A Ledger Excel Template for Nonprofit Organizations streamlines financial record-keeping by providing an easy-to-use format for tracking income, expenses, and donations. This template enhances accuracy and transparency, ensuring compliance with nonprofit accounting standards. Customizable features allow organizations to tailor the ledger to their specific reporting needs and financial management practices.

Donation Tracking Ledger for Nonprofit Organizations

A

Donation Tracking Ledger for Nonprofit Organizations is a detailed record-keeping document that systematically tracks all incoming donations, including donor information, donation amounts, dates, and designated purposes. This ledger is essential for ensuring transparency, accurate financial reporting, and compliance with regulatory requirements, which builds trust with donors and stakeholders. It streamlines fundraising efforts by providing clear insights into donation patterns, enabling better strategic planning and resource allocation for nonprofit missions.

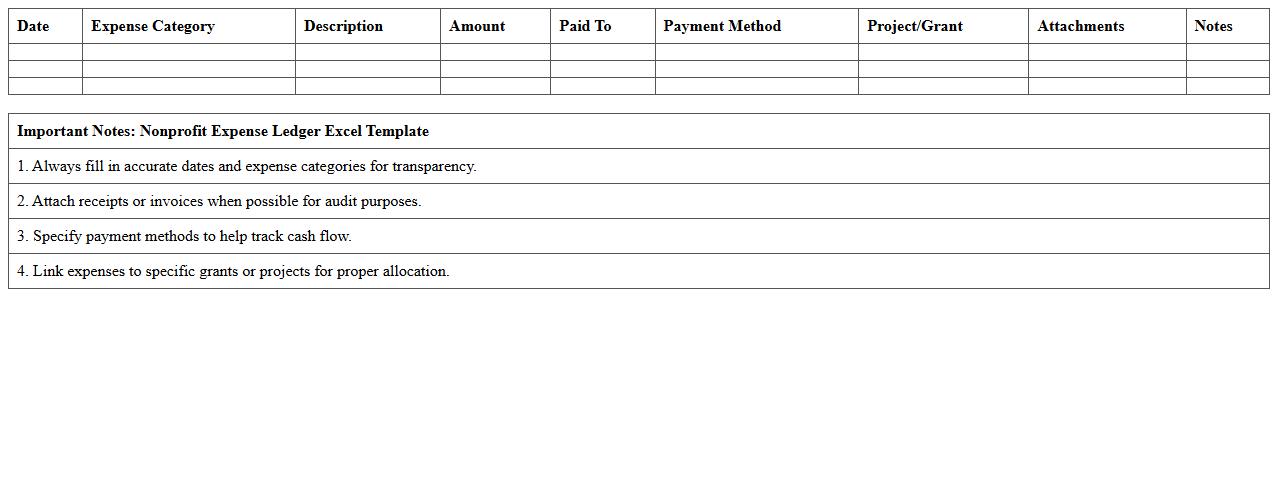

