The Petty Cash Ledger Excel Template for Nonprofits offers a user-friendly way to track small cash expenses efficiently. Designed specifically for nonprofit organizations, it helps maintain transparency and accountability in managing petty cash transactions. This template simplifies record-keeping and ensures accurate financial reporting for grant compliance and auditing purposes.

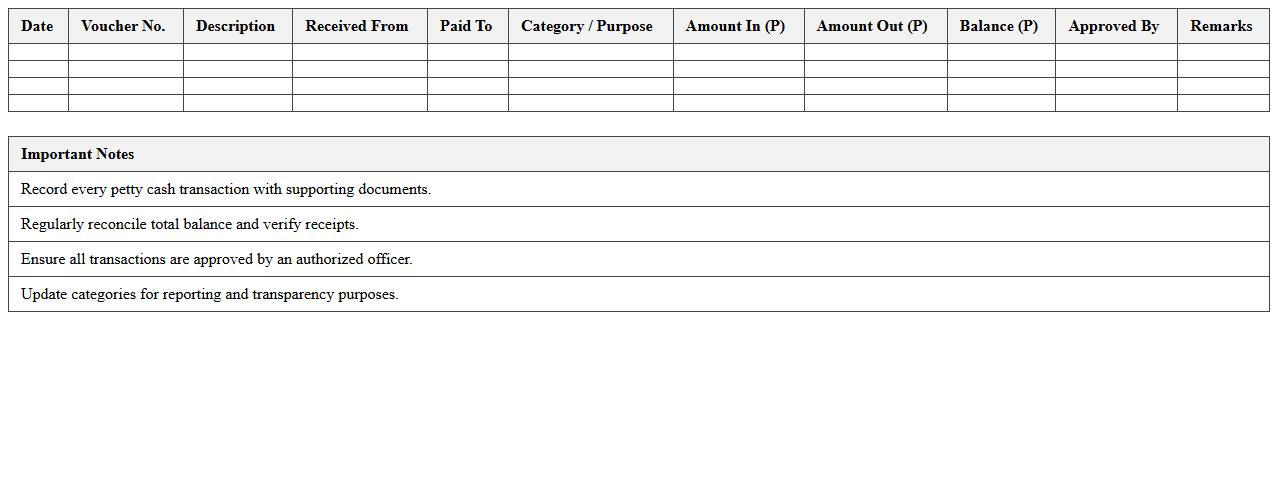

Monthly Petty Cash Tracking Excel Template for Nonprofits

The

Monthly Petty Cash Tracking Excel Template for Nonprofits is a specialized financial tool designed to help organizations monitor and record small cash expenses systematically. It streamlines the tracking process by providing structured fields for date, amount, purpose, and approval, ensuring transparency and accountability. This template is useful for nonprofits by enhancing financial accuracy, simplifying budget management, and maintaining clear audit trails for petty cash transactions.

