The Ledger Excel Template for Side Hustle Accounting offers a streamlined way to track income, expenses, and profits efficiently. Designed specifically for small businesses and freelancers, it enables precise financial management without complex software. This template simplifies bookkeeping, helping users stay organized and make informed financial decisions.

Income and Expense Tracker for Side Hustle

An

Income and Expense Tracker for Side Hustle document systematically records all revenue and costs associated with a secondary business or freelance work, ensuring accurate financial monitoring. It helps users maintain organized financial data, simplifies tax preparation, and provides clear insights into profitability and cash flow management. Utilizing this tool enables better budgeting, identifies spending patterns, and supports strategic decision-making to grow the side hustle effectively.

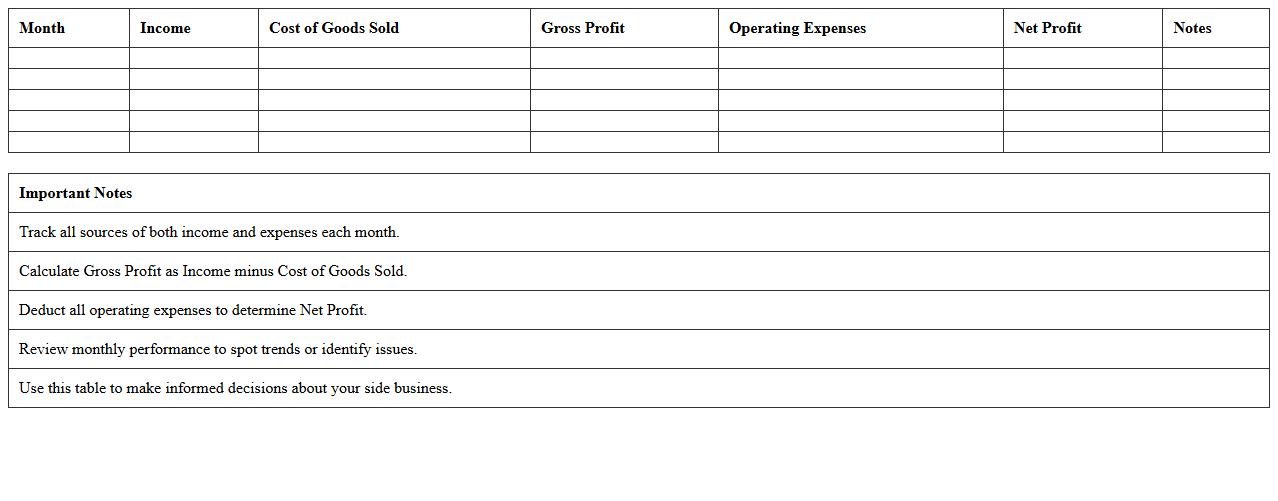

