The Loan Repayment Dashboard Excel Template for Financial Consultants offers a comprehensive tool to track, analyze, and visualize loan repayment schedules efficiently. It features customizable charts and detailed payment summaries, enabling financial consultants to provide clear insights and optimize client loan strategies. This Excel template enhances decision-making by presenting data in a user-friendly and interactive format.

Loan Portfolio Payment Tracking Template

A

Loan Portfolio Payment Tracking Template is a structured document designed to monitor and manage multiple loan repayments efficiently. It helps track payment dates, amounts, outstanding balances, and borrower details, ensuring timely payments and minimizing defaults. Utilizing this template enhances financial organization and facilitates better decision-making for lenders and financial managers.

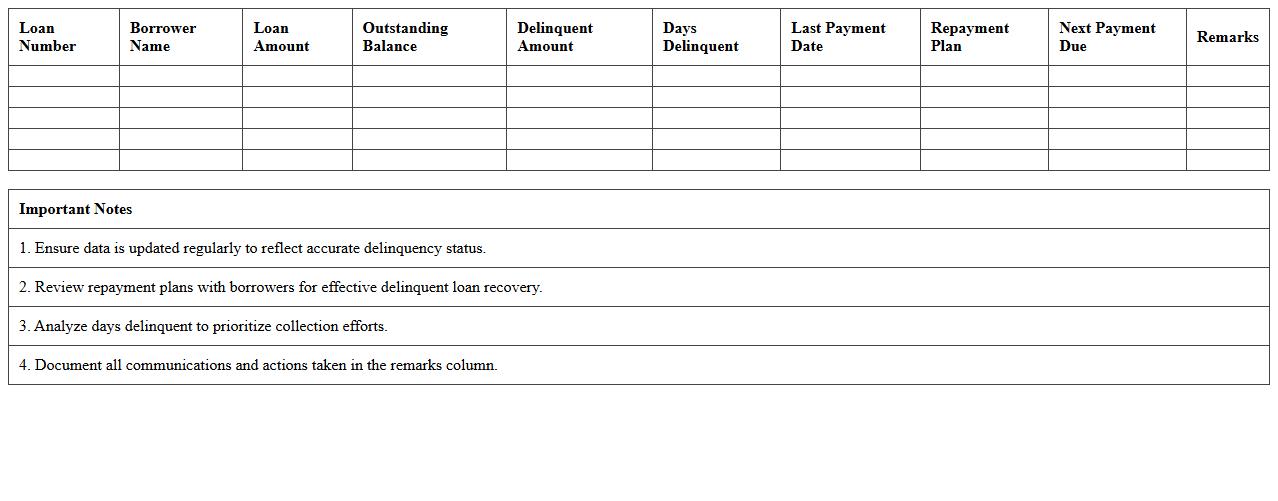

Delinquent Loan Repayment Analysis Sheet

The

Delinquent Loan Repayment Analysis Sheet is a financial document that tracks overdue loan payments and categorizes borrowers based on the severity and duration of their delinquency. It provides detailed insights into repayment patterns, helping lenders identify high-risk accounts and prioritize collection efforts effectively. This analysis sheet aids in assessing credit risk, improving cash flow management, and supporting strategic decision-making to minimize loan defaults.

