A Ledger Excel Template for Freelancers helps track income, expenses, and project payments efficiently in one organized spreadsheet. It simplifies financial management by allowing freelancers to monitor cash flow, categorize transactions, and generate reports for tax purposes. Using this customizable template ensures accurate record-keeping and improves budgeting for freelance professionals.

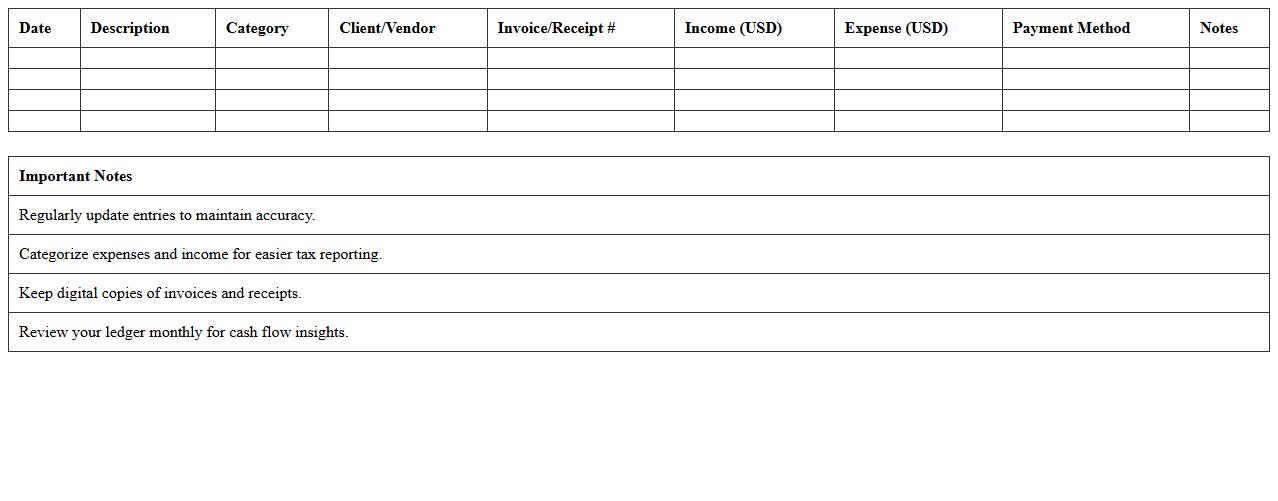

Income and Expense Ledger Excel Template for Freelancers

The

Income and Expense Ledger Excel Template for Freelancers is a detailed financial tracking tool designed to help freelancers record and monitor their earnings and expenditures efficiently. It provides organized columns for categorizing income sources and expense types, enabling accurate calculation of net profit and tax preparation. By using this template, freelancers can maintain clear financial records, which aids in budgeting, financial planning, and ensuring compliance with tax regulations.