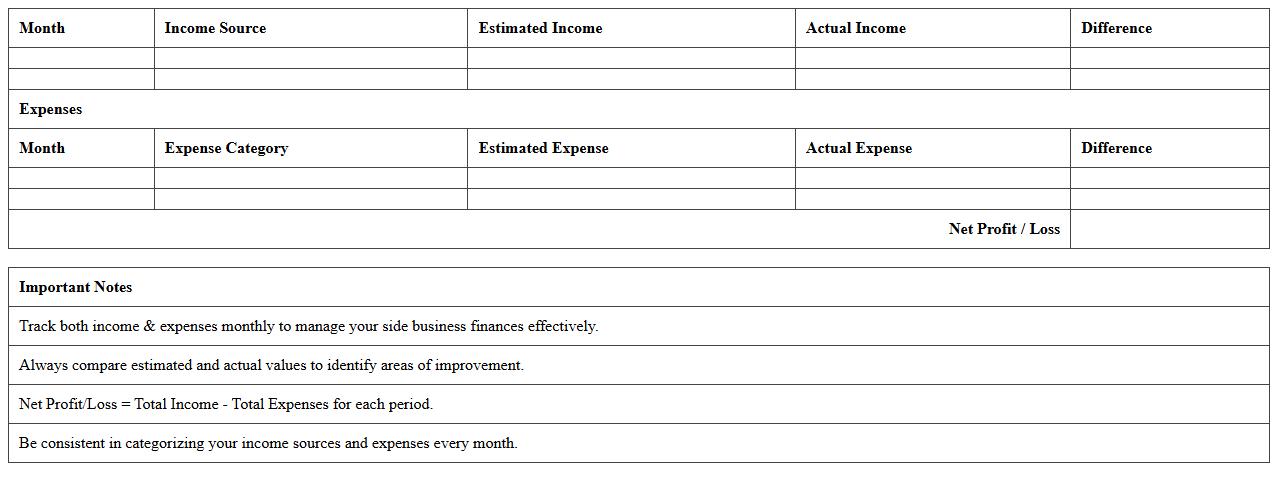

Monthly Profit and Loss Statement for Side Business

A

Monthly Profit and Loss Statement for a side business is a financial document summarizing income, expenses, and net profit or loss within a specific month. It provides crucial insights into the business's financial health, enabling better budgeting and expense management. This statement helps identify trends, measure profitability, and make informed decisions to improve overall business performance.

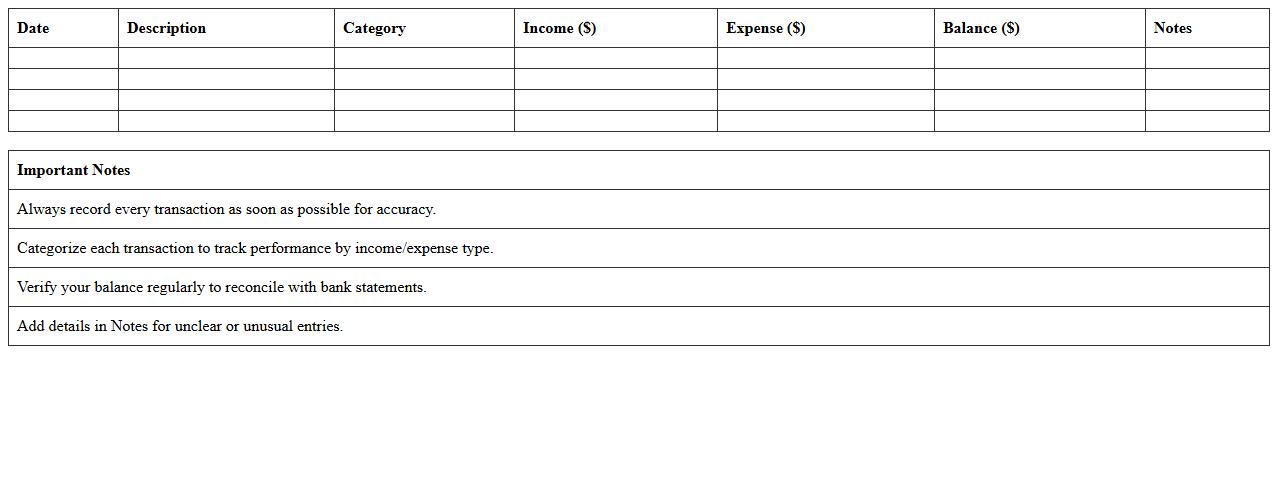

Side Hustle Cash Flow Ledger

The

Side Hustle Cash Flow Ledger is a financial tracking document designed to monitor income and expenses specifically from side businesses or freelance work. It helps entrepreneurs maintain clear records of cash flow, enabling better budgeting and financial planning for their secondary income streams. Using this ledger promotes organized finances, ensuring accurate profit calculations and tax preparation.

