The Loan Repayment Ledger Excel Template for Peer-to-Peer Lending is designed to help track and manage loan repayments efficiently. It provides a clear overview of payment schedules, outstanding balances, and interest calculations for peer-to-peer loans. This template simplifies monitoring borrower transactions, ensuring accurate financial records and timely repayments.

Peer-to-Peer Loan Payment Tracking Spreadsheet

A

Peer-to-Peer Loan Payment Tracking Spreadsheet document is designed to systematically record and monitor loan payments between individuals without intermediaries. It helps users keep accurate records of payment schedules, amounts, and outstanding balances, ensuring transparency and accountability. This tool is essential for managing private loans efficiently, preventing misunderstandings, and maintaining clear financial agreements.

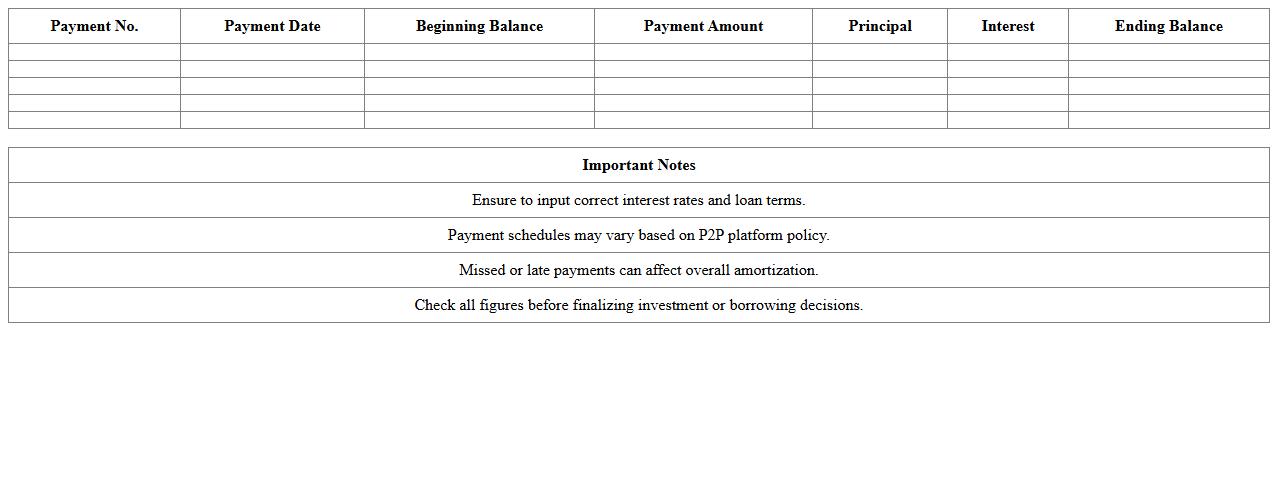

P2P Lending Amortization Schedule Template

The

P2P Lending Amortization Schedule Template is a financial document designed to systematically outline repayment plans for peer-to-peer loans, detailing principal and interest payments over time. This template provides borrowers and lenders with a transparent, organized schedule that helps track loan balances, due dates, and payment amounts, ensuring clarity and consistency in loan management. Utilizing this schedule enhances financial planning accuracy, facilitates timely repayments, and supports better cash flow management in P2P lending scenarios.