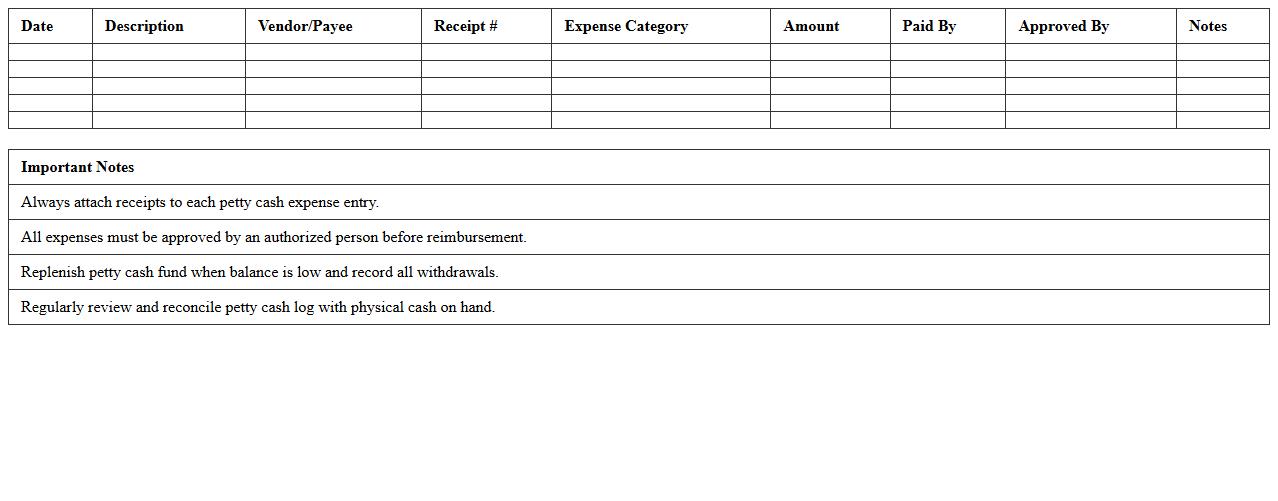

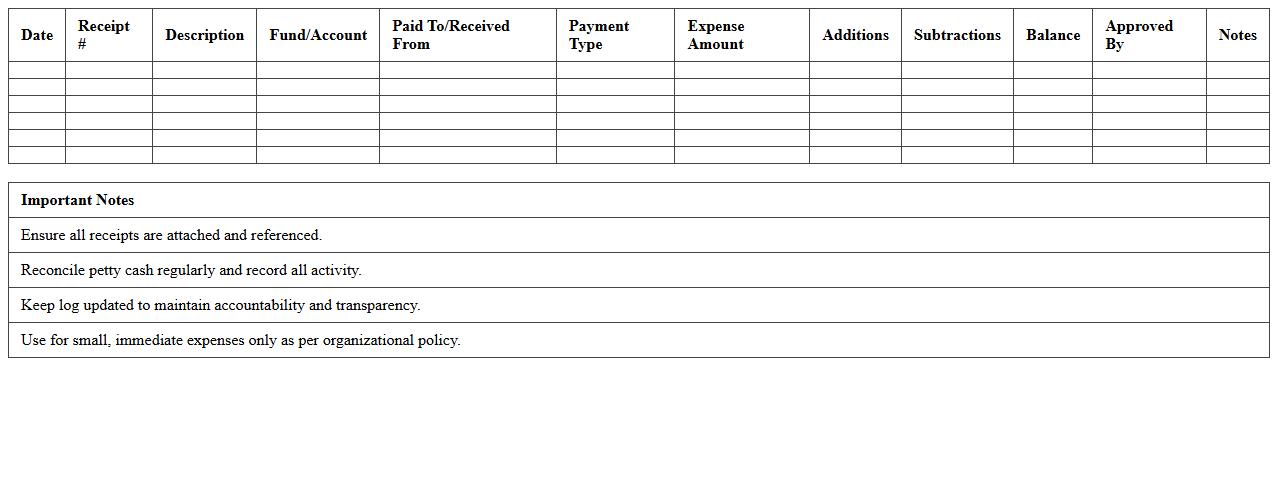

Nonprofit Petty Cash Expense Log Spreadsheet

A

Nonprofit Petty Cash Expense Log Spreadsheet is a document designed to accurately track small cash expenditures within a nonprofit organization. It helps maintain transparency and accountability by recording dates, amounts, purposes, and approvals of petty cash usage. This spreadsheet streamlines financial oversight, ensuring compliance with budgeting policies and simplifying audit processes.