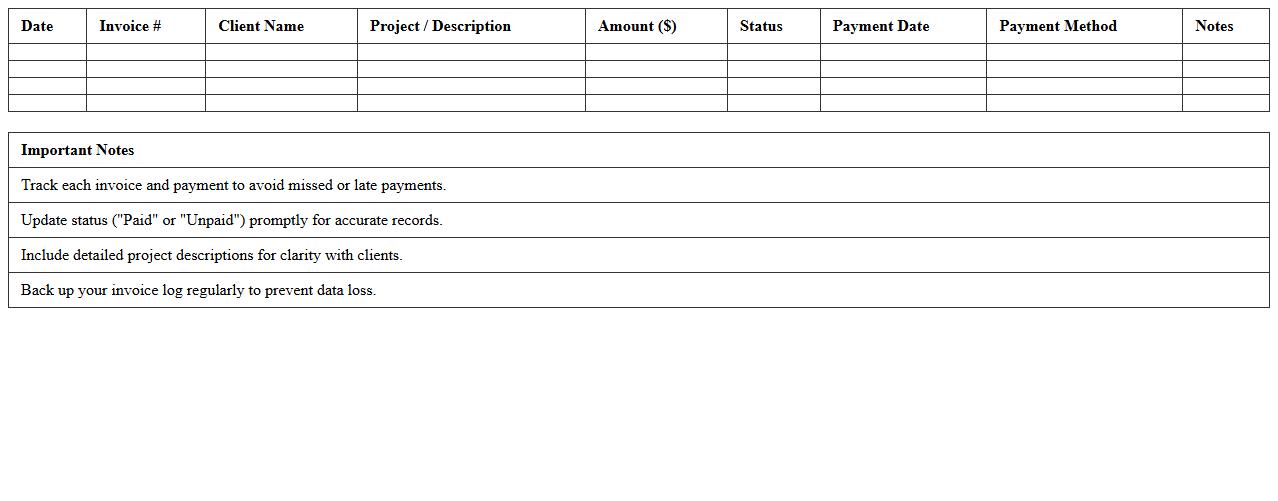

Simple Invoice and Payment Log for Freelancers

A

Simple Invoice and Payment Log for Freelancers is a streamlined document designed to track all client invoices and payments efficiently. It helps freelancers maintain accurate financial records, ensuring timely follow-ups on unpaid invoices and simplifying tax preparation. Using this log enhances cash flow management and provides clear documentation for income verification.

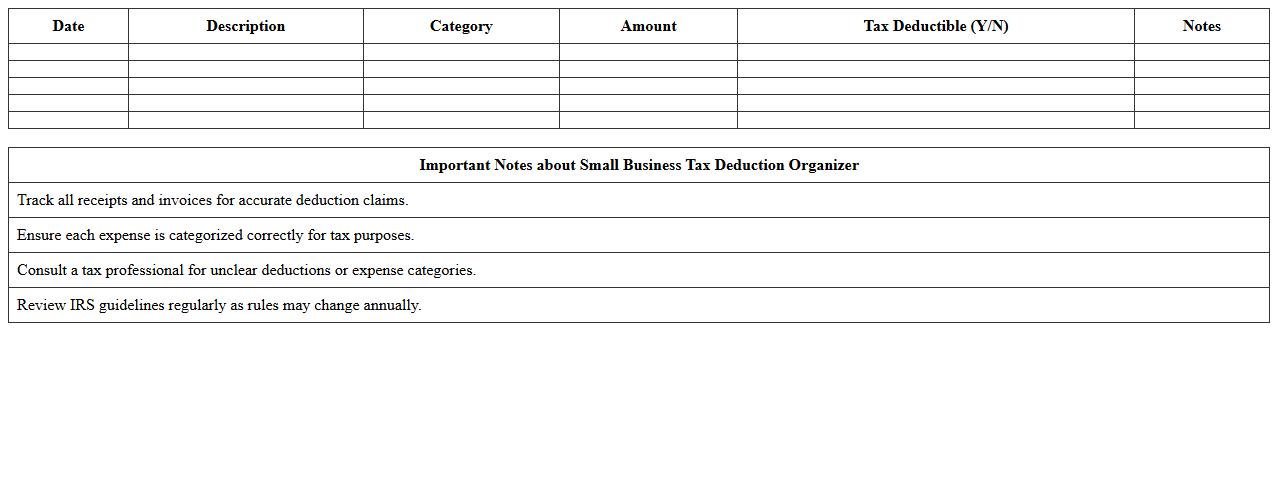

Small Business Tax Deduction Organizer

The

Small Business Tax Deduction Organizer document simplifies the process of tracking and categorizing deductible expenses throughout the fiscal year, ensuring accurate and comprehensive record-keeping. It helps business owners identify eligible deductions such as office supplies, travel costs, and equipment purchases, which can significantly reduce taxable income. Using this organized approach minimizes errors, saves time during tax preparation, and maximizes potential tax savings for small businesses.

