A Ledger Excel Template for Small Business Accounting simplifies financial record-keeping by organizing income, expenses, and transactions in a structured spreadsheet. It enhances accuracy and efficiency, allowing small businesses to track cash flow and generate financial reports effortlessly. Customizable features in the template support budgeting, tax preparation, and overall financial management.

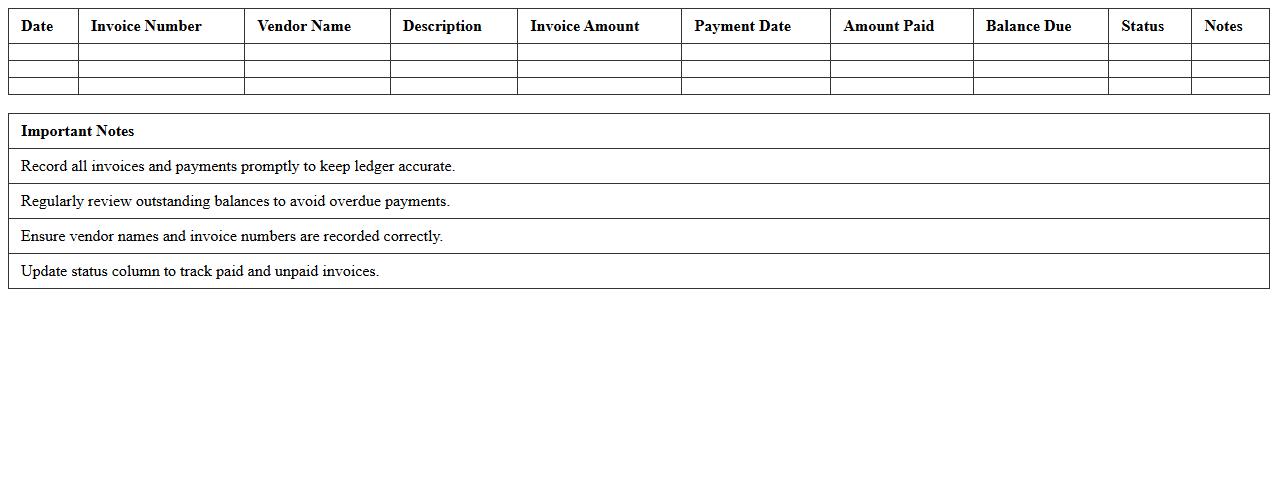

Accounts Payable Ledger Template for Small Businesses

The

Accounts Payable Ledger Template for small businesses is a structured document used to record and track outgoing payments to suppliers and vendors. It helps maintain accurate financial records, ensures timely payments, and facilitates effective cash flow management. Utilizing this template reduces errors and enhances overall accounting efficiency by organizing payable transactions in one place.

