The Loan Ledger Excel Template for Microfinance Institutions is a powerful tool designed to track loan disbursements, repayments, and outstanding balances efficiently. It simplifies financial record-keeping by providing customizable columns for borrower details, payment schedules, and interest calculations. This template enhances accuracy and transparency, helping microfinance institutions manage their loan portfolios effectively.

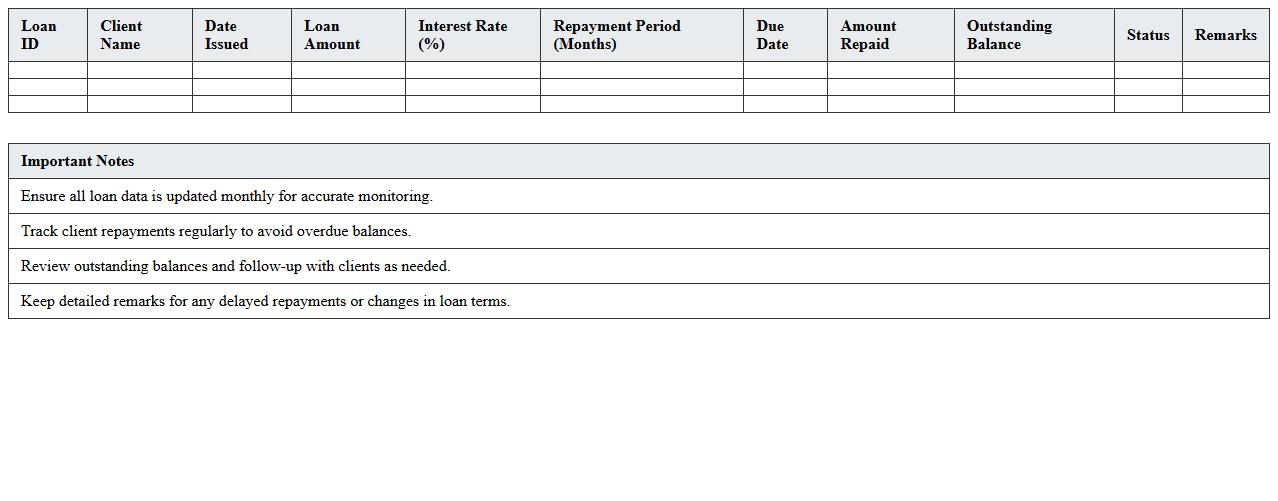

Loan Repayment Schedule Tracker for Microfinance Excel

A

Loan Repayment Schedule Tracker for Microfinance Excel document is a specialized tool designed to manage and monitor loan repayments efficiently. It helps microfinance institutions track borrowers' payment dates, amounts, outstanding balances, and interest calculations, ensuring timely follow-ups and accurate financial reporting. This tracker enhances loan portfolio management, reduces default risks, and improves overall loan recovery rates by providing clear visibility into repayment progress.

Microfinance Borrower Loan Portfolio Management Sheet

A

Microfinance Borrower Loan Portfolio Management Sheet is a detailed document that tracks individual borrower loans, payment schedules, outstanding balances, and repayment status within a microfinance institution. This sheet enables effective monitoring and analysis of loan performance, helping to identify defaulters and ensure timely collections. It improves decision-making by providing a clear overview of the loan portfolio's health, facilitating risk management and financial planning.