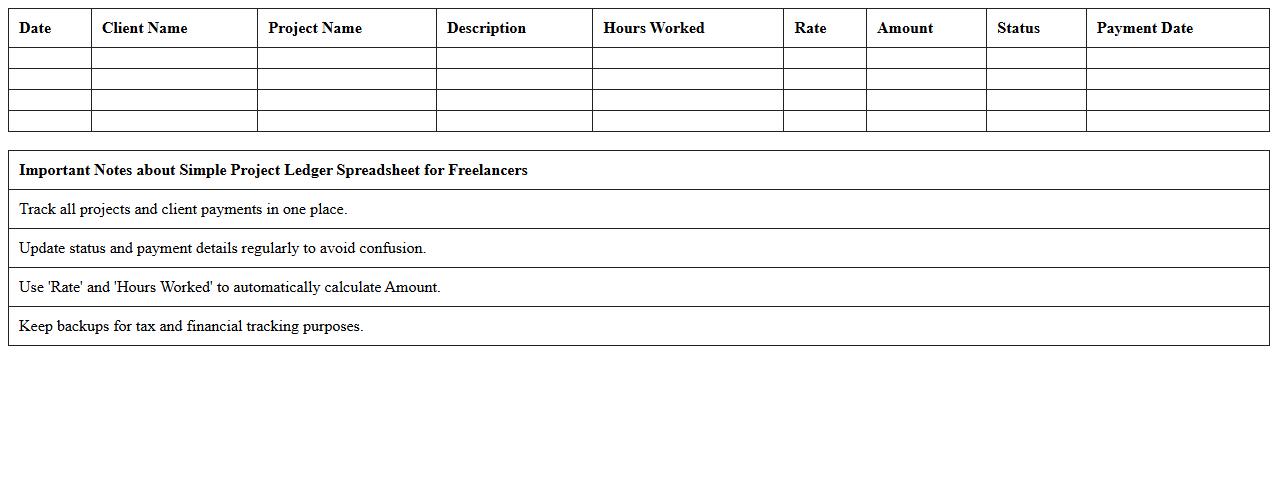

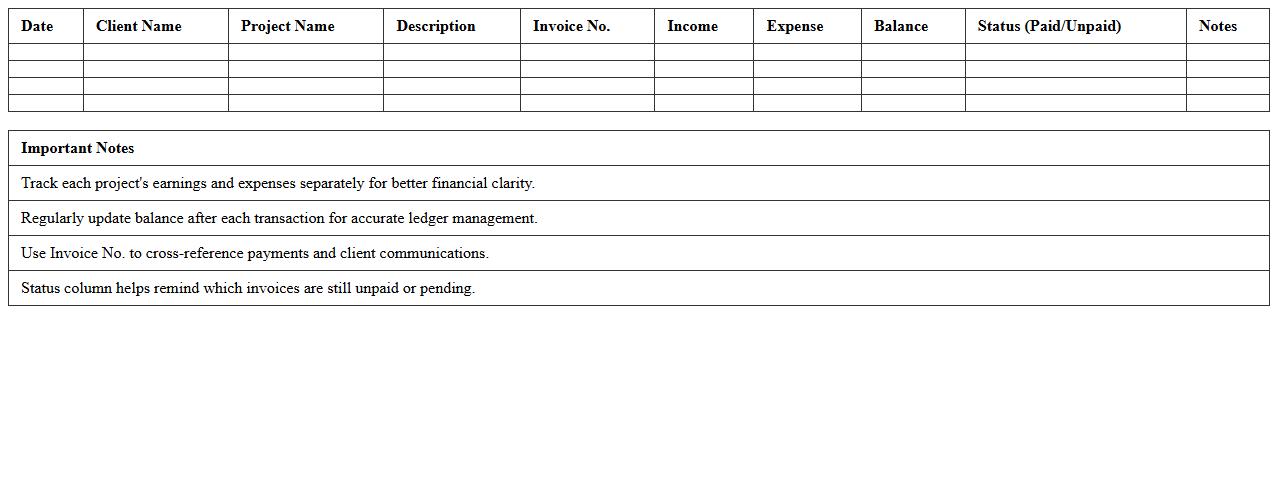

Simple Project Ledger Spreadsheet for Freelancers

A

Simple Project Ledger Spreadsheet for freelancers is a structured document designed to track income, expenses, and project details efficiently. It helps freelancers maintain organized financial records, monitor project budgets, and streamline invoice management. Utilizing this spreadsheet improves financial accuracy and simplifies tax preparation for independent contractors.

