The Portfolio Growth Forecast Excel Template for Investment Advisors offers a user-friendly tool to project investment returns and analyze portfolio performance over time. It automates complex calculations, helping advisors present clear growth scenarios to clients. This template enhances decision-making by integrating customizable variables such as asset allocation, risk factors, and market conditions.

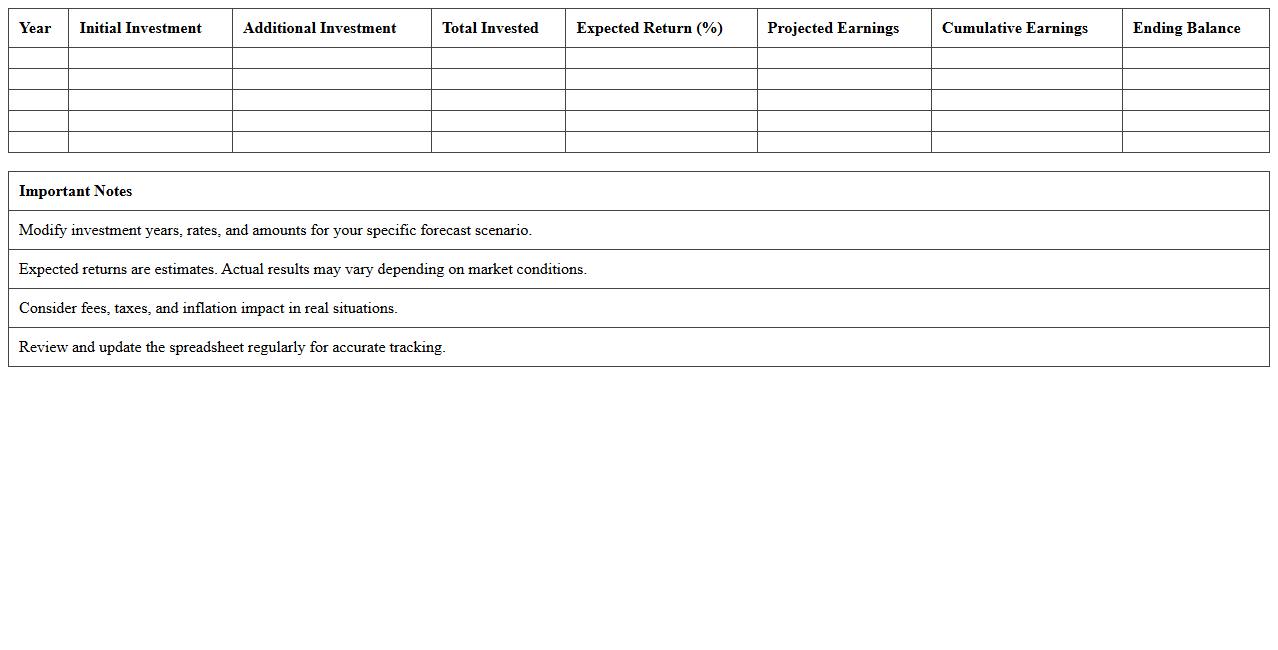

Annual Portfolio Growth Projection Tracker

The

Annual Portfolio Growth Projection Tracker document monitors expected increases in investment value over a 12-month period, providing clear insights into performance trends and future opportunities. It helps investors and portfolio managers make informed decisions by identifying growth patterns, managing risks, and optimizing asset allocation. This tool enhances strategic planning and supports achieving financial goals through data-driven projections.

Investment Forecast Analysis Spreadsheet

An

Investment Forecast Analysis Spreadsheet is a dynamic financial tool designed to project the future performance of investments by analyzing historical data, market trends, and key financial indicators. It helps investors make informed decisions by visualizing potential returns, risks, and cash flow scenarios over time. This spreadsheet enhances strategic planning by enabling precise budgeting, portfolio optimization, and scenario analysis to maximize investment outcomes.