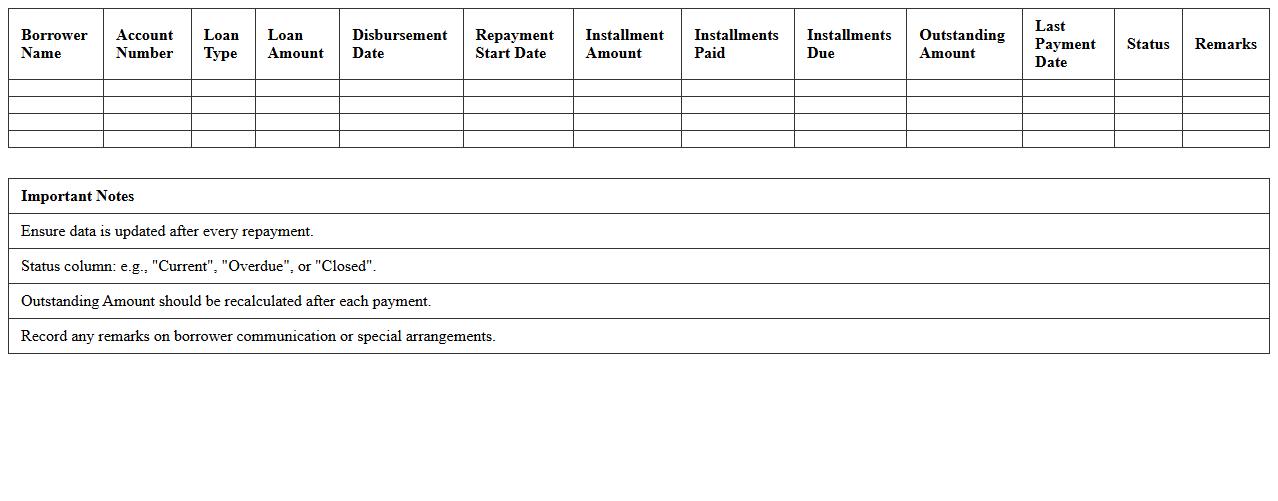

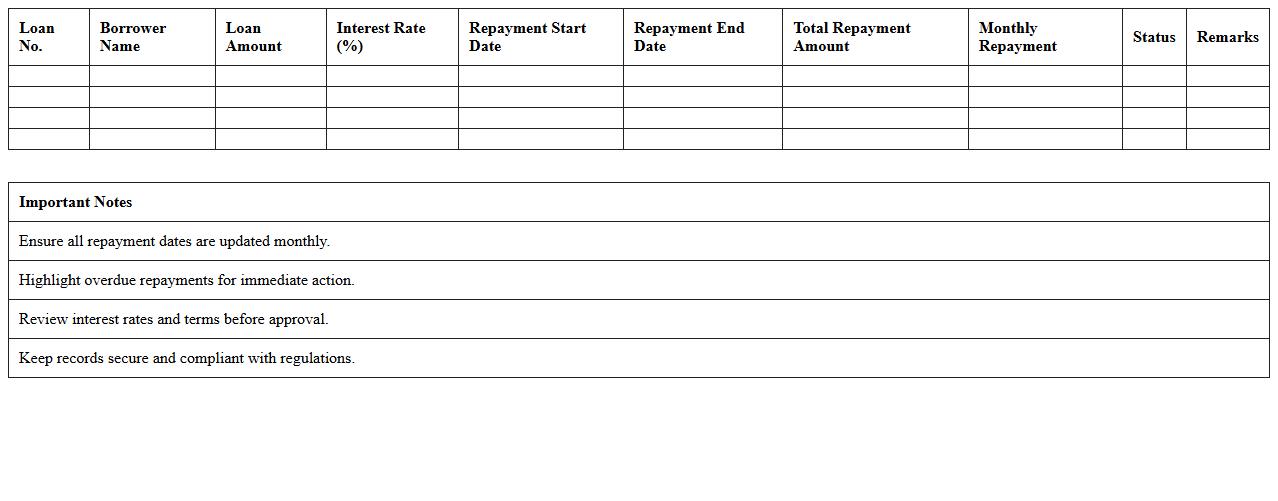

Borrower Repayment Monitoring Excel Sheet

The

Borrower Repayment Monitoring Excel Sheet is a comprehensive tool designed to track loan repayments, calculate outstanding balances, and schedule due dates efficiently. By organizing payment statuses and recording borrower information systematically, it helps lenders minimize defaults and maintain clear financial records. Its automated formulas and customizable features enable timely follow-ups and accurate cash flow forecasting, enhancing loan portfolio management.