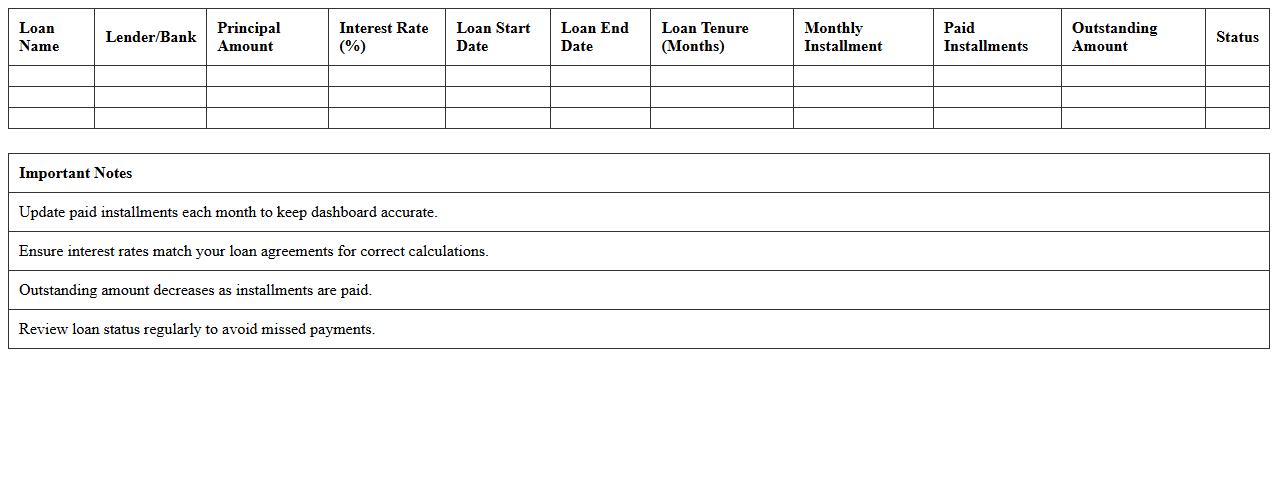

Monthly Loan Installment Dashboard

The

Monthly Loan Installment Dashboard document provides a comprehensive overview of loan repayment schedules, tracking each installment's due date, amount, and payment status. It helps users monitor outstanding balances, avoid late payments, and manage cash flow efficiently by visualizing payment patterns over time. This dashboard is essential for both borrowers and financial institutions to ensure timely loan servicing and effective financial planning.

Borrower Payment Performance Tracker

The

Borrower Payment Performance Tracker document records the history of payments made by borrowers, tracking timely, late, and missed payments to evaluate credit behavior. It is useful for lenders and financial institutions to assess risk, improve lending decisions, and tailor repayment plans based on accurate borrower performance data. By providing detailed insights into payment trends, this document supports effective portfolio management and reduces potential defaults.