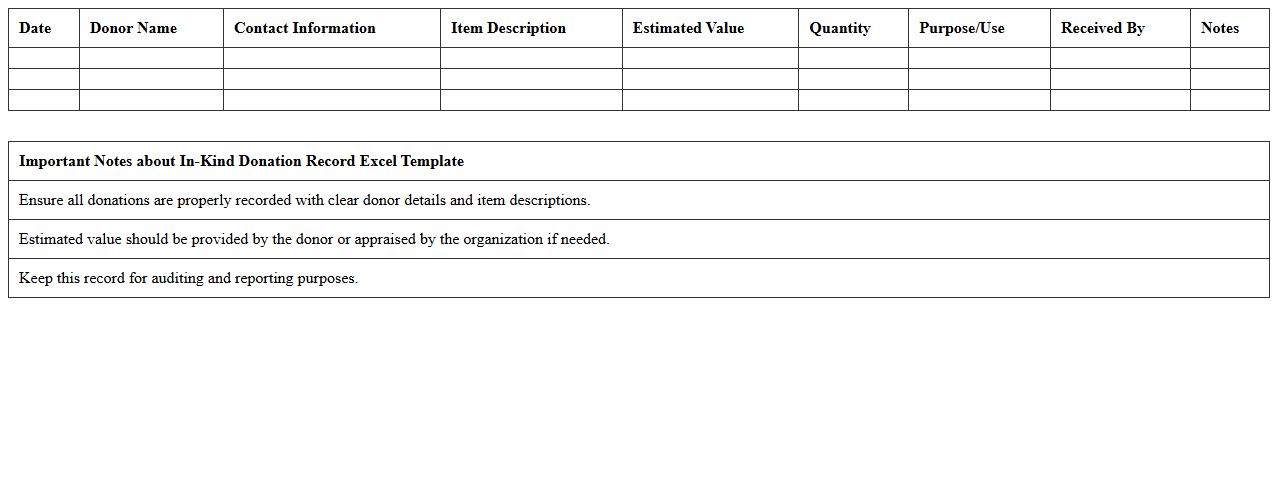

Nonprofit Expense Ledger Excel Template

The

Nonprofit Expense Ledger Excel Template document is a specialized spreadsheet designed to track and organize expenses for nonprofit organizations efficiently. It allows users to record detailed financial transactions, categorize expenditures, and monitor budget adherence in a clear, structured format. This template is useful for maintaining accurate financial records, ensuring transparency, and simplifying audit preparations for nonprofit entities.

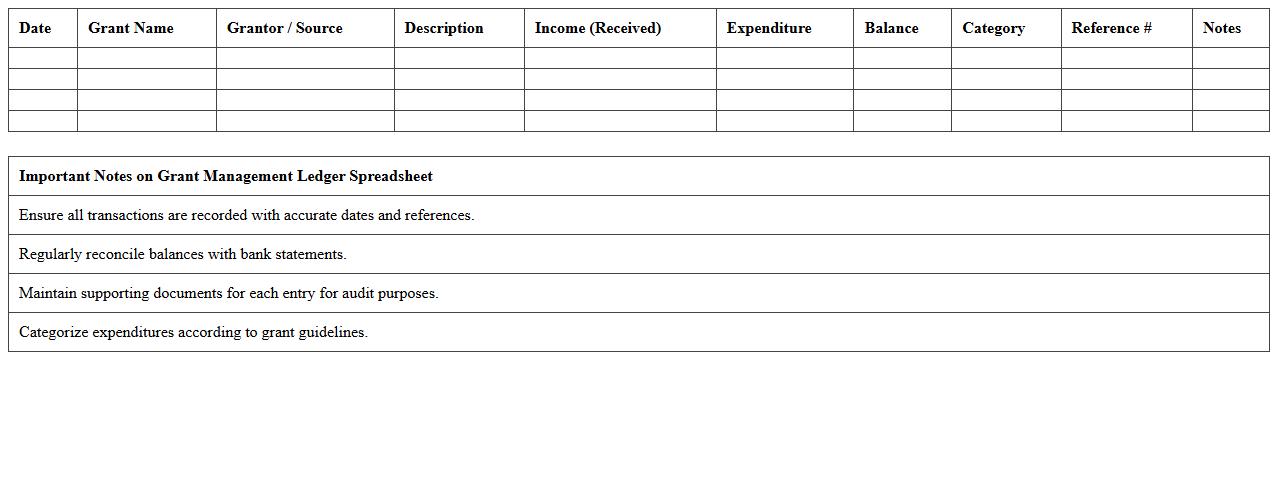

Grant Management Ledger Spreadsheet

A

Grant Management Ledger Spreadsheet document is a structured tool designed to track and organize financial data related to grant funds, including allocations, expenditures, and balances. It provides transparency and accountability by enabling precise monitoring of grant activities and ensuring compliance with funding requirements. Utilizing this spreadsheet helps organizations optimize budget management, streamline reporting processes, and maintain accurate records for auditing purposes.

