The Cash Flow Forecast Excel Template for Freelancers helps track and predict income and expenses, ensuring financial stability. This template allows freelancers to monitor project payments, manage invoices, and plan for future cash needs effectively. Using this tool improves budgeting accuracy and supports better financial decision-making throughout the year.

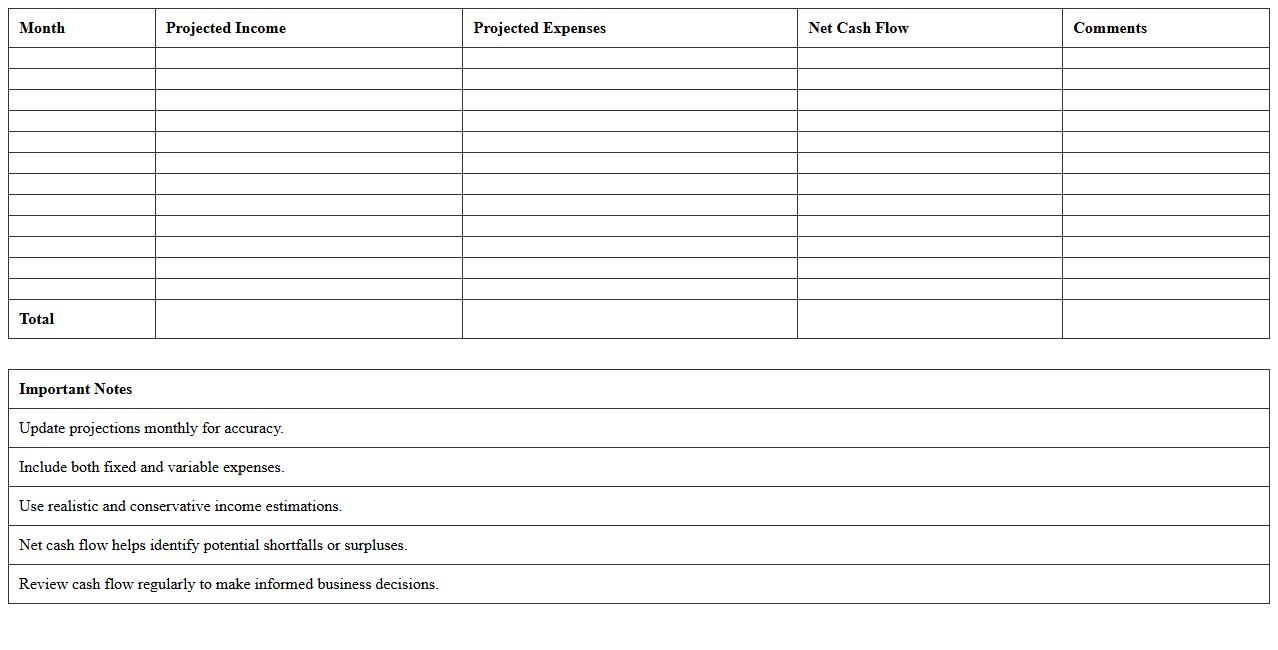

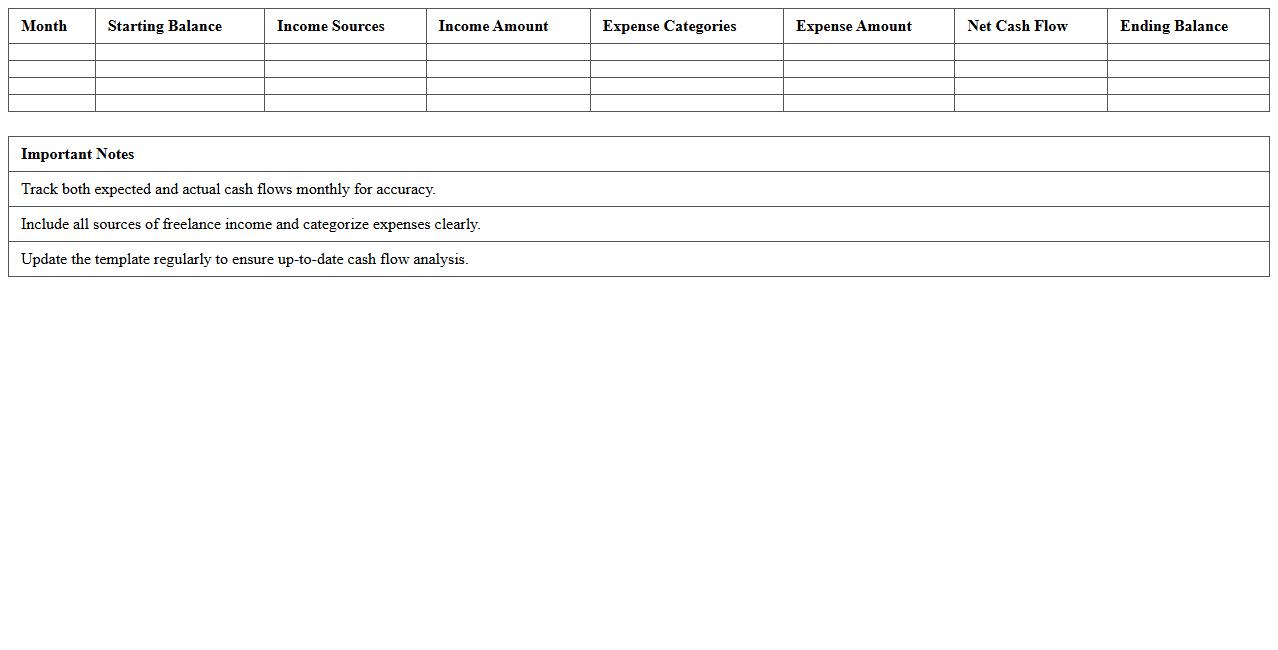

Monthly Cash Flow Projection Template for Freelancers

The

Monthly Cash Flow Projection Template for Freelancers is a financial planning tool designed to help freelancers estimate their monthly income and expenses accurately. It allows tracking of expected payments from clients, recurring costs, and variable expenses to maintain a clear view of cash inflows and outflows. Using this template, freelancers can make informed decisions, avoid cash shortages, and plan for periods of irregular income effectively.

Freelance Income and Expense Tracker Spreadsheet

A

Freelance Income and Expense Tracker Spreadsheet is a digital tool designed to help freelancers systematically record and monitor their earnings and expenditures. It offers a centralized platform to track invoices, payments received, business costs, and tax deductions, ensuring accurate financial management. This organized approach simplifies budgeting, improves cash flow analysis, and facilitates tax preparation, ultimately supporting better financial decisions for freelancers.