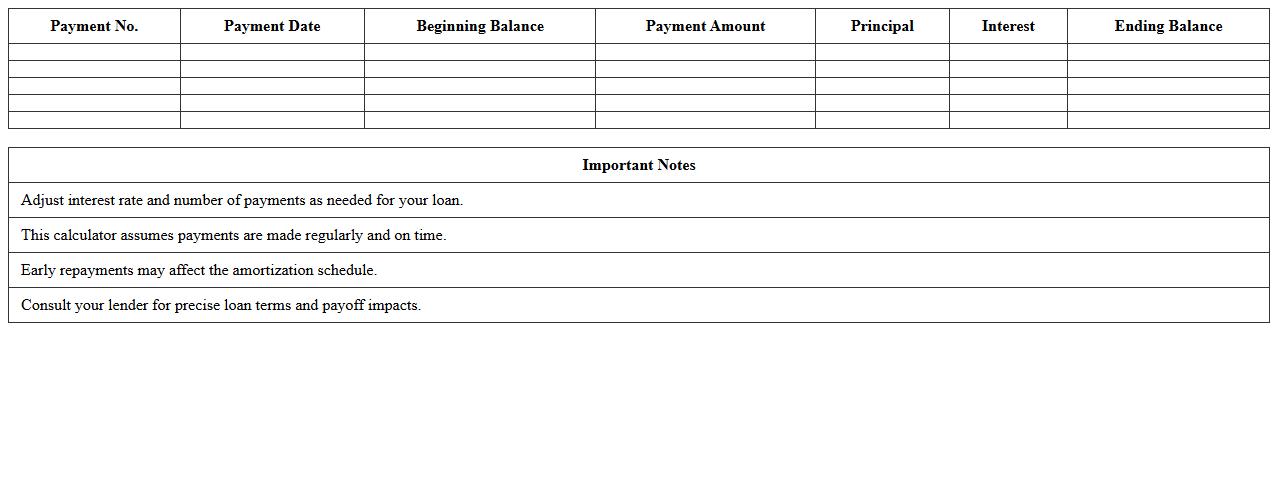

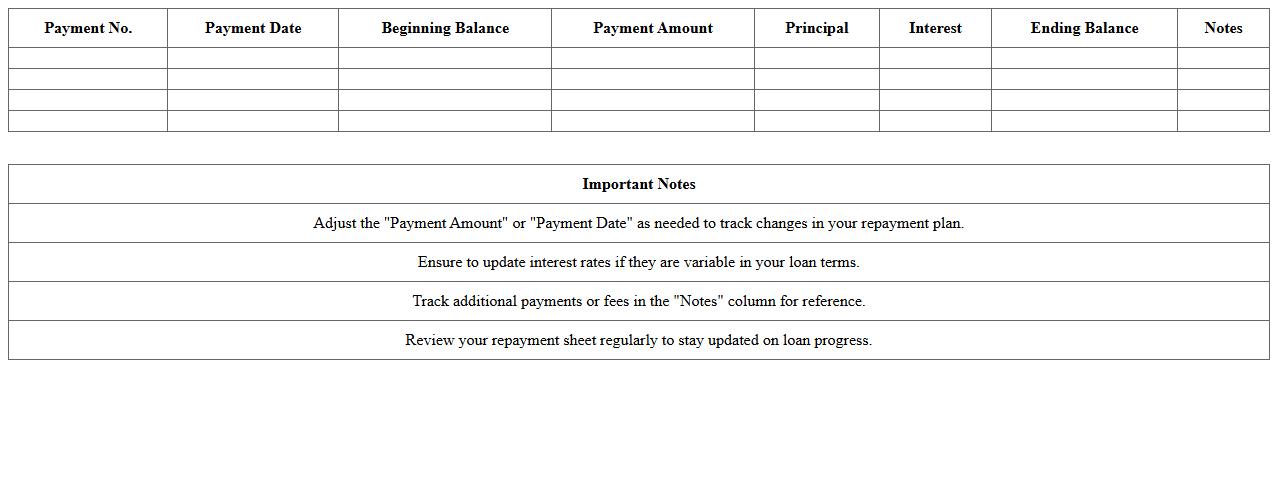

Loan Repayment Schedule Calculator

A

Loan Repayment Schedule Calculator document outlines the detailed timeline and amount of payments required to repay a loan fully, including principal and interest components. It provides borrowers with clear visibility into monthly installment amounts, payment dates, and outstanding loan balance over time. This tool helps users plan finances accurately, manage loan obligations efficiently, and avoid missed payments by offering a transparent repayment roadmap.

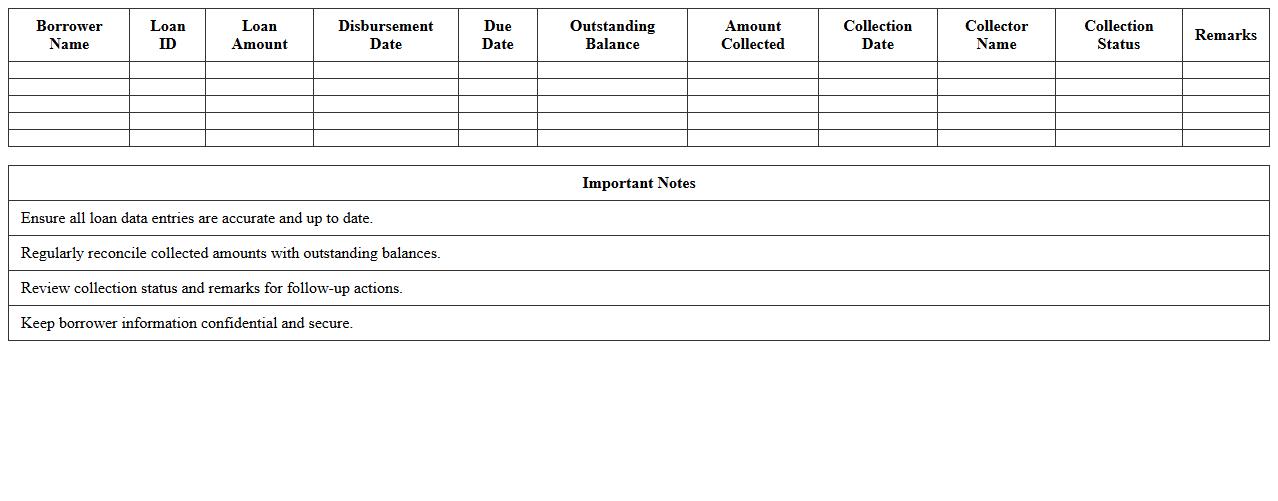

Loan Collection Analytics Spreadsheet

A

Loan Collection Analytics Spreadsheet document is a structured tool designed to track, analyze, and optimize loan recovery processes by organizing borrower data, payment statuses, and collection efforts. It helps financial institutions improve cash flow management, identify delinquent accounts quickly, and forecast recovery rates based on detailed analytics. Utilizing this spreadsheet enhances decision-making efficiency, reduces default risks, and supports targeted collection strategies tailored to specific borrower behavior patterns.