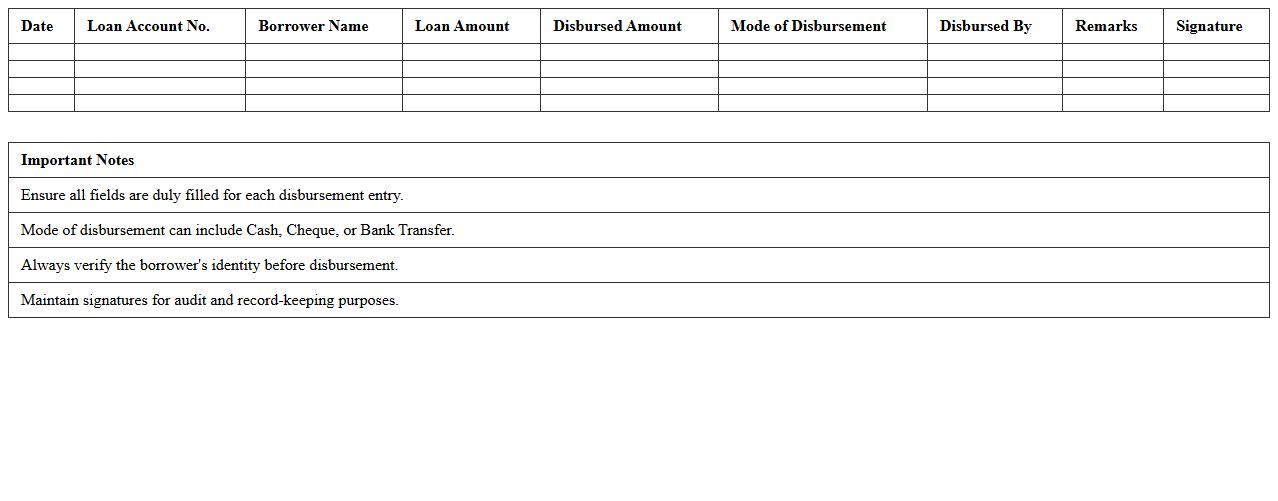

Daily Loan Disbursement Record Excel Template

The

Daily Loan Disbursement Record Excel Template is a structured spreadsheet designed to track and manage daily loan distribution activities efficiently. It helps financial institutions, lenders, and businesses maintain accurate records of loan amounts, borrower details, disbursement dates, and repayment schedules, ensuring clear accountability and easy access to data. This template enhances financial reporting, streamlines loan management processes, and supports better decision-making through organized and real-time loan tracking.

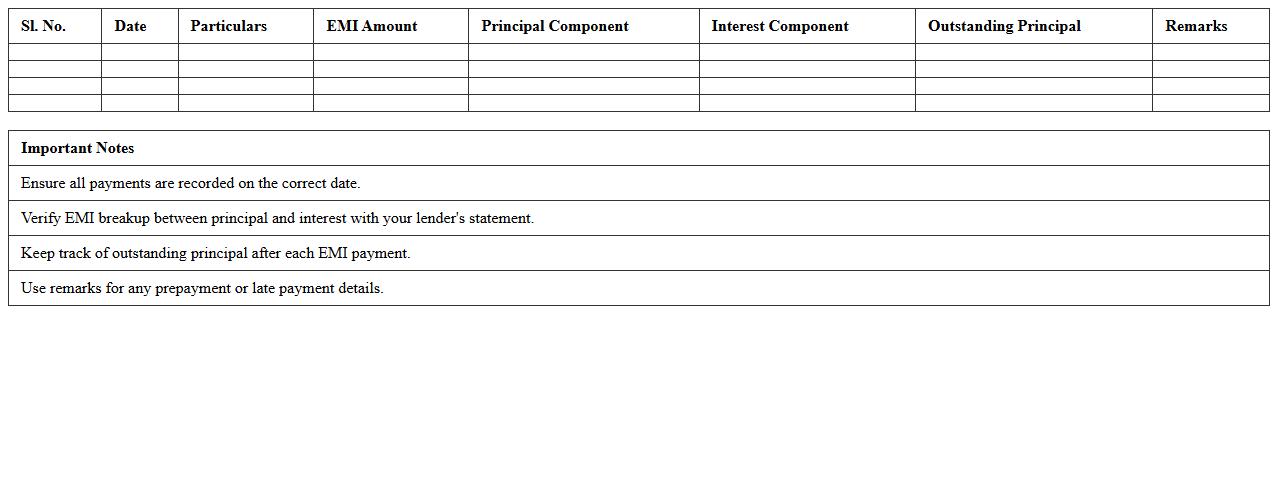

Personal Loan Amortization Register Excel

A

Personal Loan Amortization Register Excel document is a detailed spreadsheet that tracks loan payments, interest, and principal over the life of a personal loan, displaying a clear payment schedule. It helps borrowers understand the breakdown of each installment, ensuring transparency in loan repayment and assisting with financial planning. By using this register, users can monitor outstanding balances and plan budgets effectively, avoiding missed payments and managing debt efficiently.