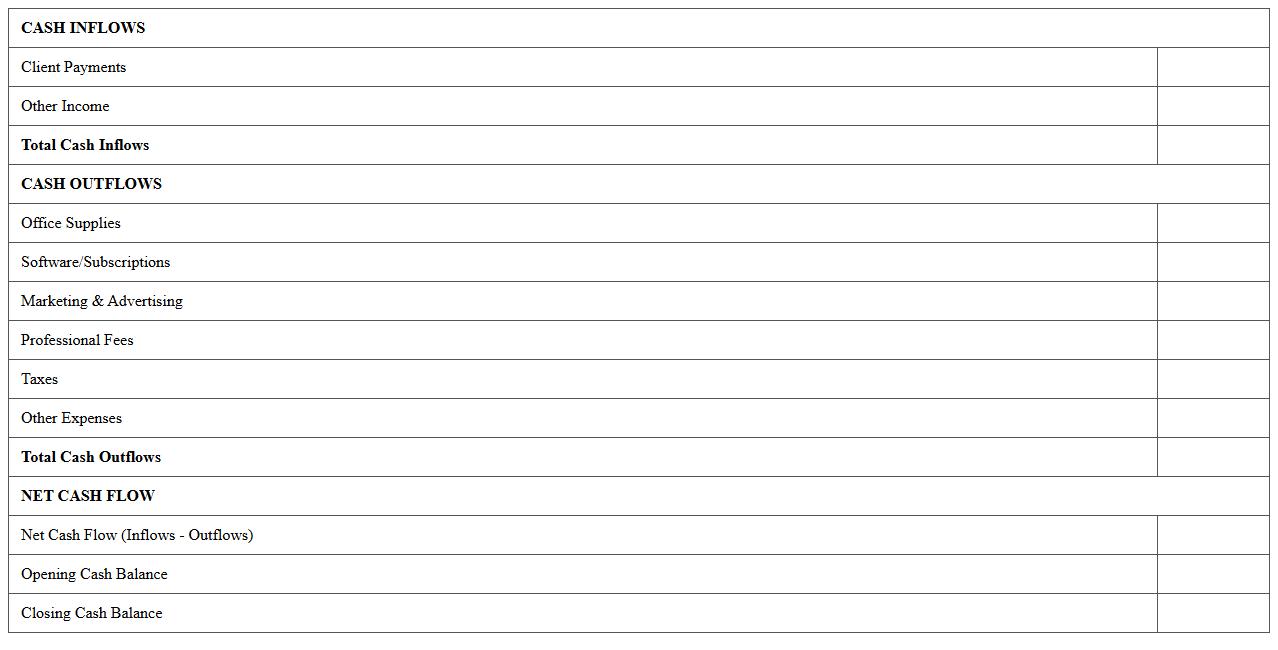

Simple Freelance Cash Flow Statement Template

A

Simple Freelance Cash Flow Statement Template document allows freelancers to systematically track income and expenses over a specific period, providing a clear overview of their financial health. It helps freelancers manage cash inflows and outflows, ensuring timely payments and better budgeting. This organized financial tracking improves decision-making and supports sustainable business growth.