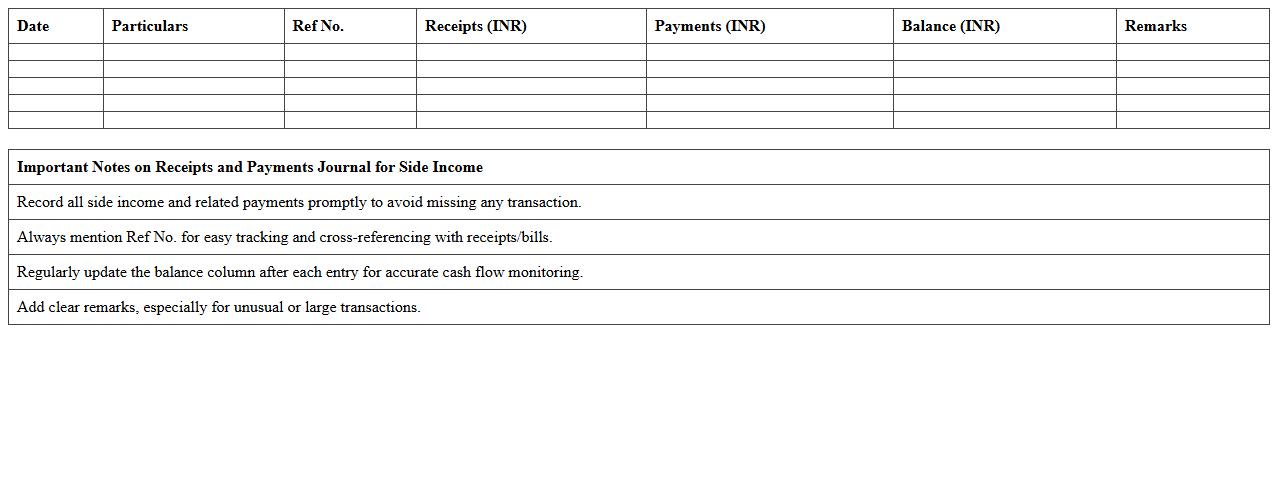

Receipts and Payments Journal for Side Income

The

Receipts and Payments Journal for Side Income is a financial record that tracks all cash inflows and outflows related to additional income sources outside of primary earnings. It helps systematically document side income transactions, ensuring accurate monitoring and management of supplementary funds. This journal is useful for budgeting, auditing, and evaluating the financial impact of extra income streams on overall financial health.

Mileage and Expense Tracker for Gig Workers

The

Mileage and Expense Tracker for Gig Workers document helps freelancers and independent contractors systematically record miles driven and business-related expenses. This tool ensures accurate tax deductions by capturing all relevant financial data, minimizing the risk of missed write-offs. It streamlines financial management, improving budget control and simplifying year-end tax reporting.

Personal Side Business Budget Spreadsheet

The

Personal Side Business Budget Spreadsheet is a detailed financial tool designed to help individuals track income, expenses, and profitability of their side ventures. It allows for organized monitoring of cash flow, ensuring accurate budgeting, expense categorization, and tax preparation. Utilizing this spreadsheet improves financial decision-making, enhances business growth potential, and provides clarity on the economic health of side businesses.