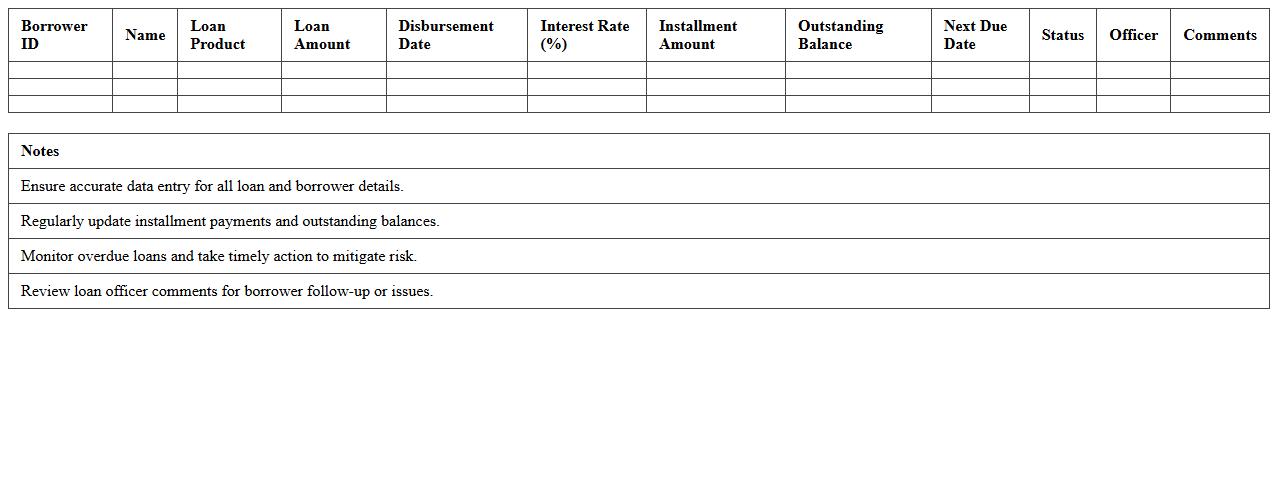

Small Business Microfinance Loan Monitoring Sheet

A

Small Business Microfinance Loan Monitoring Sheet is a detailed document used to track loan disbursements, repayments, interest rates, and borrower performance in microfinance operations. It helps lenders maintain accurate records, identify payment delays, and assess the financial health of small businesses receiving microloans. By offering real-time insights and organized data, this tool enhances loan management efficiency and supports informed decision-making for sustainable microenterprise growth.

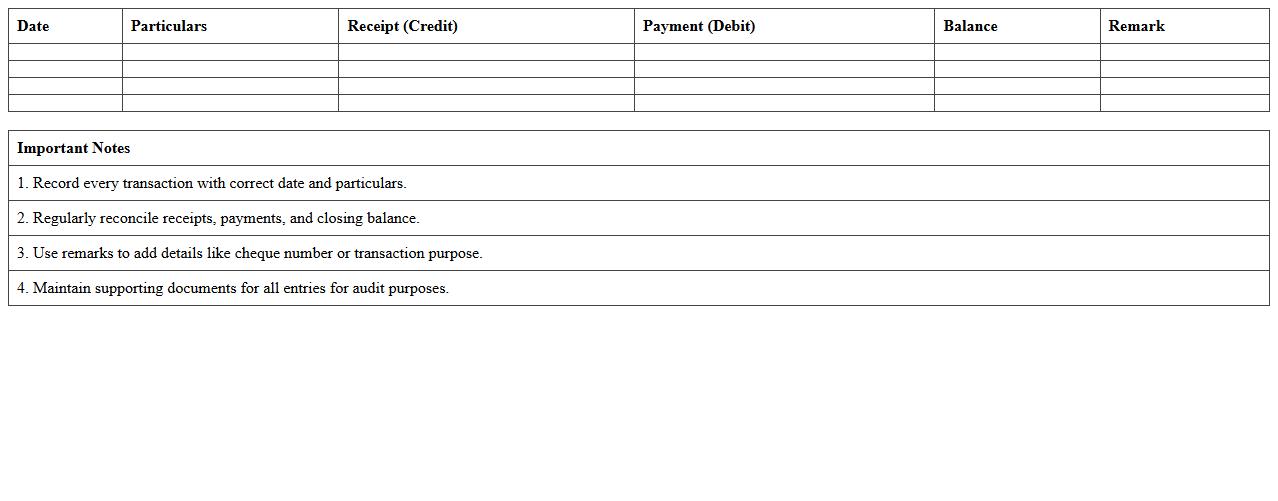

Micro Loan Receipts and Payments Ledger Excel

The

Micro Loan Receipts and Payments Ledger Excel document is a specialized financial tool designed to track and manage small-scale loan transactions, recording every receipt and payment meticulously. It provides an organized and transparent way for individuals or small businesses to monitor loan balances, ensure timely repayments, and maintain accurate financial records. By using this ledger, users can improve cash flow management, enhance accountability, and prevent errors in micro loan bookkeeping.

Group Lending Portfolio Excel Tracker

The

Group Lending Portfolio Excel Tracker is a specialized spreadsheet designed to monitor and manage group loan accounts efficiently. It enables lenders to track loan disbursements, repayment schedules, and group member contributions in one consolidated view, improving accuracy and transparency. This document is essential for optimizing loan portfolio performance and minimizing default risks through systematic data analysis.

