The Ledger Excel Template for Small Businesses simplifies financial record-keeping by providing an organized, easy-to-use format for tracking income, expenses, and balances. This template enhances accuracy and efficiency, allowing small business owners to maintain clear, up-to-date financial records without extensive accounting knowledge. Customizable features accommodate various business needs, making it an essential tool for effective financial management.

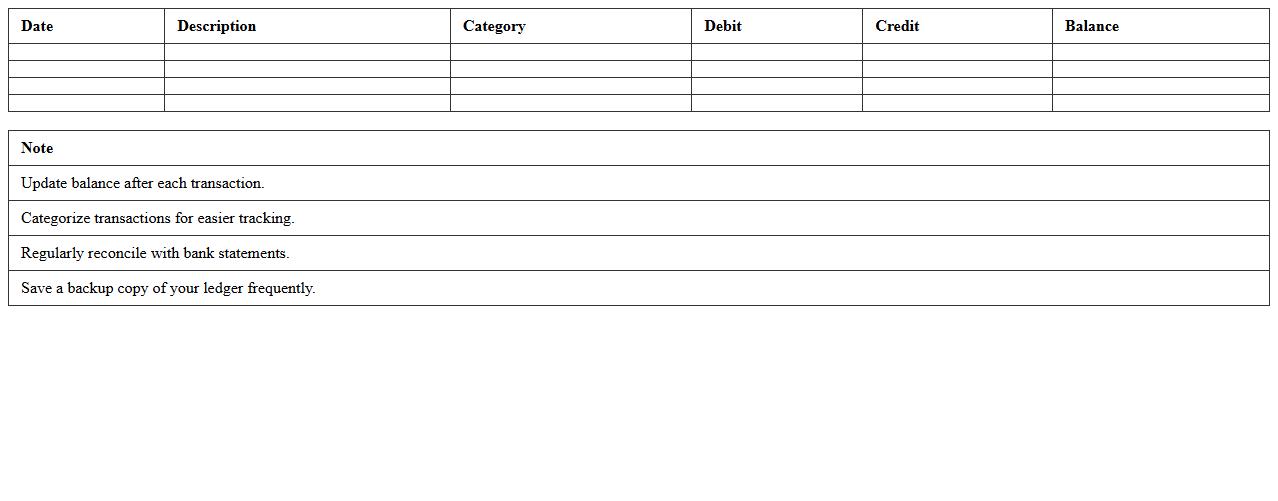

Simple Financial Ledger Excel Template

The

Simple Financial Ledger Excel Template document is a structured spreadsheet designed to track and record financial transactions systematically, enabling users to monitor income, expenses, and account balances efficiently. It simplifies budgeting and financial planning by providing clear categories and automated calculations, reducing the risk of manual errors. This tool is essential for personal finance management and small businesses seeking accurate financial oversight without complex accounting software.

