Personal Loan Repayment Tracker Ledger Excel

A

Personal Loan Repayment Tracker Ledger Excel document is a digital spreadsheet designed to monitor and record loan repayments systematically, capturing details such as payment amounts, dates, interest rates, and remaining balances. It helps borrowers maintain clear visibility of their repayment progress, ensuring timely payments, avoiding defaults, and managing personal finances effectively. By automating calculations, this tool reduces errors and provides precise insights into loan amortization schedules, making financial planning more efficient.

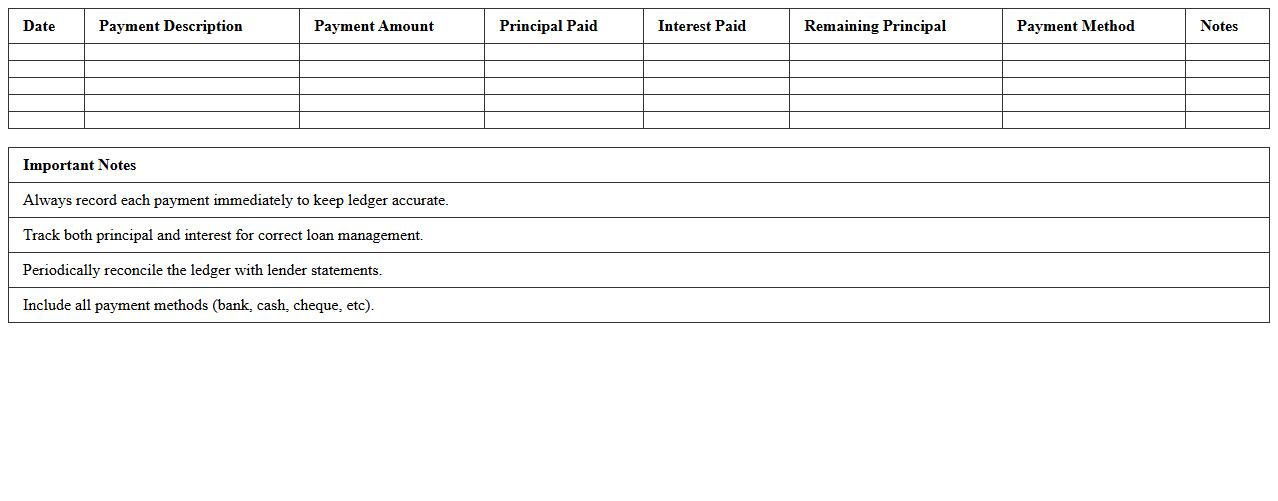

Business Loan Payment Record Ledger Template

A

Business Loan Payment Record Ledger Template is a structured document designed to systematically track loan repayments, including dates, amounts, interest, and outstanding balances. It helps businesses maintain accurate financial records, ensuring timely payments while simplifying audits and financial analysis. Using this template enhances transparency in loan management and supports effective cash flow planning.