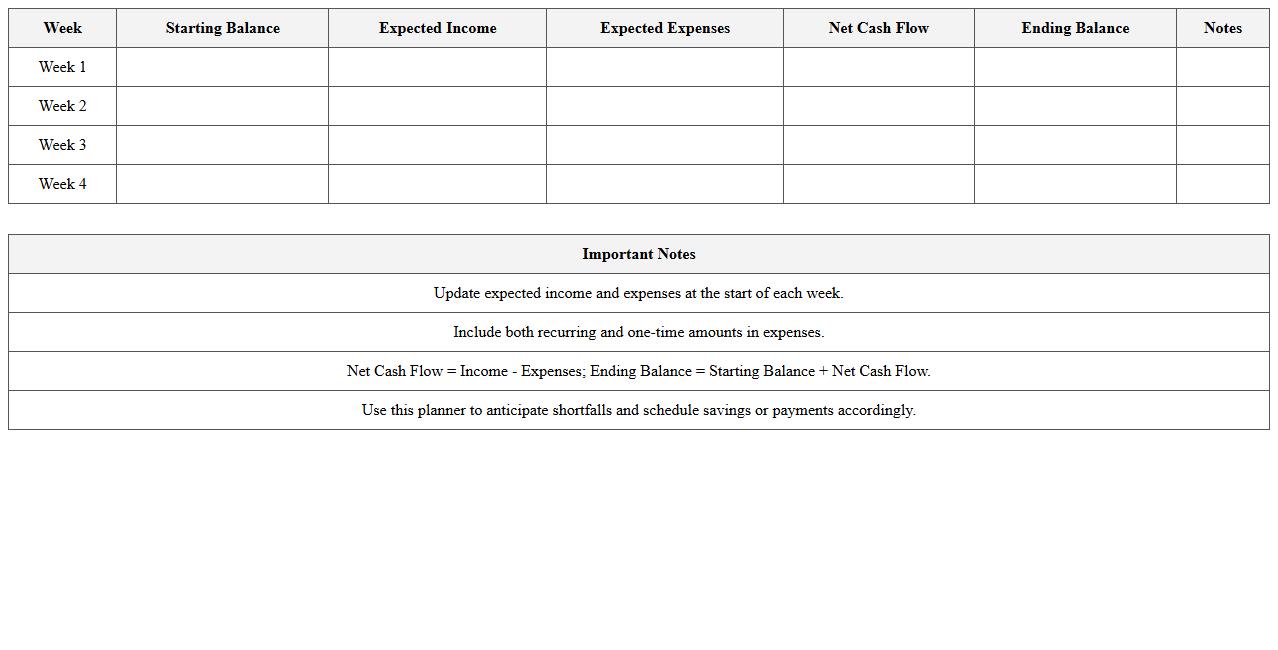

Weekly Cash Flow Planner for Freelancers

The

Weekly Cash Flow Planner for Freelancers is a financial tool designed to help freelancers track income and expenses on a weekly basis, enabling better management of irregular cash flow. It provides clear visibility into upcoming payments, outstanding invoices, and essential expenditures, ensuring timely budgeting and financial stability. This document assists freelancers in avoiding cash shortages and improving financial decision-making by projecting cash inflows and outflows consistently.

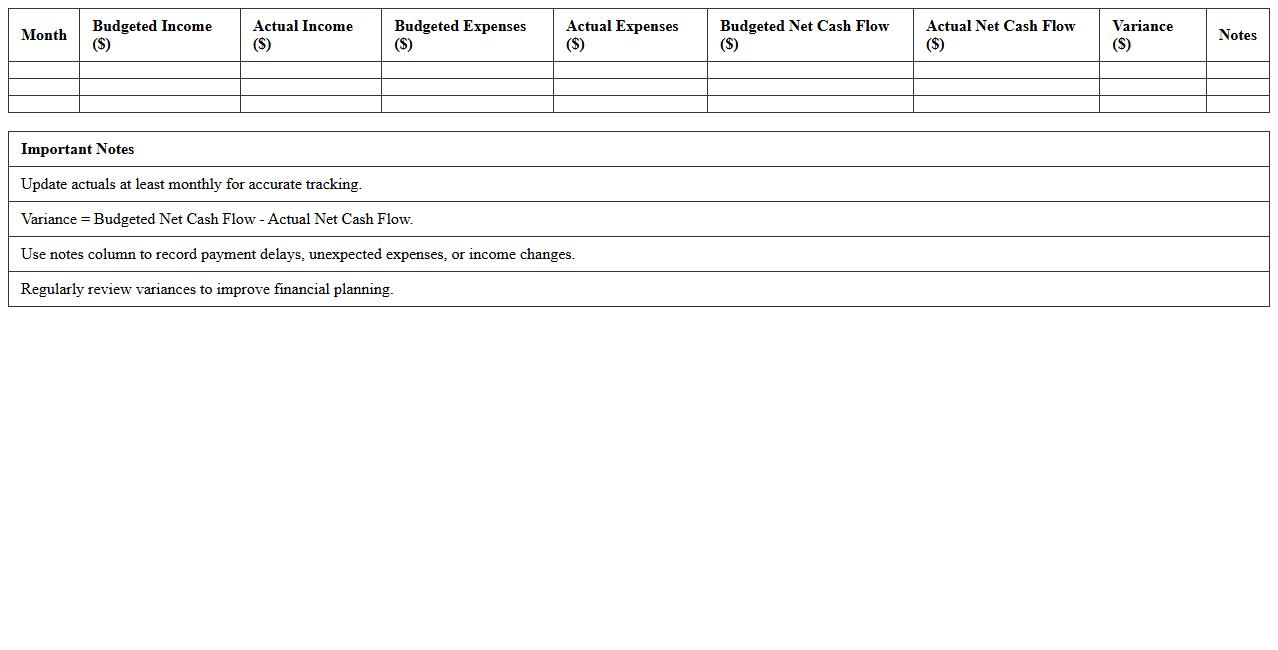

Freelancer Budget vs. Actual Cash Flow Template

A

Freelancer Budget vs. Actual Cash Flow Template document helps track and compare projected earnings against actual income and expenses over a specific period. It assists freelancers in managing finances by highlighting discrepancies, enabling better budgeting and cash flow control. Using this template supports informed decision-making and ensures financial stability throughout freelance projects.