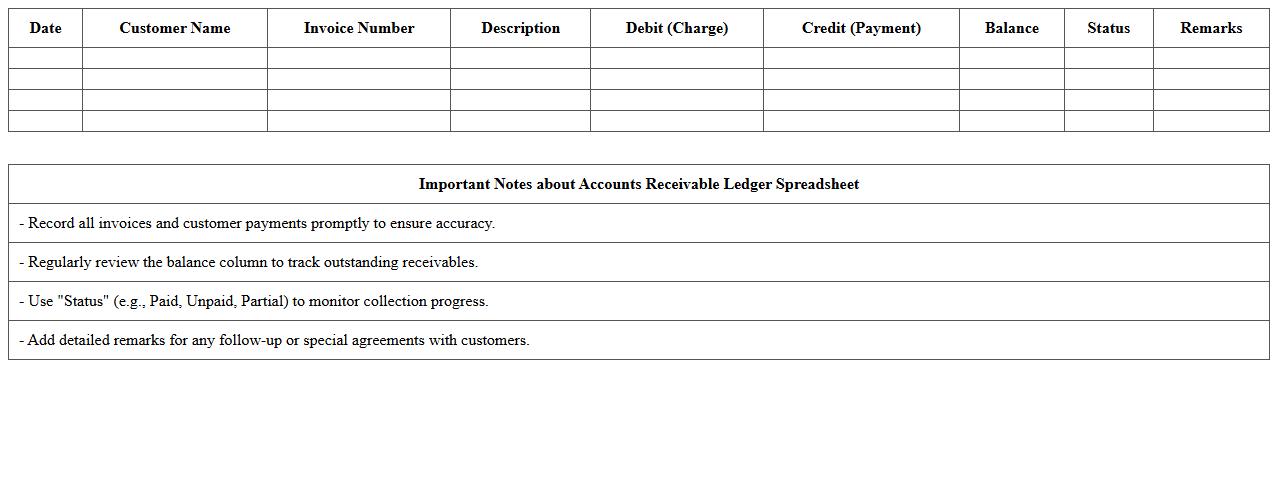

Accounts Receivable Ledger Spreadsheet

The

Accounts Receivable Ledger Spreadsheet document systematically records all outstanding customer invoices and payments, providing a clear overview of the amounts owed to a business. It helps track payment statuses, manage cash flow effectively, and ensures timely follow-ups on overdue accounts. By organizing financial data in one accessible file, it facilitates accurate financial reporting and supports better credit control decisions.

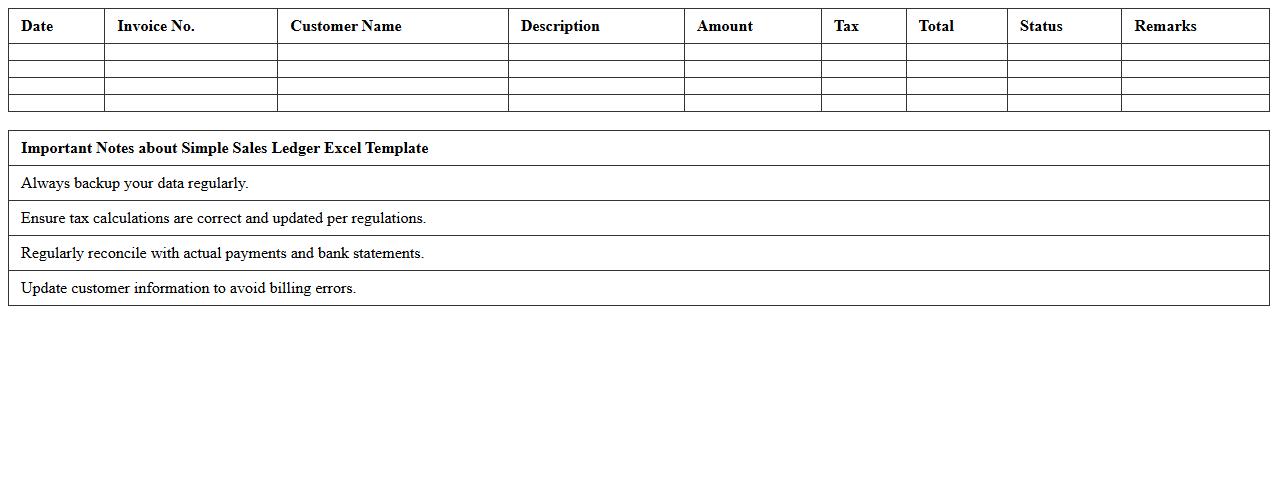

Simple Sales Ledger Excel Template

The

Simple Sales Ledger Excel Template is a structured spreadsheet designed to record and track sales transactions efficiently. It helps businesses monitor daily sales, manage customer information, and calculate total revenue accurately. Utilizing this template streamlines financial reporting and supports effective sales analysis for better decision-making.

Expense Tracking Ledger for Small Firms

An

Expense Tracking Ledger for small firms is a detailed financial document designed to record and monitor all business expenditures systematically. This ledger helps businesses maintain accurate financial records, ensuring better budgeting, tax preparation, and cash flow management. By tracking expenses regularly, small firms can identify cost-saving opportunities and enhance overall financial decision-making.