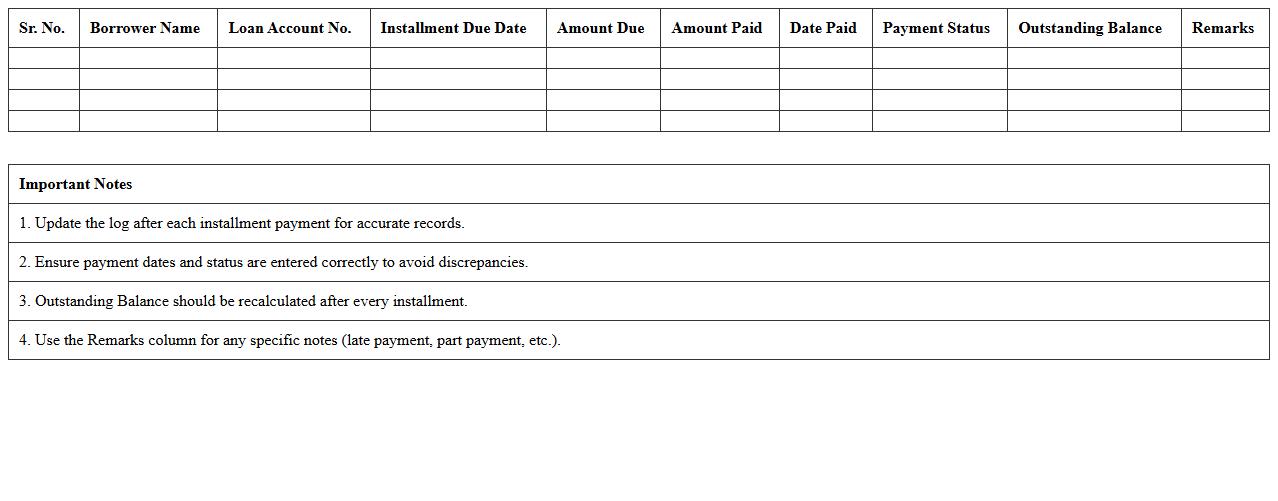

Loan Installment Payment Status Log Excel

The

Loan Installment Payment Status Log Excel document tracks each payment's date, amount, and outstanding balance, providing a detailed record of loan repayments. It helps users monitor payment history, identify missed or late payments, and manage loan schedules effectively. This log enhances financial planning by offering clear insights into repayment progress and outstanding obligations.

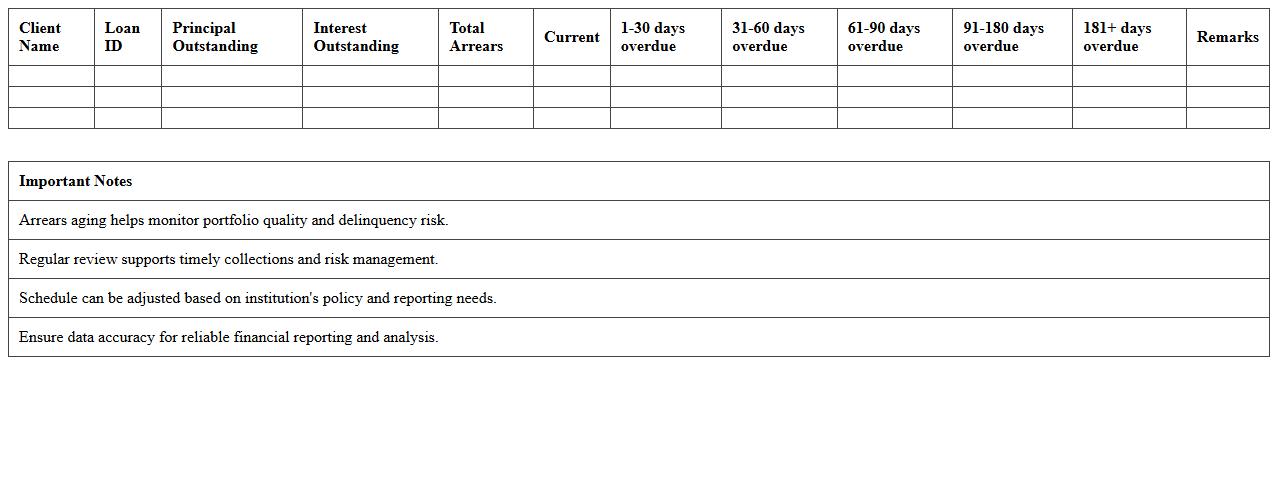

Microfinance Loan Arrears Aging Schedule Excel

The

Microfinance Loan Arrears Aging Schedule Excel document is a detailed financial tool that tracks overdue loan repayments by categorizing them into specific aging periods, such as 30, 60, or 90+ days past due. This schedule helps microfinance institutions monitor loan performance, identify delinquent accounts, and prioritize collection efforts efficiently. By providing clear visibility into arrears aging, it supports better risk management and decision-making to maintain healthy loan portfolios.

