The Financial Health Assessment Excel Template for Small Enterprises is designed to help businesses evaluate their financial stability by organizing income, expenses, assets, and liabilities in a clear, easy-to-use format. It enables small enterprises to monitor cash flow, profitability, and liquidity ratios, providing valuable insights for informed decision-making. This template streamlines financial analysis, saving time while enhancing accuracy in assessing overall financial performance.

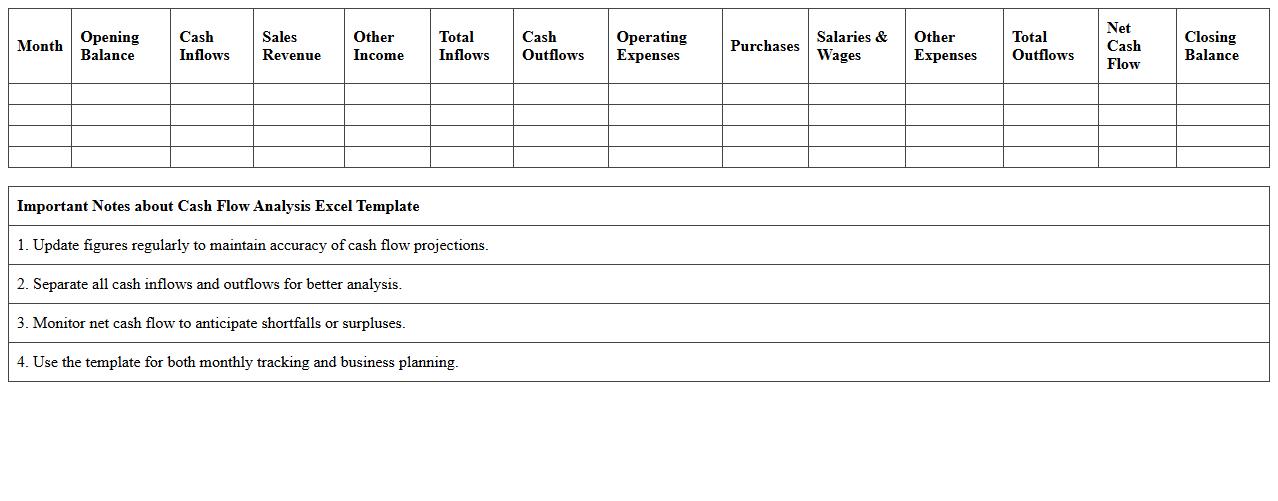

Cash Flow Analysis Excel Template for Small Enterprises

A

Cash Flow Analysis Excel Template for small enterprises is a financial tool designed to track and project cash inflows and outflows, ensuring businesses maintain liquidity and avoid cash shortages. It helps entrepreneurs and financial managers monitor operational, investing, and financing activities by organizing data into clear, customizable spreadsheets that provide real-time insights. By analyzing cash flow patterns, small businesses can make informed decisions about budgeting, expense management, and strategic planning to sustain growth and stability.

