The Income Ledger Excel Template for Real Estate Agents is designed to track commissions, rental income, and other revenue streams efficiently. This customizable template helps real estate professionals maintain organized financial records and monitor cash flow with ease. Its user-friendly format ensures quick data entry and accurate income management.

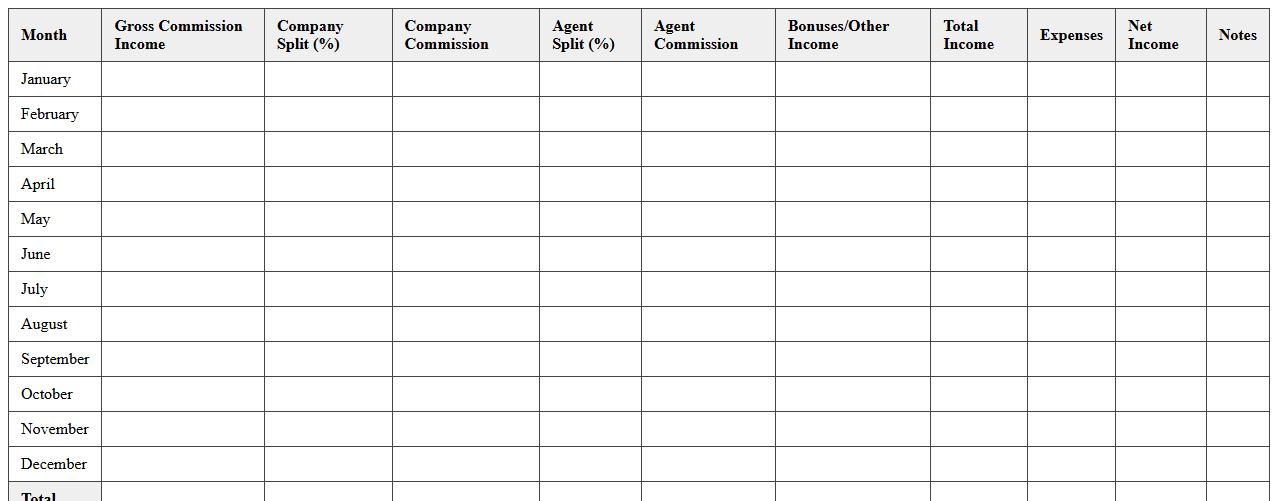

Monthly Commission Income Tracker for Realtors

The

Monthly Commission Income Tracker for Realtors is a detailed financial document designed to monitor and record monthly earnings derived from real estate commissions. This tracker allows realtors to systematically organize commission data, providing a clear overview of income trends, facilitating accurate tax reporting and financial planning. By maintaining this document, realtors can optimize cash flow management and ensure timely follow-up on pending commissions for improved financial stability.

