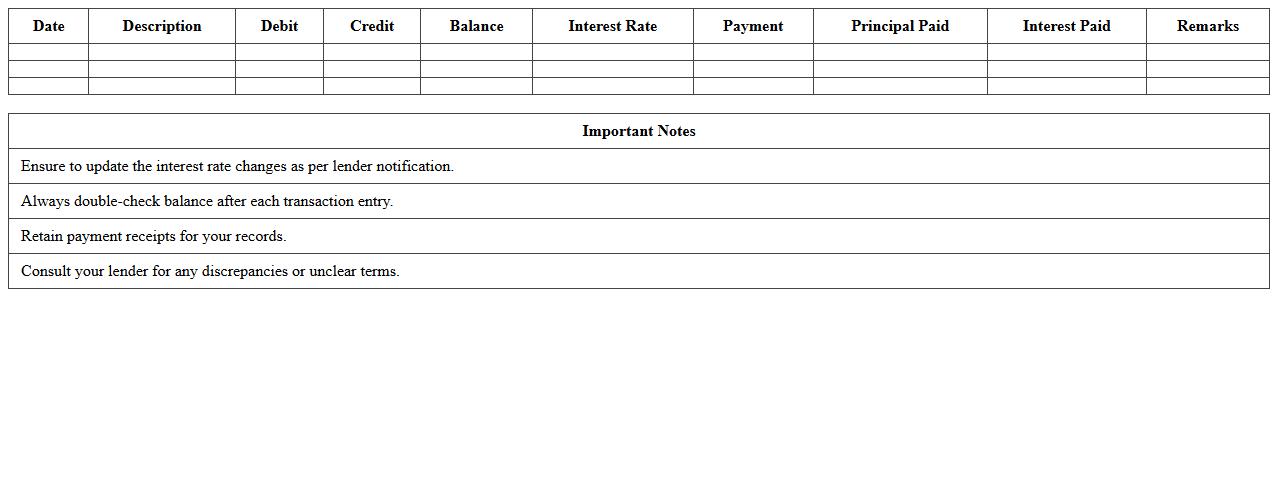

Personal Loan Repayment Ledger Excel Template

A

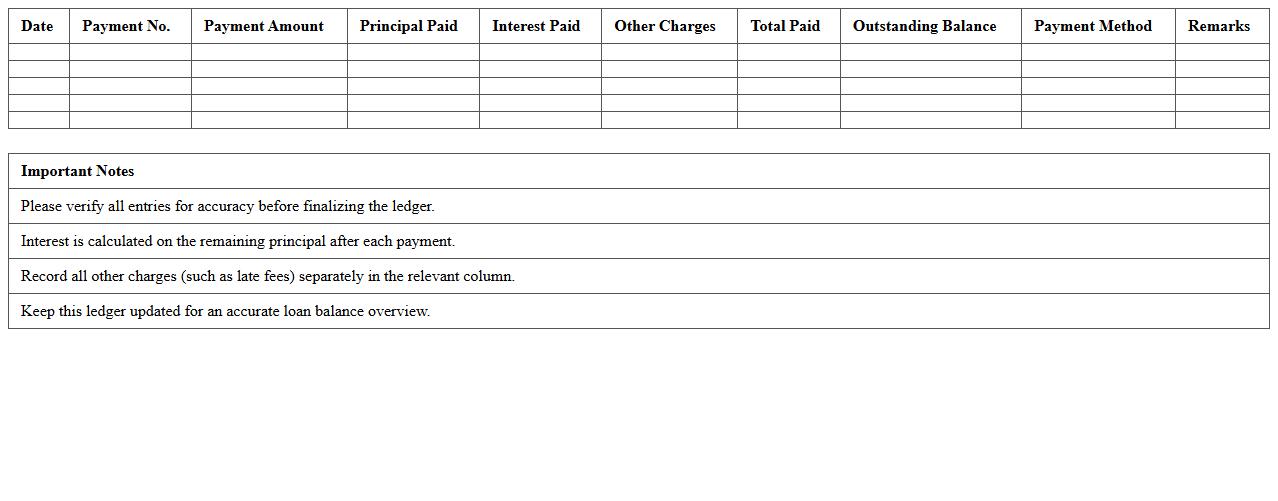

Personal Loan Repayment Ledger Excel Template is a structured spreadsheet designed to track loan repayments, interest calculations, and outstanding balances efficiently. This document helps borrowers maintain accurate records of their payment schedules, ensuring timely payments and preventing missed deadlines. Using this template enhances financial management by providing clear visibility into the loan repayment process and aids in budgeting personal finances effectively.