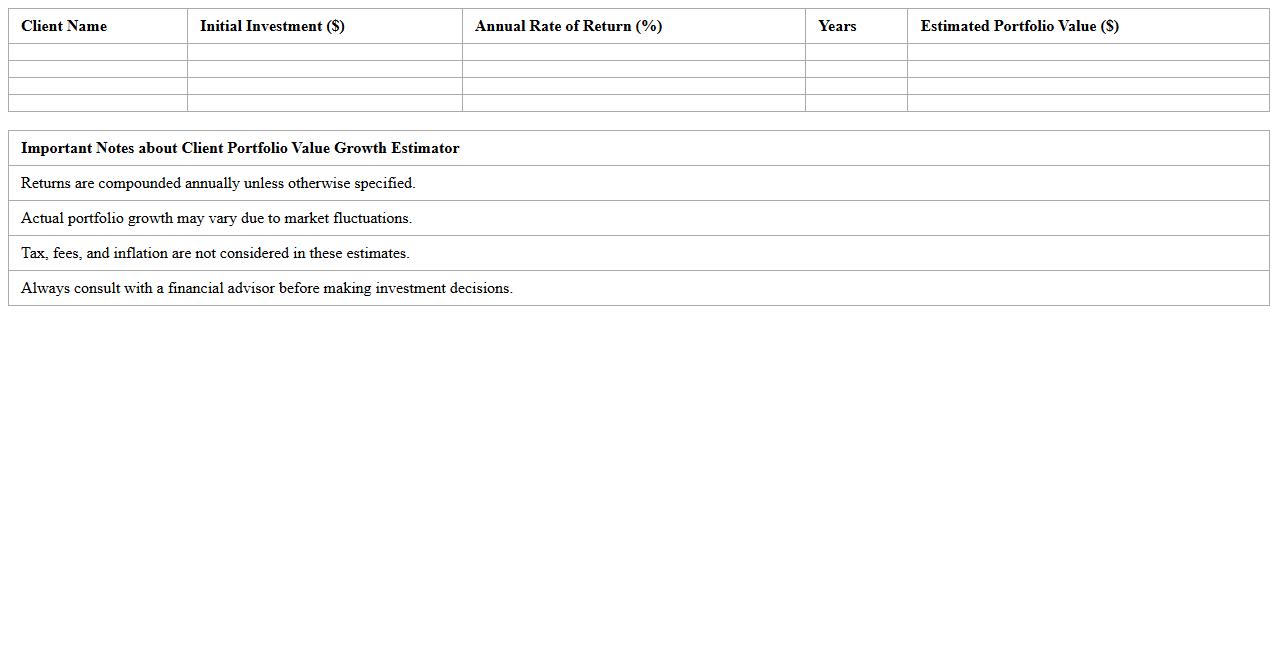

Client Portfolio Value Growth Estimator

The

Client Portfolio Value Growth Estimator document provides a detailed analysis of projected increases in the value of client investment portfolios based on various market scenarios and asset allocations. It helps financial advisors and portfolio managers to make informed decisions by forecasting potential growth, identifying risks, and optimizing investment strategies. This document is essential for strategic planning and enhancing client satisfaction through transparent performance expectations.