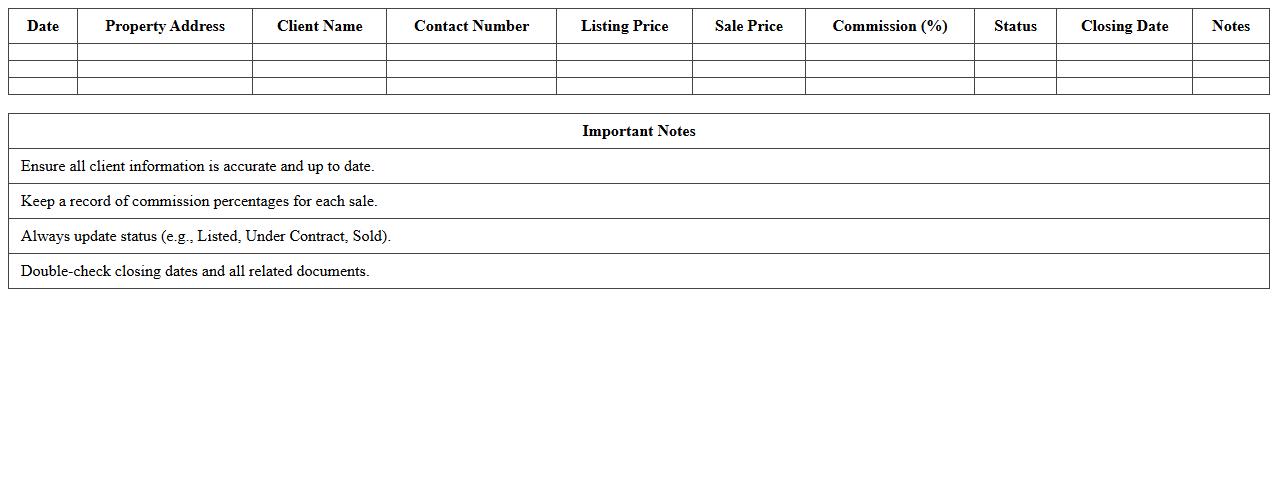

Real Estate Agent Property Sales Log

A

Real Estate Agent Property Sales Log document is a detailed record that tracks all property transactions handled by an agent, including client information, property details, sale prices, and dates of sale. This log is useful for monitoring sales performance, analyzing market trends, and ensuring accurate commission calculations. It also helps maintain organized documentation for legal compliance and client transparency.

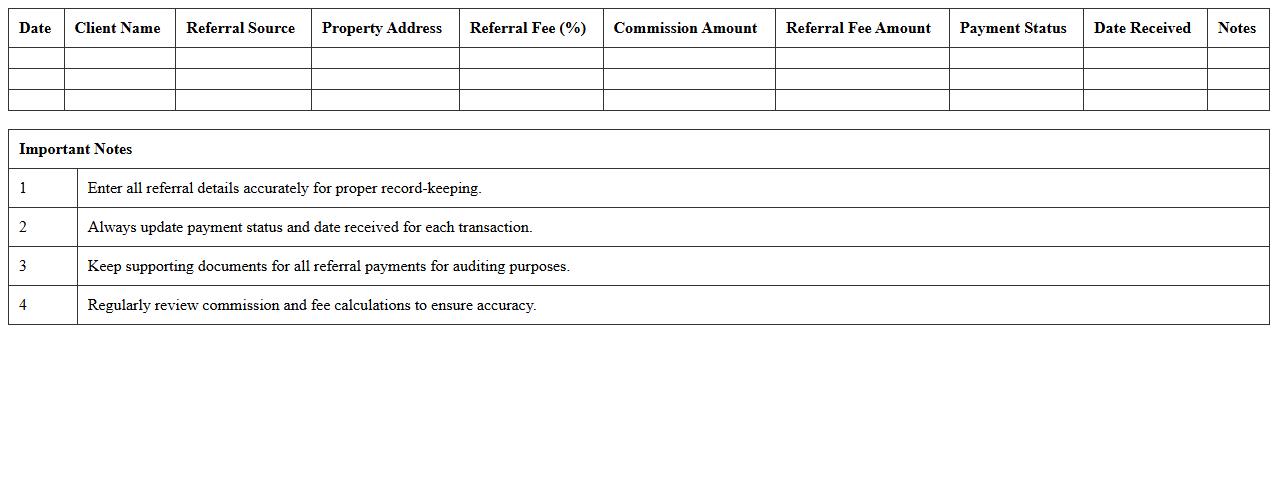

Real Estate Referral Income Record Sheet

A

Real Estate Referral Income Record Sheet is a detailed document that tracks commissions earned from referred real estate transactions. It helps agents and brokers maintain organized records of referral fees, ensuring accurate income reporting and timely payment follow-ups. Utilizing this sheet enhances financial transparency and simplifies tax preparation by consolidating all referral income in one structured format.