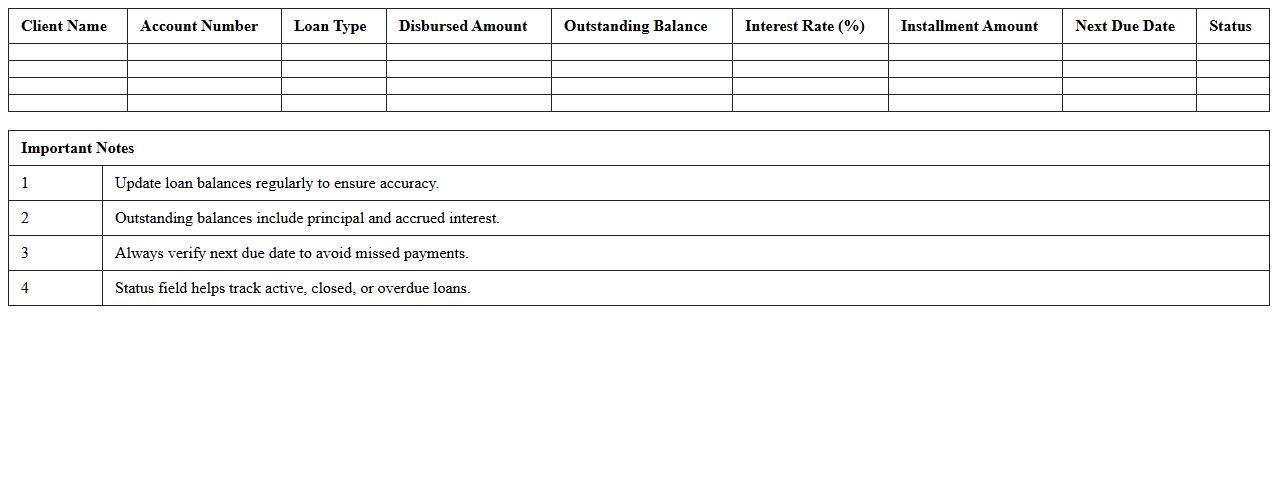

Client Loan Balance Summary Excel Sheet

The

Client Loan Balance Summary Excel Sheet document provides a clear and organized overview of all outstanding loan balances for individual clients, facilitating effective tracking and management of credit portfolios. It helps financial institutions quickly assess the total loan exposure per client, ensuring better decision-making for credit risk evaluation and repayment monitoring. This sheet streamlines reporting processes and supports accurate financial analysis by consolidating critical loan data in one accessible format.

How to automate overdue alerts in a Loan Ledger Excel for microfinance loans?

To automate overdue alerts in a Loan Ledger Excel, use the IF function combined with conditional formatting. Create a formula that compares the due date with the current date using =TODAY() to identify late payments. Then, apply a red fill or an alert message to highlight overdue accounts automatically.

What formula tracks daily interest accrual on group loans in Excel?

The formula to track daily interest accrual is: =Principal * (Annual Interest Rate/365) * Days Outstanding. This calculates interest based on the principal amount and the exact number of days the loan has been active. Using this dynamically updates the accrued interest for group loans on a daily basis.

How to integrate client demographic filters in a Loan Ledger Excel sheet?

To integrate client demographic filters, use Excel's Table feature and apply slicers for categories like age, gender, or location. This allows quick filtering and segmentation of loan data based on demographics. Additionally, data validation drop-down lists enhance user-friendly filtering capabilities.

What is the best method to flag at-risk accounts in microloan records?

The best way to flag at-risk accounts is by setting conditional formatting rules for missed payments or high overdue days. Use formulas such as =IF(OverdueDays>30,"At Risk","") to identify and highlight risky loans. This method instantly signals potential defaults for prompt follow-up.

How to create a built-in repayment calendar for multiple cycles in Excel?

Design a repayment calendar by listing payment dates using the EDATE function to generate cycles automatically. Combine this with a drop-down menu to select loan cycles and visualize scheduled repayments. This approach helps track payments across several loan cycles efficiently within Excel.

More Ledger Excel Templates