to help small enterprises analyze and manage the risks associated with fluctuating foreign exchange rates. This document allows microbusiness owners to input various currency scenarios and assess potential impacts on cash flow, profit margins, and overall financial stability. Utilizing this assessment can enhance decision-making processes, enabling businesses to implement effective hedging strategies and minimize losses due to currency volatility.

How can I customize financial risk metrics for niche industries in my Excel assessment sheet?

To effectively customize financial risk metrics for niche industries, begin by understanding the unique risk factors relevant to the specific sector. Use tailored Excel formulas such as industry-specific ratios combined with historical data analysis to reflect these factors accurately. Incorporating pivot tables or dynamic arrays enhances the customization by facilitating in-depth data segmentation and real-time updates.

What Excel formulas best detect cash flow volatility for small businesses?

The best Excel formulas to detect cash flow volatility in small businesses include standard deviation (STDEV.P or STDEV.S) to measure variability in cash inflows and outflows. Using the formula for coefficient of variation (standard deviation divided by average cash flow) offers a normalized view of volatility. Additionally, the TREND function can help highlight unexpected fluctuations by comparing actual cash flows to projected trends.

Which conditional formatting rules highlight high-risk financial ratios in my document?

Conditional formatting rules that effectively highlight high-risk financial ratios include setting color scales to indicate danger levels based on pre-set thresholds like debt-to-equity or current ratio values. Use custom formulas in conditional formatting to flag ratios exceeding the industry's risk benchmarks. Applying icon sets such as traffic lights or flags visually emphasizes critical data points for quick assessment.

How do I automate risk scoring for new expenses in my financial risk assessment letter?

Automate risk scoring in Excel by creating a weighted scoring model for new expenses based on predefined risk criteria such as amount, frequency, and impact. Use the IF and SUMPRODUCT functions to assign and calculate scores dynamically as new data entries occur. Integrate VBA macros if advanced automation is needed for updating the risk assessment letter in real time.

What Excel template structures optimize risk reporting for microenterprises?

Optimized risk reporting templates for microenterprises focus on simplicity and clarity, incorporating sections for key financial indicators, risk scores, and graphical summaries. Use dashboard layouts with interactive slicers and charts to easily visualize risk trends and facilitate decision-making. Incorporate pivot tables and structured tables for efficient data organization and update capabilities.

More Assessment Excel Templates