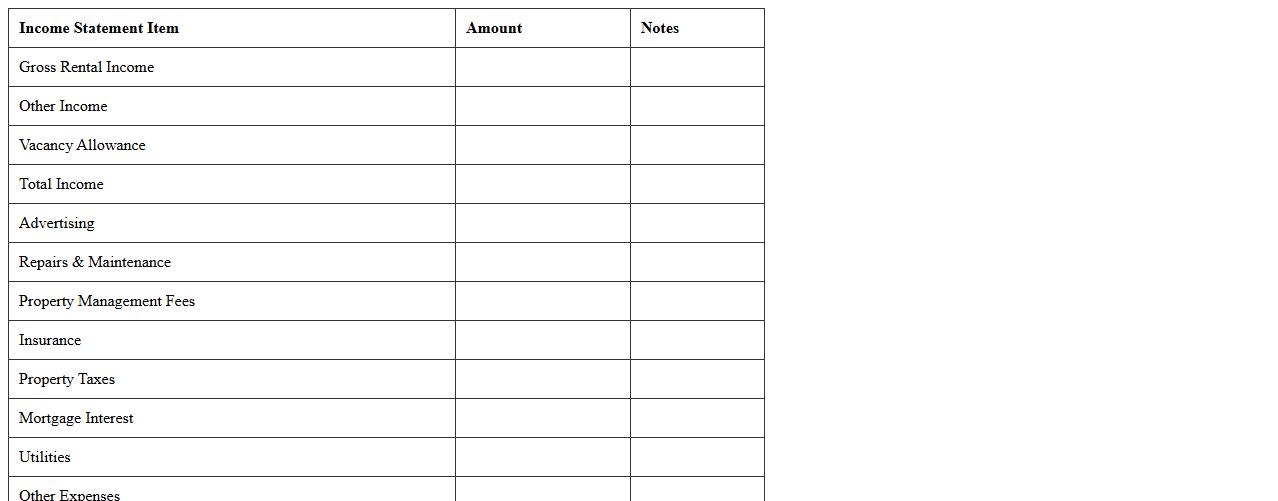

Rental Property Income Statement Excel

A

Rental Property Income Statement Excel document is a financial tool designed to track income and expenses related to rental properties, allowing property owners to monitor profitability accurately. It organizes data such as rental income, maintenance costs, taxes, and mortgage payments in a clear, customizable spreadsheet format. This helps landlords and property managers make informed decisions by providing a precise overview of cash flow and financial performance.

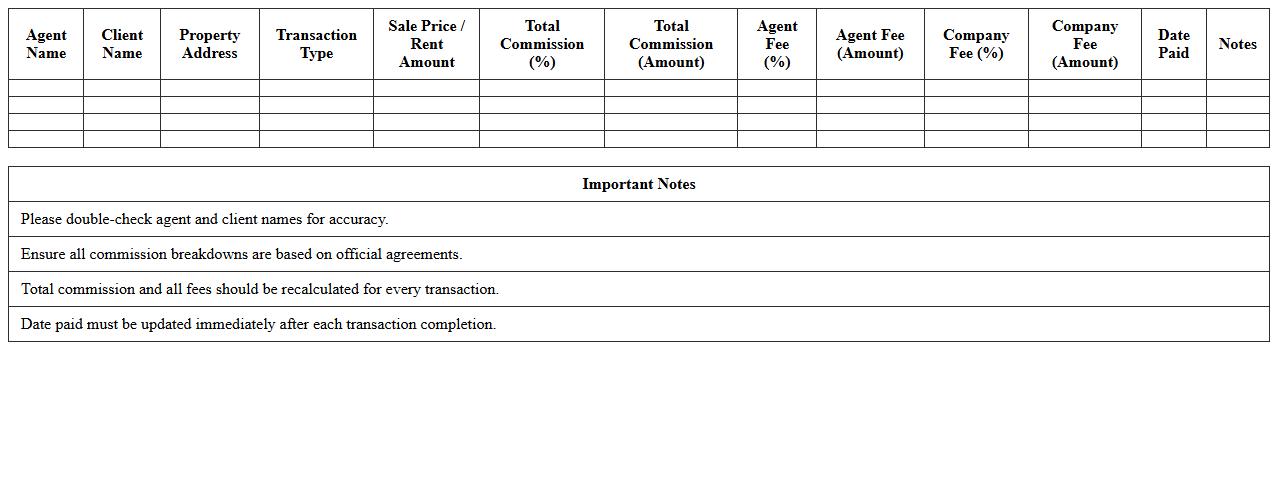

Agent Fee and Commission Breakdown Spreadsheet

The

Agent Fee and Commission Breakdown Spreadsheet is a detailed financial document that organizes and itemizes fees and commission structures for agents, providing transparency in transactions. It helps businesses track earnings, calculate payouts accurately, and maintain clear records for accounting and performance analysis. Using this spreadsheet improves financial management, ensures timely payments, and supports data-driven decision-making.