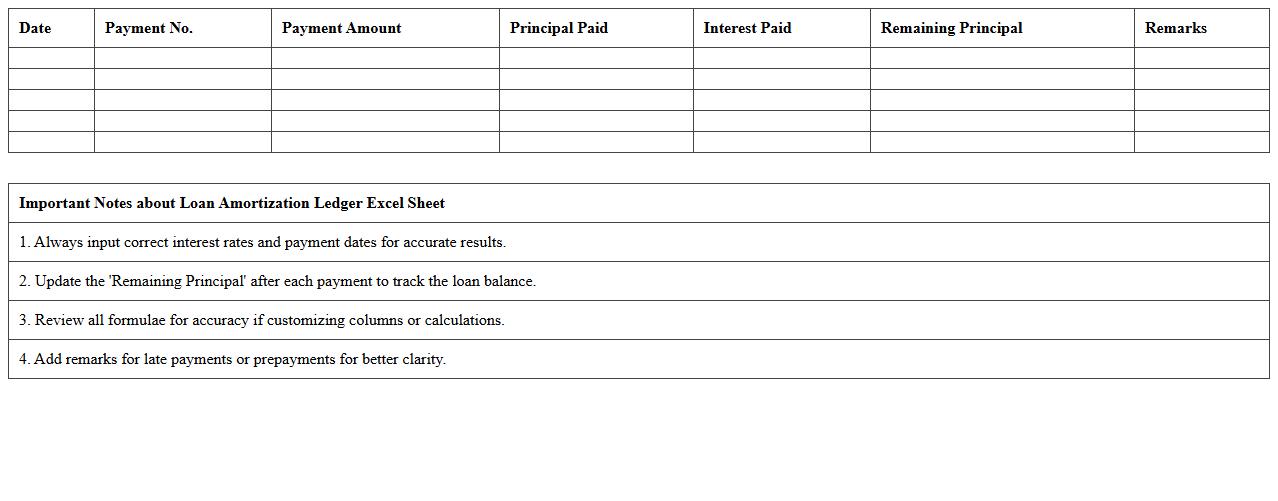

Loan Amortization Ledger Excel Sheet

A

Loan Amortization Ledger Excel Sheet document is a detailed record that tracks the schedule of loan repayments, including principal and interest amounts over time. It helps borrowers and lenders visualize payment breakdowns, outstanding balances, and due dates, ensuring accurate financial planning and loan management. Using this tool improves transparency and aids in forecasting future cash flow obligations effectively.

Multiple Loans Repayment Tracking Ledger

A

Multiple Loans Repayment Tracking Ledger is a detailed document that records and monitors the repayment schedules, amounts, and balances of several loans simultaneously. This ledger helps borrowers and financial managers maintain organized and accurate payment histories, ensuring timely repayments and avoiding missed or late payments. By providing a clear overview of multiple loan obligations, it improves financial planning and debt management efficiency.

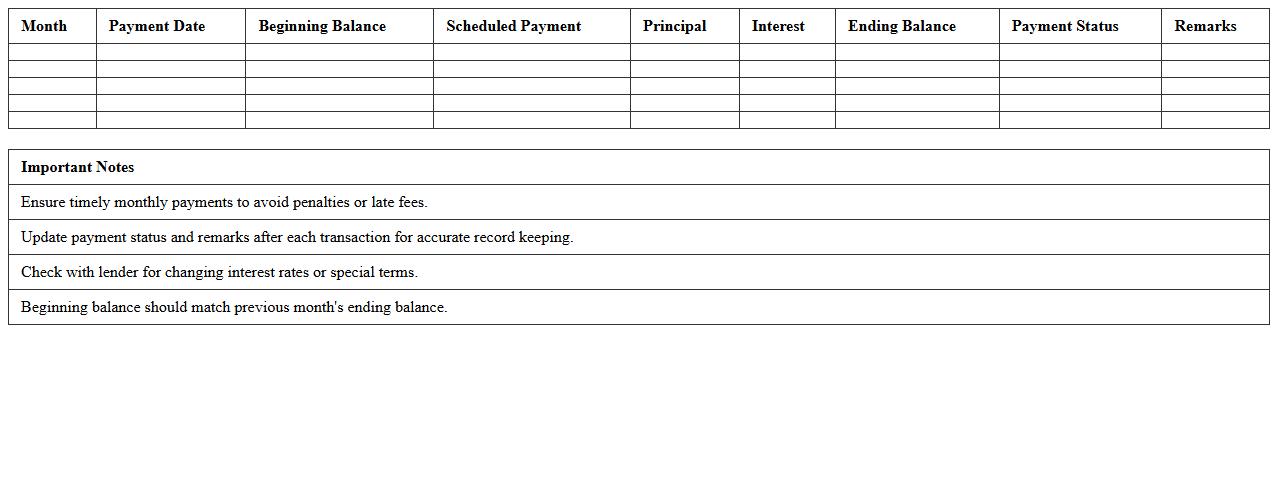

Monthly Loan Payment Schedule Ledger Excel

A

Monthly Loan Payment Schedule Ledger Excel document is a spreadsheet tool designed to track and organize monthly loan payments, including principal, interest, and outstanding balances. It helps users maintain accurate financial records, plan budgets, and forecast future payments by providing a clear, itemized overview of loan repayment progress. This ledger is essential for managing multiple loans efficiently and ensuring timely payments to avoid penalties.