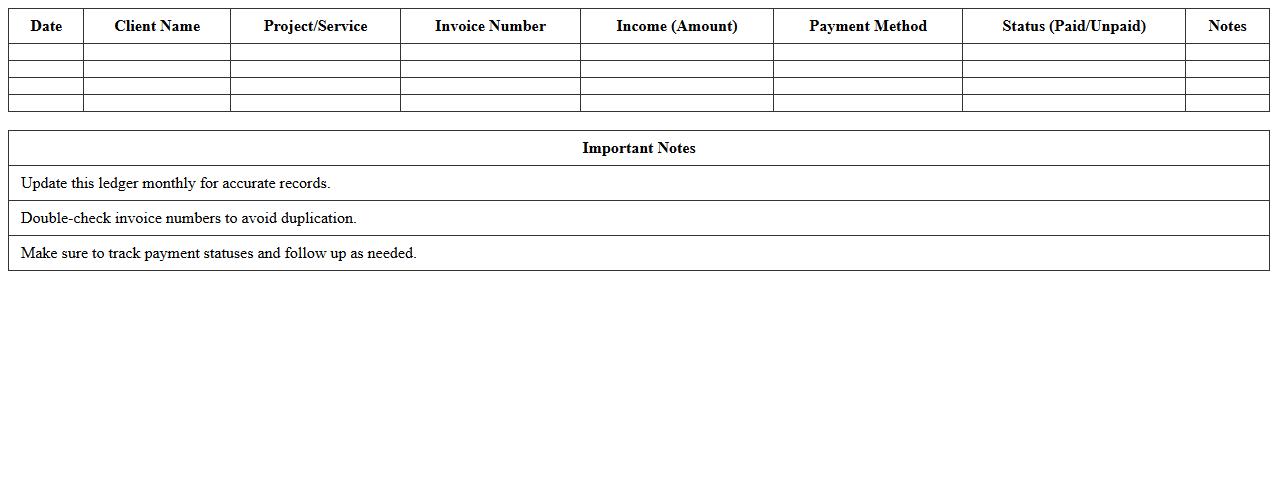

Freelance Job Payments Tracker Ledger Excel

A

Freelance Job Payments Tracker Ledger Excel document is a structured spreadsheet designed to record and monitor income from various freelance projects. It helps freelancers keep accurate records of payments received, dates, clients, and outstanding balances, streamlining financial management and ensuring timely invoicing. By organizing earnings systematically, this tool enhances budgeting, tax preparation, and overall cash flow tracking for independent professionals.

Monthly Freelance Income Ledger Template

A

Monthly Freelance Income Ledger Template is a structured document designed to track and organize income received from various freelance projects on a monthly basis. It helps freelancers maintain clear records of payments, clients, and project details, ensuring accurate financial management and easier tax preparation. This template supports budgeting and cash flow analysis by providing a comprehensive overview of earnings over time.

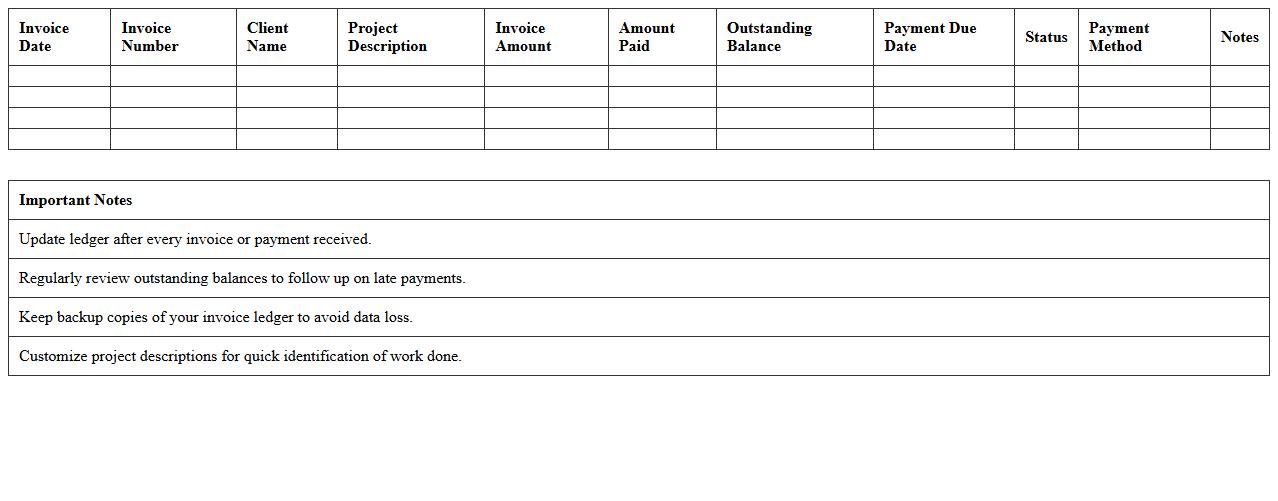

Detailed Client Invoice Ledger Excel for Freelancers

The

Detailed Client Invoice Ledger Excel for freelancers is a comprehensive document that organizes all invoicing records by client, date, payment status, and amount. It helps freelancers track payments, manage outstanding balances, and maintain accurate financial records efficiently. This ledger ensures timely follow-ups on unpaid invoices, improving cash flow and simplifying tax preparation.

