The Ledger Excel Template for Personal Finance Tracking offers a streamlined way to monitor income, expenses, and savings in one organized spreadsheet. It features customizable categories and built-in formulas to automatically calculate balances and generate insightful financial summaries. This template helps users maintain budgeting discipline and make informed financial decisions with ease.

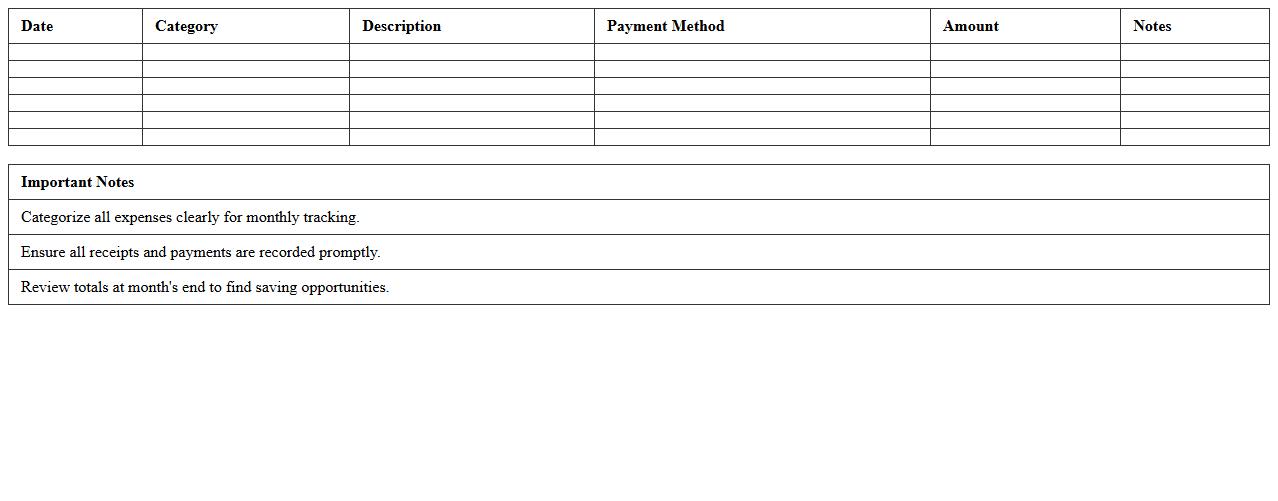

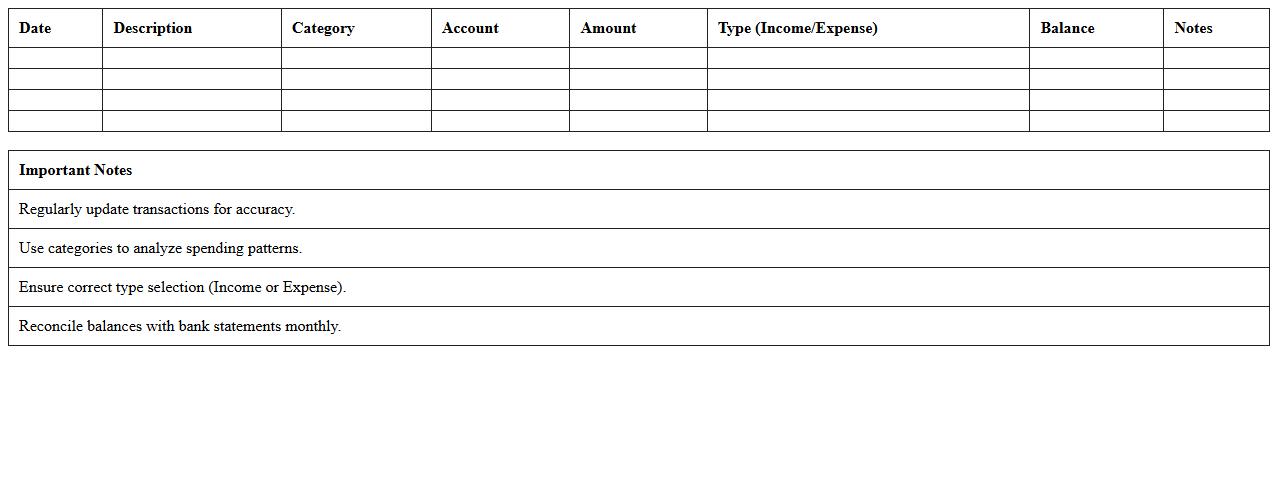

Monthly Personal Expense Ledger Spreadsheet

A

Monthly Personal Expense Ledger Spreadsheet document is a tool designed to track and organize individual financial transactions on a monthly basis, including income, expenditures, and savings. It helps users maintain a clear overview