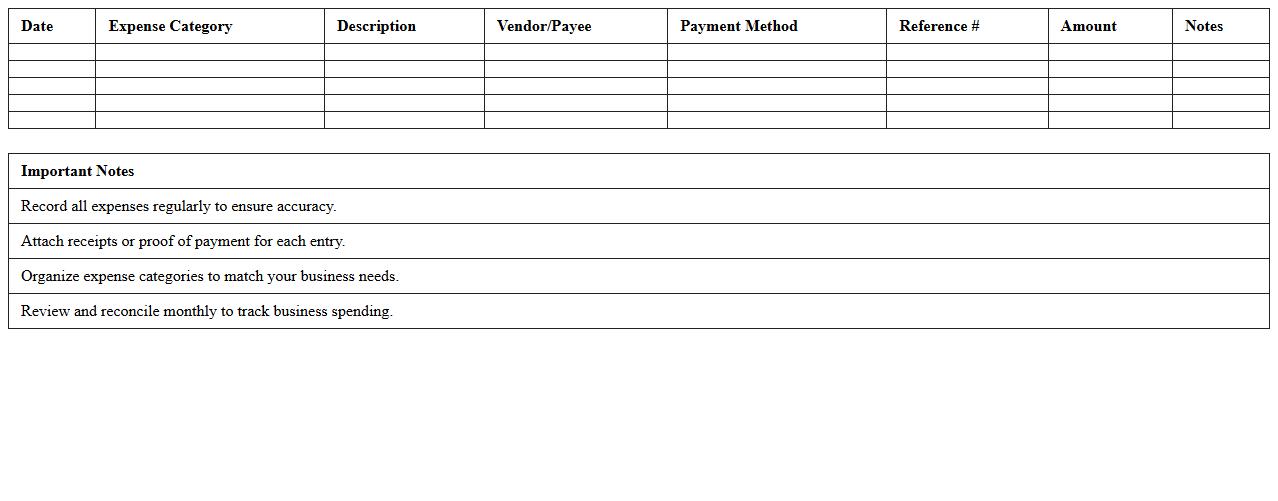

Small Business Expense Ledger Sheet

A

Small Business Expense Ledger Sheet is a detailed financial record used to track all business-related expenses systematically. This document helps businesses maintain accurate accounting, monitor cash flow, and ensure compliance with tax regulations by organizing expense data in one place. Using an expense ledger sheet improves budgeting, supports informed decision-making, and simplifies financial reporting and auditing processes.

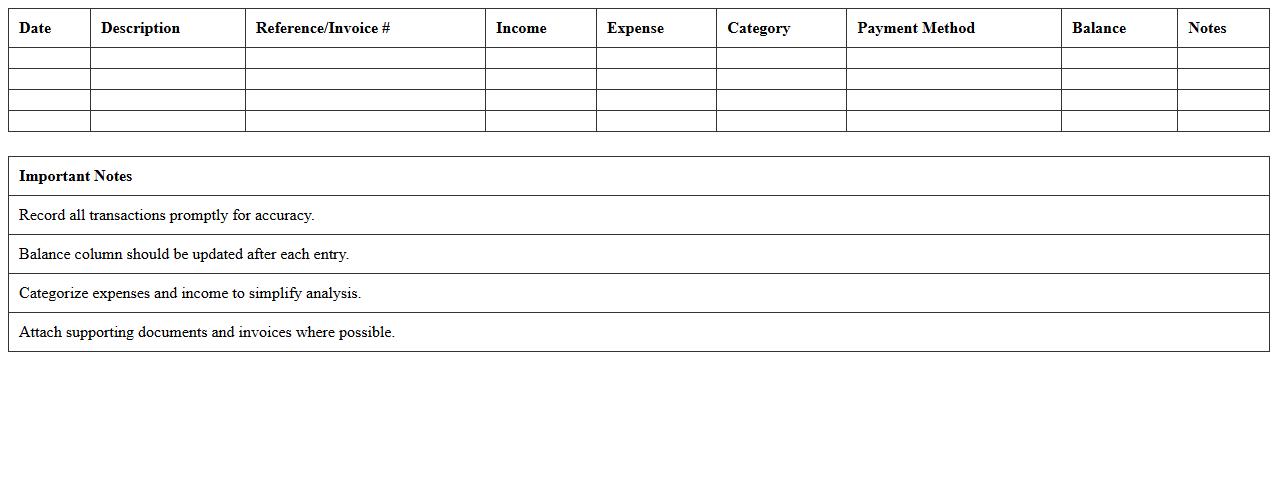

Income and Expense Tracker Excel Template

The

Income and Expense Tracker Excel Template is a structured spreadsheet designed to help individuals and businesses systematically record and monitor their financial transactions. It allows users to categorize income sources and expenses, providing clear insights into cash flow patterns and financial health. By using this template, one can efficiently budget, identify spending trends, and make informed decisions to improve financial management.

Monthly Business Ledger Spreadsheet

The

Monthly Business Ledger Spreadsheet is a detailed financial record that tracks all monthly transactions, including income, expenses, and profits for a business. It provides clear visibility into cash flow and financial health by organizing data in a structured format, making it easier to analyze trends and prepare accurate reports. This document is essential for budgeting, tax preparation, and strategic decision-making, helping businesses maintain financial discipline and improve overall performance.