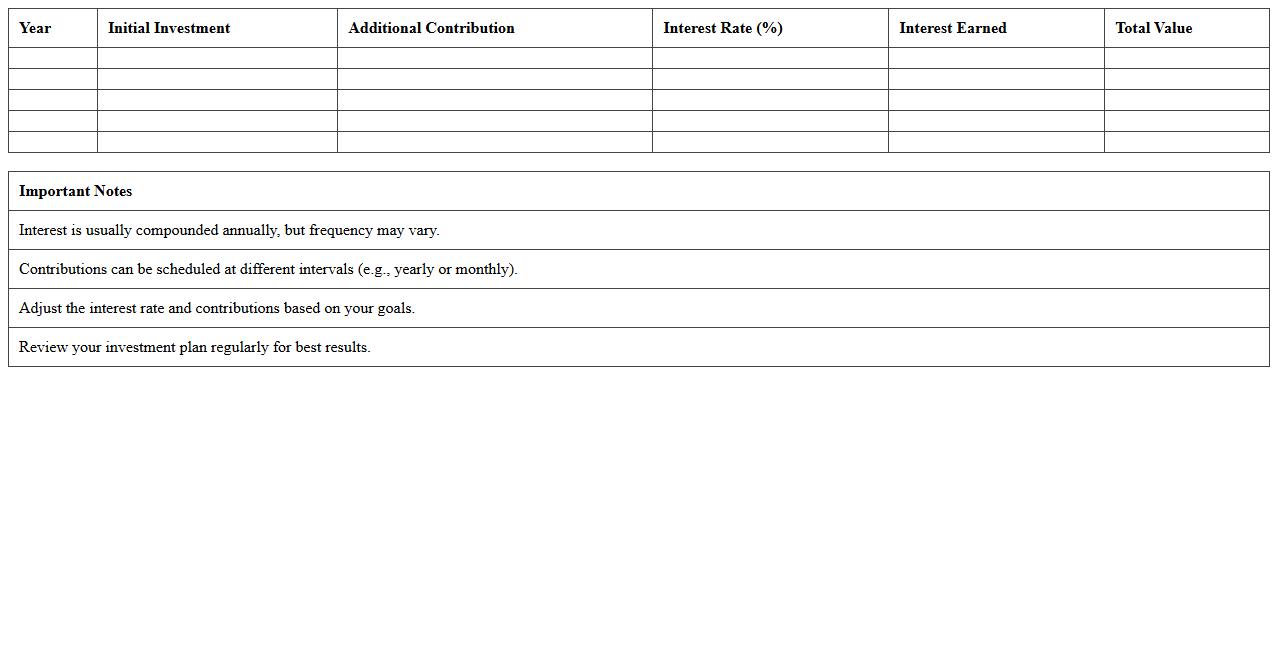

Multi-Year Investment Growth Planner

A

Multi-Year Investment Growth Planner is a strategic document that outlines projected investment returns and financial goals over several years, helping individuals and businesses track and optimize their investment performance over time. It provides a clear roadmap for allocating resources, assessing risk, and adjusting portfolios to achieve sustainable growth. By using this planner, investors can make informed decisions, measure progress against benchmarks, and plan for long-term financial stability effectively.