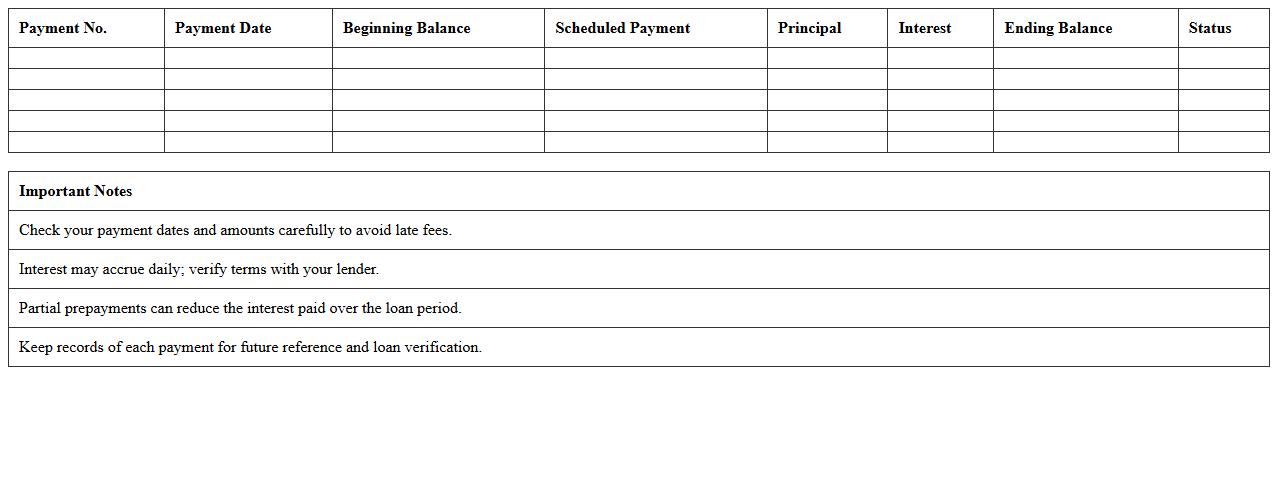

Business Loan Amortization Schedule Excel Template

A

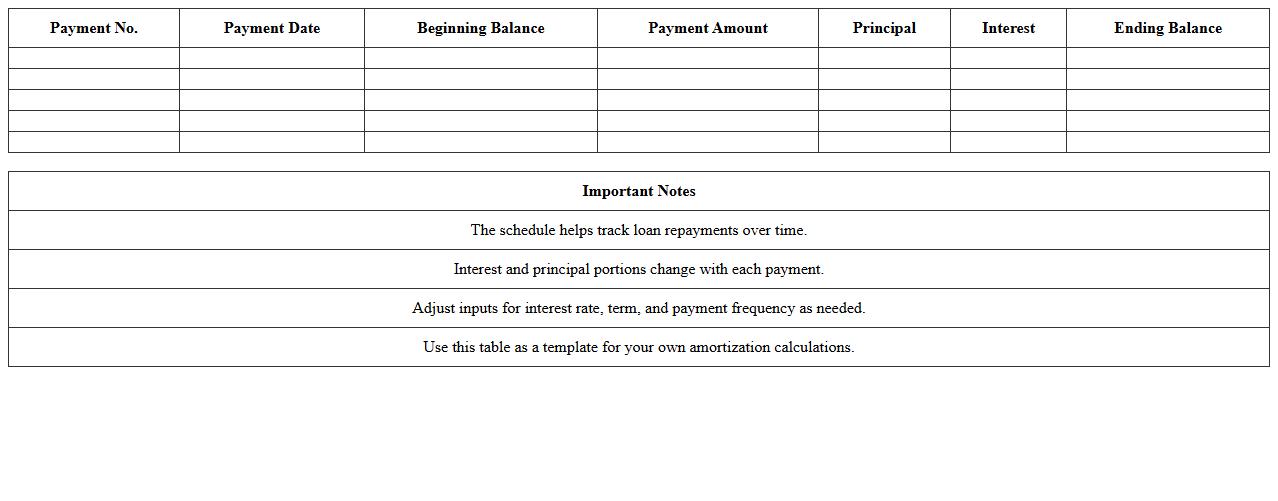

Business Loan Amortization Schedule Excel Template is a structured spreadsheet designed to calculate and display the repayment plan for a business loan over time, detailing principal and interest payments for each period. This template helps businesses manage cash flow by providing clear visibility into payment amounts, due dates, and remaining loan balance, allowing for accurate financial planning. It simplifies complex loan calculations and supports informed decision-making to optimize debt management and budgeting.