Cash Flow Ledger for Small Companies

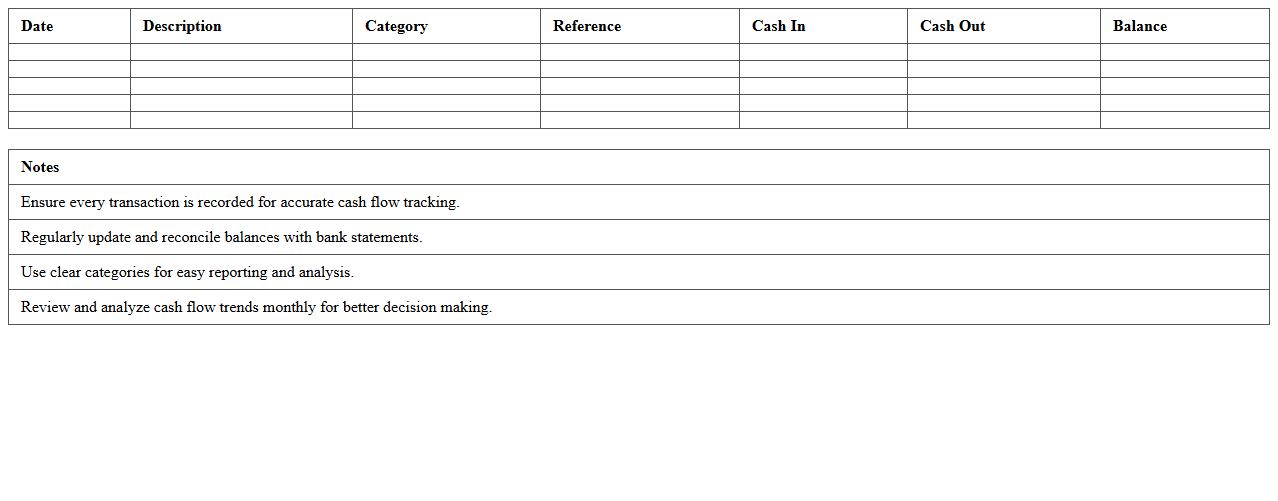

A

Cash Flow Ledger for small companies is a detailed record of all cash inflows and outflows over a specific period, helping businesses track liquidity and manage finances effectively. This document provides clear visibility into operating, investing, and financing activities, allowing for better budgeting and forecasting. Maintaining an accurate cash flow ledger enables small companies to avoid cash shortages, plan strategic growth, and meet financial obligations on time.

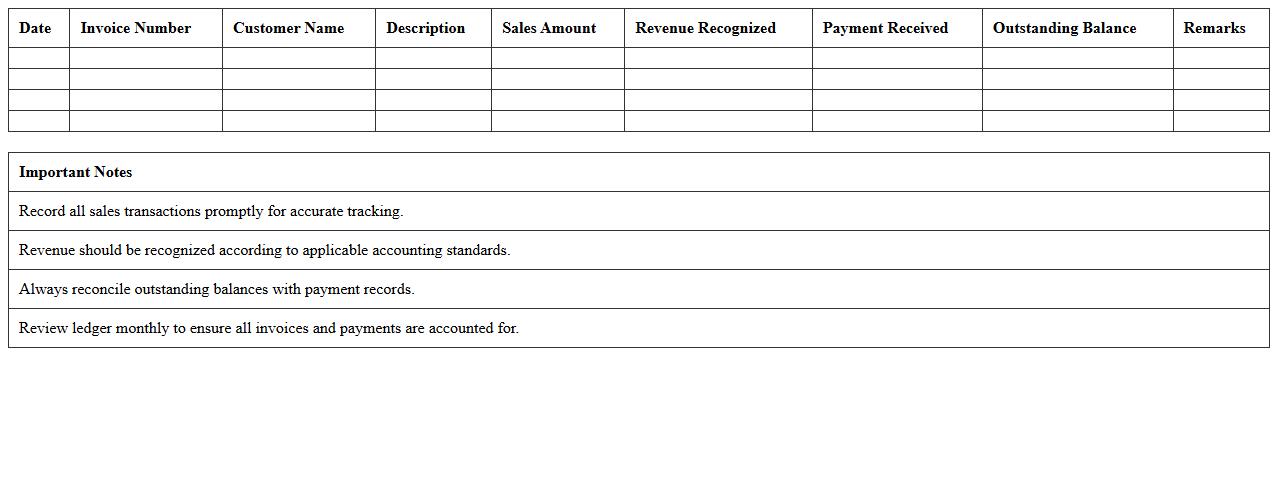

Sales and Revenue Ledger Excel Chart

A

Sales and Revenue Ledger Excel Chart document is a detailed financial record that tracks sales transactions and revenue inflows over a specified period. It helps businesses monitor performance by categorizing sales data, identifying trends, and calculating total income, enabling accurate forecasting and budgeting. Using this chart enhances financial transparency, streamlines reporting, and supports informed decision-making for growth strategies.