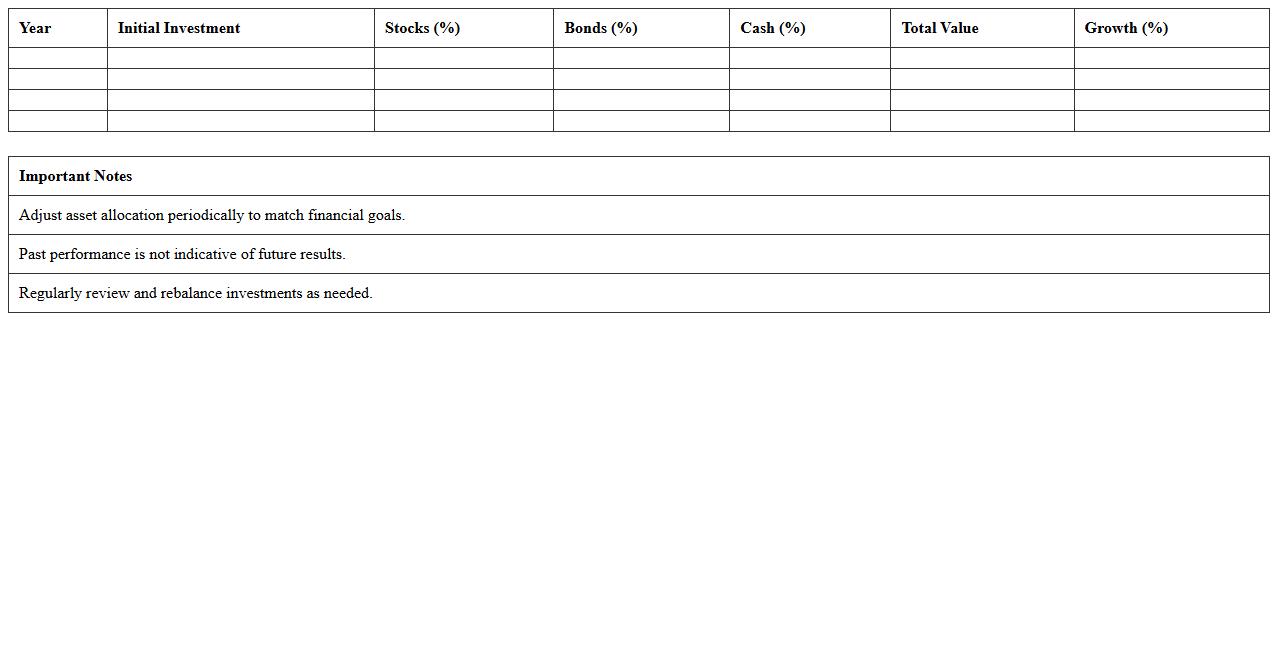

Asset Allocation Growth Chart Template

An

Asset Allocation Growth Chart Template is a strategic tool used to visualize the distribution and performance of various investment assets over time, helping investors balance risk and reward effectively. This template enables users to track the growth of different portfolio segments such as stocks, bonds, and cash, providing clear insights into diversification and portfolio adjustments. By utilizing this document, investors can make informed decisions, optimize their investment strategies, and monitor progress toward financial goals systematically.

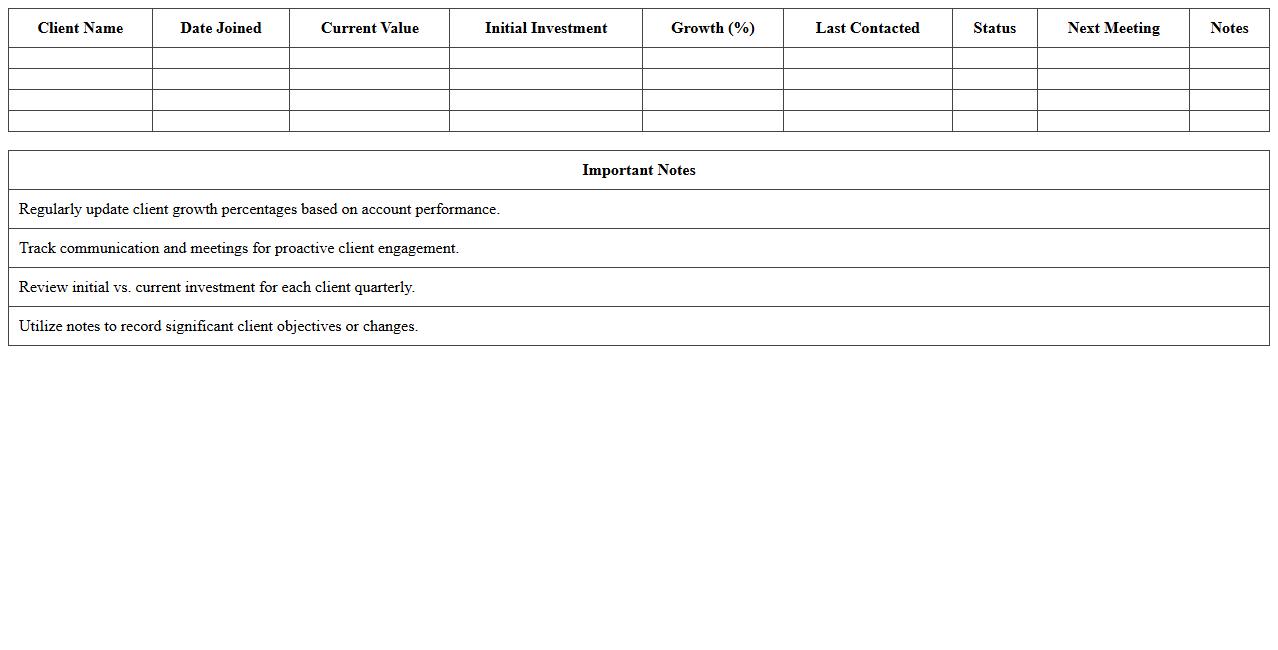

Financial Advisor Client Growth Dashboard

The

Financial Advisor Client Growth Dashboard document provides a comprehensive overview of client acquisition, retention, and portfolio performance metrics, enabling advisors to monitor and analyze growth trends effectively. This tool helps identify high-value clients, track engagement levels, and optimize marketing strategies to enhance client relationships. By leveraging data-driven insights, financial advisors can make informed decisions that drive sustainable business expansion and improve client satisfaction.