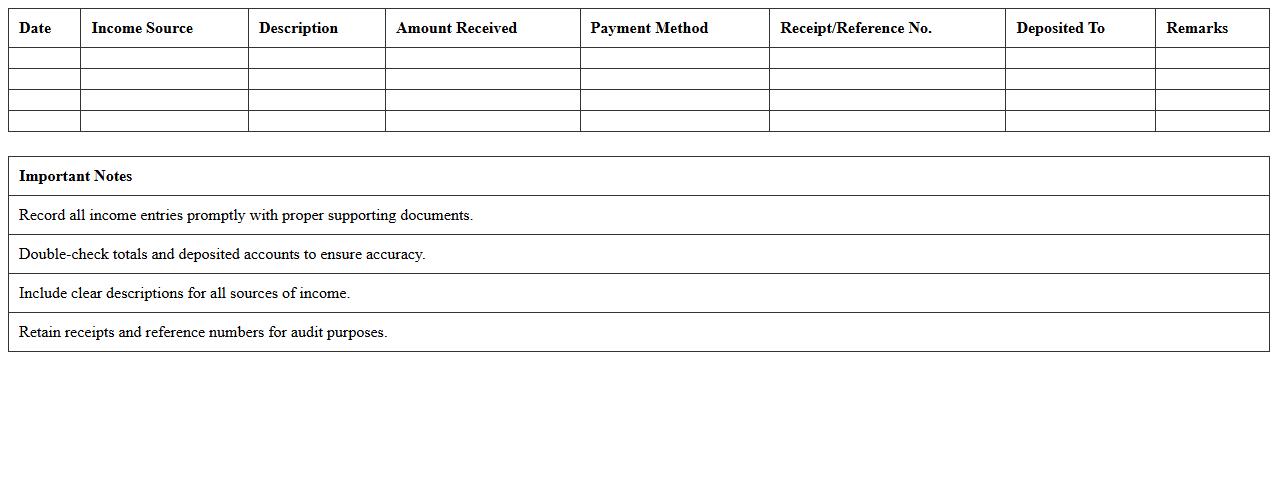

Fundraising Event Income Ledger

The

Fundraising Event Income Ledger document systematically records all income generated from fundraising events, providing a clear and organized financial overview. It tracks donations, ticket sales, sponsorships, and other revenue streams, ensuring accountability and transparency for event organizers. This ledger is essential for budgeting, financial analysis, and reporting to stakeholders, enhancing the overall management and success of fundraising efforts.

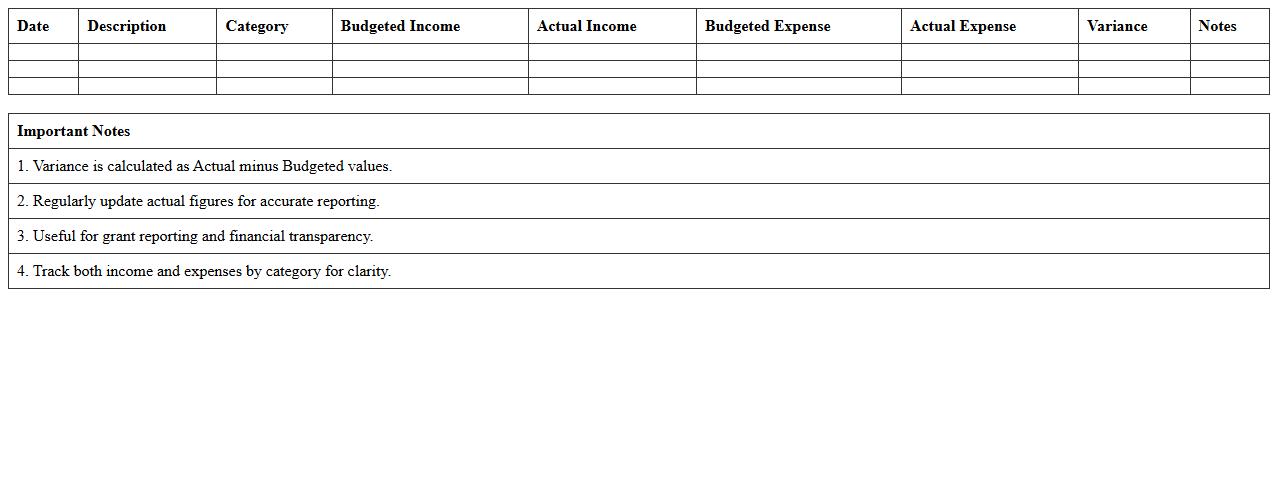

Nonprofit Budget vs Actual Ledger Template

A

Nonprofit Budget vs Actual Ledger Template is a financial tool that tracks and compares projected budget figures against actual income and expenses throughout a fiscal period. This document helps organizations monitor financial performance, ensuring accountability and supporting strategic decision-making by highlighting variances between planned and real financial outcomes. Using this template improves transparency for stakeholders and aids in maintaining fiscal responsibility.

Volunteer Hours Tracking Ledger

A

Volunteer Hours Tracking Ledger is a detailed record-keeping document used to log the time volunteers spend on various activities or projects. This ledger helps organizations monitor volunteer contributions, ensuring accurate recognition and accountability for service hours. It supports efficient management of volunteer resources and assists in reporting for grants, awards, or organizational evaluations.

Program-Specific Financial Ledger

The

Program-Specific Financial Ledger document is a detailed record that tracks financial transactions and budgetary allocations within a particular program or project. It provides precise insights into expenditure, income, and fund utilization, enabling accurate financial management and accountability. This document is essential for ensuring transparency, aiding in audits, and supporting informed decision-making for program efficiency and compliance.