of their spending habits, identify areas for budget adjustments, and make informed financial decisions. By providing detailed records and summaries, this spreadsheet enhances financial discipline and supports effective money management.

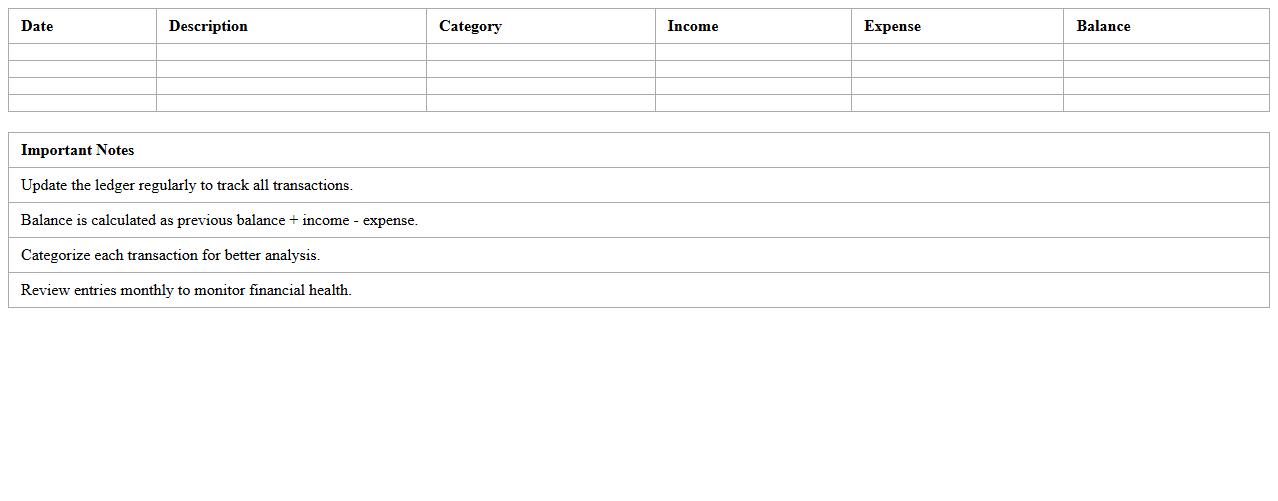

Simple Income and Expense Ledger Excel

A

Simple Income and Expense Ledger Excel document is a structured spreadsheet tool designed to track daily financial transactions, categorizing income and expenses efficiently. It helps users maintain accurate records, monitor cash flow, and generate insights for budgeting or tax purposes. This ledger simplifies financial management by providing clear visibility into spending patterns and income sources, aiding in better decision-making.