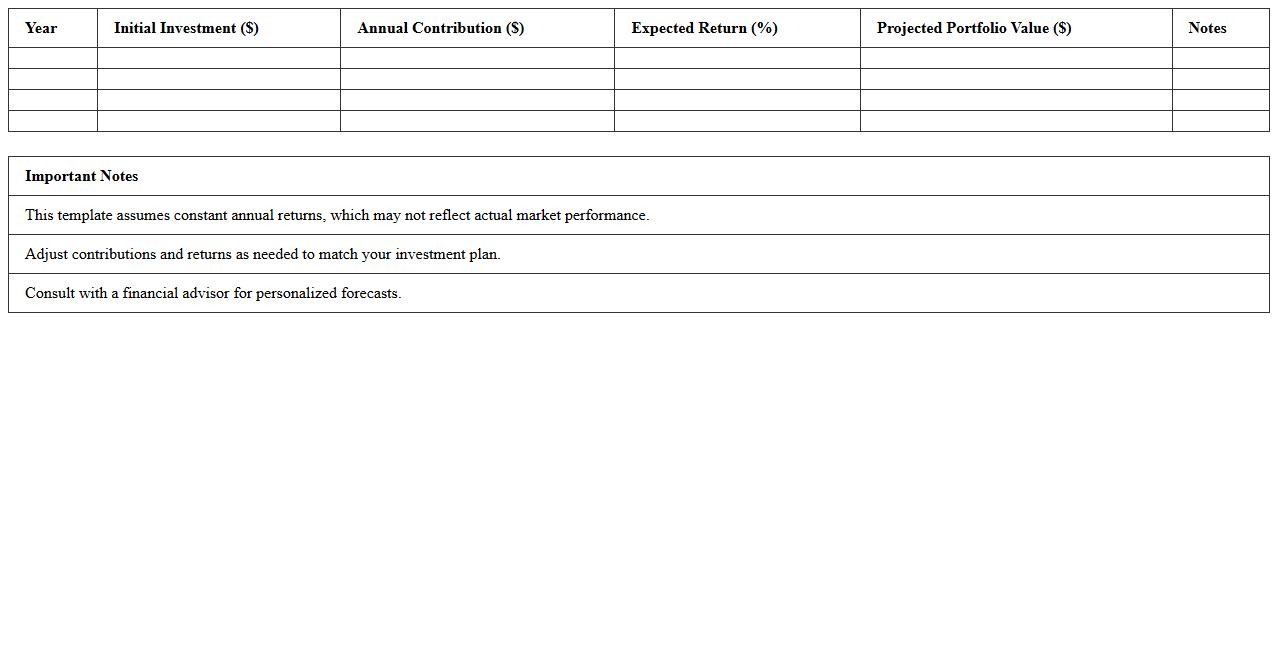

Long-Term Portfolio Performance Forecaster

The

Long-Term Portfolio Performance Forecaster document provides a comprehensive analysis of expected investment returns and risk metrics over extended periods. It helps investors make informed decisions by projecting future portfolio growth based on various economic and market scenarios. Utilizing this tool enhances strategic planning and risk management for sustained financial success.

Year-over-Year Returns Tracking Workbook

The

Year-over-Year Returns Tracking Workbook is a comprehensive financial tool designed to analyze and compare investment performance across multiple years. It enables investors and analysts to identify trends, assess growth consistency, and make informed decisions based on historical return data. By visualizing annual returns side-by-side, the workbook enhances portfolio management and strategic financial planning.