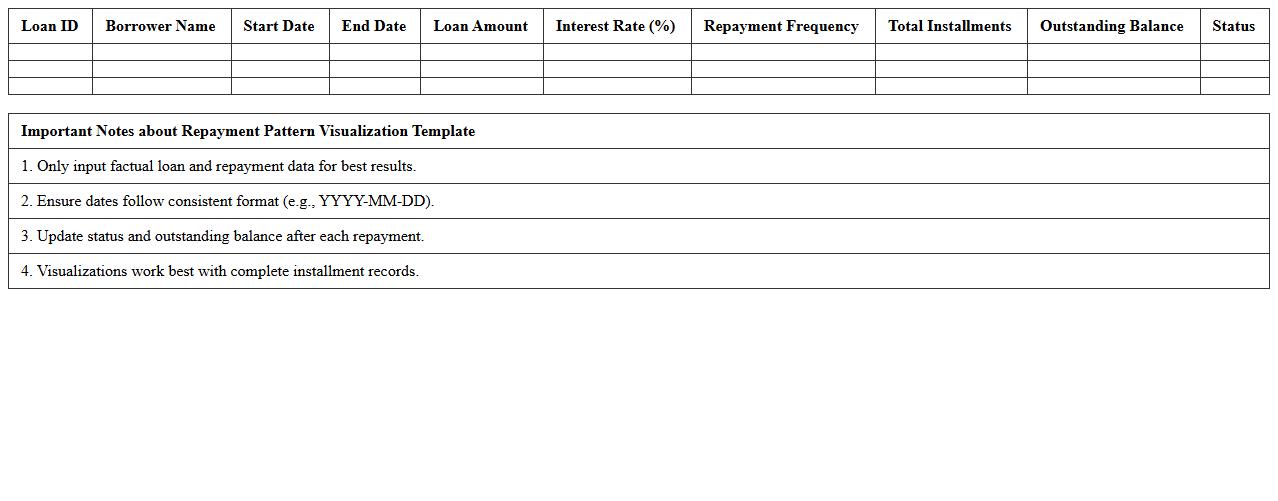

Repayment Pattern Visualization Template

The

Repayment Pattern Visualization Template document provides a structured framework to graphically represent loan repayment schedules, helping users identify trends and irregularities in payment behavior over time. It is especially useful for financial analysts and loan officers to assess borrower reliability, forecast cash flows, and make data-driven decisions. By visualizing repayment patterns, organizations can improve risk management and optimize collection strategies effectively.

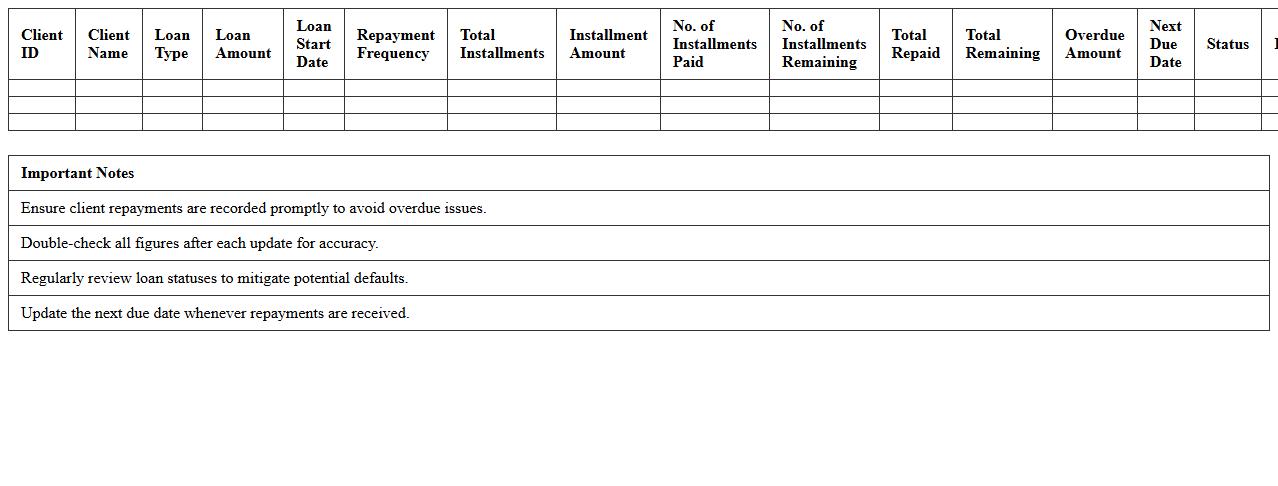

Multi-Client Loan Repayment Monitor

The

Multi-Client Loan Repayment Monitor document tracks and consolidates loan repayment data from multiple clients, providing a clear overview of their payment statuses and outstanding balances. It helps organizations manage risk by identifying delayed or missed payments early and streamlines financial reporting for improved decision-making. This tool enhances cash flow management and supports proactive client engagement strategies.