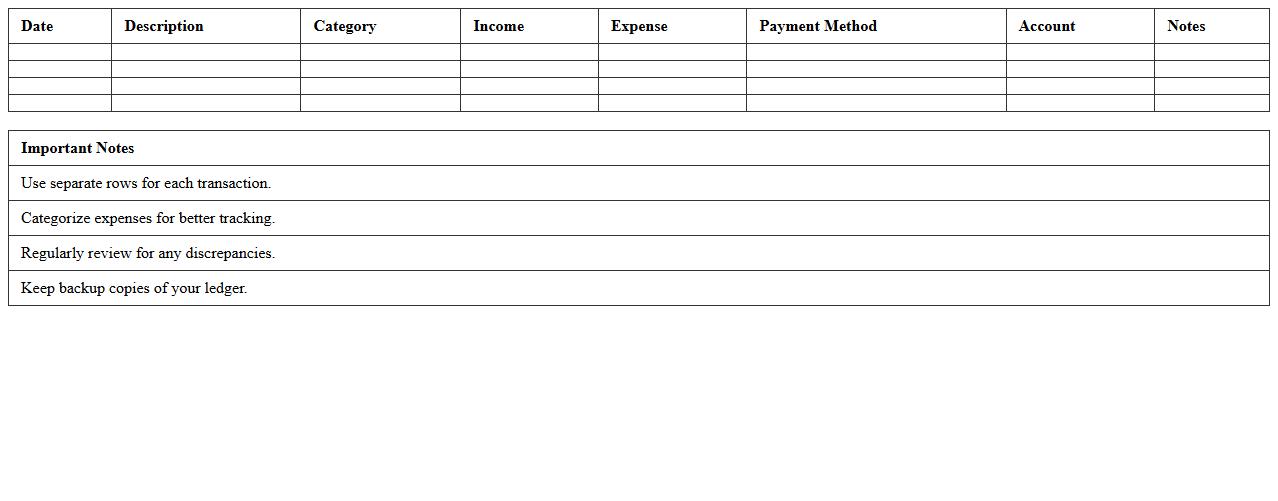

Personal Budget and Ledger Tracking Sheet

A

Personal Budget and Ledger Tracking Sheet is a financial tool designed to help individuals monitor and manage their income, expenses, and savings systematically. It provides a clear overview of monthly cash flow, enabling users to identify spending patterns and make informed decisions to achieve financial goals. This document is essential for maintaining financial discipline, avoiding debt, and enhancing overall money management skills.

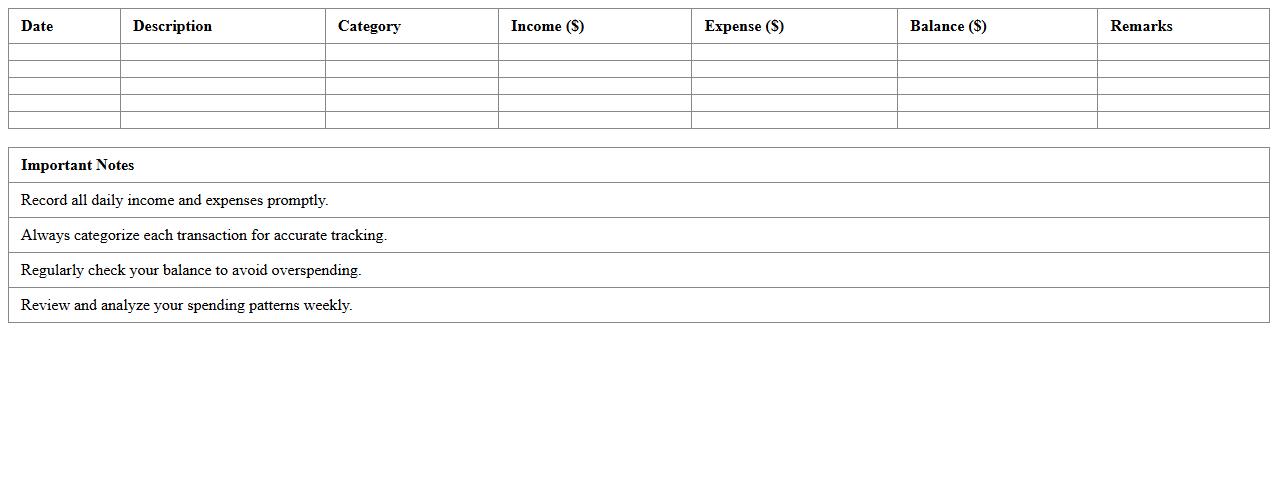

Family Finance Ledger Template XLS

The

Family Finance Ledger Template XLS document is a spreadsheet tool designed to track and organize household income, expenses, and savings efficiently. It helps users monitor financial goals, manage budgets, and identify spending patterns to improve money management. Using this template enhances financial transparency within the family and supports informed decision-making for future expenditures.