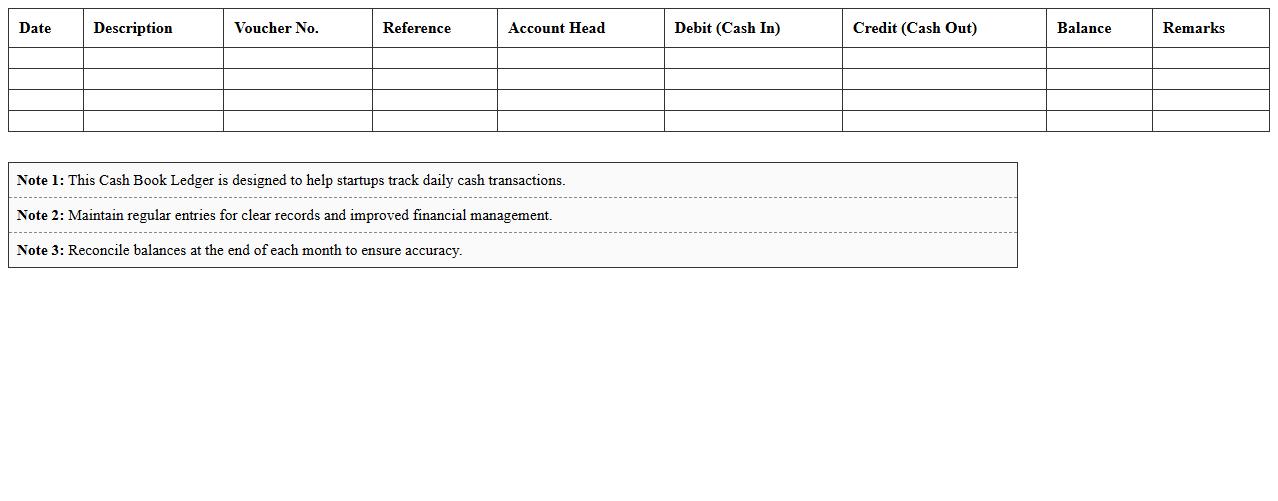

Cash Book Ledger Template for Startups

A

Cash Book Ledger Template for Startups is a structured financial tool designed to record all cash transactions systematically, helping new businesses monitor daily income and expenses. It improves accuracy in cash management by providing a clear, organized format that tracks receipts and payments, essential for maintaining financial transparency. Utilizing this template aids startups in budgeting effectively, preparing financial statements, and ensuring compliance with accounting standards.

General Ledger Excel Template for Entrepreneurs

A

General Ledger Excel Template for entrepreneurs is a pre-designed spreadsheet that organizes all financial transactions systematically, allowing easy tracking of income, expenses, assets, and liabilities. It simplifies accounting processes by providing a clear overview of a business's financial health, enabling accurate record-keeping and quick reconciliation of accounts. Entrepreneurs benefit from improved financial management, time savings, and enhanced decision-making capabilities through the use of this efficient, customizable tool.