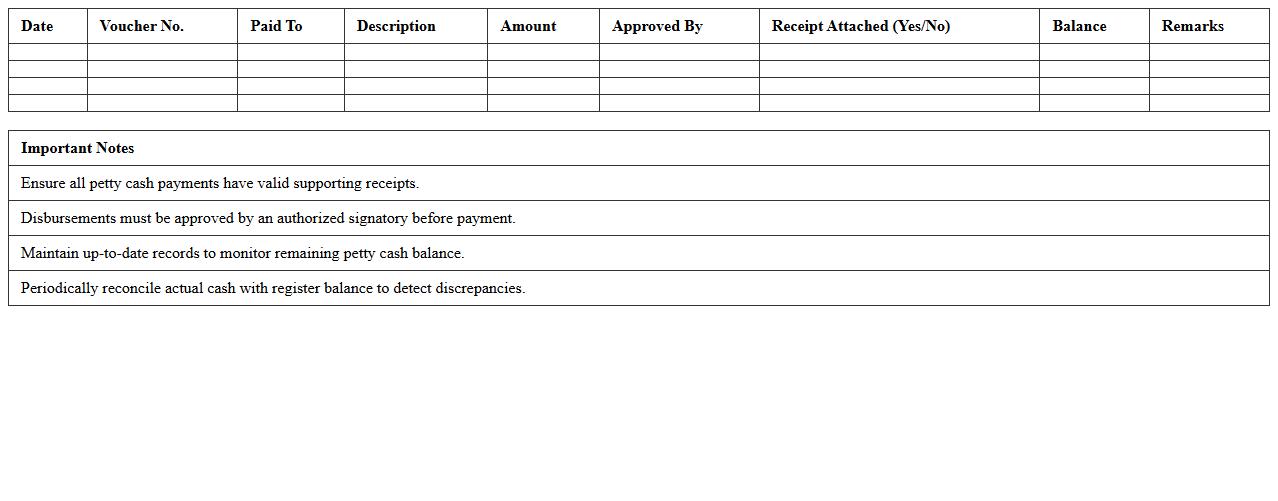

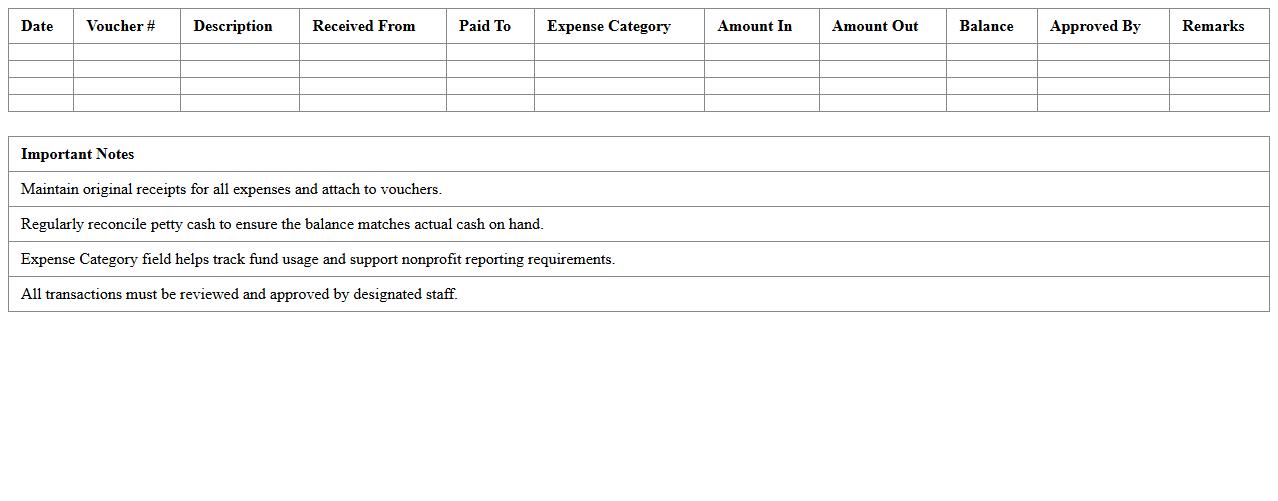

Petty Cash Disbursement Register Template for Charities

The

Petty Cash Disbursement Register Template for charities is a structured document designed to track small, day-to-day expenses efficiently. It helps maintain transparency and accountability by recording every petty cash transaction with dates, amounts, and purposes, ensuring compliance with financial policies. This register is essential for charitable organizations to streamline budgeting, prevent misuse of funds, and facilitate accurate financial reporting.