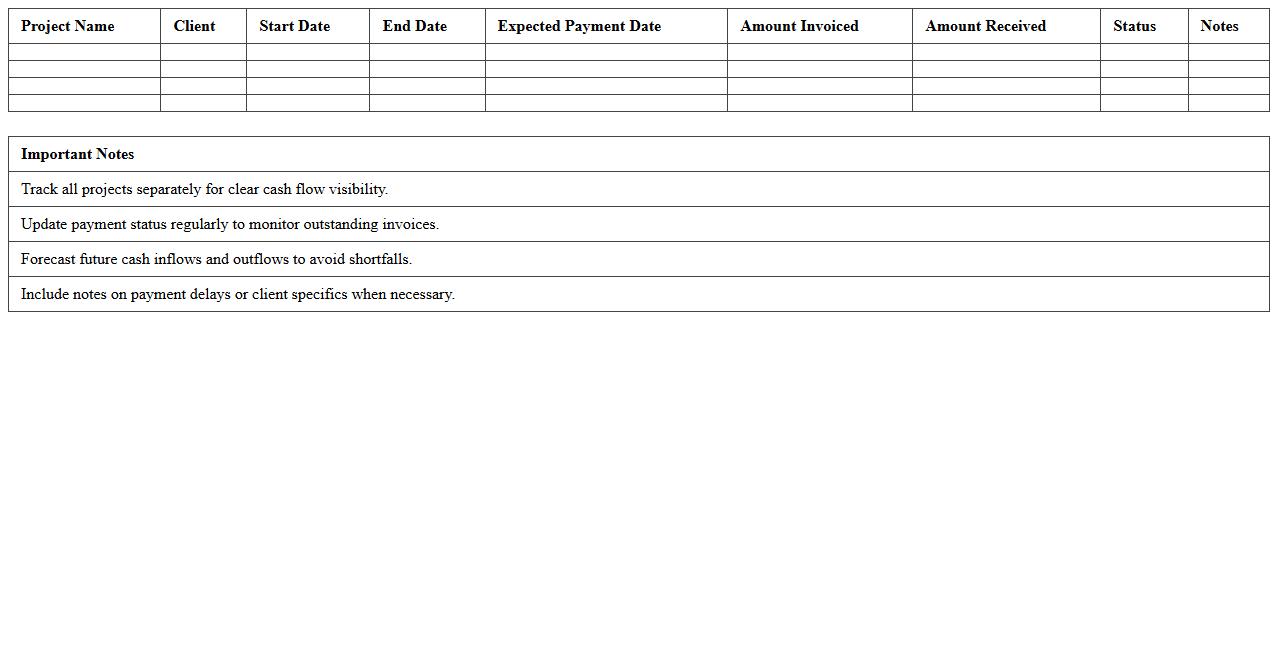

Project-Based Cash Flow Forecast for Freelancers

A

Project-Based Cash Flow Forecast for freelancers is a financial planning document that estimates income and expenses linked to specific projects over a set period. It helps freelancers manage their finances by predicting payment schedules, identifying potential cash shortfalls, and optimizing project timelines for steady cash flow. Using this forecast improves budgeting accuracy, ensures timely bill payments, and supports strategic decision-making to maintain financial stability throughout project cycles.