Daily Personal Cash Ledger Worksheet

The

Daily Personal Cash Ledger Worksheet is a financial tool used to track all daily cash transactions, including income and expenses. It helps individuals maintain accurate records, monitor cash flow, and manage budgets effectively by providing a clear overview of spending habits. Regular use of this worksheet enhances financial discipline and supports better decision-making for personal money management.

Automated Personal Finance Ledger Excel

An

Automated Personal Finance Ledger Excel document is a spreadsheet tool designed to track income, expenses, and savings automatically by using formulas and macros. It streamlines budgeting and financial planning by categorizing transactions, generating reports, and providing real-time insights into spending habits. This automation reduces errors, saves time, and enhances financial decision-making by offering a clear overview of personal finances.

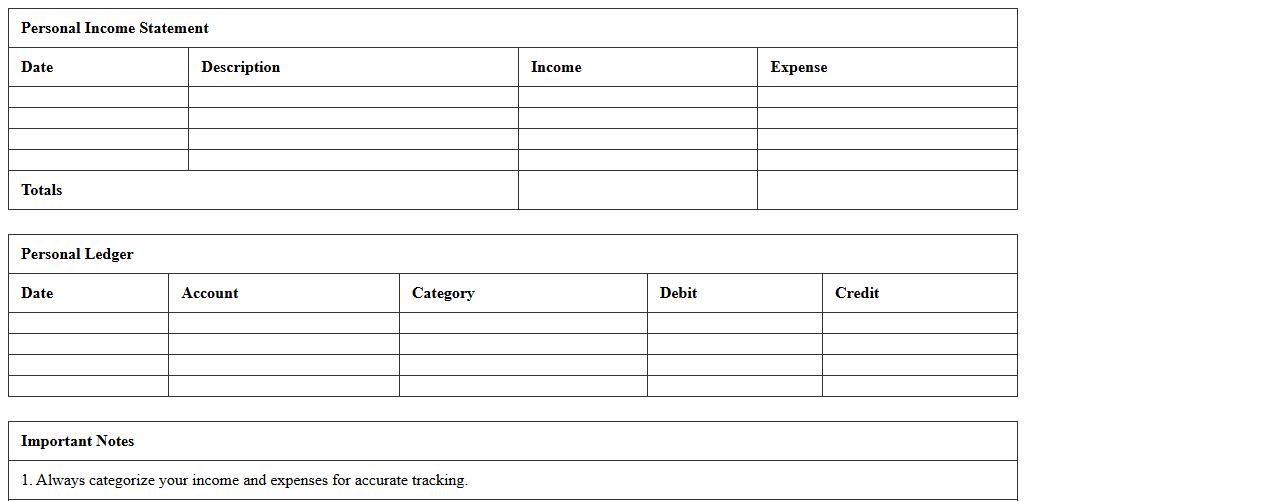

Personal Income Statement and Ledger Template

A

Personal Income Statement and Ledger Template is a financial document that tracks individual income sources and expenses, providing a clear overview of cash flow and financial health. It helps users categorize earnings and expenditures systematically, enabling effective budgeting and expense management. This template is essential for identifying spending patterns, optimizing savings, and ensuring accurate financial record-keeping for personal financial planning.