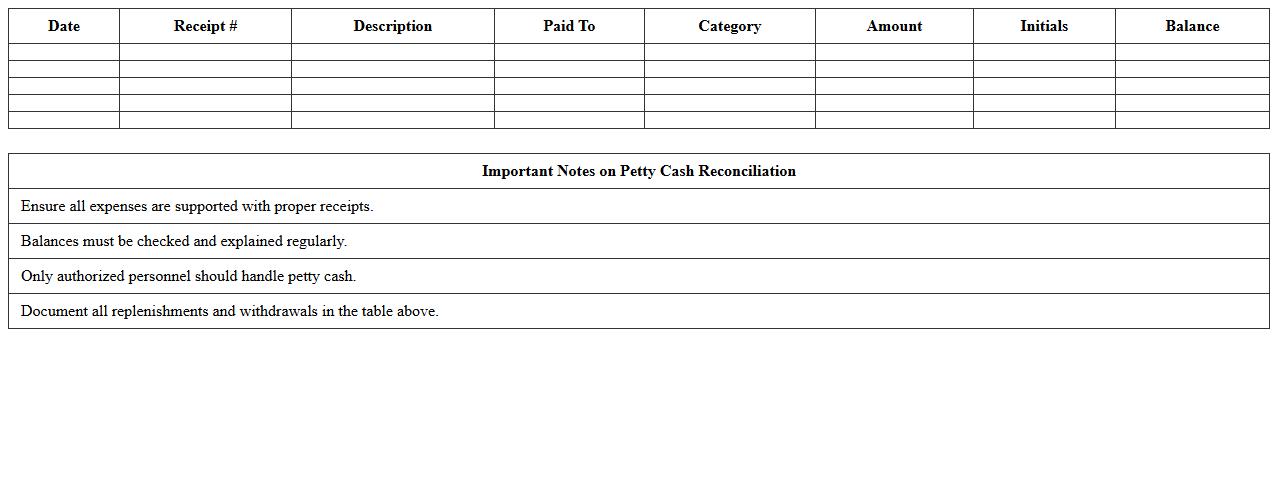

Nonprofit Organization Petty Cash Reconciliation Sheet

A

Nonprofit Organization Petty Cash Reconciliation Sheet is a financial document used to track and verify small cash expenses within the organization. This sheet helps ensure transparency and accountability by recording receipts and balancing the petty cash fund accurately. Maintaining this document reduces errors, prevents misuse of funds, and supports proper financial auditing and reporting.

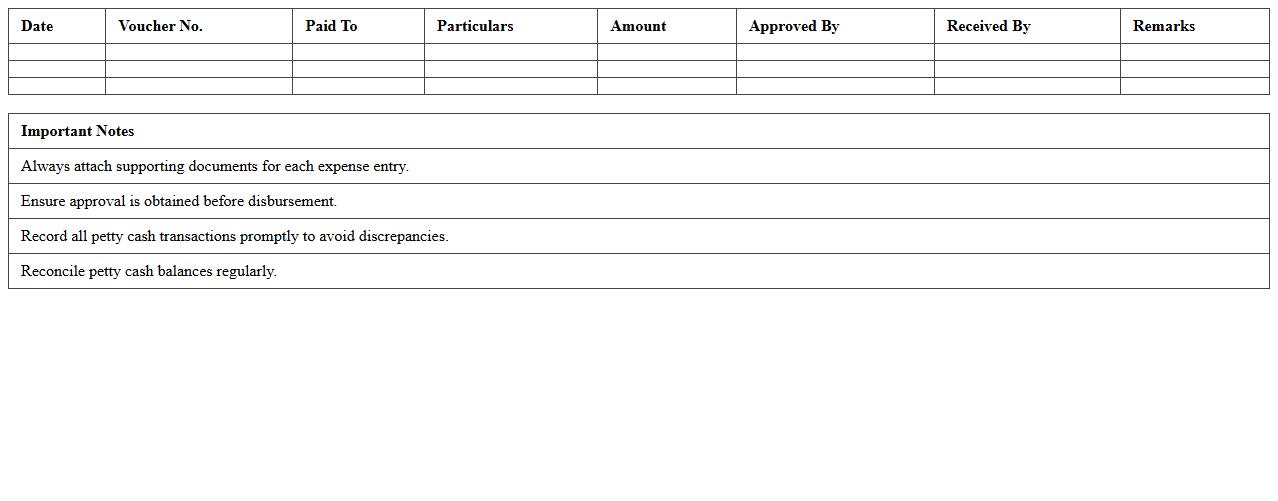

Simple Petty Cash Voucher Excel Template for Nonprofits

The

Simple Petty Cash Voucher Excel Template for Nonprofits is a customizable spreadsheet designed to track and document small cash expenses efficiently within nonprofit organizations. It helps maintain transparency and accountability by recording details such as amounts, dates, purposes, and approvals, ensuring compliance with financial policies. This template streamlines petty cash management, reducing errors and facilitating accurate bookkeeping and auditing processes.