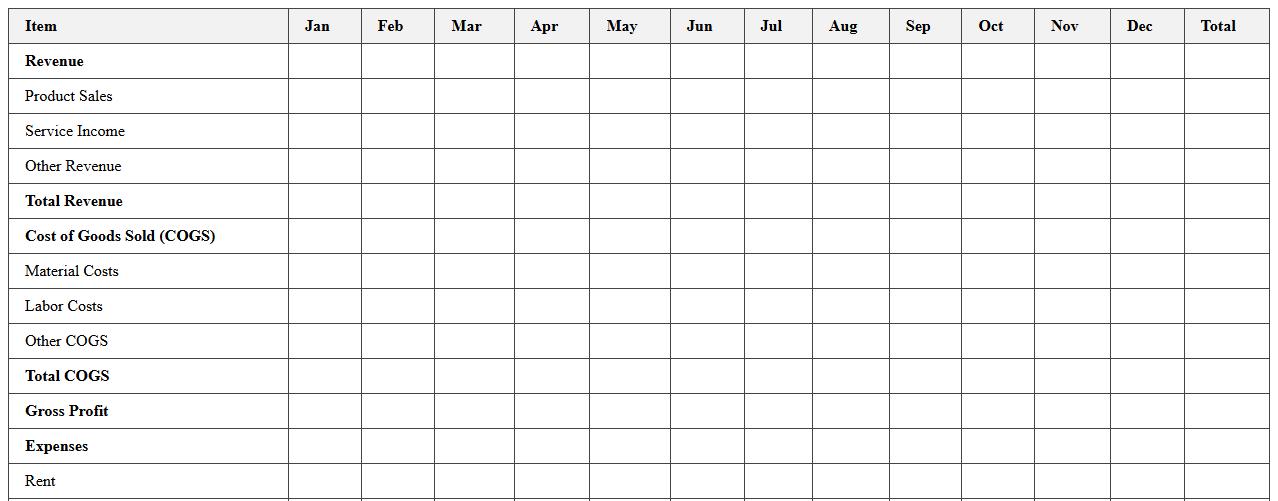

Profit and Loss Statement Excel Template for Small Enterprises

A

Profit and Loss Statement Excel Template for Small Enterprises is a financial tool designed to systematically record and summarize income, expenses, and net profit over a specific period. This document helps small business owners track financial performance, identify cost-saving opportunities, and make informed decisions to enhance profitability. Utilizing this template improves accuracy in financial reporting and facilitates easier tax preparation and financial planning.

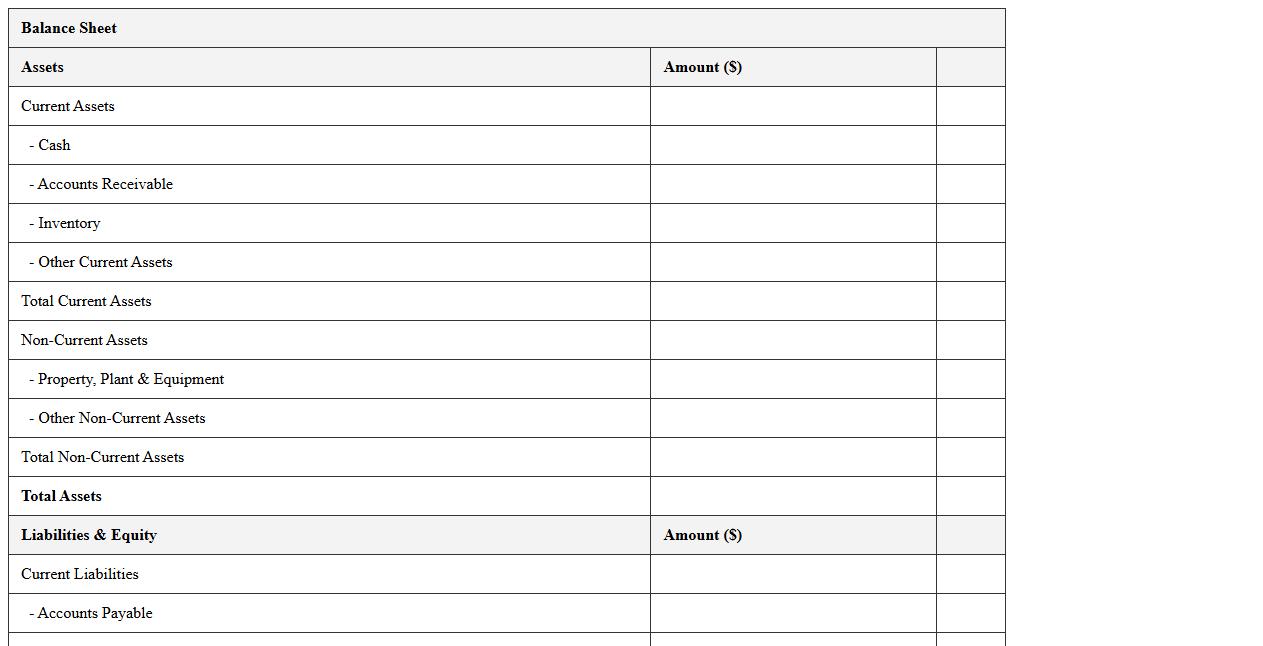

Balance Sheet Excel Template for Small Enterprises

A

Balance Sheet Excel Template for Small Enterprises is a pre-formatted spreadsheet designed to help businesses accurately record and organize their financial position by listing assets, liabilities, and equity. This template streamlines the financial reporting process, enabling small business owners to monitor cash flow, manage debts, and make informed decisions based on clear financial data. Using this tool improves accuracy, saves time, and provides a structured overview essential for budgeting and securing investments.