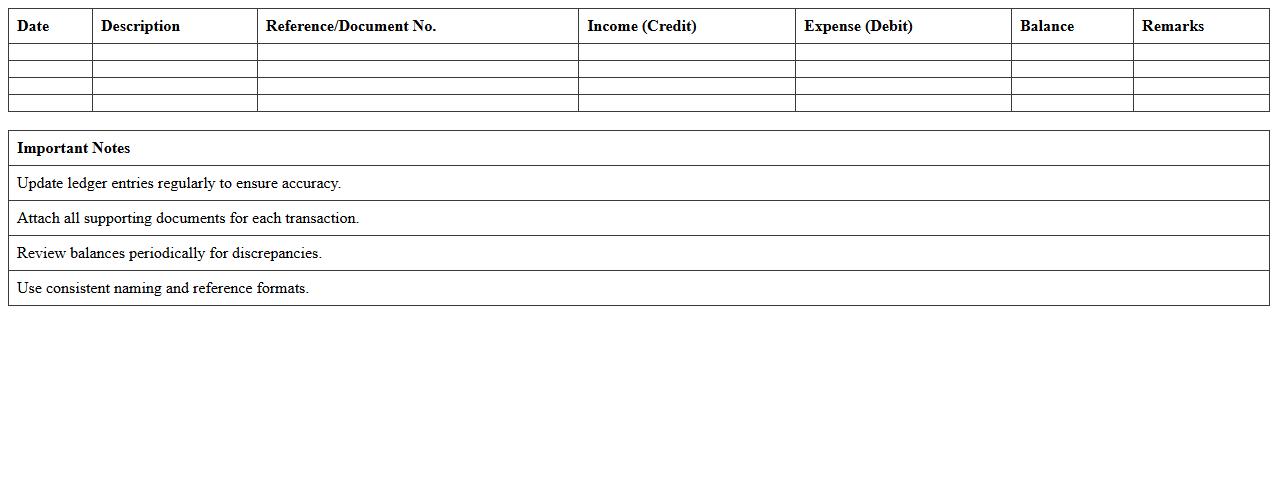

Membership Dues Ledger for Nonprofits

The

Membership Dues Ledger for nonprofits is a detailed record that tracks membership fees paid by individuals or organizations over time. This document helps maintain accurate financial accountability, ensuring all dues are collected and properly recorded for auditing and reporting purposes. By using this ledger, nonprofits can efficiently manage member payments, improve budgeting accuracy, and enhance member engagement through clear financial transparency.

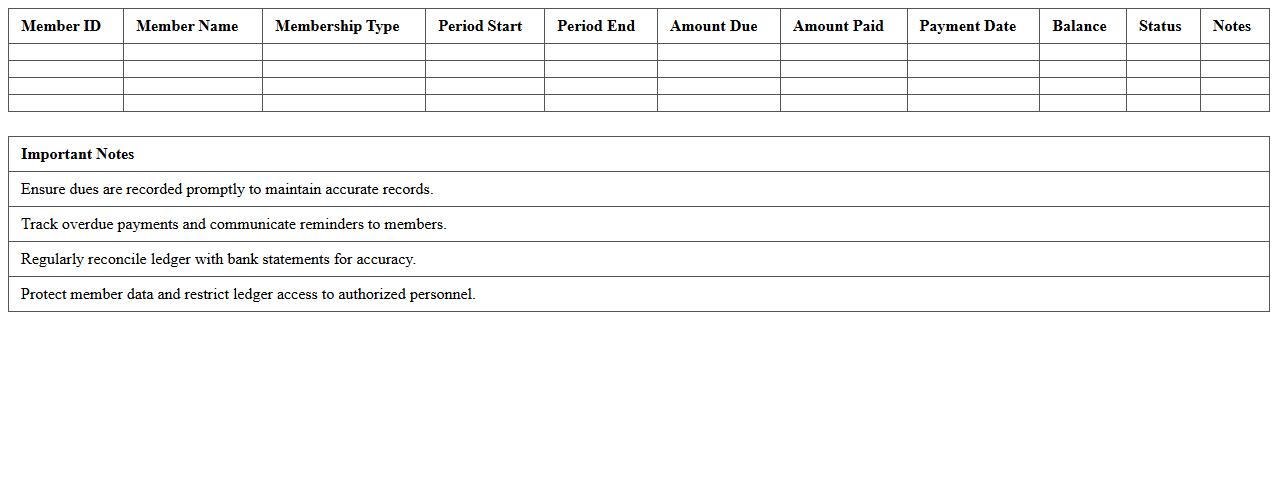

In-Kind Donation Record Excel Template

The

In-Kind Donation Record Excel Template document is a structured tool designed to track and organize non-monetary contributions such as goods or services donated to an organization. It helps maintain accurate records by detailing donor information, item descriptions, estimated values, and donation dates, ensuring transparency and accountability. This template streamlines the donation management process, simplifies reporting for tax purposes, and enhances the efficiency of resource allocation within nonprofits or charitable initiatives.