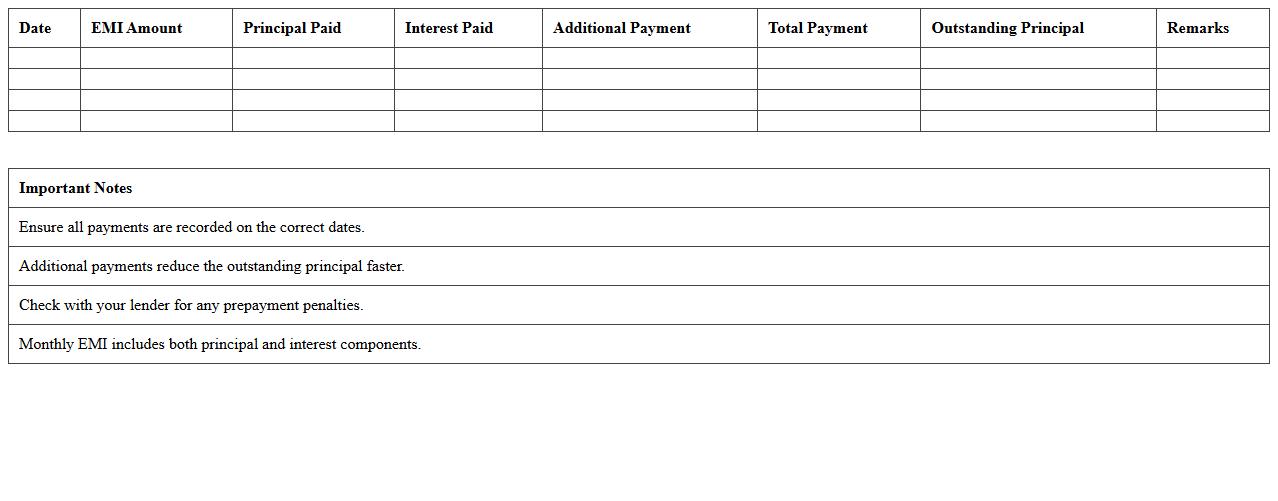

Home Loan Repayment Ledger Excel Template

A

Home Loan Repayment Ledger Excel Template is a structured spreadsheet designed to track loan repayments, interest accrual, and outstanding balances over the tenure of a home loan. This document helps borrowers maintain an organized record of monthly installments, calculate remaining principal, and monitor payment progress efficiently. Utilizing this template improves financial planning by providing clear insights into amortization schedules and minimizing the risk of missed or delayed payments.

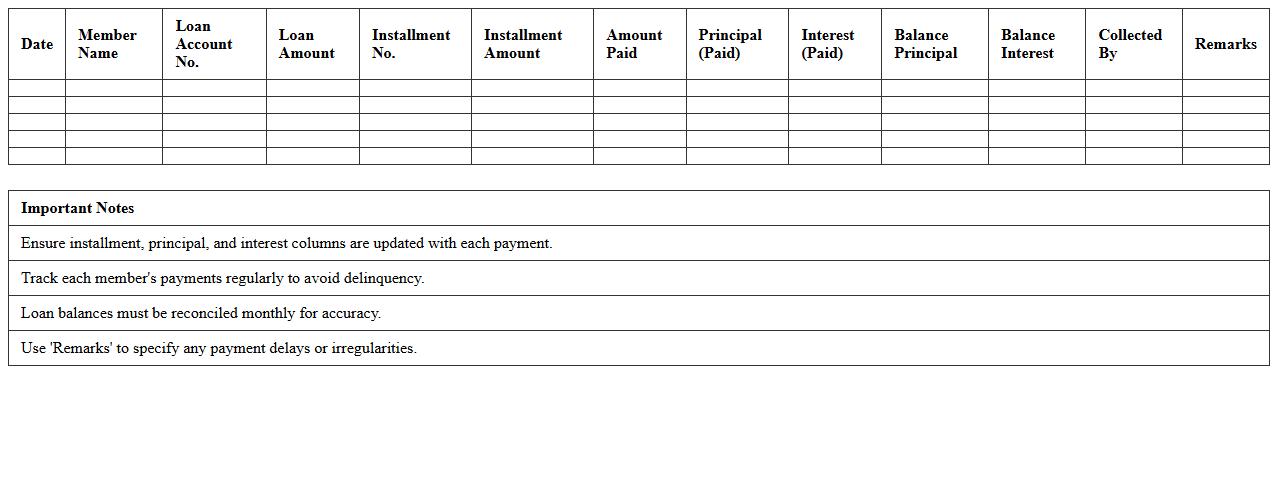

Microfinance Loan Collection Ledger Excel

A

Microfinance Loan Collection Ledger Excel document is a structured spreadsheet designed to track loan disbursements, repayments, outstanding balances, and borrower details for microfinance institutions. It enables efficient monitoring of loan recovery, helps maintain accurate financial records, and supports transparent reporting for better decision-making. Using this tool enhances cash flow management and reduces the risk of loan defaults through organized data entry and timely follow-ups.

Student Loan Payment Tracking Ledger

A

Student Loan Payment Tracking Ledger is a detailed document used to record and monitor all student loan payments, including principal, interest, payment dates, and remaining balances. This ledger helps borrowers stay organized, ensuring timely payments to avoid penalties and maintain a clear understanding of their loan payoff progress. It is an essential tool for managing debt efficiently and planning financial strategies for loan repayment.