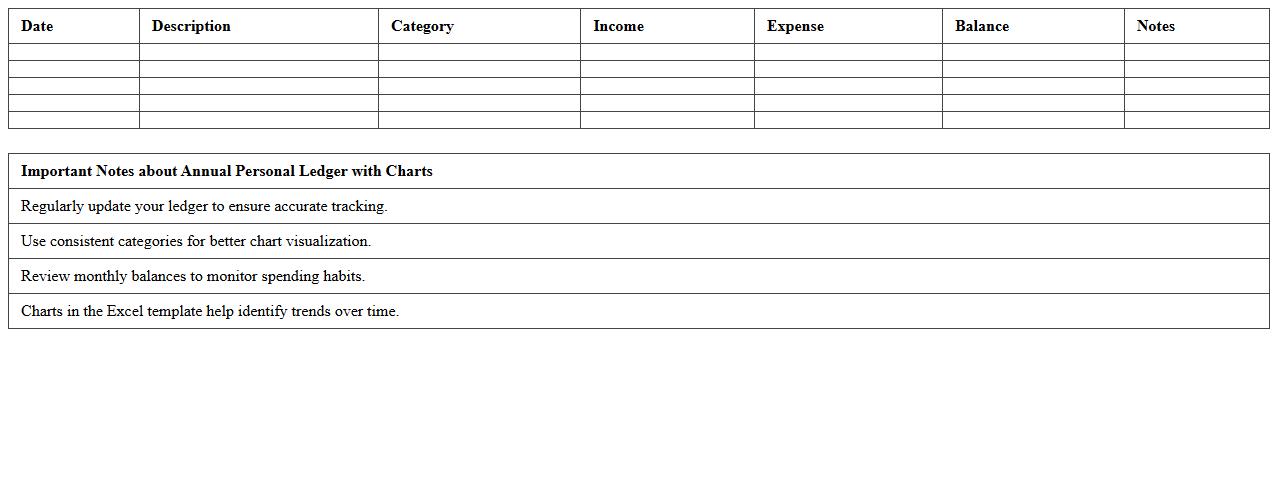

Annual Personal Ledger with Charts

The

Annual Personal Ledger with Charts document provides a detailed record of individual financial transactions throughout the year, accompanied by visual representations like pie charts and bar graphs to illustrate spending patterns and income sources. This document helps users track their budget, manage expenses, and identify trends for better financial planning. By offering clear insights into personal finances, it supports informed decision-making and improves overall money management.

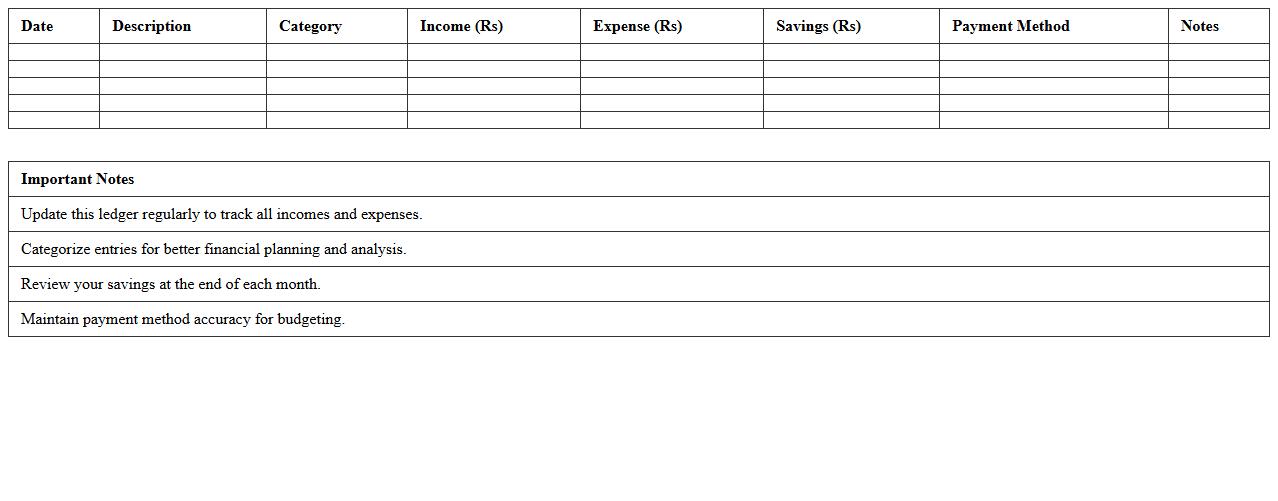

Personal Savings and Expense Ledger Excel

A

Personal Savings and Expense Ledger Excel document is a digital tool designed to track and organize individual financial transactions, including income, expenses, and savings. It helps users monitor spending patterns, set budgeting goals, and analyze financial health through customizable charts and formulas. By maintaining accurate records, this ledger promotes better money management and supports informed decision-making for improved financial stability.