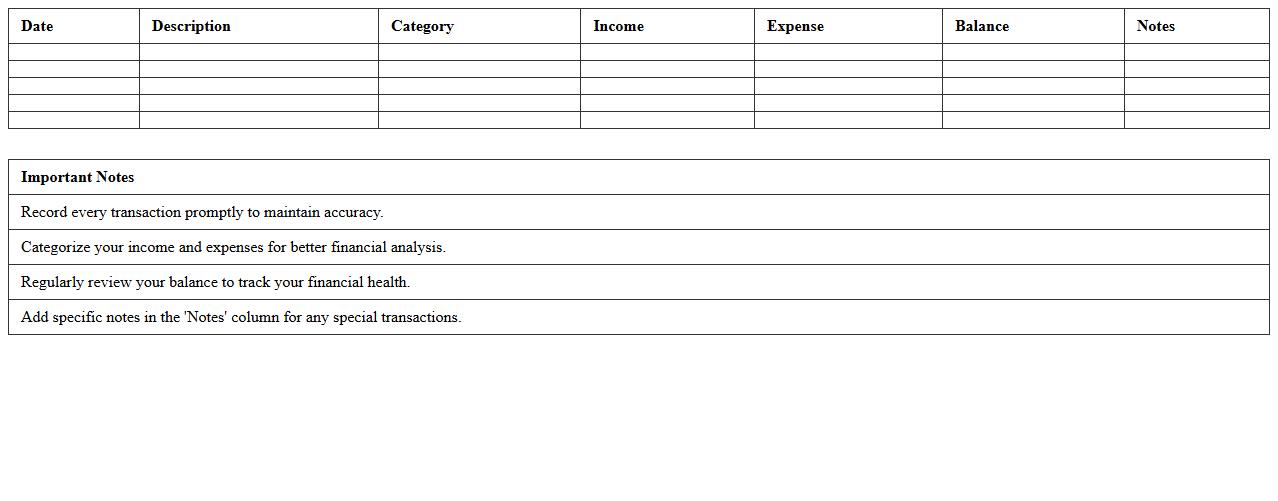

Income and Expense Ledger Spreadsheet

An

Income and Expense Ledger Spreadsheet is a digital document designed to systematically record and track all financial inflows and outflows over a specific period. It helps users maintain accurate records of earnings and expenditures, facilitating budget management and financial analysis. By providing a clear overview of cash flow, this spreadsheet supports informed decision-making and efficient financial planning.

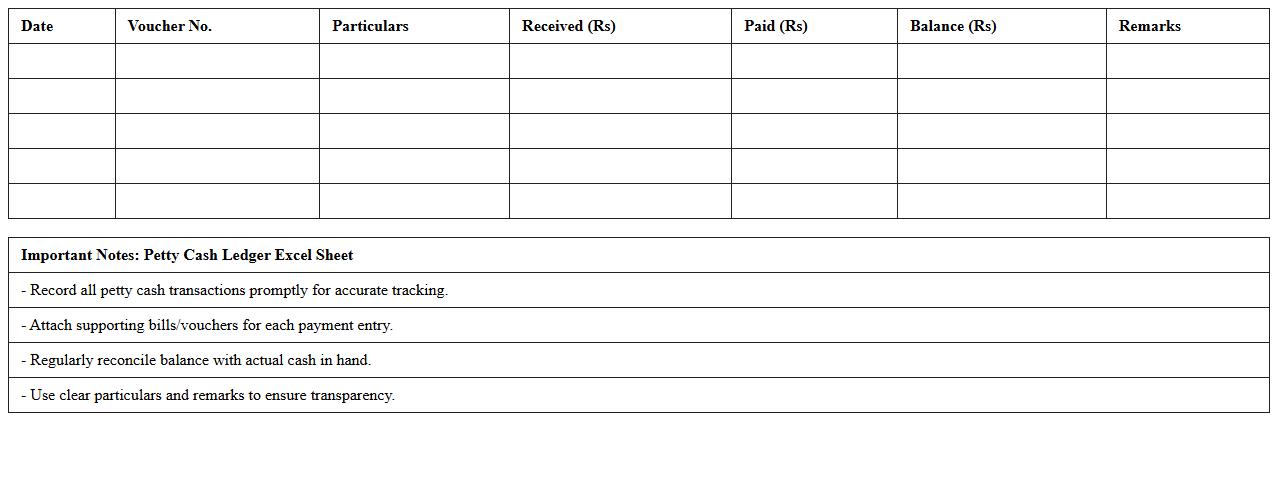

Petty Cash Ledger Excel Sheet

A

Petty Cash Ledger Excel Sheet is a digital record-keeping tool designed to track small, daily expenses within an organization or business. It helps maintain accuracy in managing petty cash transactions, ensuring transparency and accountability. By organizing expenditures systematically, it simplifies financial auditing and enhances budget control.