Real Estate Closing Income Tracker Template

The

Real Estate Closing Income Tracker Template document is a structured tool designed to monitor and record income generated from property sales and closings. It helps real estate professionals accurately track commissions, fees, and other earnings associated with each transaction, ensuring precise financial management. Using this template enhances organization, simplifies income reporting, and supports better financial planning for real estate agents and brokers.

Yearly Income Summary for Real Estate Agents

The

Yearly Income Summary for Real Estate Agents document provides a comprehensive record of all earnings, commissions, and bonuses received throughout the year. It is essential for tracking financial performance, simplifying tax preparation, and ensuring accurate reporting to regulatory authorities. Using this summary helps agents monitor their business growth and make informed financial decisions.

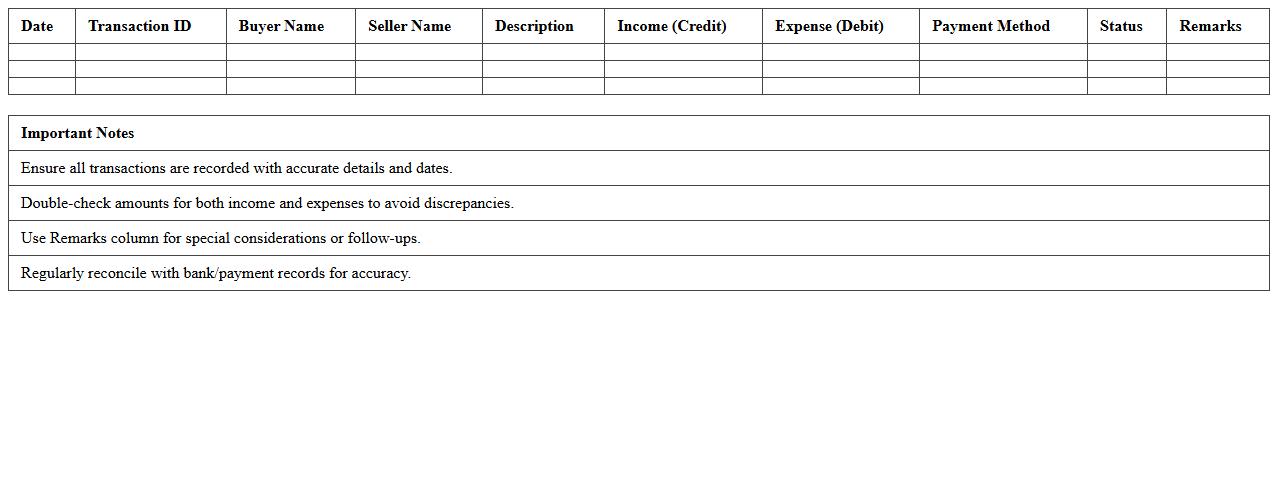

Buyer/Seller Transaction Income Register

The

Buyer/Seller Transaction Income Register is a detailed financial document that records all income generated from transactions between buyers and sellers within a specific period. It helps track revenue flow, monitor sales performance, and ensures accurate accounting for tax and auditing purposes. This register is crucial for maintaining transparency, improving financial reporting, and facilitating data-driven business decisions.

Open House Lead Income Tracking Sheet

The

Open House Lead Income Tracking Sheet is a document designed to systematically record and monitor leads generated from open house events. It helps real estate professionals track potential client information, follow up actions, and the income earned from closed deals resulting from those leads. This organized approach improves lead management efficiency and enhances sales forecasting accuracy.