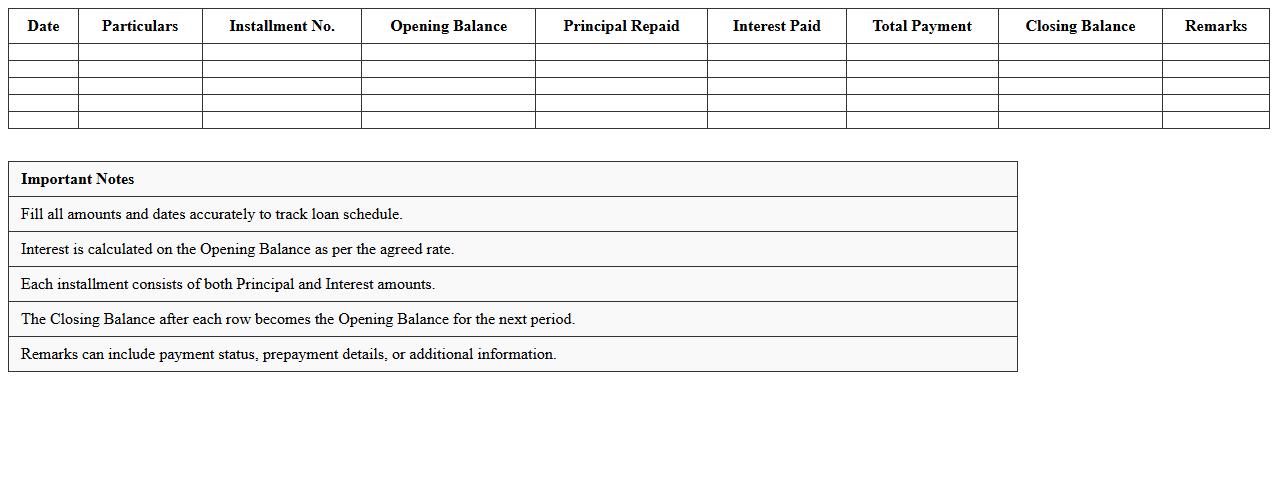

Interest & Principal Loan Ledger Excel Sheet

The

Interest & Principal Loan Ledger Excel Sheet document is a detailed financial record that tracks loan repayments by separating the interest and principal components for each installment. It helps borrowers and lenders accurately monitor payment progress, outstanding balances, and interest accrual over time, ensuring transparent loan management. Utilizing this ledger improves budgeting, forecasting, and financial planning for both individuals and businesses.

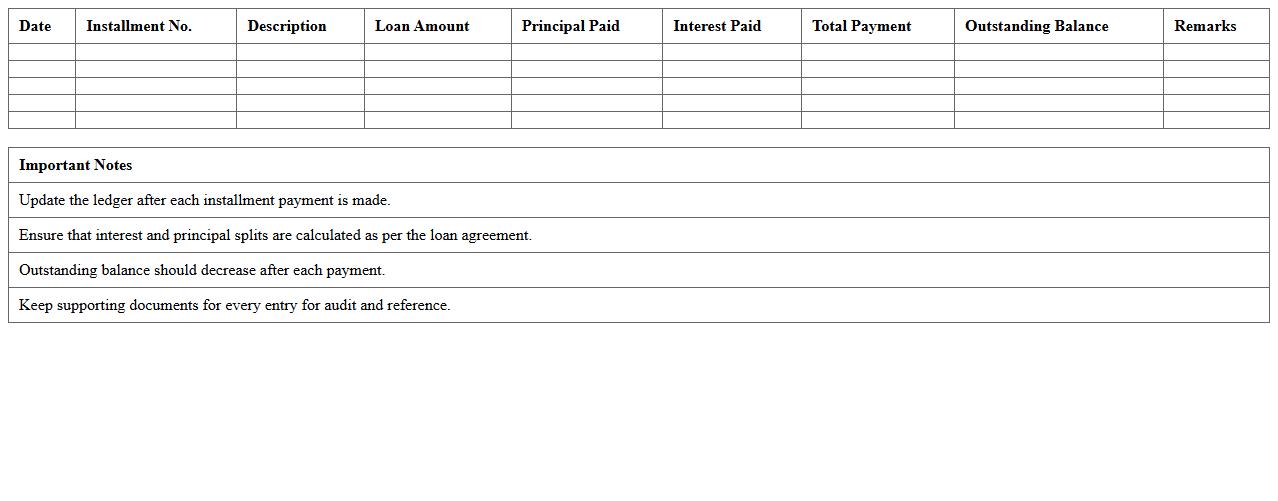

Small Business Loan Installment Ledger Excel

A

Small Business Loan Installment Ledger Excel document is a structured spreadsheet designed to track loan repayments, including principal, interest, and due dates for each installment. It helps business owners maintain accurate financial records, monitor payment schedules, and manage cash flow effectively. Utilizing this ledger minimizes the risk of missing payments and supports better loan management for small businesses.

![]()