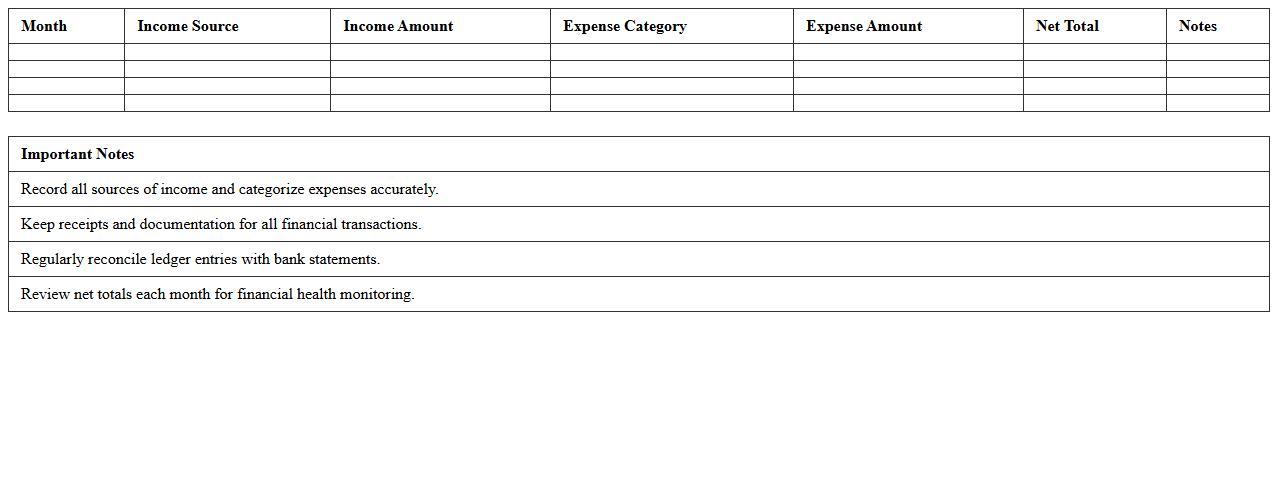

Monthly Financial Summary Ledger for Nonprofits

The

Monthly Financial Summary Ledger for Nonprofits is a detailed record that consolidates all financial transactions and balances within a given month, tailored specifically for nonprofit organizations. It provides a clear overview of income sources, expenditures, grants, and donations, enabling accurate tracking of funds and ensuring compliance with financial regulations. This document is crucial for maintaining transparency, supporting audit processes, and facilitating informed decision-making to enhance the nonprofit's fiscal responsibility.

How can Ledger Excel templates track donor-specific contributions for nonprofits?

Ledger Excel templates can track donor-specific contributions by incorporating dedicated columns for donor names and unique IDs. These templates allow nonprofits to record individual donations, enabling detailed reporting on contribution sources. Using structured tables improves data accuracy and eases donor management.

What custom formulas optimize fund allocation reporting in a nonprofit Ledger Excel?

Custom formulas such as SUMIFS and VLOOKUP streamline fund allocation reporting by aggregating donations based on specific criteria. These formulas help categorize funds according to program, donor type, or time period. This optimized approach enhances clarity and accountability in financial reports.

How to structure restricted vs. unrestricted funds in a nonprofit Ledger spreadsheet?

Separate sheets or columns for restricted and unrestricted funds are essential to maintain clarity. Clearly labeling each transaction's funding type helps comply with donor requirements and regulatory standards. This structural distinction simplifies tracking and reporting across fund categories.

Which Excel functions automate grant expense reconciliation in a nonprofit ledger?

Excel functions like IFERROR, SUMPRODUCT, and INDEX-MATCH automate grant expense reconciliation by cross-checking data entries. These tools identify discrepancies and ensure accuracy between grant disbursements and expenses. Automation reduces manual errors and increases financial transparency.

What's the best way to tag and filter program-specific transactions in Excel for nonprofit accounting?

Using data validation drop-down lists to tag transactions with program codes enhances filtering capabilities. Combined with Excel's FILTER and PIVOT TABLE functions, this enables dynamic and precise extraction of program-specific data. This method supports comprehensive analysis and efficient financial tracking.

More Ledger Excel Templates