Petty Cash Transaction Record Excel for Nonprofit Groups

The

Petty Cash Transaction Record Excel for Nonprofit Groups document is a structured template designed to accurately track small cash expenditures within nonprofit organizations. It enables clear documentation of all petty cash inflows and outflows, ensuring transparent financial management and easy reconciliation during audits. Using this tool improves accountability, reduces errors, and supports compliance with nonprofit financial regulations.

Fund Activity Petty Cash Log Excel Template for Nonprofits

The

Fund Activity Petty Cash Log Excel Template for nonprofits is a structured spreadsheet designed to accurately track and manage small cash expenditures within an organization. This template helps nonprofits maintain transparency and accountability by documenting each petty cash transaction, including date, amount, purpose, and remaining balance. Utilizing this tool streamlines financial reporting, improves budget monitoring, and ensures compliance with auditing standards specific to nonprofit fund management.

Nonprofit Petty Cash Balance Monitoring Spreadsheet

The

Nonprofit Petty Cash Balance Monitoring Spreadsheet is a financial tool designed to track and manage small cash expenditures within nonprofit organizations, ensuring transparency and accountability. It helps monitor cash inflows and outflows, maintain accurate records, and prevent discrepancies by providing a clear snapshot of the remaining petty cash balance at any time. This document aids in budgeting efficiency, supports audit preparedness, and promotes responsible fund management in nonprofit operations.

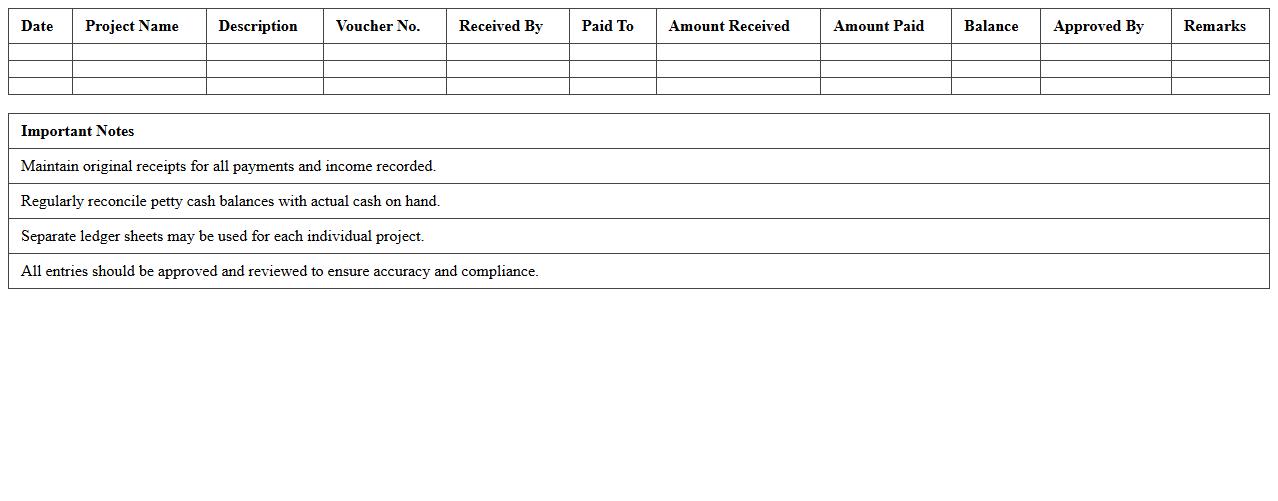

Project-Based Petty Cash Ledger Excel for Nonprofit Use

The

Project-Based Petty Cash Ledger Excel for nonprofit use is a detailed financial tracking tool designed to monitor small cash transactions related to specific projects, ensuring transparency and accountability. It helps nonprofits maintain accurate records of expenses, streamline budgeting processes, and simplify financial reporting by categorizing petty cash expenditures per project. Using this ledger improves fiscal management, supports audit readiness, and enhances overall operational efficiency in managing project funds.