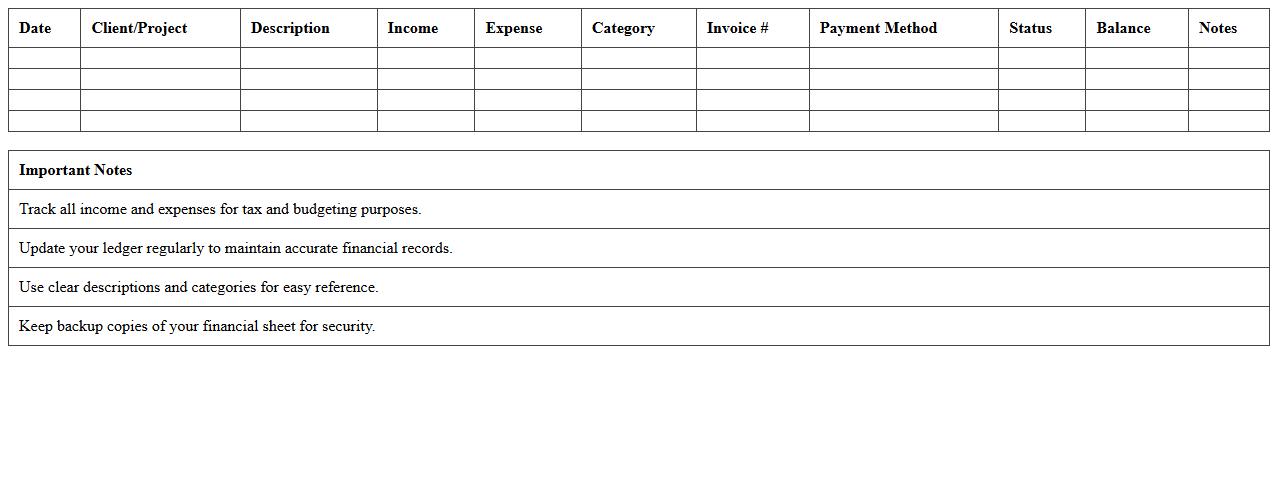

Freelancers’ Budget and Ledger Excel Sheet

A

Freelancers' Budget and Ledger Excel Sheet document serves as a comprehensive financial management tool designed to track income, expenses, and project budgets efficiently. It helps freelancers maintain accurate records of payments received, outstanding invoices, and expenditures, enabling better cash flow management and financial planning. By consolidating all transactions in a structured format, it simplifies tax preparation and supports informed decision-making for business growth.