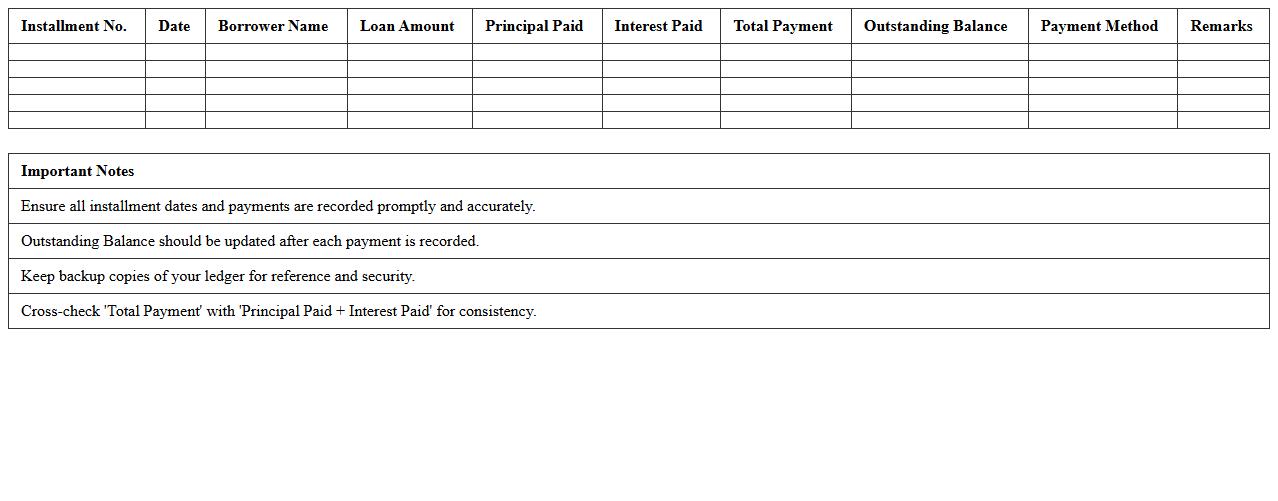

Microloan Installment Ledger Template

A

Microloan Installment Ledger Template is a structured document used to track and record installment payments made by borrowers on microloans. It helps lenders maintain clear, organized records of payment dates, amounts, and outstanding balances, ensuring transparency and efficient loan management. This template is useful for monitoring repayment schedules, preventing defaults, and enabling accurate financial reporting.

Peer Loan Payment History Tracker

The

Peer Loan Payment History Tracker document records detailed information on repayment activities between loan participants, enabling transparent monitoring of payment status and schedules. It helps users track timely payments, identify delinquencies, and analyze borrowing patterns for informed financial decisions. By maintaining accurate loan history, the tracker supports accountability, improves credit management, and enhances mutual trust in peer-to-peer lending environments.

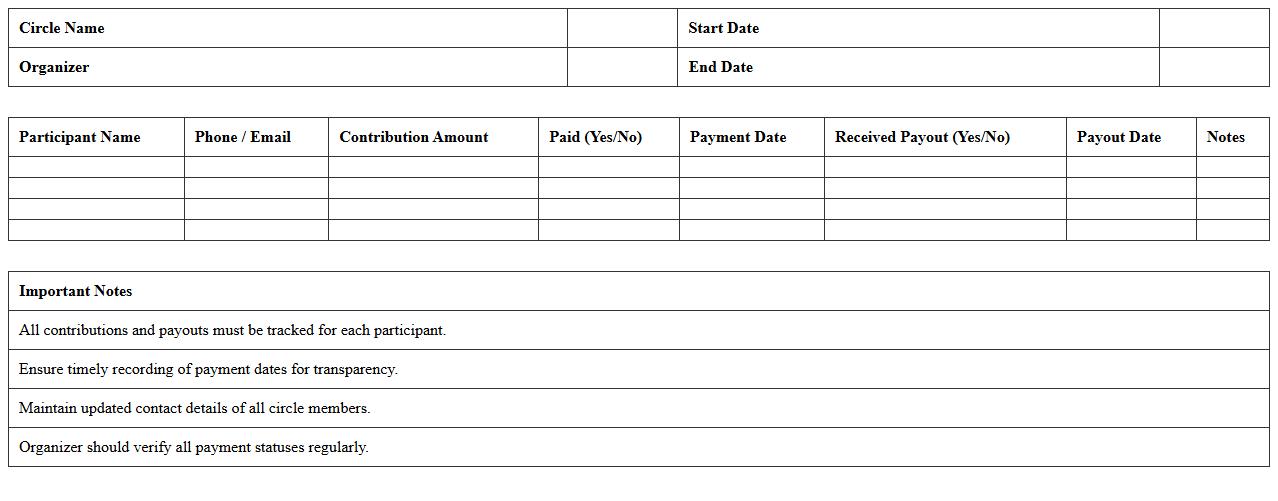

Lending Circle Payment Record Template

The

Lending Circle Payment Record Template document is a structured tool designed to track and document individual payments within lending circles, ensuring transparency and accountability among participants. It records essential details such as payment dates, amounts, payer and receiver information, and outstanding balances, facilitating accurate financial management. This template is useful for maintaining clear payment histories, simplifying dispute resolution, and promoting trust within community lending groups.