Student Loan Payment Tracker Excel Sheet

A

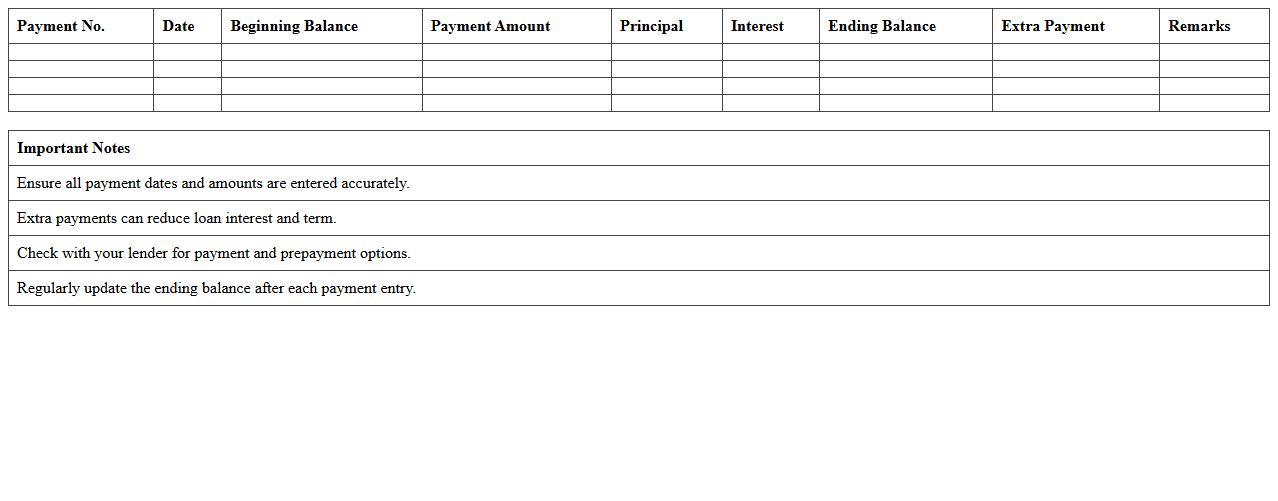

Student Loan Payment Tracker Excel Sheet document is a digital tool designed to help individuals organize and monitor their student loan payments efficiently. It allows users to record payment dates, amounts, interest rates, and outstanding balances, providing a clear overview of their repayment progress. This tracking system aids in budgeting, avoiding missed payments, and planning strategies to pay off loans faster, ultimately reducing financial stress.

