The Home Budget Plan Excel Template for Families offers an easy-to-use format for tracking income, expenses, and savings, helping households maintain financial control. With customizable categories and automatic calculations, it simplifies monthly budget management and highlights areas for cost-saving. This template ensures families can plan effectively for both short-term needs and long-term goals.

Monthly Family Budget Planner Excel Template

The

Monthly Family Budget Planner Excel Template is a customizable spreadsheet designed to track income, expenses, and savings on a monthly basis, helping families manage their finances efficiently. It provides categorized expense inputs, visual charts, and automatic calculations to give clear insights into spending patterns and financial goals. Using this template improves budgeting accuracy, encourages saving habits, and aids in making informed financial decisions.

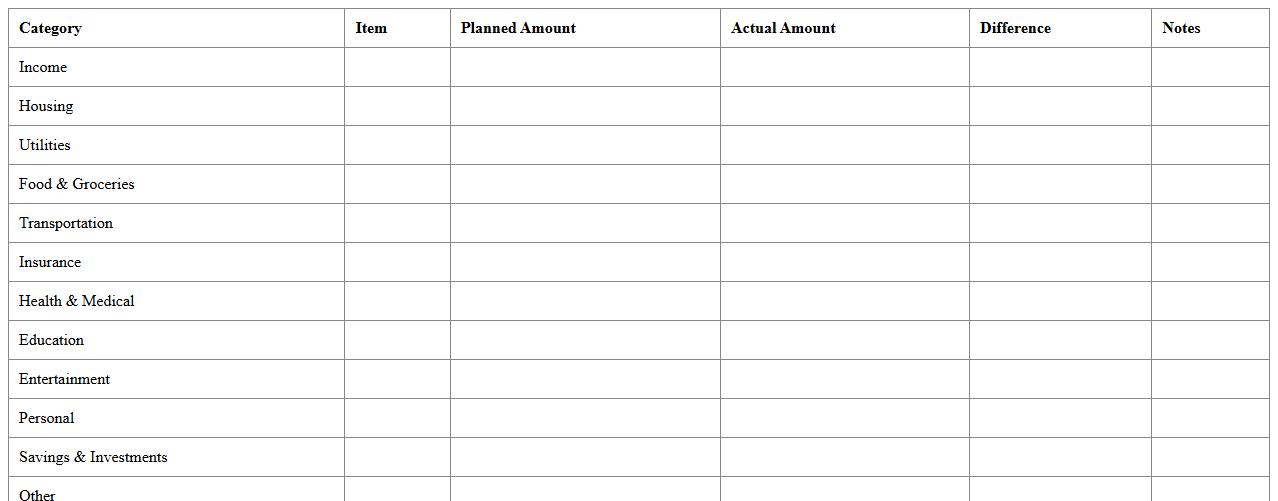

Household Expense Tracker Spreadsheet

A

Household Expense Tracker Spreadsheet is a digital tool designed to record, categorize, and analyze daily, weekly, or monthly spending patterns within a home. It helps users maintain a clear overview of their financial activities, identify unnecessary expenses, and create effective budgets to enhance savings. By offering detailed insights into income versus expenditure, this spreadsheet supports informed decision-making for better money management and financial planning.