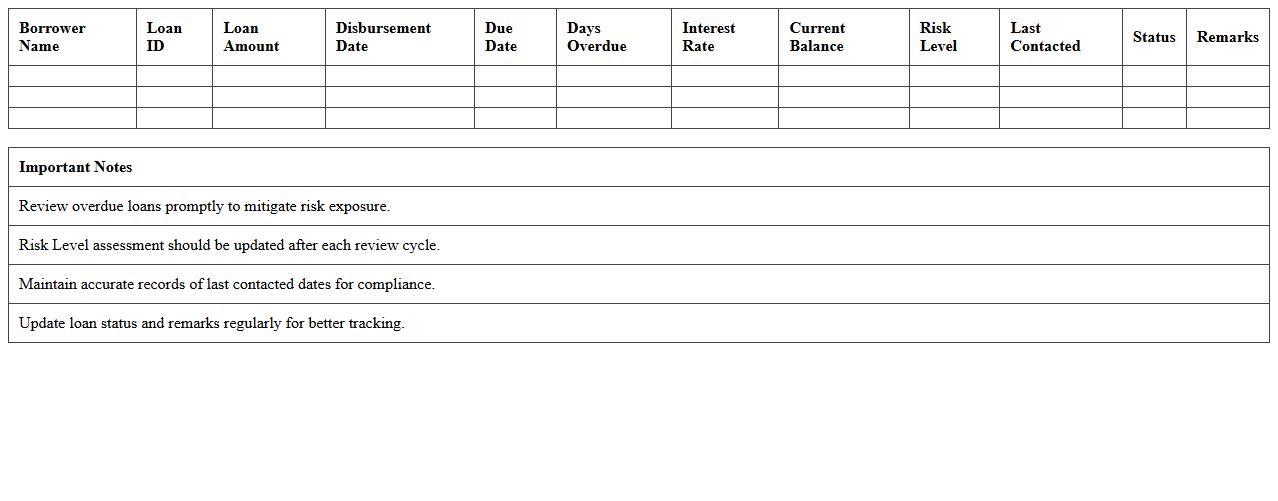

Overdue Loan Risk Assessment Dashboard

The

Overdue Loan Risk Assessment Dashboard document provides a comprehensive overview of loan portfolios by highlighting overdue accounts and identifying potential default risks. It integrates key risk indicators, borrower credit profiles, and payment histories to enable financial institutions to monitor and mitigate loan default probabilities effectively. This tool enhances decision-making by facilitating early intervention strategies and optimizing risk management processes.

Customizable Loan Repayment Progress Sheet

A

Customizable Loan Repayment Progress Sheet is a detailed document that tracks loan payments, outstanding balances, and interest accrued over time, allowing users to personalize the format based on their specific loan terms and repayment schedules. It is useful for monitoring repayment progress, forecasting remaining payments, and ensuring adherence to loan agreements by providing clear visibility into financial commitments. This tool helps borrowers manage finances efficiently, avoid missed payments, and plan for early loan payoff strategies.

How does the dashboard visualize overdue loan repayments by client segment?

The dashboard employs interactive charts to display overdue loan repayments segmented by client groups, allowing quick identification of high-risk segments. Visualization tools like bar graphs and heat maps highlight overdue amounts and frequency per segment. This segmentation aids in targeted collection strategies by displaying trends and anomalies clearly.

What custom KPIs are tracked for loan collection efficiency?

Key custom KPIs include Days Sales Outstanding (DSO), collection rate, and recovery ratio, tailored to measure efficiency in loan collections. These KPIs provide insights into the speed and effectiveness of repayment processes. Monitoring these indicators helps in optimizing resource allocation and improving overall collection performance.

Can the dashboard auto-calculate interest accrual on partial repayments?

Yes, the dashboard features an auto-calculation engine that dynamically updates interest accrual based on partial repayments made by the borrower. This ensures accurate reflection of outstanding balances and accrued interest in real-time. The functionality supports precise financial reporting and enhances decision-making accuracy.

How is client risk tiering integrated into repayment tracking?

Client risk tiers are integrated via color-coded risk indicators aligned with repayment status, enabling quick visual assessment of risk levels. The dashboard combines historical payment behavior with risk scores to prioritize collection efforts effectively. This integration helps focus resources on clients with higher default probabilities.

What filters exist for loan type or repayment status analysis?

The dashboard offers comprehensive filter options including loan type, repayment status, client segment, and loan tenure to customize the displayed data. Users can drill down into specific categories to analyze trends and patterns relevant to their needs. These filters enhance flexibility and precision in loan portfolio management analysis.

More Dashboard Excel Templates