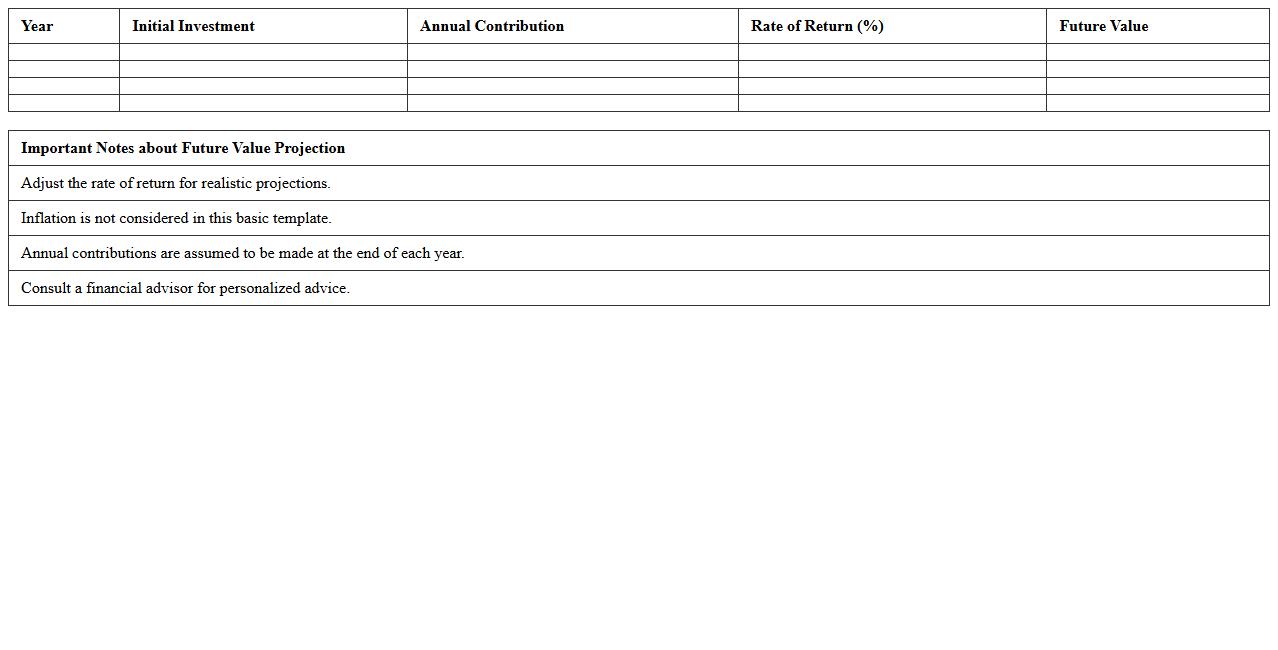

Future Value Projection Excel Sheet

A

Future Value Projection Excel Sheet is a financial tool designed to estimate the growth of investments or savings over time using compound interest formulas. It helps users visualize potential returns based on variables such as initial investment, interest rate, and time period, enabling informed decision-making for personal finance or business planning. By providing a clear projection, this document aids in setting realistic financial goals and optimizing investment strategies.