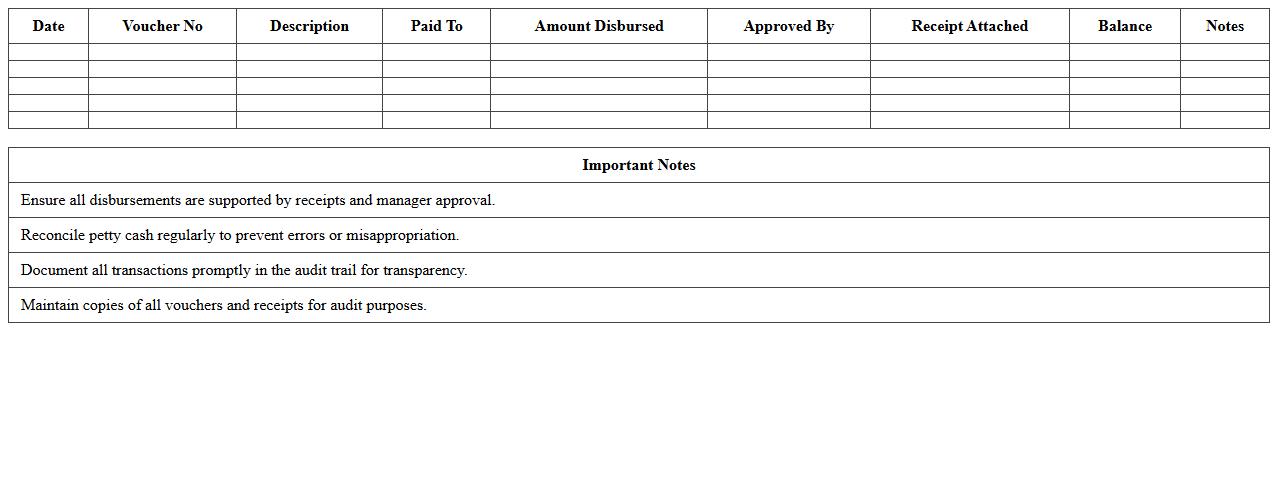

Petty Cash Audit Trail Excel Template for Nonprofit Accounting

The

Petty Cash Audit Trail Excel Template for Nonprofit Accounting is a structured spreadsheet designed to track and document small cash transactions within nonprofit organizations. It enables accurate recording, monitoring, and reconciliation of petty cash expenses, ensuring transparency and accountability in financial operations. This tool supports compliance with nonprofit financial regulations and facilitates easier auditing by providing a clear and organized record of cash disbursements.

How to automate expense categorization in a petty cash ledger Excel template for nonprofits?

To automate expense categorization, use Excel's Data Validation with a dropdown list of predefined categories. Incorporate the VLOOKUP or XLOOKUP formula to assign categories based on expense descriptions automatically. This process ensures consistent categorization across all petty cash entries with minimal manual effort.

What formulas ensure real-time balance updates in a nonprofit's petty cash Excel sheet?

Use the SUM formula to calculate total expenses and the starting balance to update the petty cash balance dynamically. The formula should subtract summed expenses from the initial balance in a continuous manner. Employing cell references ensures real-time updates as you add new transactions.

How can I track grant-restricted petty cash spending in an Excel ledger?

Add a grant identification column alongside each transaction to specify restricted funds. Use conditional formatting or filters to highlight or separate grant-restricted expenses automatically. PivotTables can also summarize spending by grant to monitor compliance with funding requirements.

Which Excel features facilitate multi-user access and tracking for nonprofit petty cash records?

Use Excel Online or SharePoint to enable multi-user access for simultaneous editing and real-time updates. Track changes via the 'Track Changes' feature to maintain accountability and review edits. Implementing permissions controls helps secure sensitive petty cash records from unauthorized access.

How to generate monthly printable petty cash reconciliation reports from an Excel ledger for board review?

Create a dedicated report sheet summarizing inflows, outflows, and ending balances for the selected month using formulas and PivotTables. Use Excel's Print Area and Page Setup features to ensure formatted, printer-friendly output. Automate date-based filtering to streamline monthly reconciliation report generation for smooth board presentations.

More Ledger Excel Templates