Mortgage Loan Repayment Ledger Spreadsheet

A

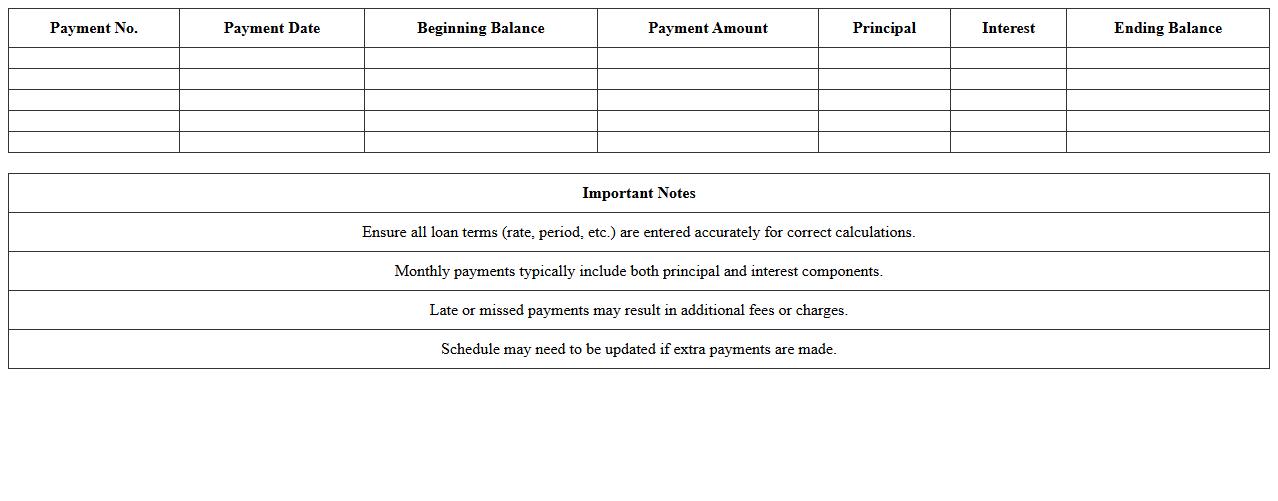

Mortgage Loan Repayment Ledger Spreadsheet is a detailed financial document used to track all payments made towards a mortgage loan, including principal, interest, and remaining balance. This spreadsheet helps borrowers monitor their repayment progress, manage budgets, and identify any discrepancies in payment records. Its organized format provides clear insights into amortization schedules, payment dates, and outstanding loan amounts, enhancing financial planning and loan management efficiency.

Auto Loan Repayment Schedule Excel Template

The

Auto Loan Repayment Schedule Excel Template is a structured spreadsheet designed to track and manage car loan payments efficiently. It helps users calculate monthly installments, interest amounts, and remaining balances, promoting accurate financial planning. By organizing loan details clearly, it ensures timely payments and aids in budgeting for vehicle expenses.

Home Equity Loan Ledger Excel Format

The

Home Equity Loan Ledger Excel Format document is a structured spreadsheet designed to track and manage outstanding balances, payment schedules, interest rates, and principal amounts related to home equity loans. It enables precise monitoring of loan repayment progress, helping users avoid missed payments and understand their financial obligations clearly. This format supports budgeting and financial planning by consolidating loan data into an easily accessible and editable platform.

Small Business Loan Payment Tracker Excel

The

Small Business Loan Payment Tracker Excel document is a structured spreadsheet designed to monitor and manage loan repayments effectively. It helps businesses keep accurate records of payment dates, amounts, outstanding balances, and interest calculations, ensuring timely payments and reducing the risk of defaults. This tool streamlines financial management by providing clear visibility into loan statuses, aiding in budgeting and cash flow planning for small business owners.