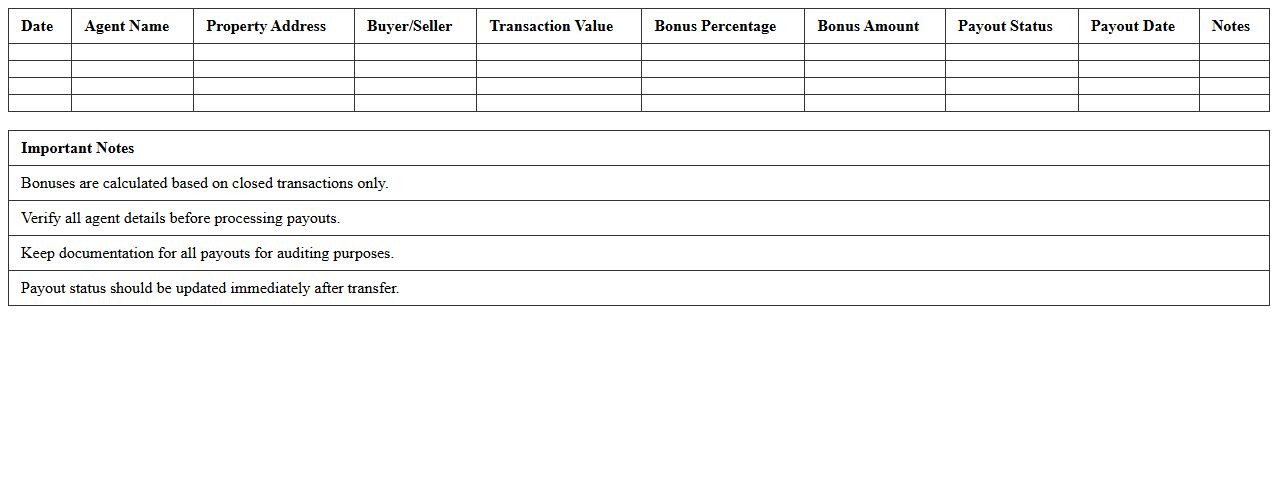

Real Estate Agent Bonus Payout Log

The

Real Estate Agent Bonus Payout Log document systematically records all bonus payments made to agents, ensuring transparency and accuracy in commission tracking. It helps brokers and management monitor performance-based rewards efficiently, facilitating timely and error-free bonus distributions. This log also serves as a valuable tool for financial auditing and compliance, providing clear documentation for internal reviews and tax purposes.

How can I automate commission calculations in an Income Ledger Excel for real estate transactions?

To automate commission calculations in Excel, use formulas like =SALE_AMOUNT*COMMISSION_RATE to compute earnings dynamically. Setting up named ranges for sale prices and rates enhances formula readability and accuracy. You can also apply conditional formatting to highlight commissions exceeding certain thresholds for better monitoring.

What are essential columns to include for tracking rental vs. sales income in a real estate agent's ledger?

Include distinct columns such as Transaction Type (Rental or Sale), Income Amount, and Date Received to differentiate income sources clearly. Additional columns like Property Address and Client Name help in detailed record-keeping. This structure allows seamless filtering and reporting on rental versus sales income streams.

How do I categorize agent referral fees within an Excel income ledger?

Referral fees should have a dedicated Category column labeled as "Referral Fee" to separate them from other income types. This enables easier tracking of income sources and simplifies tax reporting. Use data validation to ensure consistent categorization across all entries.

What Excel formulas best track pending vs. received payments for closed deals?

Use the IF function, like =IF(Payment_Status="Received", Amount, 0), to differentiate received payments from pending ones automatically. SUMIF or SUMIFS formulas can aggregate totals for pending and received payments separately for clear dashboards. These formulas help maintain real-time accuracy in cash flow management.

How can I integrate tax deduction tracking for business expenses in the income ledger?

Incorporate a Tax Deduction column to log deductible expenses alongside income entries. Use formulas to calculate deductible amounts and generate summary reports for tax filing purposes. Keeping this integration within the ledger reduces manual calculations and improves expense tracking efficiency.

More Ledger Excel Templates