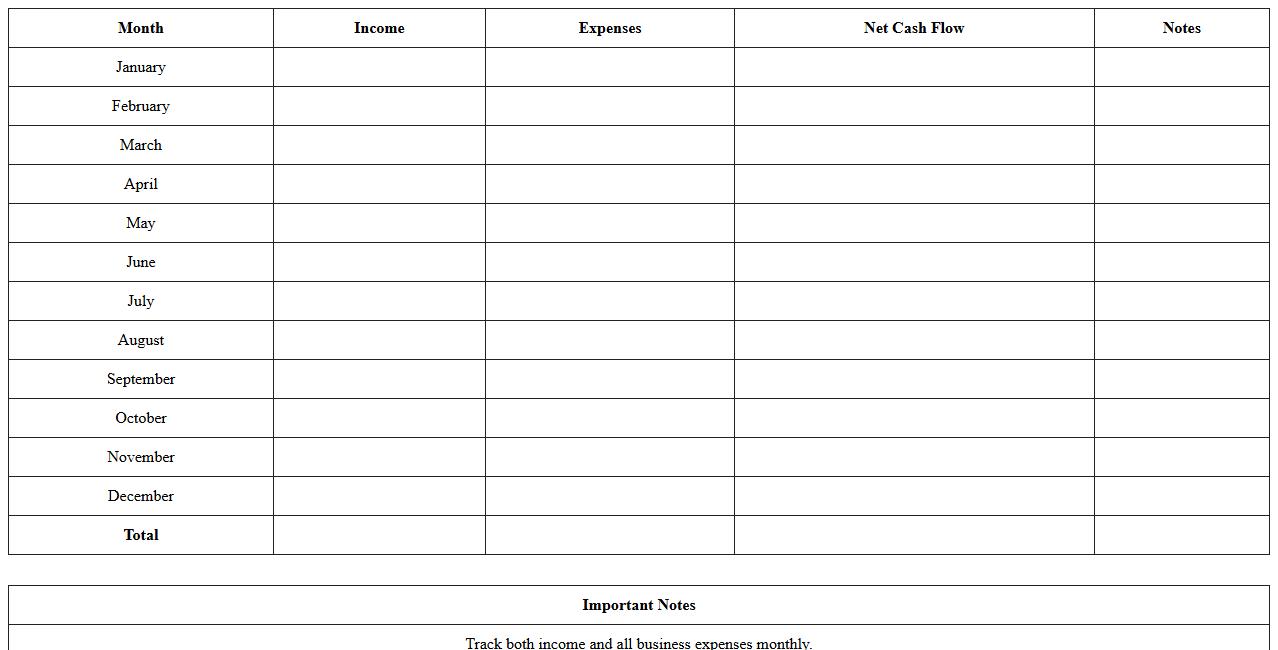

Annual Freelance Cash Flow Spreadsheet Template

The

Annual Freelance Cash Flow Spreadsheet Template is a financial tool designed to help freelancers track and manage their income and expenses over the course of a year. This document enables users to forecast cash inflows and outflows, providing a clear overview of financial health and aiding in budgeting and tax preparation. By organizing payment schedules and expense categories systematically, freelancers can maintain steady cash flow and make informed decisions for business growth.