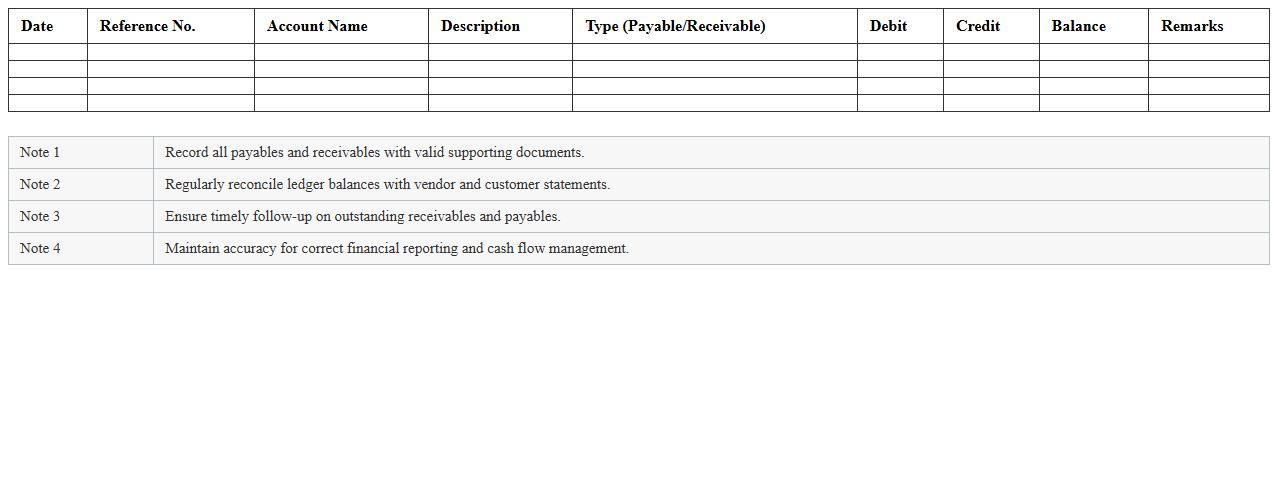

Accounts Payable and Receivable Ledger

The

Accounts Payable and Receivable Ledger document is a detailed financial record tracking all outstanding payments owed to suppliers and amounts due from customers. It helps businesses maintain accurate cash flow management by monitoring liabilities and receivables, ensuring timely payments and collections. This ledger is essential for improving financial transparency, supporting budgeting decisions, and facilitating audits.

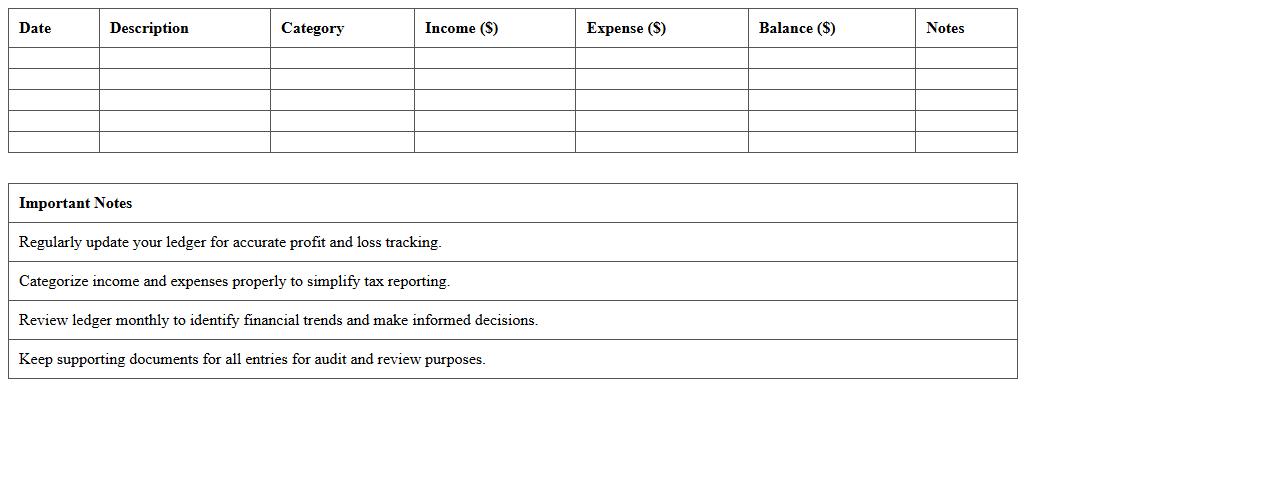

Small Business Profit and Loss Ledger

The

Small Business Profit and Loss Ledger is a financial document that tracks revenues, costs, and expenses over a specific period to determine net profit or loss. It provides critical insights into the business's financial health, enabling informed decision-making and effective budget management. Maintaining this ledger helps identify trends, control spending, and improve overall profitability for small enterprises.