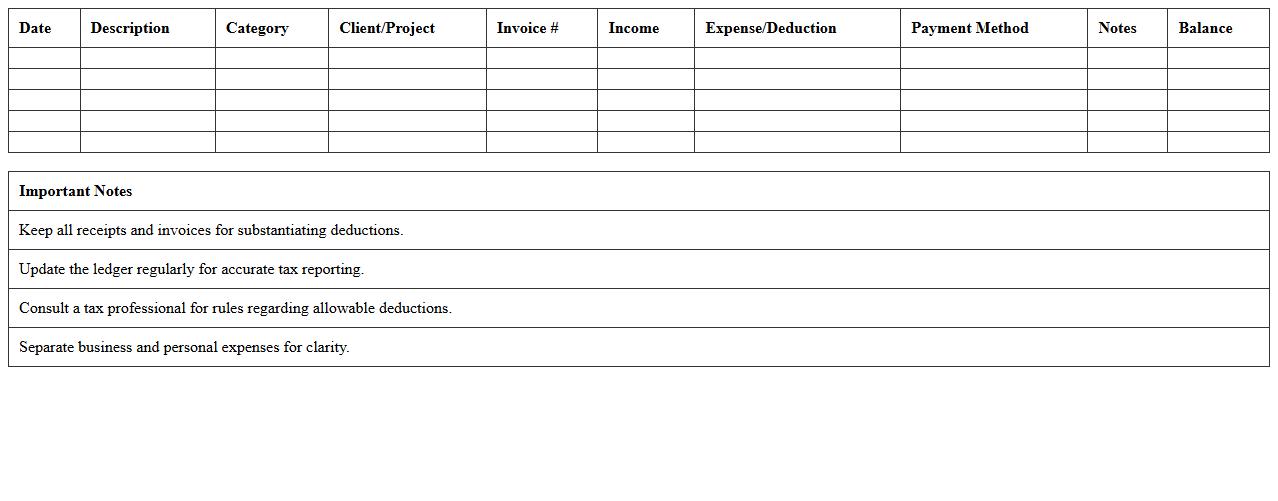

Tax Deductions Ledger Template for Freelancers

A

Tax Deductions Ledger Template for Freelancers is a structured document designed to track and categorize deductible expenses related to freelance work. It helps freelancers systematically record tax-deductible expenses such as office supplies, travel costs, and professional fees, ensuring accurate financial records for tax filing purposes. This template simplifies tax preparation, reduces errors, and maximizes potential deductions, ultimately saving time and money during tax season.

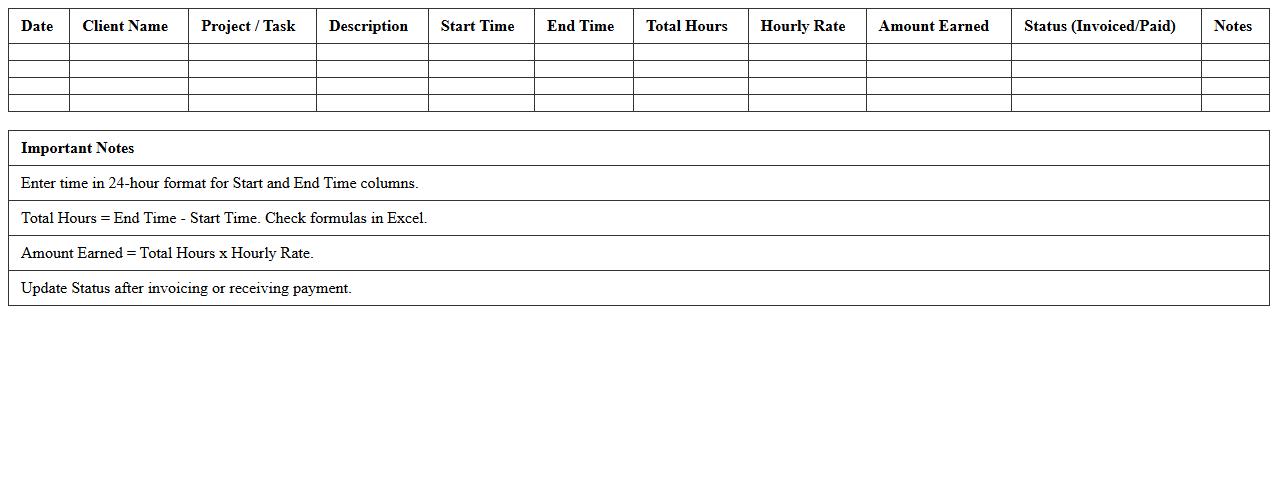

Freelance Hourly Work Ledger Excel Template

The

Freelance Hourly Work Ledger Excel Template document is a structured tool designed to help freelancers accurately track their billable hours and manage client projects efficiently. It allows users to record work hours, calculate earnings based on hourly rates, and generate organized reports for invoicing purposes. This template streamlines time management and financial tracking, ensuring accurate payment and improved project oversight.