Expense Tracking Excel Template for Small Enterprises

An

Expense Tracking Excel Template for Small Enterprises is a tailored spreadsheet designed to systematically record and analyze daily business expenditures, facilitating accurate financial management. It enables small business owners to monitor cash flow, identify spending patterns, and ensure budget adherence with customizable categories and automated calculations. This tool improves decision-making efficiency by providing clear insights into operational costs and enhancing expense accountability.

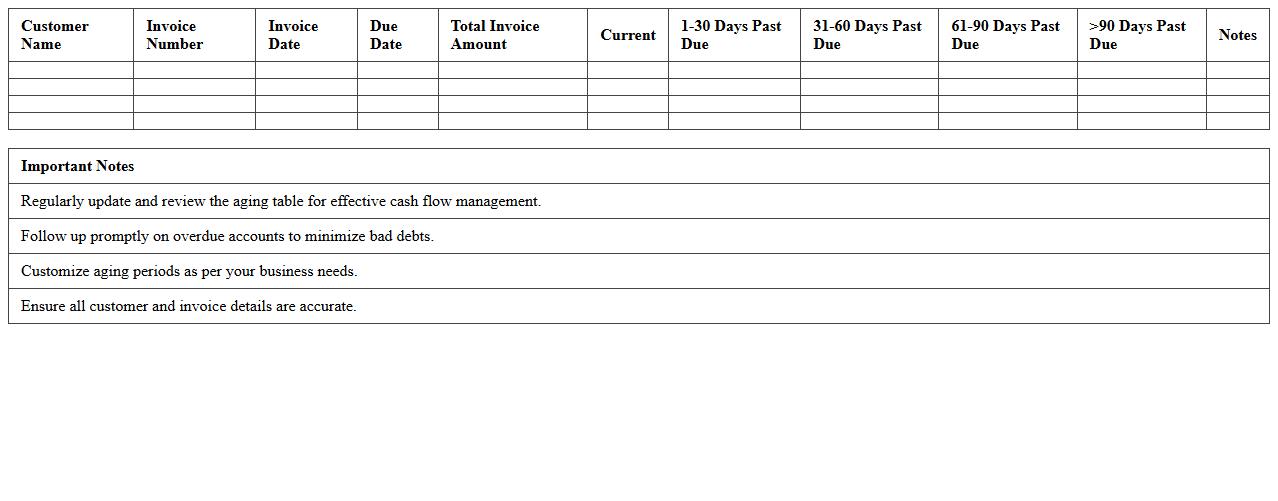

Accounts Receivable Aging Excel Template for Small Enterprises

The

Accounts Receivable Aging Excel Template for small enterprises is a practical financial tool designed to track outstanding customer invoices by categorizing them based on the length of time they have been unpaid. This template helps businesses monitor their cash flow, identify overdue accounts, and prioritize collection efforts to enhance liquidity. By providing a clear visual representation of receivables aging, it supports timely decision-making for credit management and reduces the risk of bad debts.