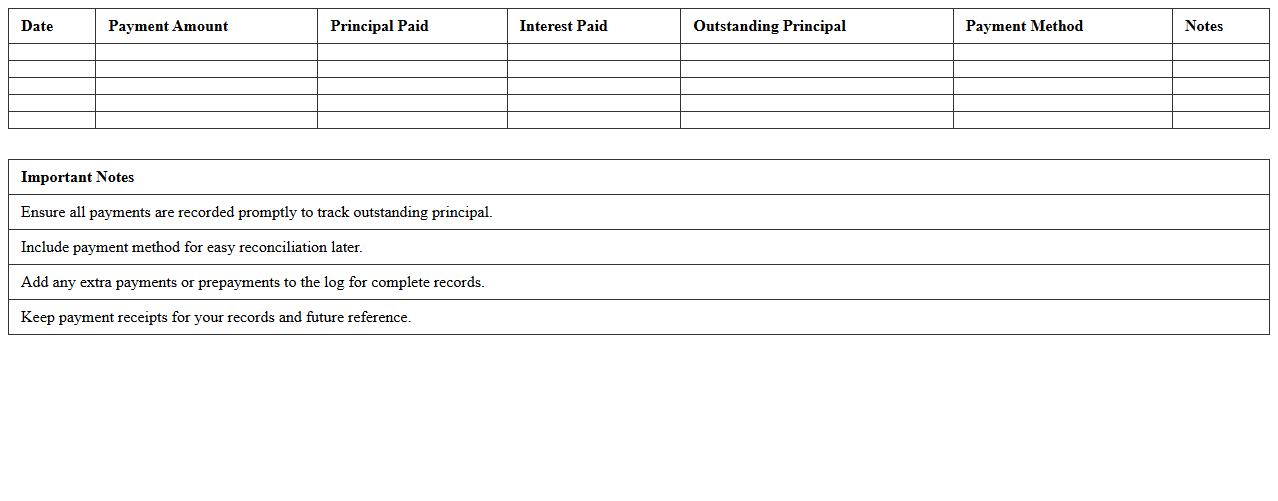

Personal Loan Repayment Log Excel

A

Personal Loan Repayment Log Excel document is a structured spreadsheet designed to track loan payments systematically, including dates, amounts paid, balance remaining, and interest accrued. It helps individuals monitor their repayment progress, avoid missed payments, and manage loan schedules effectively to maintain financial discipline. By providing a clear overview of all transactions, it aids in budgeting and ensures timely loan closure, reducing stress and potential penalties.

Crowdlending Repayment Summary Template

The

Crowdlending Repayment Summary Template document provides a detailed overview of loan repayments made by borrowers to multiple lenders within a crowdlending platform. It helps track principal amounts, interest payments, repayment dates, and outstanding balances in a structured format, ensuring transparency and efficient financial management. This template is useful for investors and loan managers to monitor cash flows, assess repayment performance, and maintain accurate records for reporting and decision-making purposes.

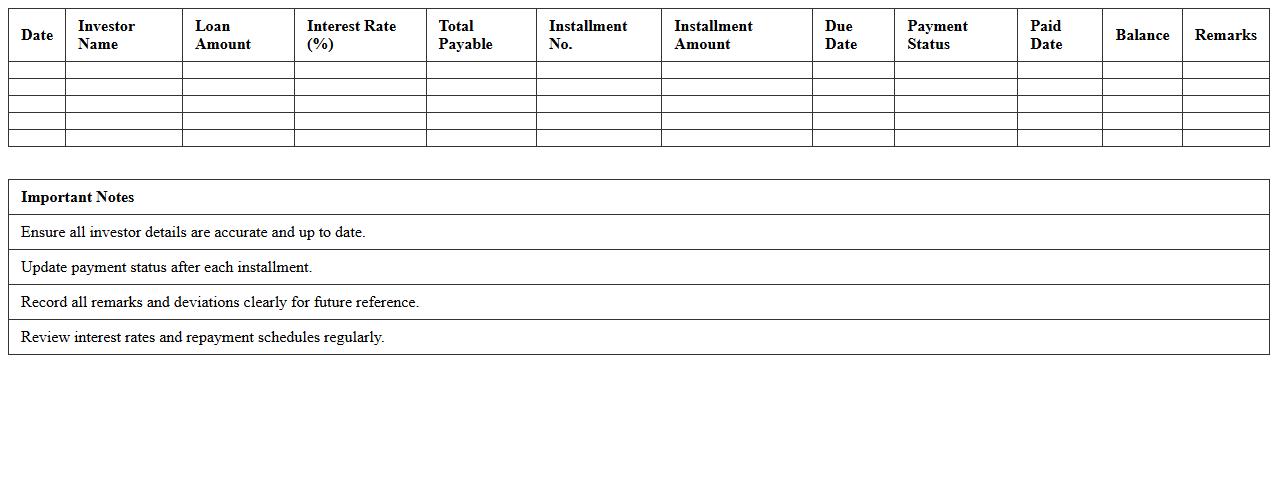

Investor Loan Payback Record Sheet

The

Investor Loan Payback Record Sheet is a detailed document used to track and manage the repayment schedule of loans provided by investors. It helps maintain transparent financial records by logging payment dates, amounts paid, and outstanding balances, ensuring accountability and clear communication between borrowers and investors. Utilizing this sheet supports effective financial planning and audit readiness, minimizing risks of missed payments or disputes.