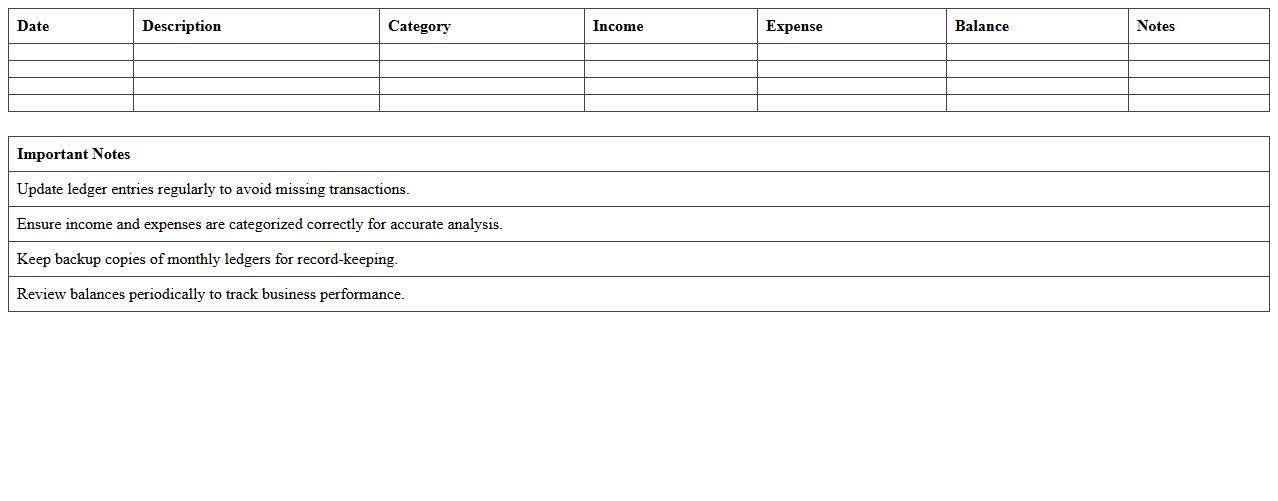

Monthly Business Ledger Template

A

Monthly Business Ledger Template is a structured document designed to systematically record financial transactions, including income, expenses, and other monetary activities on a monthly basis. This template enables businesses to maintain accurate and organized financial records, facilitating easier tracking of cash flow, budgeting, and financial analysis. Utilizing such a ledger improves financial transparency, supports timely decision-making, and simplifies tax preparation processes.