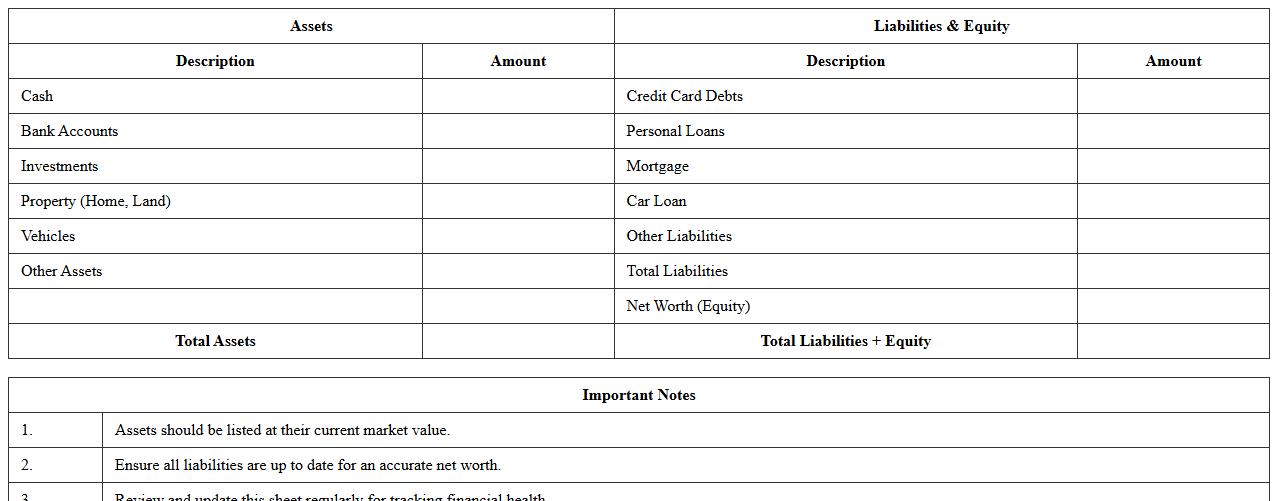

Comprehensive Personal Ledger Balance Sheet

A

Comprehensive Personal Ledger Balance Sheet is a detailed financial statement that aggregates all personal assets, liabilities, incomes, and expenses in one organized document. This balance sheet provides a clear snapshot of an individual's net worth, facilitating informed financial planning and effective debt management. By tracking financial transactions systematically, it helps in budgeting, identifying investment opportunities, and achieving long-term wealth goals.

How can I automate income and expense categorization in my personal finance Ledger Excel sheet?

You can automate income and expense categorization in Excel by using the IF, VLOOKUP, or SWITCH functions to assign categories based on transaction descriptions. Setting up a reference table with keywords linked to categories allows Excel to automatically match and categorize new entries. This method eliminates manual sorting and ensures your ledger stays organized efficiently.

What are effective formulas for monthly budget variance analysis in a finance tracking ledger?

Effective formulas like SUMIFS can sum income and expenses for specific categories and months, enabling detailed budget tracking. By subtracting actual spending from budgeted amounts using simple subtraction formulas, you can calculate variance to monitor financial performance. Incorporating percentage variance formulas enhances insight into overspending or savings per category.

How do I set up conditional formatting for overspending alerts in an Excel personal finance ledger?

Use conditional formatting rules to highlight cells where expenses exceed budgeted amounts by selecting the range and applying a rule with a formula such as =Actual>Budget. Choose a distinctive format like red fill or bold text to make the overspending alerts visually clear. This setup allows immediate identification of budget overruns without manual review.

What's the best way to visualize savings progress in a personal Ledger Excel document?

The best method to visualize savings progress is by creating dynamic charts such as line graphs or bar charts that track cumulative savings over time. Using Excel's chart tools with data series for monthly savings and targets helps in observing trends and goal achievements. Adding data labels and trendlines further enhances understanding of your financial growth.

How can I link multiple bank accounts for consolidated tracking within one Excel finance ledger?

Link multiple bank accounts by importing transaction data into separate Excel sheets and then consolidating the information using formulas like INDIRECT or Power Query. Power Query is particularly effective for merging data from various files or worksheets into a master ledger automatically. This approach provides a comprehensive view of your finances without switching between accounts.

More Ledger Excel Templates

![]()