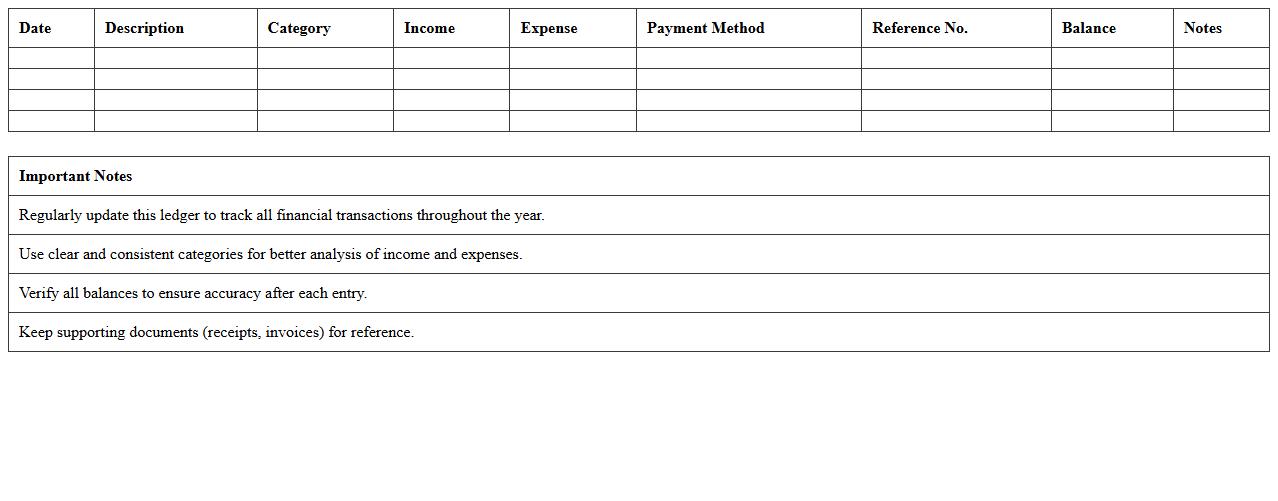

Yearly Financial Ledger Excel Sheet

A

Yearly Financial Ledger Excel Sheet is a comprehensive document designed to track and organize an individual's or organization's financial transactions over a calendar year. It helps users monitor income, expenses, and savings in a systematic way, enabling efficient budgeting and financial planning. This tool is essential for accurate record-keeping, tax preparation, and analyzing financial health throughout the year.

Petty Cash Ledger Tracking Template

A

Petty Cash Ledger Tracking Template document is a structured tool designed to record and monitor small cash expenses within an organization. It helps maintain accurate financial control by tracking inflows and outflows of petty cash, preventing discrepancies and ensuring accountability. Using this template streamlines expense reconciliation and provides clear audit trails for efficient financial management.

How can I automate recurring expense entries in a small business ledger Excel template?

To automate recurring expenses in Excel, use the combination of the IF and TODAY functions to trigger repeated entries based on dates. Setting up a dynamic template with macros or VBA scripts can streamline this process further. This allows the ledger to update automatically without manually entering each recurring expense.

What are the best Excel formulas for tracking accounts receivable in a document ledger?

Effective formulas for tracking accounts receivable include SUMIF to total outstanding amounts by customer and VLOOKUP or INDEX-MATCH for retrieving specific payment details. The use of conditional formatting highlights overdue invoices for better visibility. Together, these formulas simplify monitoring and managing receivables efficiently.

How do I customize a ledger Excel sheet for inventory management in a small business?

Customizing an Excel ledger for inventory management requires adding columns for stock quantities, reorder levels, and product IDs. Using data validation ensures accurate data entry, while formulas like SUMPRODUCT calculate current inventory value dynamically. This setup helps maintain organized and real-time inventory control within the ledger.

Which Excel features help visualize monthly cash flow directly from a ledger document?

Excel features such as PivotTables and PivotCharts enable dynamic visualization of monthly cash flow. Conditional formatting highlights trends and anomalies in income and expenses over time. Additionally, using the built-in chart tools presents cash flow data graphically for quick financial insights.

How can I securely share a ledger Excel document with my accountant online?

To securely share a ledger file, use cloud services like OneDrive or Google Drive with password protection and access controls. Enabling two-factor authentication adds an extra security layer. Always keep backup copies and use Excel's built-in encryption features to safeguard sensitive financial data.

More Ledger Excel Templates