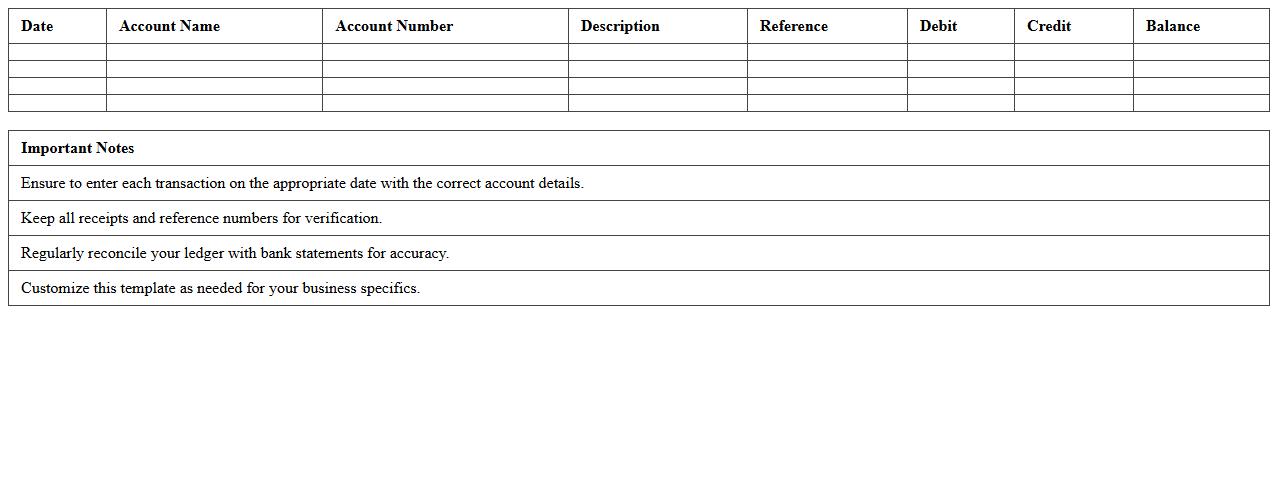

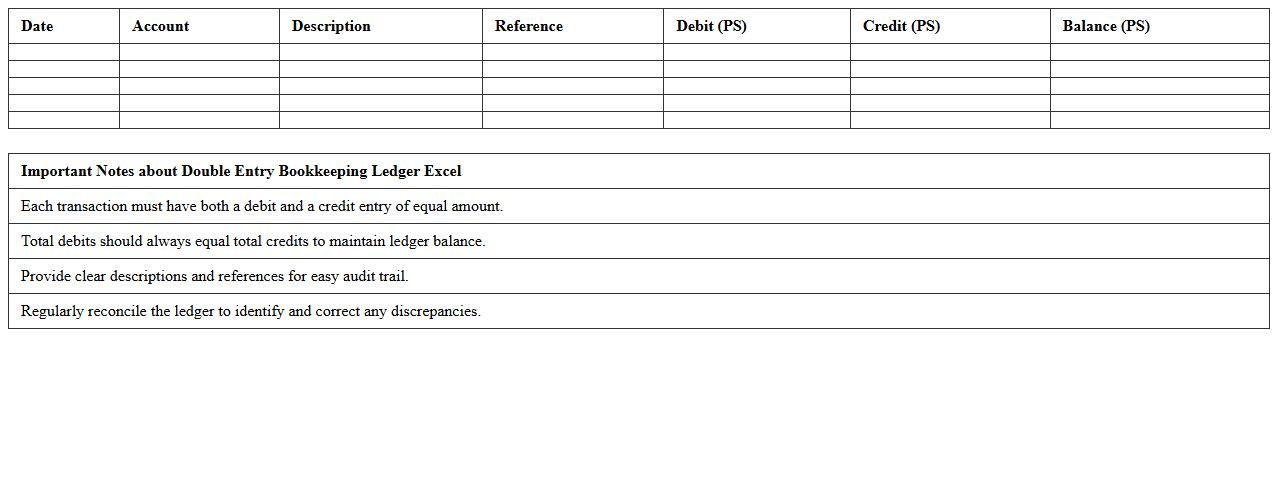

Double Entry Bookkeeping Ledger Excel

A

Double Entry Bookkeeping Ledger Excel document records financial transactions by maintaining balanced debit and credit entries, ensuring accuracy in accounting processes. It allows users to monitor income, expenses, assets, and liabilities efficiently, providing a clear financial overview for businesses and individuals. Utilizing this Excel ledger improves financial management, facilitates error detection, and supports compliance with accounting standards.

How to automate recurring transactions in a ledger Excel sheet for small business accounting?

To automate recurring transactions, use Excel's built-in features like tables and formulas. Set up a master template with transaction details and employ the OFFSET or INDIRECT functions to dynamically reference recurring entries. Additionally, utilize Excel macros or VBA scripts to automate the insertion of transactions on specified intervals efficiently.

What Excel formulas best track account balances in small business ledgers?

Excel formulas such as SUMIF and SUMIFS are essential for tracking account balances by summing transactions based on criteria like account type or date. The Running Total can be calculated using the SUM function in combination with absolute and relative cell references. Also, employing VLOOKUP or INDEX-MATCH enhances accuracy in reconciling ledger entries with account balances.

How to structure multi-period income statements within a ledger Excel workbook?

Organize multi-period income statements by creating separate sheets or tables for each accounting period within one ledger workbook. Use consistent row and column headers to align revenues and expenses across periods for easy comparison. Incorporate dynamic formulas that pull data from your transaction ledger to update your income statement automatically each period.

What methods secure sensitive financial data in a small business ledger Excel document?

Protect sensitive financial data by encrypting your Excel file with a strong password and restricting editing and viewing permissions. Use Excel's built-in sheet protection and limit access by controlling user permissions within a network environment. Additionally, consider regular backups and storing files in secure, encrypted cloud services to prevent data loss.

How to generate tax-ready financial summaries from ledger Excel sheets?

Generate tax-ready financial summaries by compiling key figures such as income, expenses, and deductions using pivot tables and summary formulas. Create dedicated worksheets that aggregate ledger data according to tax categories to simplify reporting. Ensure your data is categorized correctly and updated to meet compliance requirements during tax preparation.

More Ledger Excel Templates