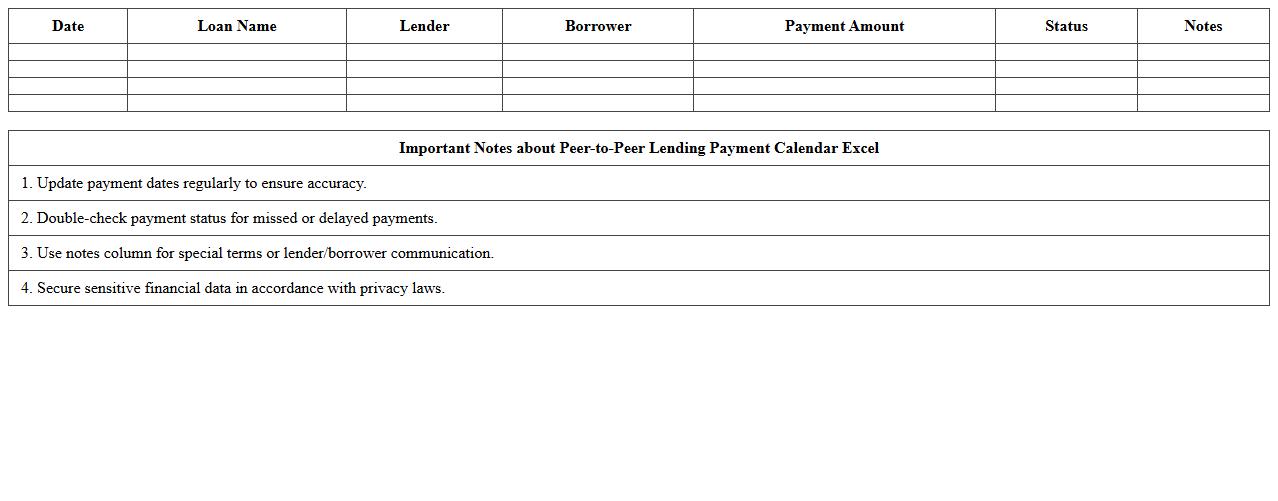

Peer-to-Peer Lending Payment Calendar Excel

The

Peer-to-Peer Lending Payment Calendar Excel document helps track and manage loan repayments between individual borrowers and lenders without traditional financial institutions. It organizes payment schedules, due dates, and amounts in a clear, easy-to-update format, reducing the risk of missed payments and improving financial oversight. Using this tool enhances loan management efficiency and supports better cash flow planning for both parties involved in peer-to-peer lending.

How can I automate interest calculations in a Loan Repayment Ledger Excel for P2P lending?

To automate interest calculations in Excel, use the built-in financial functions such as PMT, IPMT, and PPMT that calculate payments, interest, and principal portions respectively. Set up dynamic formulas that reference the loan amount, interest rate, and repayment period to update automatically with changing input data. This approach minimizes errors and ensures accurate tracking of loan interest accrual in your ledger.

Which Excel formulas best track overdue repayments for individual borrowers?

Use the IF, TODAY, and DATEDIF functions to identify overdue repayments by comparing the due date with the current date. For example, =IF(TODAY()>DueDate, "Overdue", "On Time") quickly flags late payments in the ledger. Additionally, combining these with conditional formulas can help calculate the number of days a payment is late for precise tracking.

What template structure optimizes visibility of principal vs. interest in P2P loans?

An optimal template structure separates columns clearly into Principal Paid, Interest Paid, and Remaining Balance for transparent tracking. Include sections for loan details like Loan ID, Borrower Name, and Payment Date to provide comprehensive insights. Use tables or structured references allowing easy filtering and summarization of principal versus interest components in the repayment schedule.

How do I generate late payment alerts using conditional formatting in Excel ledgers?

Apply conditional formatting rules based on formulas that detect overdue payments, such as =AND(TODAY()>DueDate, Status<>"Paid"). Highlight cells or rows with distinctive colors like red to draw immediate attention to late repayments. This visual alert boosts proactive loan management and ensures timely follow-up with borrowers.

Can Excel macros batch-update multiple borrower repayment statuses efficiently?

Yes, Excel macros can automate batch updates by looping through borrower records and modifying repayment statuses according to conditions like payment dates and amounts. Using VBA scripting enhances efficiency, especially when handling large datasets in P2P lending ledgers. Macros save time by reducing manual updates and minimizing human error in repayment tracking.

More Ledger Excel Templates