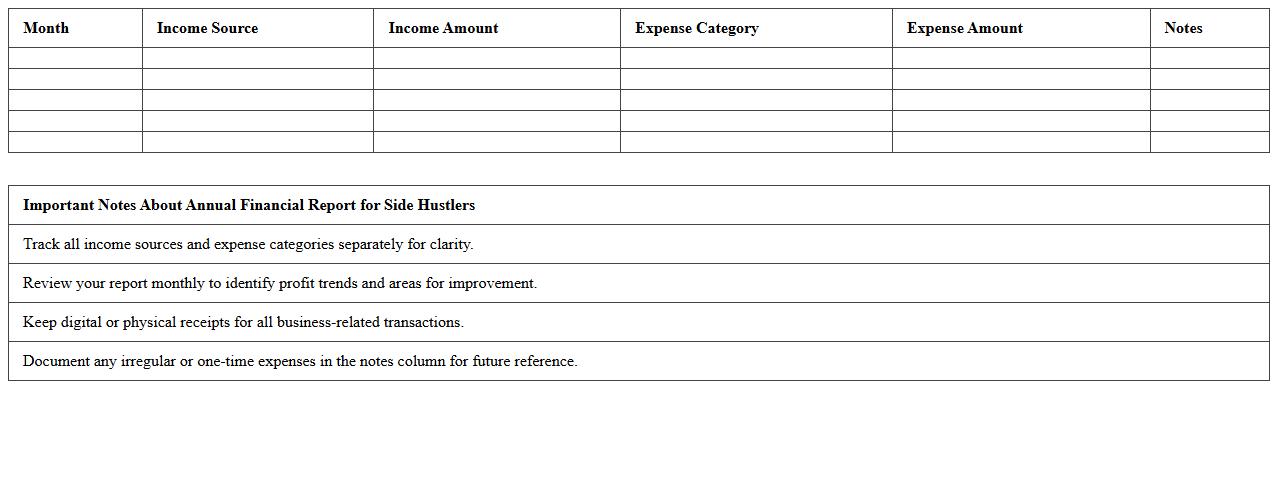

Annual Financial Report for Side Hustlers

The

Annual Financial Report for Side Hustlers is a comprehensive document that summarizes income, expenses, and profits from side businesses over a year, providing clear financial insights and performance metrics. It helps side hustlers track financial progress, identify growth opportunities, and make informed budgeting or tax planning decisions. By organizing financial data systematically, this report supports better money management and prepares entrepreneurs for future financial challenges.

Client Payment and Project Tracking Ledger

The

Client Payment and Project Tracking Ledger document serves as a comprehensive record of financial transactions and project milestones, enabling precise monitoring of client payments and project progress. It helps maintain transparency by tracking invoices, payments received, outstanding balances, and key project deliverables in one centralized location. This ledger enhances financial accuracy, supports timely decision-making, and ensures smooth cash flow management essential for successful project execution.

How can I automate income and expense categorization in a Side Hustle ledger Excel sheet?

To automate income and expense categorization, use Excel's IF and VLOOKUP functions to assign categories based on keywords. Set up a lookup table with common income and expense terms for accurate classification. This method saves time and ensures consistent categorization across your ledger.

What formulas best track monthly profit trends for side gigs in Excel?

SUMIFS is ideal for calculating monthly profits by summing income and expenses within specific date ranges. Combine it with DATE and EOMONTH functions to define month boundaries accurately. This approach provides a dynamic view of profits over each month for insightful trend analysis.

How do I set up separate tax deduction columns in a Side Hustle ledger Excel template?

Create dedicated tax deduction columns next to your income and expense entries to itemize deductible amounts. Use formulas like a fixed percentage or lookup tables that apply tax rules based on transaction type. This keeps tax-related calculations transparent and easy to update when tax laws change.

Which Excel features help monitor unpaid invoices for freelance work?

Excel's conditional formatting highlights unpaid invoices based on payment status or due dates, improving tracking visibility. Use filters and tables to sort and review overdue invoices quickly. Additionally, the COUNTIF function can summarize the total number of unpaid bills at a glance.

What pivot table setup visualizes revenue sources in a Side Hustle ledger?

Create a pivot table with income categories as rows and dates as columns to display revenue by source and period. Add sum values of income to quickly identify top-performing sources. This dynamic setup makes it easy to analyze and compare revenue streams over time.

More Ledger Excel Templates