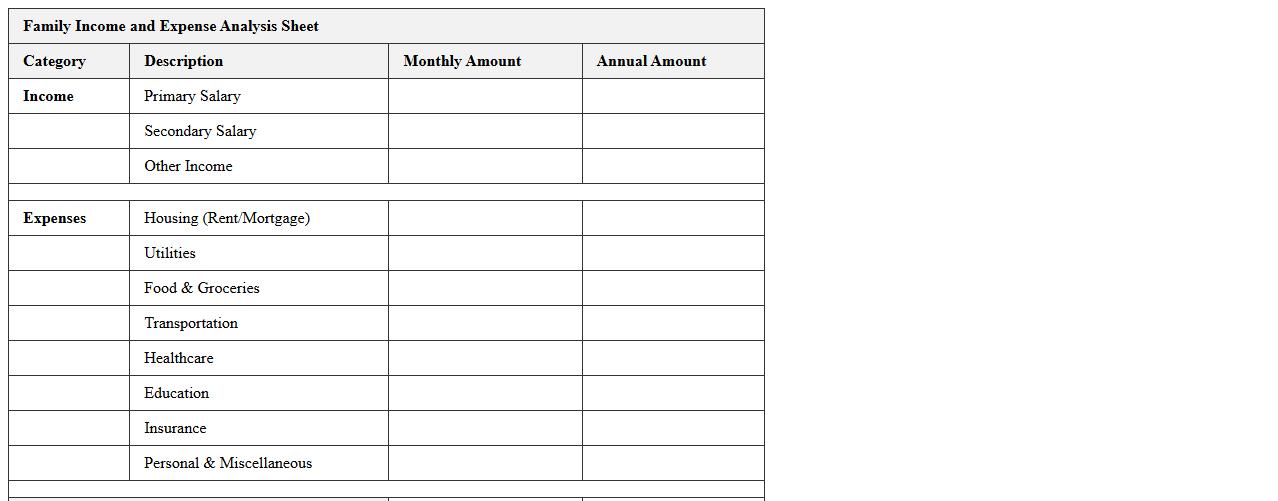

Family Income and Expense Analysis Sheet

A

Family Income and Expense Analysis Sheet is a detailed financial document that tracks all sources of income and categorizes household expenses to provide a clear overview of the family's financial status. It helps identify spending patterns, manage budgets effectively, and plan for future financial goals by highlighting areas where expenses can be reduced or reallocated. This tool is essential for improving financial literacy, ensuring timely bill payments, and achieving long-term savings or investment objectives.

Family Savings Goal Tracker Excel

The

Family Savings Goal Tracker Excel document is a customizable spreadsheet designed to help families monitor and manage their savings targets effectively. It allows users to input income sources, set specific savings goals, and track progress over time, providing clear visual representations such as charts and graphs. This tool improves financial discipline, encourages consistent saving habits, and ensures transparent budgeting for future family expenses.

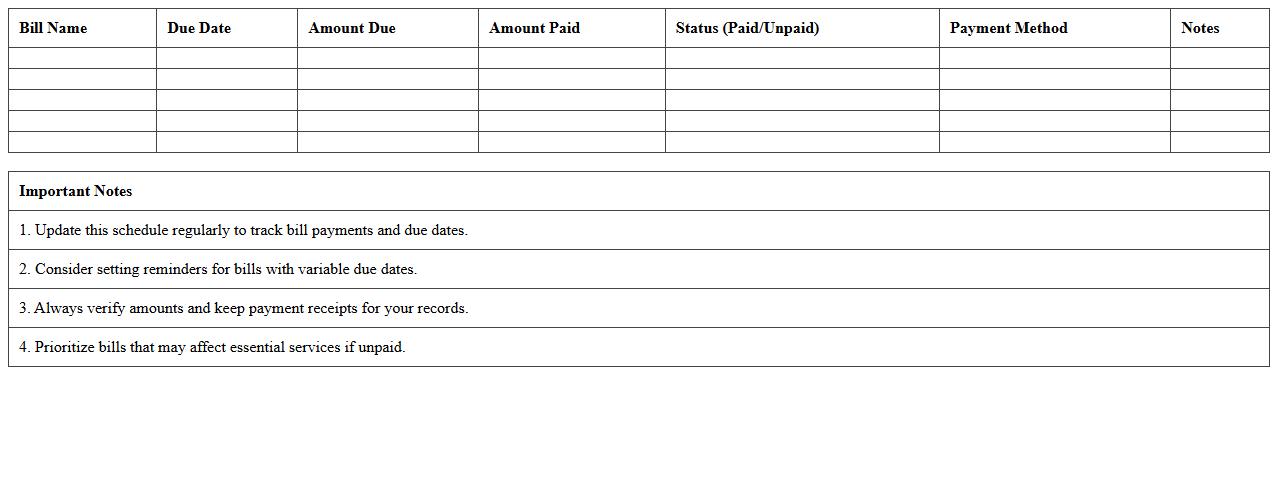

Household Bill Payment Schedule Template

A

Household Bill Payment Schedule Template is a structured document designed to organize and track monthly bills such as utilities, rent, and subscriptions. It helps users avoid missed payments, manage cash flow efficiently, and maintain a clear overview of due dates and amounts. By using this template, households can improve budgeting accuracy and reduce financial stress.