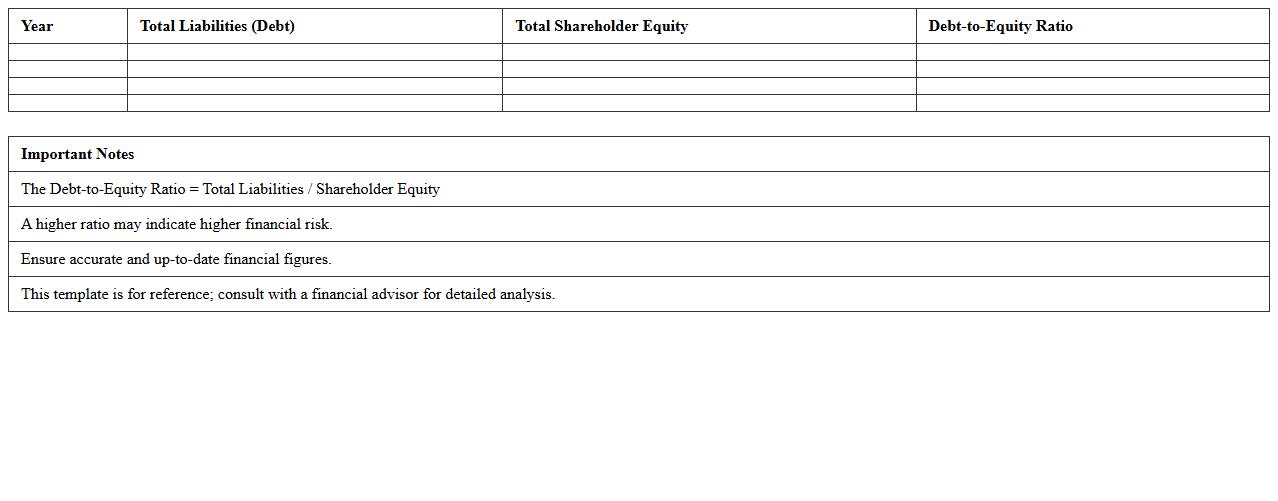

Debt-to-Equity Ratio Calculator Excel Template

The

Debt-to-Equity Ratio Calculator Excel Template is a financial tool designed to help users quickly and accurately compute the debt-to-equity ratio, a key indicator of a company's financial leverage. This template streamlines the process by allowing input of total debt and total equity values, automatically generating the ratio to assess the balance between company debt and shareholders' equity. It is useful for investors, analysts, and business owners to evaluate financial stability, make informed decisions, and plan for sustainable growth.

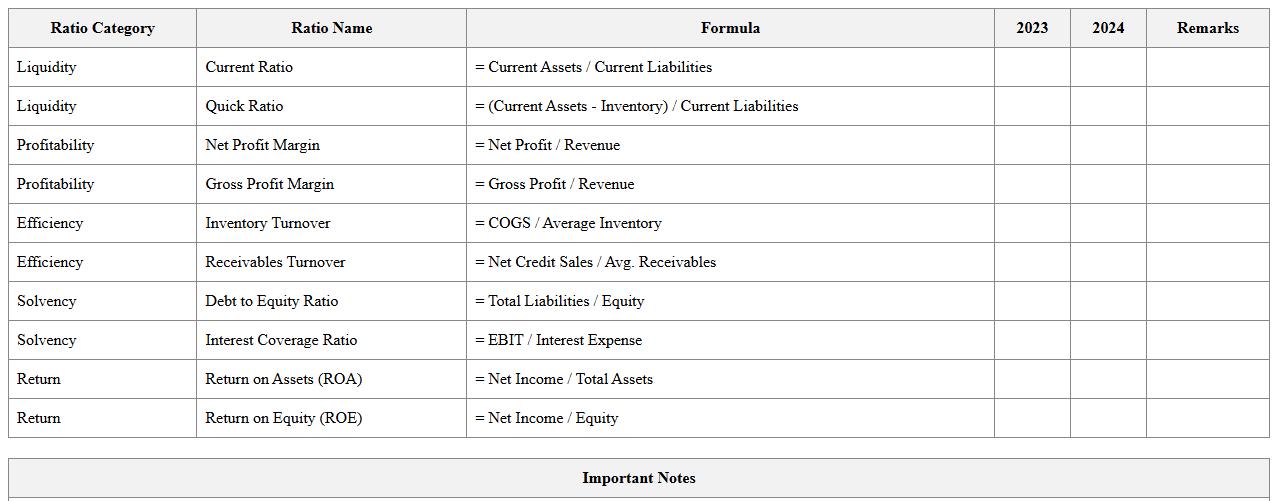

Financial Ratio Analysis Excel Template for Small Enterprises

The

Financial Ratio Analysis Excel Template for Small Enterprises is a pre-designed spreadsheet that simplifies the process of evaluating a business's financial health through key performance indicators such as liquidity, profitability, and solvency ratios. It helps small business owners and managers quickly input financial data to generate meaningful insights, allowing for informed decision-making and strategic planning. This tool improves financial visibility, supports budgeting, and enhances the ability to monitor financial trends over time efficiently.