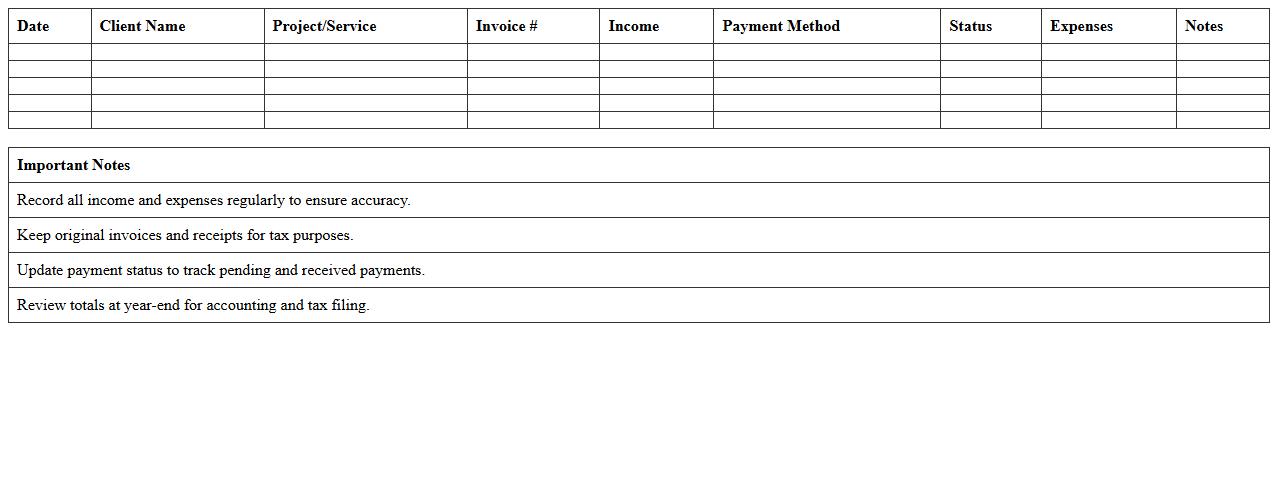

Yearly Freelance Earnings Ledger Spreadsheet

A

Yearly Freelance Earnings Ledger Spreadsheet is a detailed financial document that tracks all income earned from freelance projects throughout the year. It allows freelancers to organize payments by client, date, and project, ensuring accurate record-keeping for tax reporting and budgeting purposes. This spreadsheet helps users monitor their earnings trends, manage cash flow efficiently, and prepare comprehensive financial summaries for business growth analysis.

Multi-Project Freelancer Ledger Excel Template

The

Multi-Project Freelancer Ledger Excel Template is a comprehensive tool designed to help freelancers efficiently track income, expenses, and project timelines across multiple clients. This template streamlines financial management by organizing payments and budget details in a single, easy-to-use spreadsheet format, enabling better cash flow monitoring and tax preparation. By consolidating project data, it enhances productivity and ensures accurate record-keeping for diverse freelance assignments.

How can freelancers automate invoice tracking in a ledger Excel template?

Freelancers can automate invoice tracking by using Excel features such as conditional formatting to highlight overdue invoices. They can also employ data validation and drop-down lists to streamline invoice status updates. Additionally, linking invoices with payment dates through formulas ensures real-time tracking and accuracy.

What custom formulas are best for calculating taxable income in a freelancer's ledger?

Custom formulas combining SUMIF and IF statements help calculate taxable income by filtering income and deductible expenses. Using Excel's SUMPRODUCT can efficiently sum income over specific conditions like client or project type. Incorporating tax rate multipliers into formulas ensures precise calculation of tax liabilities within the ledger.

Which Excel functions help track overdue client payments in freelance workbooks?

Excel functions like TODAY() paired with IF statements are essential for identifying overdue payments in freelance workbooks. Conditional formatting can visually flag payments past their due date for swift action. Leveraging DATEDIF helps calculate the number of days late, enhancing payment follow-up efficiency.

How can freelancers categorize expenses for financial reports using ledger Excel sheets?

Freelancers can categorize expenses by assigning descriptive tags or categories via data validation drop-down menus in their Excel ledger. PivotTables effectively summarize categorized expenses, providing clear insights for financial reports. Using consistent expense categories simplifies tracking and ensures accurate reporting.

What security measures protect client data within a freelancer's Excel ledger?

Protecting client data in Excel involves enabling password encryption to restrict unauthorized access to the ledger file. Utilizing worksheet protection and locked cells prevents accidental data alterations during edits. Additionally, storing the Excel ledger in secure, encrypted cloud services offers an extra layer of data security.

More Ledger Excel Templates