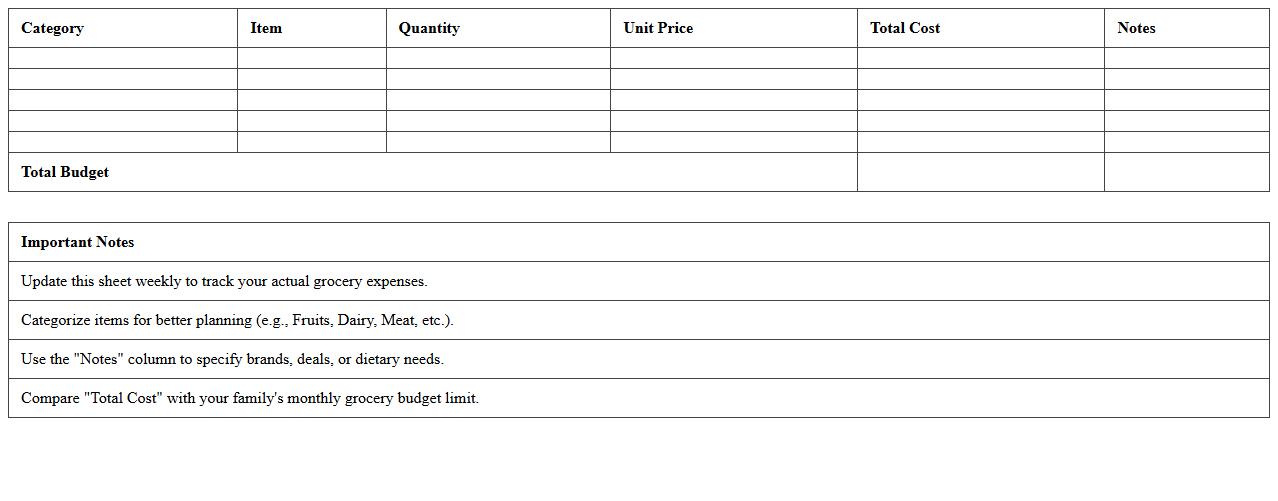

Family Grocery Budget Planner Spreadsheet

A

Family Grocery Budget Planner Spreadsheet is a digital tool designed to track and manage household grocery expenses efficiently. It helps users categorize purchases, compare costs, and set spending limits, ensuring better financial control and reducing waste. By providing clear insights into grocery spending patterns, this spreadsheet supports smarter shopping decisions and long-term budget adherence.

Annual Family Budget Overview Worksheet

The

Annual Family Budget Overview Worksheet is a comprehensive financial tool that helps families track income, expenses, savings, and debt throughout the year. It enables effective money management by providing a clear snapshot of monthly and annual financial health, facilitating better decision-making and financial planning. Using this worksheet promotes accountability, helps identify spending patterns, and supports long-term goals such as emergency funds, education, or retirement savings.

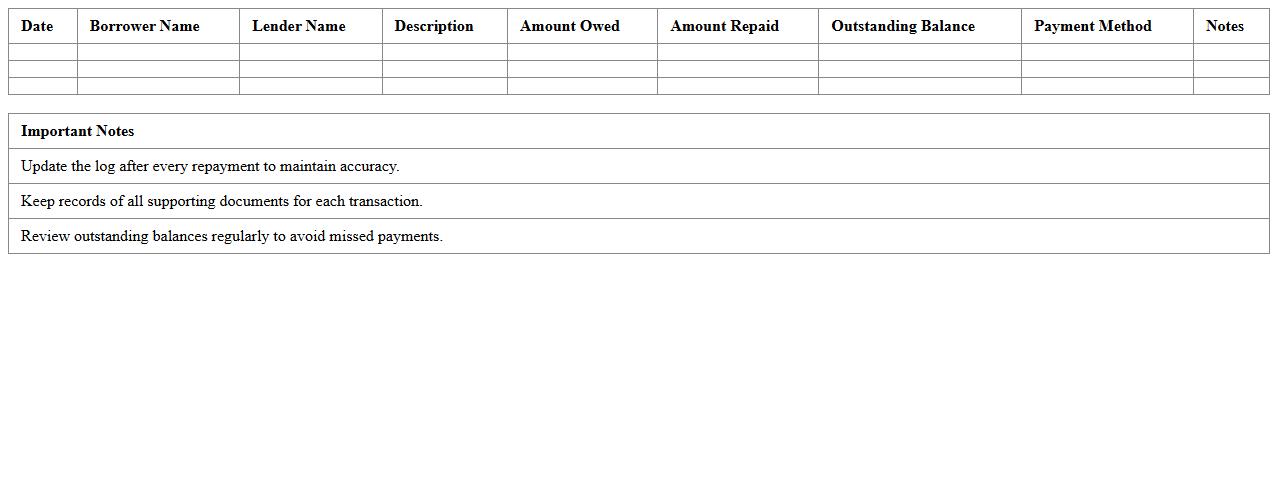

Family Debt Repayment Log Excel Template

The

Family Debt Repayment Log Excel Template is a structured spreadsheet designed to track and manage household debt payments efficiently. It helps individuals monitor balances, due dates, interest rates, and payment progress, promoting financial discipline and clear insights into debt reduction. Using this template supports budgeting efforts and aids in strategizing debt repayment to achieve financial stability.