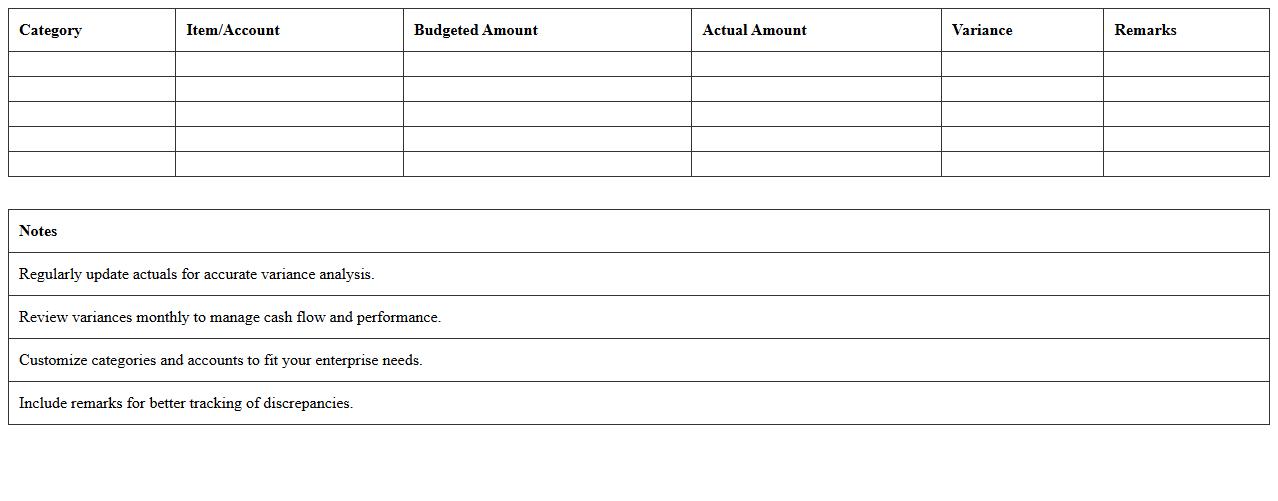

Budget vs Actuals Excel Template for Small Enterprises

The

Budget vs Actuals Excel Template for small enterprises is a financial tool designed to track and compare planned budgets against actual expenses and revenues. It helps businesses identify variances, monitor financial performance, and make informed decisions to improve cash flow management. This template is essential for maintaining accurate financial control and ensuring that business operations stay within budgetary limits.

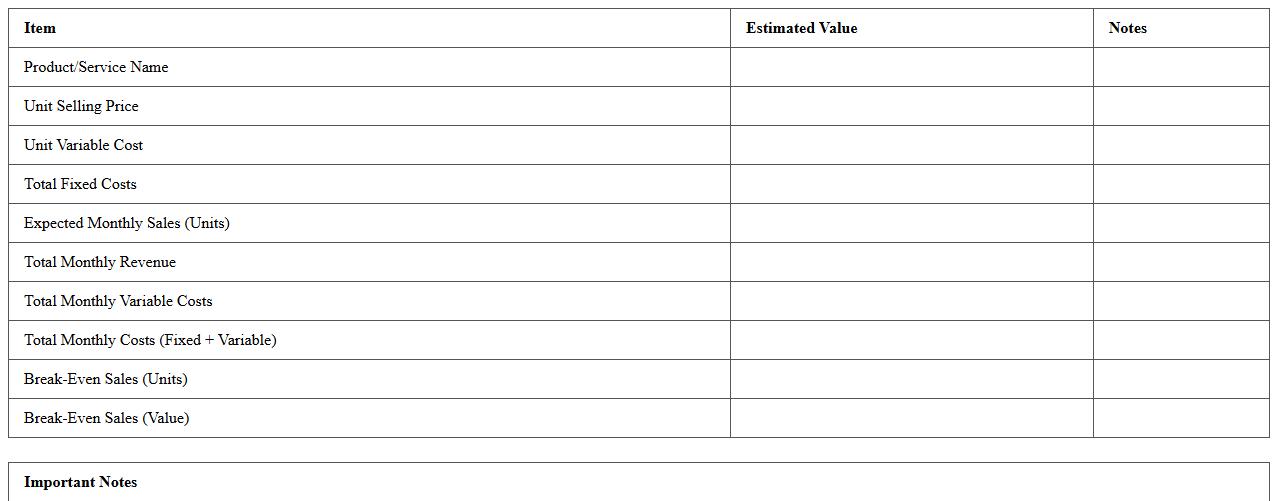

Break-Even Analysis Excel Template for Small Enterprises

The

Break-Even Analysis Excel Template for small enterprises is a practical financial tool designed to calculate the point at which total revenues equal total costs, enabling businesses to identify when they will become profitable. This template helps entrepreneurs forecast expenses, sales volume, and pricing strategies, facilitating informed decision-making and efficient resource allocation. Small business owners benefit from its user-friendly format by visualizing profit margins and assessing financial viability with accuracy.