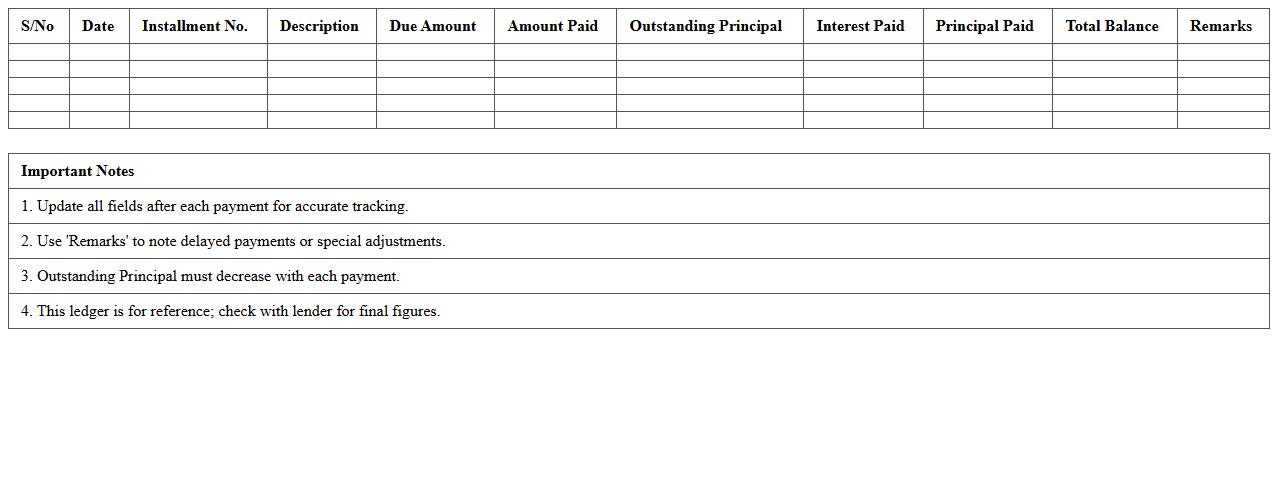

Installment Loan Repayment Ledger Excel Sheet

An

Installment Loan Repayment Ledger Excel Sheet is a structured document designed to track and manage loan repayments over time, detailing each installment's principal and interest components along with payment dates. This tool helps borrowers and lenders maintain clear records, ensuring accurate monitoring of outstanding balances and payment history. By organizing financial information systematically, it supports effective budgeting and financial planning, reducing the risk of missed payments or discrepancies.

Peer-to-Peer Loan Repayment Schedule Excel

A

Peer-to-Peer Loan Repayment Schedule Excel document is a spreadsheet tool designed to track and manage repayment timelines, interest calculations, and outstanding balances for loans between individuals without traditional financial institutions. It helps borrowers and lenders maintain clear records of payment dates, amounts due, and total loan progress, reducing confusion and enhancing financial transparency. Utilizing this schedule allows for efficient planning and ensures timely repayments, fostering trust and informed decision-making in peer-to-peer lending agreements.

Multi-Loan Repayment Tracking Excel Ledger

The

Multi-Loan Repayment Tracking Excel Ledger is a comprehensive financial tool designed to monitor multiple loan repayments in one organized spreadsheet, allowing users to record loan amounts, interest rates, payment dates, and outstanding balances. It helps users maintain an accurate overview of their debts, ensuring timely payments and avoiding late fees or missed deadlines. This ledger enhances financial planning and budgeting by providing clear, real-time insights into loan repayment progress and outstanding obligations.

How to automate overdue loan alerts in a Ledger Excel for repayment schedules?

To automate overdue loan alerts, use the IF and TODAY functions in Excel. Create a formula that compares the repayment due date with the current date to identify overdue payments. Then, apply conditional formatting to highlight these cells for immediate visibility.

What formulas track principal vs interest in loan repayment Excel ledgers?

Tracking principal and interest separately requires using payment breakdown formulas based on the loan's amortization schedule. Use functions like IPMT for interest payment and PPMT for principal payment. These formulas help allocate each payment accurately across the repayment timeline.

How to integrate amortization tables within a ledger for multiple loans in Excel?

Integrate amortization tables by creating separate sheets for each loan within the workbook. Use cell references and named ranges to dynamically link loan balances and payments to the main ledger. This method enables consolidated tracking while maintaining detailed loan schedules.

What's the best way to visualize late payments in a loan ledger Excel sheet?

The best way to visualize late payments is through conditional formatting using color scales or icons like red flags. Incorporate charts such as bar or line graphs to display trends in late payments over time. These visual cues facilitate quick identification and analysis of repayment issues.

How to set conditional formatting for missed payments in loan repayment schedules Excel?

Set conditional formatting by selecting the payment due date cell range and applying a formula rule that checks if payment dates are past due without payment recorded. Use formatting options like fill color or font change to mark missed payments distinctly. This approach ensures missed payments are instantly recognizable in the schedule.