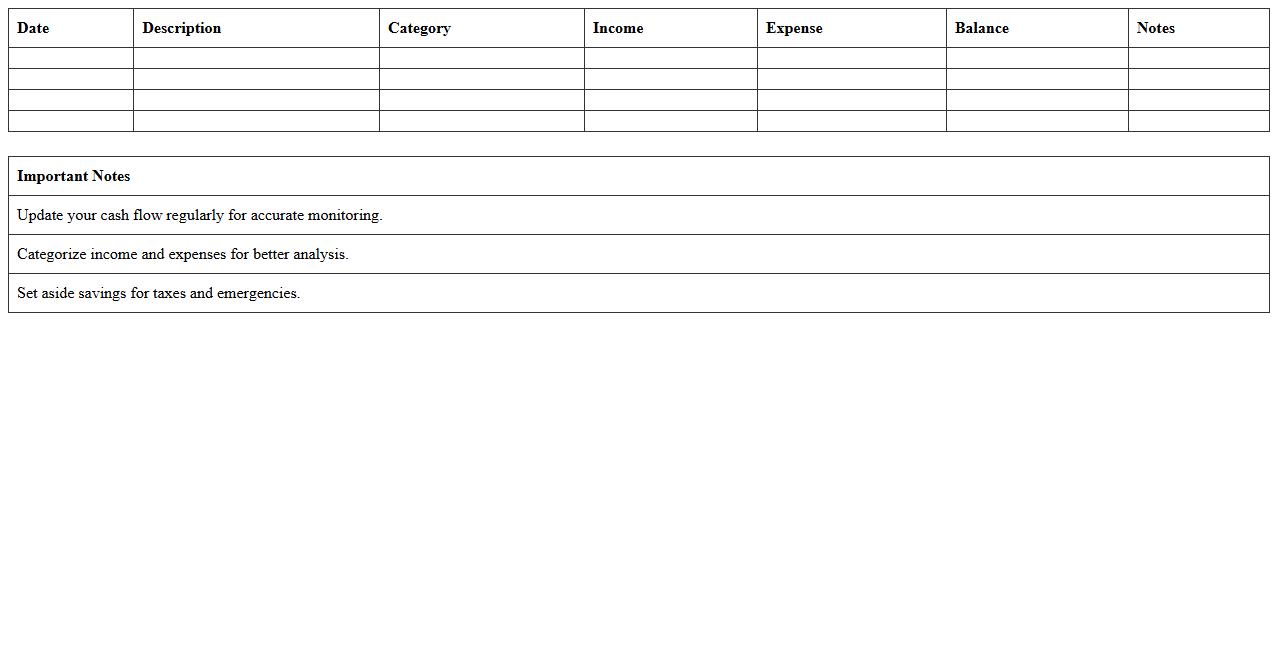

Freelance Invoice and Payment Tracking Excel Sheet

A

Freelance Invoice and Payment Tracking Excel Sheet is a digital tool designed to organize and monitor client billing and received payments efficiently. This document helps freelancers maintain accurate financial records by tracking invoice status, payment dates, and outstanding balances, ensuring timely cash flow management. It simplifies financial oversight, reduces errors, and enhances professionalism in freelance business operations.

Freelance Business Cash Flow Monitoring Template

A

Freelance Business Cash Flow Monitoring Template is a structured document designed to track income, expenses, and net cash flow for independent professionals. This template helps freelancers maintain financial stability by providing clear visibility into their earnings and outgoing costs, ensuring timely payments and budget management. Utilizing such a tool enhances decision-making and supports long-term business sustainability.

Personal Freelance Cash Flow Analysis Template

A

Personal Freelance Cash Flow Analysis Template document is a tool designed to track and manage income and expenses for freelancers, providing a clear overview of cash inflows and outflows over time. It helps in budgeting effectively, identifying financial trends, and ensuring sufficient funds are available for future obligations. Using this template improves financial planning, reduces unexpected shortfalls, and supports sustainable freelance business growth.

How can a freelancer automate recurring income entries in a Cash Flow Forecast Excel template?

Freelancers can use the Excel formula OFFSET combined with COUNTA to dynamically reference recurring income entries. Creating a template with fixed intervals such as monthly or weekly allows for easier automation. Alternatively, leveraging Excel tables with structured references helps update recurring income rows automatically when adding new data.

What are the best Excel formulas for tracking overdue client payments in a cash flow forecast?

SUMIF and IF formulas are essential for identifying and summing overdue client payments based on due dates. Using the formula =IF(TODAY()>DueDate, "Overdue", "Paid") helps label payments by status. Combining the logic with conditional formatting visually highlights late payments to improve tracking efficiency.

How to factor in seasonal fluctuations specific to freelance work in Excel cash flow projections?

Introducing a seasonality multiplier in the cash flow model accounts for income variability by month or quarter. Using historical data with the AVERAGEIFS formula helps quantify seasonal trends effectively. Graphical analysis of past income can refine projections and accommodate fluctuations unique to freelance work.

Which Excel chart type most effectively visualizes fluctuating freelance income streams?

Line charts

How do freelancers categorize irregular business expenses within a cash flow forecasting spreadsheet?

Freelancers often use a dedicated expense category column for irregular costs, separating fixed and variable expenses clearly. Applying data validation dropdown lists ensures consistent categorization for irregular items. Grouping irregular expenses in pivot tables or summary sheets improves analysis and expense management.

More Forecast Excel Templates