Working Capital Management Excel Template for Small Enterprises

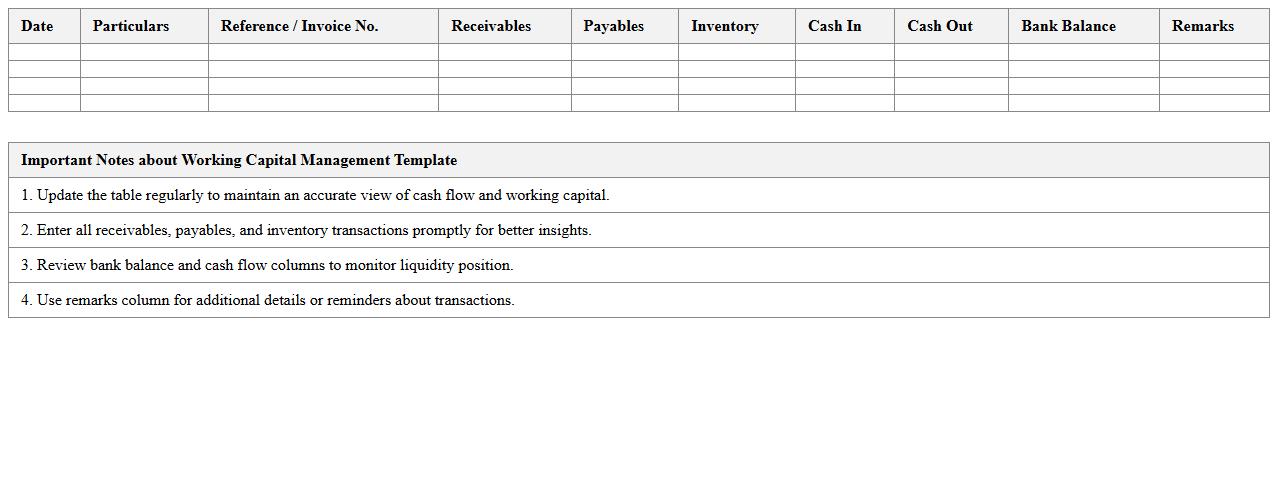

The

Working Capital Management Excel Template for small enterprises is a practical tool designed to track and optimize current assets and liabilities, ensuring efficient cash flow management. This template helps businesses monitor inventory levels, accounts receivable, and accounts payable in a structured format, enabling better decision-making to maintain liquidity. Using this document enhances financial planning accuracy, reduces the risk of cash shortages, and supports sustainable business operations.

How does the Financial Health Assessment Excel template calculate liquidity ratios for small enterprises?

The Financial Health Assessment Excel template calculates liquidity ratios by using key balance sheet components such as current assets and current liabilities. The primary ratios included are the current ratio and quick ratio, which provide insight into a business's ability to meet short-term obligations. These ratios are dynamically updated based on the inputted financial statements to offer real-time analysis.

Which specific financial metrics are auto-generated to highlight cash flow vulnerabilities?

The template auto-generates critical cash flow vulnerability metrics including the operating cash flow ratio, cash conversion cycle, and days sales outstanding. These metrics allow small enterprises to identify potential cash shortages and inefficiencies in managing working capital. Automated calculations help business owners proactively address cash flow gaps before they impact operations.

Can the template accommodate multiple currencies for cross-border small businesses?

The Financial Health Assessment template supports multiple currencies by allowing users to set a base currency and input exchange rates for transactions in different currencies. This functionality is essential for cross-border small businesses needing consolidated financial analysis. Currency conversion features ensure accurate financial health assessment despite varying monetary units.

How are debt service coverage ratios visualized within the dashboard?

The dashboard visualizes the debt service coverage ratio (DSCR) using interactive charts and gauges that track the ratio over time. Color-coded indicators highlight whether the DSCR meets acceptable thresholds, making it easy to assess debt repayment capacity. This visual approach facilitates quick decision-making for managing financial obligations.

What built-in features flag common data entry errors impacting financial analysis accuracy?

The template includes error detection features such as data validation rules, conditional formatting, and automatic alerts for anomalies like negative values or inconsistent entries. These safeguards minimize human errors and enhance the reliability of the financial analysis. Real-time feedback prompts users to correct mistakes before finalizing reports.

More Assessment Excel Templates