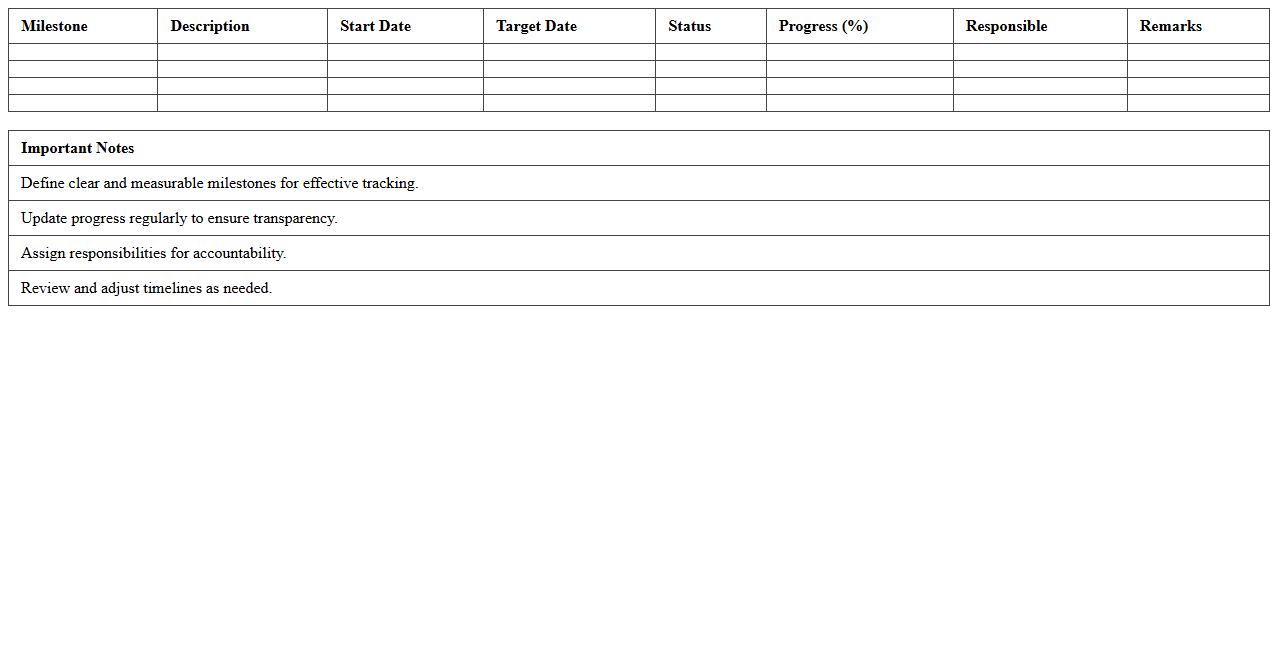

Investment Milestone Progress Planner

The

Investment Milestone Progress Planner document tracks key financial objectives and timelines within an investment project, ensuring systematic monitoring and evaluation. It helps investors and project managers align on deliverables, assess progress against set benchmarks, and make informed decisions to optimize resource allocation. Utilizing this planner enhances transparency, accountability, and strategic planning throughout the investment lifecycle.

How can I customize asset class assumptions in a Portfolio Growth Forecast Excel sheet?

To customize asset class assumptions, start by defining expected returns, volatilities, and correlations for each asset class in your Excel sheet. Use data validation or dropdown menus to make inputs dynamic and easy to adjust. This approach allows you to reflect changing market conditions or investment strategies precisely within your forecast model.

What formulas best project compounding returns for client portfolios?

The compound annual growth rate (CAGR) formula is essential for projecting compounding returns in Excel: =((Ending Value / Beginning Value)^(1 / Number of Years)) - 1. Additionally, using the FV function (Future Value) helps model the portfolio growth over multiple periods =FV(rate, nper, pmt, pv). These formulas accurately capture the exponential nature of portfolio growth over time.

How do I integrate risk-adjusted return calculations into portfolio forecasts?

Incorporate risk-adjusted return measures like the Sharpe ratio by calculating portfolio returns minus the risk-free rate divided by portfolio standard deviation. Use Excel's STDEV.P function to compute volatility and subtract the risk-free rate with a simple arithmetic formula. This integration gives you a more realistic projection considering both returns and the associated risks.

Which Excel charts most effectively visualize multi-year portfolio growth?

Line charts are ideal for visualizing multi-year portfolio growth as they clearly display trends over time. Complement them with area charts to emphasize cumulative growth or stacked bar charts to show asset allocation changes. These chart types enhance understanding of both performance trajectories and portfolio composition.

How do I automate scenario analysis in an investment portfolio forecast spreadsheet?

Automate scenario analysis by creating separate input tables for different market conditions and linking these to your portfolio forecast formulas. Use Excel's Data Tables feature or the Scenario Manager to dynamically switch between scenarios. This method enables quick comparison of portfolio outcomes under various assumptions without manual recalculations.

More Forecast Excel Templates