Child Expenses Tracking Sheet for Families

A

Child Expenses Tracking Sheet for families is a structured document designed to monitor and organize all costs related to a child's upbringing, including education, healthcare, clothing, and extracurricular activities. It helps families maintain financial clarity, budget effectively, and identify spending patterns to manage expenses better. This tool supports informed decision-making, ensuring that resources are allocated efficiently for the child's needs.

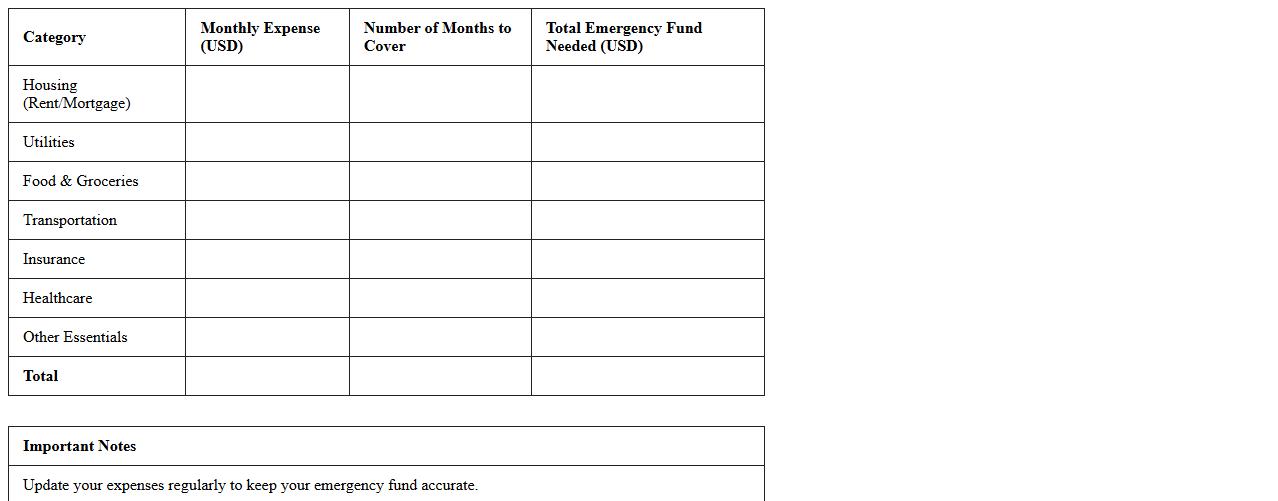

Family Emergency Fund Calculator Excel

The

Family Emergency Fund Calculator Excel is a practical tool designed to help individuals estimate the amount of savings needed to cover unforeseen family emergencies such as medical expenses, urgent repairs, or unexpected travel costs. By inputting variables like monthly expenses, number of dependents, and emergency scenarios, users can generate a personalized savings target to ensure financial preparedness. This calculator enhances budgeting accuracy and provides peace of mind by helping families maintain financial stability during crises.

How can I customize income categories in a family home budget Excel template?

To customize income categories in an Excel template, start by locating the section dedicated to income sources. Replace the default categories with your specific income types, such as salaries, freelance work, or rental income. Use Excel's data validation feature to create dropdown lists for easy selection and consistency across your budget sheet.

What are the best formulas to track monthly savings goals in an Excel budget plan?

Effective formulas for tracking savings goals include SUM, SUMIF, and simple subtraction to calculate actual savings versus targets. Use the formula =SUM(range) to total your monthly income and expenses, then subtract expenses from income to find available savings. Implement conditional formatting to highlight whether your savings meet the preset monthly goals.

How do I automate recurring household expenses in an Excel family budget sheet?

Automate recurring expenses by setting up a template section where you list fixed monthly costs such as mortgage, utilities, and subscriptions. Use the IF function combined with DATE or TODAY functions to ensure these expenses log automatically each month. Linking these to a master calculation cell will keep your budget updated without manual entry.

Which Excel charts visualize family spending trends most effectively?

The most effective Excel charts for visualizing family spending trends are pie charts for category distribution and line charts for tracking expenses over time. Bar charts can also compare spending between different months or categories clearly. Utilize dynamic ranges to update charts automatically as you input new budget data.

How can I securely share a family budget Excel document with multiple household members?

To securely share your family budget Excel document, use cloud storage platforms like OneDrive or Google Drive with restricted access permissions. Enable password protection and data encryption features available in Excel to safeguard sensitive financial information. Encourage family members to use their own accounts and assign edit or view-only rights as necessary.

More Plan Excel Templates